Cynnwys

- Main points

- Changes in this release

- Upcoming changes

- Things you need to know about this release

- GFCF and business investment main figures

- Which sectors are contributing to the fall in GFCF in Quarter 1 2018?

- Which assets are contributing to the fall in GFCF in Quarter 1 2018?

- How has GFCF performed over a longer period?

- What other information can tell us more about GFCF?

- Which assets are contributing to the fall in business investment in Quarter 1 2018?

- How has business investment performed over a longer period?

- Business investment in the wider economy

- International comparisons of GFCF

- Revisions to GFCF and business investment

- Links to related statistics

- Quality and methodology

- Annex A: Impact of changes introduced at Blue Book 2018

1. Main points

Gross fixed capital formation (GFCF), in volume terms, was estimated to have fallen by 1.3% to £85.6 billion in Quarter 1 (Jan to Mar) 2018 from £86.8 billion in Quarter 4 (Oct to Dec) 2017.

Business investment was estimated to have fallen by 0.4% to £47.7 billion between Quarter 4 2017 and Quarter 1 2018.

Between Quarter 1 2017 and Quarter 1 2018, GFCF was estimated to have increased by 1.5% from £84.3 billion; business investment was estimated to have increased by 2.0% from £46.8 billion.

The sectors that contributed to the 1.3% GFCF fall between Quarter 4 2017 and Quarter 1 2018 were general government, public corporations’ dwellings and business investment.

The asset that contributed most to the decrease in GFCF over the same period was other buildings and structures and transfer costs; transport equipment was the only asset to have increased as all other assets also fell in this period.

Estimates in this bulletin are consistent with the UK National Accounts, Blue Book 2018 edition to be published on 31 July 2018; all data have been revised from their start point and the reference year for the chained volume estimates has now moved on from 2015 to 2016.

2. Changes in this release

Blue Book 2018

This release is our Blue Book 2018-consistent release. Each year in the Blue Book-consistent publications of business investment we incorporate methodological and data changes that will impact on the business investment and gross fixed capital formation (GFCF) datasets. More information on these changes and their impact can be found in the Revisions section of this bulletin.

Other changes – English housing associations reclassification

In Blue Book 2017, Office for National Statistics (ONS) implemented the reclassification of “private registered providers” of social housing in England (“English housing associations”) to the public corporations sector. In November 2017, following changes to the regulation of social housing in England, English housing associations were reclassified back into the private non-financial corporations sector. This reclassification has been implemented from November 2017, the date the regulations came into force and so has led to revisions in sector-level data for both public corporations and private non-financial corporations from Quarter 4 (Oct to Dec) 2017 onwards in this release. These can be found in the Gross fixed capital formation – by sector and asset dataset accompanying this release. Total GFCF has been unaffected by this change.

Nôl i'r tabl cynnwys3. Upcoming changes

Future of the business investment provisional estimate

Following a consultation process, the response to which was published on 19 October 2017, a new publication model for gross domestic product (GDP) will come into effect in August 2018. As part of this new model, publication of the first quarterly estimate of GDP for all three approaches – output, income and expenditure – will be brought forward. An article was published on 27 April 2018 explaining the wider changes to the new GDP publication model in more detail, covering all the products that will be produced under the new model and a clear schedule of publication dates from the date of implementation.

In the provisional business investment estimate published on 25 May 2018, we announced we had reviewed the feasibility of continuing publication of the business investment provisional release in its existing format and described a new business investment publication model to be introduced in August 2018.

That publication model announced in May is being reviewed further to ensure that we continue to provide the same level of data quality in our publication material and so a confirmed publication model will be announced on our website on 4 July 2018 when that review process has concluded.

There are no plans currently to change the format and content of the revised business investment release published alongside the quarterly national accounts, other than the normal evolution of a bulletin.

Nôl i'r tabl cynnwys4. Things you need to know about this release

The estimates in this release are short-term indicators of investment in non-financial assets in the UK, such as dwellings (residential buildings), transport equipment (planes, trains and automobiles), machinery (electrical equipment), buildings (non-residential buildings and roads) and intellectual property products (assets without physical properties – formerly known as intangibles). This release covers not only business investment, but asset and sector breakdowns of total gross fixed capital formation (GFCF), of which business investment is one component.

Business investment is net investment by private and public corporations. These include investments in transport, information and communication technology (ICT) equipment, other machinery and equipment, cultivated assets (such as livestock and vineyards), intellectual property products (IPP, which includes investment in software, research and development, artistic originals and mineral exploration), and other buildings and structures.

Business investment does not include investment by central or local government, investment in dwellings, or the costs associated with the transfer of non-produced assets (such as land). Business investment is not an internationally recognised concept and it should not be used to make international comparisons, however, GFCF is an internationally recognised standard and is therefore internationally comparable. Please see A short guide to GFCF and business investment for more detailed information, including asset and sector hierarchies.

