Cynnwys

- Introduction

- Background to public sector finances

- Public sector net debt excluding public sector banks and Bank of England (PSND ex BoE)

- Public sector net financial liabilities (PSNFL ex)

- Time series

- Data quality (sources and coverage)

- Concluding remarks

- Annex A: Public sector balance sheet

- Annex B: Composition of the public sector

- Annex C: Estimates of PSND ex BoE

- Annex D: Estimates of PSNFL ex

- Annex E: Sectoral breakdown of PSNFL ex

- Annex F: Reconciliation of PSND ex and PSNB ex with PSNFL ex

1. Introduction

On 4 August 2016, the Bank of England’s Monetary Policy Committee announced a package of new measures to support the economy. This package included an expansion of the Asset Purchase Facility (APF) and included a new initiative called the Term Funding Scheme (TFS). On 21 October 2016, the Office for National Statistics (ONS) announced its decision concerning the classification of the TFS in the public sector finances. The effect of the TFS, and other APF schemes, is to increase public sector net debt (PSND ex), the government’s target measure for debt.

The impact of the TFS and other APF schemes on the public sector balance sheet is not fully captured in PSND. The government’s 2016 Autumn Statement, published on 23 November 2016, therefore includes 2 new supplementary fiscal aggregates to provide additional commentary on the state of the public sector balance sheet and context for the key fiscal metric of public sector net debt. The 2 new supplementary fiscal aggregates are:

- public sector net debt excluding public sector banks and the Bank of England (PSND ex BoE)

- public sector net financial liabilities (PSNFL)

This methodology paper defines PSND ex BoE and PSNFL and explains the coverage of the aggregates and, in broad terms, what they represent. It also discusses the quality of the different data sources underpinning the new aggregates and provides first estimates of their values.

As PSNFL is much wider in concept than PSND ex (the metric used for the main fiscal target) the initial estimates presented in this paper will be subject to revision as the additional data sources required to compile PSNFL are subject to a process of review and quality assurance. Indeed, the process of greater scrutiny for a metric typically improves the quality of the data on which it is based. This methodology paper also provides initial indications of the work that ONS will be undertaking over the next 12 months to further improve the PSNFL estimates contained within this paper.

Outturn estimates for the new supplementary aggregates will be incorporated from next month, December 2016, as part of the monthly public sector finances bulletin and associated datasets published jointly by ONS and HM Treasury.

Nôl i'r tabl cynnwys2. Background to public sector finances

Public sector finances (PSF) statistics are compiled and published monthly in the public sector finances statistical bulletin which aims to provide users with an indication of the current state of the UK government’s fiscal position. PSF statistics are published jointly by the Office for National Statistics (ONS) and HM Treasury. HM Treasury is responsible for UK fiscal policy and for defining the fiscal aggregates required to be monitored in the PSF. ONS is responsible for compiling the statistical measures presented in the PSF and for ensuring their compilation conforms to statistical standards. Full details of each organisation’s responsibilities and accountabilities are set out and published on the ONS website.

The PSF statistics are compiled in accordance with national accounts concepts and rules, following the European System of Accounts 2010 (ESA 2010) and associated guidance. In accordance with these principles, the PSF statistics report all UK public sector revenue and expenditure with the difference between the total revenue and expenditure being known as the public sector net borrowing (PSNB). Revenue and expenditure flows which are constituents of PSNB are recorded at the point in time when the related economic activity takes place; that is according to ESA 2010 “when economic value is created, transformed or extinguished, or when claims and obligations arise, are transformed or are cancelled”. This means that expenditure and revenue which are contingent on the occurrence of future events, such as calls on guarantees or future pension payments are not recorded in PSNB. Similarly contingent assets and liabilities are not recorded, under national accounts, in the balance sheet. Although the national accounts recognises all non-contingent assets and liabilities not all are used in the compilation of the public sector net debt (PSND) or reported in the PSF statistics. Annex A provides more detail on the different elements of the public sector balance sheet.

The UK public sector is composed of both government bodies (in central and local government) and public corporations. The PSF statistics do not only provide public sector total figures but also provide separate figures for each component subsector, recognising 5 such subsectors:

- central government

- local government

- public corporations (excluding the Bank of England and public sector banks)

- the Bank of England

- public sector banks

Although the PSF statistics provide an overview of the entire public sector the UK government’s fiscal framework focuses on the public sector excluding public sector banks. This is reflected in the fiscal metrics of PSNB ex and PSND ex, where the “ex” refers to excluding public sector banks. Annex B provides more detail on the relationship between the different subsectors and brief background on the ex measures.

Nôl i'r tabl cynnwys3. Public sector net debt excluding public sector banks and Bank of England (PSND ex BoE)

As explained in section 2 and Annex B, the boundary used in the fiscal aggregates (most notably PSND ex and PSNB ex) is that of the public sector excluding public sector banks. This means that transactions and stocks related to the Bank of England (and its operations) are included in PSNB ex and PSND ex, respectively. The Bank of England is not only responsible for issuing banknotes but also for maintaining monetary and financial stability in the UK. One of the key tools used by the Bank is the Asset Purchase Facility Fund (APF). Of all the Bank of England operations it is the APF that currently has the biggest impact on the fiscal aggregates of PSNB ex and PSND ex. The impacts arise from both the APF’s quantitative easing operations and through the recently announced Term Funding Scheme.

To illustrate the contribution of Bank of England interventions to the evolution of public sector net debt, the 2016 Autumn Statement included a supplementary aggregate of public sector net debt excluding both public sector banks and the Bank of England (PSND ex BoE).

