Cynnwys

- Main points

- Statistician’s comment

- Summary

- The UK economy grew by 0.2% in Quarter 1 2018, revised up from the second estimate of 0.1%

- Construction sees its sharpest quarterly decline since Quarter 3 2012, but it has been revised up notably in the latest quarter

- Growth in household consumption remains subdued and business investment falls in Quarter 1 2018

- Growth in compensation of employees strengthens in Quarter 1, while profits fall

- The UK’s current account deficit narrows to 3.4% of GDP in Quarter 1 2018

- Households’ saving ratio remains low, falling to 4.1% in Quarter 1 2018, as households continue to be net borrowers

- Employment

- Unemployment and inactivity

- The structure of unemployment

- 12-month growth rate of CPIH rose to 2.3% in May 2018

1. Main points

The Quarterly national accounts shows that the UK economy grew by 0.2% in Quarter 1 (Jan to Mar) 2018, revised up from the second estimate of 0.1%.

In the most recent quarter, the revisions to the output measure of gross domestic product (GDP) have been driven by methodological changes to improve the quality of early estimates of construction output.

The expenditure measure of GDP shows that private consumption, government consumption and net trade all contributed positively to growth in Quarter 1 2018, while gross capital formation made zero contribution.

The households’ saving ratio remains low, falling to 4.1% in Quarter 1 2018, as households continue to be net borrowers.

Employment increased by 146,000 compared with the three months to January 2018 to a record high of 32.39 million.

The 12-month growth rate of the Consumer Prices Index including owner occupiers’ housing costs (CPIH) rose to 2.3% in May 2018, from 2.2% in April 2018; the input Producer Price Index (input PPI) grew by 9.2% in the 12 months to May 2018, up from 5.6% in the 12 months to April 2018; and the output Producer Price Index (output PPI) grew by 2.9% in the 12 months to May 2018.

Recent increases in global prices for crude oil have also driven increases in the 12-month growth rate for the input Producer Price Index (PPI), which rose to 9.2% in May 2018.

2. Statistician’s comment

Commenting on today’s GDP figures, Head of GDP Rob Kent-Smith said:

“GDP growth was revised up slightly in the first three months of 2018, with later construction data, and significantly improved methods for measuring the sector, nudging up growth.

“These improved methods, introduced as part of ONS’s annual update to its figures, will lead to better early estimates of the construction sector with smaller revisions in the future.

“Overall, households were borrowers at the beginning of 2018 and for the sixth consecutive quarter, as households continued to face increasing prices, squeezing their budgets.

“Investment by both local and central government and the private sector fell, with spending on buildings, machinery and software all seeing notable falls.”

Nôl i'r tabl cynnwys3. Summary

The UK economy grew by 0.2% in Quarter 1 (Jan to Mar) 2018, revised up from the second estimate of 0.1%. There have been some notable upward revisions to construction output in recent quarters, particularly in Quarter 1, which mainly reflect methodological changes to improve the quality of early estimates of construction output. Meanwhile, production output rose by a downwardly revised 0.4% in Quarter 1, while services grew by an unrevised 0.3%. Household consumption remained subdued and business investment fell in Quarter 1. Gross fixed capital formation fell by 1.3%, driven by a downward revision reflecting updated government investment figures. The households’ saving ratio fell to 4.1% in Quarter 1, while the UK’s current account deficit narrowed to 3.4% of GDP.

All time periods are open for revision in today’s Quarterly national accounts.

Employment reached a record high in the three months to April 2018. The unemployment rate stood at 4.2%. Long-term unemployment rate is both falling and lower than the unemployment rate. Recently, both the unemployment rate and the number of vacancies have fallen, while the percentage of the part-time workforce that could not find a full-time job has failed to return to pre-downturn levels.

The 12-month growth rate of the Consumer Prices Index including owner occupiers’ housing costs (CPIH) rose to 2.3% in May 2018. By far the largest driver of this increase was transport. The input Producer Price Index (input PPI) grew by 9.2% in the 12 months to May 2018, up from 5.6% in the 12 months to April 2018; this was driven mainly by increases in prices for crude oil and fuels. The output Producer Price Index (output PPI) grew by 2.9% in the 12 months to May 2018; the largest upward contribution was from coke and refined petroleum products. Prices for coke and refined petroleum products increased by 12.4% in the 12 months to May 2018; this was up from 5.6% in the 12 months to April 2018. Rising global prices for crude oil are feeding through into both producer and consumer prices.

More detailed theme day economic commentary is available for:

Nôl i'r tabl cynnwys4. The UK economy grew by 0.2% in Quarter 1 2018, revised up from the second estimate of 0.1%

Today’s gross domestic product (GDP) release estimates that UK economic growth was 0.2% in Quarter 1 (Jan to Mar), revised up by 0.1 percentage points (Figure 1). This mainly reflects improvements to how early estimates of construction output are produced, which has led to a notable upward revision in Quarter 1. Compared with the same quarter a year ago, GDP rose by an unrevised 1.2% in Quarter 1 2018 – the weakest growth since Quarter 2 (Apr to June) 2012, continuing its recent subdued performance. On a calendar-year basis, growth in 2017 has been revised down to 1.7%, slightly weaker than the revised 1.8% recorded in 2016.