All investment data referred to in this bulletin are estimates of seasonally adjusted chained volume measures. To see a time series of the data please use our time series datasets.

The Business investment QMI was updated in January 2018 and includes updated information on the quality and methodology used in the production of business investment statistics.

Nôl i'r tabl cynnwys5. GFCF and business investment main figures

Table 1: Gross fixed capital formation and business investment headline figures by sector and by asset, UK, Quarter 1 (Jan to Mar) 2018, chained volume measure, seasonally adjusted

| % change | % change | £ million | ||

|---|---|---|---|---|

| Most recent quarter on previous quarter | Most recent quarter on same quarter a year earlier | Most recent level | ||

| Gross fixed capital formation | -1.3 | 1.5 | 85,609 | |

| Business investment | -0.4 | 2.0 | 47,711 | |

| General government | -6.2 | -1.6 | 12,628 | |

| GFCF by sector | Public corporations' dwellings | -18.9 | -34.1 | 1,471 |

| Public corporations' cost of ownership transfer on non-produced assets | -13 | 0.0 | 160 | |

| Private sector dwellings | 1.5 | 8.0 | 19,181 | |

| Private sector cost of ownership transfer on non-produced assets | -0.6 | -2.2 | 4,458 | |

| Transport equipment | 10.2 | -9.0 | 5,620 | |

| ICT equipment and other machinery and equipment | -1.4 | 6.3 | 15,715 | |

| GFCF by asset | Dwellings | -0.3 | 3.3 | 20,652 |

| Other buildings and structures and transfer costs | -4.3 | -2.2 | 27,638 | |

| Intellectual property products | -0.9 | 5.8 | 15,984 | |

| Source: Office for National Statistics | ||||

Download this table Table 1: Gross fixed capital formation and business investment headline figures by sector and by asset, UK, Quarter 1 (Jan to Mar) 2018, chained volume measure, seasonally adjusted

.xls (44.0 kB)6. Which sectors are contributing to the fall in GFCF in Quarter 1 2018?

Between Quarter 4 (Oct to Dec) 2017 and Quarter 1 (Jan to Mar) 2018, gross fixed capital formation (GFCF) fell by 1.3%, having last fallen in Quarter 4 2016 when it fell by 0.6%. This latest fall is the largest since Quarter 3 (July to Sept) 2015 when it fell by 2.1%.

On a sector basis, the largest negative contribution came from general government, which contributed negative 1.0 percentage point. Public corporations’ dwellings and business investment contributed negative 0.4 and negative 0.2 percentage points respectively.

Private sector dwellings was the only sector to have increased and contributed a positive 0.3 percentage points.

GFCF for public corporations’ transfer costs and private sector transfer costs was unchanged (Figure 1).

Figure 1: Contributions to growth in gross fixed capital formation by sector for Quarter 1 (Jan to Mar) 2018, chained volume measure, seasonally adjusted

Reference year: 2016, coverage: UK

Source: Office for National Statistics

Notes:

- The data in this chart covers Quarter 1 (Jan to Mar) 2018.

Download this chart Figure 1: Contributions to growth in gross fixed capital formation by sector for Quarter 1 (Jan to Mar) 2018, chained volume measure, seasonally adjusted

Image .csv .xlsBetween Quarter 1 2017 and Quarter 1 2018, GFCF increased by 1.5% with private sector dwellings contributing 1.7 percentage points. Business investment was the only other sector to have contributed positively, contributing 1.1 percentage points. The largest negative contribution came from public corporations’ dwellings, at negative 0.9 percentage points.

Nôl i'r tabl cynnwys7. Which assets are contributing to the fall in GFCF in Quarter 1 2018?

Four of the five gross fixed capital formation (GFCF) assets fell in Quarter 1 (Jan to Mar) 2018, contributing to the 1.3% decrease between Quarter 4 (Oct to Dec) 2017 and Quarter 1 2018. The largest of these was other buildings and structures and transfer costs, which contributed negative 1.4 percentage points. Information and communication technology (ICT) equipment and other machinery and equipment contributed negative 0.3 percentage points, intellectual property products (IPP) contributed negative 0.2 percentage points and dwellings contributed negative 0.1 percentage points (Figure 2).

Transport equipment provided the only positive contribution at 0.6 percentage points.

Figure 2: Contributions to growth in gross fixed capital formation by asset for Quarter 1 (Jan to Mar) 2018, chained volume measure, seasonally adjusted

Reference year: 2016, coverage: UK

Source: Office for National Statistics

Notes:

- The data in this chart covers Quarter 1 (Jan to Mar) 2018.

Download this chart Figure 2: Contributions to growth in gross fixed capital formation by asset for Quarter 1 (Jan to Mar) 2018, chained volume measure, seasonally adjusted

Image .csv .xlsBetween Quarter 1 2017 and Quarter 1 2018, the largest contributions to the 1.5% GFCF increase came from ICT equipment and other machinery and equipment, which contributed 1.1 percentage points, IPP, which contributed 1.0 percentage point and dwellings, which contributed 0.8 percentage points. Transport equipment, and other buildings and structures and transfer costs each contributed negative 0.7 percentage points.

