Cynnwys

- Main points

- Household income by ethnic group

- Household income by occupation and propensity for homeworking

- Potential exposure to the coronavirus and household income

- Household income of key workers

- Effects of taxes and benefits on income inequality

- Effects of taxes and benefits on UK household income data

- Glossary

- Measuring the data

- Strengths and limitations

- Related links

1. Main points

While levels of income inequality between the whole population have fallen since the financial year ending (FYE) 2008, disparities in household income between different ethnic groups remain; White ethnic groups had, on average, just under 65% higher original household income (pre-tax and benefits) compared with Black ethnic groups (£42,400 versus £26,000) in the FYE 2019.

While the effects of taxes and benefits reduces the income gap with White ethnic groups, the average income of Black ethnic groups was still around 18% lower after all these redistributive measures in the FYE 2019.

Employees who were working in occupations with a higher propensity for homeworking were on average more likely to have higher household disposable income in the FYE 2019.

Almost 40% of workers in the poorest fifth of people worked in occupations that have greater potential exposure to the coronavirus (COVID-19) – for instance, care workers and catering assistants – in the FYE 2019, compared with just over 25% of workers in the richest fifth of people.

While overall employees who were defined as key workers had similar household incomes to non-key workers (£35,300 versus £35,400), key workers in the food and necessary goods occupation group had an average household disposable income of £28,000.

Overall, taxes and benefits continued to redistribute income from the richest to the poorest people in the FYE 2019; the ratio of average income between the richest and poorest fifth of people fell from 13.7 to 3.8 after accounting for all these redistributive measures.

The effectiveness of benefits (both cash and in-kind) in terms of redistribution has diminished slightly over the two years up to the FYE 2019, meaning that inequality has increased over this period.

2. Household income by ethnic group

Figure 1 provides estimates of household income by different ethnic groups. Due to sample size limitations, ethnic groups are deliberately broad. For instance, the Asian ethnic group includes Indian; Bangladeshi; Pakistani; Chinese; and Asian Other ethnic group categories.

People in White ethnic groups on average had higher levels of household income than all other ethnic groups on a range of income measures in financial year ending 2019. The original income of people in White ethnic groups was 27% higher than the average for all other ethnic groups, and 63% higher than Black ethnic groups (the group with the lowest average original income).

Original income refers to the income that people within households receive from employment, private pensions, investments and other non-government sources. People then receive income from cash benefits, which taken together with original income is referred to as gross income. Direct taxes, such as Income Tax and National Insurance, are deducted from gross income to measure disposable income. Then, indirect taxes (such as Value Added Tax (VAT) and alcohol duties) are paid via expenditure, which are deducted from disposable income to estimate post-tax income. Finally, people receive benefits-in-kind (for example, the NHS and state education), which are added to post-tax income to estimate final income. More information on the stages of the redistribution are provided in the Glossary.

Figure 1: While taxes and benefits reduced income inequality between different ethnic groups, Black ethnic groups still had the lowest final income in the FYE 2019

Mean equivalised household disposable income, by income type and ethnic group, financial year ending 2019

Embed code

Notes:

- Original income includes all sources of income from employment, private pensions, investments and other non-government sources. The receipt of cash benefits is then added to original income and direct taxes are subtracted to estimate disposable income. Indirect taxes (for example, Value Added Tax (VAT) and alcohol duties) are then subtracted, and finally benefits-in-kind (for example, state education and the NHS) are added to estimate final income.

- Incomes are equivalised using the modified Organisation for Economic Co-operation and Development (OECD) equivalisation scale.

- “White” encompasses White British; Irish; Gypsy or Irish Traveller; and White Other ethnic group categories.“Asian” encompasses Indian; Bangladeshi; Pakistani; Chinese; and Asian Other ethnic group categories. “Other” encompasses Arab and Other ethnic group categories.“Mixed” encompasses White and Black Caribbean; White and Asian; White and Black African; and Other Mixed ethnic group categories.“Ethnic Minorities” encompasses all ethnic groups that are not “White”.“Black” encompasses Black Caribbean; Black African; and Black Other ethnic group categories.

Overall, taxes and benefits led to household income being shared more equally between different ethnic groups; the disposable income of White ethnic groups compared with the average of all ethnic groups overall, and Black ethnic groups separately, was 23% and 37% higher respectively. On a final income basis, taking into account indirect taxes and benefits-in-kind, these estimates were reduced to 10% and 18%.

