Cynnwys

- Other pages in this release

- Main points

- Overall aggregate private pension wealth in Great Britain

- Components of aggregate private pension wealth in Great Britain

- Trends in active private pension wealth – membership

- Aggregate levels of active pension wealth by pension type

- Average levels of active private pension wealth by pension type

- Preserved pension wealth

- Trends in pensions in payment

- Levels of wealth in private pensions in payment

- Pensions wealth in Great Britain data

- Glossary

- Measuring the data

- Strengths and limitations

- Related links

1. Other pages in this release

Commentary relating to the Wealth and Assets Survey in Great Britain April 2016 to March 2018 is split into three distinct articles. This bulletin is Pension wealth in Great Britain: April 2016 to March 2018. The other two can be found on the following pages:

2. Main points

Total private pension wealth in Great Britain was £6.1 trillion in April 2016 to March 2018 (42% of total wealth), up from £3.6 trillion (34% of total wealth) in July 2006 to June 2008, after adjusting for inflation.

In April 2016 to March 2018, nearly half (48%) of all private pension wealth was held in pensions in payment, 37% in active pensions and 15% in preserved pensions; these proportions have been stable over time.

The percentage of adults below the State Pension age actively contributing to a private pension has increased, from 43% in July 2010 to June 2012, to 53% in April 2016 to March 2018; this rise reflects increased participation in defined contribution schemes, likely to be a result of the introduction of automatic enrolment between 2012 and 2018.

In April 2016 to March 2018, men below State Pension age were more likely to have active private pensions than equivalent women (56%, compared with 51%) and, for those that have this type of wealth, men had higher (£25,300) median active pension wealth than women (£20,000).

For all individuals with an active occupational defined contribution scheme the median wealth held in these pensions has decreased in each of the last three survey periods, from £11,600 (July 2010 to June 2012) to £3,300 (April 2016 to March 2018), likely a consequence of automatic enrolment bringing in new members who have not yet accrued high levels of private pension wealth.

For those aged 65 years and over, median pension wealth for pensions in payment for men is double that for women.

Figures are deflated to April 2016 to March 2018 average prices using the Consumer Prices Index including owner occupiers’ housing costs (CPIH) to reflect the change in the value of money over time. This is a change from previous releases, which were all in nominal terms, to allow better comparisons over time.

3. Overall aggregate private pension wealth in Great Britain

Aggregate total wealth is an estimate of the value of wealth held in Great Britain and aggregate private pension wealth is an estimate of the value of all private pension wealth.

In April 2016 to March 2018, aggregate private pension wealth in Great Britain was £6.1 trillion, accounting for 42% of all wealth in Great Britain (Figure 1).

Since the Wealth and Assets Survey (WAS) started in July 2006 to June 2008, the proportional share of private pension wealth to total wealth has increased from 34% to 42%. Private pension wealth in Great Britain has increased above inflation in each of the last three survey periods, increasing by 14% in real terms between April 2014 to March 2016 and April 2016 to March 2018. As discussed in the linked release Total wealth in Great Britain: April 2016 to March 2018, the increase in private pension wealth is one of the major drivers behind the increase observed in total wealth, alongside increases in property wealth since July 2012.

The increase in total private pension wealth reflects the fact that there are now many more people paying into private pension schemes (active pensions) and with preserved pensions (pensions that are no longer being contributed to but are not yet in payment). Changes in the financial assumptions used to calculate private pension wealth (for those with pensions in payment) also “valued” private pensions pots higher in April 2016 to March 2018 compared with previous periods.

Estimates of the value of pension pots where a specific level of payment is guaranteed at retirement, such as occupational defined benefit type schemes (actively contributing or preserved), or for pensions in payment where an annuity has already been purchased, are calculated using expected or received retirement income with external economic indicators such as annuity rates and discount factors. These factors are obtained each month and applied to the relevant month when the interview has taken place to reflect market values at the time of interview (see Wealth and Assets Survey QMI).

Figure 1: Private pension wealth has been increasing in real terms for the last three survey periods

Aggregate private pension wealth and aggregate total wealth (inflation adjusted), Great Britain, July 2006 to March 2018

Source: Office for National Statistics – Wealth and Assets Survey

Notes:

- Figures have been deflated to April 2016 to March 2018 prices using the Consumer Prices Index including owner occupiers’ housing costs (CPIH).

- Note the change in periodicity from two-years starting in July and ended in June two years later to a two-year periodicity that starts in April and ends in March two years later (financial year-based). More information on this change can be found in the Moving the Wealth and Assets Survey onto a financial years basis methodology article.

- Nominal values are taken from the pension wealth datasets Table 6.11 and total wealth datasets Table 2.1.

Download this chart Figure 1: Private pension wealth has been increasing in real terms for the last three survey periods

Image .csv .xls4. Components of aggregate private pension wealth in Great Britain

Private pensions can be employer-based or personal and are engaged with in three separate ways.

Active pension wealth is held in pensions that are regularly contributed to and usually accumulated during your working life.

Preserved pension wealth is contained within pensions to which contributions are no longer being made, are not yet in payment but have accrued rights that will come into payment at some point in the future.

Pensions in payment wealth consists of pensions from which individuals are receiving an income (including spouse pensions).

In April 2016 to March 2018, nearly half (48%) of all private pension wealth, £2,916 billion, was held in pensions in payment, 37% (£2,242 billion) in active pensions and 15% (£940 billion) held in preserved pensions (Figure 2).