Nôl i'r tabl cynnwys8. How has GFCF performed over a longer period?

Gross fixed capital formation (GFCF) is now 11.0% above the pre-economic downturn peak of Quarter 1 (Jan to Mar) 2008 and 34.3% above the level seen at the trough of the financial crisis in Quarter 2 (Apr to June) 2009.

The 1.3% fall in GFCF in Quarter 1 2018 is the first fall since Quarter 4 (Oct to Dec) 2016 when GFCF fell by 0.6%. This was followed by four consecutive quarters of growth in 2017 when the average increase was 1.0%. Quarter on same quarter a year ago growth remains positive, however, increasing by 1.5% in Quarter 1 2018, having last fallen in Quarter 1 2013 (Figure 3).

Figure 3: Quarterly levels and quarter-on-quarter growth of gross fixed capital formation, chained volume measure, seasonally adjusted. Quarter 1 (Jan to Mar) 2008 to Quarter 1 2018

Reference year: 2016, coverage: UK

Source: Office for National Statistics

Notes:

Q1 equals Quarter 1 (January to March), Q2 equals Quarter 2 (April to June), Q3 equals Quarter 3 (July to September), Q4 equals Quarter 4 (October to December).

The data in this chart covers Quarter 1 (Jan to Mar) 2008 to Quarter 1 2018.

Download this chart Figure 3: Quarterly levels and quarter-on-quarter growth of gross fixed capital formation, chained volume measure, seasonally adjusted. Quarter 1 (Jan to Mar) 2008 to Quarter 1 2018

Image .csv .xls9. What other information can tell us more about GFCF?

Developments in the housing market can be an important indicator of investment and wider activity in the economy. The estimates in this publication incorporate data consistent with Construction output in Great Britain: April 2018 and new orders January to March 2018, published on 11 June 2018.

The Construction output in Great Britain bulletin shows that construction fell by 2.7% in the three months to March 2018 and contracted in the month-on-month series by 2.3% in March 2018. Falls in private housing contrast with the private sector dwellings series for gross fixed capital formation (GFCF), which increased in Quarter 1 (Jan to Mar) 2018. This contrast, however, is due largely to conceptual differences and timing of recording. More information can be found in the article Conceptual differences between an aggregate of construction output measures and the GFCF dwellings measure, which was published in June 2013.

Nôl i'r tabl cynnwys10. Which assets are contributing to the fall in business investment in Quarter 1 2018?

Business investment fell by 0.4% between Quarter 4 (Oct to Dec) 2017 and Quarter 1 (Jan to Mar) 2018, the first fall since Quarter 1 2017 when it fell by 0.2%. With falls for other buildings and structures, other machinery and equipment within information and communication technology (ICT) equipment and other machinery and equipment, and software within intellectual property products, transport equipment was the only asset to have grown in this period (Figure 4).

Figure 4: Contributions to growth in business investment by asset for Quarter 1 (Jan to Mar) 2018

Reference year: 2016, coverage: UK

Source: Office for National Statistics

Notes:

The data in this chart covers Quarter 1 (Jan to Mar) 2018.

Series may not sum due to rounding.

Download this chart Figure 4: Contributions to growth in business investment by asset for Quarter 1 (Jan to Mar) 2018

Image .csv .xls11. How has business investment performed over a longer period?

The 0.4% fall in business investment in Quarter 1 (Jan to Mar) 2018 follows three consecutive quarter-on-quarter increases in 2017, business investment having last fallen in Quarter 1 (Jan to Mar) 2017. Growth for business investment on an annual basis has been falling since 2014, decreasing by 0.2% in 2016 but recovering in 2017, averaging 2.6% over the four years (Figure 5).

Business investment is now 13.7% above the pre-economic downturn peak of Quarter 1 2008 and 37.5% above the level seen at the lowest point of the economic downturn.

Figure 5: Quarterly levels and quarter-on-quarter growth of business investment, chained volume measure, seasonally adjusted, Quarter 1 (Jan to Mar) 2008 to Quarter 1 2018

Reference year: 2016, coverage: UK

Source: Office for National Statistics

Notes:

Q1 equals Quarter 1 (January to March), Q2 equals Quarter 2 (April to June), Q3 equals Quarter 3 (July to September), Q4 equals Quarter 4 (October to December).

The data in this chart covers Quarter 1 (Jan to Mar) 2008 to Quarter 1 2018.

Download this chart Figure 5: Quarterly levels and quarter-on-quarter growth of business investment, chained volume measure, seasonally adjusted, Quarter 1 (Jan to Mar) 2008 to Quarter 1 2018

Image .csv .xls12. Business investment in the wider economy

The Bank of England, in its most recent Agents’ summary of business conditions (PDF, 478KB), stated that investment intentions had “remained modest, reflecting continued uncertainty around Brexit”, however, it is noted that business services and manufacturing had positive investment intentions with some investing in “expanding capacity for exports, as well as in automation to counter rising labour costs”. Consumer service investment intentions, in contrast, “remained weak”.

