1. Other pages in this release

Household income inequality, UK: financial year ending 2020

Nôl i'r tabl cynnwys2. Main points

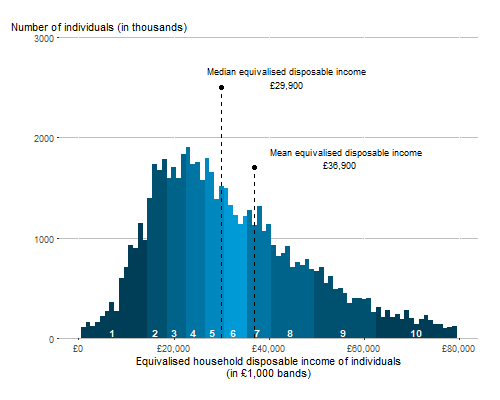

In financial year ending (FYE) 2020 (April 2019 to March 2020), the period leading up to the coronavirus (COVID-19) pandemic, median household income in the UK was £29,900, based on estimates from the Office for National Statistics (ONS) Household Finances Survey.

Between FYE 2011 and FYE 2020, median household income increased by 7%, an average of 0.8% per year, after accounting for inflation.

Growth in income of the poorest fifth of people did not keep pace with inflation, which led to the median income of the poorest fifth falling by an average of 3.8% per year between FYE 2017 and FYE 2020.

Median income of the richest fifth continued to grow steadily between FYE 2017 and FYE 2020, meaning that some measures of income inequality have increased over this period.

Median income for people living in retired households fell by an average of 1.1% between FYE 2018 and FYE 2020; this compares with 1.8% growth per year for those living in non-retired households.

3. Analysis of average income

Figure 1: Median income was £29,900 in the financial year ending 2020

Distribution of UK household disposable income, financial year ending 2020

Source: Office for National Statistics – Household Finances Survey

Download this image Figure 1: Median income was £29,900 in the financial year ending 2020

.png (6.2 kB) .xlsx (23.7 kB)

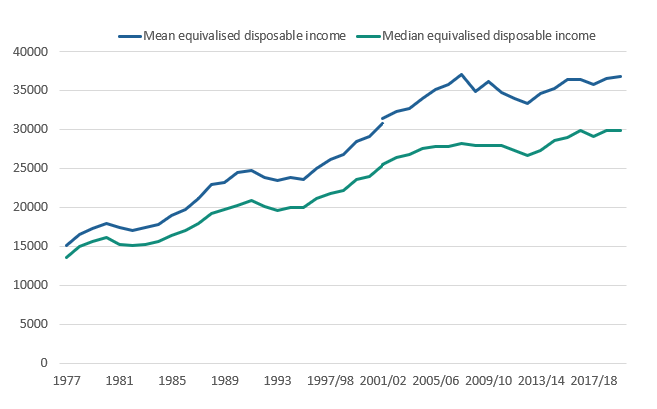

Figure 2: Median income grew by 7% during the 10-year period leading up to financial year ending 2020

Median and mean real equivalised household disposable income of individuals, UK, 1977 to financial year ending 2020

Source: Office for National Statistics – Household Finances Survey

Notes:

- Incomes are adjusted for inflation using the consumer prices index including owner-occupiers' housing costs (CPIH).

- Estimates of income from FYE 2002 onwards have been adjusted for the under-coverage of top earners.

- FYE 2011 represents the financial year ending 2011, and similarly through to FYE 2020, which represents the financial year ending 2020. Estimates prior to FYE 1995 are measured on a calendar year basis.

- Individuals are ranked by their equivalised household disposable incomes, using the modified OECD scale.

- Estimates up to and including financial year ending (FYE) 2017 are sourced from the Living Costs and Food (LCF) survey. Estimates from FYE 2018 onwards are based on the Household Finances Survey, which the LCF is part of.

Download this image Figure 2: Median income grew by 7% during the 10-year period leading up to financial year ending 2020

.png (22.0 kB) .xls (8.2 kB)Median income between the financial year ending (FYE) 2019 (April 2018 to March 2019) and FYE 2020 (April 2019 to March 2020) remained broadly unchanged at £29,900. However, during the 10-year period leading up to FYE 2020, median income grew by 7%, on average 0.8% per year.

Similarly, in the same period, mean income increased by 6.2%, an average of 0.7% per year and between FYE 2019 and FYE 2020 mean income grew by 0.7%. The growth in both median and mean incomes can be attributed to increases in original income (which includes income from employment, private pension, investment and other income sources) but very little change in the overall amount of benefits received and taxes paid.

Throughout 2020, household finances have been affected because of the restrictions and subsequent financial support measures put in place because of the coronavirus. The Personal and Economic Well-being bulletin presents analysis to understand how these have affected household income during this time.

ONS estimates of median and mean household income from 1977, up to and including FYE 2016, are based on the Living Costs and Food Survey (LCF). Estimates produced from FYE 2017 onwards have been revised to include data from the Household Finances Survey (HFS) and remain comparable with those produced using the LCF for the same period. More information about the impact of this change in data source can be found in Improving the measurement of household income.