The proportion held in each component has been stable over time. Despite this apparent stability, there have been some large changes in private pension wealth provision, which are discussed in more detail in the following sections. These include:

6% growth in active pension wealth (since previous period, inflation adjusted); despite large increases in membership of active occupational defined contribution pensions, active pension wealth growth is predominantly driven by occupational defined benefit pensions

27% growth in preserved pension wealth (from previous period, inflation adjusted), influenced by increased membership in preserved pensions

17% growth in pensions in payment wealth (from previous period, inflation adjusted), largely driven by changes in the annuity factors used to calculate this type of wealth

Figure 2: Component proportions of aggregate private pension wealth relatively unchanged since July 2008, with pensions in payment remaining the largest component of total pension wealth

Components of aggregate private pension wealth, Great Britain, July 2008 to March 2018

Source: Office for National Statistics – Wealth and Assets Survey

Notes:

- Active members' pension wealth comprises those currently contributing to an occupational defined benefit and defined contribution pension, additional voluntary contribution schemes and personal pensions (including group personal/stakeholder pensions).

- Preserved pension wealth comprises preserved occupational defined benefit pensions, preserved defined contribution (both occupational and personal) pensions, preserved pensions for drawdown and expected income from former partner or spouse.

- Pension in payment wealth comprises private pensions from which individuals were receiving an income (including spouse pensions).

- July 2006 to June 2008 data excluded as aggregate private pension wealth during this period does not equal the sum of active, preserved and pension in payment wealth because of the the presence of imputed values in the Wave 1 dataset for aggregate private pension wealth only.

- Note the change in periodicity from two-years starting in July and ended in June two years later to a two-year periodicity that starts in April and ends in March two years later (financial year-based). More information on this change can be found Moving the Wealth and Assets Survey onto a financial years basis methodology article.

- Figures have been deflated to April 2016 to March 2018 prices using the Consumer Prices Index including owner occupiers’ housing costs (CPIH).

- Figures may not sum to totals because of rounding.

- Nominal values are taken from the pension wealth datasets Table 6.12.

Download this chart Figure 2: Component proportions of aggregate private pension wealth relatively unchanged since July 2008, with pensions in payment remaining the largest component of total pension wealth

Image .csv .xls5. Trends in active private pension wealth – membership

There has been a clear increase in the proportion of individuals with active private pension wealth since July 2010, increasing by 10 percentage points from 43% to 53% of individuals, to April 2016 to March 2018 (Figure 3).

The remaining 47% of individuals without active private pension wealth may be self-employed, unemployed, economically inactive, chosen to opt-out, or ceased membership of workplace pensions or do not fulfil current automatic enrolment criteria. Figure 3 shows that in April 2016 to March 2018, this was the first time there was a higher proportion of individuals aged 16 years to State Pension age with active private pensions than without.

This increase in active private pension participation coincides with the roll-out of automatic enrolment (see Glossary).

Figure 3: There has been a 10 percentage points increase in active private pension participation since July 2010 to June 2012

Proportion of individuals (aged 16 years to State Pension age) with and without active private pension wealth, Great Britain, July 2010 to March 2018

Source: Office for National Statistics – Wealth and Assets Survey

Notes:

- Excludes those aged 16 to 18 years and in full-time education.

- State Pension age at the time of interview.

- Note the change in periodicity from two-years starting in July and ended in June two years later to a two-year periodicity that starts in April and ends in March two years later (financial year-based). More information on this change can be found in the Moving the Wealth and Assets Survey onto a financial years basis methodology article.

- Active members' pension wealth comprises those currently contributing to an occupational defined benefit and defined contribution pension, additional voluntary contribution pension and personal pension (including group personal/stakeholder pensions).

Download this chart Figure 3: There has been a 10 percentage points increase in active private pension participation since July 2010 to June 2012

Image .csv .xlsActive private pensions can be of different types, with the pension type often defining the benefits received on retirement. The most common are occupational defined contribution and personal pensions, where the benefits are determined by the contributions paid into the scheme, the investment return on those contributions and the type of annuity (if any) purchased upon retirement and occupational defined benefit pensions in which the benefits to be paid are salary related and based on number of years of pensionable service and accrual rate (see Glossary for details).

Personal pensions are arrangements between individuals and insurance companies, whereas occupational defined contribution and occupational defined benefit pensions are arrangements between employers and insurance companies.

