1. Main points

This is the second edition of an experimental release designed to provide provisional estimates of measures of the distribution of household income significantly ahead of the main estimates produced from household surveys.

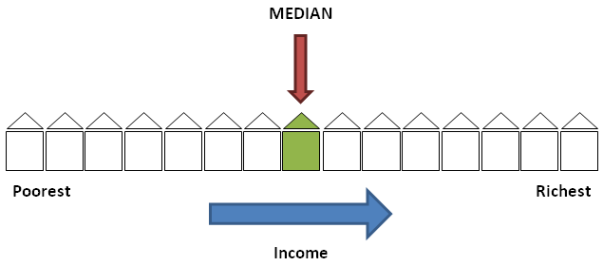

The provisional estimate of median household disposable income for 2015/16 is £26,400, an estimated increase of £700 from 2014/15, after accounting for inflation and household composition, and £400 higher than its pre-downturn value of £26,000 in 2007/08.

Median income for retired households continued to increase following the economic downturn and provisional estimates for 2015/16 suggest it is now £21,500, £1,700 higher in real terms than in 2007/08 (£19,800).

By contrast, the provisional 2015/16 results indicate that the value of median income for non-retired households is £29,200, which remains £400 below its level of £29,600 in 2007/08.

Early estimates of income inequality in 2015/16 are broadly unchanged from those for the previous financial year.

Nôl i'r tabl cynnwys2. Introduction

In order to properly understand changes in households' material living conditions, it is important to have measures that reflect the experience of the typical household, such as median household disposable income, as well as other indicators that can also provide a description of the income distribution. However, the complexities involved in collecting, processing and analysing household financial survey data mean such indicators are typically only available with a significant time lag.

In order to meet the considerable user demand for more timely data on household incomes, we have developed this set of Experimental Statistics, produced using so-called “nowcasting” techniques.

What is nowcasting?

Nowcasting is an increasingly popular approach for providing initial estimates of household income indicators. Unlike forecasting, which relies heavily on projections and assumptions about the future economic situation, nowcasting makes use of data that are already available for the period of study.

Although, at the time of producing these statistics, detailed survey data on household incomes are not yet available for 2015/16, a lot is known about various individual components of household income, as well as other factors that affect them. This information includes data on earnings, employment and inflation, as well as details of how changes to the tax and benefits system affect different types of households and individuals. This information is used to adjust income survey data for recent years to reflect the current period. This technique allows the publication of estimates for measures such as median disposable income far earlier than was previously possible.

It is unrealistic to expect nowcast estimates to perfectly reflect changes in the distribution of income, particularly when examining smaller subgroups of the population, so the estimates should be treated as providing an early indication of what the full survey-based data may show when they are available in 2017.

The methodology used in this bulletin has undergone significant testing and benefited from having a range of external experts ensure it is as robust as possible. As Experimental Statistics, the content of this bulletin and the methodology behind it will continue to be evaluated to ensure that user needs are met.

Nôl i'r tabl cynnwys3. Trends in household incomes

This section presents the provisional, “nowcast” estimates for 2015/161 in the context of longer-term trends in household income.

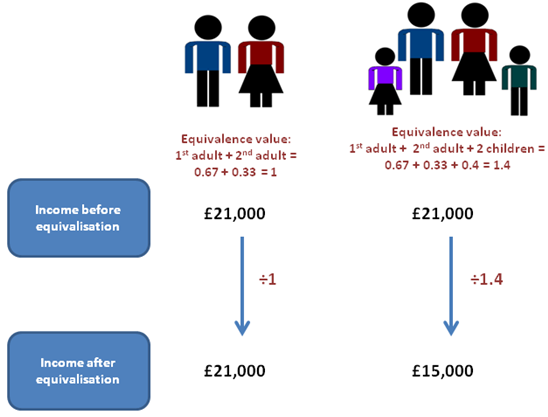

Based on these provisional estimates, the median household disposable income was £26,400 in 2015/16. After taking account of inflation2 and changes in household composition over time, this figure is £400 higher than the pre-economic downturn level observed in 2007/08 (£26,000). Median household income declined after the start of the economic downturn, with most of that decrease occurring between 2009/10 and 2012/13, with median incomes in 2012/13 £1,300 lower in real terms than in 2009/10. However, since 2012/13 there has been a real terms increase, with the provisional 2015/16 figure indicating it is around 8% higher than in 2012/13 (Figure 1).

