Cynnwys

- Main points

- What’s changed in this release?

- Things you need to know about this release

- How much is the public sector borrowing?

- How big is public sector debt?

- How much cash does the public sector need to raise?

- How was debt in this financial year accumulated?

- How do these figures compare with official forecasts?

- Revisions since previous release

- International comparisons of borrowing and debt

- Quality and methodology

1. Main points

Public sector net borrowing (excluding public sector banks) decreased by £19.9 billion to £47.8 billion in the current financial year-to-date (April 2016 to February 2017), compared with the same period in the previous financial year; this is the lowest year-to-date borrowing since the financial year-to-date ending February 2008.

The Office for Budget Responsibility (OBR) has forecast that public sector net borrowing (excluding public sector banks) will be £51.7 billion during the financial year ending March 2017.

Public sector net borrowing (excluding public sector banks) decreased by £2.8 billion to £1.8 billion in February 2017, compared with February 2016; this is the lowest February borrowing since 2007.

Public sector net debt (excluding public sector banks) was £1,699.7 billion at the end of February 2017, equivalent to 85.4% of gross domestic product (GDP); an increase of £111.1 billion (or 2.3 percentage points as a ratio of GDP) since February 2016.

Public sector net debt (excluding both public sector banks and Bank of England) was £1,591.6 billion at the end of February 2017, equivalent to 80.0% of GDP; an increase of £48.1 billion (or a decrease of 0.7 percentage points as a ratio of GDP) since February 2016.

Central government net cash requirement decreased by £0.9 billion to £43.7 billion in the current financial year-to-date, compared with the same period in the previous financial year; this is the lowest year-to-date central government net cash requirement since February 2008.

2. What’s changed in this release?

This section presents information on aspects of data or methodology that is important to understand when reading this bulletin. Where appropriate, further details of individual changes are discussed in the Quality and methodology section of this bulletin.

Rolls-Royce PLC receipt

On 17 January 2017, the Serious Fraud Office (SFO) announced that Rolls-Royce PLC had paid a Deferred Prosecution Agreement of £497.25 million following an investigation into bribery and corruption.

This payment has been accrued to January 2017 and is included for the first time in this publication, having the effect of reducing central government and so public sector net borrowing by £0.5 billion in January 2017.

Self-assessed tax receipts

In both January and (to a lesser extent) July, receipts are particularly high due to the receipt of self-assessed Income Tax, Capital Gains Tax and self-assessed (Class 4) National Insurance contributions.

The revenue raised through self-assessed taxes, although primarily affecting January and July receipts, also tends to lead to high receipts in the following month (February and August respectively), although to a lesser degree.

The proportion of self-assessed taxes recorded in January and February can vary year-on-year and it is therefore advisable to consider data for the 2 months (January and February) together.

In January and February 2017, the government received £13.4 billion and £4.7 billion respectively in self-assessed Income Tax, giving a combined total of £18.1 billion. These represent the highest combined self-assessed Income Tax receipts on record (records begin in 1998).

Similarly, in January and February 2017, the government received £6.2 billion and £2.2 billion respectively in Capital Gains Tax, giving a combined total of £8.4 billion. These represent the highest combined Capital Gains Tax receipts on record (records begin in 1998).

Lloyds share sales

In recent years the government has entered a programme of selling shares in publicly owned organisations. On 23 February 2017, the government announced that its current trading plan has enabled its remaining shareholding in Lloyds Banking Group (LBG), to be reduced to less than 4%.

This month we have recorded £1.0 billion of LBG shares sales in February 2017, bringing the government’s disposal of LBG share sales since September 2013 to £19.0 billion.

The proceeds of such sales reduce the central government net cash requirement (CGNCR) and public sector net debt (PSND) by an amount corresponding to the cash raised from the sale but have no impact on public sector net borrowing.

Nuclear decommissioning

Eurostat, in its 2016 version of the Manual on Government Deficit and Debt, introduced new European statistical rules on the treatment of the transfer of an asset to government to be decommissioned.

In this month’s bulletin we have applied these rules to the transfer, in 2005, of nuclear assets between British Nuclear Fuels Limited (BNFL) and the Nuclear Decommissioning Authority (NDA). In 2005, BNFL was a public corporation and NDA a central government body, and the transfer covered all nuclear sites and plants owned by BNFL.

The revisions as a result of this methodological change are limited to the periods between April 2005 and September 2010, inclusive. The impact of the methodology change is to change the time of recording of capital transfers associated with the decommissioning from the point of the transfer in April 2005 to later periods when the associated decommissioning took place.

There is no impact on public sector fiscal aggregates as the amended transactions recorded are between the central government and public corporations sub-sectors. For more information on the magnitude of the revisions see section 9 - revisions since previous bulletin.

Nôl i'r tabl cynnwys3. Things you need to know about this release

What are the most important terms I need to know?

Public sector net borrowing excluding public sector banks (PSNB ex) measures the gap between revenue raised (current receipts) and total spending (current expenditure plus net investment (capital spending less capital receipts)). Public sector net borrowing is often referred to as “the deficit”.

The public sector net cash requirement (PSNCR) represents the cash needed to be raised from the financial markets over a period of time to finance the government’s activities. This can be close to the deficit for the same period but there are some transactions, for example, loans to the private sector, that need to be financed but do not contribute to the deficit. It is also close but not identical to the changes in the level of net debt between 2 points in time.

Public sector net debt excluding public sector banks (PSND ex) represents the amount of money the public sector owes to private sector organisations including overseas institutions, largely as a result of issuing gilts and treasury bills, less the amount of cash and other short-term assets it holds.

While borrowing (or the deficit) represents the difference between total spending and receipts over a period of time, debt represents the total amount of money owed at a point in time.

The debt has been built up by successive government administrations over many years. When the government borrows (that is, runs a deficit), this normally adds to the debt total. So reducing the deficit is not the same as reducing the debt.

If you’d like to know more about the relationship between debt and deficit, please refer to our article The debt and deficit of the UK public sector explained.

What does the public sector include?

In the UK, the public sector consists of 5 sub-sectors: central government, local government, public non-financial corporations, Bank of England and public financial corporations (that is, public sector banks – currently only Royal Bank of Scotland (RBS)).

The figures quoted in this bulletin exclude public financial corporations (unless otherwise stated) as the reported position of both borrowing and debt would be dominated and distorted by the inclusion of RBS’s balance sheet (and transactions) given its size relative to the rest of the public sector.

Additionally the government’s fiscal rules are based on aggregates that exclude public sector banks.

The sub-sector breakdown of public sector net borrowing is summarised in Table PSA2 in the Public Sector Finances Tables 1 to 10: Appendix A dataset.

Should I look at monthly or financial year-to-date data to understand public sector finances?

A financial year is an accounting period of 12 months running from 1 April one year to 31 March the following year. For example, the financial year ending March 2016 comprises the months from April 2015 to March 2016.

Due to the volatility of the monthly data, the cumulative financial year-to-date borrowing figures provide a better indication of the position of the public finances than the individual months.

Are our figures adjusted for inflation?

All monetary values in the PSF bulletin are expressed in terms of “current prices‟, that is, they represent the price in the period to which the expenditure or revenue relates and are not adjusted for inflation.

In order to compare data over long time periods, to aid international comparisons and provide an indication of a country’s ability to service borrowing and debt, commentators often discuss changes over time to fiscal aggregates in terms of gross domestic product (GDP) ratios. GDP represents the value of all the goods and services currently produced by the UK economy in a period of time.

Are our figures adjusted for seasonal patterns?

All monetary values in the PSF bulletin are not seasonally adjusted. We recommend you use year-on-year comparisons (be it cumulative financial year-to-date or individual monthly borrowing figures) rather than making month-on-month comparisons.

Are our monthly figures likely to change over time?

Each PSF bulletin contains the first estimate of public sector borrowing for the most recent period and is likely to be revised in later months as more data become available.