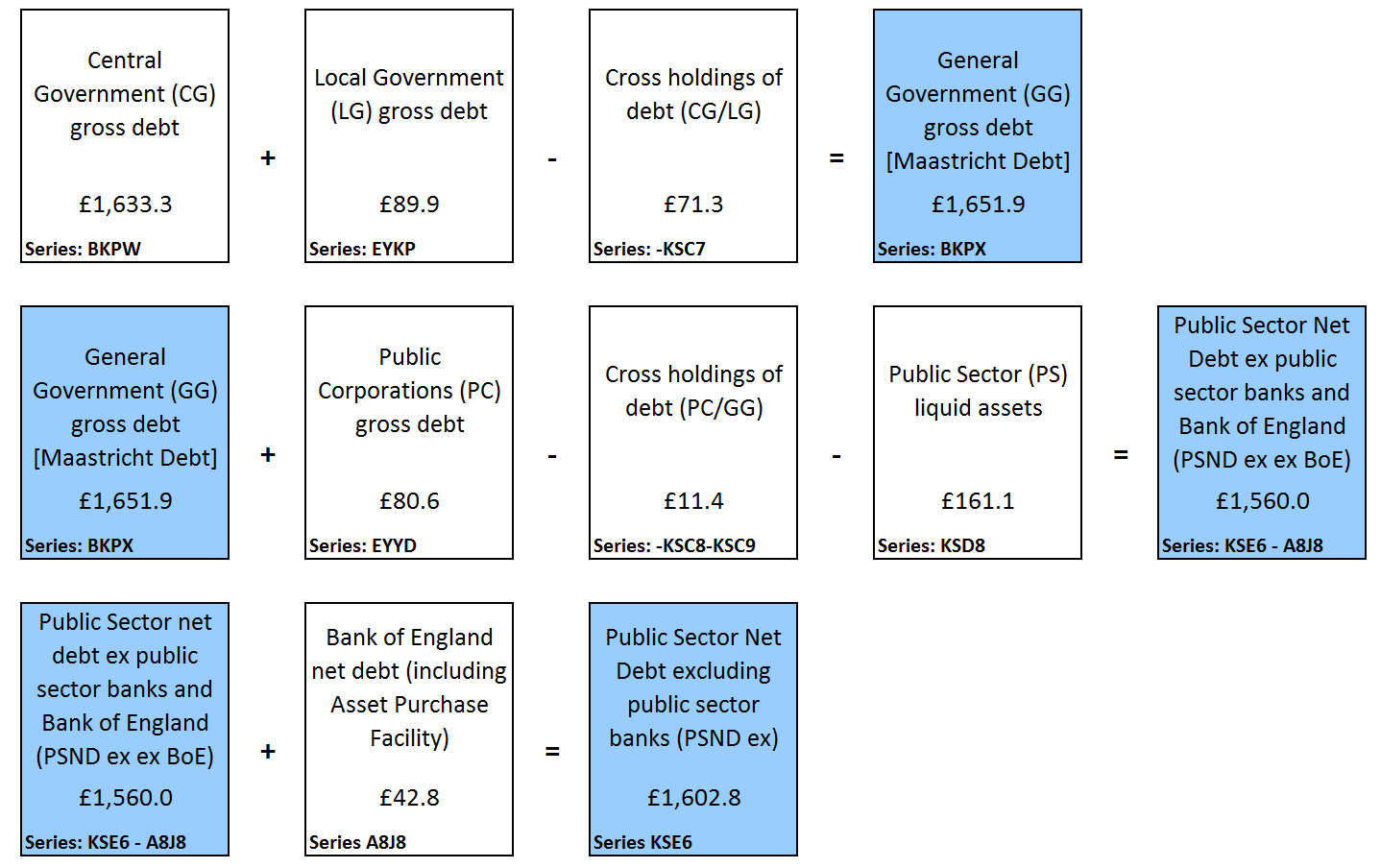

Although PSND ex BoE is not currently published in the monthly public sector finances it can easily be derived from published information in the bulletin, as can the corresponding borrowing aggregate PSNB ex BoE. The derivation of PSND ex BoE can be seen in Figure 1.

Figure 1: Components of PSND ex BoE (data are as at end of 2015/161) UK £ billion

Source: Office for National Statistics

Notes:

- Data in figure are consistent with those published in the PSF bulletin on 21 October 2016.

Download this image Figure 1: Components of PSND ex BoE (data are as at end of 2015/16^1^) UK £ billion

.png (81.9 kB) .xls (129.5 kB)Since the APF began operation in 2009 PSND ex BoE has usually been lower than PSND ex, and was £43 billion lower as of the end of the financial year ending in March 2016. The reason for this is that the APF incurs debt as a result of its purchases of gilts and, following the August 2016 announcement, corporate bonds. These purchases are funded through the creation of central bank reserves which creates a Bank of England liability equal to the value of the central bank reserves created.

When the APF purchases corporate bonds (financed by the creation of central bank reserves) then the total borrowing required to fund these purchases impacts on PSND ex as the corporate bonds held by the APF are not considered liquid assets. In the more common case, where the APF purchases gilts on the secondary market, there is still an increase in APF debt (albeit a smaller one) of the difference between the purchase price of the gilts and the face value of those same gilts. This is because debt liabilities are recorded in PSND ex at face (or redemption) value. The purchase of gilts from the private sector effectively extinguishes those liabilities (whilst they remain within the public sector) at face value but replaces them with the liability relating to the creation of central bank reserves.

The net debt of the APF is reduced as a result of the interest it receives in relation to its holdings of gilts and corporate bonds. The impact of these interest payments is to accumulate cash in the APF which, as a liquid asset, reduces PSND ex. However, in recent years the Bank of England has been transferring the accumulated cash from the APF to HM Treasury which has helped reduce government financing, and so government debt, but increased the APF debt.

