1. Main points

In the week ending 23 December 2021, the percentage of people testing positive for coronavirus (COVID-19) reached 3.71% in England, 2.52% in Wales, 2.59% in Northern Ireland and 2.57% in Scotland; in comparison, in 2020, the positivity rate was 1.47% in England, 1.91% in Wales (week ending 23 December 2020), 0.43% in Northern Ireland, and 0.69% in Scotland (week ending 22 December 2020).

Retail sales volumes were above pre-coronavirus pandemic levels during the Christmas period in both 2020 and 2021 (up 3% in December 2020 and 2% in December 2021 when compared with the same period in 2019).

Where customers spent their money differed compared with the pre-coronavirus pandemic period; textile, clothing and footwear stores retail sales volumes dropped 14% in December 2020 and were 6% lower in December 2021 (both compared with December 2019).

In December 2021, the value of online retail sales decreased by 8% compared with the previous December, but still made up more than a quarter (27%) of all retail sales, substantially higher than in December 2019.

In the first two weeks of December 2021, the seven-day average estimate of UK seated diners exceeded 2019 levels, but not in London, likely reflecting high COVID-19 infection rates in the city during the Christmas period.

In December 2021, over 6 in 10 adults (63%) said they had planned to visit (or had already visited) family and friends in their homes and just over a half (51%) said they planned to have (or had already had) family and friends visit their home over the Christmas season.

At the end of 2021, the proportion of people who felt it will take more than a year for life to return to normal was higher than at the end of 2020 (35% compared with 20%).

In December 2021, less than half of people (46%) thought they would be able to save money in the next year, and two thirds of people (66%) said their cost of living had increased at the end of 2021.

2. Infection rates and overview of restrictions

In 2020 and 2021, the Christmas period was affected by different restrictions put in place by the UK government to manage the coronavirus (COVID-19) pandemic. This article explores how retail, hospitality and social activities around the 2021 Christmas period compare with 2020 and pre-coronavirus.

Infection rates

Data from the coronavirus (COVID-19) infection survey showed that in the week leading up to Christmas 2021 (week ending 23 December 2021), the percentage of people testing positive for coronavirus (COVID-19) reached 3.71% in England, 2.52% in Wales, 2.59% in Northern Ireland and 2.57% in Scotland. In the same period, the percentage of people testing positive for coronavirus (COVID-19) in London was 7.58%, more than double of that seen in England as a whole.

In the week after Christmas (week ending 31 December 2021), infection levels increased further.

Figure 1: The percentage of people testing positive for COVID-19 in the UK increased in December 2021

Estimated percentage of the population testing positive for COVID-19 on nose and throat swabs, UK, 27 December 2020 to 31 December 2021

Embed code

Notes:

- Information surrounding quality and methodology of these statistics can be found in the footnotes of the data download.

In comparison, in the week leading up to Christmas 2020, an estimated 1.47% of the population tested positive for COVID-19 in England and 1.91% in Wales (week ending 23 December 2020). In the week ending 22 December 2020, the positivity rate was 0.43% in Northern Ireland and 0.69% in Scotland.

UK coronavirus (COVID-19) restrictions

Following the emergence of the new Omicron variant across the UK in November 2021, each constituent country introduced new measures that aimed to control the spread and protect the NHS. They also accelerated the coronavirus booster vaccination programmes.

In late 2020, lockdown measures varied between different areas of the UK, and were adapted and reviewed week by week. The main measures introduced, which affected people's spending habits and socialising, included introducing the "rule of six" in indoor and outdoor hospitality settings, a curfew for the hospitality sector and only serving alcohol with a substantial meal. During winter 2020, in some areas of the UK, hospitality settings and non-essential stores were closed completely, except for click-and-collect services.

A more detailed overview of the UK coronavirus restrictions can be found in the glossary section.

Nôl i'r tabl cynnwys3. Shopping and spending

In December 2020 and 2021, retail sales volumes were above pre-coronavirus (COVID-19) pandemic levels (December 2019).

In December 2020, sales volumes were 3% higher than in the same month in 2019. In December 2021, they were 2% higher than in 2019.

In December 2020, restrictions in place to curb the spread of COVID-19 meant that non-essential retail was closed in most areas. Restrictions varied between and within the UK countries, and further information on the rules in each area are summarised at the end of this article.

While total retailing volumes went up in December 2020 compared with December 2019, where customers spent their money was different than the previous year. Textile, clothing and footwear stores sales volumes dropped 14% in December 2020 compared with December 2019, but were only 6% lower in December 2021 than in December 2019.

