1. Main points

In financial year ending 2016, average net annual household income in small areas within England and Wales ranged from £16,800 per year to £93,800 per year, with around half of small areas falling in the £25,000 to £35,000 net income band.

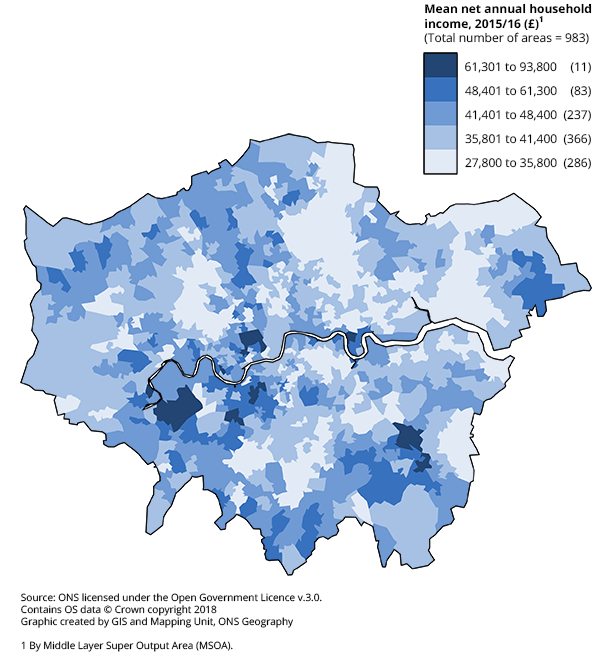

Average net annual household income in financial year ending 2016 was highest in London and its surrounding areas.

Areas of lowest average household incomes were more widely spread geographically across England and Wales than areas of highest average household incomes.

2. Things you need to know about this release

This bulletin presents the official estimates of household income for small areas.

The small area model-based income estimates are the official estimates of annual household income at the middle layer super output area (MSOA) level in England and Wales for the financial year ending 20161. They are designated National Statistics, which are calculated using a model-based method to produce four estimates of income. The estimates are produced using a combination of survey data from the Family Resources Survey and previously published data from the 2011 Census and a number of administrative data sources. The four different measures of income are:

total (gross) annual household income

net annual household income

net annual household income (equivalised) before housing costs

net annual household income (equivalised) after housing costs

The first two measures provide an indication of both average (mean) overall household income and average household income after including tax payments and housing costs. The last two measures provide equivalised estimates of household income, which consider the composition of households. This enables meaningful comparisons between households with different numbers of occupants.

Although the data accompanying this release is for all four income types, this bulletin focuses specifically on net income.

Related publications

The estimates described in this statistical bulletin follow publication of Administrative Data Research Outputs on income, which have been produced from administrative data on income and benefits. Those outputs are published as a result of research into a different methodology to that currently used in the production of official income statistics, and could ultimately be used to improve the quality of the official income estimates presented in this bulletin. These Research Outputs present both individual and household distributions of gross income distributions down to lower layer super output area (LSOA) level for the tax year ending 2016.

There is more detailed information about the method and data sources used to produce these estimates available in the technical report that accompanies this release. In addition, you might find it helpful to read our user guide to the small area income estimates, which accompanied the release of previous estimates, but also applies to this release.

Uses for small area income estimates

The small area income estimates are particularly useful for local authority planning. They are used to support effective service provision, targeting of resources and the allocation of grants and funding. They are also used by a range of government policy-makers, businesses and academic organisations for various purposes including:

assessing the relationship between local economies, industry sectors and income

combining income data with indicators from related topics such as skills, employment, migration and housing

strategic planning of site locations and forecasting by businesses

Confidence intervals

Due to an increase in variability of the underlying survey data in financial year ending 2016, these estimates have wider confidence intervals than in previous years. This results in more areas having overlapping confidence intervals and this should be taken into consideration when comparing income across areas. The confidence intervals are included with the results in the associated dataset with this release.

Definitions of income

Definitions of the four types of income and the way they are calculated are summarised in Table 1.

Table 1: Types of income

| Total annual household income | Net annual household income | Net annual household income before housing costs (equivalised to allow for household size and composition) | Net weekly household income after housing costs (equivalised to allow for household size and composition) | ||||

|---|---|---|---|---|---|---|---|

| sum of income from: | same components as total income but net of: | same components as net income but is subject to an equivalisation scale | same components as net income less deductions (prior to an equivalisation scale being applied) of: | ||||

| wages and salaries (gross) | Income Tax payments | rent (gross of housing benefit) | |||||

| self-employment | National Insurance contributions | water rates, community water charges and council water charges | |||||

| investments | domestic rates or Council Tax | mortgage interest payments (net of any tax relief) | |||||

| tax credits | contributions to occupational pension schemes | structural insurance premiums (for owner- occupiers ) | |||||

| State Pension and Income Support or Pension Credit | all maintenance and child support payments, which are deducted from the income of the person making the payments | ground rent and service charges | |||||

| other pensions | parental contribution to students living away from home | ||||||

| other benefits | |||||||

| disability benefits | |||||||

| other sources of income | |||||||

| Source: Office for National Statistics | |||||||

Download this table Table 1: Types of income

.xls (39.4 kB)Equivalisation

Applying an equivalisation scale adjusts the household income values to take account of the number and composition of people in the household. Therefore, it represents the income level of every individual in the household.