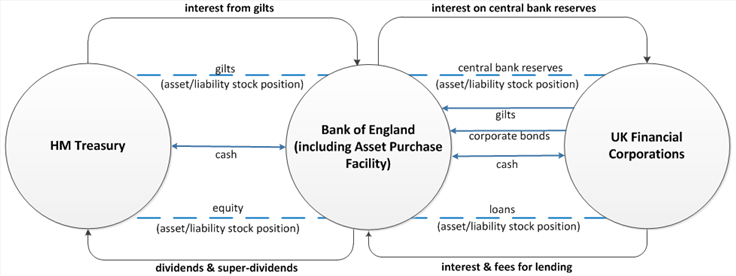

Figure 2: Transactions and stock cross-holdings between HM Treasury, Bank of England and the UK financial sector

Source: Office for National Statistics

Download this image Figure 2: Transactions and stock cross-holdings between HM Treasury, Bank of England and the UK financial sector

.png (57.9 kB)The new Term Funding Scheme (TFS), announced by the Bank of England’s Monetary Policy Committee in August 2016, operates as part of the APF and, as with the purchase of gilts and corporate bonds, the lending conducted by the TFS is financed through the creation of central bank reserves. The Office for National Statistics (ONS) reviewed the operation of the TFS and concluded that for the purposes of economic statistics the lending of the TFS should be recorded as long-term loans. As loans are not liquid assets the impact of the TFS on the net debt of the Bank of England (and PSND ex) is to increase it by the value of the lending being provided through the TFS. As with the purchase of corporate bonds the net debt will be partially offset by the interest or fees received, under the terms of the lending. As at the end of October 2016, £1.3 billion in loans had been provided to financial institutions but the Bank of England has indicated that the value of lending in the TFS could reach £100 billion.

Nôl i'r tabl cynnwys4. Public sector net financial liabilities (PSNFL ex)

The net impact of the Bank of England’s Asset Purchase Facility (APF) schemes on the public sector balance sheet are not fully captured in either PSND ex or PSND ex BoE. This is because, as explained in section 3 and Annex A, public sector net debt does not capture the non-liquid assets purchased by the APF. To reflect more fully the public sector balance sheet position, with respect to not only the APF but also other public sector operations, the 2016 Autumn Statement introduced a new supplementary aggregate of public sector net financial liabilities (PSNFL). PSNFL is a more comprehensive measure of the public sector balance sheet which captures a wider range of financial assets and liabilities than recorded in PSND ex.

PSNFL is very similar to the national accounts concept of public sector net financial worth (PSNFW). The only difference between the 2 aggregates is that in PSNFL the deposit, loan and debt security liabilities are recorded at face value whereas in PSNFW these assets and liabilities are recorded at market value. In general, any difference between market and face value for deposit and loan liabilities will be small but there can be a significant difference between the market and face value of gilts and other debt securities. Latest Office for National Statistics (ONS) estimates indicate that the market value of government debt securities in issuance at the end of March 2016 was nearly £300 billion higher than the face value of those debt securities.

The market value provides information on what a creditor could realise in any particular month by selling their assets. It takes into account a large number of factors including the perceptions of repayment risk, market interest rates, the liquidity of the market and the risk aversion of the potential purchasers. By contrast face value provides information on what a debtor owes, only reflecting what will need to be repaid at maturity. In the context of government debt and fiscal sustainability measures, debt securities are most commonly recorded at face (or nominal) value as this more closely reflects the financing requirements of government. Movements in the market value of gilts can be difficult to interpret, sensitive as they are to external circumstances and market perceptions. The market value can fluctuate significantly from month to month with no, or little, change to the face value of the debt. For these reasons PSNFL ex includes the liability of debt instruments (such as gilts and loans) at face value. This approach is also consistent with the recommendations of the 2013 Review of PSF statistics. This Review recommended maintaining international comparability where possible (see Annex B for more details). Within the European Union, the Maastricht debt and deficit aggregates are used to measure and compare the fiscal position of countries. Maastricht debt records all component debt liabilities (deposits, loans and debt securities) at face value. The face value approach to PSNFL ex debt liabilities therefore promotes comparability and transparency between the 2 different fiscal frameworks.

