1. Main points

- At the whole economy level, 3-month year-on-year growth rates change by between negative 0.2 and positive 0.2 percentage points, with growth rates affected upwards in 2010 to 2011 and 2015 but downwards in between; however, the overall trend remains broadly the same.

- The revisions cause whole-economy total pay to decrease by between £7 and £10 between July 2010 and December 2015, with the revisions in pay levels generally increasing in magnitude as time goes on.

- For some sectors, there is a noticeable step change in July 2015. This is due to the improvements to the methods having different effects across sectors.

- The step change especially affects the Construction industry sector, but Finance and Business Services, and Manufacturing industry sectors are also noticeably affected.

- Revisions prior to July 2010 affect the whole economy pay levels by between approximately £5 to £8, with the amount increasing from January 2000, but 1-month and 3-month growth rates remain the same.

2. Introduction

Average Weekly Earnings (AWE) is a key economic indicator designed to capture changes in the average earnings of employees in Great Britain. It is largely derived from the Monthly Wages and Salaries Survey which is conducted by ONS and samples approximately 9,000 businesses per month. Businesses with fewer than 20 employees (from here on referred to as “U20 businesses”) are excluded from the sample, to control ONS costs and the respondent burden on small businesses. However, to allow us to reflect the earnings of employees in these businesses, pay is estimated using a factor derived from the Annual Survey of Hours and Earnings (ASHE), which does cover small businesses. These estimates are then weighted using employee information from the Inter-Departmental Business Register (IDBR), the main sampling frame for our business surveys.

A review of the methodology used to calculate estimates of small businesses was carried out in 2016. As a result, a package of changes will be introduced in late spring to early summer 2017, which aims better to reflect the earnings of employees in small businesses as well as reflect recent improvements to the coverage of small businesses on our main sampling frame, the Inter-Departmental Business Register.This article sets out the indicative impact of these improvements for the period between July 2010 and December 2015. Revisions to later periods will be similarly affected.

These indicative revisions may change slightly between the date of publishing this article and final release of these estimates.

Note – These revisions specifically affect the period July 2010 onwards, when the industrial classification changed from SIC 2003 to SIC 2007. However, due to the consequential discontinuity this introduces, values prior to July 2010 have also been revised to account for this. This has been done by modelling the levels from July 2010 to January 2000, without adjusting the growth rates for this period. The last section of the article describes the impact on the earnings estimates for this period.

Nôl i'r tabl cynnwys3. Impact: July 2010 onwards

Whole economy impact

At the whole economy level, these methodological improvements leave the trend in earnings at the whole economy level broadly the same after the revisions are made. However, they cause a noticeable decrease in the levels of earnings (Figure 1), with total pay decreasing by between £7 and £10 between July 2010 and December 2015 (the most recent data used in this analysis). In terms of a percentage change, total pay decreases by between approximately 1.6% and 1.9%.

Figure 1: The original and revised estimates of total pay for the whole economy

Great Britain, July 2010 to December 2015

Source: Office for National Statistics

Notes:

Download this chart Figure 1: The original and revised estimates of total pay for the whole economy

Image .csv .xlsThe effect of these changes on bonuses is seasonal (Figure 2), with bonuses affected downwards on average by approximately £0.34 to £0.66 except in February and March where bonuses are affected downwards by on average £1.03 and £1.53 respectively (Figure 3).

Figure 2: The change in the levels of the pay components for the whole economy

Great Britain, July 2010 to December 2015

Source: Office for National Statistics

Download this chart Figure 2: The change in the levels of the pay components for the whole economy

Image .csv .xls

Figure 3: Average nominal and percentage change in bonus pay at the whole economy level, by month

Great Britain, July 2010 to December 2015

Source: Monthly Wages and Salaries Survey (MWSS)

Download this chart Figure 3: Average nominal and percentage change in bonus pay at the whole economy level, by month

Image .csv .xlsIn terms of the headline measure of Average Weekly Earnings (AWE), namely 3-month year-on-year growth, the whole economy trend remains largely unchanged (Figure 4), but these revisions lead to a change of between approximately negative 0.2pp and positive 0.2pp over the course of the period between July 2010 and December 2015 (Figure 5). This leads to an increase in growth rates between mid-2010 and mid-2011 and from early 2015 onwards, with a decrease in other periods, particularly in March 2014 (negative 0.2pp).