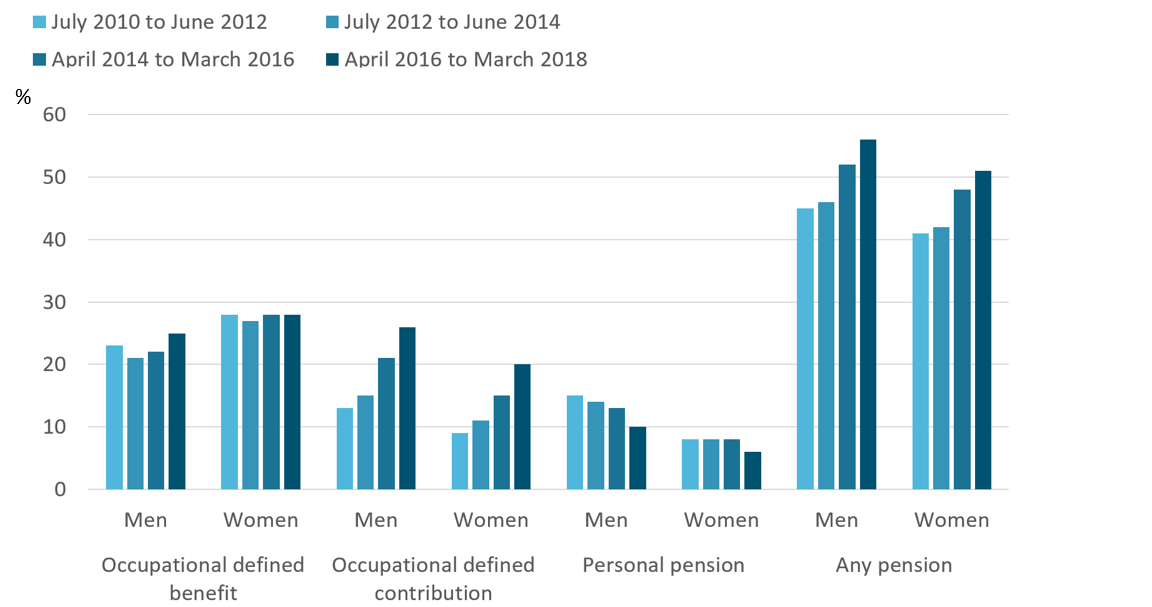

Figure 4 shows that occupational defined benefit pensions are the only pension type where women have higher participation than men. This is likely to be linked to the fact that the majority of occupational defined benefit pensions are public sector pensions and in 2017 women made up just over two-thirds of public sector employees in the UK. In April 2016 to March 2018, for all women aged 16 years to State Pension age, 28% had an active occupational defined benefit pension, compared with 25% of men. There has been a small increase in the proportion of men with these pensions over time, whereas for women, participation has been stable since July 2010 to June 2012.

Figure 4: An increased proportion of individuals with active occupational defined contribution pensions is the main driver of the overall increase in active private pension membership rates

Proportion of individuals (aged 16 years to State Pension age) with active private pensions by sex and pension scheme type, Great Britain, July 2010 to March 2018

Source: Office for National Statistics – Wealth and Assets Survey

Download this image Figure 4: An increased proportion of individuals with active occupational defined contribution pensions is the main driver of the overall increase in active private pension membership rates

.png (79.7 kB)Notes:

- Excludes those aged 16 to 18 years and in full-time education.

- State Pension Age at the time of interview.

- Note the change in periodicity from two-years starting in July and ended in June two years later to a two-year periodicity that starts in April and ends in March two years later (financial year-based). More information on this change can be found in the Moving the Wealth and Assets Survey onto a financial years basis methodology article.

- Any active private pensions include occupational defined benefit, occupational defined contribution, additional voluntary contribution schemes and personal pensions.

The proportion of men with personal private pensions has been falling, reducing by 5 percentage points since July 2010 to June 2012, consequently only 1 in 10 men aged 16 years to State Pension age were actively contributing to a personal private pension in April 2016 to March 2018. The proportion of women with a personal private pension was stable between July 2010 and March 2016 but dropped by 2 percentage points in April 2016 to March 2018, to 6%.

The most significant change since July 2010 to June 2012 has been in active occupational defined contribution pension participation and this is driving the overall increase in the proportion of individuals (aged 16 years to State Pension age), with active pension wealth shown in Figure 3. Table 6.3 in the pension wealth datasets shows that there have been increases in proportions of individuals with active occupational defined contribution pensions in all age groups (except 65 years and over) with clear evidence of an increase in participation of these schemes coinciding with the roll-out of automatic enrolment from 2012 onwards.

Figure 4 shows that both men and women have seen increases in the proportion of individuals with active occupational defined contribution pensions over the last three survey periods. The increase for men has been 13 percentage points and for women 11 percentage points. The rate of increase has been similar for men and women. Consequently, in April 2016 to March 2018, there was a higher proportion of men contributing to an occupational defined contribution pension (26%), than contributing to an occupational defined benefit pension (25%).

Overall, there remains a gender gap in active private pension participation. The proportion of men (aged 16 years to State Pension age) with active private pensions in April 2016 to March 2018 was 56% and the equivalent for women was 51%. The gender gap has not changed significantly since July 2010 to June 2012.

Nôl i'r tabl cynnwys6. Aggregate levels of active pension wealth by pension type

In April 2016 to March 2018, even though there is a similar proportion of men (and to a lesser extent women) contributing to occupational defined benefit as there are contributing to occupational defined contribution pensions (Figure 4), four-fifths of active pension wealth was held in occupational defined benefit pensions, a proportion that has remained largely unchanged over time (Figure 5).

Figure 5: Four-fifths of active pension wealth is held in occupational defined benefit pensions, a proportion that has remained largely unchanged over time

Breakdown of aggregate active pension wealth by pension type, Great Britain, July 2010 to March 2018

Source: Office for National Statistics – Wealth and Assets Survey

Notes:

- Occupational defined contribution wealth includes additional voluntary contributions.

- Personal pensions include group personal and stakeholder pensions.

- Includes all individuals aged 16 years to State Pension age but excludes those aged 16 to 18 years and in full-time education.

- Note the change in periodicity from two-years starting in July and ended in June two years later to a two-year periodicity that starts in April and ends in March two years later (financial year-based). More information on this change can be found in the Moving the Wealth and Assets Survey onto a financial years basis methodology article.

- Figures have been deflated to April 2016 to March 2018 prices using the Consumer Prices Index including owner occupiers’ housing costs (CPIH).

- Nominal values are taken from the pension wealth datasets (Table 6.11).