These findings are similar to other studies examining differential incomes across ethnic groups. The inequality in household original income between White and other ethnic groups reported here mirrors some of the findings from Ethnicity pay gaps in Great Britain: 2018, which highlights that White employees tended to have greater gross hourly earnings than Asian, Black and Other ethnic groups. While the pay gap between White and Mixed ethnic groups is closer to zero over time (although volatile), higher employment rates for White ethnic groups compared with other ethnicities (A09: Labour market status by ethnic group) could also be a factor here.

Further, findings reported in Ethnicity facts and figures, using information from the Family Resources Survey (FRS), found that Black households were most likely to have an annual disposable income less than £20,800 in the three years from the financial year ending (FYE) 2016 to the FYE 2018. It also highlights inequality between different ethnic groups within the Asian ethnic group included here. For instance, 42% of Indian households had a household income above £1000 per week, compared with 20% for both Bangladeshi and Pakistani households separately. As mentioned earlier, the ethnicity analysis within this bulletin doesn’t report further breakdowns of Asian ethnic groups due to sample size limitations

Figure 2: Black ethnic groups receive the most in terms of cash benefits and benefits-in-kind

Summary of the effects of taxes and benefits by ethnic group, UK, financial year ending 2019

Source: Office for National Statistics – Effects of taxes and benefits on UK household income

Notes:

- Incomes are equivalised using the modified Organisation for Economic Co-operation and Development (OECD) equivalisation scale.

- “White” encompasses White British; Irish; Gypsy or Irish Traveller; and White Other ethnic group categories.“Asian” encompasses Indian; Bangladeshi; Pakistani; Chinese; and Asian Other ethnic group categories. “Other” encompasses Arab and Other ethnic group categories.“Mixed” encompasses White and Black Caribbean; White and Asian; White and Black African; and Other Mixed ethnic group categories.“Ethnic Minorities” encompasses all ethnic groups that are not “White”.“Black” encompasses Black Caribbean; Black African; and Black Other ethnic group categories.

Download this chart Figure 2: Black ethnic groups receive the most in terms of cash benefits and benefits-in-kind

Image .csv .xlsFigure 2 highlights the net position (in terms of benefits received and taxes paid by households) of each ethnic group. It shows that overall, all non-white groups categories, with the exception of Asian ethnic groups, were net beneficiaries in terms of taxes paid and benefits received. Overall, Black ethnic groups received the most in terms of benefits (£15,500) and paid the least in taxes (£9,100), likely reflecting lower employment rates for these ethnic groups.

Nôl i'r tabl cynnwys3. Household income by occupation and propensity for homeworking

With the coronavirus (COVID-19) pandemic, most employees are expected to work from home if possible. Drawing on analysis provided in Coronavirus and homeworking in the UK labour market: 2019, Figure 3 examines the relationship between the proportion of employees within occupations that have reported working from home in the past and average household income of employees within those occupations.

Figure 3: There was a positive correlation between occupations with a higher proportion of those working from home and the average income of those employees

Median equivalised household disposable income in financial year ending 2019, and proportion of employees reporting having ever worked from home, by occupation group, January to December 2019

Embed code

Notes:

- Incomes are equivalised using the modified Organisation for Economic Co-operation and Development (OECD) equivalisation scale.

There is a positive correlation between occupations that have higher proportion of employees working from home and the average household disposable income of employees within those occupations. For instance, around 55% of people in the business, research and administrative professionals occupation group reported that they have ever worked from home when interviewed in 2019. On average, employees in this occupation group had an average disposable income of £50,900. Looking more closely at lower income occupation groups, only around 3% of sales assistants and retail cashiers (£27,000 average disposable income) reported having ever worked from home.

This demonstrates the potential for widening inequalities to emerge during the coronavirus pandemic. Employees with occupations that are less likely to allow homeworking risk greater potential exposure to the virus when they must travel to work. This may lead to workers either accepting the increased level of risk or reducing their activity in the labour market, with their household income suffering detrimentally.