Figure 1: Gross domestic product growth, quarter-on-quarter and quarter on same quarter a year ago growth rate

UK, Quarter 1 (Jan to Mar) 2008 to Quarter 1 2018

Source: Office for National Statistics

Notes:

- Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept), Q4 refers to Quarter 4 (Oct to Dec).

Download this chart Figure 1: Gross domestic product growth, quarter-on-quarter and quarter on same quarter a year ago growth rate

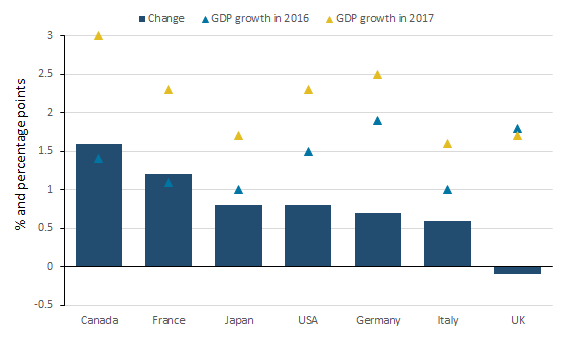

Image .csv .xlsThe UK is the only G7 economy to have seen a slowing in annual GDP growth in 2017, with the other advanced economies experiencing a marked pickup in activity in 2017 (Figure 2). Having experienced the second-fastest rate of growth in 2016, the UK was the joint fifth fastest-growing economy in the G7 in 2017, ahead of only Italy.

Figure 2: Difference between 2017 and 2016 annual gross domestic product growth

G7 countries

Source: Office for National Statistics and Organisation for Economic Co-operation and Development

Download this image Figure 2: Difference between 2017 and 2016 annual gross domestic product growth

.png (8.5 kB) .xlsx (10.3 kB)All quarters are open to revision in today’s publication and further information on the methodological changes introduced in today’s figures can be found. Figure 3 shows that there have been some small revisions to the quarterly path in recent years, but that the overall trend is largely unchanged, with a slowing in growth in 2017 still observed in the latest figures. The average quarterly growth rate in 2017 was 0.3% (revised down from 0.4%), weaker than the average rate of 0.5% recorded in 2016.

One of the more notable revisions is in Quarter 2 2016, which has been revised down from 0.5% to 0.2%, in part driven by a downward revision to services. The EU Referendum took place in June 2016 and the median independent forecast for annual GDP growth in 2017 was revised down to 0.8% following the vote to leave the EU. However, in contrast to the consensus views on the anticipated effects, the previous estimates showed that GDP growth picked up in the second half of 2016. Today’s figures show that the economy now expanded at broadly the same rate throughout 2016, although still by more than the consensus had expected at the time. Growth has also been revised up in Quarter 1 2018, reflecting stronger figures for construction output.

There was some uncertainty around the provisional estimates, reflecting the lower data content for March, which had been impacted to some extent by adverse weather conditions. Today’s numbers incorporate methodological changes to improve the quality of early estimates of construction output, which explains some of the revision in Quarter 1. While today’s revised figures show that the adverse weather conditions had a negative impact on some areas of the economy, such as construction and parts of retail trade, the overall impact still appears to have been limited with the cold weather boosting energy supply and online spending.

Figure 3: Revisions to quarterly gross domestic product growth path

UK, Quarter 1 (Jan to Mar) 2015 to Quarter 1 2018

Source: Office for National Statistics

Notes:

- Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept), Q4 refers to Quarter 4 (Oct to Dec).

Download this chart Figure 3: Revisions to quarterly gross domestic product growth path

Image .csv .xlsFigure 4 shows that these revisions to GDP are relatively small in nature. The economy has tracked a broadly similarly path to the previous published one since the 2008 economic downturn. While the economy’s peak-to-trough fall is slightly more marked (6.3% compared with a previously published 6.1%), the number of quarters it took to recover to its pre-downturn peak remains unrevised. The economy is now estimated to have grown by 17.8% since the trough of the economic downturn in Quarter 1 2009, revised slightly from the previous estimate of 18.0%.

Figure 4: Impact of revisions on headline gross domestic product growth since pre-downturn peak

UK, Quarter 1 (Jan to Mar) 2008 to Quarter 1 2018

Source: Office for National Statistics

Notes:

- Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (April to June), Q3 refers to Quarter 3 (July to Sept), Q4 refers to Quarter 4 (Oct to Dec).

