Cynnwys

- Main points

- What is the Producer Price Index (PPI)?

- Output prices: summary

- Supplementary analysis: output prices

- Output prices: detailed commentary

- Output PPI range of movements

- Input prices: summary

- Supplementary analysis: input prices

- Input prices: detailed commentary

- Input PPI indices range of movements

- Economic context

- Revisions

- Quality and methodology

- Background notes

1. Main points

The reporting period for this release covers the calendar month of July 2016, therefore, the data refers to the period after the EU referendum.

The price of goods bought and sold by UK manufacturers, as estimated by the Producer Price Index, rose in the year to July 2016 following 2 years of falls.

Factory gate prices (output prices) for goods produced by UK manufacturers rose 0.3% in the year to July 2016, compared with a fall of 0.2% in the year to June 2016.

This is the first time that factory gate prices have increased on the year since June 2014. The index has been following an upward trend since August 2015. The increase of 0.3% in the year to July 2016 is therefore a continuation of the trend over the past 11 months.

Core factory gate prices, which exclude the more volatile food, beverage, tobacco and petroleum products, rose 1.0% in the year to July 2016, compared with a rise of 0.7% in the year to June 2016.

The overall price of materials and fuels bought by UK manufacturers for processing (total input prices) rose 4.3% in the year to July 2016, compared with a fall of 0.5% in the year to June 2016.

Similar to factory gate prices, total input prices have also been following an upward trend in recent months. With the exception of April 2016, the annual rate has been trending upwards since November 2015.

Core input prices, which exclude purchases from the more volatile food, beverage, tobacco and petroleum industries, rose 4.7% in the year to July 2016, compared with a fall of 0.3% in the year to June 2016.

Nôl i'r tabl cynnwys2. What is the Producer Price Index (PPI)?

The Producer Price Index (PPI) is a monthly survey that measures the price changes of goods bought and sold by UK manufacturers and provides an important measure of inflation, alongside other indicators such as Consumer Price Index (CPI) and Services Producer Price Index (SPPI). This statistical bulletin contains a comprehensive selection of data on input and output index series. It contains producer price indices of materials and fuels purchased, and output of manufacturing industry by broad sector.

The output price indices measure change in the prices of goods produced by UK manufacturers (these are often called “factory gate prices”).

The factory gate price (the output price) is the price of goods sold by UK manufacturers and is the actual cost of manufacturing goods before any additional charges are added, which would give a profit. It includes costs such as labour, raw materials and energy, as well as interest on loans, site or building maintenance, or rent.

Core factory gate inflation excludes price movements from food, beverage, petroleum, and tobacco and alcohol products, which tend to have volatile price movements. It should give a better indication of the underlying output inflation rates.

The input price indices measure change in the prices of materials and fuels bought by UK manufacturers for processing. These are not limited to just those materials used in the final product, but also include what is required by the company in its normal day-to-day running.

The input price is the cost of goods bought by UK manufacturers for use in manufacturing, such as the actual cost of materials and fuels bought for processing.

Core input inflation strips out purchases from the volatile food, beverage, tobacco and petroleum industries to give an indication of the underlying input inflation pressures facing the UK manufacturing sector.

Nôl i'r tabl cynnwys3. Output prices: summary

Factory gate inflation rose 0.3% in the year to July 2016, compared with a fall of 0.2% in the year to June 2016. This is the first annual increase since June 2014.

During 2012 and 2013, core factory gate inflation tended to run at a lower rate than total output inflation and showed a smaller degree of volatility. This trend changed in 2014, as total output fell into negative inflation: a result of the downward pressures from petroleum, which is excluded from the core measure of inflation. In 2015, total output inflation has remained consistently below core output price inflation, with total output averaging a fall of 1.7% during 2015 and core output averaging growth of 0.2% in the same period (Figure A).