Early evidence suggests that the former may more likely be true. Coronavirus and how people spent their time under lockdown: 28 March to 26 April 2020 found that households on lower incomes continued to spend less time working from home during lockdown, and that meant there was a much smaller reduction in the total time spent travelling and working compared with those on higher incomes.

Nôl i'r tabl cynnwys5. Household income of key workers

The Coronavirus and key workers in the UK article developed a definition of key workers based on an interpretation of UK government guidance. A full description of the methods can be found in the key workers article. Using data from the Annual Population Survey (APS), the article estimated there to be 10.6 million key workers, with the largest group of key workers in health and social care, followed by education. Figure 5 applies these definitions to effects of taxes and benefits data to understand how household income varies by different key worker groups.

Figure 5: Average household disposable income of key workers and non-key workers were similar in the FYE 2019

Median equivalised household disposable income of key-workers, by occupation group, financial year ending 2019

Source: Office for National Statistics – Effects of taxes and benefits on UK household income

Notes:

- Incomes are equivalised using the modified Organisation for Economic Co-operation and Development (OECD) equivalisation scale.

Download this chart Figure 5: Average household disposable income of key workers and non-key workers were similar in the FYE 2019

Image .csv .xlsOverall, key workers and non-key workers typically had similar disposable income (£35,300 versus £35,400) in the financial year ending (FYE) 2019. However, there was greater variation within the different key worker occupation groups. For instance, key workers within food and necessary goods had the lowest average income (£28,000) compared with those key workers in public services, who had an average disposable income of £41,900.