In publishing monthly estimates, it is necessary to use a range of different types of data sources. Some of these are subject to revision as budget estimates (forecasts) are replaced by out-turn data and these then feed into the published aggregates.

In addition to those that stem from updated data sources, revisions can also result from methodology changes. An example of the latter is the changes that were due to the introduction of improved methodology for the recording of Corporation Tax, Bank Corporation Tax Surcharge receipts and Bank Levy implemented in the PSF estimates released in February 2017.

Nôl i'r tabl cynnwys4. How much is the public sector borrowing?

In the current financial year-to-date (April 2016 to February 2017), the public sector spent more money than it received in taxes and other income. This meant it had to borrow £47.8 billion; £19.9 billion less than in the same period last year (April 2015 to February 2016).

Of this £47.8 billion of public sector net borrowing excluding public sector banks (PSNB ex), £16.4 billion related to the cost of the “day-to-day” activities of the public sector (the current budget deficit), while £31.4 billion related to capital spending (or net investment) such as infrastructure.

Figure 1 presents cumulative public sector net borrowing (excluding public sector banks) by month in the current financial year-to-date and compares the cumulative borrowing in the current financial year-to-date with that in the previous financial year.

Figure 1: Cumulative public sector net borrowing (excluding public sector banks) by month; current and previous financial year-to-date (April to February)

Source: Office for National Statistics

Download this chart Figure 1: Cumulative public sector net borrowing (excluding public sector banks) by month; current and previous financial year-to-date (April to February)

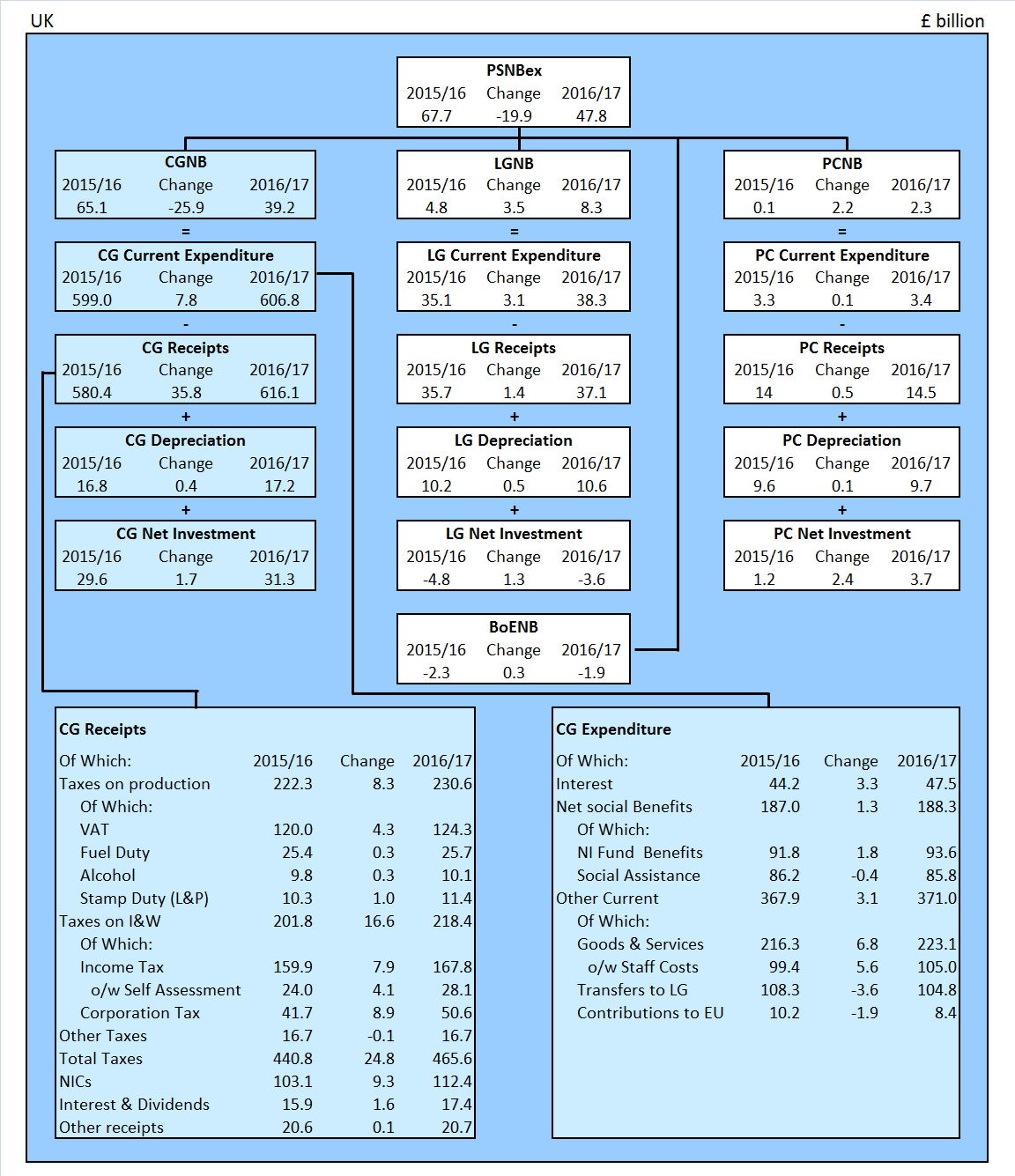

Image .csv .xlsThe difference between central government's income and spending makes the largest contribution to the amount borrowed by the public sector. In the current financial year-to-date, £39.2 billion of the £47.8 billion borrowed by the public sector was by central government.

In the current financial year-to-date, central government received £616.1 billion in income; including £465.6 billion in taxes. This was around 6% more than in the previous financial year-to-date.

Over the same period, central government spent £638.1 billion; around 2% more than in the previous financial year-to-date. Of this amount, just below two-thirds was spent by central government departments (such as health, education and defence), around a third on social benefits (such as pensions, unemployment payments, Child Benefit and Maternity Pay) with the remaining being spent on capital investment and interest on government’s outstanding debt.