Looking at the latest estimates (Table A), movements in factory gate prices over the 12 months to July 2016 were as follows:

- factory gate prices rose 0.3%, compared with a fall of 0.2% in the year to June 2016

- core factory gate prices rose 1.0%, compared with a rise of 0.7% in the year to June 2016

- factory gate inflation excluding excise duty rose 0.3%, compared with a fall of 0.1% in the year to June 2016

Between June and July 2016:

- factory gate prices increased 0.3%, unchanged from last month

- core factory gate prices increased 0.4%, compared with an increase of 0.1% in June 2016

Table A: Output prices (home sales), February 2016 to July 2016, UK

| UK, February 2016 to July 2016 | |||||||

| Percentage change | |||||||

| All manufactured products | Excluding food, beverage, tobacco and petroleum | All manufactured products excluding duty | |||||

| 1 month | 12 months | 1 month | 12 months | 1 month | 12 months | ||

| 2016 | Feb | 0.1 | -1.1 | 0.1 | 0.2 | 0.1 | -0.8 |

| Mar | 0.5 | -0.7 | 0.1 | 0.3 | 0.4 | -0.7 | |

| Apr | 0.4 | -0.5 | 0.2 | 0.5 | 0.4 | -0.4 | |

| May | 0.1 | -0.5 | 0.1 | 0.6 | 0.0 | -0.4 | |

| Jun | 0.3 | -0.2 | 0.1 | 0.7 | 0.3 | -0.1 | |

| Jul | 0.3 | 0.3 | 0.4 | 1.0 | 0.3 | 0.3 | |

| Source: Office for National Statistics | |||||||

Download this table Table A: Output prices (home sales), February 2016 to July 2016, UK

.xls (25.6 kB)

Figure A: Output prices

UK, July 2012 to July 2016

Source: Office for National Statistics

Download this chart Figure A: Output prices

Image .csv .xls4. Supplementary analysis: output prices

Table B shows the annual percentage change in price across all product groups and Figure B shows their contribution to the annual factory gate inflation rate.

Table B: Output prices, 12 months’ change, July 2016, UK

| UK | |

| Product group | Percentage change |

| Food products | -2.8 |

| Tobacco and alcohol (incl. duty) | 0.9 |

| Clothing, textile and leather | 0.4 |

| Paper and printing | 0.4 |

| Petroleum products (incl. duty) | -3.4 |

| Chemical and pharmaceutical | -1.3 |

| Metal, machinery and equipment | 1.4 |

| Computer, electrical and optical | 0.8 |

| Transport equipment | 2.5 |

| Other manufactured products | 2.4 |

| All manufacturing | 0.3 |

| Source: Office for National Statistics | |

Download this table Table B: Output prices, 12 months’ change, July 2016, UK

.xls (25.1 kB)

Figure B: Output prices, contribution to 12 months growth rate, July 2016

UK

Source: Office for National Statistics

Download this chart Figure B: Output prices, contribution to 12 months growth rate, July 2016

Image .csv .xlsTable C shows the monthly percentage change in price across all product groups and Figure C shows their contribution to the month factory gate inflation rate.

Table C: Output prices, 1 month change, July 2016, UK

| UK | |

| Product group | Percentage change |

| Food products | 0.0 |

| Tobacco and alcohol (incl. duty) | -0.1 |

| Clothing, textile and leather | 0.1 |

| Paper and printing | 0.1 |

| Petroleum products (incl. duty) | 0.7 |

| Chemical and pharmaceutical | 0.2 |

| Metal, machinery and equipment | 0.5 |

| Computer, electrical and optical | 0.3 |

| Transport equipment | 1.1 |

| Other manufactured products | 0.2 |

| All manufacturing | 0.3 |

| Source: Office for National Statistics | |

Download this table Table C: Output prices, 1 month change, July 2016, UK

.xls (26.1 kB)

Figure C: Output prices, contribution to 1 month growth rate, July 2016

UK

Source: Office for National Statistics

Download this chart Figure C: Output prices, contribution to 1 month growth rate, July 2016

Image .csv .xls5. Output prices: detailed commentary

Factory gate prices rose 0.3% in the year to July 2016, compared with a fall of 0.2% in the year to June 2016. This is the first annual increase since June 2014. The main contribution to the increase in the annual rate for July 2016 came from other manufactured products. An increase in the price of transport equipment also contributed towards the rise in the output price of manufactured products. These increases were offset by decreases in the prices of food products, and petroleum (Figure B).

Other manufactured products rose 2.4% in the year to July 2016, compared with a rise of 2.6% in the year to June 2016. The majority of other manufactured products showed increases, however, the main contributions to this rise came from soft drinks, mineral water and other bottled waters, and repair and installation of service machinery, with prices rising by 11.2% and 6.8% respectively in the year.