The Bank of England also noted that the boost in net trade over the past 18 months should positively impact on business investment as exporters and those in the supply chain are encouraged to invest as a result. The Bank’s survey source concluded that “the drag on investment growth from Brexit uncertainty appeared to diminish” in the second half of 2017. For a more comprehensive analysis around Brexit and business investment, please see page 11 of the Bank of England’s latest inflation report.

Another important factor to consider when looking at business investment is the availability or supply of credit. Although the increase in Bank Rate in November 2017 pushed up the cost of borrowing, the cost of borrowing to firms remains low. The Bank of England’s Credit Conditions survey, however, reported demand for lending across firms of all sizes was unchanged in the first quarter of 2018.

Nôl i'r tabl cynnwys13. International comparisons of GFCF

In Quarter 1 (Jan to Mar) 2018, Germany had the strongest quarter-on-quarter growth in gross fixed capital formation (GFCF) of any G7 nation at 1.7%, followed by the United States of America (USA) at 1.4%, contrasting with a 1.3% fall in GFCF for the UK. The only other fall was 1.4% for Italy (Figure 6).

Canada had the strongest quarter on same quarter a year ago growth at 5.3%. The next largest quarter on same quarter a year ago growths were seen in the USA and Italy, where GFCF grew by 4.5% for each. The weakest growths in GFCF were those of the UK and Japan, which grew by 1.5% and 1.6% respectively.

Figure 6: Gross fixed capital formation growth for the G7 nations, for Quarter 1 (Jan to Mar) 2018, chained volume measure, seasonally adjusted

Reference year: 2016, coverage: UK

Source: Office for National Statistics (UK) and Organisation for Economic Co-operation and Development (OECD)

Notes:

- The data in this chart covers Quarter 1 (Jan to Mar) 2018.

Download this chart Figure 6: Gross fixed capital formation growth for the G7 nations, for Quarter 1 (Jan to Mar) 2018, chained volume measure, seasonally adjusted

Image .csv .xlsAverage quarterly growth in GFCF for the UK has been 0.6% since 2015 with GFCF for Italy, France and Germany each increasing by 0.8% on average in the same period, followed by the USA at 0.7%.

Since 2015, average quarter on same quarter a year ago growth for the UK has been 2.9% with Italy the only country to have performed more strongly at 3.2%.

For more comprehensive comparisons of GFCF, please refer to An international comparison of gross fixed capital formation published November 2017 and An analysis of investment expenditure in the UK and other Organisation for Economic Co-operation and Development nations published in May 2018.

The estimates quoted in this international comparison section are the latest available estimates at the time of preparation of this statistical bulletin and may have subsequently been revised.

Nôl i'r tabl cynnwys14. Revisions to GFCF and business investment

Revisions have been made to gross fixed capital formation (GFCF) and business investment back to 1997 in this release as part of the annual Blue Book changes and these are described in detail in sub-section Blue Book 2018 revisions – 1997 to 2016.

For 2017 and beyond, there will have been some impact from those changes introduced as part of the annual Blue Book update but there are also changes due to taking on revised source data for 2017 and Quarter 1 (Jan to Mar) 2018, in addition to revisions due to seasonal adjustment.

Revisions between Quarter 1 2017 and Quarter 1 2018

The 2.2 percentage points Quarter 1 2018 downward revision to GFCF growth was mainly due to the incorporation of improved estimates from central government departments and local government. Including this data led to a downwards revision to total GFCF in the other buildings and structures asset, in particular. The addition of these new data in Quarter 1 2018 also impacted the seasonal adjustment of that series, again affecting other buildings and structures, particularly in Quarter 1 2017, which saw a 0.4 percentage points revision to total GFCF.

In addition, the inclusion of new benchmark data for 2016 from the Annual Business Survey as well as revisions due to revised seasonal adjustment contributed to the revised quarterly profile of 2017, most notably affecting Quarter 1 2017 (Figure 7).

Revisions to private sector dwellings and public corporations’ dwellings for Quarter 4 (Oct to Dec) 2017 and Quarter 1 2018 were mainly a result of the reclassification of English housing associations as described in the section Changes in this release.

Figure 7: Quarterly gross fixed capital formation growth compared with previously published GFCF growth,

chained volume measure, seasonally adjusted, Quarter 1(Jan to Mar) 2017 to Quarter 4 Oct to Dec) 2017, reference year: 2016, coverage: UK

Source: Office for National Statistics

Notes:

Q1 equals Quarter 1 (January to March), Q2 equals Quarter 2 (April to June), Q3 equals Quarter 3 (July to September), Q4 equals Quarter 4 (October to December).

The data in this chart covers Quarter 1 (Jan to Mar) 2015 to Quarter 4 (Oct to Dec) 2017.