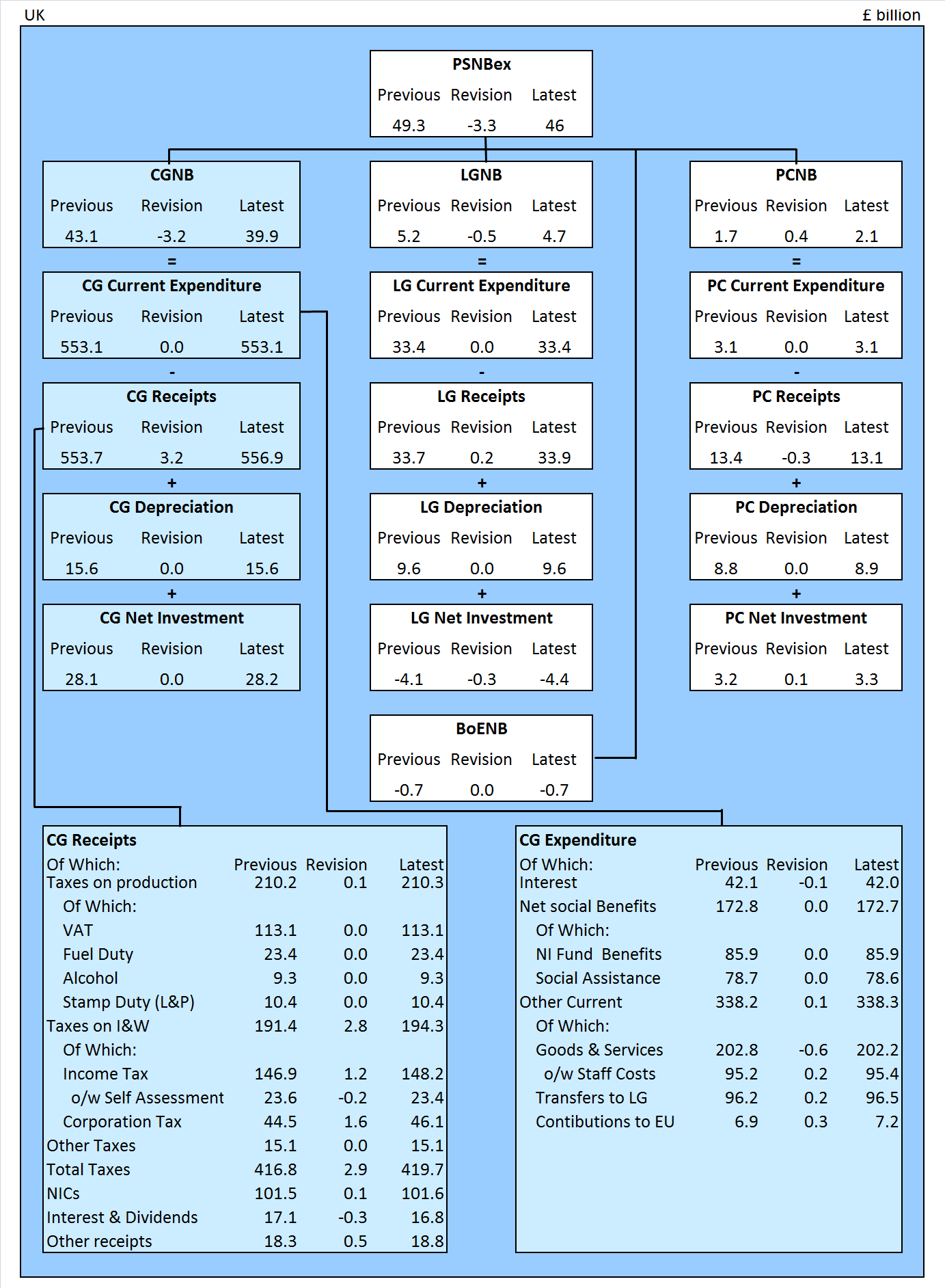

Figure 2 summarises public sector borrowing by sub-sector for the current financial year-to-date and compares these measures with the same period in the previous financial year (April 2015 to February 2016).

This presentation splits PSNB ex into each of its 4 sub-sectors: central government, local government, public corporations and Bank of England.

A further breakdown (receipts, expenditure (both current and capital) and depreciation) is provided for central government, local government and public corporations; with current receipts and current expenditure being presented in further detail.

Figure 2: Contributions to public sector net borrowing (excluding public sector banks) in financial year-to-date (April 2016 to February 2017) compared to same period in the previous financial year

Source: Office for National Statistics

Notes:

- PSNBex - Public sector net borrowing excluding public sector banks.

- CGNB - Central government net borrowing.

- LGNB - Local government net borrowing.

- PCNB - Non-financial public corporations' net borrowing.

- BoENB - Bank of England net borrowing.

- L&P - Land and property.

- I&W - Income and wealth.

- NICs - National insurance contributions.

- Contributions to EU - UK VAT, GNI and abatement contributions to the EU budget.

Download this image Figure 2: Contributions to public sector net borrowing (excluding public sector banks) in financial year-to-date (April 2016 to February 2017) compared to same period in the previous financial year

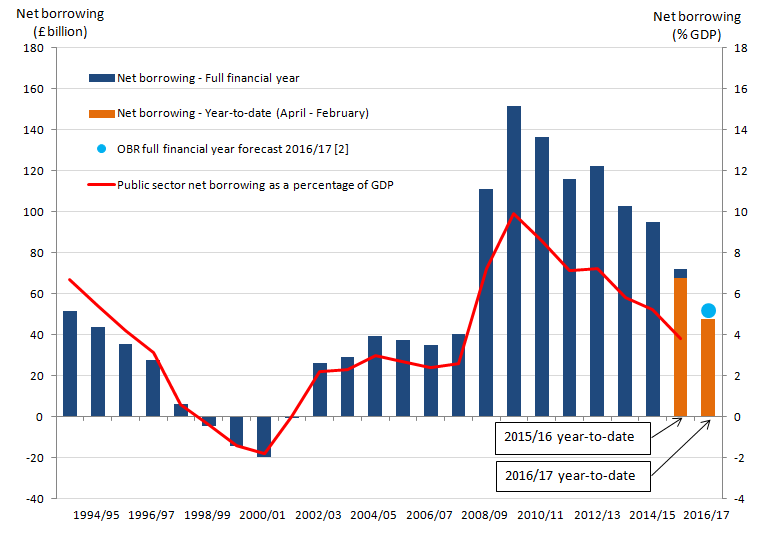

.png (104.5 kB) .xls (67.1 kB)Figure 3 illustrates that annual borrowing has generally been falling since the peak in the financial year ending March 2010 (April 2009 to March 2010).

In the financial year ending March 2016 (April 2015 to March 2016), the public sector borrowed £72.0 billion. This was £22.9 billion lower than in the previous financial year and less than half of that in the financial year ending March 2010 (both in terms of £ billion and percentage of gross domestic product (GDP)).

Figure 3: The amount borrowed by the public sector has been falling since the peak in the financial year1 ending March 2010

UK public sector borrowing excluding public sector banks, April 1993 to February 2017

Source: Office for National Statistics

Notes:

- Financial year 2016/17 represents financial year ending 2017 (April 2016 to March 2017).

- Office for Budget Responsibility (OBR) full financial year forecast of £68.2 billion for public sector net borrowing excluding public sector banks (November 2016 Economic and Fiscal Outlook).

Download this image Figure 3: The amount borrowed by the public sector has been falling since the peak in the financial year^1^ ending March 2010