Figure 1: Change in mean and median equivalised household disposable income, 1977 to 2015/16

UK

Source: Office for National Statistics

Notes:

- Indices are calculated relative to 1977 values.

- 1994/95 represents the financial year ending 1995 (April 1994 to March 1995), and similarly through to 2015/16, which represents the financial year ending 2016 (April 2015 to March 2016).

- Income figures have been deflated to 2015/16 prices using the implied deflator for the household sector.

- Income is equivalised using the modified-OECD scale.

Download this chart Figure 1: Change in mean and median equivalised household disposable income, 1977 to 2015/16

Image .csv .xlsThere has been a broadly similar pattern of growth in mean household income, with a provisional estimate for 2015/16 of £31,900, up from £30,100 in 2012/13. An important factor contributing to the growth in average disposable incomes has been rising income from employment. Average earnings grew in real terms in 2015/16, which, combined with the continued growth in employment rates, meant that this impact was felt strongly in household incomes.

Taking a longer-term perspective, median disposable income is estimated to be over twice (2.2 times) as high in 2015/16 as in 1977, growing from £12,100 in 1977 at an average rate of 2.1 % per year. Over the same period, mean household income is estimated to have increased at a faster rate than the median measure, growing at an average annual rate of 2.3% from £13,600 to £31,900. The faster growth of the mean measure was primarily due to incomes of high-income households growing at a faster rate than for households in the middle and lower parts of the income distribution between 1977 and 1990.

Figure 2 shows the growth of median household incomes for retired and non-retired households. For both groups of households, the provisional estimates for 2015/16 show that the value of median disposable income has increased since its recent low in 2012/13, after taking account of inflation and changes in household composition over time. However, the pattern of change since the start of the economic downturn has been very different for retired and non-retired households. While incomes of non-retired households remained higher than those of retired households, since 2007/08, median income for retired households has increased in most years, with the value rising to £20,200 in 2012/13, £400 higher than in 2007/08. By contrast, the median income for non-retired households decreased over the same period, and was £2,600 lower in 2012/13 than in 2007/08. However, since 2012/13, the value of the median for non-retired households has grown at a faster average rate (2.7% per year) than for retired households, for whom the median has grown at an average rate of only 2% per year.

Figure 2: Growth of median equivalised household disposable income by household type, 1977 to 2015/16

UK

Source: Office for National Statistics

Notes:

- Indices are calculated relative to 1977 values.

- 1994/95 represents the financial year ending 1995 (April 1994 to March 1995), and similarly through to 2015/16, which represents the financial year ending 2016 (April 2015 to March 2016).

- Income figures have been deflated to 2015/16 prices using the implied deflator for the household sector.

- Income is equivalised using the modified-OECD scale

- 23 November 2016: The unit of this chart has been amended to 1977=100 due to an error at the time of publishing.

Download this chart Figure 2: Growth of median equivalised household disposable income by household type, 1977 to 2015/16

Image .csv .xlsSimilar patterns for retired and non-retired households are also observed in the value of mean disposable income. Unlike median income growth rate, however, the growth rate in the mean since 2012/13 was stronger for retired households. A number of factors have driven the consistent growth in the incomes of retired households since 2007/08. One is a rise in the number of households reporting receipts from private pensions or annuities. Another is an increase in average income from the state pension, due in part to the impact of the “triple lock”3.

