Cynnwys

- Main points

- Statistician’s comment

- Summary

- Passenger transport by air made the biggest contribution to the fall in the 12-month growth rate of CPIH

- Prices for the mineral waters, soft drinks and juices component of CPIH rose sharply in March and April 2018

- Recent appreciation of sterling and changes in global crude oil prices have impacted on producer prices of imported raw materials and fuels

- Since 2016, new builds account for a greater proportion of property sales in London compared with the rest of Great Britain

- Authors

1. Main points

The 12-month growth rate of the Consumer Prices Index including owner occupiers’ housing costs (CPIH) fell to 2.2% in April 2018, from 2.3% in March 2018.

Passenger transport by air made the biggest contribution to the fall in the 12-month growth rate of CPIH, with Easter falling between the March and April collection periods, unlike 2017 when Easter influenced the April prices.

Prices for the mineral waters, soft drinks and juices component of CPIH rose sharply both before and after the introduction of the Soft Drinks Industry Levy, although the impact on headline inflation was minimal due to its low expenditure within the basket.

Imports made the largest contribution to the increase in the 12-month growth rate of the input Producer Price Index in April 2018, driven by changes in the global price of crude oil.

Since 2016, new builds have made up a higher proportion of property sales in London than in the rest of Great Britain.

2. Statistician’s comment

Commenting on today's inflation figures, ONS Head of Inflation Mike Hardie said:

“Inflation continued to slow in April, with air fares making the biggest downward contribution, due to the timing of Easter. This was partially offset by the rise in petrol prices.

"Soft drink prices saw their biggest ever rise for this time of year, due to the introduction of the sugar tax. However, many retailers still haven't passed the impact of the tax onto shoppers.

“Annual price growth for goods leaving factories was unchanged in April. However, the cost of raw materials increased, mainly driven by strong rises in crude oil prices.

“House prices continued to fall in London seeing their second annual decline since the financial crisis. However, Scotland continued to see strong annual growth."

Nôl i'r tabl cynnwys3. Summary

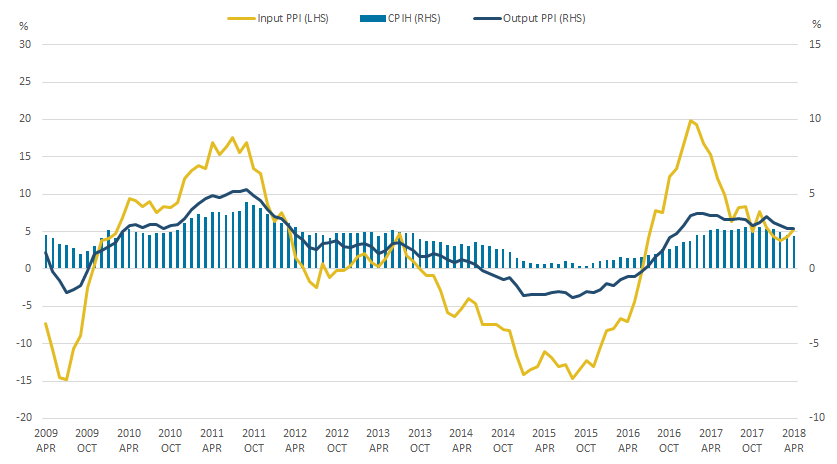

Figure 1 shows that the 12-month growth rate of the Consumer Prices Index including owner occupiers’ housing costs (CPIH) fell to 2.2% in April 2018 from 2.3% in March 2018, with the largest downward effect coming from air fares. The input Producer Price Index (input PPI) grew by 5.3% in the 12 months to April 2018, up from 4.4% in the 12 months to March 2018; this was driven mainly by increases in prices for crude oil and fuels. The growth in the output Producer Price Index (output PPI) remained unchanged at 2.7% in the 12 months to April 2018.

CPIH measures the change in the prices of the goods and services as consumed by households. However, because the consumption baskets of specific households differ, the price experience of different groups of households may differ from the average figure for all households. CPIH-consistent inflation rates have been calculated for different UK household groups, including households by different tenure types (namely owner occupiers, renters and subsidised renters), with new estimates released today (23 May 2018).

Figure 1: 12-month growth rates for input Producer Price Index (PPI) (left-hand side), output PPI and Consumer Prices Index including owner occupiers' housing costs (CPIH) (right-hand side)

UK, April 2009 to April 2018

Source: Office for National Statistics

Notes:

- These data are also available within the Dashboard: Understanding the UK economy.