.png (34.5 kB) .xls (60.4 kB)Focusing on the current month

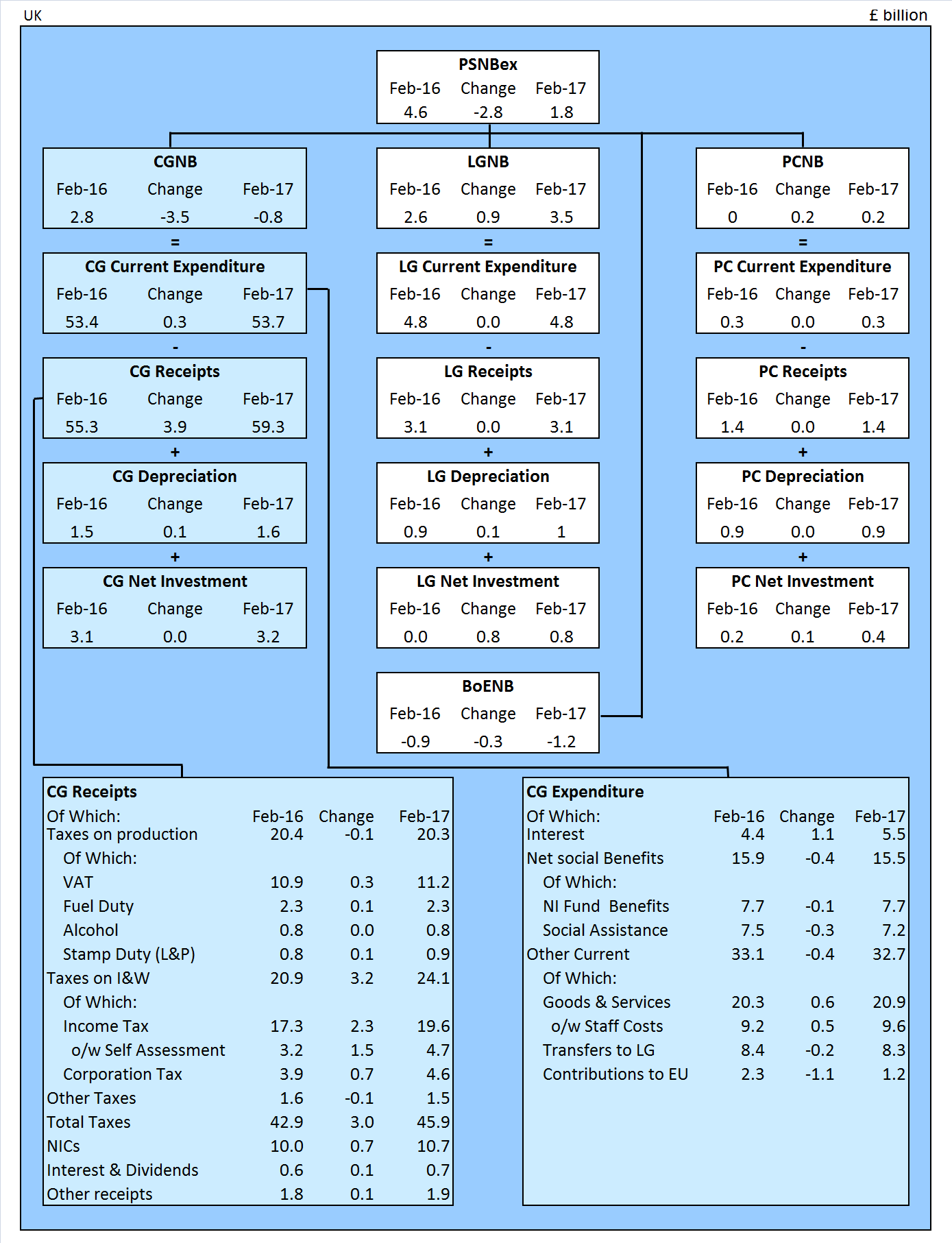

In February 2017, the public sector spent more money than it received in taxes and other income. This meant it had to borrow £1.8 billion; £2.8 billion less than in February 2016.

Figure 4 summarises public sector borrowing by sub-sector in February 2017 and compares this with the equivalent measures in the same month a year earlier (February 2016).

This presentation splits PSNB ex into each of its 4 sub-sectors: central government, local government, public corporations and Bank of England.

A further breakdown (receipts, current expenditure, capital expenditure and depreciation) is provided for central government, local government and public corporations, with receipts and current expenditure being presented in further detail.

Figure 4: Contributions to public sector net borrowing (excluding public sector banks) in February 2017 compared to February 2016

Source: Office for National Statistics

Notes:

- PSNBex - Public sector net borrowing excluding public sector banks.

- CGNB - Central government net borrowing.

- LGNB - Local government net borrowing.

- PCNB - Non-financial public corporations' net borrowing.

- BoENB - Bank of England net borrowing.

- L&P - Land and property.

- I&W - Income and wealth.

- NICs - National insurance contributions.

- Contributions to EU - UK VAT, GNI and abatement contributions to the EU budget.

Download this image Figure 4: Contributions to public sector net borrowing (excluding public sector banks) in February 2017 compared to February 2016

.png (139.2 kB) .xls (67.1 kB)5. How big is public sector debt?

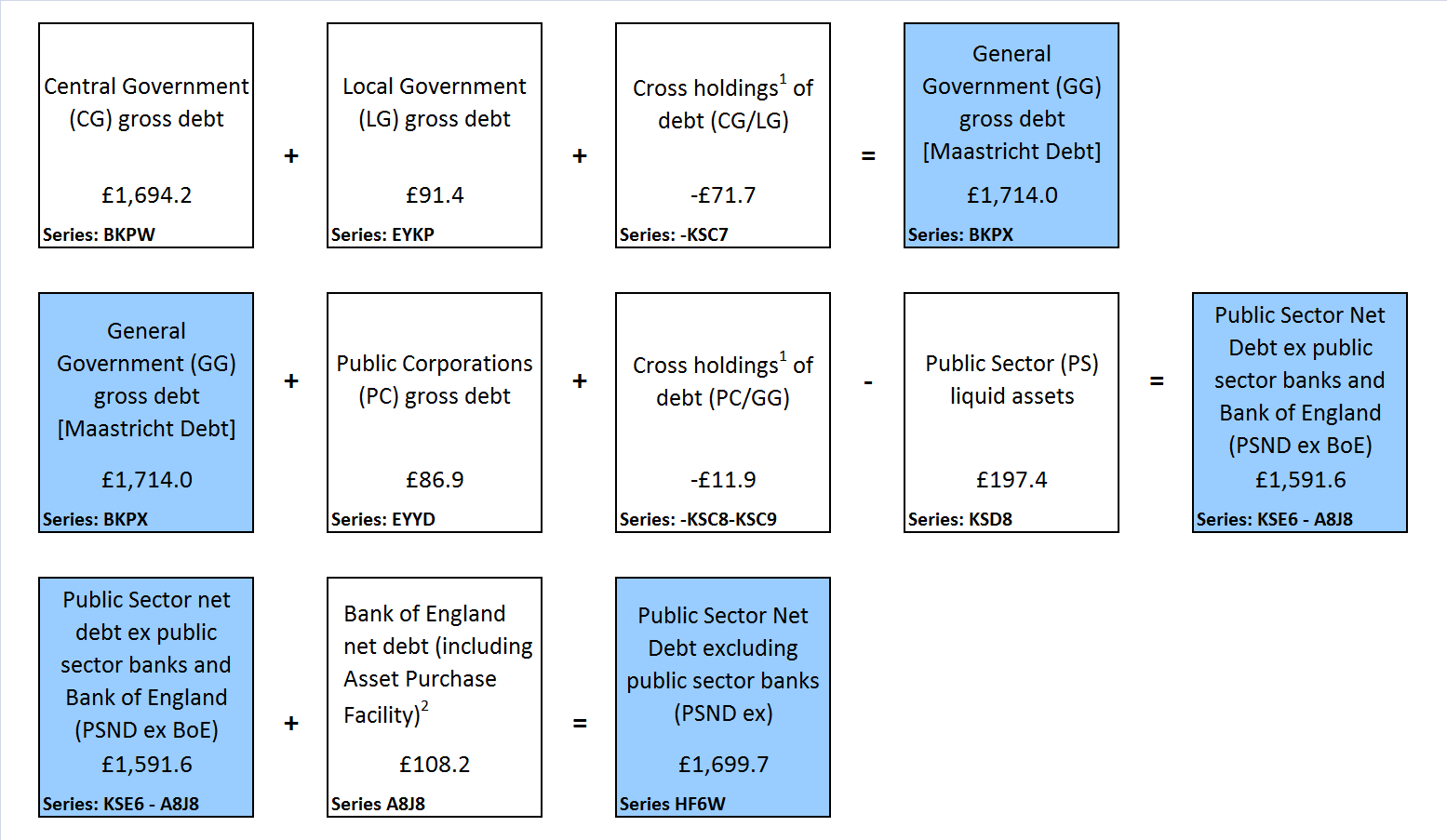

The amount of money owed by the public sector to the private sector stood at just below £1.7 trillion at the end of February 2017, which equates to 85.4% of the value of all the goods & services currently produced by the UK economy in a year (or gross domestic product (GDP)).

This debt figure of £1.7 trillion (or £1,699.7 billion) at the end of February 2017, represents an increase of £111.1 billion since the end of February 2016. A significant portion of this increase, £63.0 billion is attributable to debt accumulated within the Bank of England, mainly the Asset Purchase Facility (APF).

The total increase in net debt of £111.1 billion can be considered largely as a result of £52.1 billion of public sector net borrowing over that period plus cash transactions related to acquisition or disposal of financial assets (for example, loans or asset sales).

Figure 5 breaks down outstanding public sector net debt at the end of February 2017 into the sub-sectors of the public sector. In addition to public sector net debt excluding public sector banks (PSND ex), this presentation includes the impact of public sector banks on debt.

