Cynnwys

- Main points

- Latest indicators at a glance

- Business impacts and insights

- UK spending on debit and credit cards

- Restaurant seated diners

- Online job adverts

- Retail footfall

- Social impact of the coronavirus

- Road traffic in Great Britain

- Data

- Glossary

- Measuring the data

- Strengths and limitations

- Related Links

1. Main points

The proportion of UK businesses' workforce who are reported to be on furlough has decreased to 6% (approximately 1.5 million people) in early June 2021; this is the lowest level reported since the furlough scheme began (Initial results from Wave 33 of the Business Insights and Conditions Survey (BICS)). See Section 3.

In the week to 17 June 2021, the aggregate CHAPS-based indicator of credit and debit card purchases decreased by 5 percentage points from the previous week to 90% of its February 2020 average level; all spending categories except for "work-related" spending decreased in the latest week (Bank of England CHAPS data). See Section 4.

In the week to Monday 21 June 2021, the seven-day average estimate of UK seated diners was at 128% of its level in the equivalent week of 2019, an increase of 9 percentage points from the previous week (OpenTable). See Section 5.

On 18 June 2021, the volume of online job adverts had increased slightly by 2% when compared with a week ago and remained substantially above the level seen before the coronavirus (COVID-19) pandemic, at 129% of its February 2020 average level (Adzuna). See Section 6.

In the week to 19 June 2021, overall retail footfall in the UK saw a weekly decrease of 3% and was at 77% of the level seen in the equivalent week of 2019 (Springboard). See Section 7.

The proportion of working adults in Great Britain who in the past seven days travelled to work (either exclusively or in combination with working from home) remained unchanged from the previous week at 64% (Opinions and Lifestyle Survey (OPN) 16 to 20 June 2021). See Section 8.

The volume of motor vehicle traffic on Monday 21 June 2021 was at 97% of the level seen on the Monday of the first week of February 2020, a slight decrease of 2 percentage points from a week ago (Department for Transport (DfT)). See Section 9.

There were 13,658 company incorporations in the week to 18 June 2021, a 2% decrease from the previous week (13,955), but 8% higher than the equivalent week in 2019 (12,642) (Companies House). See the accompanying dataset.

There were 6,494 voluntary dissolution applications in the week to 18 June 2021, broadly similar to the previous week (6,424), but 33% higher than the equivalent week of 2019 (4,882) (Companies House). See the accompanying dataset.

In the week ending 20 June 2021, average counts of traffic camera activity for cars decreased slightly in London and the North East of England by 3% and 1%, respectively, compared with the previous week; despite this they remain above their pre-pandemic levels (week ending 22 March 2020) (Transport for London, North East Traffic Cameras). See the accompanying dataset.

The overall price of items in the online food and drink basket was unchanged in the latest week ending 20 June 2021; the main upward contribution came from "mineral waters, soft drinks and juices", but this was largely offset by price decreases for "sugar, jam, syrup, chocolate and confectionery" and "vegetables including potatoes and tubers" (Online price collection). See the accompanying dataset.

Results presented in this bulletin are experimental and may be subject to revision.

2. Latest indicators at a glance

Embed code

3. Business impacts and insights

Initial results from Wave 33 of the Business Insights and Conditions Survey (BICS) cover the reference period 31 May to 13 June 2021, with a response rate of 21.8% (8,415 responses). The survey was live for the period 14 to 22 June 2021.

Figure 1: The proportion of UK businesses’ workforce who are reported to be on furlough has decreased to 6% in early June 2021, the lowest level reported since the furlough scheme began

Headline indicators from the Business Insights and Conditions Survey (BICS), 31 May to 22 June 2021

Embed code

Notes:

Initial weighted results, Wave 33 of Office for National Statistics' (ONS') Business Insights and Conditions Survey (BICS).

A detailed description of the weighting methodology and the weights used for each variable is available in Business Insights and Conditions Survey (BICS).

Download this chart

Across all UK industries in Wave 33:

86% of businesses had been trading for more than the last two weeks

2% of businesses had started trading within the last two weeks after a pause in trading

2% of businesses had paused trading but intend to restart in the next two weeks (unchanged from Wave 32)

6% of businesses had paused trading and do not intend to restart in the next two weeks (unchanged from Wave 32)

4% of businesses had permanently ceased trading (unchanged from Wave 32)

| All Industries | |

|---|---|

| Turnover has increased by more than 50% | 1% |

| Turnover has increased between 20% and 50% | 3% |

| Turnover has increased by up to 20% | 10% |

| Turnover has not been affected | 46% |

| Turnover has decreased by up to 20% | 15% |

| Turnover has decreased between 20% and 50% | 10% |

| Turnover has decreased by more than 50% | 5% |

| Not sure | 10% |

Download this table Table 1: 30% of businesses saw a decrease in turnover in early June 2021 compared with what is normally expected this time of year, the lowest proportion seen since the series began in June 2020