Nôl i'r tabl cynnwys6. Effects of taxes and benefits on income inequality

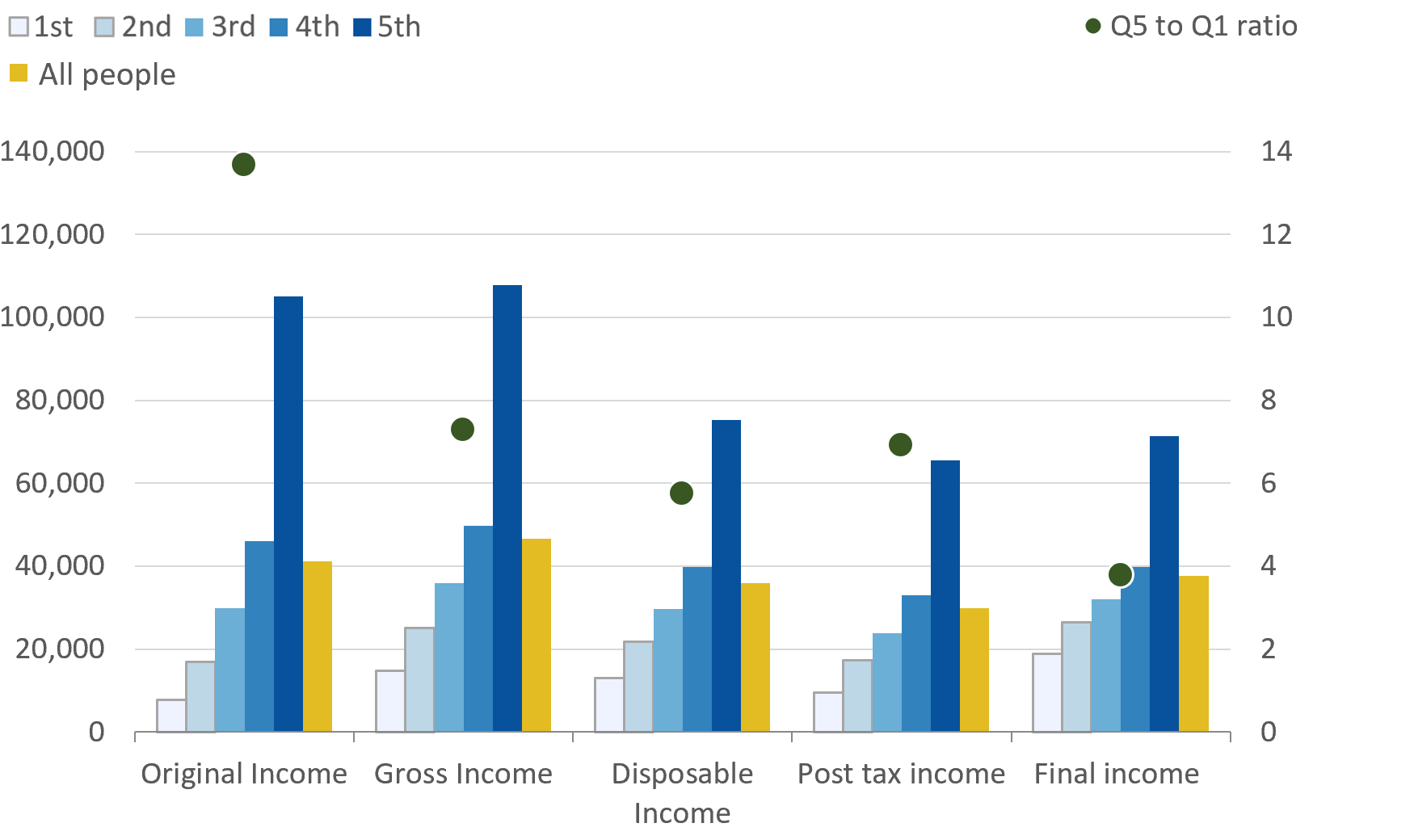

Figure 6: Taxes and benefits lead to household income being shared more equally between people

Household original, gross, disposable, post-tax and final income, equivalised, by quintile group, and richest fifth to poorest fifth of individuals ratio, all individuals, UK, financial year ending 2019

Source: Office for National Statistics

Notes:

- Original income includes all sources of income from employment, private pensions, investments and other non-government sources. The receipt of cash benefits is then added to original income and direct taxes are subtracted to estimate disposable income. Indirect taxes (for example, Value Added Tax (VAT) and alcohol duties) are then subtracted, and finally benefits-in-kind (for example, state education and the NHS) are added to estimate final income.

- Incomes are equivalised using the modified Organisation for Economic Co-operation and Development (OECD) equivalisation scale.

Download this image Figure 6: Taxes and benefits lead to household income being shared more equally between people

.png (45.0 kB) .xlsx (18.2 kB)Overall, taxes and benefits lead to household income being shared more equally between people. In the financial year ending (FYE) 2019, before taxes and benefits, the richest one-fifth of people had an average household original income that was 13.7 times larger than the income of the poorest one-fifth - £105,000 compared with £7,700, after adjusting for household size and composition.

The receipt of cash benefits and payment of direct taxes reduces income inequality between the poorest and richest 20% of people. The average household disposable income of the richest one-fifth of people was 5.7 times larger than the income of the poorest one-fifth - £75,300 compared with £13,100 (Figure 6). After indirect taxes (for example, Value Added Tax (VAT) and alcohol duties) and benefits-in-kind (for example, the NHS and state education) are taken into account, the ratio further reduces to 3.8.

Figure 7: The richest 40% of people, on average, lived in households that paid more in tax than they received in benefits

Summary of the effects of taxes and benefits by quintile groups1, UK, financial year ending 2019

Source: Office for National Statistics – Effects of taxes and benefits on UK household income

Notes:

- Incomes are equivalised using the modified Organisation for Economic Co-operation and Development (OECD) equivalisation scale.

- Individuals are ranked by their equivalised household disposable incomes, using the modified Organisation for Economic Co-operation and Development (OECD) scale.

Download this chart Figure 7: The richest 40% of people, on average, lived in households that paid more in tax than they received in benefits

Image .csv .xlsTo better understand how taxes and benefits reduce the income gap between the richest and poorest, Figure 7 summarises the net positions (in terms of benefits received and taxes paid by households) of each income quintile group. The poorest one-fifth of people live in households that received relatively large amounts of both cash benefits and benefits-in-kind and were net recipients in the FYE 2019. Richer households, on the other hand, paid more in taxes – both direct and indirect – and received less in benefits, meaning the people in the top income quintile were net contributors.

Figure 8: Inequality of final income has increased by 1.5 percentage points between financial year ending 2017 and financial year ending 2019

Gini coefficients for different income measures, UK, 1977 to the financial year ending 2019

Embed code

Notes:

Original income includes all sources of income from employment, private pensions, investments and other non-government sources. The receipt of cash benefits is then added to original income to estimate gross income, and then direct taxes are subtracted to estimate disposable income. Indirect taxes (for example, VAT, alcohol duties and so on) are further subtracted to form post-tax income, and finally benefits-in-kind (for example, state education, National Health Service) are added to estimate final income.