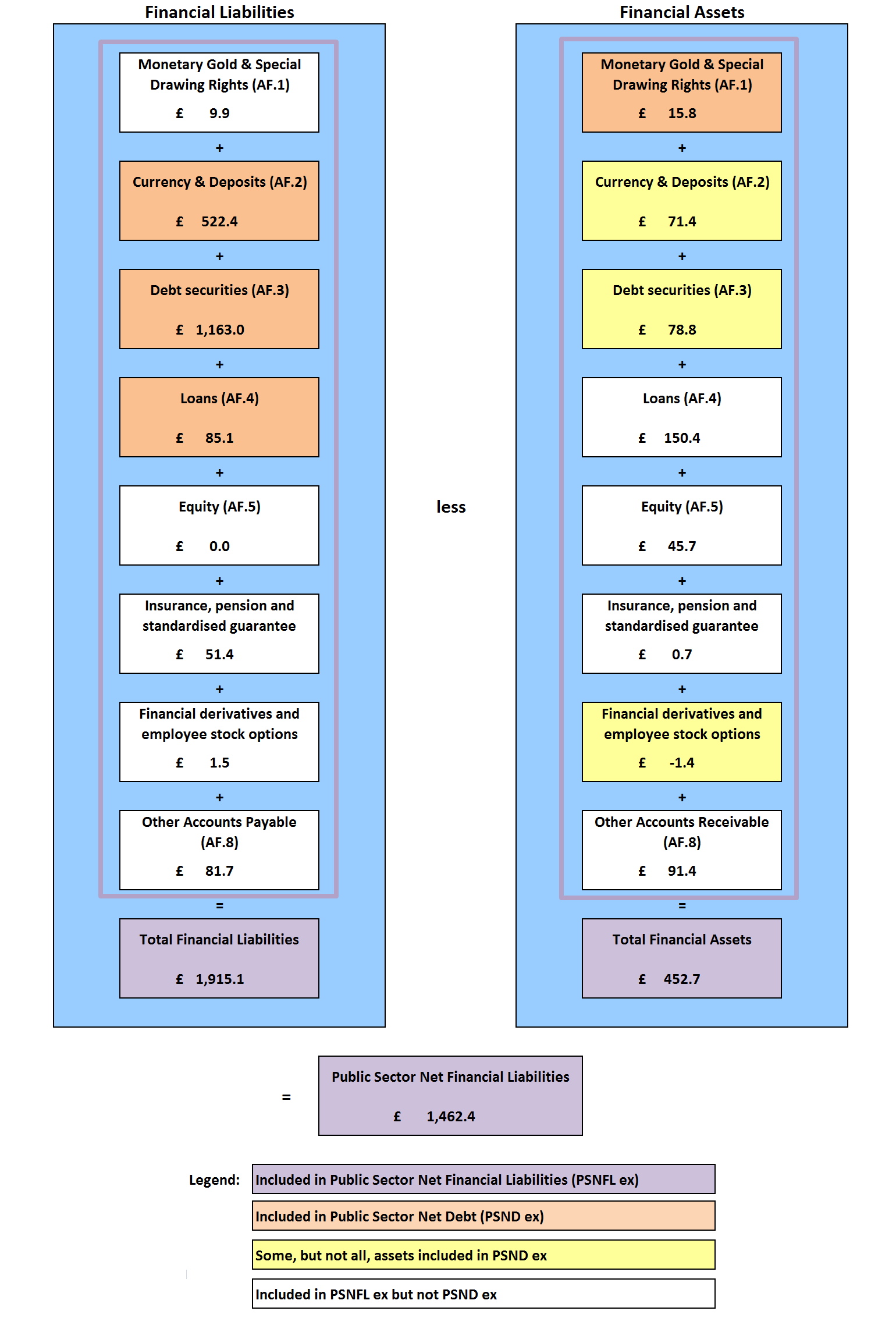

Figure 3 compares and contrasts the components of PSND ex and PSNFL ex and includes our initial estimates for the size of the different components as at the end of the financial year ending in March 2016. It should be noted that the boundary of the PSNFL ex supplementary fiscal aggregate, like PSND ex, excludes the public sector banks. To maintain consistency in notation, we are therefore referring to the supplementary fiscal aggregate as PSNFL ex.

Table 1 provides summary descriptions of each of the financial assets and liabilities that are included in PSNFL ex, as well as examples of the different assets and liabilities, and information about the valuation used for each of the assets and liabilities in PSNFL ex.

Table 1: Component financial instruments of PSNFL ex, UK

| asset / liability type | asset / liability description | valuation basis in PSNFL ex | ||

| Monetary gold and SDRs (AF.1) | Gold bullion and special drawing rights (SDRs) which are international reserves created by the International Monetary Fund (IMF) and which are allocated to its members to supplement existing reserves. | Market | ||

| Assets: gold and SDR assets held in the official reserves | ||||

| Liabilities: SDR allocations recorded as liabilities in the official reserves | ||||

| Currency and deposits (AF.2) | Currency and non-negotiable deposits, in both sterling and foreign currencies. | Nominal / Face: (proxy for market for non-negotiable instruments) | ||

| Assets: public sector deposits with UK and overseas financial institutions | ||||

| Liabilities: coins in circulation (a liability of central government), banknotes in circulation (a liability of the Bank of England), household and corporate deposits with public sector institutions, such as National Savings and Investment | (Foreign currency deposits are recorded at the latest foreign exchange rate) | |||

| Debt securities (AF.3) | Negotiable financial instruments, which usually pay interest and have fixed dates of issuance and maturity/redemption. | Assets: Market | ||

| Assets: corporate bonds and bills held by public sector bodies | Liabilities: Face (redemption value) | |||

| Liabilities: gilts (government bonds), treasury bills, public sector corporate bonds (such as those of Network Rail) | ||||

| Loans (AF.4) | Non-negotiable financial instruments, which are usually-interest bearing and which have to be repaid at maturity. | Assets: Nominal (principal plus accrued interest) (proxy for market for non-negotiable instruments) | ||

| Assets: lending from public sector bodies to households and private sector corporations (such as student loans and housing loans) | Liabilities: Face (principal) | |||

| Liabilities: lending of public sector bodies from financial institutions (such as bank loans) | ||||

| Equity (AF.5) | Residual claims on the assets of corporations through share holdings or ownership. | Market | ||

| Assets: shares held by government in corporations such as Royal Mail, Lloyds Banking Group and Royal Bank of Scotland | ||||

| Liabilities: none | ||||

| Insurance, pensions, standardised guarantees (AF.6) | Net pension liabilities for funded public sector pension schemes. Non-life insurance technical reserves. Provisions for calls under standardised guarantees. | Pensions: Market for assets and actuarial valuation for liabilities | ||

| Assets: solely relate to insurance technical reserves of some local government bodies | Standardised guarantees and Insurance: Market for assets and actuarial valuation (or similar) for liabilities | |||

| Liabilities: dominated by net pension liabilities of the Local Government Pension Schemes (LGPS). Other public sector funded pension schemes have yet to be implemented in the figures. In recent years there are very small amounts of liabilities relating to provisions for the mortgage guarantees provided under the Help to Buy scheme. | ||||

| Financial derivatives (AF.7) | Financial instruments linked to financial or non-financial assets or to an index where the value is derived from the underlying asset or index. | Market | ||

| Assets/Liabilities: largely relate to financial derivatives used for debt management and management of the official reserves. | ||||

| Accounts receivable/payable (AF.8) | Financial assets and liabilities created as counterparts to transactions where there is a timing difference between these transactions and the corresponding payments. | Nominal: (proxy for market for non-negotiable instruments) | ||

| Assets: where a public sector body has recorded a revenue transaction but the related cash has not yet been received | ||||

| Liabilities: where a public sector body has recorded an expenditure transaction but the related cash has yet to be paid | ||||

| Source: Office for National Statistics | ||||

Download this table Table 1: Component financial instruments of PSNFL ex, UK

.xls (35.3 kB)

Figure 3: Components of PSNFL ex (data are as at end of 2015/161) UK £ billion

Source: Office for National Statistics

Notes:

- Data in figure are consistent with those published in the PSF bulletin on 21 September 2016.

