Cynnwys

- Introduction

- How to respond to the consultation

- Background

- Options for the recording of pensions in public sector finances

- Questions

- Next steps

- Annex 1: Net and gross liabilities approaches for the recording of funded pension schemes

- Annex 2: Changes in the structure of public sector pension scheme

- Annex 3: 2013 Review of public sector finances statistics – principles defining ex-measures

- Annex 4: Glossary

1. Introduction

The purpose of this article is to explain the different options for the presentation of pension statistics in the public sector finances (PSF) publication and gather and assess user views on each of these options.

The PSF statistics provide important information on the UK government financial position. They enable government, the public, economists and financial analysts to monitor public sector expenditure, revenue, investments, borrowing and debt. A number of the main aggregates (such as public sector net borrowing and public sector net debt) are used nationally by the government to monitor progress against fiscal targets.

An important component of the PSF statistics is public sector pensions, which constitute a significant proportion of public sector liabilities. The treatment of those liabilities has changed in recent years with the adoption of a new international statistical framework in 2014 (European System of Accounts 2010: ESA 2010). This change led to an extensive programme of work, which enabled us to review our sources and methods for compiling pension statistics within the UK National Accounts. The results were published in an article, Pensions in the national accounts, a fuller picture of the UK’s funded and unfunded pension obligations: 2010 to 2015, published on 7 March 2018.

Prior to this, in September 2017, PSF statistics were updated to include the latest pension estimates available. However, the treatment of pensions in PSF is complicated by the need to balance exhaustiveness against the risk of distorting the main fiscal aggregates. It is important that the PSF statistics remain fully consistent with international statistical frameworks, but we have identified a number of different possible treatments of pensions within the PSF fiscal statistics that all maintain alignment to these wider frameworks. This article explains the full range of options available for recording pensions in PSF, and their impact on the balance sheet measures, and encourages users to provide their opinions on the different options under consideration. The scope of this article is limited to the PSF statistics only and does not cover the presentation of pensions in the wider UK National Accounts.

The article is structured as follows:

Section 2 explains how to respond to this consultation

Section 3 provides important background information for understanding the issues

Section 4 lists the various types of pensions and the options for their treatment in PSF

the Annexes explore the various types of pensions and the options for their treatment in PSF in more detail

The article contains the recommendations made by the expert advisory committee, the Public Sector Finance Technical Advisory Group, and offers the opportunity to provide feedback on these recommendations within the following broad themes:

how the assets and liabilities of the funded public sector pension schemes should be presented

how the balance sheet and transactions of the Pension Protection Fund should be incorporated

how the obligations of the unfunded public sector pension schemes should be presented

To get a full understanding of the issues, we recommend that you read Annexes 1 to 4 before completing the consultation.

Nôl i'r tabl cynnwys2. How to respond to the consultation

The consultation opened on 21 June 2018 and will close on Friday 31 August 2018. You can respond by answering the questions in this article and emailing your response to psa@ons.gov.uk. You can also post your responses to:

David Bailey

Room 1.264

Office for National Statistics

Government Buildings

Cardiff Road

Newport

NP10 8XG

3. Background

3.1. Composition of the UK public sector

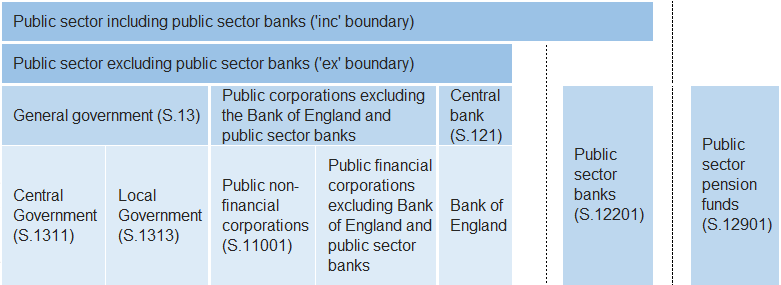

The published public sector finances (PSF) statistics recognise five component sub-sectors that constitute the UK public sector:

central government

local government

public corporations (excluding the Bank of England and public sector banks)

the Bank of England

public sector banks

PSF’s main statistics, which underpin the fiscal targets, do not include all of these five sub-sectors but only the first four sub-sectors. Statistics that exclude the public sector banks, which are deemed to have distortive effects on the fiscal aggregates, are known as the "ex-measure". For completeness, fiscal statistics that include the public sector banks are also reported. These are known as the "inc-measures".

Figure 1: Composition of the UK public sector, inc- and ex-boundaries in the public sector finances statistics

Source: Office for National Statistics

Download this image Figure 1: Composition of the UK public sector, inc- and ex-boundaries in the public sector finances statistics

.png (22.2 kB) .xlsx (98.3 kB)It can be seen from Figure 1 that neither the ex- nor the inc-boundary currently includes public pension funds. This does not mean that all pension liabilities remain outside of the public sector boundary. Such liabilities are recognised as ultimately resting with the pension managers, such as the employers in the case of most workplace pension schemes, and are recorded in the managers’ sub-sectors, in accordance with the international statistical guidance for the compilation of national accounts. Section 4 and Annex 1 explain the current way of recording pensions in more detail.

3.2. Principles underlying PSF statistics

The concept of public sector excluding public sector banks was introduced in September 2014 following a wide reaching Review of the PSF statistics in 2013. Prior to this date a different fiscal boundary was defined, known as the public sector excluding temporary effects of financial interventions. The 2013 Review recommended the move to fiscal aggregates based on the public sector excluding public sector banks and in doing so defined the six main principles that any ex-boundary or measure should follow in the PSF statistics, which are included in the methodological guide and also listed in Annex 3. Three of these principles are of particular relevance to the topic of pensions.

The first principle stipulates that PSF should be as inclusive as possible, whilst avoiding manifest distortions. It ensures that the full range of public sector liabilities (on a national accounts basis) are reported but allows transactions or classifications to be excluded from the PSF ex-boundary in specific circumstances. Such an exclusion can be justified if recording a transaction or classification impairs the understanding of PSF statistics because of its size and lack of correlation with the government’s need to issue gilts.