Download this chart Figure 4: Impact of revisions on headline gross domestic product growth since pre-downturn peak

Image .csv .xlsThe implied GDP deflator represents the broadest measure of inflation in the domestic economy, as it reflects changes in the price of all goods and services that comprise GDP, including the price movements in private and government consumption, investment and the relative price of exports and imports. In the year to Quarter 1 2018, the GDP deflator increased by 1.6%, revised up by 0.2 percentage points compared with the previous estimate. This was largely driven by a revision to the household consumption deflator, which was revised up from 1.5% to 2.1% in the year to Quarter 1 2018. This reflected revisions to financial intermediation services indirectly measured (FISIM) where forecast data were replaced by actual data.

Nôl i'r tabl cynnwys5. Construction sees its sharpest quarterly decline since Quarter 3 2012, but it has been revised up notably in the latest quarter

The output measure of gross domestic product (GDP) grew by 0.2% in Quarter 1 (Jan to Mar) 2018, revised up from the second estimate of GDP. This has been driven by revised construction estimates, with its output growth revised up by 1.9 percentage points to negative 0.8%. In other industries, production output was revised down by 0.2 percentage points to 0.4%, while growth in services output was unrevised at 0.3%. Consistent with previously published figures, the overall impact of adverse weather conditions on output in Quarter 1 2018 appears to be relatively small, and in line with our previous judgements.

There have been some notable upward revisions to construction output in recent quarters, particularly in Quarter 1 2018 (Figure 5). While the 0.8% fall in Quarter 1 marks the largest quarterly decline since Quarter 3 (July to Sept) 2012, it is now estimated that this is the first fall since Quarter 3 2015 – earlier estimates had recorded falling output through much of 2017. Today’s new construction estimates show a much stronger growth profile throughout 2017, with upward revisions recorded in each quarter except Quarter 3 (Figure 5).

Construction output is now estimated to have increased by 7.1% in 2017, up from 5.7%. The revisions contained in today’s release reflect late survey and Value Added Tax (VAT) returns, an update of the seasonal adjustment factors as part of the annual review, the incorporation of VAT data in Quarter 4 (Oct to Dec) 2017 and updated mark-up data used within the price indices. It also includes methodological changes to improve the quality of early estimates of construction output. One change relates to improving how values are imputed for those businesses who have not responded to the Monthly Business Survey. This tends to have a larger impact in the first quarter of the year as there are more newly selected businesses and therefore a larger number of imputations are required. The second change relates to the flexibility to how the bias adjustment can be applied. This is no longer constrained to being only applied to the first estimate of GDP, so there is more scope to adjust the underlying data so that it is closer to where a more mature estimate is expected to be.

It is important to note that while these improvements have led to a large revision in the latest quarter, it is expected that this will reduce the scope for further revisions in subsequent estimates. Furthermore, these improvements will be applied in real time so it is not expected that these improvements will lead to large one-off revisions in the future. Further information on the impact of these methodological improvements shows how these improvements would have improved the revisions performance of early estimates in real time.

Figure 5: Revisions to quarterly growth in construction output

UK, Quarter 1 (Jan to Mar) 2015 to Quarter 1 2018

Source: Office for National Statistics

Notes:

- Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept), Q4 refers to Quarter 4 (Oct to Dec).

Download this chart Figure 5: Revisions to quarterly growth in construction output

Image .csv .xlsMeanwhile, production output rose by a revised 0.4% in Quarter 1 2018, driven by a 1.4% increase in energy supply as unusually cold weather boosted gas and electricity production in February and March. Quarterly production growth was also supported by a 2.5% increase in mining and quarrying output, reflecting a bounce back following a sharp 4.8% fall in Quarter 4 2017. The decline in Quarter 4 was due to the unexpected shutdown of the Forties pipeline system for several weeks in December 2017.

Today’s new data show a 0.2 percentage point downward revision to production growth in Quarter 1 2018, reflecting downward revisions to both manufacturing and energy supply (0.3 and 1.1 percentage points respectively). Following a strong run of expansion in the second half of 2017, manufacturing output is now estimated to have fallen marginally by 0.1% in Quarter 1 2018, marking the first quarterly decline in manufacturing since Quarter 3 2016. Annual manufacturing growth in 2017 was unrevised.

In the services industry, output grew by an unrevised 0.3% in Quarter 1 2018, slightly weaker than the 0.4% recorded in Quarter 4 2017 but in line with average quarterly growth recorded throughout 2017. Information on VAT turnover has been incorporated into the figures for Quarter 4 2017 for the first time, as well as the inclusion of new and updated VAT from Quarter 1 2016. There has also been an increase in coverage of VAT in services industries in today’s figures. The selection of other professional, scientific and technical services as a new industry for VAT caused the large revision up in this industry for Quarter 1 2017.

Following upward revisions to Quarter 4 2016, annual services output growth has been revised up to 1.8% in 2017, though this still reflects a slowing compared with previous years. This reflects a longer-term weakening in consumer-focused industries, such as retail trade, with output in these industries falling by 0.4% in Quarter 1 2018 (revised down from a fall of 0.3%). Output in the distributions, hotels and catering industry has been revised up by 0.2 percentage points to a small rise of 0.1%, meaning that output in all four main components of services rose in Quarter 1 2018. Looking over a longer period, the underlying story on services remains largely unrevised, with business services and finance continuing to be the driver of services growth (Figure 6); Quarter 1 2018 marked the third consecutive quarter in which the sector has been the largest positive contributor to total services growth (to two decimal places).