- References in brackets, such as (AF.3) are ESA 2010 identifiers for financial instruments.

Download this image Figure 3: Components of PSNFL ex (data are as at end of 2015/16^1^) UK £ billion

.png (98.7 kB) .xls (133.1 kB)As a result of the inclusion of all financial assets and liabilities the drivers of changes over time in PSNFL ex are not always the same as in PSND ex. For one thing, movements in equity holdings, public sector funded pension liabilities and other accounts receivable or payable impact PSNFL ex whereas they are not included in PSND ex and so have no impact on this aggregate.

Another important difference to consider is the sale of illiquid assets, such as loans and equity. When illiquid assets are sold PSND ex is reduced (as the cash proceeds increase the public sector liquid assets) but the same sale will have no impact on PSNFL ex, assuming they are sold at the value held in the accounts (nominal value for loans and market value for equity). However, if an illiquid asset is sold at a loss then this would still lead to a reduction in PSND ex (through the cash received) but it would increase PSNFL ex, as the cash value received would be less than the value of the asset sold.

A third important difference is in those cases where the public sector incurs a liability but offsets this with an illiquid asset. The most common case of this is when the public sector offers loans for policy purposes. The loans are illiquid assets for the public sector but in order to fund the lending the public sector incurs a financing liability. When this occurs PSND ex increases (as a result of the liability not being offset by a liquid asset) but PSNFL ex will not change, as long as the value of the asset is exactly equal to the liability incurred. This effect is important when it comes to the operations of the Asset Purchase Facility (APF) discussed in section 3 of this paper. The APF’s purchase of gilts and corporate bonds on the secondary market and its lending through the Term Funding Scheme (TFS) all result in (temporary) increases to PSND ex. However, the lending operations of the TFS and quantitative easing purchases of corporate bonds will not impact PSNFL ex as equal movements in liabilities and assets will be recorded (at the time of purchase or lending). The impact on PSNFL ex of the purchase of gilts on the secondary market will be the same as that on PSND ex as in that case the impact is as a result of the fact that government bond (that is, gilt) liabilities are recorded in both aggregates at face value.

Nôl i'r tabl cynnwys5. Time series

Figures 4a and 4b show estimates of the paths of PSND ex, PSND ex BoE and PSNFL ex over the last 20 years, both in absolute terms (figure 4a) and as percentages of GDP (figure 4b). While the levels are broadly similar there is a marked diversion in the trends since the financial downturn in 2007. This is largely due to the significant increases in loan and equity assets from 2008 onwards related to the financial interventions that the UK government made in the financial corporation sector during this period.

Annex C provides financial year figures for PSND ex BoE and PSNB ex BoE that are consistent with the PSF bulletin and tables published on 21 October 2016 and a full quarterly time series from 1997 can be found in the separate appendix to this article.

Annex D provides financial year figures for PSNFL ex that are consistent with the PSF bulletin and tables published on 21 September 2016 and a full quarterly time series from 1997 can be found in the separate appendix to this article.

Figure 4a: Debt metrics over the last 20 financial years in £ billion, UK

Source: Office for National Statistics

Download this chart Figure 4a: Debt metrics over the last 20 financial years in £ billion, UK

Image .csv .xls

Figure 4b: Debt metrics over the last 20 financial years as a percentage of GDP, UK

Source: Office for National Statistics

Notes:

- GDP used is a 12 month GDP centered on the end of March each year.

Download this chart Figure 4b: Debt metrics over the last 20 financial years as a percentage of GDP, UK

Image .csv .xls6. Data quality (sources and coverage)

As explained in section 3, the supplementary aggregate PSND ex BoE is derivable from data currently published in the monthly public sector finances bulletin and so there are no data quality issues to raise with regard to this aggregate.

The situation is different for PSNFL ex as the compilation of PSNFL ex requires that the data underlying the current calculations of PSND ex are supplemented with a large number of data sources relating to the assets and liabilities not included in PSND ex. The first estimates in this paper represent our best estimates of PSNFL ex, but we would expect these estimates to undergo revisions, some of them potentially sizeable, as we embed the new data sources and subject them to the same quality assurance as the data currently used in the production of PSND ex.

Although there are undoubtedly some data quality issues which we will need to address over the coming year, the asset and liability data sources used in the production of these first estimates of PSNFL ex are the same as those used by the Office for National Statistics (ONS) on a quarterly basis to compile both general government finance statistics and quarterly national accounts in accordance with European statistical legislation. Specifically, the first estimates for PSNFL ex presented in this article use as their basis the quarterly consolidated general government balance sheet data transmitted to Eurostat (the European Commission’s statistical arm) at the end of September 2016 and published by ONS on 20 October 2016. These general government figures are designated National Statistics and a Quality and Methodology Information report on the data coverage and quality is available.