The fall in average disposable income for non-retired households after the economic downturn largely reflected a fall in income from employment (including self-employment). Similarly, it is earnings growth at the household level, in part due to rising employment levels, which has been the main driver of the most recent increases in average income for non-retired households.

Notes for Trends in household incomes

Throughout this release, 2015/16 refers to the financial year ending 2016. Similarly for other split years, for example 2014/15 refers to the financial year ending 2015.

All income measures given for the UK in this article have been deflated to 2015/16 prices using an implied deflator for the household sector in order to give a better comparison of households’ standards of living.

A mechanism currently used by the government which guarantees to increase the basic State Pension by the higher of inflation (as measured by the Consumer Price Index), average earnings or a minimum of 2.5% every year.

4. Trends in income inequality

There are a number of different ways in which inequality of household income can be presented and summarised. Amongst them, the Gini coefficient is perhaps the most commonly used internationally. It ranges between 0 and 100, where 0 indicates that income is shared equally among all households and 100 indicates that 1 household has all the income. Therefore, the lower the value of the Gini coefficient, the more equally household income is distributed.

Looking at the results for all households, the 1980s were characterised by a large increase in inequality of disposable income, particularly during the second half of that decade. Following that rise, inequality of disposable income reduced slowly from 1990 until the mid-1990s, although it did not reverse the rise seen in the previous decade. In the late 1990s, income inequality rose slightly before falling once again in the early 2000s.

Figure 3: Gini coefficients, 1977 to 2015/16

UK

Source: Office for National Statistics

Notes:

- On this figure 1994/95 represents the financial year ending 1995 (April 1994 to March 1995), and similarly through to 2015/16, which represents the financial year ending 2016 (April 2015 to March 2016).

- (p) indicates results are provisional.

Download this chart Figure 3: Gini coefficients, 1977 to 2015/16

Image .csv .xlsIn recent years, there has been relatively little change in levels of income inequality. The provisional estimate for the Gini coefficient for disposable income in 2015/16 was 32.3%. This is not statistically significantly different to the 2014/15 value of 32.6%, and is in line with the longer term trend, which has shown a very gradual decline in inequality on this measure since 2006/07.

Inequality of disposable income for retired households has followed a similar trend, with the Gini coefficient increasing significantly during the 1980s and peaking at 30.3% in 1990. Since then the broad trend has been downwards, though income inequality levels remain above those seen in the late 1970s and early 1980s.

The characteristics of the Gini coefficient make it particularly useful for making comparisons over time, between countries and before and after taxes and benefits. However, no indicator is completely without limitations and one drawback of the Gini is that, as a single summary indicator, it cannot distinguish between different shaped income distributions. For that reason, it is useful to look at this index alongside other measures of inequality. One such measure is the S80/S20 ratio, which is the ratio of the total income received by the 20% of households with the highest income to that received by the 20% of households with the lowest income. Another related measure is the P90/P10 ratio. This is the ratio of the income of the household at the bottom of the top decile to that of the household at the top of the bottom decile.

A relatively recently developed inequality measure, the Palma ratio, takes the ratio of the income share of the richest 10% of households to that of the poorest 40% of households. The idea behind using the Palma ratio is that the middle 50% of households are likely to have a relatively stable share of income over time, and so isolating them should not lead to a substantial loss of information (Cobham and Sumner, 2013). Together these measures provide further evidence of how incomes are shared across households and how this is changing over time.

Figure 4: Change in Gini coefficient, S80 and S20 ratio, P90 and P10 ratio and Palma ratio for equivalised disposable income, all households, 1977 to 2015/16

UK

Source: Office for National Statistics

Notes:

- Indices are calculated relative to 1977 values.

- 1994/95 represents the financial year ending 1995, and similarly through to 2015/16, which represents the financial year ending 2016.

- (p) indicates results are provisional.

Download this chart Figure 4: Change in Gini coefficient, S80 and S20 ratio, P90 and P10 ratio and Palma ratio for equivalised disposable income, all households, 1977 to 2015/16

Image .csv .xlsFigure 4 shows the pattern of change in each of these measures since 1977 for all households, using provisional figures based on nowcast estimates for 2015/16.