Download this chart Figure 7: Quarterly gross fixed capital formation growth compared with previously published GFCF growth,

Image .csv .xlsThe 0.2 percentage points downward revision to business investment growth in Quarter 1 2018 was due mainly to downward revisions from later data for other machinery and equipment, and intellectual property products, particularly software data.

Other machinery and equipment was also the largest contributing cause of the revisions to Quarter 1 2017 and Quarter 2 (Apr to June) 2017, which revised downwards and upwards by 0.5 percentage points in each quarter respectively (Figure 8).

Figure 8: Quarterly business investment growth compared with previously published business investment growth

Chained volume measure, seasonally adjusted, Quarter 1 (Jan to Mar) 2017 to Quarter 4 (Oct to Dec) 2017, reference year: 2016, coverage: UK

Source: Office for National Statistics

Notes:

Q1 equals Quarter 1 (January to March), Q2 equals Quarter 2 (April to June), Q3 equals Quarter 3 (July to September), Q4 equals Quarter 4 (October to December).

The data in this chart covers Quarter 1 (Jan to Mar) 2015 to Quarter 4 (Oct to Dec) 2017.

Download this chart Figure 8: Quarterly business investment growth compared with previously published business investment growth

Image .csv .xlsBlue Book 2018 revisions – 1997 to 2016

Once a year, in line with the National Accounts Revisions Policy, the GFCF dataset is opened for revision to much earlier periods as part of the national accounts annual Blue Book publication. This year, revisions to GFCF have been taken back to 1997. Revisions are broadly due to the following:

methodology changes

standard updates to data sources

standard updates to statistical processes

Summary of impacts

The average revision to GFCF growth between 1997 and 2016 is 0.3 percentage points. The largest revision is in 2001, with growth revising up 1.4 percentage points. The largest downward revision is in 2010 (negative 0.4 percentage points). This is one of just two downward revisions to growth for GFCF.

For business investment, the average revision to growth is 0.4 percentage points, with a maximum of 2.1 percentage points in 2001. The largest downward revision is negative 0.6 percentage points in 2010. This is one of six negative revisions between 1997 and 2016.

In quarterly terms, growth in GFCF from the end of the economic downturn to the end of 2016 has remained unchanged at 30.8%. For business investment over the same period, growth has been revised up from 34.8% to 35.0%.

The following sections describe the impact of the methodological changes, data source changes and seasonal adjustment review. Annex A gives the impact of each of those changes for the years 1997 to 2015. Revisions to the quarterly path of GFCF can be found in the Gross fixed capital formation – by sector and asset dataset accompanying this release.

Methodology changes – asset level

ICT equipment and other machinery and equipment

As first announced in the provisional estimate of business investment in Quarter 4 2017, a correction in Blue Book 2017 to remove double-counting of purchased software was not fully implemented. This is because a counterpart adjustment to information and communication technology (ICT) equipment and other machinery and equipment was not applied. This adjustment was needed to reflect the fact that the data being used in the double-counting of purchased software was in fact other machinery and equipment data, which had not been reallocated following a change to the data source.

This has now been corrected, resulting in an upward revision to ICT equipment and other machinery and equipment. The magnitude of the revision is larger from 2001 onwards because the size of the double-counting identified was largest from 2001 onwards.

Discovery of this omission came from quality assurance of another change relating to ICT equipment and other machinery and equipment introduced in the Blue Book 2018-consistent dataset.

Prior to 2015, survey data used to estimate this asset did not distinguish between “ICT equipment” and “other machinery and equipment”. Following a data coherence check between GFCF data and supply use data, changes were made to the asset composition, with more ICT equipment being recognised and less other machinery and equipment.

Dwellings

English housing associations were reclassified from private non-financial corporations (PNFCs) to public corporations in Blue Book 2017. This affected the sector breakdown from Quarter 2 (Apr to June) 2008 onwards, but had no impact at the total GFCF level. A further reclassification decision was taken in time for Blue Book 2018, which treated housing associations in the devolved administrations (Scotland, Wales and Northern Ireland) in the same way and so has been implemented in this Blue Book 2018-consistent GFCF dataset. It should be noted that further legislation has changed the treatment of English housing associations again in 2017. This is described in the section Changes in this release.

Methodology changes – sector level

Rail for London

In Blue Book 2018, the reclassification of Rail for London from the local government sector to the public corporations sector has been implemented. This change is effective from Quarter 2 (Apr to June) 2008. From 2013 onwards, the change between sectors is equal and offsetting. Between 2008 and 2012, other data changes have revised the level of GFCF by an average of £0.2 billion.

For more information about all the described changes, including how they have been treated in other parts of the national accounts, please refer to the Sector accounts article and GDP/ and Blue Book articles.

Regular updates to data sources

In compiling estimates of GFCF, the Annual Business Survey (ABS) is used to create annual benchmark figures for investment by many industries. The Blue Book 2018-consistent GFCF dataset includes 2016 benchmarks for the first time, as well as revisions to benchmarks previously used for 2014 and 2015.