Figure 6: Growth in total services output and industry contributions

UK, Quarter 1 (Jan to Mar) 2016 to Quarter 1 2018

Source: Office for National Statistics

Notes:

- Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept), Q4 refers to Quarter 4 (Oct to Dec).

Download this chart Figure 6: Growth in total services output and industry contributions

Image .csv .xlsToday’s new Index of Services figures show that total services output rose by 0.3% in April 2018. This monthly rise was driven by distribution, hotels and restaurants and business services and finance with each contributing 0.1 percentage points towards growth in total services output. Meanwhile, transport, storage and communication, and government and other services sectors did not contribute towards total services growth to one decimal place. The growth in the distribution, hotels and restaurants sector was almost entirely driven by a 1.8% increase in retail trade, in line with the retail sales figures for April 2018, which also showed a bounceback in retail volumes following a weather-affected March figure.

Consistent with previously published data, today’s revised figures still indicate that the adverse weather conditions in February and March had little overall impact on services output in Quarter 1 2018. While there was a negative impact on retail sales volumes in March due to a sharp decline in petrol sales, there was also a boost in online retail spending, particularly for department stores. In the three months to April 2018, services output increased by 0.2%.

Nôl i'r tabl cynnwys6. Growth in household consumption remains subdued and business investment falls in Quarter 1 2018

The expenditure measure of gross domestic product (GDP) increased by 0.2% in Quarter 1 (Jan to Mar) 2018. Private consumption, government consumption and net trade all contributed positively to growth, while gross capital formation made zero contribution (Figure 7). Gross fixed capital formation contributed negative 0.2 percentage points – this is driven by a downward revision reflecting updated government investment figures.

Figure 7: Contributions to gross domestic product growth, expenditure component, quarter-on-quarter, chained volume measure

UK, Quarter 1 (Jan to Mar) 2016 to Quarter 1 2018

Source: Office for National Statistics

Notes:

Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept), Q4 refers to Quarter 4 (Oct to Dec).

Components may not sum to total gross domestic product due to rounding and loss of additivity in data prior to open period. The statistical discrepancy is also not displayed.

Download this chart Figure 7: Contributions to gross domestic product growth, expenditure component, quarter-on-quarter, chained volume measure

Image .csv .xlsGrowth in household consumption remained subdued at 0.2% in Quarter 1 2018, unrevised from the second estimate of GDP. While some parts of consumer spending, such as petrol sales, were affected by the adverse weather in Quarter 1, the weakness in consumption also reflects a continuation of a longer-term trend of subdued growth in household expenditure. This has been driven by weak growth in real wages, with households’ incomes squeezed by rising import prices following the past depreciation of sterling. Despite an upward revision of 0.2 percentage points, 2017 annual growth in household consumption remained at its weakest since 2012 (1.9%). This weakening in household consumption is consistent with the slowdown in output for consumer-focused services industries, which has been on a declining trend since late 2016.

Figure 8: Revisions to growth in household final consumption expenditure

UK, Quarter 1 (Jan to Mar) 2015 to Quarter 1 2018

Source: Office for National Statistics

Notes:

- Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept), Q4 refers to Quarter 4 (Oct to Dec).

Download this chart Figure 8: Revisions to growth in household final consumption expenditure

Image .csv .xlsGross fixed capital formation (GFCF) is estimated to have declined by 1.3% in Quarter 1 2018, revised down by 2.2 percentage points (Figure 9). The quarterly decline was driven by a 6.2% fall in government investment and a 0.4% fall in business investment, partly offset by a 1.5% rise in private dwelling investment. The quarterly fall in business investment marked the third consecutive slowing in growth and was the slowest quarterly rate since Quarter 4 (Oct to Dec) 2016.

The Quarter 1 revision has been primarily driven by updates to government investment, although business investment and private dwelling investment also saw downward revisions. The revision in government investment was mainly due to the incorporation of improved estimates from central government departments and local government. There have also been downward revisions to GFCF across 2016 and 2017, with capital expenditure growth since the start of 2016 now estimated to have increased by around half of the previous estimate, with the latest available information pointing to weaker outturns in recent quarters. Today’s figures also incorporate methodological changes to GFCF – further information can be found in the business investment release.

Figure 9: Revisions to growth in gross fixed capital formation (GFCF)

UK, Quarter 1 (Jan to Mar) 2015 to Quarter 1 2018

Source: Office for National Statistics

Notes:

- Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept), Q4 refers to Quarter 4 (Oct to Dec).