Figure 5: Sub-sector contributions to public sector net debt at February 2017 UK (£ billion)

Source: Office for National Statistics

Notes:

- PSND - Public sector net debt.

- PSBsND - Public sector Banks net debt.

- PSNDex - Public sector net debt excluding public sector banks.

- BoEND - Bank of England's contribution to net debt.

- PSND ex Boe - Public sector net debt excluding both public sector banks and Bank of England.

- NFPCND - Non-financial public corporations' net debt.

- GGND - General government net debt.

Download this chart Figure 5: Sub-sector contributions to public sector net debt at February 2017 UK (£ billion)

Image .csv .xlsNet debt is defined as total gross financial liabilities less liquid financial assets, where liquid assets are cash and short-term assets, which can be released for cash at short notice without significant loss. These liquid assets mainly comprise foreign exchange reserves and bank deposits.

Figure 6 presents PSND ex at the end of February 2017 by sub-sector. Time series for each of these component series are presented in Tables PSA8A to D in the Public Sector Finances Tables 1 to 10: Appendix A dataset.

Figure 6: Sub-sector split of public sector net debt excluding public sector banks at February 2017 UK (£ billion)

Source: Office for National Statistics

Notes:

- Cross-holdings between sub-sectors are removed in calculating public sector net debt, gross debt and liquid assets.

- APF - Bank of England Asset Purchase Facility.

Download this image Figure 6: Sub-sector split of public sector net debt excluding public sector banks at February 2017 UK (£ billion)

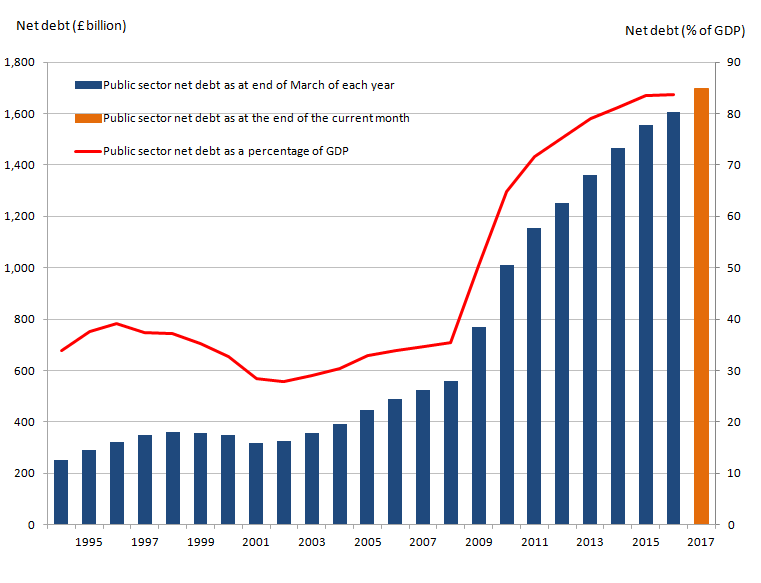

.png (73.1 kB) .xls (166.4 kB)Figure 7 illustrates PSND ex from the financial year ending March 1994 to the end of February 2017.

Figure 7: UK public sector debt, March 1994 to the end of February 2017

Source: Office for National Statistics

Download this image Figure 7: UK public sector debt, March 1994 to the end of February 2017

.png (35.8 kB) .xls (42.5 kB)PSND ex increased at the time of the economic downturn. Since then, it has continued to increase but at a slower rate. The introduction of the Term Funding Scheme in late 2016 has led to a rise in net debt as the loans provided under the scheme are not liquid assets and therefore do not net off in public sector net debt (against the liabilities incurred in providing the loans).

Nôl i'r tabl cynnwys6. How much cash does the public sector need to raise?

The net cash requirement is a measure of how much cash the public sector needs to raise from the financial markets (or pay out from its cash reserves) to finance its activities. This amount can be close to the deficit for the same period but there are some transactions, for example, lending to the private sector or the purchase of shares, that need to be financed but do not contribute to the deficit. Similarly, repayments of principal on loans extended by government or sales of shares will reduce the level of financing necessary but not reduce the deficit.

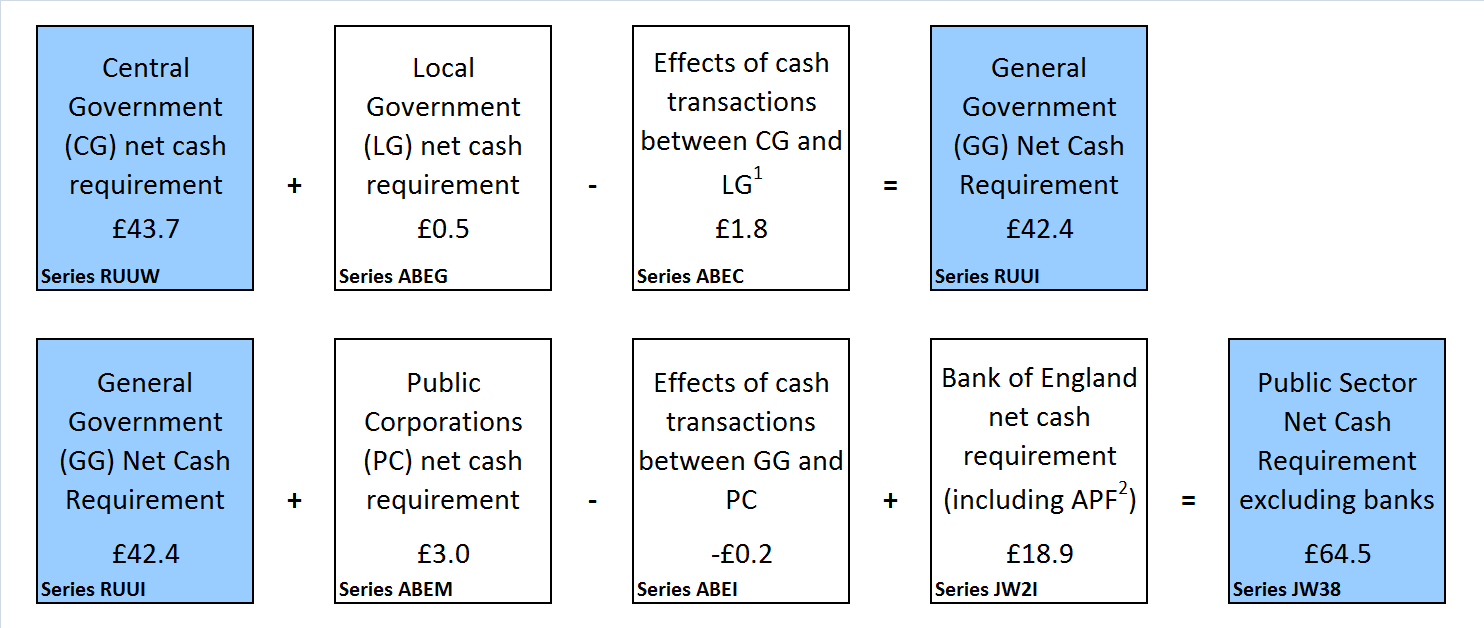

Figure 8 presents public sector cash requirement by sub-sector for the financial year-to-date (April 2016 to February 2017). Time series for each of these component series are presented in Table PSA7A in the Public Sector Finances Tables 1 to 10: Appendix A dataset.

Figure 8: Sub-sector split of public sector net cash requirement excluding public sector banks, financial year-to-date (April 2016 to February 2017) UK (£ billion)

Source: Office for National Statistics

Notes:

- Effects of cash transactions between sub-sectors are removed in calculating public sector total net cash requirement (and consolidated expenditure and income totals).

- APF - Bank of England Asset Purchase Facility.