Incomes are equivalised using the modified Organisation for Economic Co-operation and Development (OECD) equivalisation scale.

2018 to 2019 represents the financial year ending 2019 (April to March), and this applies for all other years expressed in this format.

Estimates of income inequality from the FYE 2002 onwards have been adjusted for the under-coverage of top earners.

As highlighted in Household income inequality, UK: financial year ending 2019, the inequality of disposable income increased between the FYE 2017 and FYE 2019.

This was largely driven by a continuation of the diminished effectiveness of cash benefits at reducing income inequality (demonstrated by the reduction in the gap between the Gini coefficients on original and gross income). This most likely reflects a moderation in the value of cash benefits received relative to households' original incomes, which will partly be because of rising employment levels during this period but may also reflect the cash terms freeze since the FYE 2017 up to the end of the FYE 2019 (and 1% uprating for three financial years prior to this) in many working-age benefits.

Figure 8 highlights that inequality of final income increased by 1.5 percentage points to 29.9% between the FYE 2017 and FYE 2019. While indirect taxes and benefits-in-kind overall acted to reduce income inequality (the Gini coefficient on final income was 4.8 percentage points lower than the disposable income measure in the FYE 2019), they did not offset the reduced effectiveness of cash benefits over this period.

Nôl i'r tabl cynnwys7. Effects of taxes and benefits on UK household income data

Average incomes, taxes and benefits of all individuals, retired and non-retired by decile group

Dataset | Released 23 June 2020

Average annual incomes, taxes and benefits and household characteristics of retired and non-retired households in the UK. Data for financial years, by quintile and decile groups, country and region, and tenure type.

Average incomes, taxes and benefits of all individuals, retired and non-retired by quintile group

Dataset | Released 23 June 2020

Average annual incomes, taxes and benefits and household characteristics of retired and non-retired households in the UK. Data for financial years, by quintile and decile groups, country and region, and tenure type.

Summary of the effects of taxes and benefits of individuals by household type

Dataset | Released 23 June 2020

Average annual incomes, taxes and benefits and household characteristics of retired and non-retired households in the UK. Data for financial years, by quintile and decile groups, country and region, and tenure type.

Effects of taxes and benefits on household income

Dataset | Released 23 June 2020

Average annual incomes, taxes and benefits and household characteristics of retired and non-retired households in the UK. Data for financial years, by quintile and decile groups, country and region, and tenure type.

8. Glossary

Stages in the redistribution of income

The five stages in the redistribution of income are:

stage one: household members begin with income from employment, private pensions, investments and other non-government sources; this is referred to as "original income"

stage two: households then receive income from cash benefits; the sum of cash benefits and original income is referred to as "gross income"

stage three: households then pay direct taxes; direct taxes, when subtracted from gross income, are referred to as "disposable income"

stage four: indirect taxes are then paid via expenditure; disposable income minus indirect taxes is referred to as "post-tax income"

stage five: households finally receive a benefit from services (benefits-in-kind); benefits-in-kind plus post-tax income is referred to as "final income"

Note that at no stage are deductions made for housing costs.

Equivalisation

Comparisons across different types of individuals and households (such as retired and non-retired or rich and poor) or over time are made after income has been equivalised. Equivalisation is the process of accounting for the fact that households with many members are likely to need a higher income to achieve the same standard of living as households with fewer members. Equivalisation considers the number of people living in the household and their ages, acknowledging that while a household with two people in it will need more money to sustain the same living standards as one with a single person, the two-person household is unlikely to need double the income.

This analysis uses the modified Organisation for Economic Co-operation and Development (OECD) equivalisation scale (PDF, 166KB).

Nôl i'r tabl cynnwys9. Measuring the data

This release provides estimates of the redistributive role of taxes and benefits on household income and inequality. These data are from our Living Costs and Food Survey (LCF), a voluntary sample survey of around 5,000 private households in the UK. These statistics are assessed as being fully compliant with the Code of Practice for Statistics and are therefore designated as National Statistics. The derivation of household income, and its components, is based on international best practice, following as close as possible guidelines laid out in the Canberra Group Handbook on Household Income Statistics (2011).