Download this chart Figure 9: Revisions to growth in gross fixed capital formation (GFCF)

Image .csv .xlsThere have also been revisions to the trade figures, which primarily reflect methodological improvements that relate to the incorporation of revised estimates for net spread earnings and enhancements to the processing of UK trade data. More information of these revisions can be found in a national accounts article published on 1 June 2018. Exports were flat in volume terms in Quarter 1 2018, with a 2.1% rise in goods exports offset by a 2.3% fall in services; this was the sharpest quarterly decline in services exports since Quarter 2 (Apr to June) 2015. Today’s figures show an upward revision to export volumes growth in both Quarter 4 2017 and Quarter 1 2018 (1.8 and 0.6 percentage points respectively), with the previously estimated two consecutive quarterly declines being revised because of improvements to trade system processing and methods. However, overall exports growth in 2017 was revised down by 0.3 percentage points. Meanwhile, import volumes fell by 0.2%, the second consecutive quarterly decline. This was driven by a 0.9% fall in goods imports, partly offset by a 2.0% rise in services imports.

Nôl i'r tabl cynnwys7. Growth in compensation of employees strengthens in Quarter 1, while profits fall

Nominal gross domestic product (GDP) grew by 0.8% in Quarter 1 (Jan to Mar) 2018, revised up from the second estimate of 0.3%. This was driven by upward revisions to both gross operating surplus and other income, and was partly offset by a downward revision to Compensation of Employees (CoE). All three components rose in Quarter 1 2018, while taxes less subsidies fell by 2.3%. Annual nominal GDP growth in recent years remains largely unchanged.

There have been updates to CoE growth, which is now estimated to have increased by 1.1% in Quarter 1 2018, a downward revision of 0.5 percentage points. This was matched by an upward revision of 0.4 percentage points in Quarter 4 2017. The figures in Quarter 1 still reflect strong employment levels in the UK labour market, but there have been revisions to employers' social contributions due to updated pension data.

Figure 10: Contributions to nominal gross domestic product growth by income component, quarter-on-quarter

UK, Quarter 1 (Jan to Mar) 2015 to Quarter 1 2018

Source: Office for National Statistics

Notes:

Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept), Q4 refers to Quarter 4 (Oct to Dec).

Components may not sum to nominal gross domestic product due to rounding and loss of additivity in data prior to open period. The statistical discrepancy is also not displayed.

Download this chart Figure 10: Contributions to nominal gross domestic product growth by income component, quarter-on-quarter

Image .csv .xls8. The UK’s current account deficit narrows to 3.4% of GDP in Quarter 1 2018

The UK’s current account deficit narrowed to 3.4% of gross domestic product (GDP) in Quarter 1 (Jan to Mar) 2018, driven by improvements to net trade and net investment income received on direct, portfolio and other investment. Since 2011, the current account deficit has widened to historically high levels, with the revised figures showing that this peaked at 5.2% in 2016. However, this has narrowed to a revised 3.9% in 2017, with the latest figures showing a trade deficit of 1.3% and a primary income deficit of 1.6% – these are the narrowest since 2011 and 2012 respectively.

Today’s new figures incorporate revisions to the balance of payments, which mainly reflect improvements to how net spread earnings (NSE) and how trade in goods are recorded. The impact of these revisions has typically been for the current account deficit to be narrower than previously estimated, though this is not the case in the second half of 2017 (Figure 11). NSE refers to the margins when financial companies buy assets at a price that is typically lower than the prevailing market price and sell them at a price that is typically above the market price. Traders are compensated for such transactions, and the improvements to how this is recorded is reflected in higher estimates of those earnings by financial traders based in the UK. As a financial service is typically embedded in the price of the assets when sold to foreign investors by traders based in the UK, this is recorded as an increase in exports. The revisions to trade in goods reflect the implementation of a new processing system, a new delivery of administrative data from Her Majesty’s Revenue and Customs and a review of how balance of payments adjustments are now made.

Figure 11: Decomposition of revisions to the current account balance, percentage of gross domestic product

UK, Quarter 1 (Jan to Mar) 2015 to Quarter 1 (Jan to Mar) 2018

Source: Office for National Statistics

Notes:

- Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept), Q4 refers to Quarter 4 (Oct to Dec).

Download this chart Figure 11: Decomposition of revisions to the current account balance, percentage of gross domestic product

Image .csv .xlsFinancial flows in and out of the UK tend to be volatile. The UK’s borrowing from the rest of the world in Quarter 1 2018 was financed by a £37.5 billion net inflow of portfolio investment, with a £14.2 billion inflow of investment into the UK and a £23.3 billion reduction in the holding of portfolio investment by UK investors. There was also a £11.4 billion net inflow of foreign direct investment. As reported in the latest mergers and acquisitions publication, there were a couple of high-valued transactions, including the acquirement of Worldpay Group Plc of the UK. However, overall foreign investors reduced their holding of direct investment in the UK by £3.9 billion in Quarter 1. This was more than offset by a reduction of £15.3 billion by UK investors of their direct investment held overseas, explaining the net inflow of foreign direct investment. The revised figures show that current account deficit in 2017 was primarily financed by net inflows of both portfolio and other investment, while there was a net outflow of direct investment. This is in line with previous estimates and it marks the first annual net outflow of foreign direct investment (FDI) since 2011. This compares with a net inflow of investment of £161.9 billion in 2016.

