1. Summary

We are transforming the production of Office for National Statistics (ONS) household financial statistics. The reasons for doing this include:

an increased policy and research need to understand with more precision than is possible through household surveys alone - the distribution of household income, consumption and wealth; international interest in this joint analysis and combination of sources is also high for example from the Organisation for Economic Co-operation and Development (OECD) and Eurostat

opportunities to use new technology such as online data collection and new data sharing legislation (the Digital Economy Act) to enable administrative data to be used for statistical purposes and to improve statistical outputs

opportunities to improve the respondent experience and reduce the respondent burden of our voluntary household surveys

We have produced official statistics on expenditure patterns (Family Spending) and income distribution (Effects of Taxes and Benefits) for over 50 years with detailed wealth data available for over a decade (Wealth in Great Britain).

This workplan explains how we are transforming the production of its household financial statistics, using a mixture of a new integrated survey design (the Household Finance Survey (HFS)) as well as identifying and integrating administrative data sources. Our ultimate vision is for an “admin data first” approach to the production of household financial statistics wherever possible, which is particularly relevant for the production of small area income statistics.

The focus of this workplan is ONS statistical outputs related to household finances and the time-frame is limited to the next 18 months. It will be reviewed in the light of feedback from users and updated as ONS transformation plans develop and the ways in which ONS disseminates outputs and uses web-based tools also evolve. The workplan shows that we will maintain the production of our regular outputs and national statistics such as Effects of taxes and benefits, Wealth in Great Britain, and Family spending which draw on our household financial surveys, with increasing use of the new HFS framework being brought in during the period. We are also planning a range of research outputs to explore aspects of household financial survey transformation on our statistical outputs, including research on how to adjust survey estimates for higher earner households and work around joint analysis of income and consumption using statistical matching techniques.

We are taking a partnership approach to delivering this workplan, and will be seeking to work closely with Department for Work and Pensions (DWP), HM Revenue and Customs (HMRC) and other stakeholders on a range of research areas. To help us shape our workplans, we are aiming to hold some discussion sessions with stakeholders on a range of research topics, starting in Autumn 2018.

To improve coherence, and help users find data more easily which relate to household disposable income and inequality, we are also planning to rename the three related statistical bulletins on household disposable income and income distribution, to have a common “Effects of taxes and benefits” title.

Nôl i'r tabl cynnwys2. Transforming ONS household financial statistics

The transformation of ONS household financial statistics is complex and involves three large-scale household surveys: the Living Costs and Food survey (LCF), Survey on Living Conditions (SLC) and Wealth and Assets Survey (WAS).

There are several regular statistical outputs and data deliveries that are produced from these surveys and are included in this workplan:

Effects of taxes and benefits, annual publication

Household disposable income and inequality, annual publication

Nowcasting household disposable income, annual publication

Family spending, annual publication

Delivery of cross-sectional and longitudinal EU-SILC data to Eurostat, annual deliveries.

Wealth in Great Britain main report, every two years.

Early indicators from wealth in Great Britain, every six months.

Each of these outputs has its own development plan and governance arrangements, for example, resulting from the National Statistical Quality Report (NSQR) on the LCF, or based on funding consortium arrangements for example for the Wealth and Assets Survey. These groups will be important stakeholders to help guide the development of the HFS framework while ensuring the survey outputs continue to meet existing and future user needs.

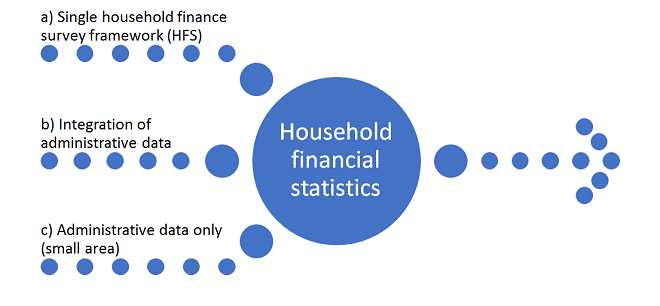

Figure 1 shows the three work-strands that make up the transformation of ONS household financial statistics.

Figure 1: Transforming ONS household financial statistics

Source: Office for National Statistics

Download this image Figure 1: Transforming ONS household financial statistics

.png (41.2 kB) .xlsx (12.9 kB)The focus of this workplan is on strands a) and b) and for next 18 months only. Strand c) Administrative data only (small area) income estimates, are outside the scope of this workplan. There is however, potential for the methodology for these to develop from a modelled approach based on household survey data (currently using Department for Work and Pensions’ (DWP’s) Family Resource Survey (FRS)) to a pure administrative data system as the quality and more complete coverage of the administrative data sources is established. See Administrative Data Census research outputs for more information on small area income statistics.

The workplan will be reviewed regularly as the household financial statistics transformation plans develop and the ways in which we disseminate outputs and use web-based tools also evolve.