Download this image Figure 1: 12-month growth rates for input Producer Price Index (PPI) (left-hand side), output PPI and Consumer Prices Index including owner occupiers' housing costs (CPIH) (right-hand side)

.png (25.5 kB) .xls (45.1 kB)4. Passenger transport by air made the biggest contribution to the fall in the 12-month growth rate of CPIH

The 12-month growth rate of the Consumer Prices Index including owner occupiers’ housing costs (CPIH) fell to 2.2% in April 2018, down from 2.3% in March 2018. The largest downward contribution to the change in the rate came from air fares that were influenced by the timing of Easter. Figure 2 explores the “Easter effect” in more detail. It shows the air fares component of CPIH for January 2014 to April 2018, indexed to January equals 100 for each year. In the chart legend, the month in the bracket indicates which month Easter fell in that particular year.

Higher prices seen in air fares around the Easter holidays usually feed through into the CPIH for March or April, but the scale of their impact varies depending on when Easter falls in relation to the dates of the flights that are priced. In three of the last five years, uplifts were seen in April reflecting that Easter fell in that month, whereas in 2016 the price increases were seen in March as Easter was a month earlier. The scale of the uplift is further influenced by the timing within the month so that the effects were larger in April 2014, March 2016 and April 2017 than in April 2015.

Similar to 2015 – when Easter Sunday fell on 5 April – this year Easter Sunday fell on 1 April, which was largely between the dates of flights collected for CPIH for March and April. This meant that most of the Easter holiday price increases were not picked up in either March or April CPIH data. Prices for air fares within CPIH therefore remained broadly unchanged between March and April 2018, having fallen slightly compared with February 2018. For the rest of the year, air fares follow predictable seasonal patterns with similar trends seen in the summer and Christmas holidays.

Figure 2: Passenger transport by air component of Consumer Prices Index including owner occupiers' housing costs (CPIH)

UK, January 2014 to April 2018

Source: Office for National Statistics

Download this chart Figure 2: Passenger transport by air component of Consumer Prices Index including owner occupiers' housing costs (CPIH)

Image .csv .xls5. Prices for the mineral waters, soft drinks and juices component of CPIH rose sharply in March and April 2018

It was announced in March 2016 that the government would introduce a new tax on soft drinks containing more than five grammes of added sugar per 100 millilitres. The Soft Drinks Industry Levy is applied to producers at a rate of 18 pence per litre for between five and eight grammes of added sugar or 24 pence per litre for over eight grammes of added sugar and came into force on 6 April 2018. Some manufacturers responded to the levy by reducing the sugar content in their drinks to fall below the level at which they would be subject to the levy, while others kept their sugar content unchanged.

Figure 3 shows prices for the mineral waters, soft drinks and juices component of CPIH for January 2014 to April 2018, indexed to January equals 100 for each year. This category contains a range of drinks, some of which are subject to the levy and some of which are not.

Figure 3: Mineral waters, soft drinks and juices component within the Consumer Prices Index including owner occupiers’ housing costs (CPIH)

UK, January 2014 to April 2018

Source: Office for National Statistics

Download this chart Figure 3: Mineral waters, soft drinks and juices component within the Consumer Prices Index including owner occupiers’ housing costs (CPIH)

Image .csv .xlsPrices for mineral waters, soft drinks and juices as a whole have increased by around 5% between February and April 2018 suggesting that the Soft Drinks Industry Levy is having some effect on consumer prices for soft drinks. Although almost half of this increase occurred in March 2018, prior to the introduction of the levy, this may be due to some manufacturers or retailers introducing the price increase more gradually to reduce the extent of the price increase in a single month.

Mineral waters, soft drinks and juices prices rose by 2.8% between March and April, a record for the time of year, following what was already a record increase for the time of year between February and March at 2.2%. Price quote data for April show, however, that the majority of soft drink prices collected did not change between March and April.

The items with the largest number of observed price increases were fizzy energy drinks and cola-flavoured drinks. Some of these price increases were due to the items having been discounted in March and “recovering” to full price in April, although the majority of these recoveries were to a higher price than seen before the discount. It should be noted, however, that 500 millilitres bottles of still mineral water saw the same number of price increases as bottled cola drinks between March and April, suggesting that there may be underlying inflationary pressures in addition to the Soft Drinks Industry Levy.