Figure 2: Sales in most sectors were lower in December 2021 than in December 2019

Percentage change, volume seasonally adjusted, Great Britain, December 2020 and December 2021 compared with December 2019

Source: Office for National Statistics – Monthly Business Survey – Retail Sales Inquiry

Notes:

Non-store retailing refers to retailers that do not have a store presence. While the majority is made up of online retailers, it also includes other retailers such as stalls and markets.

Percentage changes have been calculated using rounded seasonally adjusted estimates of retail sales volumes, published within the monthly retail sales release.

Download this chart Figure 2: Sales in most sectors were lower in December 2021 than in December 2019

Image .csv .xlsNon-store retailing (including online stores) volumes increased by 44% in December 2020 when compared with 2019, with a number of physical stores closed to customers. In December 2021, though no in-store retail restrictions were in place, the impact of Plan B measures and the advice to work from home where possible meant that this trend persisted, though to a lesser extent, with non-store retailing volumes 26% higher than in 2019.

In December 2021, the value of online retail sales decreased by 8% compared with the previous December, but made up more than a quarter (27%) of all retail sales.

While sales were up compared with 2019, retail footfall was reduced in the run up to Christmas 2021. This reflects a possible change in habits because of the rise in cases and introduction of Plan B measures.

According to Springboard, the volume of overall daily retail footfall in the week to 18 December 2021 was 81% of the level seen in the equivalent week of 2019. This is the lowest level since the last week of September 2021, when compared with the equivalent week of 2019. Among UK countries and English regions, the South West had the highest retail footfall relative to pre-coronavirus pandemic levels, at 89%.

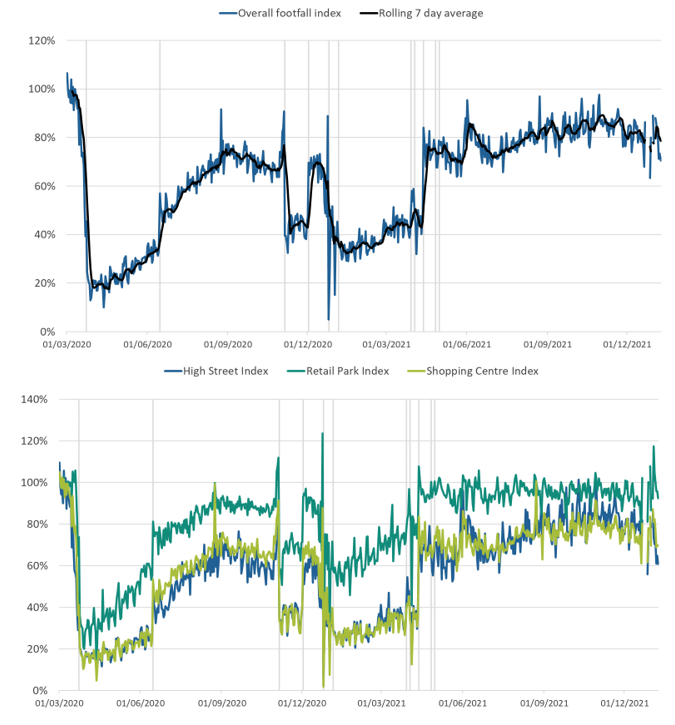

Figure 3: Retail footfall still sat below 2019 levels in the run up to Christmas 2021

Volume of overall daily retail footfall, percentage compared with the equivalent day of the equivalent week of 2019, 1 March 2020 to 8 January 2022, UK

Source: Springboard, The Department for Business, Energy and Industrial Strategy

Notes:

The vertical lines indicate notable events and coronavirus (COVID-19) restriction changes.

Users should note that week-on-week changes in retail footfall volumes are outlined as percentages, rather than as percentage point changes. Percentage change figures quoted in the commentary will therefore not necessarily match the percentage point changes observed in the chart.

Download this image Figure 3: Retail footfall still sat below 2019 levels in the run up to Christmas 2021

.png (207.9 kB)Retail parks saw higher footfall relative to 2019 levels than high streets or shopping centres.

Nôl i'r tabl cynnwys5. Attitudes towards the future

Although shopping and socialising trends suggest that people were going out more during the Christmas period in 2021 compared with 2020, people still expressed concern about the coronavirus pandemic and attitudes to the future.

During December 2021, more than a third of people (ranging between 35% and 39%) said they felt it would be more than a year before life returned to normal, according to the Opinions and Lifestyle Survey (OPN). This is an increase compared with the same time the year before; during December 2020, less than a quarter of people (ranging between 18% to 23%) said returning to normal would take more than a year.

During November and December 2021, the proportion of adults who felt that life would never return to normal (ranging between 13% and 16%) was higher than those who felt life would return to normal in six months or less (ranging between 7% and 9%).