Estimates of general government investment have also been updated from 2015 as more data have become available. Other data sources have been updated, including sources of dwellings and construction data.

Regular seasonal adjustment review

Each year, the seasonal adjustment models used in the processing of GFCF data are reviewed to ensure they are still appropriate following revisions to the data. Changes to seasonal adjustment models following this review have revised data back to 1997. The impact of the new seasonal adjustment models will be most noticeable in the ICT equipment and other machinery and equipment series because of the change in asset allocation previously discussed.

Update to reference year

As happens in every Blue Book update, the reference year used in the calculation of chained volume measures (CVM) has been moved on, from 2015 and 2016. This will generally cause an upward revision to the level of GFCF in CVM, but does not impact growth rates.

Annual input-output table balancing

As part of the Blue Book process, the three measures of GDP are compared and balanced using input-output tables. This process ensures that the three measures are consistent and economically plausible. As a result of this process, changes to the annual level of GFCF have been made from 1997. These values can be seen in Annex A.

What do these changes mean for GFCF?

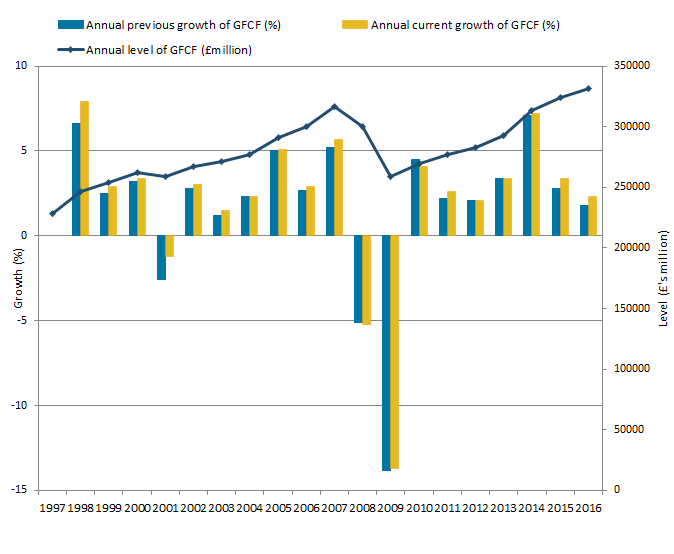

The annual path of GFCF is largely the same as previous estimates. The largest annual revision is in 2001, where growth is less negative than previously reported, increasing by 1.4 percentage points to negative 1.2%. This is a consequence of implementing the counterpart adjustment to the purchased software correction in ICT equipment and other machinery and equipment (Figure 9).

Figure 9: Annual levels and annual growth of gross fixed capital formation, chained volume measure, seasonally adjusted, 1997 to 2016

Reference year: 2016 Coverage: UK.

Source: Office for National Statistics

Notes:

- The data in this chart covers 1997 to 2016.

Download this image Figure 9: Annual levels and annual growth of gross fixed capital formation, chained volume measure, seasonally adjusted, 1997 to 2016

.png (19.4 kB) .xlsx (19.9 kB)The next largest revision to growth is in 1998, with growth revised up 1.3 percentage points to 7.9%. This revision is caused by the reallocation of data from other machinery and equipment to ICT equipment. The price index used to deflate ICT equipment is much stronger than those used for other machinery in the earlier periods of the dataset, resulting in higher levels of CVM data than previously reported. The reallocation is particularly impactful in earlier periods, with the movement from other machinery to ICT being larger. Over time, the ICT deflators fall to levels more in line with those used for other machinery and so the impact is not as large.

Growth in 2015 and 2016 has been revised upwards by 0.6 and 0.5 percentage points respectively. In 2015, this is the result of an upward revision to general government data, which has a less negative impact on growth than previously estimated. In 2016, the upward revision to GFCF is due to upward revisions to business investment (negative 0.5% to negative 0.2%) and private sector dwellings (6.9% to 9.1%). These revisions are largely coming from the revised Annual Business Survey benchmarks and revised source data for the number of new dwellings constructed in the period.

Changes in the quarterly profile of GFCF can be seen in the Gross fixed capital formation – by sector and asset dataset accompanying this release.

What do these changes mean for business investment?