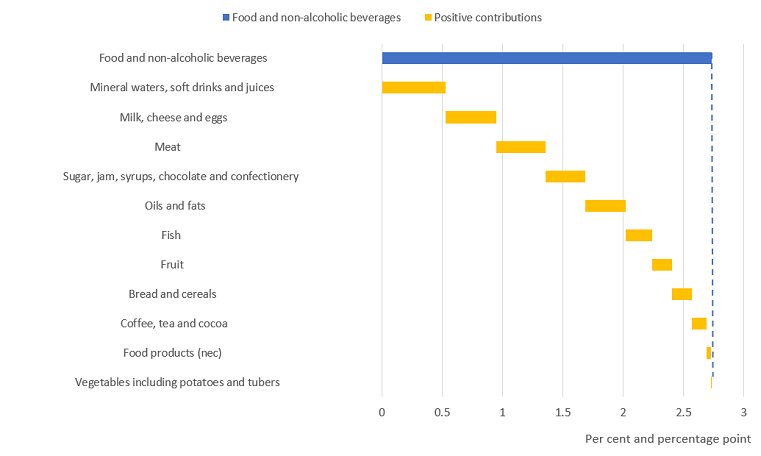

Mineral waters, soft drinks and juices make up a very small proportion (0.7%) of the overall CPIH basket and therefore have very limited impact on overall inflation. Figure 4 shows the contribution that individual components made to the 12-month growth rate of food and non-alcoholic beverages in April 2018.

Figure 4: Contributions to the 12-month growth rate of food and non-alcoholic beverages component within Consumer Prices Index including owner occupiers' housing costs (CPIH)

UK, April 2018

Source: Office for National Statistics

Download this image Figure 4: Contributions to the 12-month growth rate of food and non-alcoholic beverages component within Consumer Prices Index including owner occupiers' housing costs (CPIH)

.png (34.7 kB) .xls (28.7 kB)Prices for food and non-alcoholic beverages as a whole grew by 2.7% between April 2017 and April 2018. Despite having a relatively low weight, mineral waters, soft drinks and juices was the largest contributor to the 12-month growth rate for food and non-alcoholic beverages, contributing 0.53 percentage points, followed closely by milk, cheese and eggs at 0.41 percentage points and meat at 0.41 percentage points. Food and non-alcoholic beverages as a whole contributed 0.2 percentage points to headline CPIH this month, only the fifth-highest contribution out of 11 divisions.

Nôl i'r tabl cynnwys6. Recent appreciation of sterling and changes in global crude oil prices have impacted on producer prices of imported raw materials and fuels

Figure 5 shows the 12-month growth rates for the input Producer Price Index (PPI) and the contributions made by imports and domestic components respectively, as well as the inverted sterling effective exchange rate.

Following a period of sustained negative growth between November 2013 and June 2016, the 12-month growth rate in input producer prices rose considerably between July 2016 and January 2017, reaching a peak of 19.9% in January 2017. Since January 2017, the 12-month growth rate has been broadly falling to a recent low of 3.8% in February 2018, although the most recent data show price growth picking up again in March and April 2018.

Figure 5: Contributions of imported and domestic components to the 12-month growth rate of total input Producer Price Index (PPI)

UK, January 2013 to April 2018

Source: Office for National Statistics, Bank of England

Download this chart Figure 5: Contributions of imported and domestic components to the 12-month growth rate of total input Producer Price Index (PPI)

Image .csv .xlsImports contribute the most to input PPI accounting for around two-thirds of the expenditure weight. Prices for imported components of input PPI are also generally more volatile than those for domestic components so imports are typically a significant driver of changes in the 12-month growth rate.

Recent falls in the 12-month growth rate of input PPI have been driven mainly by imports, which have seen decreasing 12-month growth rates in recent months as sterling has appreciated. The 12-month growth rate of input PPI broadly follows similar trends to the inverted sterling effective exchange rate as imports become relatively more expensive when the value of sterling falls and relatively cheaper when the value of sterling increases. Domestic components of input PPI also show a similar, but more muted, trend, which may reflect some of these components being traded at global prices.