To move from quarterly general government financial balance sheet data to monthly PSNFL ex requires, firstly, full information on the financial assets and liabilities of public corporations and, secondly, a methodology for deriving monthly stock positions. Although financial balance sheet data are available for public corporations through the quarterly national accounts, these data are unconsolidated. That is to say, the data do not identify asset or liability cross-holdings between public corporations and other public sector bodies. This is problematic as PSNFL ex is a consolidated aggregate and so we want to remove intra-public sector cross-holdings. In addition to the problems of consolidation, we have identified during the compilation of the PSNFL ex first estimates some areas where improvements are needed to both the financial instrument coverage of the data and the timeliness of the data. On the latter point, much of the financial balance sheet outturn data for public corporations is sourced from the Whole of Government Accounts, produced by HM Treasury, or the annual financial reports of public corporations, which can be published up to 12 months after the end of the year. To improve the quality and timeliness of financial balance sheet data for public corporations we plan to conduct a programme of work reviewing existing data sources for public corporations. As can be seen in Annex E the contribution of public corporations (excluding Bank of England) to PSNFL ex was estimated to be nearly £200 million at the end of the financial year ending 2016. One third of this is attributable to the balance sheet of housing associations in England. Other significant public corporation contributions to PSNFL ex are the housing revenue account (which is treated as a single quasi public-corporation in national accounts), London Underground (and other Transport for London subsidiaries), Scottish Water, Export Credits Guarantee Department and the Post Office.

In addition to reviewing the public corporations data and the production of monthly estimates, the other main area where we will be focusing our efforts to improve data quality is that of our estimates for the net liabilities of public funded pension schemes. There are 2 issues here, the first is that the current methodology by which we are calculating pension net liabilities (and imputed flows between the public sector pension manager and pension administrator) was introduced in 2014 as an interim methodology and needs some improvements and the second is that ONS has recently classified some pension schemes to the public sector which have not yet been implemented in the accounts.

With regard to the methodology, we stated at the time of introduction in 2014 that we would be working to improve our methodology around our pension estimates as part of the statistical work ONS is doing to deliver the internationally legislated Supplementary Table on Pensions by the end of 2017. During 2017 we will, therefore, be reviewing the existing methods and introducing improvements where possible. These improvements are likely to result in revisions to both the net liability stocks and the imputed flows.

In the first estimates published with this article the only pension scheme included in the pension net liabilities is the Local Government Pension Scheme (LGPS) with an estimated £51 billion net liability at the end of the financial year ending March 2016. Other funded public sector schemes which have been classified to the public sector but that are not included in the first estimates presented here are the Transport for London Scheme, British Coal Staff Superannuation Scheme, Bradford & Bingley Staff Pension Scheme, Mineworkers’ Pension Scheme and 3 other smaller schemes. Initial estimates based on the published accounts of these schemes suggest that the impact on PSNFL ex of implementing these schemes is likely to be less than £0.5 billion. The classification review of potential public sector pension schemes is ongoing so other schemes may still be classified to the public sector. It is expected that this classification review will be completed in early 2017 at which point we will look to implement the schemes into the public sector finances.

We plan to incorporate outturn estimates for PSND ex BoE and PSNFL ex in the monthly public sector finances from next month, December 2016. The PSNFL ex estimates will be subject to revision as a result of both the above methodological work and the more general rolling programme of quality and methodology improvements conducted regularly by ONS. For these reasons we plan to publish PSNFL ex, initially, as an "Experimental Statistic". This is a label used within UK official statistics to identify that the statistics do not yet meet the overall quality standards necessary to be designated as National Statistics.

Nôl i'r tabl cynnwys7. Concluding remarks

This article has provided first estimates for the 2 new supplementary fiscal aggregates, PSND ex BoE and PSFL ex. We have sought to put these fiscal aggregates in context by explaining what they represent, how they relate to existing fiscal aggregates and how they have been compiled. We will incorporate these aggregates in the monthly public sector finances dataset from December 2016 and during 2017 will work to address the data and methodology quality issues that we have highlighted in this article so as to successfully move the PSNFL ex aggregate from being an Experimental Statistic to a full National Statistic.