Download this chart Figure 5: Four-fifths of active pension wealth is held in occupational defined benefit pensions, a proportion that has remained largely unchanged over time

Image .csv .xlsIn April 2016 to March 2018, of all active pension wealth, 11% was held in occupational defined contribution schemes, an increase of 1 percentage point since the last period. The difference in share of wealth between occupational defined benefit and occupational defined contribution is largely based on many defined contribution pensions being newly started, (fewer years of pension membership to accumulate wealth) and defined benefit requiring larger estimated “pot sizes” to provide guaranteed income-related retirement benefits (see Estimating private pension wealth for detail).

Wealth held in active personal pensions in the latest period (£205 billion) decreased by 7% from the previous period, driven by the reduction in active membership of this type of pension (Figure 4).

Nôl i'r tabl cynnwys7. Average levels of active private pension wealth by pension type

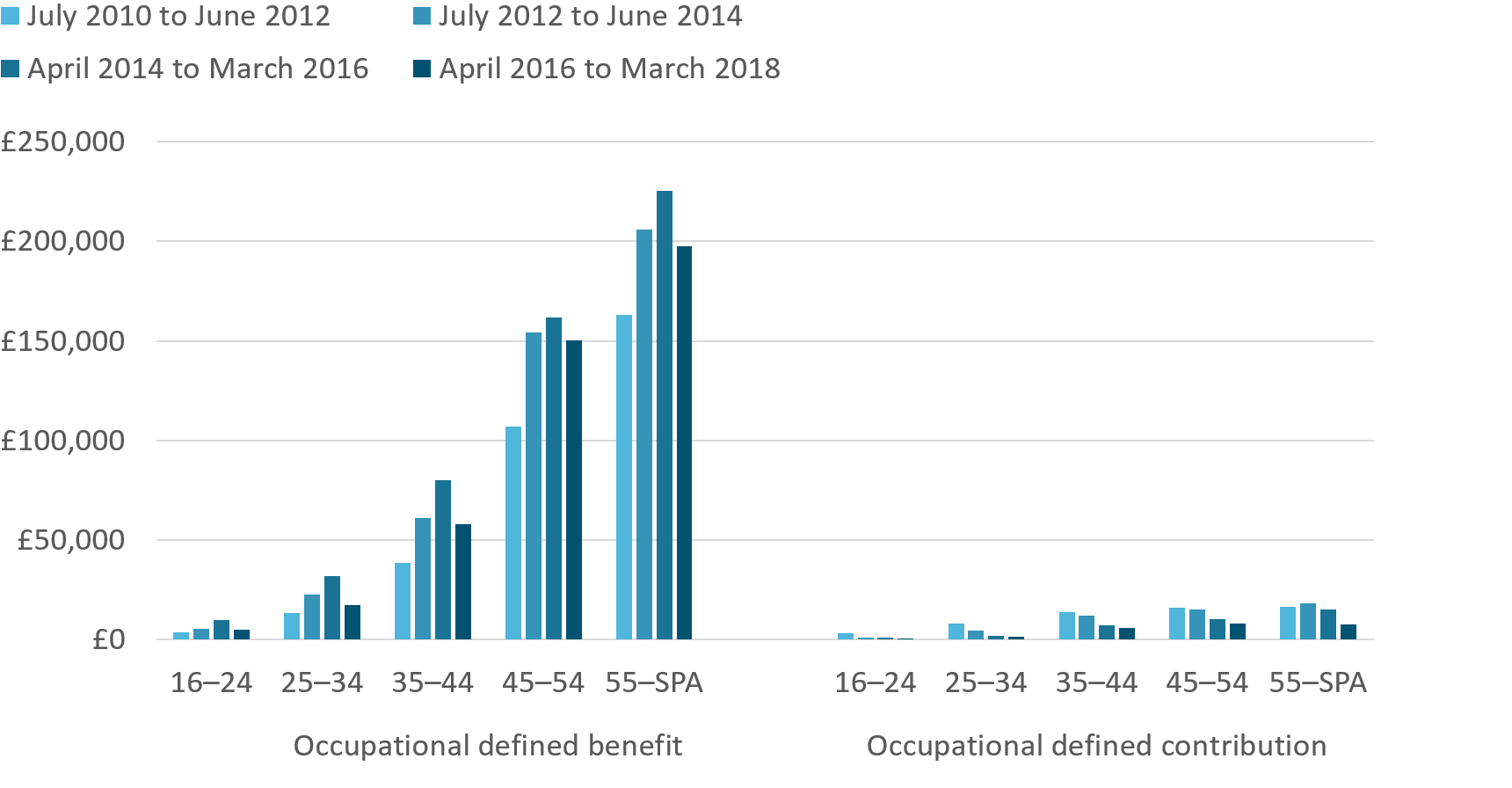

As with aggregate wealth (Figure 5), Figure 6 shows for all periods the median in active occupational defined benefit schemes is higher than in active occupational defined contribution schemes for all age groups, with the difference becoming larger as you get older.

For those closest to retirement, (aged 55 years to State Pension age), median wealth in active occupational defined benefit pensions is 10 times higher than in active occupational defined contribution pensions in July 2010, increasing to 26 times in April 2016 to March 2018.

The difference (for all age groups) is because of occupational defined benefit schemes typically offering guaranteed retirement income benefits and consequently requiring a larger equivalent “pension pot” when estimating their value in wealth terms. This contrasts with active occupational defined contribution schemes being joined by new members with lower contribution levels as a result of recent automatic enrolment; these new members have not yet had time to accrue high levels of wealth within their scheme.