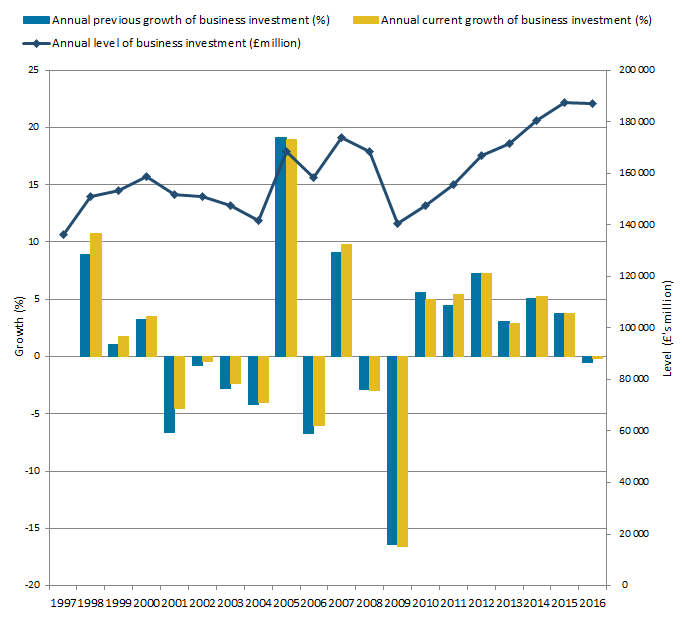

As with GFCF, on an annual basis, these changes have not significantly impacted the path of business investment from 1997 to 2016, with general weakness in the early 2000s punctuated by occasional periods of growth before the downturn of 2008 and 2009. The subsequent recovery is broadly unchanged, with growth in 2010 being 0.6 percentage points weaker than previously reported, and 0.9 percentage points stronger in 2011 (Figure 10).

Figure 10: Annual levels and annual growth of business investment, chained volume measure, seasonally adjusted, 1997 to 2016

Reference year: 2016 Coverage: UK

Source: Office for National Statistics

Notes:

- The data in this chart covers 1997 to 2016.

Download this image Figure 10: Annual levels and annual growth of business investment, chained volume measure, seasonally adjusted, 1997 to 2016

.png (28.3 kB) .xlsx (22.1 kB)The largest changes to growth are in 2001 and 1998 (revisions of 2.1 and 1.8 percentage points respectively). These revisions are a consequence of the changes to ICT equipment and other machinery and equipment described previously. Business investment in 2016 is less negative than previously reported, due mainly to the introduction of new ABS benchmark data for 2016.

Changes in the quarterly profile of business investment can be seen in the Gross fixed capital formation – by sector and asset dataset accompanying this release.

Nôl i'r tabl cynnwys16. Quality and methodology

The Business investment Quality and Methodology Information (QMI) report contains important information on:

the strengths and limitations of the data and how it compares with related data

uses and users

how the output was created

the quality of the output including the accuracy of the data

The changes signposted in this bulletin have not yet been reflected in either the Quarterly Acquisitions and Disposals of Capital Assets Survey QMI or the Business investment QMI, but changes will be incorporated into revised QMIs in the future. We recently updated the Business investment QMI on 30 January 2018.

Adjustments

Large capital expenditure tends to be reported later in the data collection period than smaller capital expenditure. This means that larger expenditures are often included in the revised (month 3) results, but are not reported in time for the provisional (month 2) results, leading to a tendency towards upward revisions in the later estimates for business investment and gross fixed capital formation (GFCF). Following investigation of the impact of this effect, from Quarter 3 (July to Sept) 2013, in the provisional estimate a bias adjustment is introduced to business investment and its components. The bias adjustment has been removed in this revised release.

Survey response rates

Table 2 presents the provisional (month 2) and revised (month 3) response rates for the Quarterly Acquisitions and Disposals of Capital Assets Survey (QCAS). The estimates in this release are based on the Quarter 1 (Jan to Mar) 2018 revised survey results.

Table 2: UK response rates for quarterly acquisitions and disposals of capital assets survey for Quarter 4 (Oct to Dec) 2015 to Quarter 1 (Jan to Mar) 2018

| At month 2 (provisional) | At month 3 (revised) | ||||||

|---|---|---|---|---|---|---|---|

| Period | Survey response rates/% | Period | Survey response rates/% | ||||

| 2015 | Q4 | 68.6 | 2015 | Q4 | 89.8 | ||

| 2016 | Q1 | 69.2 | 2016 | Q1 | 89.4 | ||

| Q2 | 71.4 | Q2 | 89.1 | ||||

| Q3 | 72.8 | Q3 | 83.5 | ||||

| Q4 | 68.5 | Q4 | 84.5 | ||||

| 2017 | Q1 | 68.2 | 2017 | Q1 | 82.8 | ||

| Q2 | 70.8 | Q2 | 89.6 | ||||

| Q3 | 69.7 | Q3 | 88.1 | ||||

| Q4 | 69.6 | Q4 | 83.6 | ||||

| 2018 | Q1 | 68.1 | 2018 | Q1 | 83.3 | ||

| Source: Office for National Statistics | |||||||

| Notes: | |||||||

| 1. Q1 is Quarter 1 (Jan to Mar) | |||||||

| 2. Q2 is Quarter 2 (Apr to June) | |||||||

| 3. Q3 is Quarter 3 (July to Sept) | |||||||

| 4. Q4 is Quarter 4 (Oct to Dec) | |||||||

Download this table Table 2: UK response rates for quarterly acquisitions and disposals of capital assets survey for Quarter 4 (Oct to Dec) 2015 to Quarter 1 (Jan to Mar) 2018

