Cynnwys

- Main points

- Statistician’s comment

- Summary

- The UK economy grew by 0.1% in Quarter 1 2018, unrevised from the preliminary estimate

- Growth in services and manufacturing slows, while construction sees its sharpest decline since Quarter 2 2012

- Growth in household consumption remains subdued and business investment falls in Quarter 1 2018

- Growth in compensation of employees strengthens in Quarter 1 2018, while profits fall

- The 12-month growth rate of CPIH fell to 2.2% in April 2018

- Employment, unemployment and inactivity

- Youth unemployment

- Labour market flows

1. Main points

The second estimate of gross domestic product (GDP) shows that the UK economy grew by 0.1% in Quarter 1 (Jan to Mar) 2018, unrevised from the preliminary estimate.

Construction output declined sharply in Quarter 1 2018, while growth in services and manufacturing also slowed.

Growth in household consumption remained subdued in Quarter 1 2018, while business investment fell.

Compensation of employees grew strongly in Quarter 1 2018, reflecting record-high UK employment levels.

The 12-month growth rate of the Consumer Prices Index including owner occupiers’ housing costs (CPIH) fell to 2.2% in April 2018, from 2.3% in March 2018.

The input Producer Price Index (input PPI) grew by 5.3% in the 12 months to April 2018 and growth in the output Producer Price Index (output PPI) remained unchanged at 2.7% in the 12 months to April 2018.

Prices for the mineral waters, soft drinks and juices component of CPIH rose sharply both before and after the introduction of the Soft Drinks Industry Levy, although the impact on headline inflation was minimal due to its low expenditure within the basket.

The employment rate in the UK reached a record high of 75.6% between January and March 2018.

2. Statistician’s comment

Commenting on today’s gross domestic product (GDP) figures, Head of GDP Rob Kent-Smith said:

“Overall, the economy performed poorly in the first quarter with manufacturing growth slowing and weak consumer-facing services. Oil and gas bounced back strongly, however, following the shutdown of the Forties pipeline at the end of last year.

“While there was some evidence of the poor weather hitting construction and high street shopping, this was offset to an extent by increased energy supply and online sales."

Nôl i'r tabl cynnwys3. Summary

The UK economy grew by 0.1% in Quarter 1 (Jan to Mar) 2018, unrevised from the preliminary estimate. The latest evidence shows that while adverse weather conditions in Quarter 1 2018 had a negative impact on some areas of the economy, such as construction and parts of retail trade, its overall impact was limited with the bad weather also boosting energy supply and online sales.

Construction output declined sharply in Quarter 1 2018, while growth in manufacturing and services also slowed. Household consumption growth remained subdued, growing by 0.2%.

The 12-month growth rate of the Consumer Prices Index including owner occupiers’ housing costs (CPIH) fell to 2.2% in April 2018 from 2.3% in March 2018, with the largest downward effect coming from air fares. The input Producer Price Index (input PPI) grew by 5.3% in the 12 months to April 2018, up from 4.4% in the 12 months to March 2018; this was driven mainly by increases in prices for crude oil and fuels. The growth in the output Producer Price Index (output PPI) remained unchanged at 2.7% in the 12 months to April 2018. Prices for the mineral waters, soft drinks and juices component of CPIH rose by around 5% between February and April 2018, suggesting that the Soft Drinks Industry Levy is having some effect on consumer prices for soft drinks.

The employment rate in the UK reached a record high of 75.6% between January and March 2018. The UK unemployment rate stood at 4.2% in the three months to March 2018. This is 0.2 percentage points below the October to December 2017 figure. The youth unemployment rate declined; it was higher for men than for women, but the difference between the rates has been narrowing. Between the last quarter of 2017 and the first quarter of 2018, there was a net inflow into employment, a net outflow from unemployment and a net outflow from inactivity. The number of people changing jobs declined by 254,000 in the first quarter of 2018.