Download this image Figure 8: Sub-sector split of public sector net cash requirement excluding public sector banks, financial year-to-date (April 2016 to February 2017) UK (£ billion)

.png (53.3 kB) .xls (151.6 kB)Central government net cash requirement (CGNCR) is a focus for some users, as it provides an indication of the volume of gilts (government bonds) the Debt Management Office may issue to meet the government’s borrowing requirements.

CGNCR is quoted both including and excluding the net cash requirement of Network Rail (NR) and UK Asset Resolution LTD (UKAR) (who manage the closed mortgage books of both Bradford and Bingley and Northern Rock Asset Management). It is the CGNCR excluding NR and UKAR that is the particular focus of users with an interest in the gilt market.

CGNCR excluding NR and UKAR decreased by £6.8 billion to £52.8 billion in the current financial year-to-date (April 2016 to February 2017), compared with the same period in 2016.

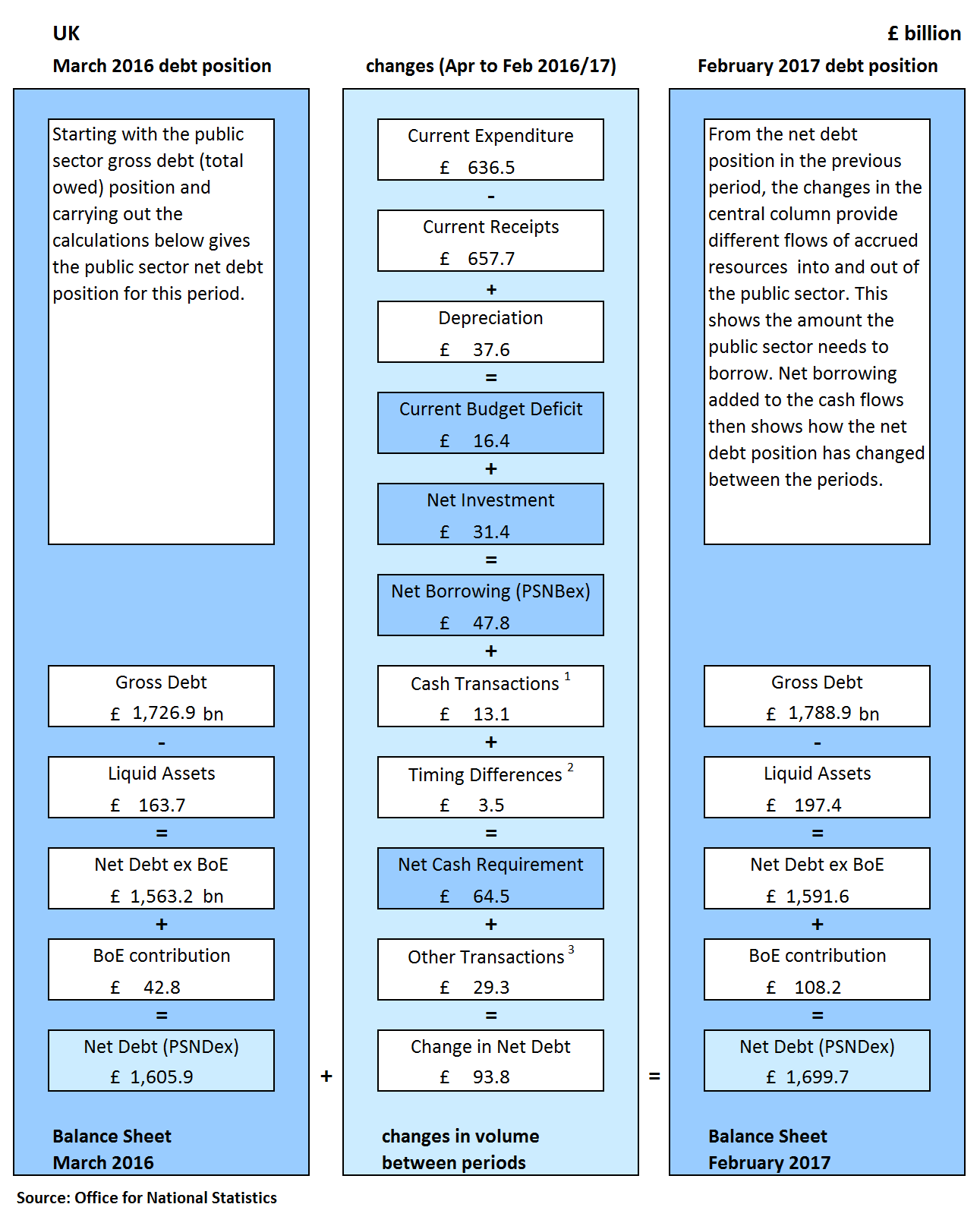

Nôl i'r tabl cynnwys7. How was debt in this financial year accumulated?

Figure 9 brings together the borrowing components detailed in Figure 2 to illustrate how the differences between income and spending (both current and capital) have led to the accumulation of debt in the current financial year-to-date.

This presentation excludes public sector banks, focusing instead on the public sector net borrowing excluding public sector banks (PSNB ex) measure.

Figure 9: Changes in public sector finances (excluding public sector banks) financial year-to-date (April 2016 to February 2017) UK (£ billion)

Source: Office for National Statistics

Notes:

- Cash transactions in (non-financing) financial assets which do not impact on net borrowing.

- Timing differences between cash and accrued data.

- Revaluation of foreign currency debt (for example foreign currency). Debt issuances or redemptions above or below debt valuation (for example bond premia/discounts and capital uplifts). Changes in volume of debt not due to transactions (for example sector reclassification).

Download this image Figure 9: Changes in public sector finances (excluding public sector banks) financial year-to-date (April 2016 to February 2017) UK (£ billion)

.png (136.4 kB) .xls (43.0 kB)The reconciliation between public sector net borrowing and net cash requirement is presented in more detail in Table REC1 in the Public Sector Finances Tables 1 to 10: Appendix A dataset.

Nôl i'r tabl cynnwys8. How do these figures compare with official forecasts?

The Office for Budget Responsibility (OBR) normally produces forecasts of the public finances twice a year (currently in March and November). The latest OBR forecast was published on 8 March 2017.

The government has adopted OBR forecasts as its official forecast.

OBR has forecast that the public sector will borrow £51.7 billion during the financial year ending March 2017; a reduction of £20.3 billion on the provisional out-turn for the financial year ending March 2016.

Figure 10 presents the cumulative public sector net borrowing for the current and previous financial year-to-date. The figure also presents the OBR forecasts for both financial years-to-date.

Figure 10: Cumulative public sector net borrowing by month; financial year ending March 2016 and current financial year-to-date (April 2016 to February 2017)

UK, all data excluding public sector banks

Source: Office for National Statistics

Notes:

- For the financial year ending 2016 (April 2015 to March 2016) and the financial year ending 2017 (April 2016 to March 2017).

- OBR forecast for public sector net borrowing excluding public sector banks from March 2016 Economic and Fiscal Outlook (EFO).

- OBR forecast for public sector net borrowing excluding public sector banks from November 2016 Economic and Fiscal Outlook (EFO).

Download this chart Figure 10: Cumulative public sector net borrowing by month; financial year ending March 2016 and current financial year-to-date (April 2016 to February 2017)

Image .csv .xlsTable 1 compares emerging financial year-to-date data against the OBR forecasts. Caution should be taken when comparing public sector finances data with OBR figures for the full financial year as data are not finalised until after the financial year ends. Initial estimates soon after the end of the financial year can be subject to sizeable revisions in later months. In addition, the monthly path of spending and receipts is not smooth within the year and also can vary compared with previous years, both of which can affect year-to-date comparisons with previous years.

There can also be methodological differences between OBR forecasts and out-turn data. In its latest publication, OBR published a table within its Economic and fiscal outlook supplementary fiscal tables: receipts and other - November 2016 titled “Table: 2.46 Items included in OBR forecasts that ONS have not yet included in out-turn”.