Nôl i'r tabl cynnwys8. Annex A: Public sector balance sheet

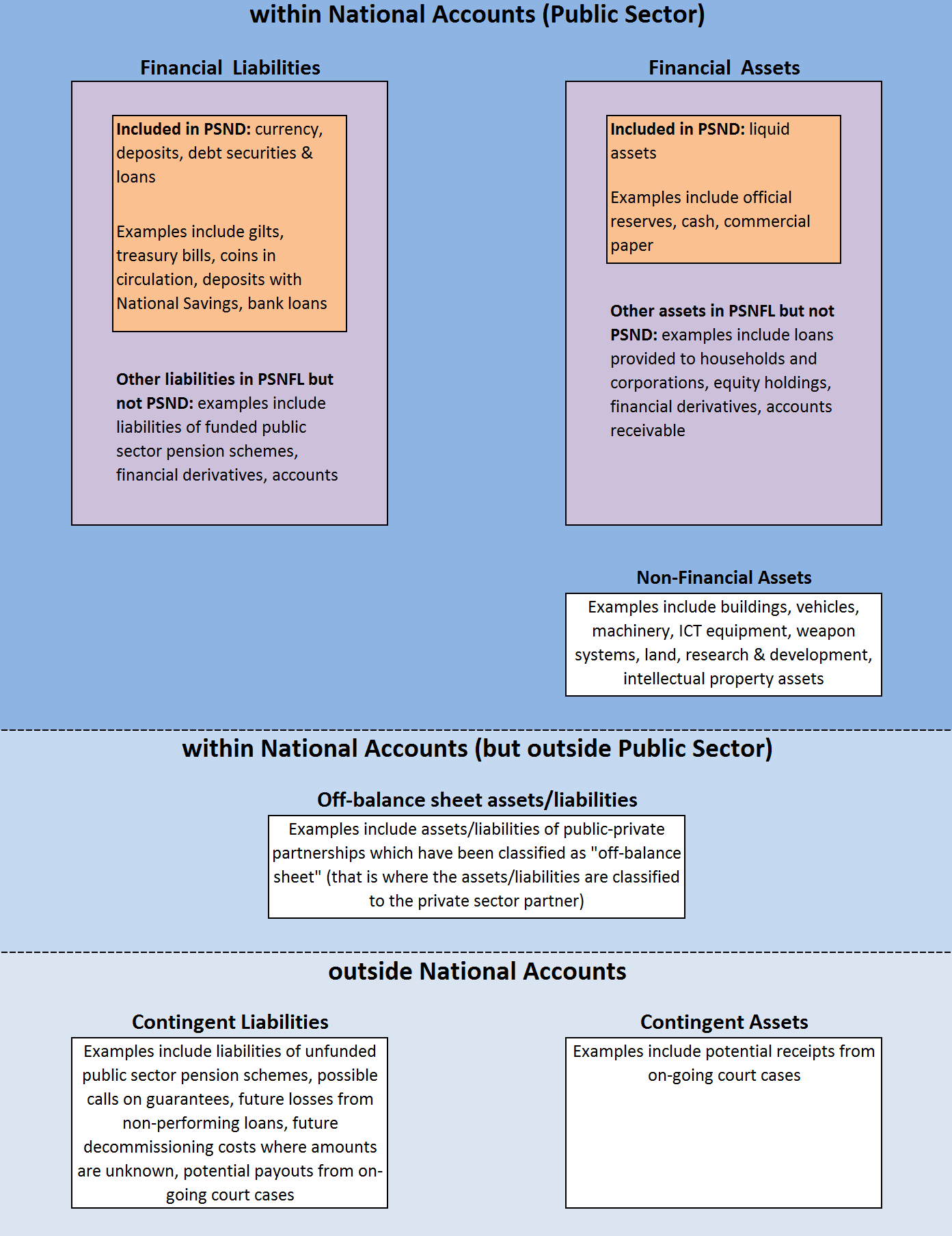

Although all non-contingent assets and liabilities are recorded within the national accounts framework the PSF statistics have a somewhat narrower balance sheet focus and only report financial debt liabilities (largely consisting of gilts, treasury bills, loans, currency and holdings of the deposits of others) and liquid financial assets (largely consisting of official reserves and cash deposits). Figure A1 provides a pictorial overview to show which balance sheet assets and liabilities are currently included in the public sector net debt (PSND ex) fiscal metric, which are included in the new supplementary aggregate of public sector net financial liabilities (PSNFL ex) and which are not included in either.

More information on the public sector balance sheet can be found in an ONS article from 2009 and in the 2016 Fiscal Sustainability Analytical Paper of the Office for Budget Responsibility.

Figure A1: Schematic of the different public sector balance sheet assets and liabilities

Source: Office for National Statistics

Download this image Figure A1: Schematic of the different public sector balance sheet assets and liabilities

.png (115.6 kB) .xls (135.7 kB)9. Annex B: Composition of the public sector

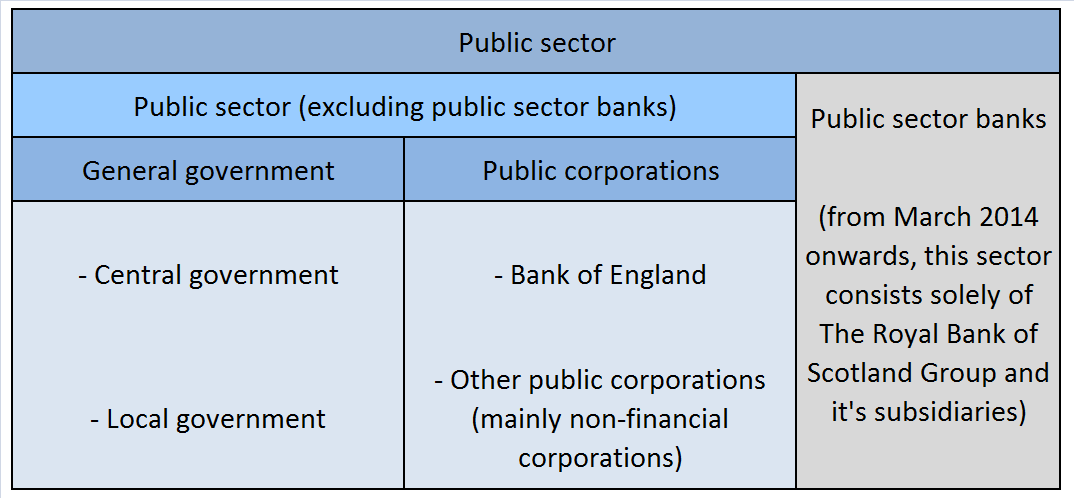

The published PSF statistics recognise 5 component subsectors which constitute the UK public sector and these are:

- central government

- local government

- public corporations (excluding the Bank of England and public sector banks)

- the Bank of England

- public sector banks

Figure B1 shows how these subsectors sum together to construct the total public sector. For fiscal statistics which underpin the fiscal targets the boundary followed is not that of the total public sector but rather the public sector excluding public sector banks.

Figure B1: Schematic of the composition of the UK public sector

Source: Office for National Statistics

Download this image Figure B1: Schematic of the composition of the UK public sector

.png (28.8 kB) .xls (20.0 kB)The concept of public sector excluding public sector banks was introduced in September 2014 following a wide reaching Review of the PSF statistics in 2013. Prior to this date a different fiscal boundary was defined, known as the public sector excluding temporary effects of financial interventions. The 2013 Review recommended the move to fiscal aggregates based on the public sector excluding public sector banks and in doing so defined 6 principles that any “ex” boundary or measure should follow in the PSF statistics. These principles were:

ensure that the full range of public sector liabilities (on a national accounts basis) are reported as transparently as possible

- do not intrinsically create one-off factors in their design without justification

- only allow transactions or classifications to be excluded if they create distortions which clearly impair the understanding of public sector finances due to their size and their lack of correlation with their effects on the government’s need to issue gilts

be consistent in their effect on debt and borrowing

not sub-divide institutional units

not exclude any bodies which are categorised in the government sector, to allow alignment with the government (“Maastricht”) measures used in EU fiscal policy

be wholly consistent with the European System of Accounts (ESA) guidance on transactions and stocks

be created alongside a publication strategy that maximises the transparency of factors which impact on the public sector finances

10. Annex C: Estimates of PSND ex BoE

Table C1 provides financial year figures for PSND ex BoE and PSNB ex BoE that are consistent with the PSF bulletin and tables published on 21 October 2016. Quarterly data are available in the separate dataset (Table C2) provided alongside this article.