More detailed theme day economic commentary is available for:

Nôl i'r tabl cynnwys4. The UK economy grew by 0.1% in Quarter 1 2018, unrevised from the preliminary estimate

Today’s Gross domestic product (GDP) release estimates that UK economic growth was 0.1% in Quarter 1 (Jan to Mar) 2018, unrevised from the preliminary estimate and the weakest rate since Quarter 4 (Oct to Dec) 2012. Compared with the same quarter a year ago, GDP rose by 1.2% in Quarter 1 2018 – slightly weaker than the 1.4% recorded in Quarter 4 2017 and the weakest growth since Quarter 2 (Apr to June) 2012. Quarter on same quarter a year ago GDP growth has been on a declining trend over the past three years (Figure 1).

The latest evidence shows that while adverse weather conditions in Quarter 1 2018 had a negative impact on some areas of the economy, such as construction and parts of retail trade, its overall impact is limited with the cold weather boosting energy supply and online spending. The soft growth in Quarter 1 2018 reflects pockets of weakness more broadly across the economy.

Figure 1: Gross domestic product growth, quarter-on-quarter and quarter on same quarter a year ago growth rate

UK, Quarter 1 (Jan to Mar) 2008 to Quarter 1 2018

Source: Office for National Statistics

Notes:

- Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept), Q4 refers to Quarter 4 (Oct to Dec).

Download this chart Figure 1: Gross domestic product growth, quarter-on-quarter and quarter on same quarter a year ago growth rate

Image .csv .xlsThe implied GDP deflator represents the broadest measure of inflation in the domestic economy, as it reflects changes in the price of all goods and services that comprise GDP, including the price movements in private and government consumption, investment and the relative price of exports and imports. In the year to Quarter 1 2018, the GDP deflator increased by 1.4%.

Nôl i'r tabl cynnwys5. Growth in services and manufacturing slows, while construction sees its sharpest decline since Quarter 2 2012

The output measure of gross domestic product (GDP) grew by an unrevised 0.1% in Quarter 1 (Jan to Mar) 2018. This was driven by a sharp decline in construction output and a sluggish manufacturing sector, while growth in the services industry also slowed. Consistent with previously published figures, the overall impact of adverse weather conditions on output in Quarter 1 2018 is relatively small.

Construction output fell by 2.7% in Quarter 1 2018, revised up by 0.6 percentage points from the preliminary estimate of GDP. This marked the second consecutive quarterly decline and the largest quarterly fall since Quarter 2 (Apr to June) 2012, reflecting widespread weakness across the industry. All sectors subtracted from quarterly growth except for private industrial new work, with the largest negative contribution coming from non-housing repair and maintenance (negative 0.5 percentage points). While there is some evidence that adverse weather conditions had a negative impact on construction activity in both February and March 2018, a large portion of the fall in Quarter 1 2018 was due to a sharp 2.6% decline in January 2018.

Meanwhile, production output rose by 0.6% in Quarter 1 2018, revised down from the preliminary estimate of 0.7%. Production growth in Quarter 1 2018 was driven by a 2.5% increase in energy supply as unusually cold weather in February and March 2018 boosted electricity and gas production. Quarterly production growth was also boosted by a 2.2% rise in mining and quarrying, largely reflecting a bounce back of 22.2% in January 2018, following the unexpected shutdown of the Forties pipeline system for several weeks in December 2017.

However, these two temporary factors in energy supply and mining masked a slowdown in manufacturing, which grew by a modest 0.2% in Quarter 1 2018 following a strong run of expansion at the end of 2017. There has been no evidence to date to suggest that the recent adverse weather conditions had any negative impact on manufacturing in Quarter 1 2018, with the subdued performance in manufacturing reflecting a relatively broad-based weakness across the sector.

New data on services output in March 2018 have been published today (25 May 2018). Growth in total services output is estimated to have slowed to 0.3% in Quarter 1 2018, unrevised from the preliminary estimate. However, there have been minor revisions to the monthly path, with an upward revision of 0.1 percentage points to January 2018 and a downward revision of 0.1 percentage points to February 2018. These monthly revisions were relatively broad-based across the main components of services.