Principle 3 specifies that any ex-measures should not sub-divide institutional units. Institutional units are the building blocks for national accounts and are bodies or organisations that are deemed to have sufficient autonomy of decision-making to be considered separate economic units.

Principle 5 prescribes full consistency with the European System of Accounts 2010: ESA 2010 framework. Among other things, this principle ensures that PSF statistics are calculated in the same way as related international statistics and prevents ex-measures being developed that are not consistent with the UK National Accounts and the relevant fiscal statistics used under the European Statistical System, commonly known as the Maastricht Debt and Deficit.

3.3. Changes to statistical framework

ESA 2010 introduced changes to the way that defined benefit pension schemes are recorded in the national accounts and public sector finances. This new treatment of funded pensions led to a classification review, which identified several cases where government should be considered liable for the provision of pension benefits. The inclusion of these newly-classified, funded public sector pension schemes, as well as the general improvements to methods and data sources, were implemented in the PSF release on 21 September 2017.

An article was published alongside the release to explain the rationale for those improvements and to show how the pension changes affect the main fiscal aggregates of public sector net borrowing (PSNB), public sector net debt (PSND) and public sector net financial liabilities (PSNFL). Section 4 builds on the material presented in that article and describes a range of alternative options for the treatment of pensions in the PSF statistics.

3.4. Public Sector Finances Technical Advisory Group

The adoption of the ESA 2010 framework and the associated classification review led to the delineation of new types of public bodies, namely public pension funds and the units exercising day-to-day administration of those funds. In accordance with the ESA 2010 terminology, these units together are considered pension administrators.

The novelty of pension administrators for the PSF framework and the adverse effects of their inclusion in the PSF statistics, which are discussed in the next section, prompted the referral of the methods associated with the recording of public sector pensions to the Public Sector Finances Technical Advisory Group (PSFTAG), a group of experts, which advises on issues that arise when defining how organisations, transactions and balance sheet levels should be recorded in the PSF statistics.

The next section describes the options available for the recording of the three main types of pension schemes (as relevant for the PSF statistics). It also lists the PSFTAG recommendation for recording each of these types. Together with the guidance provided in this article, it may be useful to consider the further information provided in Annexes 1 to 4.

The next section focuses mainly on the impacts on public sector net debt (PSND) and public sector net financial liabilities (PSNFL), as this is where the inclusion of the pension schemes would have the greatest impact. Public sector net borrowing (PSNB) would also be affected, based on data in the UK National Accounts Table 29: Accrued-to-date pension entitlements in social insurance presentation, we would expect PSNB to increase by up to £2 billion per financial year. However, more generally, whether PSNB increases or decreases depends on the balance between employee contributions and pension benefits paid.

Nôl i'r tabl cynnwys4. Options for the recording of pensions in public sector finances

4.1. Funded pension schemes

The functions of the funded pension schemes are usually deemed to be performed by two separate types of institutional units – pension administrators (which include pension funds themselves) and pension managers (typically employers).

In the UK National Accounts presentation, pension administrators, and with them total assets and total liabilities of funded pension schemes, are recorded in the pension funds sub-sector of the economy (S.129). Pension administrators do not bear the ultimate responsibility for the provision of pension benefits. Therefore, where appropriate, net liabilities, often referred to as the pension fund deficit outside of the national accounts framework, are recorded in the institutional sectors to which the associated pension managers (normally the employers) are classified.

In simple terms, such liabilities measure the amount of shortfall or surplus of assets in relation to total pension liabilities. This subdivision of pension schemes into a pension administrator and pension manager applies to both funded defined benefit schemes and funded defined contribution schemes, although in the latter case the liabilities of the pension manager are zero by design. Annexes 1 and 4 clarify some of the concepts described in this section.