The chart shows that income inequality trends in the UK have been very similar on all 4 measures. Some year-on-year movements may reflect survey volatility; however, inequality of disposable income increased in the late 1980s and, to a lesser extent, during the late 1990s, during periods of faster growth in income from employment, and fell in the early 1990s during a period of slower growth in employment income.

Since the turn of the millennium, changes in income inequality have been relatively small compared with previous decades. In the early 2000s, income inequality fell. This was in part due to faster growth in income from earnings and self-employment income at the bottom end of the income distribution. Policy changes, such as increases in the national minimum wage, increases in tax credit payments, and the increase in National Insurance contributions in 2003/04 are also likely to have had an impact.

The most recent peak in income inequality was in 2006/07 or 2007/08 depending on the measure used. Since then, the broad trend has been one of gradual decline in levels of inequality on each of the measures.

Nôl i'r tabl cynnwys5. Economic context

In the financial year 2015/16, real output in the UK economy increased 2.0% on the preceding 12 months, continuing a period of growth following the 2008/09 economic downturn but at a slower pace than the 2014/2015 financial year (3.1%). By the end of the period, the UK had recorded 13 quarters of consecutive economic growth. While aggregate real GDP surpassed its pre-downturn peak in Quarter 2 (Apr to June) 2013, GDP per head took until Quarter 3 (July to Sept) 2015 to overtake its pre-downturn peak.

The labour market continued to perform strongly in the 2015/16 financial year. In the 3 months to March 2016, the headline employment rate was 74.2%, the joint highest since comparable records began in 1971. Over the same period, the unemployment rate was 5.1%, lower than a year earlier (5.6%).

Other headline indicators in the May 2016 Labour Market Release suggest the labour market has been performing strongly in recent months, which typically correlates with increasing nominal earnings growth. However, after increasing growth in early 2015, nominal regular pay growth has eased since then and stood at 2.2% in the 3 months to March 2016. This is less than its peak of 2.9% on an annual basis seen in the 3 months ending July 2015.

Figure 5: Contributions to the growth of real regular pay: Consumer Price Index (CPI) inflation and the growth of average regular weekly earnings, 2008 to 2016

UK

Source: Office for National Statistics

Notes:

- The data for regular pay presents the 3 months on 3 months a year ago growth rate for the month at the end of the period (the final data is for January to March 2016).

Download this chart Figure 5: Contributions to the growth of real regular pay: Consumer Price Index (CPI) inflation and the growth of average regular weekly earnings, 2008 to 2016

Image .csv .xlsThe rate of price inflation in the economy is also an important component that determines households’ real income growth. There was persistent low inflation in the 2015/2016 financial year, driven partly by a fall in oil prices. This low inflation combined with nominal pay increases has meant that real wages continued to grow in the 2015/16 financial year as they did towards the end of the second half of the previous financial year, following several years of falling real wages after the economic downturn.

Figure 6: Measures of economic well-being: GDP per head and net national disposable Income per head, chained volume measure, Quarter 1 2005 to Quarter 1 2016

UK

Source: Office for National Statistics

Download this chart Figure 6: Measures of economic well-being: GDP per head and net national disposable Income per head, chained volume measure, Quarter 1 2005 to Quarter 1 2016

Image .csv .xlsFigure 6 presents 2 alternative measures of economic well-being – gross domestic product per head and net national disposable income (NNDI) per head. NNDI per head makes 2 adjustments to GDP per head; (a) subtracts the consumption of capital – the wear and tear resulting from assets being used in production – from GDP, capturing the net value of production and (b) includes a measure of net international investment income. While the 2 measures grew at broadly the same rate through much of 2014, their growth rates have diverged in recent periods. Between Quarter 1 (Jan to Mar) 2015 and Quarter 1 2016, GDP per head grew by 1.3%, while NNDI per head contracted by 0.9%. These relatively marked differences reflect some of the more detailed developments in the UK economy. In particular, the fall of NNDI relative to these other measures reflects the fall in the UK’s balance on income with the rest of the world: over this period, UK earnings overseas have grown less strongly than the earnings of overseas agents in the UK. This trend is largely accounted for by the fall in the relative rate of return on UK assets held overseas.