Consistent with previously published figures, today’s data indicate that the heavy snow and adverse weather conditions in February and March 2018 had little overall impact on services output in Quarter 1 2018. While there was a negative impact on retail sales volumes in March 2018 due to a sharp decline in petrol sales, there was also a boost in online retail spending, particularly for department stores. The latest Retail sales figures show a bounce back in retail volumes in April 2018, as petrol and other sales recovered from the snow. It also showed a decline in department store sales following the relatively strong growth in March 2018.

The 0.3% rise in services output in Quarter 1 2018 is slightly weaker than the 0.4% recorded in Quarter 4 (Oct to Dec) 2017 and is in line with average quarterly growth recorded throughout 2017. Services growth was relatively subdued in 2017, reflecting a weakening in consumer-focused industries, such as retail trade.

A number of industries saw particularly strong growth in Quarter 4 2017 and a subsequent unwinding in Quarter 1 2018 (Figure 2). These included retail trade, warehousing, postal and courier services, activities of head offices, travel agents, and office administration, all of which contributed positively towards services growth in Quarter 4 2017 (together contributing 0.20 percentage points) but saw a decline in Quarter 1 2018 (together subtracting 0.12 percentage points). Apart from retail trade, the adverse weather had little observed impact on these sectors. The rises in warehousing, and postal and courier services in Quarter 4 2017 were attributed to increased activity around Black Friday and Christmas.

Figure 2: Contributions to growth in total services output, selected sectors

UK, Quarter 1 (Jan to Mar) 2017 to Quarter 1 2018

Source: Office for National Statistics

Notes:

- Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept), Q4 refers to Quarter 4 (Oct to Dec).

Download this chart Figure 2: Contributions to growth in total services output, selected sectors

Image .csv .xls6. Growth in household consumption remains subdued and business investment falls in Quarter 1 2018

The second estimate of gross domestic product (GDP) includes the first detailed picture of expenditure in Quarter 1 (Jan to Mar) 2018. This shows that private and government consumption both contributed positively to growth, while gross capital formation subtracted from growth. Net trade made zero growth contribution (to one decimal place).

Figure 3: Contributions to gross domestic product growth, expenditure component, quarter-on-quarter, chained volume measure

UK, Quarter 1 (Jan to Mar) 2016 to Quarter 1 2018

Source: Office for National Statistics

Notes:

- Components may not sum to total gross domestic product due to rounding and loss of additivity in data prior to open period. The statistical discrepancy is also not displayed.

- Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept), Q4 refers to Quarter 4 (Oct to Dec).

Download this chart Figure 3: Contributions to gross domestic product growth, expenditure component, quarter-on-quarter, chained volume measure

Image .csv .xlsGrowth in household consumption remained subdued at 0.2% in Quarter 1 2018. The Bank of England’s latest Agents' summary of business conditions (PDF, 477.9KB), which surveyed businesses between late February and mid-April 2018, showed that consumer spending growth had slowed markedly, due in part to the adverse weather.

While some parts of consumer spending, such as petrol sales, were affected by the adverse weather in Quarter 1 2018, the weakness in consumption also reflects a continuation of a longer-term trend of subdued growth in household expenditure. This has been driven by weak growth in real wages, with households’ incomes squeezed by rising import prices following the past depreciation of sterling.

In 2017, household consumption grew by its weakest annual rate since 2011 (1.7%) and quarter on same quarter a year ago growth slowed for the seventh consecutive quarter in Quarter 1 2018 (Figure 4). This weakening in household consumption is consistent with the slowdown in output for consumer-focused services industries, which has been on a declining trend since late 2016.

Figure 4: Household final consumption expenditure and consumer-facing services output, quarter on same quarter a year ago, chained volume measure

UK, Quarter 1 (Jan to Mar) 2015 to Quarter 1 2018

Source: Office for National Statistics

Notes:

"Consumer-focused" services defined here include retail trade (Standard Industrial Classification (SIC) 2007 codes 45 and 47), food and beverage (SIC code 56), publishing, audiovisual and broadcasting activities (SIC codes 58 to 60; including motion pictures), and arts, entertainment and recreation (SIC codes 90 to 93).

Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept), and Q4 refers to Quarter 4 (Oct to Dec).

Download this chart Figure 4: Household final consumption expenditure and consumer-facing services output, quarter on same quarter a year ago, chained volume measure

Image .csv .xlsGross fixed capital formation (GFCF) is estimated to have increased by 0.9% in Quarter 1 2018. This was driven by increases in private dwelling investment and government investment, partly offset by a fall in business investment. Initial estimates indicate that business investment fell by 0.2% in Quarter 1 2018, the first quarterly contraction since Quarter 4 (Oct to Dec) 2016. This was driven largely by a 2.3% fall in investment by services firms, which was partly offset by a 2.8% increase in manufacturing investment.

Meanwhile, private dwelling investment saw a rise of 3.4% in Quarter 1 2018, despite falls recorded in new private housing and private housing repair and maintenance, published in the latest construction figures. This contrast, however, is due largely to timing of recording differences and also conceptual differences – more information can be found in the article Conceptual differences between an aggregate of construction output measures and the GFCF dwellings measure (published June 2013). When Quarter 1 2018 is open for revision in the June 2018 revised business investment release, actual data will replace some forecast data and may continue to be revised as new data become available.

The total trade deficit remained at 1.5% of GDP in Quarter 1 2018, with a 1.2% fall in the value of exports offset by a 1.1% fall in the value of imports. Compared with UK trade figures published on 10 May 2018, the trade deficit has been revised up by £0.8 billion to £7.7 billion.

In volume terms, exports fell by 0.5% in Quarter 1 2018, the second consecutive quarterly decline. This was driven by a 1.3% fall in services exports, which was partly offset by a 0.1% rise in goods exports. Meanwhile, import volumes fell by 0.6%, the first decline since Quarter 4 2016. This reflected a decline in both goods and services imports, which fell by 0.3% and 1.3% respectively.

Total export and import prices both fell in Quarter 1 2018 for the first time since Quarter 4 2015. The 0.7% fall in total export prices was driven by a 1.5% fall in the price of services exports, while the price of goods exports also fell marginally by 0.1% (Table 1). Meanwhile, total import prices fell by 0.6%, reflecting a 0.6% fall in goods import prices and a 0.4% fall in services import prices.

Table 1: Export and import implicit price deflators, quarter-on-quarter growth

| UK, Quarter 2 (Apr to June) 2017 to Quarter 1 (Jan to Mar) 2018 | ||||||

| Goods exports | Services exports | Total exports | Goods imports | Services imports | Total imports | |

|---|---|---|---|---|---|---|

| Quarter 2 2017 | -0.7 | 1.3 | 0.2 | 0 | 0.2 | 0 |

| Quarter 3 2017 | 0.7 | 0.6 | 0.7 | 0.3 | -0.1 | 0.2 |

| Quarter 4 2017 | 1.2 | 0.3 | 0.8 | 1.3 | 0.3 | 1.1 |

| Quarter 1 2018 | -0.1 | -1.5 | -0.7 | -0.6 | -0.4 | -0.6 |

| Source: Office for National Statistics | ||||||

Download this table Table 1: Export and import implicit price deflators, quarter-on-quarter growth

.xls (35.8 kB)7. Growth in compensation of employees strengthens in Quarter 1 2018, while profits fall

Nominal gross domestic product (GDP) growth slowed to 0.3% in Quarter 1 (Jan to Mar) 2018, the weakest quarterly growth since Quarter 3 (July to Sept) 2015. This was driven by growth in compensation of employees (CoE) and other income, partly offset by falls in gross operating surplus and taxes less subsidies (Figure 5).

Growth in CoE rose to 1.6% in Quarter 1 2018, the strongest quarterly rate since Quarter 2 (Apr to June) 2016. This reflects strong employment levels in the UK labour market, with the latest figures showing that the number of people in employment increased by 197,000 to a record high of 32.34 million in the three months to March 2018.