There have been some revisions to the UK’s net international investment position (NIIP). At the end of 2017, the net liability position has been revised from £260 billion (12.8% of annual GDP) to £164.5 billion (8.1%). The revisions partly reflect the latest benchmark data on the stock of UK-listed shares that are held by foreign investors. The net liabilities incurred by the UK increased in Quarter 1 2018 to £262.3 billion, reflecting a fall in the UK’s holding of external assets, specifically portfolio investment.

Nôl i'r tabl cynnwys9. Households’ saving ratio remains low, falling to 4.1% in Quarter 1 2018, as households continue to be net borrowers

The Quarterly sector and financial accounts published today provide further information about the UK economy. The households’ saving ratio fell to 4.1% in Quarter 1 (Jan to Mar) 2018, from a downwardly revised 4.5% in Quarter 4 (Oct to Dec) 2017 (previously estimated to be 5.2%) and is the third lowest on record. This fall reflected a rundown in household savings, due to a combination of household spending increasing and a slowdown in the accumulation of pension entitlements.

There have been revisions to the saving ratio across 2017, with the ratio being revised down in each quarter (Figure 12) so that it now stands at 4.1% in 2017 – the lowest on record. The revisions in most recent quarters reflect updated estimates of wages and salaries. However, the underlying story remains broadly unchanged in 2017 with the saving ratio still hitting a historical low in Quarter 1 2017. This was attributed to a large increase in taxes on income and wealth due to the timing of payment of taxes on self-reported income and capital gains. This effect subsequently unwound in Quarter 2 (Apr to June) with a rise in the saving ratio, although it has remained low compared with recent levels.

Figure 12: Revisions to household saving ratio, seasonally adjusted

UK, Quarter 1 (Jan to Mar) 2010 to Quarter 1 2018

Source: Office for National Statistics

Notes:

- Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept), Q4 refers to Quarter 4 (Oct to Dec).

Download this chart Figure 12: Revisions to household saving ratio, seasonally adjusted

Image .csv .xlsReal household disposable income (RHDI) grew by 0.3% in Quarter 1, with growth in the household consumption deflator (1.1%) more than offset by the rise in gross disposable income (1.4%). This rise in RHDI in Quarter 1 2018 followed a weak 2017, in which RHDI fell by 0.5% – the weakest annual rate since 2011. The 0.5% fall in RHDI in 2017 was revised down from a rise of 0.3%, which was driven by these revisions to wages and salaries.

The recent low levels of the households’ saving ratio is also reflected in the net lending and borrowing position of households over recent quarters. Today’s figures show that the household sector, traditionally a net lender, was a net borrower of 1.0% of GDP in Quarter 1. This marked the sixth consecutive quarter in which households have had to borrow (or run down their savings) to finance its spending and investment, continuing its record run as a net borrower (Figure 13). General government was a net borrower in Quarter 1 of 2.5% of GDP, a widening from 1.3% in the previous quarter. This was driven by a fall in the income received from distributed income of corporations and the UK receiving a refund larger than its contributions in Quarter 2 2017. This follows amendments to the 2017 EU budget, which improved its net borrowing position. Financial corporations were a net lender in Quarter 1, the first time since Quarter 3 (July to Sept) 2015.

Figure 13: Net lending and borrowing position by sector, percentage of nominal gross domestic product

UK, Quarter 1 (Jan to Mar) 2010 to Quarter 1 2018

Source: Office for National Statistics

Notes:

Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (April to June), Q3 refers to Quarter 3 (July to Sept), Q4 refers to Quarter 4 (Oct to Dec).

Corporations is the sum of private non-financial corporations and financial corporations, and Households includes households and non-profit institutions serving households.

Download this chart Figure 13: Net lending and borrowing position by sector, percentage of nominal gross domestic product

Image .csv .xls10. Employment

The latest estimates from the Labour Force Survey (LFS) show that in the three months to April 2018, the employment rate increased by 0.3 percentage points to 75.6% when compared to the three months to January 2018. The number of people in employment increased by 146,000 when compared to the previous quarter. Employment increased to a record high of 32.39 million in the February to April 2018 period.

Figure 14 shows the employment and unemployment trends. The unemployment rate continues its decline and the employment rate continues its rise.

Figure 14: Employment and unemployment rate

UK, seasonally adjusted, February to April 2006 to February to April 2018

Source: Office for National Statistics, Labour Force Survey

Download this chart Figure 14: Employment and unemployment rate

Image .csv .xlsIn the three months to April 2018, employment increased among all age groups except for those aged 25- to 34-years-old when compared to the previous quarter. The increase in overall employment was mainly driven by the increase in employment among those aged 50 to 64 years, whose numbers increased by 86,000 when compared with the November to January 2018 period.