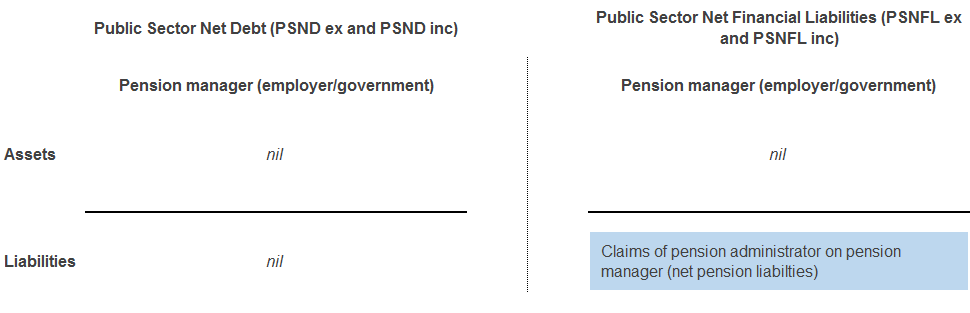

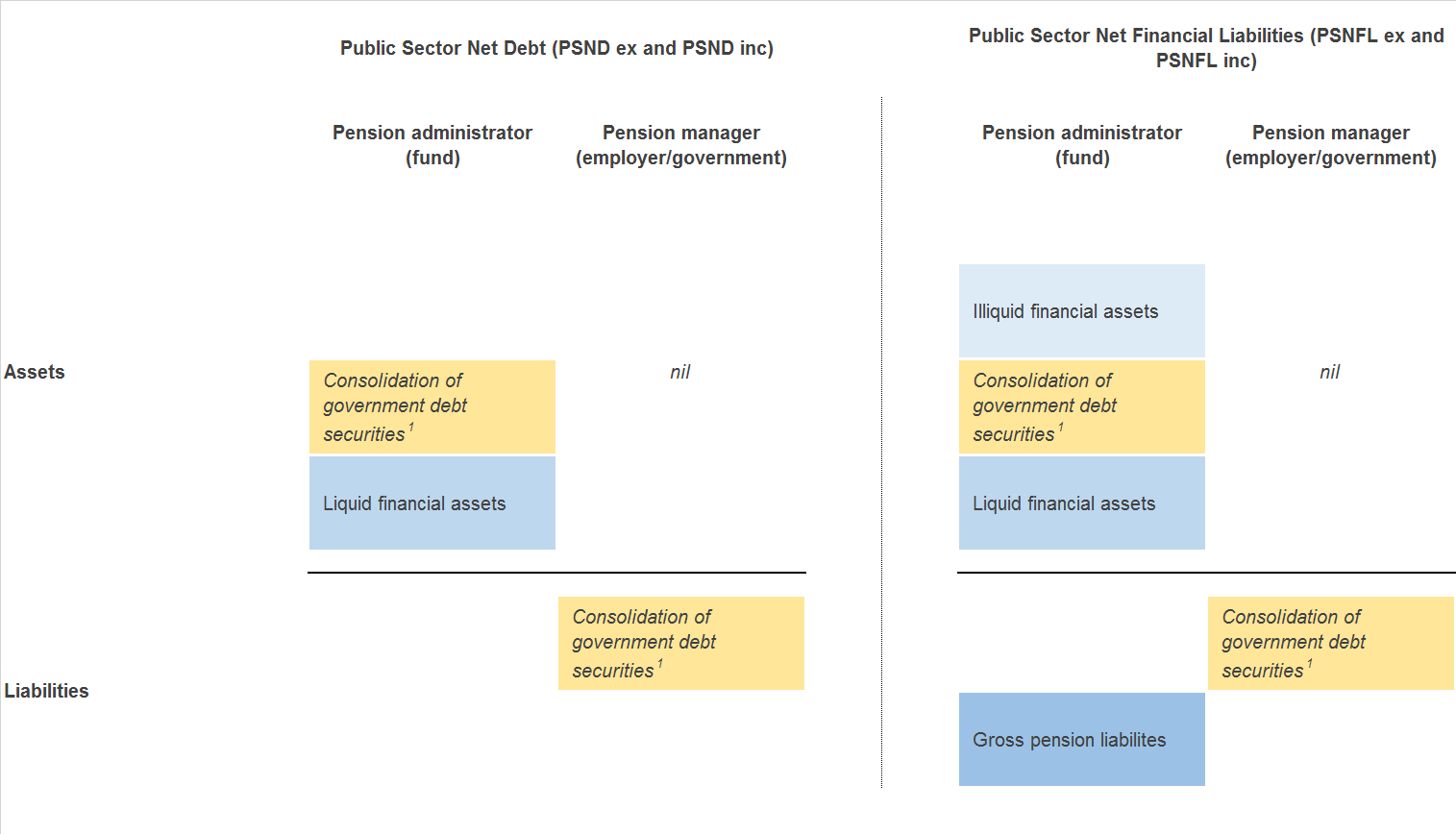

In the public sector finances (PSF) statistics, the present approach is to record only the net pension liability that arises from the funded defined benefit public sector schemes, but not the total pension liabilities and not the investment assets held in the pension funds. Under this approach, pension administrators are deemed to be outside of either the inc- or ex-boundary. Figure 2a shows the impact of pension liabilities on public sector net debt (PSND) and public sector net financial liabilities (PSNFL) under the current treatment; this is equivalent to recording only the financial assets and liabilities listed under the “pension manager (employer)”.

Figure 2a: Balance sheet effects of pension administrators recorded outside of the public sector finances boundary

Source: Office for National Statistics

Download this image Figure 2a: Balance sheet effects of pension administrators recorded outside of the public sector finances boundary

.png (11.7 kB) .xlsx (92.5 kB)Alternatively, pension administrators could be brought into either the ex- or inc-boundaries; and this is the main area for user consideration. The inclusion of pension administrators in either the ex- or inc-boundaries would impact the fiscal aggregates; these impacts are described briefly in this section and in more detail in Annex 1.

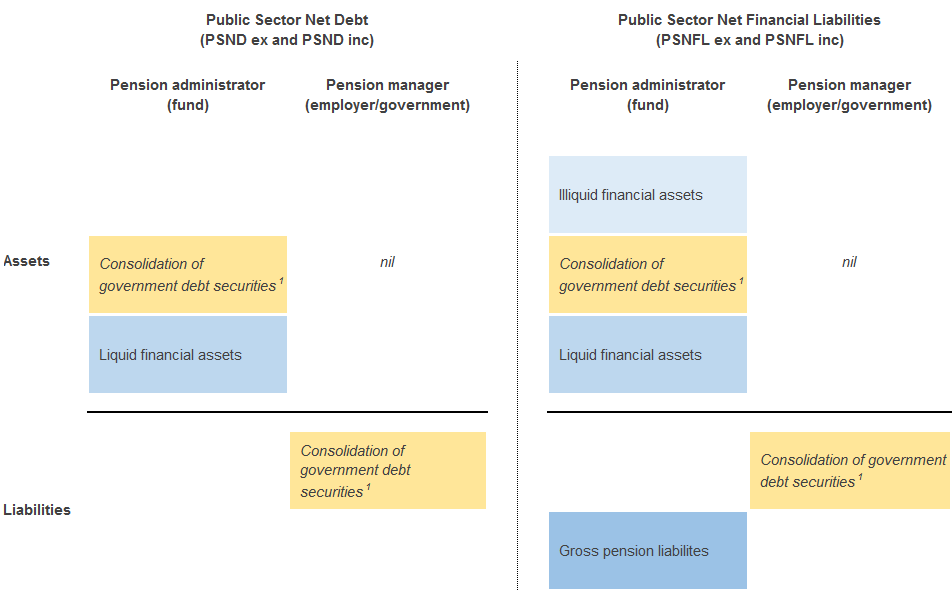

To include the pension administrators in either the ex- or inc-boundaries, total assets and total pension liabilities held in the pension fund would need to be recorded in the public sector balance sheet. This would see a transition to the gross liabilities presentation, which is followed in the UK National Accounts Table 29: Accrued-to-date pension entitlements in social insurance presentation. Figure 2b shows how inclusion of the assets and liabilities of both the pension manager and the pension administrator impacts the fiscal aggregates.

It can be seen, by comparing Figures 2a and 2b, that the application of either the net or gross approach has a similar effect on PSNFL, which is predominantly impacted by the gap between the total assets and total liabilities. Under the net liability approach, the gap is recorded explicitly as a liability in the pension manager’s balance sheet. Under the gross liability, it is represented by the balance between total pension fund assets and total pension liabilities held jointly by the administrator and the manager1.