The latest labour market data also showed that the number of self-employed fell by 33,000 to 4.75 million in Quarter 1 2018, continuing a recent decline following a prolonged period of rapid growth. Initial estimates show that mixed income fell by 0.3% in Quarter 1 2018, despite a rise in total other income. Meanwhile, gross operating surplus of corporations and taxes less subsidies both fell, by 1.3% and 2.4% respectively.

Figure 5: Contributions to nominal gross domestic product growth by income component, quarter-on-quarter

UK, Quarter 1 (Jan to Mar) 2015 to Quarter 1 2018

Source: Office for National Statistics

Notes:

- Components may not sum to total gross domestic product due to rounding and loss of additivity in data prior to open period. The statistical discrepancy is also not displayed.

- Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept), Q4 refers to Quarter 4 (Oct to Dec).

Download this chart Figure 5: Contributions to nominal gross domestic product growth by income component, quarter-on-quarter

Image .csv .xls8. The 12-month growth rate of CPIH fell to 2.2% in April 2018

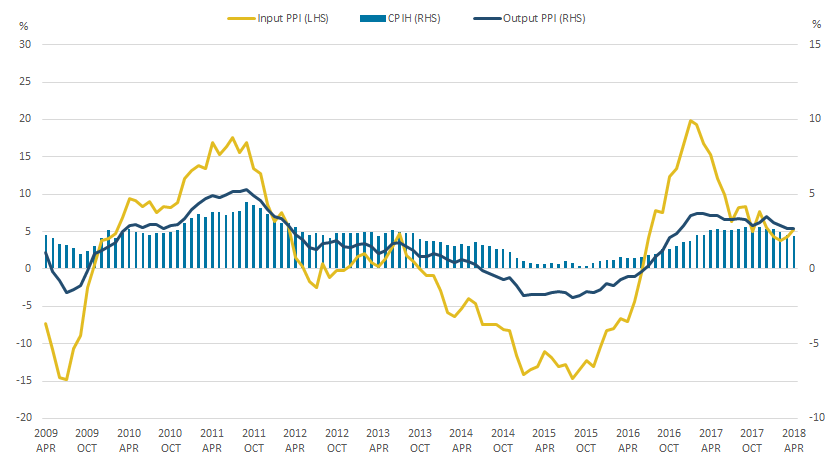

Figure 6 shows that the 12-month growth rate of the Consumer Prices Index including owner occupiers’ housing costs (CPIH) fell to 2.2% in April 2018 from 2.3% in March 2018, with the largest downward effect coming from air fares. The input Producer Price Index (input PPI) grew by 5.3% in the 12 months to April 2018, up from 4.4% in the 12 months to March 2018; this was driven mainly by increases in prices for crude oil and fuels. The growth in the output Producer Price Index (output PPI) remained unchanged at 2.7% in the 12 months to April 2018.

Figure 6: 12-month growth rates for input Producer Price Index (PPI) (left-hand side), output PPI and Consumer Prices Index including owner occupiers' housing costs (CPIH) (right-hand side)

UK, April 2009 to April 2018

Source: Office for National Statistics

Download this image Figure 6: 12-month growth rates for input Producer Price Index (PPI) (left-hand side), output PPI and Consumer Prices Index including owner occupiers' housing costs (CPIH) (right-hand side)

.png (25.5 kB) .xls (45.1 kB)It was announced in March 2016 that the government would introduce a new tax on soft drinks containing more than five grams of added sugar per 100 millilitres. Manufacturers have responded differently to the Soft Drinks Industry Levy, with some reducing the sugar content in their drinks to fall below the level at which they would be subject to the levy, while others kept their sugar content unchanged.

Figure 7 shows prices for the mineral waters, soft drinks and juices component of CPIH for January 2014 to April 2018, indexed to January equals 100 for each year. This category contains a range of drinks, some of which are subject to the levy and some of which are not.