The most generous occupational defined benefit pensions (final salary-based) are more likely to be available to older people, allowing more time to accrue benefits, driving the largest differences of median wealth between pension types. It is important to note that increased occupational defined benefit wealth does not mean increased income in retirement, it relates to the pension pot required to provide a specified income. As the pension pot required is derived using market factors (at the time of interview), changing market factors will affect the value of the pension pot required, not the specified income.

Figure 6: Median private pension wealth increases with age for both pension types but median pension wealth in defined benefit schemes is substantially higher across all age groups, and also increases more rapidly with age

Median wealth in active occupational defined benefit and occupational defined contribution pensions, after adjusting for inflation, by age band, Great Britain, July 2010 to March 2018

Source: Office for National Statistics – Wealth and Assets Survey

Download this image Figure 6: Median private pension wealth increases with age for both pension types but median pension wealth in defined benefit schemes is substantially higher across all age groups, and also increases more rapidly with age

.png (46.7 kB)Notes:

- Values exclude individuals with zero wealth in actively contributing schemes.

- Figures have been deflated to April 2016 to March 2018 prices using the Consumer Prices Index including owner occupiers’ housing costs (CPIH).

- Individuals include adults aged 16 plus, but does not include those individuals aged 16 to 18 years and in full-time education.

- State Pension age at the time of interview.

- Occupational defined contribution medians exclude additional voluntary contributions (AVC).

Figure 6 shows that the value of active occupational defined benefit wealth varies over time, reducing in the latest survey period. This is driven largely by the variation of annuity rates and discount factors applied in the calculation of occupational defined benefit wealth as described in the section Estimating private pension wealth.

Table 6.17 (in the pension wealth datasets) shows that over half of the change in the median active occupational defined benefit pension wealth between April 2014 and March 2016 and April 2016 and March 2018 is because of changes in the annuity rates and discount factors used.

Other factors that may have contributed to the decrease in the median for occupational defined benefit wealth could be: a change in the ratio of women-to-men with active occupational defined benefit pensions (Figure 4); a change in the age distribution of those with occupational defined benefit pensions (Table 6.2 in the pension wealth datasets shows larger increases in participation in these schemes for younger age groups) and phasing out of the higher value occupational defined benefit pension schemes (evidence for this in the reduction at the 75th percentile for this pension type, Table 6.2 in the pension wealth datasets).

Figure 6 also shows that median wealth for active occupational defined contribution schemes has decreased in each of the last three survey periods for all age groups, likely a consequence of automatic enrolment.

As Figure 4 shows, there have been large increases in the number of people with active occupational defined contribution pensions for each of the last three survey periods. These new entrants have not been contributing long enough to accrue high levels of private pension wealth. The result is that the overall average (median) therefore decreases from £11,600 (July 2010 to June 2012) to £3,300 (April 2016 to March 2018) when considering all individuals with an active defined contribution pension (see pension wealth datasets Table 6.3 for nominal values).

From the pension wealth datasets (Tables 6.2, 6.3, 6.4 and 6.5) median wealth in all active pension types (for all ages) is lower for women (£20,000) than men (£25,300) in April 2016 to March 2018, with the difference being largest in occupational defined benefit schemes. This may be a consequence of the gender pay gap and women being more likely to work part-time or take career breaks than men.

Nôl i'r tabl cynnwys8. Preserved pension wealth

Preserved pension wealth is wealth held in pensions to which contributions are no longer being made but from which an income is not yet being drawn. Preserved pensions are usually a result of individuals leaving employment (of which they were actively contributing to their workplace pension) before reaching the age at which retirement income can be drawn.

The smallest component of pension wealth in April 2016 to March 2018 was preserved pension wealth, with £940 billion held in pensions of this type. Although this type of wealth was the smallest component, unchanged from previous periods (Figure 2), this component saw the largest growth of all the components, increasing from £741 billion in April 2014 to March 2016 (inflation adjusted).

Figure 7 shows that just over three-fifths (61%) of preserved pension wealth was held in occupational defined benefit schemes (£573 billion) in April 2016 to March 2018, a proportion that has decreased since the previous period when occupational defined benefit schemes accounted for 69% of preserved pension wealth.

The proportion of preserved pension wealth held in occupational defined benefit schemes has decreased between the current and previous period because of:

increased wealth in preserved defined contribution pensions, contributed to by increased membership of individuals with preserved entitlements of this type in April 2016 to March 2018 (Figure 8)

changes to annuity rates and discount factors used to calculate preserved occupational defined benefit pension pots between current and previous period

Preserved defined benefit wealth is valued as the pension pot required for an agreed specified income in the future. It is calculated using financial assumptions (discount and annuity factors) that are obtained each month to reflect current market influences. The pension pot required to provide a specified income in retirement can therefore change when market influences change. This does not affect the specified income a person with a defined benefit pension will receive though.

The resulting effect of changes to annuity rates and discount factors between the previous (April 2014 to March 2016) and current period (April 2016 to March 2018) accounted for approximately a quarter of the decrease in the proportion of preserved pension wealth held in occupational defined benefit schemes (see Table 6.17 of the pension wealth datasets).

Figure 7: More than three-fifths of preserved pension wealth is held in occupational defined benefit schemes

Breakdown of aggregate preserved pension wealth, by pension type, Great Britain, July 2010 to March 2018

Source: Office for National Statistics – Wealth and Assets Survey

Notes:

- Defined contribution includes occupational defined contribution and personal pensions.