Figure 2b: Balance sheet effects of pension administrators recorded inside of the public sector finances boundary

Source: Office for National Statistics

Notes:

- Many pension funds hold some government debt securities as part of their investment portfolios. These securities also represent a liability for government. When both the asset and the liability belongs to units within the PSF boundary (inc or ex), consolidation is applied. This means that the government liability is reduced by the amount of debt securities held by public sector pension funds, but no asset is recorded.

Download this image Figure 2b: Balance sheet effects of pension administrators recorded inside of the public sector finances boundary

.png (20.2 kB) .xlsx (93.2 kB)However, the two methods vary in their impact on the more restrictive PSND aggregate. If recorded on a net liability basis (in other words, if pension administrators remain outside of the PSF boundary), none of the assets or liabilities related to pensions affect this fiscal measure. However, recording on a gross liabilities basis leads to the consolidation of government debt securities held as investment assets by the pension administrator, and further recognises its liquid assets. Therefore, as PSND does not include pension liabilities, the gross recording contributes to a reduction in this measure of debt, through consolidation of debt securities and increased liquid assets, irrespective of whether the pension scheme is in surplus or in deficit.

Recommendation

In the view of the Public Sector Finances Technical Advisory Group (PSFTAG), recording pension liabilities based on the manager’s perspective fell short of the principles set out by the 2013 Review. In particular, the public pension administrators are part of the public sector and so their inclusion is necessary for completeness as mandated by principle 1, to ensure that the full range of public sector liabilities are reported transparently. PSFTAG acknowledged the effects of consolidation of debt securities and inclusion of pension fund liquid assets as being potentially distortive, but did not consider the potential degree of distortion to clearly impair understanding of the public finances. This was based on an estimated impact on PSND of around £20 billion – an amount that should be contrasted with a total PSND ex of approximately £1,700 billion.

PSFTAG noted that the exclusion of pension administrators from the ex-measure could also be considered a distortion. Therefore, PSFTAG felt that including pension administrators within the ex-measure (and also the inc-measure) best complied with the principles established by the 2013 Review. However, PSFTAG did acknowledge potential practical issues in following this approach, as the current time lag in the availability of data on pension fund assets and actuarial liabilities may lead to significant revisions in PSND ex long after the end of the financial year, once estimates are replaced with outturn data.

4.2. Pension Protection Fund

The Pension Protection Fund (PPF) was established in April 2005, in accordance with the Pensions Act 2004, however, it has never been included in the PSF statistics. This has been for a combination of reasons.

Initially, this was due to the ringfenced nature of the PPF and its relative immateriality in its early years in terms of the fiscal aggregates. In more recent years, implementation was delayed while we awaited clarification on the international statistical guidance around the classification of protection funds. Following clarification on that guidance, a review of the PPF by the Office for National Statistics (ONS) Economic Statistics Classifications Committee in January 2018 reconfirmed that the PPF is a public financial corporation, more specifically, a public pension fund (S.12901) that is both a pension administrator and a pension manager. This classification stems from the fact that the unit not only manages its pension funds on a day-to-day basis but also bears the responsibility for providing pension benefits to members of schemes that enter the PPF. The PPF is therefore currently the only funded public sector pension scheme for which the pension manager and pension administrator are the same institutional unit.

Similar to the case of other funded pension schemes, the inclusion of the PPF would have an impact on the headline PSND measure at the point of implementation. The consolidation of PPF’s holdings of government debt securities and the inclusion of its liquid assets in the net debt calculations are expected to reduce PSND, rather than increase it. Furthermore, the insolvency of companies that results in the transfer of their pension schemes to the PPF in the future may have a similarly counter-intuitive effect on PSND, resulting from the relatively narrow definition of liabilities that are included in PSND.

This caveat is addressed in the PSNFL supplementary aggregate, which recognises liabilities of the funded pension schemes and will therefore reflect the net balance sheet position of the PPF.

Recommendation

In the view of PSFTAG, it is very difficult to meaningfully split the PPF’s pension manager from the pension administrator function, as both are performed by the same institutional unit. Such a partition would violate principle 3 of the 2013 Review, which prescribed respecting the institutional unit as the building block for PSF statistics (see Annex 3).

PSFTAG noted that the option of including the PPF only in the inc-measures would deviate from the practice of recording pension managers within the ex-boundary. Additionally, the definition of the inc-boundary would have to be widened to place the PPF within it. As with other funded schemes, PSFTSAG did not consider the potential degree of distortion from including the PPF within the ex-boundary to clearly impair understanding of the public finances. This was based on an estimated impact on PSND of up to £15 billion – an amount that should be contrasted with a total PSND ex of approximately £1,700 billion.

Furthermore, the exclusion of the PPF from the ex-measure could also be considered a distortion. Therefore, PSFTAG judged that the inclusion of the PPF within the ex-measure best complied with principles 1 and 3 of the 2013 Review and was necessary to ensure that the full range of public sector liabilities were reported transparently.

PSFTAG therefore recommended that the entire unit should be recorded within the ex- (and consequently in the inc-) boundary.

4.3. Unfunded pension schemes

Under the unfunded structure, the functions of the administrator and the manager are deemed to be performed by a single unit, or at least within a single institutional sector in the example of large public sector schemes that cover employees of multiple organisations, such as the Principal Civil Service Pension Scheme or the NHS Pension Scheme.

In compliance with the European System of Accounts 2010: ESA 2010, neither the obligations of unfunded employment-related pension schemes nor the obligations related to the State Pension are currently included in the core UK National Accounts and PSF balance sheets2. Therefore, the liabilities of these schemes do not impact the fiscal debt aggregates directly3. Instead, the estimates compiled on a national accounts basis are available in our publication on pension obligations4.

An alternative treatment in PSF can be justified by two arguments. Firstly, the System of National Accounts 2008: SNA 2008 framework does not preclude the option of recording unfunded employer pension liabilities, and the International Monetary Fund (IMF) Government Finance Statistics Manual 2014 (GFSM 2014) framework requires unfunded public sector workplace pension liabilities to be recorded, although not obligations for the social security pension benefits, such as the UK State Pension.