Figure 7: Mineral waters, soft drinks and juices component within the Consumer Prices Index including owner occupiers’ housing costs (CPIH)

UK, January 2014 to April 2018

Source: Office for National Statistics

Download this chart Figure 7: Mineral waters, soft drinks and juices component within the Consumer Prices Index including owner occupiers’ housing costs (CPIH)

Image .csv .xlsMineral waters, soft drinks and juices prices rose by 2.8% between March and April 2018, a record for the time of year, following what was already a record increase for the time of year between February and March 2018 at 2.2%. The items with the largest number of observed price increases were fizzy energy drinks and cola-flavoured drinks. Some of these price increases were due to the items having been discounted in March 2018 and “recovering” to full price in April 2018, although the majority of these recoveries were to a higher price than seen before the discount.

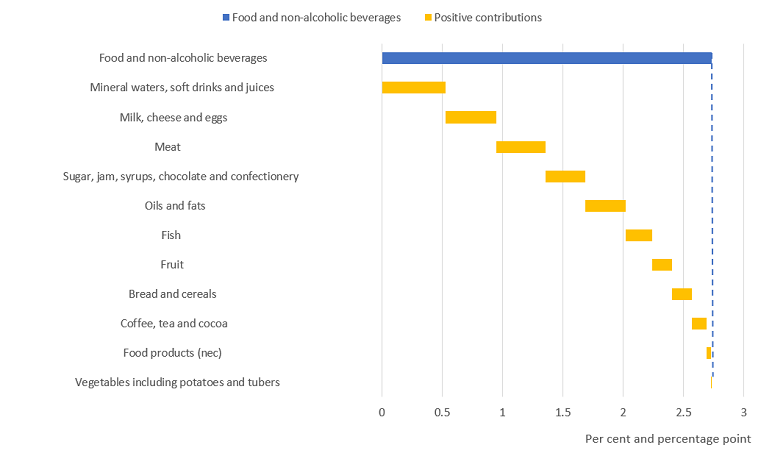

It should be noted, however, that 500-millilitre bottles of still mineral water saw the same number of price increases as bottled cola drinks between March and April 2018, suggesting that there may be underlying inflationary pressures in addition to the Soft Drinks Industry Levy. Mineral waters, soft drinks and juices make up a very small proportion (0.7%) of the overall CPIH basket and therefore have very limited impact on overall inflation. Figure 8 shows the contribution that individual components made to the 12-month growth rate of food and non-alcoholic beverages in April 2018.

Figure 8: Contributions to the 12-month growth rate of food and non-alcoholic beverages component within Consumer Prices Index including owner occupiers' housing costs (CPIH)

UK, April 2018

Source: Office for National Statistics

Notes:

- Contributions may not sum exactly due to rounding.

Download this image Figure 8: Contributions to the 12-month growth rate of food and non-alcoholic beverages component within Consumer Prices Index including owner occupiers' housing costs (CPIH)

.png (34.7 kB) .xls (28.7 kB)Prices for food and non-alcoholic beverages as a whole grew by 2.7% between April 2017 and April 2018. Despite having a relatively low weight, mineral waters, soft drinks and juices was the largest contributor to the 12-month growth rate for food and non-alcoholic beverages, contributing 0.53 percentage points. This was followed closely by milk, cheese and eggs at 0.41 percentage points and meat at 0.41 percentage points. Food and non-alcoholic beverages as a whole contributed 0.2 percentage points to headline CPIH this month, only the fifth-highest contribution out of 11 divisions.

Nôl i'r tabl cynnwys9. Employment, unemployment and inactivity

In Quarter 1 (Jan to Mar) 2018, the number of people in employment increased by 197,000 to a record high of 32.34 million. The employment rate increased by 0.4 percentage points on the quarter and by 0.8 percentage points compared with the same period a year ago.

Breaking down the employment data by sex shows that employment of women increased by 108,000 and employment of men increased by 90,000. Overall, the number of men in employment increased to 17.1 million in the three months to March 2018, while that of women increased to 15.2 million during the same period. Both are new record levels. Figure 9 shows the trends of employment and unemployment.