Figure 4: The original and revised 3 month year-on-year percentage total pay growth for the whole economy

Great Britain, July 2010 to December 2015

Source: Office for National Statistics, Monthly Wages and Salaries Survey (MWSS)

Download this chart Figure 4: The original and revised 3 month year-on-year percentage total pay growth for the whole economy

Image .csv .xls

Figure 5: Percentage point change in the 3 month year-on-year total pay growth for the whole economy as a result of these revisions

Great Britain, July 2010 to December 2015

Source: Office for National Statistics

Download this chart Figure 5: Percentage point change in the 3 month year-on-year total pay growth for the whole economy as a result of these revisions

Image .csv .xlsFigures 1 and 4 show that the trend in earnings at the whole economy level remains broadly the same after the revisions are made.

Sector impact

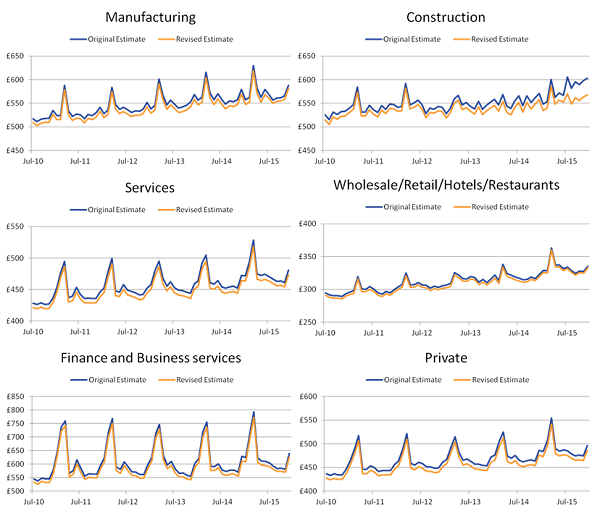

Overall, there is a decrease in earnings levels for all industry sectors as a result of the new small business factors (Figure 6) but there are two distinct phases to the decrease: the period between July 2010 and July 2015 (when the small business factors were last modified); and thereafter (Figure 7). This step-change occurs due to inconsistencies introduced at the point at which the small business factors were last modified compared with the revised historical estimates.

The following illustrates the effect on the private sector as well as the industry sectors. It should be noted that public sector estimates are unaffected, as the package of improvements affects only small private businesses with less than 20 employees.

For the first phase (July 2010 to June 2015), in terms of total, regular and bonus pay levels, the Finance and Business services industry sector is the most affected, with the Construction industry sector also notably affected, while Wholesaling, Retailing, Hotels and Restaurants industry sector is the least affected (Figures 6 and 7). The drivers for the negative change in the Finance and Business Service industry sector are Real Estate Activities (total pay down on average negative 4.5%) and Professional, Scientific and Technical Activities (total pay down on average negative 2.9%).

Figure 6: The levels of total pay for each industry sector, before and after revisions

Great Britain, July 2010 to December 2015

Source: Office for National Statistics, Monthly Wages and Salaries Survey (MWSS)

Download this image Figure 6: The levels of total pay for each industry sector, before and after revisions

.png (117.1 kB)For the second phase (July 2015 onwards), the Construction industry sector is the most affected for total and regular pay. Again, the Wholesaling, Retailing, Hotels and Restaurants industry sector is least affected by these revisions. For bonus pay, in percentage terms, on average the Construction industry sector is most affected but the range of changes in the Financial and Business services industry sector is much higher due to the seasonality of bonuses. The effect on the level of bonus pay can be seen in Figure 8.

Figure 7: The nominal change in the levels of regular pay for the industry sectors of AWE

Great Britain, July 2010 to December 2015

Source: Monthly Wages and Salaries Survey (MWSS)

Download this chart Figure 7: The nominal change in the levels of regular pay for the industry sectors of AWE

Image .csv .xls

Figure 8: The nominal change in the levels of bonus pay for the industry sectors of AWE

Great Britain, July 2010 to December 2015

Source: Office for National Statistics, Monthly Wages and Salaries Survey (MWSS)

Download this chart Figure 8: The nominal change in the levels of bonus pay for the industry sectors of AWE

Image .csv .xlsThe step change difference between the two phases is especially noticeable for some of the industry sectors (Figure 7), particularly for Construction, but it can be seen in Manufacturing and the Finance and Business services industry sectors too. Construction estimates can be prone to large changes due to the sector comprising of a relatively small number of distinct industries (SIC divisions 41-43; Construction of buildings, Civil engineering and Specialised construction activities) and the composition of this sector encompassing a relatively high proportion of small businesses. Hence the improvements made to the factors representing small businesses in AWE from 2015 will impact the Construction industry sector estimates more than other industry estimates.