Table 1: Public sector latest outturn estimates vs Office for Budget Responsibility (OBR) forecasts

| UK, excluding public sector banks | £ billion1 (not seasonally adjusted) | ||||||

| Financial year-to-date7 | Full financial year8 | ||||||

| 2015/168 | 2016/178 | % change | 2015/16 Outturn | 2016/17 OBR Forecast9 | % change | ||

| Current budget deficit2 | 41.7 | 16.4 | -60.7 | 40.4 | 15.2 | -62.3 | |

| Net investment3 | 26.0 | 31.4 | 20.6 | 31.6 | 36.5 | 15.5 | |

| Net borrowing 4 | 67.7 | 47.8 | -29.4 | 72.0 | 51.7 | -28.1 | |

| Net debt 5 | 1,588.6 | 1,699.7 | 7.0 | 1,605.9 | 1,730.0 | 7.7 | |

| Net debt as a percentage of GDP6 | 83.1 | 85.4 | NA | 83.7 | 86.6 | NA | |

| Source: Office for National Statistics | |||||||

| Notes: | |||||||

| 1. Unless otherwise stated. | |||||||

| 2. Current budget deficit is the difference between current expenditure (including depreciation) and current receipts. | |||||||

| 3. Net investment is gross investment (net capital formation plus net capital transfers) less depreciation. | |||||||

| 4. Net borrowing is current budget deficit plus net investment. | |||||||

| 5. Net debt is financial liabilities (for loans, deposits, currency and debt securities) less liquid assets. | |||||||

| 6. GDP at current market price. | |||||||

| 7. Financial year-to-date refers to the period from April to February. | |||||||

| 8. 2016/17 refers to financial year ending in March 2017 and 2015/16 refers to financial year ending in March 2016. | |||||||

| 9. All OBR figures are from the OBR Economic and Fiscal Outlook published in March 2017. | |||||||

| 10. NA denotes 'not applicable'. | |||||||

Download this table Table 1: Public sector latest outturn estimates vs Office for Budget Responsibility (OBR) forecasts

.xls (34.8 kB)9. Revisions since previous release

Revisions can be the result of both updated data sources and methodology changes. This month the reported revisions are largely the result of data changes, with methodology changes introduced around the treatment of nuclear decommissioning (discussed in section 2) having no impact on public sector fiscal aggregates as the amended transactions are offset between the central government and public corporations sub-sectors.

Table 2 summarises revisions to the headline statistics presented in this bulletin and the previous publication (21 February 2017), while Figure 11 focuses solely on the revisions to public sector net borrowing excluding public sector banks (PSNB ex) in the current financial year-to-date between publications.

Table 2: Revisions between this bulletin and the previous bulletin

| UK, previous bulletin refers to the PSF bulletin published on 21 February 2017 | ||||||||

| £ billion1 (not seasonally adjusted) | ||||||||

| Net Borrowing | ||||||||

| Period | CG2 | LG3 | NFPCs4 | BoE5 | PSNB ex6 | PSND ex7 | PSND % of GDP | PSNCR ex8 |

| 2005/06 | 3.7 | 0.0 | -3.7 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| 2006/07 | -0.4 | 0.0 | 0.4 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| 2007/08 | -0.4 | 0.0 | 0.4 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| 2008/09 | -1.1 | 0.0 | 1.2 | 0.0 | 0.1 | 0.0 | 0.0 | 0.0 |

| 2009/10 | -1.2 | 0.0 | 1.3 | 0.0 | 0.1 | 0.0 | 0.0 | 0.0 |

| 2010/11 | -0.5 | 0.0 | 0.6 | 0.0 | 0.1 | 0.0 | 0.0 | 0.0 |

| 2011/12 | 0.0 | 0.0 | 0.1 | 0.0 | 0.1 | 0.0 | 0.0 | 0.0 |

| 2012/13 | 0.0 | 0.0 | 0.1 | 0.0 | 0.1 | 0.0 | 0.0 | 0.0 |

| 2013/14 | 0.0 | 0.0 | 0.1 | 0.0 | 0.1 | 0.0 | 0.0 | 0.0 |

| 2014/15 | 0.0 | -0.3 | 0.4 | 0.0 | 0.1 | 0.0 | 0.0 | 0.0 |

| 2015/16 | 0.2 | 0.0 | 0.1 | 0.0 | 0.3 | 0.0 | 0.0 | 0.0 |

| 2016/17 ytd10 | -3.2 | -0.5 | 0.4 | 0.0 | -3.3 | 2.9 | -0.3 | 18.8 |

| 2016 April | -0.2 | 0.0 | 0.0 | 0.0 | -0.1 | 0.7 | 0.0 | 1.1 |

| 2016 May | -0.3 | 0.0 | 0.0 | 0.0 | -0.3 | 0.7 | 0.1 | 2.9 |

| 2016 June | -0.1 | 0.0 | 0.0 | 0.0 | -0.1 | 0.7 | 0.1 | 1.6 |

| 2016 July | 0.1 | 0.0 | 0.0 | 0.0 | 0.2 | 0.8 | 0.1 | 1.3 |

| 2016 Aug | -0.4 | 0.0 | 0.0 | 0.0 | -0.4 | 0.7 | -0.1 | 1.6 |

| 2016 Sept | -0.4 | 0.0 | 0.0 | 0.0 | -0.3 | 0.7 | -0.1 | 3.5 |

| 2016 Oct | -0.6 | -0.2 | 0.1 | 0.0 | -0.8 | 0.6 | -0.2 | 0.9 |

| 2016 Nov | -0.2 | -0.2 | 0.1 | 0.0 | -0.3 | 0.5 | -0.3 | 1.0 |

| 2016 Dec | 0.4 | -0.2 | 0.1 | 0.0 | 0.2 | 0.5 | -0.4 | 1.2 |

| 2017 Jan | -1.5 | 0.0 | -0.2 | 0.0 | -1.6 | 2.9 | -0.3 | 3.7 |

| Source: Office for National Statistics | ||||||||

| Notes: | ||||||||

| 1. Unless otherwise stated. | ||||||||

| 2. Central government. | ||||||||

| 3. Local government. | ||||||||

| 4. Non-financial public corporations. | ||||||||

| 5. Bank of England. | ||||||||

| 6. Public sector net borrowing excluding public sector banks. | ||||||||

| 7. Public sector net debt excluding public sector banks. | ||||||||

| 8. Public sector cash requirement excluding public sector banks. | ||||||||

| 9. 2015/16 represents financial year ending 2016 (April 2015 to March 2016). | ||||||||

| 10. ytd = Year-to-date, April to January 2017. | ||||||||

Download this table Table 2: Revisions between this bulletin and the previous bulletin

.xls (36.9 kB)Revisions to net borrowing in the current financial year

Figure 11 compares the latest estimate of public sector net borrowing excluding public sector banks (PSNB ex) for the period April 2016 to January 2017, with that presented in the previous bulletin (21 February 2017).

This presentation splits PSNB ex into each of its 4 sub-sectors: central government, local government, public corporations and Bank of England (BoE).

Given that, in the current financial year-to-date, £39.2 billion of the £47.8 billion borrowed by the public sector was borrowed by central government, a further breakdown of central government current receipts and current expenditure is presented to reflect the significance of these components.

Since the previous bulletin, central government borrowing in the period April 2016 to January 2017 has been revised down by £3.2 billion, largely due to the increase in the estimates of receipt data. Of this:

- Corporation Tax receipts were revised up by £1.5 billion due to the inclusion of the latest Office for Budget Responsibility (OBR) forecast data (8 March 2017) being incorporated into HM Revenue and Customs (HMRC’s) forecast model

- Income Tax receipts were revised up by £1.2 billion due to updated data received from HMRC replacing previous estimates

- other receipts were revised up by £0.5 billion due to the recording of the receipt of a Deferred Prosecution Agreement payment imposed by the Serious Fraud Office (SFO) on Rolls-Royce PLC in January 2017

Revisions to net borrowing in earlier financial years

As a result of the inclusion of improved estimates of gross operating surplus data for Northern Irish Housing Associations in this month’s bulletin, public corporations’ net borrowing has been increased by £0.1 billion in each of the 8 financial years from that ending in March 2009, to date.