Figure 9: Unemployment and employment rate

UK, seasonally adjusted, January to March 2006 to January to March 2018

Source: Labour Force Survey, Office for National Statistics

Download this chart Figure 9: Unemployment and employment rate

Image .csv .xlsThe figure shows that the employment rate continues to increase and the unemployment rate continues to decline quarter-on-quarter. Unemployment declined by 0.2 percentage points on the quarter to 4.2% in the three months to March 2018. The total number of unemployed people fell to 1.43 million.

The employment level for all age groups increased in the first quarter of 2018. Part-time employment increased to 8.6 million and the number of people working full-time increased to 23.75 million during the same period. Overall, the number of employees increased to a record high of 27.43 million, while the number of self-employed declined to 4.75 million. Among the self-employment, the number of part-time self-employed increased.

The number of people who were inactive decreased by 115,000 on the previous quarter as the level of inactivity continued to decline. The rate of inactivity fell to a record low of 21%. Women’s inactivity fell by more than that of men. The fall in inactivity was driven by the fall in inactivity among non-UK nationals. Within this group, inactivity among EU27 nationals fell by 49,000 while that of non-EU workers fell by 65,000 when compared with the same period in 2017. The level of inactivity among UK nationals fell by 68,000 during the same time period.

Nôl i'r tabl cynnwys10. Youth unemployment

The unemployment of persons aged 16 to 24 years continued to decline on the quarter for both men and women in Quarter 1 (Jan to Mar) 2018. The trend of youth unemployment is shown in Figure 10. The figure shows that male unemployment is consistently lower than that for women and that in the latest period, the gap between the two unemployment rates has been narrowing. In addition, both unemployment rates are now below their pre-downturn levels.

Figure 10: The trend of youth unemployment

UK, seasonally adjusted, January to March 2006 to January to March 2018

Source: Office for National Statistics

Download this chart Figure 10: The trend of youth unemployment

Image .csv .xlsThe UK has a higher youth unemployment rate when compared with other countries like Japan, the US and Germany, but it has a lower rate than some European countries like Poland (14.8%), France (22.3%) and Italy (34.8%).

Nôl i'r tabl cynnwys11. Labour market flows

This month’s labour market data enable us to analyse labour market flows. One important feature of the labour market flows is the indication of a changing skills composition of employment. The trend since Quarter 1 (Jan to Mar) 2006 is that the net quarterly flow of low-skilled jobs has been positive in only five quarters, otherwise the low-skilled jobs were declining. The net quarterly flow of high-skilled jobs declined in only six quarters, while that of medium-skilled jobs declined in nine quarters during the same period.

In 2017, there was a net positive average growth in medium- and high-skilled jobs. This was accompanied by a net decline in low-skilled jobs. In the first quarter of 2018, low-skilled jobs declined, medium-skilled jobs declined and high-skilled jobs increased. Since Quarter 3 (July to Sept) 2016, the number of low-skilled jobs declined in every quarter. The changes show that there is contraction of low-skilled jobs.