Figure 3: Average income of the poorest fifth of people fell by 3.8% per year on average between financial year ending (FYE) 2017 and FYE 2020

Median equivalised household disposable income of indivduals by quintile group, financial year ending (FYE) 2011 to FYE 2020

Source: Office for National Statistics – Household Finances Survey

Notes:

- Individuals are ranked by their equivalised household disposable incomes, using the modified OECD scale.

- Incomes are adjusted for inflation using the Consumer Prices Index including owner-occupiers’ housing costs (CPIH).

- FYE 2011 represents the financial year ending 2011, and similarly through to FYE 2020, which represents the financial year ending 2020.

- Estimates up to and including financial year ending (FYE) 2017 are sourced from the Living Costs and Food (LCF) survey. Estimates from FYE 2018 onwards are based on the Household Finances Survey, which the LCF is part of.

Download this chart Figure 3: Average income of the poorest fifth of people fell by 3.8% per year on average between financial year ending (FYE) 2017 and FYE 2020

Image .csv .xlsIn the 10-year period leading up to FYE 2020, median income for the poorest fifth fell overall by 4.8% (£690) to £13,800. Estimates show a steady increase in the median income between FYE 2013 and FYE 2017 followed by a subsequent decrease of 3.8% on average per year between FYE 2017 and FYE 2020. The recent downturn in income for the poorest fifth of people in part reflects that a larger proportion of their household income is composed of cash benefits, many of which are frozen at their FYE 2016 values.

In contrast, median income of the richest fifth of people has increased steadily over recent years by 0.7% per year on average over the same 10-year period to £62,400 in FYE 2020. The divergence in growth rates of median income of the richest and poorest fifth of households is reflected in measures of income inequality presented in Household income inequality. For instance, this bulletin highlights that the ratio of the income of the person at the bottom of the top 10% to that of the person at the top of the bottom 10% – the P90/P10 ratio – increased from 3.9 to 4.5 between FYE 2017 and FYE 2020.

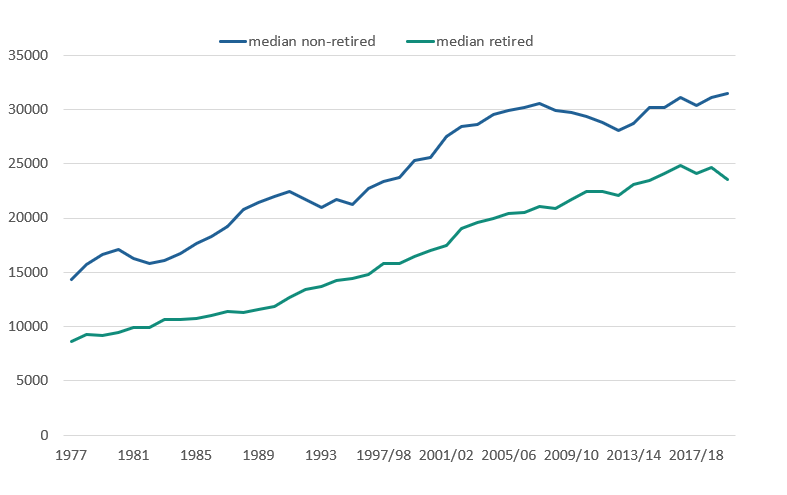

Figure 4: Median income of people living in retired households fell by an average of 1.1% between financial year ending (FYE) 2018 and FYE 2020

Median equivalised disposable household income for individuals living in retired, and non-retired households, and all individuals, UK, 1977 to financial year ending 2020

Source: Office for National Statistics – Household Finances Survey

Notes:

- Incomes are adjusted for inflation using the consumer prices index including owner-occupiers’ housing costs (CPIH).

- Estimates of income from FYE 2002 onwards have been adjusted for the under coverage of top earners.

- FYE 2011 represents the financial year ending 2011, and similarly through to FYE 2020, which represents the financial year ending 2020. Estimates prior to FYE 1995 are measured on a calendar year basis.

- Individuals are ranked by their equivalised household disposable incomes, using the modified OECD scale.

- Estimates up to and including financial year ending (FYE) 2017 are sourced from the Living Costs and Food (LCF) survey. Estimates from FYE 2018 onwards are based on the Household Finances Survey, which the LCF is part of.

Download this image Figure 4: Median income of people living in retired households fell by an average of 1.1% between financial year ending (FYE) 2018 and FYE 2020

.png (20.3 kB) .xls (8.7 kB)Median income for people living in retired households fell by an average of 1.1% between FYE 2018 and FYE 2020. This follows a period of steady growth (1.7% per year between FYE 2011 and FYE 2017) so that overall, the median income for people living in retired households is up 4.7% over the 10-year period to FYE 2020. Falling median income of people living in retired households reflects a decline over this period in the average amount of income received from private pensions. Median income for people living in non-retired households increased overall by 7.1% over the same 10-year period and has grown by an average of 1.6% per year since FYE 2014.

Nôl i'r tabl cynnwys4. Average household income data

The effects of taxes and benefits on household income, disposable income estimate

Dataset | Released 21 January 2021

Average UK household incomes taxes and benefits by household type, tenure status, household characteristics and long-term trends in income inequality.