- Preserved drawdown pension wealth includes when part of the pension fund has been drawn but a portion of the pot is retained to use at a later date.

- Pension wealth valuation for preserved defined benefit and expected pensions from former spouse or partner are calculated using market factors.

- Figures have been deflated to April 2016 to March 2018 prices using the Consumer Prices Index including owner occupiers’ housing costs (CPIH).

- Note the change in periodicity from two-years starting in July and ended in June two years later to a two-year periodicity that starts in April and ends in March two years later (financial year-based). More information on this change can be found in the Moving the Wealth and Assets Survey onto a financial years basis methodology article.

- Includes all individuals with preserved pension wealth and aged 16 years and over but excludes those aged 16 to 18 years and in full-time education.

Download this chart Figure 7: More than three-fifths of preserved pension wealth is held in occupational defined benefit schemes

Image .csv .xlsPension wealth in preserved defined contribution pensions in April 2016 to March 2018 increased by 60% since the previous period (inflation adjusted). This increase was partially caused by increased levels of membership in preserved defined contribution pensions.

Figure 8 shows an increase in the proportion of individuals with wealth in preserved defined contribution pensions from April 2014 to March 2016 and April 2016 to March 2018 for all age groups, with the largest increases for those aged 25 to 34, 45 to 54 and 55 to 64 years.

Figure 8: The share of people with preserved defined contribution pensions has increased across all age groups

Proportion of individuals with preserved defined contribution pensions, by age band, Great Britain, July 2010 to March 2018

Source: Office for National Statistics – Wealth and Assets Survey

Notes:

- Individuals include adults aged 16 and over, but does not include those individuals aged 16 to 18 years and in full-time education.

- Defined contributions pensions include occupational and personal pensions.

- Note the change in periodicity from two-years starting in July and ended in June two years later to a two-year periodicity that starts in April and ends in March two years later (financial year-based). More information on this change can be found in the Moving the Wealth and Assets Survey onto a financial years basis methodology article.

Download this chart Figure 8: The share of people with preserved defined contribution pensions has increased across all age groups

Image .csv .xlsA reason for the increase in the number of individuals with this type of wealth could be the effects of automatic enrolment and large increases to actively contributing occupational defined contribution pensions (Figure 4). Leaving employment, opting out, ceasing membership of their workplace pension or employers providing new workplace pension schemes have resulted in more adults with preserved pension entitlements in defined contribution pensions.

Nôl i'r tabl cynnwys9. Trends in pensions in payment

Proportions of individuals with pensions in payment

As shown in Figure 2, pensions in payment wealth accounts for nearly half of all private pension wealth, largely unchanged over time. The proportions of individuals with pensions in payment has been quite steady since the period July 2006 to June 2008.

Figure 9: Women are less likely than men to have private pensions in payment, at any age

Proportion of individuals with private pensions in payment by age band and sex, Great Britain, April 2016 to March 2018

Source: Office for National Statistics – Wealth and Assets Survey

Notes:

- Pensions in payment wealth comprises private pensions from which individuals were receiving an income (including spouse pensions).

- Nominal values are taken from the pension wealth datasets Table 6.9.

Download this chart Figure 9: Women are less likely than men to have private pensions in payment, at any age

Image .csv .xlsFigure 9 shows that for those aged less than 60 years old, the percentage of individuals with pensions in payment is low but, as expected, increases with age. For example, of individuals aged 50 to 54 years, 4% have a pension in payment, whereas for those aged between 55 and 59 years, 16% have a pension in payment. For those aged 65 years and over, the proportion of individuals with a private pension in payment is much higher, at around 64%. For older individuals, those with no private pension in payment will either have no private pension to draw, or chosen to defer drawing their retirement income or withdrawn their entire pension pot in one go.

The gender gap for all age groups above age 65 years is fairly consistent, with men being around one and a half times more likely to have a private pension in payment. This may be a result of differences in historic working patterns between men and women, which may have affected the likelihood of women to contribute to a private pension or (for those that did contribute) women may be more likely to take their entire pension pot in one go than men (rather than purchasing an annuity, for example) on account of women typically accruing lower levels of pension wealth.

Men being more likely than women to have private pensions in payment is likely to continue into the future, as there remains a gap in participation of active private pensions (in April 2016 to March 2018). There is potential for the gap to narrow over the longer-term as a result of changes in the labour market (women more likely to be in employment than in previous decades) and the impact of automatic enrolment.

Nôl i'r tabl cynnwys10. Levels of wealth in private pensions in payment

Although levels of participation in private pensions in payment has remained stable during the last two periods, aggregate private pension wealth (of pensions in payment) grew by 17%, from £2,498 billion in April 2014 to March 2016 (figures adjusted by inflation) to £2,916 billion in April 2016 to March 2018.

As already discussed, derivation of this type of pension wealth uses annuity rates, allocated at wealth estimation time point, which are determined by market influences. Therefore, although an individual’s retirement income broadly remains unchanged over time, the value of the pension pot required to provide the income may change over time if the annuity rates used to estimate the wealth change. Between the current and previous period more than four-fifths (85%) of the growth between these periods can be attributed to the change in annuity rates used in deriving pensions in payment wealth (see Tables 6.17 and 6.18 in the pension wealth datasets).

In Figure 10 we are focusing on age groups 65 years and above; however, as Figure 9 shows, there are individuals younger than this with pensions in payment wealth (Table 6.9 of the pension wealth datasets).