Figure 5: At the end of 2021, the proportion of people who thought it would take more than a year for life to return to normal was higher than at the end of 2020

Great Britain, March 2020 to December 2021

Source: Office for National Statistics, Opinions and Lifestyle Survey

Notes:

Question: "How long do you think it will be before your life returns to normal?"

Base; all adults.

Not all response categories are included in this chart.

Confidence intervals are provided in the datasets associated with this article. As a general rule, if the confidence interval around one estimate overlaps with the interval around another, we cannot say with certainty that there is more than a chance difference between the two estimates.

Download this chart Figure 5: At the end of 2021, the proportion of people who thought it would take more than a year for life to return to normal was higher than at the end of 2020

Image .csv .xlsAdditional data from the OPN on household finances found that between 15 December and 3 January 2022, less than half of people (46%) thought they would be able to save money in the next year, and two thirds of people (66%) said their cost of living had increased in the last month. This increased to 76% among those aged over 70 years, and to 74% among self-employed people.

During the start of the coronavirus pandemic (April to June 2020), the UK households' saving ratio (household saving as a percentage of total available resources) reached a record high of 24%. By July to September 2020, this had decreased to 13% and by July to September 2021 this further decreased to 9%, though remained above pre-coronavirus pandemic levels.

Nôl i'r tabl cynnwys7. Glossary

UK Coronavirus (COVID-19) restrictions

Winter 2020 restrictions: In late 2020, lockdown measures varied between different areas of the UK, and were adapted and reviewed week by week. England operated a tiered system of local measures from October, Wales adopted a firebreak lockdown in October and November followed by alert level 4 restrictions, and Scotland introduced local protection levels from late October. Northern Ireland increased restrictions and implemented a two week circuit breaker, which included closure of non-essential retail and hospitality from late November.

Although restrictions varied between areas of the UK, the main measures that were introduced affected people's spending habits and socialising. These restrictions included introducing the "rule of six" in indoor and outdoor hospitality settings, a curfew for the hospitality sector and only serving alcohol with a substantial meal. During winter 2020, hospitality settings and non-essential stores were closed completely in some areas of the UK, with the exception of a click-and-collect option.

During the 2020 Christmas period, the UK government introduced a number of restrictions including forming Christmas bubbles and travel restrictions for England. Similar restrictions were announced for Northern Ireland, Scotland and Wales.

From 5 January 2021, the UK government announced a further national lockdown for England. Similar rules applied for Northern Ireland, Scotland and Wales, which all included the message to "stay at home".

In Spring 2021, restrictions across the UK began to ease with each country of the UK setting out its own plans for coming out of lockdown.

Winter 2021 restrictions: Following the emergence of the new Omicron variant of COVID-19 across the UK in November 2021, each constituent country introduced new measures aiming to control the spread and protect the NHS. They also accelerated the coronavirus (COVID-19) booster vaccination programmes.

In England, the move to Plan B was confirmed on 8 December 2021. This included:

- mandatory use of face coverings in most indoor venues from 10 December

- advice to work from home for those who can from 13 December

- mandatory use of NHS COVID Passes for proof of two doses of a COVID-19 vaccine, or proof of a negative lateral flow test, for entry to large events and venues from 15 December

- advice to test using a lateral flow device, particularly before entering a high-risk setting or visiting a vulnerable person

In Scotland, similar measures on face coverings, working from home and NHS COVID Passes were already in place, with new measures aimed at reducing social interactions at home and indoor settings recently announced, including:

- advice to reduce social contact by meeting in groups of no more than three households from 14 December

- large events being limited in capacity with one-metre physical distancing from 26 December

- a limit to three households meeting at indoor and outdoor venues, such as bars and cinemas from 27 December

In Wales, measures on face coverings, working from home and NHS COVID Passes were also in place, with further measures more recently announced, including:

- a move to alert level 2, reintroducing the "rule of six" and limiting the number of people at indoor and outdoor events from 26 December

- the closure of nightclubs and two-metre social distancing in public places and offices from 26 December

In Northern Ireland, measures on face coverings, working from home and NHS COVID Passes were also similarly in place, with further measures more recently announced, including:

advice to reduce social contact by meeting in groups of no more than three households

a limit to meeting more than 30 people in a private home and overnight stays

mandatory use of NHS COVID Passes for proof of two vaccine doses for hospitality venues and tourist accommodation

reintroducing the "rule of six" for hospitality settings

An overview of current coronavirus (COVID-19) restrictions for each of the four UK constituent countries is available as follows:

These restrictions should be considered when interpreting the data featured throughout this article.

The households' saving ratio

The saving ratio estimates the amount of money households have available to save as a percentage of their gross disposable income plus pension accumulations.

Nôl i'r tabl cynnwys8. Data sources and quality

Infection rates

Quality and methodology information for the Coronavirus (COVID-19) Infection Survey data is available in our COVID-19 Infection Survey: methods and further information methodology article and our Coronavirus (COVID-19) Infection Survey QMI.