5. Glossary

Disposable income

Disposable income is arguably the most widely used household income measure. Disposable income is the amount of money that households have available for spending and saving after direct taxes (such as Income Tax, National Insurance and Council Tax) have been accounted for. It includes earnings from employment, private pensions and investments as well as cash benefits provided by the state.

Equivalisation

Comparisons across different types of individuals and households (such as retired and non-retired, or rich and poor) or over time is done after income has been equivalised. Equivalisation is the process of accounting for the fact that households with many members are likely to need a higher income to achieve the same standard of living as households with fewer members. Equivalisation considers the number of people living in the household and their ages, acknowledging that while a household with two people in it will need more money to sustain the same living standards as one with a single person, the two-person household is unlikely to need double the income.

This analysis uses the modified Organisation for Economic Co-operation and Development (OECD) equivalisation scale (PDF, 165KB).

Mean and median income

The mean measure of income divides the total income of individuals by the number of individuals. A limitation of using the mean is that it can be influenced by just a few individuals with very high incomes and therefore does not necessarily reflect the standard of living of the “typical” person. However, when considering changes in income and direct taxes by income decile or types of households, the mean allows for these changes to be analysed in an additive way.

Many researchers argue that growth in median household incomes provides a better measure of how people's well-being has changed over time. The median household income is the income of what would be the middle person, if all individuals in the UK were sorted from poorest to richest. Median income provides a good indication of the standard of living of the “typical” individual in terms of income.

Nôl i'r tabl cynnwys6. Measuring these data

This release provides headline estimates of average disposable income. This year, for the first time, estimates have been calculated using a new combined data source, Household Finances Survey data. These data are derived from a combination of the Living Costs and Food Survey (LCF) and the Survey on Living Conditions giving us a voluntary sample survey of around 17,000 private households in the UK. More information about the impact of this change in data source can be found in Improving the measurement of household income.

These statistics are assessed fully compliant with the Code of Practice for Statistics and are therefore designated as National Statistics.

More quality and methodology information on strengths, limitations, appropriate uses, and how the data were created is available in the Effects of taxes and benefits on household income QMI.

Retired and non-retired households

This bulletin presents analysis examining the incomes of people who live in retired households. A retired household is one where more than 50% of its income is sourced from retired people. A retired person requires satisfying one of the following criteria:

their self-defined employment status is “Retired”, and they are aged over 50 years

their self-defined employment status is “Sick/Injured”, not seeking work and aged at or above the State Pension Age (SPA)

As such, analysis of the average income of people living in retired households can include much younger people and potentially exclude older people. However, the strength of this measure is that it highlights those individuals who are most likely to be affected by policy, societal or economic changes that disproportionately impact upon pension income.

Transformation of data

The Office for National Statistics (ONS) has been working on transforming its data on the distribution of household finances. The first part of this work concentrated on combining the samples from the LCF and another of ONS's household surveys, the Survey on Living Conditions (SLC), and harmonising the income collection in these questionnaires. This has resulted in a dataset formed of a sample of around 17,000 households. This year, for the first time, estimates have been calculated using this new combined data source; Household Finances Survey data. Estimates for financial year ending (FYE) 2018 and FYE 2019 will be revised to incorporate these new data.

The ONS is currently conducting research into making more use of administrative data on income, including Department for Work and Pensions (DWP) benefits data and HM Revenue and Customs (HMRC) tax data. Although these other sources have their own limitations, by using them together with surveys we should be able to improve how we measure household income. In particular, administrative data are likely to help address limitations in survey-based statistics, discussed in more detail in the strengths and limitations section such as under-reporting at the top and bottom of the income distribution, and enable analysis at lower geographic levels.

Over the next year, the ONS plans to publish research using linked administrative and survey data to compare administrative and survey measures for the main income components and continue to develop our experimental Admin-based income statistics.

Nôl i'r tabl cynnwys7. Strengths and limitations

An important strength of these data is that comparable estimates are available back to 1977, allowing analysis of long-term trends. This release also currently provides the earliest survey-based analysis of the household income distribution available each year, allowing people insight into the evolution of living standards as early as possible.

However, as with all survey-based sources, the data are subject to some limitations. For instance, the Household Finances Survey (HFS) is a sample of the private household population, and therefore does not include those that live in institutionalised households, such as care homes and hostels, or the homeless. As such, it is likely that many of the poorest in society are not captured, which users should bear in mind when interpreting these statistics.

In addition, household income surveys are known to suffer from under-reporting at the top and bottom of the income distribution. While an adjustment to address survey under-coverage of the richest people has been introduced for statistics covering financial year ending (FYE) 2002 onwards, reported in more detail in Top income adjustment in effects of taxes and benefits data: methodology, measurement issues at the bottom remain (see the Effects of taxes and benefits on household income QMI for further details of the sources of error).

Table 11 and Table 32 provide estimates of uncertainty for many headline measures of average income and income inequality.

The Department for Work and Pensions (DWP) also produces an analysis of the UK income distribution in its annual Households below average income (HBAI) publication, using data from its Family Resources Survey (FRS).

Nôl i'r tabl cynnwys