Breaking the employment data by sex shows that in the period February to April 2018, women experienced an increase in employment of 112,000, while men experienced an increase of 34,000. The number of employed men stood at a record high level of 17.14 million, and that of women stood at a record high level of 15.26 million.

Nôl i'r tabl cynnwys11. Unemployment and inactivity

In the three months to April 2018, the number of unemployed people fell by 38,000 to 1.42 million when compared to the three months to January 2018. Compared with the same time a year ago, unemployment fell by 115,000. This translates into an unemployment rate of 4.2%, which is 0.1 percentage points lower than in the previous quarter.

The number of people in inactivity stood at 8.65 million in the period February to April 2018. Inactivity decreased by 72,000 from the previous quarter. Year-on-year, inactivity fell by 200,000.

Analysis of the underutilisation of labour

One of the key issues in the study of labour markets is the analysis of the underutilisation of labour. The underutilisation of labour occurs when workers are unemployed, are underemployed or they have marginal attachment to the labour market. The discussion in section 12 highlights the important issues that characterise the underutilisation of labour.

Nôl i'r tabl cynnwys12. The structure of unemployment

Long-term unemployment can be the result of the unemployed having skills that do not match with the skills required in current job openings. It is an indication of a mismatch in the labour market. It may also be a result of lack of mobility where the unemployed persons may be based in an area far away from where the jobs exist.

Long-term unemployment has negative economic and social effects for those involved. It can result in depreciation of human capital, which can then reinforce the persistence of unemployment. Figure 15 shows the trends of overall unemployment and long-term unemployment.

Figure 15: Overall unemployment and long-term unemployment

UK, seasonally adjusted, February to April 2006 to February to April 2018

Source: Office for National Statistics, Labour Force Survey

Download this chart Figure 15: Overall unemployment and long-term unemployment

Image .csv .xlsFigure 15 shows that long-term unemployment tracks the overall unemployment rate. It increased after the economic downturn to reach a high of 2.8% in the period March to May 2013, and has followed a downward trend since then to reach 1.1% in the period February to April 2018. In the period February to April 2014 to February to April 2018, long-term unemployment declined at a faster rate than the overall unemployment rate.

Further analysis of unemployment duration is presented in Figure 16. It shows that short-term unemployment (of up to six months) is the highest, but it has been generally declining since the economic downturn. For instance, in the period February to April 2017, 896,000 people were in short-term unemployment compared with 833,000 people in the February to April 2018 period. There are fewer people who are in medium-term unemployment of between 6 and 12 months, and this type of unemployment has also been declining generally over time. Long-term unemployment has been declining at a faster rate than the other two types of unemployment. In the year from February to April 2017 to February to April 2018, it decreased by 17,000 to 369,000.

Figure 16: Short-term, medium-term and long-term unemployment

UK, seasonally adjusted, February to April 2006 to February to April 2018

Source: Office for National Statistics, Labour Force Survey

Download this chart Figure 16: Short-term, medium-term and long-term unemployment

Image .csv .xlsThe structure of unemployment is similar between men and women, although there are more men than women in all states of unemployment. There is a larger difference between men and women in long-term unemployment. For instance, in the period February to April 2017, 233,000 men were in long-term unemployment compared with 152,000 women. In the period February to April 2018, there were 217,000 men and 151,000 women in long-term unemployment respectively.

The overall decline in long-term unemployment may affect the economy in the sense that less human capital is lost through skills depreciation. However, the fall in the number of the long-term unemployed may be because the people are getting discouraged and therefore transitioning into inactivity.

Nôl i'r tabl cynnwys13. 12-month growth rate of CPIH rose to 2.3% in May 2018

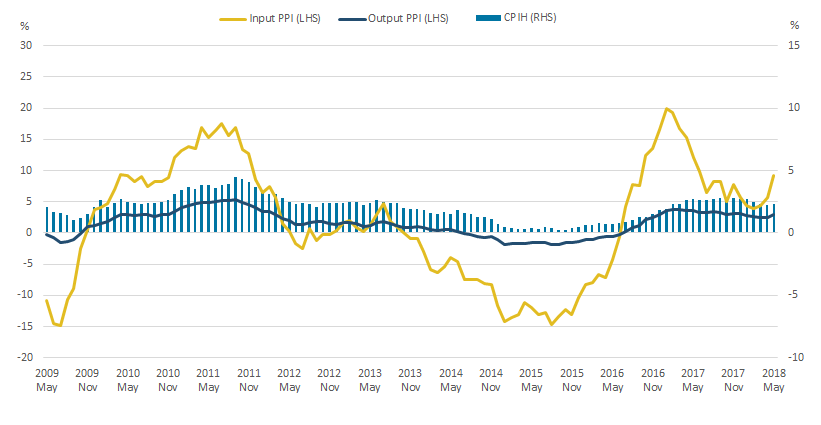

Figure 17 shows that the 12-month growth rate of the Consumer Prices Index including owner occupiers’ housing costs (CPIH) rose to 2.3% in May 2018. By far the largest driver of this increase was transport. The input Producer Price Index (input PPI) grew by 9.2% in the 12 months to May 2018, up from 5.6% in the 12 months to April 2018; this was driven mainly by increases in prices for crude oil and fuels. The output Producer Price Index (output PPI) grew by 2.9% in the 12 months to May 2018; the largest upward contribution was from coke and refined petroleum products. Prices for coke and refined petroleum products increased by 12.4% in the 12 months to May 2018; this was up from 5.6% in the 12 months to April 2018.