.xls (44.5 kB)17. Annex A: Impact of changes introduced at Blue Book 2018

Table 3: Impact of changes introduced at Blue Book 2018 on years 1997 to 20151,2,3

| All figures £ billion unless stated, current price | ||||||||||||||

| Year | Blue Book 2018 Changes | Total nominal GFCF revision | Level of GFCF at Blue Book 2018 (£ million) | Change in the level of GFCF | Blue Book 2017 growth | Blue Book 2018 growth | Percentage point revision | |||||||

| Rail for London | Housing Association | Input - Output tables | Government | ICT and Machinery1 Adjustment | Regular updates to data sources | |||||||||

| 1997 | 0.0 | 0.0 | -0.6 | 0.0 | 0.7 | 0.0 | 0.1 | 165,091 | 0.1% | |||||

| 1998 | 0.0 | 0.0 | -0.6 | 0.0 | 1.5 | 0.0 | 0.9 | 177,509 | 0.5% | 7.1% | 7.5% | 0.4 | ||

| 1999 | 0.0 | 0.0 | -0.8 | 0.0 | 1.7 | 0.0 | 0.9 | 184,709 | 0.5% | 4.0% | 4.1% | 0.1 | ||

| 2000 | 0.0 | 0.0 | -0.2 | 0.0 | 1.7 | 0.0 | 1.5 | 195,840 | 0.8% | 5.8% | 6.0% | 0.2 | ||

| 2001 | 0.0 | 0.0 | 0.1 | 0.0 | 4.2 | 0.0 | 4.3 | 198,659 | 2.2% | 0.0% | 1.4% | 1.4 | ||

| 2002 | 0.0 | 0.0 | 0.0 | 0.0 | 4.0 | 0.0 | 4.0 | 208,349 | 2.0% | 5.1% | 4.9% | -0.2 | ||

| 2003 | 0.0 | 0.0 | -0.1 | 0.0 | 4.1 | 0.0 | 4.0 | 214,162 | 1.9% | 2.8% | 2.8% | 0.0 | ||

| 2004 | 0.0 | 0.0 | -0.2 | 0.0 | 3.9 | 0.0 | 3.7 | 222,779 | 1.7% | 4.2% | 4.0% | -0.2 | ||

| 2005 | 0.0 | 0.0 | -0.6 | 0.0 | 3.9 | 0.0 | 3.3 | 238,414 | 1.4% | 7.3% | 7.0% | -0.3 | ||

| 2006 | 0.0 | 0.0 | -0.4 | 0.0 | 4.0 | 0.0 | 3.6 | 254,785 | 1.4% | 6.9% | 6.9% | 0.0 | ||

| 2007 | 0.0 | 0.0 | -0.1 | 0.0 | 4.4 | 0.0 | 4.3 | 275,664 | 1.6% | 8.0% | 8.2% | 0.2 | ||

| 2008 | 0.2 | 0.0 | -0.4 | 0.0 | 4.1 | 0.0 | 3.9 | 270,878 | 1.5% | -1.6% | -1.7% | -0.1 | ||

| 2009 | 0.1 | 0.0 | 0.3 | 0.0 | 3.3 | 0.0 | 3.7 | 237,187 | 1.6% | -12.6% | -12.4% | 0.2 | ||

| 2010 | 0.3 | 0.0 | -0.9 | 0.0 | 3.7 | 0.0 | 3.1 | 245,284 | 1.3% | 3.8% | 3.4% | -0.4 | ||

| 2011 | 0.4 | 0.0 | -0.7 | 0.0 | 4.3 | 0.0 | 4.0 | 255,410 | 1.6% | 3.8% | 4.1% | 0.3 | ||

| 2012 | 0.1 | 0.0 | -0.3 | 0.0 | 4.4 | 0.0 | 4.2 | 267,032 | 1.6% | 4.5% | 4.6% | 0.1 | ||

| 2013 | 0.0 | 0.0 | -0.4 | 0.0 | 4.6 | 0.0 | 4.2 | 281,407 | 1.5% | 5.5% | 5.4% | -0.1 | ||

| 2014 | 0.0 | 0.0 | -0.1 | 0.0 | 5.0 | -0.1 | 4.8 | 305,747 | 1.6% | 8.6% | 8.6% | 0.0 | ||

| 2015 | 0.0 | 0.0 | -0.2 | 0.5 | 4.1 | 1.8 | 6.2 | 319,432 | 2.0% | 4.1% | 4.5% | 0.4 | ||

| Source: Office for National Statistics | ||||||||||||||

| Notes: | ||||||||||||||

| 1. ICT equipment and other machinery and equipment | ||||||||||||||

| 2. Components may not sum to totals due to rounding | ||||||||||||||

| 3. Due to processing constraints, it has not been possible to separately identify the impacts of these changes in sufficient detail after 2015 to include in this table | ||||||||||||||