In March and April 2018, the 12-month growth rate of input PPI increased despite sterling appreciating. In March, imports continued to have a downward effect on the 12-month growth rate of input PPI but were offset by increases in domestic components, most notably fuel prices, which had a 12-month growth rate of 9.2% in March 2018 (up from 3.8% in February). In April, imports also contributed to the increase in the 12-month growth rate of input PPI, which reached 5.3%, driven by increasing global prices for crude oil, which saw the US dollar price for Brent crude oil increase by 9.4% between February and April 2018.

Nôl i'r tabl cynnwys7. Since 2016, new builds account for a greater proportion of property sales in London compared with the rest of Great Britain

In March 2018, the 12-month growth rate for the House Price Index (HPI) in London was negative for a second consecutive month, falling from negative 0.1% in February to negative 0.7% in March. This fall in the 12-month growth rate continues a broadly downward trend in London house price growth that began in 2014. By contrast, house price growth in Great Britain as a whole remained positive at 4.2% with particularly strong growth of 6.7% seen in Scotland.

Looking at the London housing market in more detail, Figure 6 shows the rolling three-month average sales of new builds as a proportion of total sales volumes for London and Great Britain excluding London. The latest available data at this level are for January 2018 and a rolling three-month average is used to limit seasonal volatility.

Figure 6: New builds as a proportion of total sales volumes, rolling three-month average

London and Great Britain excluding London, January 2005 to January 2018

Source: HM Land Registry, Office for National Statistics

Notes:

Three-month rolling average: Each month refers to the average of the current and preceding two months’ data, for example, January 2005 refers to November 2004, December 2004 and January 2005.

Figure 6 uses the latest available sales volumes data for the split of new and existing builds.

Download this chart Figure 6: New builds as a proportion of total sales volumes, rolling three-month average

Image .csv .xlsPrior to the economic downturn the proportion of new builds in total sales was consistently lower in London than in the rest of Great Britain. This gap narrowed considerably during the downturn as monthly sales volumes for new builds fell much more in the rest of Great Britain than they did in London (falling by 61% and 19% respectively)1 while sales of existing properties fell at similar rates (79% in Great Britain excluding London and 82% in London).

In April 2013, the UK government launched the Help-to-Buy scheme offering loans to support people purchasing new build properties in England up to the value of £600,000. This coincided with a convergence of new builds as a proportion of total sales for London and Great Britain excluding London, which tracked one another closely until mid-2015. Help-to-Buy schemes for Wales and Scotland were launched in January 2014 and January 2016 respectively, both also targeting new build properties.

Since mid-2015, new builds as a proportion of total sales volumes in London have outstripped those in the rest of Great Britain, diverging particularly from mid-2016. This follows changes to the Help-to-Buy scheme for London in February 2016, which increased the value of the available loan from 20% to 40% of the value of the property and may have increased demand for new builds over existing properties in London.

Figure 7 shows the House Price Index for both London and Great Britain excluding London for new and existing builds, indexed to January 2005.

Figure 7: House Price Index (HPI) for new and existing builds

London and Great Britain excluding London, January 2005 to January 2018

Source: HM Land Registry, Office for National Statistics

Notes:

- Figure 7 uses the latest available HPI data for the split of new and existing builds.

Download this chart Figure 7: House Price Index (HPI) for new and existing builds

Image .csv .xlsHouse prices in both London and Great Britain excluding London have experienced similar index growth for new builds and existing properties over the period. Both saw a marked price decrease during the economic downturn, before recovering to an upward trend, with prices growing considerably faster in London than the rest of Great Britain over most of the period.

London house price growth has since stalled, with latest available data showing that the annual growth in HPI for London was negative for the second consecutive month in March 2018 at negative 0.7% while the annual growth in HPI for Great Britain excluding London remained positive at 4.6%. There remains a considerable difference in house prices between London and the rest of Great Britain however; in March 2018 the average house price in London was £472,000, more than double the average house price in Great Britain excluding London of £218,000.

Notes for: Since 2016, new builds account for a greater proportion of property sales in London compared with the rest of Great Britain

- The changes in the economic downturn refer to the pre-economic downturn peak for sales volumes in Great Britain in August 2007, and trough in January 2009.

Manylion cyswllt ar gyfer y Erthygl

Related publications

- Construction output price indices (OPIs), UK: January to March 2018

- UK House Price Index: March 2018

- Index of Private Housing Rental Prices, Great Britain: April 2018

- Producer price inflation, UK: April 2018

- Services producer price inflation, UK: January to March 2018

- Consumer price inflation, UK: April 2018