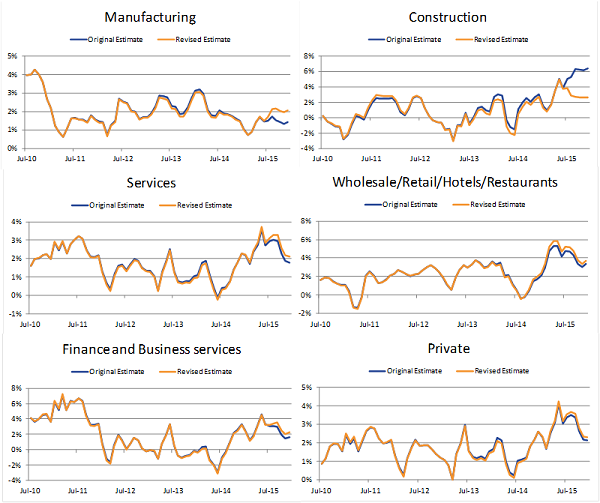

Figure 9: The 3-month year-on-year growth rates (total pay) for each of the 5 industry sectors and the private sector

Monthly Wages and Salaries Survey (MWSS)

Source: Office for National Statistics

Download this image Figure 9: The 3-month year-on-year growth rates (total pay) for each of the 5 industry sectors and the private sector

.png (106.2 kB) .xls (105.5 kB)In terms of the 3-month growth rates, we again see the step change effect occurring in July 2015 (Figure 9). Prior to this step change, the trends are generally unaffected except for the Construction industry sector which changes by between negative 0.8 and 0.4 percentage points (Figure 10). However after this change, we see that the Construction industry sector is substantially revised downwards and that Manufacturing industry sector and the Finance and Business service industry sector are substantially revised upwards, with the other industry sectors slightly revised upwards (Figure 10).

A similar pattern emerges for bonus payments (Figure 11) with the Construction industry sector and the Finance and Business service industry sector most affected on average prior to July 2015 and the Construction and Manufacturing industry sectors most affected from July 2015 onwards.

Figure 10: The percentage point change to the 3 month year-on-year growth rate (total pay) of each industry sector affected on AWE

Great Britain, July 2010 to December 2015

Source: Office for National Statistics, Monthly Wages and Salaries Survey (MWSS)

Download this chart Figure 10: The percentage point change to the 3 month year-on-year growth rate (total pay) of each industry sector affected on AWE

Image .csv .xls

Figure 11: The monthly year-on-year percentage point change to the growth rate (bonus pay) of each industry sector affected on AWE

Great Britain, July 2010 to December 2015

Source: Office for National Statistics, Monthly Wages and Salaries Survey (MWSS)

Download this chart Figure 11: The monthly year-on-year percentage point change to the growth rate (bonus pay) of each industry sector affected on AWE

Image .csv .xls4. Impact: Pre-July 2010

It is important to note that the 1-month and 3-month growth rates for this period remain the same; it is only the levels that are affected and so consequently, the trends remain identical.

On the whole, the impact on the levels of pay is generally similar to that seen for the period July 2010 onwards, with levels typically revised downwards (Figure 12). Total pay for the whole economy is affected downwards by approximately between £5.00 and £8.10 prior to July 2010, while the private sector is affected downwards by between £6.80 and £10.90 (Figure 13).

Figure 12: The original and revised total pay levels for the whole economy

Great Britain, January 2000 and July 2010

Source: Office for National Statistics, Monthly Wages and Salaries Survey (MWSS)

Download this chart Figure 12: The original and revised total pay levels for the whole economy

Image .csv .xlsFinance and Business Services is the industry sector most affected due to the reduction in bonuses (which are relatively large for this sector), followed by Construction, consistent with the trend seen for the period July 2010 onwards (Figure 14).

Figure 13: Effect on the whole economy and private sector total pay estimates

Great Britain, January 2000 to July 2010

Source: Office for National Statistics

Download this chart Figure 13: Effect on the whole economy and private sector total pay estimates

Image .csv .xls