Transport equipment prices rose 2.5% in the year to July 2016, compared with a rise of 1.4% in the year to June 2016. This index has now seen increases on the year since January 2016.

The increases were offset slightly by food products, which decreased 2.8% in the year to July 2016, compared with a fall of 3.0% in the year to June 2016. Decreases in other food products, preserved meat and meat products, and dairy products contributed to this fall.

All petroleum products showed decreases, however, the main contributions to the latest fall in the annual rate came from motor spirit, and diesel and gas oil.

The monthly price index saw a rise of 0.3% between June and July 2016, unchanged from last month. Most product groups showed small monthly movements. Transport equipment provided the largest upward contribution, and tobacco and alcohol provided the only downward contribution to the monthly rate (Figure C).

Between June and July 2016, transport equipment prices rose by 1.1%, compared with a rise of 0.2% between May and June 2016. Increases in the price of motor vehicles, trailers and semi-trailers was the main contributor towards this upwards movement.

Alcohol and tobacco prices fell by 0.1% between June and July 2016, compared with no change between May and June 2016. A decrease in the price of alcoholic beverages was the main contribution towards this decrease.

Core factory gate inflation

Core factory gate prices, which exclude the more volatile food, beverage, tobacco and petroleum product prices, giving a measure of the underlying factory gate inflation, rose 1.0% in the year to July 2016, compared with a rise of 0.7% in the year to June 2016. This was driven by increases in the price of transport equipment, other manufactured products and metals, machinery and equipment.

The index showed a rise of 0.4% between June and July 2016.

Output producer price index contribution to change in rate

The annual percentage rate for the output PPI in July 2016 rose 0.3%, compared with a fall of 0.2% last month resulting in an increase in the annual rate of 0.5 percentage points. An increase in petroleum products was the main driver behind the increase.

Figure D: Output PPI 12 month contribution to change in annual rate between June and July 2016

UK

Source: Office for National Statistics

Download this chart Figure D: Output PPI 12 month contribution to change in annual rate between June and July 2016

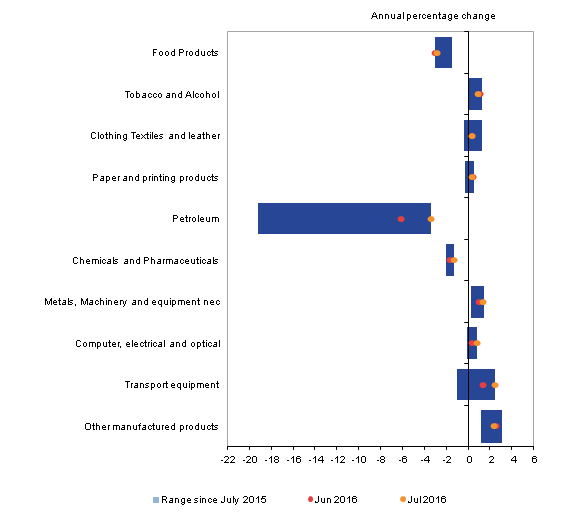

Image .csv .xls6. Output PPI range of movements

Figure E shows the year-on-year growth in output PPI by grouping for the latest 2 months and the range of the price changes that have been seen in these sections since July 2015. It can be seen that the majority of output PPI indices have experienced little variance in inflation in the past 12 months. Petroleum shows the biggest decrease, as well as the biggest range of movements; ranging from a fall of 19.2% in September 2015 to a fall of 3.4% in July 2016. Other manufactured products show the biggest increase, ranging from a rise of 1.1% in February 2016 to a rise of 3.0% in April 2016.

Figure E: Output PPI range of movements, July 2015 to July 2016

UK

Source: Office for National Statistics

Download this image Figure E: Output PPI range of movements, July 2015 to July 2016

.png (17.2 kB) .xls (28.7 kB)7. Input prices: summary

Figure F shows the annual movements in total input prices (including materials and fuels) and core input prices (excluding purchases from food, beverage, tobacco and petroleum industries) of materials and fuels purchased by the UK manufacturing industry. Between July 2012 and June 2014, both series showed relatively similar movements. Between November 2013 and early 2015, both series have been showing a downward trend, with total input prices falling more rapidly. There has been a significant gap in the price movements of total input prices and core input prices since July 2014, however, this gap has been narrowing in recent months. Both series have shown increases in the year to July 2016. Currently there is a difference of 0.4 percentage points, compared with a maximum of 10.9 percentage points in January 2015.