Retail sales

Quality and methodology information for retail sales data is available in our Retail Sales QMI.

National retail footfall

National retail footfall figures are supplied by Springboard, a provider of data on customer activity. They measure the following for overall UK retail footfall, as well as by high street, retail park, and shopping centre categories:

daily retail footfall as a percentage of its level on the same day of the equivalent week of 2019; for example, Saturday 18 December 2021 is compared with Saturday 21 December 2019

total weekly retail footfall as a percentage of its level in the equivalent week of 2019

the percentage change in weekly footfall compared with the previous week; for example, Week 50 of 2021 is compared with Week 49 of 2021

Springboard's weekly data are defined over a seven-day period running from Sunday to Saturday. Week 50 of 2021 therefore refers to Sunday 12 December to Saturday 18 December 2021.

Users should note that all quoted figures have been rounded to the nearest integer.

OpenTable seated diners

OpenTable is a data provider for online restaurant reservations, with daily data for the UK, London and Manchester being publicly available in its The state of the industry dashboard. These data show the impact of recent events and restrictions on the hospitality industry using a sample of restaurants on the OpenTable network across all channels, including online reservations, phone reservations, and walk-ins.

Opinions and Lifestyle Survey

Part of this release contains data and indicators from a module being undertaken through the Office for National Statistics' (ONS') Opinions and Lifestyle Survey (OPN) to understand the impact of the coronavirus (COVID-19) pandemic on British society. Details on the quality and methodology of the OPN can be found in the Measuring the data section of our Coronavirus and the social impacts on Great Britain bulletin.

The households' saving ratio

Quality and methodology information for the households' saving ratio is available in the Quarterly sector accounts QMI.

Nôl i'r tabl cynnwys

4. Socialising

OpenTable continues to measure the overall impact of coronavirus on the hospitality industry by showing seated diners at a sample of restaurants on the OpenTable network across online reservations, phone reservations, and walk-ins.

In 2021, data from OpenTable showed that the seven-day average estimate of UK seated diners exceeded 2019 levels throughout the majority of November and a large proportion of December, although this varied across the UK. In London, seated diners were 85% of the level seen in the equivalent week of 2019 (in the week ending 8 November 2021). This reduced to 57% of 2019 levels in the week before Christmas (week ending 20 December 2021). However, in Manchester, diners exceeded 2019 levels throughout, remaining at 104% of 2019 levels in the week before Christmas.

In the week ending 14 December 2020, the seven-day average estimate of UK seated diners in the run-up to Christmas 2020 peaked at 61% of levels in the equivalent week of 2019.

The seven-day average estimate of seated diners was lower in London than the UK during both the 2021 and 2020 Christmas periods, and throughout the whole coronavirus pandemic, compared with 2019 levels.

The low levels of seated diners in London in the week before Christmas 2021 would also likely reflect the rate of coronavirus (COVID-19) infections in London during winter 2021 because of the Omicron variant of COVID-19. In the week leading up to Christmas 2021 (week ending 23 December 2021), it is estimated that 8% of people in London would have tested positive for COVID-19, compared with 4% in England as a whole.

Figure 4: The seven-day average estimate of seated diners in London was lower than UK levels during both the 2021 and 2020 Christmas periods compared with 2019

Seated diners, seven-day average, percentage compared with the equivalent week of 2019, week ending 24 February 2020 to week ending 20 December 2021, UK, London and Manchester

Source: OpenTable

Notes:

Please note that data for Manchester are only available from week ending 16 November 2020.

A detailed overview of the UK COVID-19 restrictions in hospitality settings for each constituent country can be found in the glossary section.

Data are only available for UK, London and Manchester.

Download this chart Figure 4: The seven-day average estimate of seated diners in London was lower than UK levels during both the 2021 and 2020 Christmas periods compared with 2019

Image .csv .xlsBetween 15 December 2021 and 3 January 2022, the Opinions and Lifestyle survey (OPN) asked adults about their travel and social plans during the Christmas period.

More than 6 in 10 adults (63%) said they planned to visit (or had already visited) family and friends in their homes, and just over half (51%) said they planned to have (or had already had) family and friends visit their home.

Although not directly comparable because of question wording, between 16 and 20 December 2020, just under a quarter (24%) of adults said they were planning to have family and friends in their homes but not to stay overnight, and 10% were planning to stay overnight with family or friends for one night or more. One fifth (20%) of adults said they were planning to have family or friends visit them but not to stay overnight and 8% were planning to have family and friends visit them and stay overnight for one night or more. This largely reflects the impact of local restrictions in December 2020.

Nôl i'r tabl cynnwys