Table C1: Estimates for PSNB ex BoE and PSND ex BoE, UK

| £ billion | ||||

| Financial year | PSNB ex | PSNB ex BoE | PSND ex | PSND ex BoE |

| 1997/98 | 5.9 | 6.0 | 358.6 | 359.5 |

| 1998/99 | -4.4 | -4.3 | 357.8 | 358.7 |

| 1999/00 | -14.4 | -14.4 | 349.3 | 350.4 |

| 2000/01 | -17.2 | -17.0 | 316.7 | 317.9 |

| 2001/02 | 0.5 | 0.6 | 323.1 | 324.3 |

| 2002/03 | 26.7 | 26.7 | 356.2 | 357.3 |

| 2003/04 | 31.5 | 31.5 | 391.0 | 392.3 |

| 2004/05 | 43.6 | 43.6 | 446.5 | 448.0 |

| 2005/06 | 41.1 | 41.1 | 487.2 | 489.4 |

| 2006/07 | 36.6 | 36.7 | 523.6 | 525.6 |

| 2007/08 | 40.5 | 40.6 | 554.4 | 556.5 |

| 2008/09 | 104.0 | 104.8 | 763.8 | 764.3 |

| 2009/10 | 154.9 | 161.3 | 1,006.9 | 994.5 |

| 2010/11 | 136.8 | 144.7 | 1,151.7 | 1,147.1 |

| 2011/12 | 115.5 | 124.4 | 1,246.6 | 1,252.1 |

| 2012/13 | 123.4 | 126.7 | 1,357.5 | 1,335.2 |

| 2013/14 | 104.0 | 104.5 | 1,460.1 | 1,418.4 |

| 2014/15 | 96.3 | 98.0 | 1,548.5 | 1,506.7 |

| 2015/16 | 76.0 | 79.3 | 1,602.8 | 1,560.0 |

| Source: Office for National Statistics | ||||

| Notes: | ||||

| 1. PSND ex and PSNB ex are as published in the monthly Public Sector Finances on 21 October 2016. | ||||

| 2. PSND ex BoE and PSNB ex BoE are calculated from data published in the monthly Public Sector Finances on 21 October 2016. | ||||

Download this table Table C1: Estimates for PSNB ex BoE and PSND ex BoE, UK

.xls (20.5 kB)11. Annex D: Estimates of PSNFL ex

Table D1 provides financial year estimates for PSNFL ex. These are initial estimates which will be subject to revision as the data sources and methods are improved. See section 6 of this paper for more information on the data quality. Quarterly data are available in the separate dataset (Table D2) provided alongside this article.

Table D2: Public sector net financial liabilities excluding public sector banks (PSNFL ex)

Table D1: Estimates for PSNFL ex, UK

| £ billion | ||

| Financial year | PSND ex | PSNFL ex |

| 1997/98 | 358.6 | 346.8 |

| 1998/99 | 357.8 | 351.8 |

| 1999/00 | 349.3 | 329.9 |

| 2000/01 | 316.7 | 329.6 |

| 2001/02 | 323.1 | 343.7 |

| 2002/03 | 356.2 | 395.9 |

| 2003/04 | 391.0 | 414.6 |

| 2004/05 | 446.5 | 461.0 |

| 2005/06 | 487.2 | 487.8 |

| 2006/07 | 523.6 | 517.7 |

| 2007/08 | 554.4 | 548.0 |

| 2008/09 | 763.8 | 732.8 |

| 2009/10 | 1,006.9 | 857.2 |

| 2010/11 | 1,151.7 | 975.0 |

| 2011/12 | 1,246.6 | 1,108.3 |

| 2012/13 | 1,357.5 | 1,234.7 |

| 2013/14 | 1,460.1 | 1,321.0 |

| 2014/15 | 1,548.4 | 1,398.2 |

| 2015/16 | 1,602.3 | 1,462.4 |

| Source: Office for National Statistics | ||

| Notes: | ||

| 1. PSND ex is as published in the monthly Public Sector Finances on 21 September 2016. | ||

| 2. PSNFL ex is constructed from General Government financial account data transmitted to Eurostat at the end of September 2016 and published by ONS on 20 October 2016, supplemented with public corporations data used in the compilation of the monthly Public Sector Finances of 21 September 2016 and in the compilation of the quarterly National Accounts published on 30 September 2016. | ||

Download this table Table D1: Estimates for PSNFL ex, UK

.xls (27.6 kB)12. Annex E: Sectoral breakdown of PSNFL ex

Table E1 presents a breakdown of public sector net financial liabilities excluding public sector banks (PSNFL ex), by government sector.

Table E1: Sector components of public sector net financial liabilities (PSNLF ex)

Nôl i'r tabl cynnwys13. Annex F: Reconciliation of PSND ex and PSNB ex with PSNFL ex

Table F1 reconciles public sector net debt excluding public sector banks (PSND ex) to the public sector net financial liabilities excluding public sector banks (PSNFL ex) measure.

Table F1: Reconciliation table: PSNDex to PSNLF ex

Table F2 reconciles public sector net borrowing excluding public sector banks (PSNB ex) to changes in the public sector net financial liabilities excluding public sector banks (PSNFL ex) measure.

Table F2: Reconciliation table: PSNB ex to PSNFL ex

Nôl i'r tabl cynnwys