Secondly, the inconsistent recording of funded and unfunded schemes in PSF may create statistical distortions at the point of restructuring pension schemes, that is, either transforming an unfunded scheme into a funded one, or transforming a funded scheme into an unfunded one. The impact of such a change is explained in Annex 2.

Recommendation

The PSFTAG noted that to abide by principle 5 of the 2013 Review and remain compliant with ESA 2010, PSF cannot include the liabilities of unfunded public sector pension schemes in either the ex- or the inc-measures. PSFTAG’s preferred option was to include the unfunded scheme obligations in a supplementary table in addition to the main PSF presentation. The inclusion of these figures in a supplementary table would ensure a more complete picture of government obligations, even though it would have to be made clear in the text of the bulletin that the obligations of unfunded public sector pension schemes do not feed into the main figures presented.

Notes for: Options for the recording of pensions in public sector finances

Gross and net liabilities recording would yield some PSNFL differences due to the conventions followed in the valuation of government debt. When recognised as a government liability, such debt is recorded on a face value basis, which represents the amount due to be repaid. However, in the pension fund’s balance sheet, the recording is done on a market value basis.

For national accounts definitions of funded and unfunded schemes, please refer to Annex 4.

For a brief discussion of direct and indirect effects, see Annex 1.

The estimates for the workplace schemes (but not the UK State Pension) are also available in HM Treasury’s Whole of Government Accounts (WGA). For the reasons of methodological nature, the UK National Accounts and WGA figures are not directly comparable. Given that the Public Sector Finances (PSF) are compiled using the national accounts methodology, PSF would seek to use UK National Accounts figures as a benchmark of the liabilities of unfunded public sector pension schemes over the WGA figures.

5. Questions

Users are invited to provide their view on the recommendations of the Public Sector Finances Technical Advisory Group (PSFTAG) set out in section 4. Specifically, users are invited to consider the following questions. Details of how to respond are provided in Section 2.

Question 1a: Do you agree with the PSFTAG recommendation to record the administrators of the funded public sector pension schemes in the ex-boundary?

Question 1b: If you have answered no to Question 1a, would you favour recording administrators of funded pension schemes outside of any public sector finances (PSF) boundary or in the inc-boundary?

Question 2a: Do you agree with the PSFTAG recommendation to record the Pension Protection Fund in the ex-boundary?

Question 2b: If you have answered no to Question 2a, would you favour recording PPF outside of any PSF boundary or in the inc-boundary?

Question 3a: Do you agree with the PSFTAG recommendation to record the liabilities of the unfunded public sector pension schemes in a supplementary table, within the public sector finances, but not in any of the main fiscal aggregates?

Question 3b: If you have answered no to Question 3a, would you favour recording unfunded pension schemes in the inc- or in both the ex- and inc-boundary?

Nôl i'r tabl cynnwys6. Next steps

Once the consultation period ends on 31 August 2018, we will review the responses and decide a way forward. We will then publish a response and plans for implementation in autumn 2018.

Nôl i'r tabl cynnwys7. Annex 1: Net and gross liabilities approaches for the recording of funded pension schemes

Overview

There are two broad options for recording funded pension liabilities: on a net and gross basis. In turn, recording on a gross basis can be applied to just the inc-measures, or to both the inc- and ex-measures. This note describes the main statistical implications of employing each of the three approaches to assist responding to Questions 1a and 1b in Section 5.

It is worth bearing in mind that the main UK public sector debt aggregate, public sector net debt (PSND), and the official EU measure of the member states’ general government debt, commonly known as the Maastricht debt, both exclude pension liabilities. In recognition of the partial balance sheet coverage of PSND, the UK government introduced in November 2016 a new supplementary fiscal aggregate, public sector net financial liabilities (PSNFL), which includes all financial assets and liabilities on a national accounts basis. Given this wider balance sheet coverage, the PSNFL aggregate does reflect the pension liabilities related to public sector funded pension schemes.

It was noted in Section 4 that the approximate impact of recording of the funded public sector pension schemes on a gross liabilities basis would be a reduction in PSND of £20 billion. Table 1 provides a simplified breakdown of the assets held by the Pension Fund that would affect PSND. These are then used in the following sections, alongside the figures, to demonstrate impacts on PSND and PSNFL.

Table 1: Simplified example of assets held by Pension Fund

| £ million | |

|---|---|

| Pension Fund Assets | 2016/17 |

| UK Government Bonds at Market Value | 15,000 |

| UK Government Bonds at Face Value | 11,000 |

| Cash Assets | 9,000 |

| Source: Office for National Statistics | |

Download this table Table 1: Simplified example of assets held by Pension Fund

.xls (35.8 kB)Net liability approach: administrators recorded outside of the PSF boundary

At present, public sector finances (PSF) record pension liabilities from the pension manager’s perspective, whereby the stocks and transactions of public sector pension managers are included within the public sector boundary but those of public sector pension administrators are not. This means that the assets held in the pension funds are not used in the calculation of either PSND or PSNFL directly, although they are used to calculate the net pension liability of the pension manager, which is subsequently used to calculate the PSNFL aggregate. In summary:

the net pension liability affects PSNFL (ex and inc) by the amount equal to the cumulative deficit (or surplus) of the funded public pension schemes

funded pension schemes have no direct impact on PSND (ex and inc)

the total level of assets reported in the public sector balance sheet does not include any assets held by pension administrators

See Figure 2a in the main article for an overview of these impacts.

It is worth noting that the weakness of the net liability approach lies in its deviation from principle 1 of the 2013 Review, which stresses the importance of exhaustive recording of units classified to the public sector. In turn, the advantage of this approach is that ring-fenced investment assets held by the pension administrators do not directly affect fiscal measures.