Strand a) building the Household Finance Survey1:

We have already taken a number of steps to transform our household financial statistics and build the Household Finance Survey (HFS) framework. These include:

From 2017 to 2018 reference period, there has been harmonisation of key questions on income, pensions, employment and living conditions, so that the SLC and LCF will together provide a set of common variables for income and living condition statistics. These harmonised variables create the “core” of the HFS survey output based on an achieved sample of around 17,000 households. Each survey is also now being collected and processed on a monthly basis, allowing the production of statistics on a financial year basis.

From 2018 to 2019 LCF and SLC will be even closer aligned in terms of questionnaire content and data processing. Common questions are used, and these are more closely aligned with DWP’s Family Resources Survey (FRS). SLC will also contain some additional high-level expenditure questions to provide a fuller picture of household finance.

From 2018 (Round 7) the Wealth and Asset Survey has also adopted many of the same questions as LCF and SLC for income from employment and benefits. This will allow us to process the data using common, more efficient methods. Although WAS will only be partly harmonised with the SLC and LCF core for 2018 to 2019 it is hoped that this will provide opportunities to combine data giving an achieved sample of around 26,000 households.

We are working towards transition from the Post Code address file to AddressBase for the sampling frame for HFS. If possible, we will do this for 2019 to 2020 reference period which will improve the coverage of HFS by reducing over-coverage and by better identifying multi-households at an address.

Future development of the HFS framework, for example in harmonising data processing or questionnaire content, will include discussion with stakeholders, funding partners of surveys within the HFS framework and users of our data.

Strand b) Priorities for using administrative data

We are using the Digital Economy Act (DEA) and other data sharing mechanisms to access administrative data from other statistical producers, for particular statistical purposes. The main data sources of interest in the transformation of household finance statistics are PAYE, tax credit and self-assessment data from HM Revenue and Customs (HMRC), and benefits data from DWP. Other data on wealth, debt and borrowing could also be useful from private providers and financial institutions and regulators.

Administrative data can be used at various stages within the statistical production process and we have plans to research its potential at each stage. For example, administrative data could be used to improve sample design through flagging particular types of household that are often under-represented in samples and helping identity non-response bias. Administrative data can also help improve estimation methods through the editing, imputation and weighting process, and help reduce respondent burden and measurement error through the replacement of questions if proven to result in statistical improvements.

In line with research into using administrative data to tackle potential under-reporting of high income earners in surveys, (for example, Burkhauser and others l (2018)), we are planning to prioritise the development of an adjustment for the income of high earners in the next year. We will work closely with DWP on this research and learn from their experience in using an adjustment for high earners using HMRC Survey of Personal Incomes (SPI) data in the Households Below Average Income release. Following this, research into coverage and values reported at the lower end of the income distribution will be prioritised.

The workplan in Table1 proposes a series of research outputs that cover the use of administrative data in ONS household financial statistics, but the timing of these will be contingent on the acquisition of administrative data and time taken to understand their strengths and weaknesses. It will be important to follow the guidance in the Quality Assurance of Administrative Data standard in assessing this research work.

Notes for: Transforming ONS household financial statistics

The HFS is envisaged as consisting of a core set of common survey variables, with common routing, processing and derived variable processes linked to specialised component surveys on wealth, expenditure and living conditions. The potential for administrative data to bring statistical improvements will be tested throughout the production process with a view to being introduced when these benefits are proven and after consultation with users and wider stakeholders.

3. Proposed workplan

Table 1 shows our proposed workplan and schedule of regular and new research outputs for the rest of 2018 and during 20191.

Table 1: Proposed timeline of regular and new research outputs

| Date | Release | Comment | |||

|---|---|---|---|---|---|

| July 2018 | Publish nowcast estimate of household disposable income for financial year ending (FYE) 2018 | Existing methodology and dataset (LCF) | |||

| Aug 2018 | Wealth in Great Britain early indicators (18 months of data) – Wave 6 | Existing dataset (WAS) | |||

| Oct 2018 | Send 2017 calendar year cross-sectional EU-SILC data to Eurostat based on HFS data. | NEW dataset (HFS) | |||

| By end 2018 (provisional) | Publish research paper on methods for adjusting HFS survey data for high income households. Illustrate with HFS dataset (2017 to 18), and LCF dataset (2017 to 18) where possible to see the differences for this year, and a back-series of LCF. Will involve collaboration with government departments, stakeholders and academics. | NEW – research output | |||

| By end Feb 2019 (provisional) | Publish Effects of taxes and benefits: disposable income estimate Financial year ending 2018. Show comparisons/sensitivity tests to LCF data. | NEW dataset (HFS). Include new analysis at individual level. May include adjustment for high income earners depending on response to research paper. | |||

| Jan 2019 (provisional) | Family spending 2017-18 | LCF module - NEW – intend to calibrate to HFS disposable income deciles | |||

| By end of Mar 2019 (provisional) | Publish research output – statistical matching paper using SLC and LCF. Would allow analysis of same households with income and consumption patterns, to NUTS 2 level. | NEW research output | |||

| Mar 2019 | Deliver EU-SILC longitudinal dataset | ||||

| By end May 2019 (provisional) | Publish Effects of taxes and benefits: final income estimate FYE 2018. | NEW HFS dataset | |||