Looking at the latest data (Table D), the main movements in the year to July 2016 were as follows:

- the total input price index rose 4.3%, compared with a fall of 0.5% in the year to June 2016, the first annual increase since September 2013

- the core input price index saw a rise of 4.7%, compared with a fall of 0.3% in the year to June 2016

- the price of imported materials as a whole (including crude oil) rose 6.5%, compared with an increase of 0.6% in the year to June 2016 ; this is the second rise seen in this index since September 2013

Between June and July 2016:

- the total input price index rose 3.3%, compared with a rise of 1.7% last month (Table D)

- the seasonally adjusted input price index for the manufacturing industry excluding the food, beverage, tobacco and petroleum industries (Table D) rose 4.1%, compared with a rise of 1.0% last month

Table D: Input prices, February 2016 to July 2016, UK

| Percentage change | ||||||

| Materials and fuels purchased | Excluding purchases from food, beverage, tobacco and petroleum industries | |||||

| 1 month | 12 months | 1 month | 12 months | 1 month | ||

| (NSA)1 | (NSA)1 | (NSA)1 | (NSA)1 | (SA)2 | ||

| 2016 | Feb | 0.4 | -8.0 | 0.5 | -3.5 | 0.4 |

| Mar | 1.7 | -6.6 | 0.5 | -2.8 | 0.3 | |

| Apr | 0.8 | -7.1 | 0.3 | -2.2 | 0.8 | |

| May | 2.3 | -4.3 | -0.4 | -1.9 | 0.0 | |

| Jun | 1.7 | -0.5 | 0.7 | -0.3 | 1.0 | |

| Jul | 3.3 | 4.3 | 3.9 | 4.7 | 4.1 | |

| Source: Office for National Statistics | ||||||

| Notes: | ||||||

| 1. NSA: Not Seasonally Adjusted | ||||||

| 2. SA: Seasonally Adjusted | ||||||

Download this table Table D: Input prices, February 2016 to July 2016, UK

.xls (26.1 kB)

Figure F: Input prices (materials and fuel) manufacturing industry

UK, July 2012 to July 2016

Source: Office for National Statistics

Notes:

- Input price indices include the Climate Change Levy which was introduced in April 2001.

- Input price indices include the Aggregate Levy which was introduced in April 2002.

Download this chart Figure F: Input prices (materials and fuel) manufacturing industry

Image .csv .xls8. Supplementary analysis: input prices

Table E and Figure G show the percentage change in the price of the main commodities groups over the year and their contributions to the total input index.

Table E: Input prices, 12 months change, July 2016, UK

| Product group | Percentage change |

| Fuel including Climate Change Levy | -8.0 |

| Crude oil | -3.8 |

| Home food materials | 8.3 |

| Imported food materials | 10.2 |

| Other home-produced materials | 0.0 |

| Imported metals | 12.4 |

| Imported chemicals | 3.7 |

| Imported parts and equipment | 8.9 |

| Other imported materials | 9.7 |

| All manufacturing | 4.3 |

| Source: Office for National Statistics | |

Download this table Table E: Input prices, 12 months change, July 2016, UK

.xls (26.1 kB)

Figure G: Input prices, contribution to 12 months growth rate, July 2016

UK

Source: Office for National Statistics

Download this chart Figure G: Input prices, contribution to 12 months growth rate, July 2016

Image .csv .xlsTable F and Figure H show the percentage change in the price of the main commodities groups over the month and their contributions to the total input index.