Overall, these 2 measures compare relatively well with the strong growth observed in median household disposable income since 2013/14, based on The effects of taxes and benefits on household income (ETB) and nowcast estimates. More recently, growth in median household income more closely resembles GDP per head growth rather than NNDI per head growth. This possibly reflects that the fall in balance on income with the rest of the world has not impacted greatly upon the household sector.

Nôl i'r tabl cynnwys6. Policy context: Changes to taxes and benefits in 2015/16

Some of the main tax and benefit changes occurring during 2015/16 included the following.

Child Tax and Working Tax Credit

The basic element of Working Tax Credit (WTC) rose by £20 (around 1%) to £1,960 a year. The family element of Child Tax Credit (CTC) was frozen at £545 a year, while the child element rose by £30 (around 1%) to £2,780.

Benefit uprating

Benefits for working age people, including Universal Credit, Jobseeker’s Allowance and Income Support increased by 1% in April 2015. Benefits received by disabled people and pensioners (including Personal Independence Payments, Attendance Allowance and Incapacity Benefit) were increased by 1.2%. The State Pension also increased by 2.5% due to the “triple lock” which guarantees to increase the basic State Pension by the higher of CPI inflation, average earnings or a minimum of 2.5% every year.

Personal independence payment

The roll-out of Personal Independence Payment (PIP) continued and the final phase rollout was brought forward from October to July 2015. PIP is replacing Disability Living Allowance (DLA) for adults aged under 65 in England, Wales and Scotland. PIP is made up of 2 components and is paid at a standard and enhanced rate which both increased by 1.2% in 2015/16. Eligibility for PIP is assessed using different criteria than for DLA. The assessment for PIP includes a review of an individual’s ability to participate fully in society as opposed to the severity of impairment. All new claimants were assessed for PIP from June 2013.

Child benefit

The rate for a first child rose by £0.20 (around 1%) to £20.70, while the rate for second & subsequent children rose by £0.15 (around 1%) to £13.70 per week. Guardian’s allowance increased by £0.20 per week to £16.75.

Income tax

For the first time since the decision to phase out age-related personal allowances, those born between 6 April 1938 and 5 April 1948 received the same tax-free personal allowance as those born after 5 April 1948, increasing to £10,600 for both groups. There was no change to the personal allowance for those born before 6 April 1938, which stayed at £10,660. There was a reduction in the higher rate band for income tax from £31,866 to £31,786. Combined with the personal allowance, this meant that people paid the higher rate of 40% on any taxable income above £42,385, up from £41,865 in 2014/15.

Council tax

The average band D dwelling Council Tax set by local authorities in England for 2015/16 was £1,484, an increase of £16 or 1.1% on 2014/15. Council Tax levels were frozen in all local authorities in Scotland. However, in Wales, the average band D Council Tax increased by 4.1% compared with 2014/15.

Nôl i'r tabl cynnwys7. About these statistics

How are these statistics produced?

The input data for this analysis comes from the Living Costs and Food Survey (LCF) and The effects of taxes and benefits on household income (ETB) dataset which is derived from the LCF. Together these provide information on income, expenditure and important family characteristics. These data are first adjusted to reflect how changes in the macro-economic conditions have affected households at different points of the income distribution. The next step of the analysis involves applying the rules of the current tax and benefit system to the household level data to calculate disposable incomes for those households. Finally, adjustments are made to take into account changes in labour market participation and the socio-demographic characteristics of the population.