| June 2019 (provisional) | Wealth in GB – Round 6 (2016-18) | Existing dataset (NEW – reporting in FYs) | |||

| By end July 2019 (provisional) | Wealth in GB – early indicators Round 7 (first 6 months of data) | Existing dataset (NEW - reporting in FYs) | |||

| July 2019 (provisional) | Nowcasting household income FYE 2019 | ||||

| Oct 2019 | EU SILC cross sectional data 2018 | NEW dataset HFS | |||

| Oct 2019 (provisional) | Wealth in GB – early indicators round 7 (first 12 months of data) | Existing dataset (NEW - reporting in FYs). | |||

| Nov to Dec 2019 (provisional) | Research output – further statistical matching to include Wealth and Assets variables. | NEW research output | |||

| Dec 2019 (at earliest) | Research output – how administrative data may be used in sample design and estimation processes. | NEW research output, dependent on receiving Benefits and HMRC data during 2018-19. | |||

| Jan 2020 (provisional) | Family Spending 2019 | LCF module - intend to calibrate to HFS disposable income deciles | |||

| Notes: | |||||

| 1. Further Admin Data census income research is due to be published by the end of 2018 and also in Autumn 2019. Small area income estimates were published in April 2018. By the end of 2019, admin data outputs may become the new method for publishing small area income estimates. Research into transitioning to this potential new method will be subject to its own project plan, deliverables and user-engagement outside the scope of this workplan. | |||||

| 2. These workplans do not specifically capture the internal and external data deliveries associated with the surveys or outputs. These will also be required to be released to internal stakeholders, government departments and funding partners, End User License holders, Eurostat, and UK Data archive at or around the same time as the statistical bulletins are published. In the case of LCF micro-data is also made available quarterly for internal use (in National Accounts and Prices) and annually for external use. | |||||

| 3. Ad hoc articles are not captured in this workplan. | |||||

Download this table Table 1: Proposed timeline of regular and new research outputs

.xls (42.0 kB)Notes for: Proposed workplan

- The exact format of each release may develop over this period as we review and assess the impact and style of each output, in line with good practice across government and in response to user need.

4. Enhancing the dissemination and coherence of ONS financial statistics

The ongoing transformation of ONS household financial statistics provides opportunities to improve the presentation of the statistics we release, particularly harnessing web-based opportunities to link and cross-refer between datasets, analysis and topics of interest to users.

In the first instance, in response to user feedback, ONS is planning to rename its three releases related to Effects of taxes and benefits statistics to have a common title. This should make the releases easier to search for and see the connections between them.

See Table 2 for the current title and proposed title.

Table 2: Current and proposed titles for bulletins related to Effects of Taxes and Benefits

| Current title | Proposed title |

|---|---|

| Nowcasting household income in the UK: financial year ending 2017 | The effects of taxes and benefits on household income: flash estimate (YEAR) |

| Household disposable income and inequality in the UK: financial year ending 2017 | The effects of taxes and benefits on household income: disposable income estimate (YEAR) |

| Effects of taxes and benefits on UK household income: financial year ending 2016 | The effects of taxes and benefits on household income: final income estimate (YEAR) |

Download this table Table 2: Current and proposed titles for bulletins related to Effects of Taxes and Benefits

.xls (11.0 kB)Additional thematic analysis

In addition to the regular publications and outputs listed in Section 3, as resources allow, ad hoc publications can be planned which provide more in-depth analysis on particular topics of interest to policy-makers and for public debate. For example, inter-generational issues involving the distribution of income or wealth, analysis of debt and income, and joint analysis of consumption and income and wealth inequalities.

Nôl i'r tabl cynnwys5. Partnership approach

We are committed to working closely with other statistical producers, particularly the Department for Work and Pensions (DWP) in undertaking this workplan, so the benefits from research and statistical improvements are shared across the analytical community. For example, research outputs related to the use of administrative data for high earning households will be delivered in close co-operation with DWP alongside other stakeholders from government, external research organisations and academics.

DWP is also planning to work with ONS to investigate how administrative data can more widely be used throughout the statistical process for the Family Resource Survey (FRS), from survey design, variable estimation methods and potentially replacing values by linking administrative data to survey responses. Lessons learned from this work will be very valuable for the ongoing transformation of ONS household finance statistics given the similarities between many of the components of the FRS and the Household Finance Survey (HFS) framework. We are also intending to undertake some mapping work with DWP to understand better the methods, definitions and processes of the FRS and HFS statistical production systems, with a view to considering how they may be further improved and aligned in the future.

Nôl i'r tabl cynnwys6. User consultation and next steps

We would welcome feedback from users of ONS household finance statistics on this workplan. We would particularly welcome views on the priorities for research outputs or new statistical products that are possible under the Household Finance Survey (HFS) framework and the introduction of administrative data. Ideas for the improvement of the presentation, coherence and impact of our existing outputs would also be valuable.

We intend to set up some user events and roundtable discussions starting in the Autumn 2018 and into 2019 on key topics, such as the use of administrative data to adjust for high income earners, and will seek to involve policy-makers, research organisations and other statistical producers in these discussions.

Nôl i'r tabl cynnwys