Table F: Input prices, 1 month change, July 2016 UK

| Product group | Percentage change |

| Fuel including Climate Change Levy | 0.9 |

| Crude oil | 3.7 |

| Home food materials | 0.6 |

| Imported food materials | 2.6 |

| Other home-produced materials | 0.2 |

| Imported metals | 9.2 |

| Imported chemicals | 3.4 |

| Imported parts and equipment | 4.2 |

| Other imported materials | 4.8 |

| All manufacturing | 3.3 |

| Source: Office for National Statistics | |

Download this table Table F: Input prices, 1 month change, July 2016 UK

.xls (24.6 kB)

Figure H: Input prices, contribution to 1 month growth rate, July 2016

UK

Source: Office for National Statistics

Download this chart Figure H: Input prices, contribution to 1 month growth rate, July 2016

Image .csv .xls9. Input prices: detailed commentary

The overall input index for all manufacturing, which measures changes in the price of materials and fuels purchased by manufacturers, rose 4.3% in the year to July 2016, compared with a fall of 0.5% in the year to June 2016. The main upwards contributions to the index came from imported parts and equipment, with smaller, but notable, upward contributions from home food materials and other imported materials.

The monthly input index rose 3.3% between June and July 2016, compared with an increase of 1.7% between May and June 2016. (see Table F and Figure H).

Imported parts and equipment prices rose 8.9% in the year to July 2016, compared with a rise of 3.6% in the year to June 2016. The main contribution came from imported products used in the manufacture of machinery and equipment, which rose 13.3%, compared with a rise of 6.3% in the year to June 2016.

Home food materials prices rose 8.3% in the year to July 2016 compared with a rise of 6.1% in the year to June 2016. This is the third consecutive month of growth following over 2 years of price falls. The main contribution to this increase came from crop and animal production.

Other imported material prices showed an increase of 9.7% in the year to July 2016 compared with an increase of 4.7% in the year to June 2016. The main contribution to the rise came from imported products used in the manufacture of coke and refined petroleum products which increased 21.5%. The monthly rate showed an increase of 4.8% compared with an increase of 1.2% between May and June 2016. The main contribution to this rise came from imported products used in the manufacture of coke and refined petroleum products which increased 9.6%.

Fuel prices showed the largest downward contribution to the overall input index in the year to July 2016. With the exception of one increase in July 2015, annual fuel prices have been falling for over 2 years. The index fell 8.0% in the year to July 2016 compared with a fall of 8.6% in the year to June 2016, while the monthly index showed an increase of 0.9% compared with an increase of 0.4% between May and June 2016. The main contributions to both the annual and the monthly indices came from gas distribution, and electricity production and distribution, which fell 19.1% and 1.0% respectively in the year to July 2016 and rose 1.3% and 0.8% between June and July 2016.

Core input price index (excluding purchases from the food, beverage, tobacco and petroleum industries)

The seasonally adjusted core input price index rose 4.6% in the year to July 2016, compared with a rise of 0.1% in the year to June 2016. Between June and July 2016, the index increased 4.1%, compared with a rise of 1.0% between May and June 2016.

The unadjusted core input price index rose 4.7% in the year to July 2016, compared with a decrease of 0.3% in the year to June 2016. This is the first rise seen in this index since September 2013. The monthly index increased 3.9% between June and July 2016, compared with an increase of 0.7% between May and June 2016.

Input producer price index contribution to change in rate

The annual percentage rate for the input PPI in July 2016 rose 4.3% compared with a decrease of 0.5% last month, resulting in an increase in the annual rate of 4.8 percentage points. This is the largest increase to the annual rate since October 2009 when the rate grew by 6.4 percentage points from September 2009. The main upward contribution came from crude oil with smaller contributions from other imported parts and equipment, and imported metals (Figure I).

Figure I: Input PPI 12 month contribution to change in annual rate between June and July 2016

UK

Source: Office for National Statistics

Download this chart Figure I: Input PPI 12 month contribution to change in annual rate between June and July 2016