Considering median pensions in payment wealth for those aged 65 years and above, the average wealth for men is double that of women. This calculation only includes those men and women with private pension wealth. As there are many more women than men with no private pension wealth, were all individuals included, the difference would be greater still.

Rationalising the differences between male and female pension participation and wealth accrual over time is complex, and out of the scope of this article and datasets. Differences in historic labour market participation between men and women, the gender pay gap and societal changes in household composition and economic activity within households amongst other factors underpin the trends observed.

Figure 10: For those aged 65 years and over, with pensions in payment, median pension wealth of men is nearly double that of women

Median pension wealth for pensions in payment, for individuals with this type of wealth, by age band, and sex, Great Britain, April 2016 to March 2018

Source: Office for National Statistics – Wealth and Assets Survey

Notes:

- Pensions in payment wealth comprises private pensions from which individuals were receiving an income (including spouse pensions).

- Nominal values are taken from the pension wealth datasets Table 6.9.

- Excludes individuals with zero wealth in pensions in payment.

Download this chart Figure 10: For those aged 65 years and over, with pensions in payment, median pension wealth of men is nearly double that of women

Image .csv .xls11. Pensions wealth in Great Britain data

Total wealth: wealth in Great Britain

Dataset | Released on 5 December 2019

Total wealth is the sum of the four components of wealth and is therefore net of all liabilities.

Pension wealth: wealth in Great Britain

Dataset | Released on 5 December 2019

The value of any pension pots already accrued that are not state basic retirement or state earning-related. This includes occupational pensions, personal pensions, retained rights in previous pensions and pensions in payment.

Quality indicators: wealth in Great Britain

Dataset | Released on 5 December 2019

Standard error information for total mean, median and change of total wealth and its components.

12. Glossary

Automatic enrolment

Under reforms brought in by the Pensions Act 2008, with updates in the Pensions Acts 2011 and 2014, automatic enrolment was introduced in October 2012 stating employers must enrol all eligible employees (who are not already participating in a qualifying workplace pension scheme) into a qualifying workplace private pension.

Staged automatic enrolment is based on the size of the employer’s Pay As You Earn (PAYE) scheme and began in October 2012 with larger employers and completed in 2018. Workers can opt out but will be re-enrolled every three years.

Defined benefit scheme

An occupational pension scheme in which the rules specify the rate of benefits to be paid. The most common defined benefit scheme is a salary-related scheme in which the benefits are based on the number of years of pensionable service, the accrual rate and either the final salary, the average of selected years’ salaries or the best year’s salary within a specified period before retirement.

Defined contribution scheme

A pension scheme in which the benefits are determined by the contributions paid into the scheme, the investment return on those contributions and the type of annuity (if any) purchased upon retirement. It is also known as a money purchase scheme. Defined contribution pensions may be occupational, personal or stakeholder pensions.

Occupational pension scheme

An arrangement (other than accident or permanent health insurance) organised by an employer (or on behalf of a group of employers) to provide benefits for employees on their retirement and for their dependants on their death. In the private sector, occupational schemes are trust-based. Occupational pension schemes are a form of workplace pension.

Opt-out

Where a jobholder has been automatically enrolled, they can choose to “opt out” of a pension scheme. This has the effect of undoing active membership, as if the worker had never been a member of a scheme on that occasion. It can only happen within a specific time period, known as the “opt-out period”, which is one calendar month from whichever date is the later out of the date active membership was achieved or the date they received their enrolment letter. After this opt-out period a jobholder can still choose to leave the scheme at any time, but will not usually get a refund of contributions, which will be held in their pension until they retire.

Pension scheme

A legal arrangement offering benefits to members upon retirement. Schemes are provided by employers and are differentiated by a wide range of rules governing membership eligibility, contributions, benefits and taxation. Pension schemes in the private sector have trustees. Personal pensions and stakeholder pensions offered by insurance companies may also be referred to as schemes, but technically they are individual accounts rather than schemes.

Further definitions of pensions terms are available in the Employee workplace pensions glossary.

Nôl i'r tabl cynnwys13. Measuring the data

Data sources and collection

The Wealth and Assets Survey (WAS) was launched in 2006 and is a biennial longitudinal survey conducted by the Office for National Statistics (ONS). This survey measures the well-being of households and individuals in terms of their assets, savings and debt, and planning for retirement. The survey also examines attitudes and attributes related to these. Classificatory variables (age, sex, employment status) are also collected.

Data from this longitudinal survey will also provide users with the ability to measure changes of wealth in Great Britain over time. The survey is currently sponsored by a funding consortium, including the ONS, Department for Work and Pensions (DWP), HM Revenue and Customs (HMRC) and the Scottish Government (SG). Interviewers working on the survey refer to it as the Household Assets Survey (HAS).

The first wave of the survey began with interviews carried out over two years from July 2006 to June 2008 with approximately 30,000 households interviewed. A second wave took place two years on from initial interviews, covering the period July 2008 to June 2010, with approximately 20,000 households obtained. Wave 3 obtained approximately 21,000 households, wave 4 obtained 20,000 and wave 5 obtained 18,000.

This periodicity that started in July and ended in June two years later is referred to as a “wave” and was maintained until wave 5, which covered the period July 2014 to June 2016. The survey has now moved to a two-year, financial year-based periodicity (April to March) with this periodicity being referred to as a “round”. Therefore, round 6 covers the period April 2016 to March 2018. This move to a two-year, financial basis allows WAS to be integrated with other household financial surveys that are based on financial years. This allows WAS to be analysed on a consistent basis alongside other components included within other household financial surveys (income and expenditure). Round 6 achieved approximately 18,000 household interviews.