These statistics are produced at the individual level meaning, for example, that income quintiles are derived by ordering people, rather than households, on an equivalised household disposable income basis. This method is consistent with the statistics reported in Average household income, UK: financial year ending 2019 and Household income inequality, UK: financial year ending 2019, and it ensures the variance in household size across the income distribution is better accounted for.

Transformation of the data

The Office for National Statistics (ONS) is currently working on transforming its data on the distribution of household finances. The first part of this work has concentrated on combining the samples from the LCF and another of the ONS's household surveys, the Survey on Living Conditions (SLC), and harmonising the income collection in these questionnaires. This will result in a dataset formed of a sample of around 17,000 households. This first stage of work was carried out during the financial year ending (FYE) 2018, and we plan to release microdata covering the FYE 2019 using these combined data during 2020.

The ONS is currently conducting research into making more use of administrative data on income, including Department for Work and Pensions (DWP) benefits data and HM Revenue and Customs (HMRC) tax data. Although these other sources have their own limitations, by using them together with surveys we should be able to improve how we measure household income. In particular, administrative data are likely to help address limitations in survey-based statistics, discussed in more detail in the Strengths and limitations section, such as under-reporting at the top and bottom of the income distribution, and enable analysis at lower geographic levels.

Over the next year, the ONS plans to publish research using linked administrative and survey data to compare administrative and survey measures for the main income components and continue to develop our experimental admin-based income statistics.

Coronavirus (COVID-19)

The coronavirus (COVID-19) has introduced a number of challenges to the future production of household income statistics, both from a practical and a conceptual perspective. In respect of the former, the coronavirus has necessitated a move from face-to-face to telephone interviewing for most of the ONS's household surveys, as described in more detail in Ensuring the best possible information during COVID-19 through safe data collection. The impact of this modal change will be assessed and understood as best as possible during the production of statistics covering the FYE 2021.

In terms of the conceptual challenges, and as highlighted in Coronavirus and the effects on UK GDP, the coronavirus is likely to impact on UK households' finances through a number of different transmissions. For instance, some households' finances will likely be supported to some extent by both the Coronavirus Job Retention Scheme (CJRS) and the Self-Employment Income Support Scheme (SEISS). Notwithstanding the measurement challenges mentioned earlier, these statistics should be well placed to measure and report on these changes while recognising that important methodological decisions (such as how to classify these schemes) will need to be made. The ONS intends to consult with users and follow international best practice to help guide these decisions and to ensure that analysis and statistics remain helpful and informative.

More quality and methodology information on strengths, limitations, appropriate uses, and how the data were created is available in the Effects of taxes and benefits on household income QMI.

Nôl i'r tabl cynnwys10. Strengths and limitations

An important strength of the data is that comparable estimates are available back to 1977, allowing analysis of long-term trends. In addition, information on people's income and expenditure levels allows unique insight into the incidence of indirect taxes that different groups of households pay. This, combined with estimates of benefits-in-kind, provides the most complete assessment of the redistributive role of taxes and benefits available in the UK.

However, as with all survey-based sources, the data are subject to some limitations. For instance, the Living Costs and Food Survey (LCF) is a sample of the private household population and therefore does not include those who live in institutionalised households, such as care homes and hostels, or the homeless. As such, it is likely that many of the poorest in society are not captured, which users should bear in mind when interpreting these statistics.

In addition, the LCF is known to suffer from under-reporting at the top and bottom of the income distribution. While an adjustment to address survey under-coverage of the richest people has been introduced for statistics covering the financial year ending (FYE) 2019, reported in more detail in Top income adjustment in effects of taxes and benefits data: methodology, measurement issues at the bottom remain (see the Effects of taxes and benefits on household income QMI for further details of the sources of error).

The Department for Work and Pensions (DWP) also produce an analysis of the UK income distribution in its annual Households Below Average Income (HBAI) publication, using data from its Family Resources Survey (FRS). While the FRS is subject to the same limitations as other survey sources, it benefits from a larger sample size (approximately 19,000 households) than the LCF and, as such, will have a higher level of precision than effects of taxes and benefits estimates. These differences make the HBAI publication a better source for looking at income-based analysis that does not need a longer time series (the FRS data are available from the FYE 1995) and when looking at smaller sub-groups of the population.

Nôl i'r tabl cynnwys