Image .csv .xls10. Input PPI indices range of movements

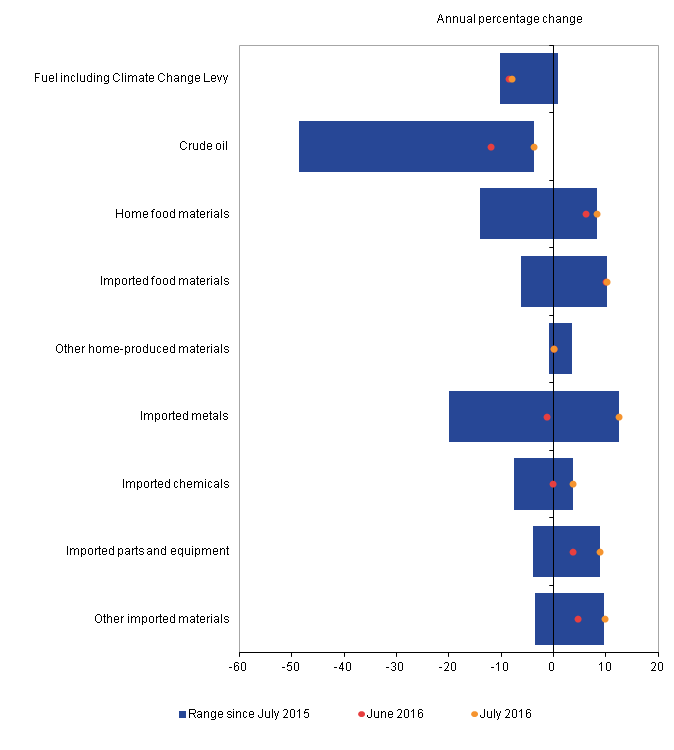

Figure J shows the year-on-year growth in input PPI by grouping for the latest 2 months and the range of the price changes that have been seen in these groupings since July 2015. Crude oil shows the biggest decrease, ranging from falls of 48.6% in August 2015 to 3.8% in July 2016. This is also the widest range of price movements seen in any PPI grouping in this period.

Imported metals shows the biggest increase, ranging from falls of 20.0% in December 2015 to rises of 12.4% in July 2016.

Figure J: Input PPI range of movements, July 2015 to July 2016

UK

Source: Office for National Statistics

Download this image Figure J: Input PPI range of movements, July 2015 to July 2016

.png (28.1 kB) .xls (28.7 kB)11. Economic context

Input producer prices increased 4.3% in the year to July 2016, in contrast to a 0.5% decrease in the year to June 2016, showing a reversal in the trend of falling input prices which had persisted since November 2013. Output producer price inflation also increased to 0.3% in the year to July 2016 compared with -0.2% in June 2016. This suggests that the higher input costs are feeding into output prices of manufactured goods.

Figure K: Input PPI inflation and contributions to the input PPI annual rate, 2014 to 2016

UK

Source: Office for National Statistics

Download this chart Figure K: Input PPI inflation and contributions to the input PPI annual rate, 2014 to 2016

Image .csv .xlsThe changes in input and output producer price inflation can be partly attributed to changing oil and petroleum prices, as the cost of crude oil, energy and refined petroleum products has continued to influence the price of manufactured goods. The rate at which input costs may be passed on to output prices will vary according to the economic situation.

Figure K shows the 12 month percentage change and percentage point contributions of input PPI components to input PPI inflation for the past 2 years. It shows that for most of this period, input PPI deflation was mainly due to downward pressure from low crude oil prices. Crude oil prices have continued on a downwards trajectory, falling from around $108 US dollars per barrel in July 2014 to around $58 dollars per barrel in July 2015, and to $46 dollars per barrel in July 2016. The stabilisation and recent recovery of the oil price over the last year means that the contribution of crude oil to the PPI series has waned in recent months. This can be seen from Figure K as the negative contribution of crude oil to input PPI began to ease off from August 2015 onwards and contributed to the gradual rise of input PPI inflation rate.

Alongside recent changes in commodity prices, the sharp depreciation in sterling immediately after the EU referendum result may also have had an impact on input producer prices. In trade-weighted terms, sterling depreciated by 15.0% in the year to July 2016, compared with 7.8% in the year to June 2016.

Holding all else equal, a depreciation of sterling tends to raise the sterling price of UK imports. Where firms purchase goods from abroad, a depreciation (appreciation) of sterling increases (reduces) the amount of domestic currency which they need to buy goods denominated in a foreign currency. In practice, this effect may be muted compared with the change in the exchange rate if importers have agreed fixed sterling prices for their imports, or if firms alter their behavior in other ways in response to relative price changes. However, there is some evidence of import cost pass-through to the input PPIs in Figure K. It shows that there has been positive contribution to input PPI inflation by imported food, other imported parts and equipment, and other imported materials since May 2016 and they have increased in June and July (refer to Figure K) in particular.