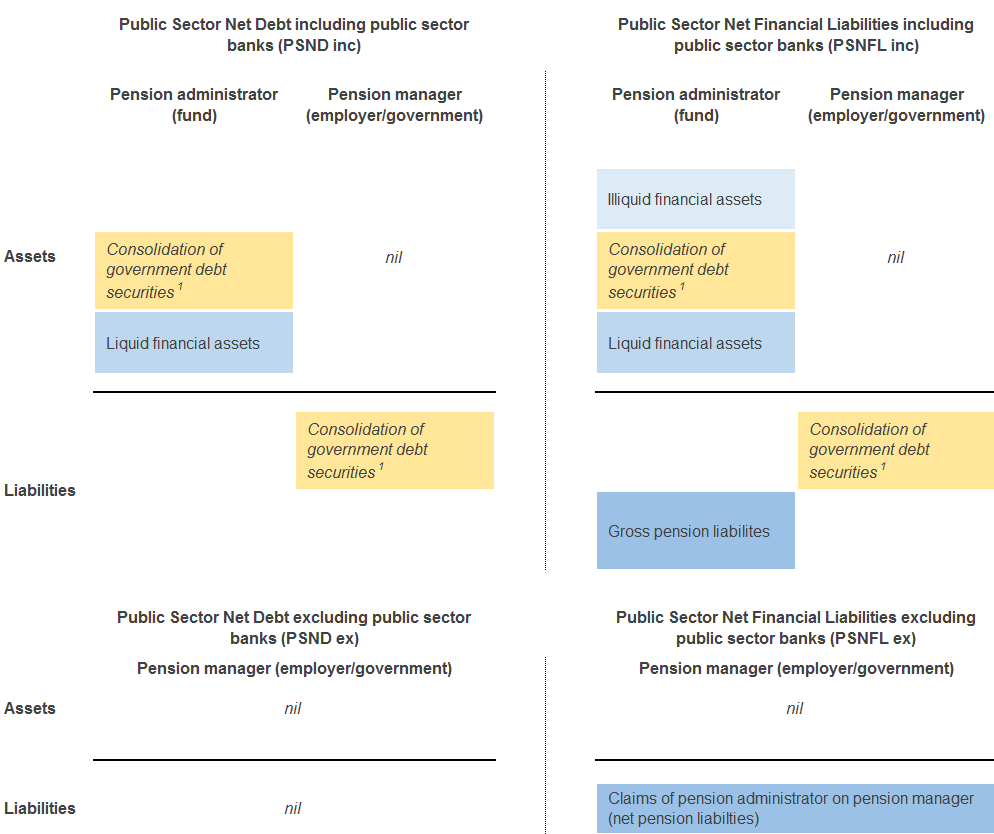

Gross liabilities: administrators recorded in the inc-boundary

Alternatively, total assets held in the pension fund and total pension liabilities could be recorded in the public sector balance sheet. This method, known as the gross liabilities approach, is followed in the European System of Accounts 2010 Table 29 presentation. In relation to PSF, this means that pension administrators are included within the PSF boundary. As such, their full balance sheets including any assets held in the pension funds will be used to calculate the fiscal aggregates.

The recording of the pension administrators in the inc-boundary but outside the ex leads to the following consequences in comparison with the status quo option of continuing to follow the net liabilities approach:

the liquid assets and government debt securities held by pension administrators will contribute to a reduction in PSND inc, leaving PSND ex unaffected

the PSNFL (ex and inc) aggregates will not be directly impacted

the total level of assets and liabilities in the inc balance sheet will increase

It follows that gross recording contributes to a reduction in PSND inc, irrespective of whether the pension scheme is in surplus or in deficit.

Figure 3: Balance sheet effects of administrators recorded in the inc-boundary but outside the ex-boundary

Source: Office for National Statistics

Notes:

- Many pension funds hold some government debt securities as part of their investment portfolios. These securities also represent a liability for government. When both the asset and the liability belongs to units within the PSF boundary (inc or ex), consolidation is applied. This means that the government liability is reduced by the amount of debt securities held by public sector pension funds, but no asset is recorded.

Download this image Figure 3: Balance sheet effects of administrators recorded in the inc-boundary but outside the ex-boundary

.png (35.0 kB) .xlsx (93.7 kB)

Table 2: Impact on PSND and PSNFL when pension administrators recorded in the inc-boundary only

| £ million | |

|---|---|

| Pension Administrators in inc-boundary | 2016/17 |

| Impact on PSNDex | 0 |

| Impact on PSNDinc | -20,000 |

| Impact on PSNFLex | 0 |

| Source: Office for National Statistics | |

Download this table Table 2: Impact on PSND and PSNFL when pension administrators recorded in the inc-boundary only

.xls (35.8 kB)Gross liabilities: administrators recorded in the ex- and inc-boundaries

The same effects take place within the ex-boundary (and, by definition, the inc-measures), should the administrators be included:

the liquid assets and government debt securities held by pension administrators will contribute to a reduction in PSND (ex and inc)

the PSNFL (ex and inc) aggregate will not be directly impacted

the total level of assets and liabilities recorded in the ex and inc balance sheets will increase

Figure 4: Balance sheet effects of administrators recorded in the ex-boundary

Source: Office for National Statistics

Notes:

- Many pension funds hold some government debt securities as part of their investment portfolios. These securities also represent a liability for government. When both the asset and the liability belongs to units within the PSF boundary (inc or ex), consolidation is applied. This means that the government liability is reduced by the amount of debt securities held by public sector pension funds, but no asset is recorded.

Download this image Figure 4: Balance sheet effects of administrators recorded in the ex-boundary

.png (32.7 kB) .xlsx (93.3 kB)

Table 3: Impact on PSND and PSNFL when pension administrators recorded in the ex- and inc-boundaries

| £ million | |

|---|---|

| Pension Administrators in ex- and inc-boundaries | 2016/17 |

| Impact on PSNDex | -20,000 |

| Impact on PSNDinc | -20,000 |

| Impact on PSNFLex | 4,000 |

| Source: Office for National Statistics | |

Download this table Table 3: Impact on PSND and PSNFL when pension administrators recorded in the ex- and inc-boundaries

.xls (35.8 kB)8. Annex 2: Changes in the structure of public sector pension scheme

Overview

Pension arrangements in the public sector are subject to policy decisions and may not remain static over time. In reaching a view on the questions posed in the article, it is important to recognise that any changes to the structure of the existing pension schemes may also have a significant effect on the public sector fiscal aggregates.