Equivalisation is needed to make sensible income comparisons between households. For example, one household may have two adults and two children and have a total weekly household income of £300. If this is compared with a household containing just one adult who has a total weekly household income of £270, then although the first household has the higher total weekly income, it is the second that could be said to have the higher standard of living (assuming equal living and housing expenses).

More information on equivalisation is contained in the technical report that accompanies this release.

Notes for: Things you need to know about this release

- Throughout this release, financial year ending 2016 refers to the period April 2015 to March 2016, and likewise for earlier years.

3. Net annual household income

Net annual household income is the sum of the net income of every member of the household. This is useful when assessing the average levels of income after considering common deductions from salary. For example, the average net annual income might be significantly higher in one area than in another, despite these areas having similar level of average total annual income. This would indicate that factors such as Council Tax payments account for some of the difference in income, rather than the average amount of earnings alone.

The measure of average net annual income does not take account of different areas having different household compositions and so is also useful in assessing the extent to which the number of people and their characteristics influence average household income.

Figure 1 shows the distribution of middle layer super output areas (MSOAs) for mean net annual household income. The £24,501 to £32,200 income band was the band with the largest number of MSOAs in the financial year ending 2016. Around half of MSOAs had a net annual household income between £25,000 and £35,000. The chart shows that some areas in the higher income bands had relatively high levels of average household income, whereas a larger number of areas fall within the lower income bands. This is typical of the distribution of household income.

Figure 1: Distribution of mean net annual household income in middle layer super output areas, England and Wales, financial year ending 2016

Source: Office for National Statistics

Notes:

- Income bands based on rounded 10% increments of the range.

Download this chart Figure 1: Distribution of mean net annual household income in middle layer super output areas, England and Wales, financial year ending 2016

Image .csv .xlsMore than half of the MSOAs in the top 50 for net annual income in England and Wales were in London in the financial year ending 2016. London also had the largest range and greatest variability in MSOA income. Figure 2 shows the estimates of net annual income for London.

Figure 2: Model-based mean net annual household income by middle layer super output area, London, financial year ending 2016

Source: Office for National Statistics licensed under the Open Government Licence v.3.0. Contains OS data © Crown copyright 2018 Graphic created by GIS and Mapping Unit, ONS Geography

Download this image Figure 2: Model-based mean net annual household income by middle layer super output area, London, financial year ending 2016

.png (220.8 kB)The distribution of net household income varies across local authority districts (LADs), even for LADs within the same region. In some regions there are LADs that do not contain any MSOAs in the same band as another LAD in the same region. For example, in the South East there are 11 LADs that have no MSOAs in the same net income band as Hart.

Figure 3 shows the number of MSOAs within each net income band for the Isle of Wight and for Hart. Both LADs are in the South East but had very different MSOA distributions in the financial year ending 2016. In the Isle of Wight, the income band with the most MSOAs in was the £28,400 to £31,320 per year band. For Hart, the income band with the most MSOAs in was the £43,001 to £45,920 per year band.

Despite MSOAs in Hart having a wider range of net household income than the Isle of Wight, there were no income bands that contained MSOAs from both LADs. This shows that the distribution of household income for small areas within LADs can differ greatly.

Figure 3: Distribution of mean net annual household income for middle layer super output areas within local authority districts, Isle of Wight and Hart, financial year ending 2016

Source: Office for National Statistics

Notes:

Income bands based on rounded 10% increments of the range of both local authority districts' MSOAs.

The Isle of Wight was the LAD containing the MSOA with the lowest maximum annual income out of all South East LADs.

Hart was the LAD containing the MSOA with the highest minimum annual income out of all South East LADs.

Download this chart Figure 3: Distribution of mean net annual household income for middle layer super output areas within local authority districts, Isle of Wight and Hart, financial year ending 2016

Image .csv .xls5. What’s changed in this release?

This release provides new estimates of mean annual household income for the financial year ending March 2016 for middle layer super output areas (MSOAs) in England and Wales.

We are also investigating the use of more administrative data to improve the quality of the modelled estimates. It is possible that the primary method of producing small area income estimates in the future may change to reflect this administrative data from tax, benefits and self-assessment records. As such, we cannot currently provide information on the timing of the next small area income output.

Nôl i'r tabl cynnwys6. Quality and methodology

Due to an increase in variability of the underlying survey data in financial year ending 2016, the confidence intervals around the estimates are wider than in previous years. This means that there is less distinguishability between the top and bottom of the distribution of income estimates.

Care needs to be taken when using ranks based on middle layer super output areas (MSOA) estimates due to the uncertainty around the estimates.

Areas with extreme estimates of income

The modelling process tends to shrink estimates towards the average level, so the true distribution of MSOA average incomes has more extremely high and low values than these estimates.

Consistency between the four estimates

Different models have been developed for the four types of income to produce the most accurate estimate of each income type. This may result in some inconsistencies between the different types of income for particular middle layer super output areas (MSOAs). For example, an MSOA may have a larger modelled estimate for net weekly household income when compared with total weekly household income.

In reality, total household income is always higher than net household income and so care should be taken when comparing estimates of total income with estimates of net income. Although there may be some inconsistencies, the models selected are the best possible to model the general patterns of that particular type of income over all MSOAs. The confidence intervals presented with these estimates provide an indication of the uncertainty around each MSOA's estimate of the different types of household income. For more information about the quality and methods used to produce these statistics, see our technical report.

Nôl i'r tabl cynnwys