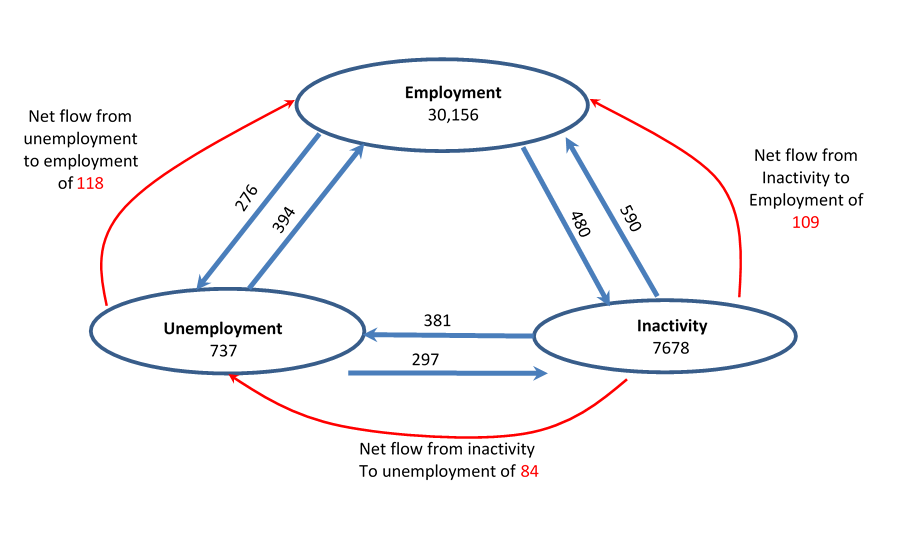

Labour market flows also show the churning of people between the three labour market statuses (employment, unemployment and inactivity (or non-participation)). The study of these flows is important because aggregate labour market indicators discussed previously are driven by the behaviour of the flows.

Figure 11 shows a summary of the flow rates between Quarter 4 (Oct to Dec) 2017 and Quarter 1 2018. The straight arrows show the direction of the flows and the curved arrows show the direction of the net flow.

Figure 11: Labour market flows

UK, seasonally adjusted, October to December 2017 to January to March 2018

Source: Office for National Statistics

Notes:

- The figures may not add up due to rounding.

Download this image Figure 11: Labour market flows

.png (63.5 kB)The employment, unemployment and inactivity figures indicate the number of people who did not change their labour market statuses between the two quarters. For instance, 30.156 million people who were in employment in the fourth quarter of 2017 remained in employment in the first quarter of 2018. The arrows indicate the flows into and out of the different labour market statuses. For instance, 276,000 people that were in employment in the fourth quarter of 2017 became unemployed in the first quarter of 2018. The differences between the corresponding arrow totals give the net flows between any two labour market statuses. Figure 12 shows the trend of employment net flows between 2006 and the first quarter of 2018.

Figure 12: Net employment flows

UK, seasonally adjusted, October to December 2006 to January to March 2018

Source: Office for National Statistics

Download this chart Figure 12: Net employment flows

Image .csv .xlsBetween the fourth quarter of 2017 and the first quarter of 2018, there was net flow into employment of 228,000 people. Of all the people who were in employment in the last quarter of 2017, 0.9% changed status into unemployment and 1.6% changed status into inactivity. The level of employment persistence was quite high between the last quarter of 2017 and the first quarter of 2018.

People left employment for various reasons. The flows data show that the main reasons for people leaving employment were resignations, dismissals and redundancies, retirement or giving up work, and “other reasons”. The largest number of people left their jobs for “other reasons” (319,000), followed by resignations (256,000). The number of resignations increased throughout 2017, but they declined in the first quarter of 2018. The number of people retiring or giving up work decreased from 21,000 in the fourth quarter of 2017 to 20,000 in the first quarter of 2018. During the same period, the number of dismissals decreased from 49,000 to 40,000. Overall, the number of people that changed jobs decreased by 254,000 on the quarter.

Some of the people who moved out of employment joined unemployment. Figure 13 shows the trend and net flows into unemployment between 2006 and the first quarter of 2018. Of the people who were unemployed in the last quarter of 2017, 50.9% remained unemployed in the first quarter of 2018, while the rest either joined employment or inactivity. There was a net outflow of 35,000 from unemployment in the first quarter of 2018.

Figure 13: Net unemployment flows

UK, seasonally adjusted, October to December 2006 to January to March 2018

Source: Office for National Statistics

Download this chart Figure 13: Net unemployment flows

Image .csv .xlsMore people moved from unemployment to employment than to inactivity. Overall, the decrease in unemployment was smaller than the decrease in inactivity.

There was a net outflow from inactivity to employment and to unemployment on the quarter. This has resulted in a very low inactivity rate in the economy. The analysis of the data shows that for every 100 people that were inactive in the last quarter of 2017, on average, seven could expect to become employed, while four could expect to become unemployed in the first quarter of 2018.

Nôl i'r tabl cynnwys