This section assumes that unfunded pension schemes remain outside of the main public sector finances (PSF) balance sheet, in compliance with the European System of Accounts 2010: ESA 2010 framework. Of course, an alternative of recording them in a similar way to the funded schemes in the main PSF presentation would mean that a change of structure would have no direct statistical impact, although there would still be a plethora of indirect effects thanks to the different ways in which funded and unfunded schemes operate. For example, public sector net debt (PSND) is impacted via the cash flows relating to pension contributions and pension benefits, as the balance affects the level of liquid assets available to the government. Similarly, investment assets held by the funded schemes generate interest, whereas the unfunded schemes, generally, do not.

This section, however, explains only the direct consequences of moving a scheme from a funded to an unfunded structure, at the point when such a transaction takes place. The subsequent indirect effects on debt and deficit that arise from the genuinely different ways in which the schemes are set up cannot be seen as violating any of the principles defined by the Review of PSF statistics in 2013 and so lie outside the scope of this consultation.

Three scenarios are offered to assist with answering the consultation Questions 1a and 1b:

pension administrators continue to be recorded outside of the PSF boundary

pension administrators are recorded in the inc-boundary but not in the ex-measures

pension administrators are recorded in the ex- and inc-boundaries, in accordance with the Public Sector Finances Technical Advisory Group (PSFTAG) advice

Administrators recorded outside of the PSF boundary

In a situation where administrators remain to be recorded outside the PSF boundary (both inc and ex), a change of the structure of a pension scheme from funded to unfunded would lead to three principal effects:

the sale of assets held by pension administrators will contribute to a reduction in PSND (ex and inc) through making more cash available to government at the point of the sale

the government debt securities transferred to government will be cancelled, also leading to a reduction in PSND (ex and inc) and PSNFL (ex and inc)

the net pension liability would no longer be recorded in the public sector balance sheet, which will reduce PSNFL but have no impact on PSND (ex and inc)

As a result, PSND (ex and inc) will immediately benefit from the cancellation of government debt securities and the amount of any cash or other liquid assets held by the pension administrators, and from the sale of illiquid assets, such as equity, when the proceeds from the sales are realised. As explained in the introduction, there will also be a change in the recording of flows (such as pension benefits and interest), which will in turn affect the fiscal aggregates. The precise nature of such effects can only be estimated for a specific scheme.

Administrators recorded in the inc-boundary

Should pension administrators be recorded within the inc-boundary but outside the ex-boundary, the effects on the latter will be identical to the case described in the previous section, with PSND (ex and inc) benefiting from the cancellation of government debt securities and the amount of any cash or other liquid assets, and the sale of illiquid assets, such as equity held by the pension administrators, as the proceeds from the sales are realised. The precise effects are as follows:

the sale of assets held by pension administrators will contribute to a reduction in PSND ex and PSNFL ex through making more cash available to government at the point of the sale

the government debt securities transferred to government will be cancelled, also leading to a reduction in PSND ex and PSNFL ex

the net pension liability would no longer be recorded within the ex-boundary, which will reduce PSNFL ex but have no impact on PSND ex

The effects on the inc-measures will be different but are also likely to contribute to a reduction in PSND inc at the point of the restructure, albeit leaving PSNFL inc materially unaffected:

the sale of illiquid assets held by pension administrators will contribute to a reduction in PSND inc in the same way as PSND ex; PSNFL inc, which recognises illiquid assets, is likely to be materially unaffected by this transaction

gross pension liabilities will no longer be recognised in the balance sheet, but neither will the claims of pension administrators on pension managers; this simultaneous reduction in assets and liabilities of pension administrators will have no direct impact on either PSNFL inc or PSND inc

It follows that PSND inc will benefit from the conversion of illiquid assets, such as equity held by the pension administrators, into liquid and the cancellation of government debt securities. PSNFL inc, which recognises a broader range of assets and liabilities, will not see a material change as a result of these transactions, but will be reduced through the conversion of (net) pension liabilities into contingent liabilities, both in the inc- and ex-measures.

Administrators recorded in the ex- and inc-boundaries

Finally, in the event that the administrators are included in the ex- and inc-boundaries, the recording will follow the scenario:

the sale of illiquid assets held by pension administrators will contribute to a reduction in both PSND ex and inc through making more cash available to government at the point of the sale; PSNFL (ex and inc), which recognises illiquid assets, is likely not to be materially affected by this transaction

gross (and net) pension liabilities will no longer be recognised in the balance sheet, also reducing PSNFL (ex and inc) by the amount of net liability (the pension scheme’s deficit) without having a direct effect on PSND (ex and inc)

There is an important difference between this scenario and the impact on the inc-measures when pension administrators are recorded in the inc-boundary but outside the ex-boundary. It stems from the recording of pension managers in the ex-boundary, meaning that a single fiscal boundary will be affected by a simultaneous conversion of the administrator’s gross and the manager’s net pension liabilities into contingent liabilities, leading to a reduction in PSNFL (both inc and ex).

Nôl i'r tabl cynnwys9. Annex 3: 2013 Review of public sector finances statistics – principles defining ex-measures

The 2013 Review of the public sector finances (PSF) statistics recommended the move to fiscal aggregates based on the public sector excluding public sector banks and in doing so defined the six main principles that any ex-boundary or measure should follow in the PSF statistics, which were as follows:

Be as inclusive as possible, whilst avoiding manifest distortions, (such as, for example, those from public sector banks) so that they:

- ensure that the full range of public sector liabilities (on a national accounts basis) are reported as transparently as possible

- do not intrinsically create one-off factors in their design without justification; the previous method of excluding some indemnified schemes until they came to an end when there was a balancing transaction intrinsically creates one-off transactions, these can then cause further issues for users in assessing underlying trends; for example, when the Special Liquidity Scheme ended there was a one-off impact on net borrowing of £2.3 billion

- allow transactions or classifications to be excluded if they create distortions that clearly impair the understanding of public sector finances due to their size and their lack of correlation with their effects on the government’s need to issue gilts

Be consistent in their effect on debt and borrowing.

Respect the building block for national accounts: the institutional unit (institutional units have autonomy of decision-making and file their accounts); this means that any ex-measures should not sub-divide institutional units.