For this statistical bulletin, historical income data were used to estimate household income data for the 2014/15 and 2015/16 financial years. The growth rate between the 2 nowcasts for measures such as equivalised disposable income was then applied to the published 2014/15 estimates from the latest The effects of taxes and benefits on household income (ETB) release, published 24 May 2016.

A detailed description of the methodology is provided in the accompanying article, Nowcasting household income in the UK: Methodology, 2016.

How do these estimates fit in with other official statistics on household incomes?

These experimental nowcast estimates have been developed to serve as early or provisional estimates of figures that are currently published in The effects of taxes and benefits on household income (ETB). When the survey based ETB figures for 2015/16 income are available in 2017, they will supersede these nowcast estimates. We will also use these survey-based figures to evaluate the accuracy of these nowcasts.

The figures published in this bulletin use exactly the same definition of disposable income used in ETB, which in turn is consistent with the concepts set out in the second edition of the UNECE Canberra Handbook (UNECE, 2011); this sets out the main international standards in this area. Additionally, these estimates and ETB use the same primary data source, the Living Costs and Food Survey.

The Department for Work and Pensions (DWP) also publishes analysis each year, particularly focussing on the lower part of the household income distribution, in their publication Households below average income (HBAI). Due to HBAI being based on a larger survey, along with some methodological and conceptual differences, HBAI and ETB estimates for these figures can differ slightly from each other. Although historical trends are broadly similar across the 2 sources, these nowcasts use the ETB methodology and data source so may not reflect future changes in HBAI.

What are Experimental Statistics?

The UK Statistics Authority Code of Practice defines Experimental Statistics as “new official statistics undergoing evaluation. They are published in order to involve users and stakeholders in their development and as a means to build in quality at an early stage.”

The data contained within this release have undergone the same high levels of quality assurance as other official statistics. However, as Experimental Statistics, the methodology used to create them remains under development and may be revised following further evaluation. It is therefore recommended that this is taken into account when using the findings.

As with any other nowcast, the accuracy of these indicators will inevitably depend on many factors. Throughout the development work feeding into this bulletin, a variety of approaches have been tested in order to develop a robust methodology, and the experience of external experts has been used in order to make use of international best practice. Despite this, it is unrealistic to expect nowcast estimates to perfectly reflect changes in the distribution of income, particularly when examining smaller subgroups of the population. This means that the final survey data may show different patterns of change for some groups. This is taken into account in the level of detail presented in the initial edition of this bulletin.

In line with the UK Statistics Authority’s statement on Assessment and Designation of Experimental Statistics, we will be carefully evaluating these new estimates against the Code of Practice for Official Statistics. This will include assessments of both the quality of the estimates themselves and the extent to which they meet user needs.

Accuracy and reliability of nowcast estimates

The nowcast estimates are subject to the same degree and types of statistical error as any other analysis based on survey data. In particular, as the LCF data is a sample survey, the estimates are subject to sampling error. Surveys gather information from a sample rather than from the whole population. The sample is designed carefully to allow for this, and to be as accurate as possible given practical limitations such as time and cost constraints, but results from sample surveys are always estimates, not precise figures. This means that they are subject to a margin of error, which can have an impact on how changes in the numbers should be interpreted, especially in the short-term. In practice, this means that small, short-term movements should be treated as indicative, and considered alongside medium and long-term patterns in the series.

As well as sampling error, all statistics, including these nowcast estimates, are also subject to non-sampling error. Non-sampling error includes all sources of data error that are not a result of the way the sample is selected. Throughout the development work feeding into this bulletin, a variety of approaches have been tested in order to develop a robust methodology, and the experience of external experts has been used in order to make use of international best practice. Despite this, it is unrealistic to expect nowcast estimates to perfectly reflect changes in the distribution of income, particularly when examining smaller subgroups of the population, so the estimates should be treated as providing an early indication of what the full survey-based data are expected to show.

Further information is available in the Accuracy of the statistics: estimating and reporting uncertainty section of this statistical bulletin.

Nôl i'r tabl cynnwys