As wealth is known to be unevenly distributed, addresses more likely to contain wealthier households were sampled at a higher rate to improve the efficiency of the sample. These addresses were identified using data from HMRC.

The WAS is a continuous survey with interviews spread evenly over the year, which helps to ensure that estimates are not biased by seasonal variations. The survey samples private households in Great Britain, excluding north of the Caledonian Canal, the Scottish Islands and the Isles of Scilly.

Quality and methodology

More quality and methodology information on strengths, limitations, appropriate uses, and how the data were created is available in the Wealth and Assets Survey QMI.

Measuring average wealth

The median and the mean are both measures of “average wealth”. Median wealth is the wealth of what would be the middle household, if all the households in Great Britain were sorted from poorest to richest, whereas the mean is the wealth of all households divided by the number of households. Median household wealth arguably provides a better measure of “typical wealth levels”, as the mean can be influenced by just a few households with high levels of wealth.

Nôl i'r tabl cynnwys14. Strengths and limitations

Accounting for inflation

Accounting for inflation in wealth is more complex than for income or expenditure as the components of wealth, such as property, pensions and investments undergo complex changes over time. However, as the survey has now been in the field for over a decade, some form of adjustment for price changes is necessary to allow sensible comparison of trends over time within this report.

We have used the Consumer Prices Index including owner occupiers’ housing costs (CPIH) for this purpose, to reflect the general change in the value of money over time. Where inflation-adjusted “real” prices are provided, these are in April 2016 to March 2018 prices (that is, average prices for the period April 2016 to March 2018). Note that the background tables are in nominal terms so may not match the figures quoted here.

Briefly, the nominal figures, recorded over a survey period (t), are multiplied by the ratio of the average of the monthly CPIH index for round 6 months (April 2016 to March 2018) to the average of the CPIH index for the survey period (t):

To allow for replication of the inflation-adjusted figures, the following table contains the deflators used for each time period. The nominal figure multiplied by the deflator for the relevant time period will give the figure in April 2016 to March 2018 prices.

| Time period | Deflator |

|---|---|

| July 2006 to June 2008 | 1.23 |

| July 2008 to June 2010 | 1.17 |

| July 2010 to June 2012 | 1.1 |

| July 2012 to June 2014 | 1.05 |

| July 2014 to June 2016 | 1.03 |

| April 2014 to March 2016 | 1.03 |

Download this table

.xls .csvMore detailed work on adjusting for price changes over time is planned ahead of publication of the next round of the Wealth and Assets Survey (WAS), including exploration of specific deflators for individual components of wealth.

Sampling errors and significance testing

All reasonable attempts have been made to ensure that the data are as accurate as possible. However, there are two potential sources of error that may affect the reliability of estimates and for which no adequate adjustments can be made; these are known as “sampling” and “non-sampling” errors. These concepts are explained further in the Wealth and Assets Survey QMI.

No estimates are included that are based on fewer than 30 responding households. However, because of the complexity of the data (such as imputed values and complex weighting) no formal significance testing has been undertaken at this stage, though this will be covered in later releases.

Wave 1 half sample

A methodological decision at wave 1 (July 2006 to June 2008) of the WAS to reduce respondent burden resulted in a selection of questions, including components of physical wealth, to be asked only of a subset of households. This decision had implications for the estimation of aggregate total wealth. This subsequent “half sample” was sufficiently large to produce robust results and does not affect the reliability of the wealth distributions at a household level. Estimates of total household wealth are therefore based upon data from this half-sample of 17,316 households.

To estimate aggregate total wealth, the full sample has been used for property wealth, financial wealth and private pension wealth. However, estimates of aggregate physical wealth are based on responses for the half sample (17,316 households), which have been adjusted using a “rating up factor” in addition to our standard weighting procedures. For subsequent periods of the survey, each household was asked the full suite of questions on the components of net wealth. Consequentially, later estimates of total household and aggregate total wealth are both based upon the full responding sample.

Estimating private pension wealth

Private pension wealth relates to the value of any private pensions already accrued that are not State Pension-related. This includes occupational pensions, personal pensions, retained rights in previous pensions and pensions in payment.

Estimating the value of some private pensions is straightforward. For example, if a pension is a defined contribution type scheme (not in payment) the valuation is obtained from the respondents’ latest statement from their pension administrator. This is an accurate estimation of each individual pension pot taking into account any relevant market influences (for example, investment returns).

However, estimating the value of other schemes where a specific level of payment is guaranteed at retirement (for example, defined benefit type schemes) or for pensions in payment where an annuity has already been purchased, any pension statements received would not include the value of the pension pot, only the value of the income to be received on retirement. Therefore, the value of the pot required to pay the defined benefit income is estimated using the length of employment, accrual fraction and earned income, together with external economic indicators such as annuity rates and discount factors.

As a result, the value of such pots can change significantly between waves when the underlying information received from respondents has not really changed. Whilst this can seem intuitively incorrect, it is simply recognising that external economic factors can significantly change the value of a pension pot required to yield a specific value of pension (see methodology link).

The strengths and limitations of the Wealth and Assets Survey (WAS) can be found in the Quality and Methodology Information (QMI) report.

Nôl i'r tabl cynnwys