Apply the European System of Accounts (ESA) boundary rules for central, local and general government:

- this ensures that the government net borrowing and gross debt measures in the public sector finances are aligned with the Maastricht definitions of government deficit and debt

- it means that no ex-measure should exclude any bodies that are categorised in the government sector and so ex-measures should only look to sub-divide the public corporations sector

Be wholly consistent with the ESA guidance on transactions and stocks:

- this ensures that measures in the public sector finances are calculated in the same way as in international measures and prevents ex-measures being developed that are not consistent with national accounts and Maastricht debt and deficit

- it further ensures that any ex-measures exclude public sector bodies and then record their transactions and stocks in accordance with national accounts principles, preventing inconsistent treatment in ex-measures of individual transactions and stocks

- in this way we are ensuring that the measures are based on sound internationally-agreed concepts and definitions

Be created alongside a publication strategy that maximises the transparency of factors that impact on the public sector finances, with details published below institutional unit level described fully in terms of the framework outlined previously.

10. Annex 4: Glossary

Pension scheme

A pension is a form of social insurance protecting the recipient against the loss of income in old age. Pensions are typically financed via employer and/or employee contributions, and the funded ones also benefit from the return on assets accumulated in the fund. Non-contributory social assistance benefits, even when they are related to old age, are not considered pensions in national accounts. Individual insurance policies, when not related to employment, are similarly excluded.

Benefits are paid out when an individual ceases employment, either through reaching an age threshold, disability, or death. There are several elements of pension schemes that need to be understood before assessing how best to classify schemes within the public sector finances (PSF) framework. The main breakdowns are:

funded compared with unfunded

direct contribution compared with direct benefit

pension manager compared with pension administrator

social security compared with workplace pension schemes

Funded and unfunded pension schemes

A funded pension scheme is defined by its use of assets. A pension fund is endowed with an investment pot that was generated through member contributions. The fund uses this pot to produce profit through investing in and trading assets (financial derivatives, gilts and property among other things). As the pot grows so does the fund’s ability to meet its liabilities (that is, to pay pension benefits). As such, a funded pension scheme holds both assets and liabilities.

In contrast, an unfunded pension scheme does not use an investment pot to generate profit, as current income (contributions from employees) is used to pay current liabilities (pension benefits to retirees). As such, an unfunded pension scheme does not hold assets, only liabilities.

Defined benefit and defined contribution pension schemes

A defined benefit (DB) pension scheme uses a formula to determine the size of the annuity and/or pay-out that a retiree is entitled to. The formula often includes considerations such as salary (either average or final salary), length of service and age at retirement, amongst various other factors. As retiree benefits are fixed (by the formula) then the liability to meet these benefits falls to the pension manager and not to the individual employee who will receive the benefits.

A defined contribution (DC) pension scheme does not fix the benefits offered to retirees. Instead, the annuities and/or pay-out awarded via this form of pension scheme are dependent upon the performance of the scheme’s investments. Typically, an employee will pay into an individual account, which the scheme then invests in a range of products. Any gains or losses are credited to the individual’s account, meaning that the employee assumes all risk. As such, the benefits are variable (until the point at which an individual cashes-out their account) and the liability to meet these benefits falls to the employee only.

Of note when reading the following sections is that PSF do not record assets or liabilities for DC pension schemes, as the benefits and liabilities of these schemes accrue to the individual employee and not to government. Therefore, there are no DC pension liabilities or entitlements recorded in the government accounts.

Pension manager and pension administrator

The pension manager is the unit ultimately responsible for setting and meeting pension entitlements and liabilities. The manager bears all fiduciary responsibility with regards to the pension scheme under their control. According to the European System of Accounts 2010: ESA 2010:

“The pension manager also retains a significant degree of responsibility over the long-term policy of investment in assets, including the selection of investment options and the structure of administrative providers. Although the same unit may frequently carry out both the functions of a pension manager and of a pension administrator, in some cases they are the responsibilities of different units1.”

A significant caveat to this definition is that ultimate responsibility does not extend as far as guarantees, which, in accordance with the ESA 2010 rules, are considered contingent liabilities. Therefore, a government guarantee to a pension scheme is not in itself sufficient to conclude that the scheme is a public sector one.

The pension administrator manages the day-to-day and investment activities of the pension scheme; they are normally an agent of the manager but retain a significant degree of independence, for example, to ensure that the fund is run in the interest of the pensioners and not the business. According to ESA 2010:

“The pension administrator, simply acts as the employer’s agent, undertaking the day-to-day administration of the pension scheme, and the responsibility for any shortfall in the scheme, or the benefit of any excess, remains with the employer2.”

Social security and workplace pension scheme

The ESA 2010 framework makes a distinction between social security and workplace (employment-related) pension schemes. Both are types of social insurance but differ in the basis on which retirement income is provided.

Social security pension schemes aim to provide a basic form of income for all retirees, financed via mandatory contributions. Social security schemes cover a large proportion of the population, normally everyone who meets the qualifying conditions. The State Pension is the largest social security pension scheme in the UK. It is financed via National Insurance contributions. Social security pension schemes are always set up by government, though the actual running of the schemes could, in principle, be done by non-government units.

Workplace pension schemes exist to provide a retiree with earnings through the employee and the employer making voluntary contributions during working life. Such schemes can therefore be seen as a deferred component of labour remuneration. Workplace pensions can be DB or DC, funded or unfunded.

Pension Protection Fund

The Pension Protection Fund (PPF) was established to pay compensation to members of entitled defined benefit pension schemes when a qualifying insolvency event occurs. The PPF raises funds through charging an annual levy on all pension schemes that are eligible for PPF protection. These funds, as well as a small grant income, are then invested to generate a surplus to reinvest and pay down liabilities. It also takes over the assets held by the pension schemes that enter the PPF. The PPF is the only funded public sector pension scheme for which the pension manager and pension administrator are the same institutional unit.

Notes for: Annex 4: Glossary

For more information, please see paragraph 17.75 on page 371 of the European System of Accounts 2010.

For more information, please see paragraph 17.74 on page 371 of the European System of Accounts 2010.