Figure 11: The latest estimate of public sector borrowing (excluding public sector banks) over the period April 2016 to January 2017, to that presented in the previous bulletin (21 February 2017)

Source: Office for National Statistics

Notes:

- PSNBex - Public sector net borrowing excluding public sector banks.

- CGNB - Central government net borrowing.

- LGNB - Local government net borrowing.

- PCNB - Non-financial public corporations' net borrowing.

- BoENB - Bank of England net borrowing.

- L&P - Land and property.

- I&W - Income and wealth.

- NICs - National insurance contributions.

- Contributions to EU - UK VAT, GNI and abatement contributions to the EU budget.

Download this image Figure 11: The latest estimate of public sector borrowing (excluding public sector banks) over the period April 2016 to January 2017, to that presented in the previous bulletin (21 February 2017)

.png (147.7 kB) .xls (67.6 kB)Revisions to net cash requirement in the current financial year

Since the previous publication, the estimate of public sector net cash requirement excluding public sector banks (PSNCR ex) in the current financial year has been increased by £18.8 billion. Of this:

- the estimate of the net cash requirement of UK Asset Resolution Ltd (UKAR) has been increased by £16.0 billion, with new data replacing previous estimates; large revisions of this nature are not uncommon when we replace monthly estimates with audited data, published in UKAR’s 6-monthly reports although the revisions this month are larger than usual

- as a result of quality assurance of our recording of the Term Funding Scheme (TFS) we have altered the end-of-month reporting date used, from published data, for the TFS loan liability; this improvement led to an upward revision of £3.0 billion of loan liabilities, reported in January - as a consequence the net cash requirement of BoE has increased by £3.0 billion in January 2017, with an offsetting reduction to the reported net cash requirement of BoE in February 2017

Revisions to net debt at the end of January 2017

Since the previous publication, the estimate of public sector net debt excluding public sector banks (PSND ex) recorded at the end of January has been increased by £3.7 billion. Of this:

- as a result of quality assurance of our recording of the Term Funding Scheme (TFS) we have altered the end-of-month reporting date used, from published data, for the TFS loan liability; this improvement led to an upward revision of £2.6 billion of loan liabilities reported in January 2017 and hence PSND ex

- new finance leasing data received this month has led to an increase in the level of central government gross debt of £0.6 billion since April 2016; this replacement of previous estimates has led to an upward revision of £0.6 billion of PSND ex reported in January 2017

The reporting of errors in the public sector finance dataset

It is important to note that revisions do not occur as a result of errors; errors lead to corrections and are identified as such when they occur.

There are no errors reported in this bulletin.

Nôl i'r tabl cynnwys10. International comparisons of borrowing and debt

The UK government debt and deficit for Eurostat statistical bulletin is published quarterly (in January, April, July and December each year), to coincide with when the UK and other European Union member states are required to report on their deficit (or net borrowing) and debt to the European Commission.

On 18 January 2017, we published the latest UK Government Debt and Deficit for Eurostat statistical bulletin, consistent with the November 2016 Public sector finance bulletin (21 December 2016). In this publication we stated that:

- general government gross debt was £1,652.0 billion at the end of March 2016, equivalent to 87.6% of gross domestic product (GDP); an increase of £47.9 billion on March 2015, or 0.2% points as a ratio of GDP

- general government deficit (or net borrowing) decreased by £19.1 billion to £76.3 billion (equivalent to 4.0% GDP) in the financial year-to-date March 2016, compared with the previous financial year

The data in this statistical bulletin present a £1.2 billion downward revision to general government deficit (or net borrowing); now standing at £75.1 billion in the financial year ending March 2016. The estimate of general government gross debt, at the end of March 2016, remains unchanged.

It is important to note that the GDP measure, used as the denominator in the calculation of the debt ratios in the UK government debt and deficit for the Eurostat statistical bulletin, differs from that used within the public sector finances statistical bulletin.

An article, The use of GDP in public sector fiscal ratio statistics explains that for debt figures reported in the monthly public sector finances, a 12-month GDP total centred on the month is employed, while in the UK government debt and deficit for Eurostat statistical bulletin the total GDP for the preceding 12 months is used.

Nôl i'r tabl cynnwys11. Quality and methodology

The public sector finances Quality and Methodology Information document contains important information on:

- the strengths and limitations of the data and how it compares with related data

- uses and users of the data

- how the output was created

- the quality of the output including the accuracy of the data

UK Statistics Authority assessment of public sector finances

On 8 November 2015, the UK Statistics Authority published its latest assessment report of public sector finances. The report confirmed the National Statistics status of the public sector finances bulletin subject to certain requirements being met.

In order to meet these requirements we published an article, Quality assurance of administrative data used in the UK public sector finances. This report provides an assessment of the administrative data sources used in the compilation of the Public sector finance statistics in accordance with the UK Statistics Authority’s Administrative Data Quality Assurance Toolkit.

How are classification decisions made?

Each quarter we publish a forward workplan outlining the classification assessments we expect to undertake over the coming 12 months. To supplement this, each month a classifications update is published which announces classification decisions made, and includes expected implementation points (for different statistics) where possible.

Classification decisions are reflected in the public sector finances at the first available opportunity and, where necessary outlined in this section of the statistical bulletin.

The Monthly statistics on the Public Sector Finances: A methodological guide was last updated in August 2012. We are currently working to update this publication in 2017.

Further details on classification decisions and data changes that impact on this (and future) publications

Blue Book 2017

In September 2017, the public sector finances will incorporate methodological improvements being implemented for the annual UK National Accounts publication, the Blue Book 2017. These improvements will include updated estimates for gross fixed capital formation (GFCF), specifically with regard to estimates for the cost of transfer of fixed assets (such as legal costs incurred at point of sale of a property) and the net acquisition of entertainment, literary and artistic originals (such as film and TV recordings).

The first of these improvements will not impact the fiscal aggregates for the financial year ending March 2015 onwards (either net investment or net borrowing) as public sector data sources already include expenditure on costs of transfer. There will be revisions for earlier financial years as a result of removing existing negative estimates of transfer costs.

The second of these improvements is expected to impact the public corporations sub-sector by both increasing net investment and decreasing current budget deficit by equal and offsetting amounts (expected to be less than £0.5 billion) in recent years, with no impact, therefore, on public sector net borrowing. It will not impact general government estimates.

We have published an article National Accounts articles: Impact of Blue Book 2017 changes on current price gross domestic product estimates, 1997 to 2012 explaining these methodological improvements in more detail.

Supporting documentation

Documentation supporting this publication is available in appendices to the bulletin.

- Appendix A – Public Sector Finances Tables 1 to 10

- Appendix B – Large impacts on public sector fiscal measures excluding financial intervention (one off events)

- Appendix C – Revisions analysis on several main components of the central government account (current receipts, current expenditure, net borrowing and net cash requirement)

- Appendix D – Public sector current receipts table

- Appendix E – Impact of the reclassification of housing associations into the public sector; the financial year ending March 2009 to the financial year ending March 2016

- Appendix F – Supplementary fiscal measures

- Appendix G – Revisions to the first reported estimates of financial-year public sector net borrowing (excluding public sector banks) by sub-sector

Public sector borrowing by sub-sector

Each month, at 9.30am on the working day following the public sector finance statistical bulletin, we publish Public Sector Finances borrowing by sub-sector. This release contains an extended breakdown of public sector borrowing in a matrix format and also estimates of Total Managed Expenditure (TME).

Nôl i'r tabl cynnwys