Figure L: Output PPI inflation and contributions to the output PPI annual rate, 2014 to 2016

UK

Source: Office for National Statistics

Download this chart Figure L: Output PPI inflation and contributions to the output PPI annual rate, 2014 to 2016

Image .csv .xlsIn the year to July 2016, output PPI inflation entered into positive territory for the first time since July 2014. Figure L shows the 12 month percentage change and percentage point contributions of output PPI components to output PPI inflation for the past 2 years. In this period, there have been downward pressures from food products, refined petroleum products (including duty), and chemicals and pharmaceuticals. The downward pressure from refined petroleum products (including duty) have eased off from September 2015 onwards as crude oil prices have stabilised as explained earlier. In the same period, transport equipment initially contributed negatively to output PPI inflation but this trend reversed from February 2016 onwards and in July 2016 there was considerable increase in its positive contribution to output PPI inflation.

While commodity prices and the exchange rate are likely to have an effect on producer prices, the strengthening of the UK labour market may have produced upward pressure on output prices of manufactures. The unemployment rate amongst those aged 16 and above fell to 4.9% in the 3 months to May 2016, the lowest rate since September 2005. Furthermore, the employment rate amongst those aged 16 to 64 rose slightly to 74.4% during the same period – which is the highest rate since records began. Unit labour costs in the manufacturing sector – which measures the labour cost per unit of output produced – increased by 1.0% in Quarter 1 (January to March) 2016 compared with the previous quarter. This was slightly higher than the quarterly growth in unit labour cost in Quarter 4 (October to December) 2015 which was 0.6%.

Output across the economy increased by 0.6% in Quarter 2 (April to June) 2016, compared with 0.4% recorded for the previous quarter (January to March) of 2016. Furthermore, output in the manufacturing sector grew by 1.8% in Quarter 2, compared with a fall of 0.2% in Quarter 1 of 2016. This is further evidence that manufacturers may have become more comfortable in passing on higher costs due to rising input prices which have outgrown output prices.

Nôl i'r tabl cynnwys12. Revisions

For this bulletin, Producer price index dataset Tables 8R and 9R highlight revisions to movements in price indices previously published in last month’s statistical bulletin. These are mainly caused by changes to the most recent estimates as more price quotes are received, and revisions to seasonal adjustment factors, which are re-estimated every month.

For more information about our revisions policy, see our website.

Table G: Revisions between first publication and estimates 12 months later

| Table G: Revisions between first publication and estimates 12 months later | |||

| Percentages | |||

| Value in latest period | Revisions between first publication and estimates 12 months later | ||

| Average over the last 5 years | Average over the last 5 years without regard to sign (average absolute revision) | ||

| Total output (JVZ7) - 12 months | 0.3 | -0.09 | 0.15 |

| Total output (JVZ7) - 1 month | 0.3 | -0.01 | 0.07 |

| Total input (K646) - 12 months | 4.3 | 0.05 | 0.34 |

| Total input (K646) - 1 month | 3.3 | 0.05 | 0.28 |

| Source: Office for National Statistics | |||

| Notes: | |||

| 1. *Statistically significant | |||

Download this table Table G: Revisions between first publication and estimates 12 months later

.xls (25.6 kB)Revisions to data provide one indication of the reliability of main indicators. Table G shows summary information on the size and direction of the revisions which have been made to the data covering a 5-year period. A statistical test has been applied to the average revision to find out if it is statistically significantly different from zero. The inclusion of an asterisk (*) would show the test is significant.

Table G presents a summary of the differences between the first estimates published between 2011 and 2015 and the estimates published 12 months later. These numbers include the effect of the reclassification onto Standard Industrial Classification (SIC) 2007.

Spreadsheets giving revisions triangles of estimates for all months from February 1998 through to December 2015 and the calculations behind the averages in the table are available in the producer price inflation datasets.

Revision triangle for total output (12 months)

Revision triangle for total output (1 month)

Revision triangle for total input (12 months)

Revision triangle for total input (1 month)

Nôl i'r tabl cynnwys13. Quality and methodology

The PPI Quality and Methodology Information document contains important information on:

- the strengths and limitations of the data and how it compares with related data

- users and uses of the data

- how the output was created

- the quality of the output including the accuracy of the data