Figure 17: 12-month growth rates for input Producer Price Index (PPI) and output PPI (left-hand side), and Consumer Prices Index including owner occupiers' housing costs (CPIH) (right-hand side)

UK, May 2009 to May 2018

Source: Office for National Statistics

Download this image Figure 17: 12-month growth rates for input Producer Price Index (PPI) and output PPI (left-hand side), and Consumer Prices Index including owner occupiers' housing costs (CPIH) (right-hand side)

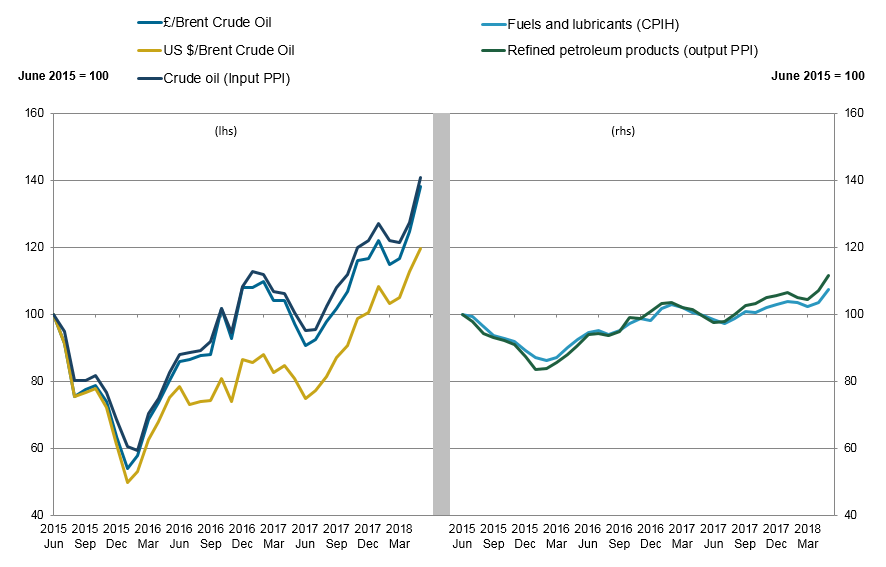

.png (22.2 kB) .xls (45.6 kB)Global prices for Brent Crude oil as well as related producer and consumer prices are shown in Figure 18. Brent Crude oil prices in pounds sterling and US dollars tracked each other closely between June and December 2015, beginning to diverge in early 2016 and diverging further as sterling depreciated following the EU referendum in June 2016. Although this gap remains, prices have nonetheless continued to follow similar trends with recent price rises following decreases in early 2018.

Figure 18: Brent Crude oil and crude oil (input PPI) index (left-hand side), and refined petroleum products (output PPI) and fuels and lubricants (CPIH) (right-hand side)

UK, June 2015 to May 2018

Source: Office for National Statistics and Financial Times

Download this image Figure 18: Brent Crude oil and crude oil (input PPI) index (left-hand side), and refined petroleum products (output PPI) and fuels and lubricants (CPIH) (right-hand side)

.png (47.1 kB) .xls (30.7 kB)The latest data for May show that the crude oil component of input PPI was 40.7% higher than in June 2015. This reflects both underlying increases in Brent crude oil prices and exchange rate effects, as the sterling price of Brent Crude oil increased by 38.1% over the same period compared with an increase of only 19.5% in the US dollar price of Brent Crude oil. All three measures have increased in April and May 2018. Recent increases in global prices for crude oil reflect a range of international supply side factors, including geopolitical tensions, declines in Venezuela’s production and the threat of new sanctions on Iran by the US.

These increases in input prices have fed through into higher producer output prices and consumer prices. The right-hand panel of Figure 18 shows the fuels and lubricants component of CPIH and the refined petroleum products component of output PPI. Consumer prices and output prices for petroleum products have followed each other closely over the period. Both series have been rising for the last two months, with the latest data for May 2018 showing that prices for the fuels and lubricants component of CPIH and the refined petroleum products component of output PPI are now 7.4% and 11.7% higher respectively than in June 2015. This reflects the trends seen in producer input prices and global prices for oil.

Nôl i'r tabl cynnwysManylion cyswllt ar gyfer y Erthygl

Related publications

- Business investment in the UK: January to March 2018 revised results

- Balance of payments, UK: January to March 2018

- Quarterly sector accounts, UK: January to March 2018

- Consumer trends, UK: January to March 2018

- GDP quarterly national accounts, UK: January to March 2018

- Index of Services, UK: April 2018