.xls .csvThe initial result of 6% of businesses' workforce on furlough leave in early June 2021 equates to approximately 1.5 million people. This number is based on multiplying the BICS weighted furlough proportions by HM Revenue and Customs (HMRC) Coronavirus Government Retention Scheme (CJRS) official statistics eligible employments1 for only those industries covered by the BICS sample

Notes for: Business impacts and insights

- An "employment" in the HMRC CJRS Official Statistics is defined as anyone who meets the scheme criteria set out within the published guidance, and data come from the whole population of HMRC CJRS claims (those applied) and Pay As You Earn (PAYE) Real Time Information systems (RTIs). The assessment of whether a person was employed on the qualifying dates is based on the methodology used for the joint HMRC and Office for National Statistics (ONS) statistics release, Earnings and employment from Pay As You Earn Real Time Information.

4. UK spending on debit and credit cards

Daily CHAPS-based indicator

These data series are experimental faster indicators for estimating UK spending on credit and debit cards. They track the daily CHAPS payments made by credit and debit card payment processors to around 100 major UK retail corporates. These payments are the proceeds of recent credit and debit card transactions made by customers at their stores, both via physical and via online platforms.

More information on the indicator is provided in the accompanying methodology article.

Companies are allocated to one of four categories based on their primary business:

"staples" refers to companies that sell essential goods that households need to purchase, such as food and utilities

"work-related" refers to companies providing public transport or selling petrol

"delayable" refers to companies selling goods whose purchase could be delayed, such as clothing or furnishings

"social" refers to spending on travel and eating out

Figure 2: In the week to 17 June 2021, the aggregate CHAPS-based indicator of credit and debit card purchases decreased by 5 percentage points from the previous week, to 90% of its February 2020 average

Index February 2020 = 100, a backward looking seven-day rolling average, 13 January 2020 to 17 June 2021, non-seasonally adjusted, nominal prices

Source: Office for National Statistics and Bank of England calculations

Notes:

- Users should note the daily payment data is the sum of card transactions processed up to the previous working day, so there is slight time lag when compared with real-life events on the chart.

- The vertical lines indicate key events. In order, the events are: first national lockdown begins; some non-essential shops allowed to reopen; regional restrictions begin in England; Christmas period; lockdowns announced in England and Scotland; reopening of non-essential shops, and outdoor pubs and restaurants in England; further easing of lockdown restrictions, including re-opening of indoor pubs and restaurants in England.

- Percentage point difference is derived from current week and previous week index before rounding.

- Data for one sub-sector with 5% weight in the "social" spending category has had to be imputed in the latest week because of data availability issues

Download this chart Figure 2: In the week to 17 June 2021, the aggregate CHAPS-based indicator of credit and debit card purchases decreased by 5 percentage points from the previous week, to 90% of its February 2020 average

Image .csv .xlsFigure 2 shows changes in the value of CHAPS payments received by large UK corporates from their credit and debit card processors, "merchant acquirers".

In the week to 17 June 2021, the CHAPS-based indicator of credit and debit card purchases in aggregate decreased by 5 percentage points from the previous week to 90% of its February 2020 average level. All spending categories except for "work-related" spending decreased in this latest week:

"work-related" spending was unchanged

"staple" fell by 6 percentage points

"delayable" fell by 5 percentage points

"social" fell by 4 percentage points

In the latest week, "staple" and "work-related" spending were above their February 2020 average levels, at 105% and 111%, respectively. Conversely, "delayable" and "social" spending were at 84% and 79% of their February 2020 average levels, respectively.

Despite its fall in recent weeks, the aggregate CHAPS-based indicator has grown since the period just before restrictions eased in England on 12 April 2021, with its level up by 7 percentage points in the week to 17 June 2021 from that seen in the week to 8 April 2021. All consumption categories except for “staples” have seen an increase in spending over this period. “Work-related” spending has seen the largest rise, by 26 percentage points, whilst “delayable” has also seen a substantial increase of 20 percentage points. “Social” spending saw a relatively smaller increase of 7 percentage points whilst “staples” has decreased by 11 percentage points since the week to 8 April 2021.

The full data time series available for data on UK spending on debit and credit cards can be found in the accompanying dataset.

Nôl i'r tabl cynnwys5. Restaurant seated diners

OpenTable is a provider of data for online restaurant reservations, with daily data for the UK, London and Manchester being publicly available in its The state of the industry dashboard. These data show the impact of recent events and restrictions on the hospitality industry using a sample of restaurants on the OpenTable network across all channels, that is, online reservations, phone reservations, and walk-ins.

Figure 3: In the week to Monday 21 June 2021, the seven-day average estimate of UK seated diners was at 128% of its level in the equivalent week of 2019

Seated diners, seven-day average, percentage compared with the equivalent week of 2019, week ending 24 February 2020 to week ending 21 June 2021, UK, London and Manchester

Source: OpenTable

Notes:

- Data show the percentage of seated diners when compared with the same week in 2019. For example, Week 24 2021 is compared with Week 24 2019.

- Please note that data for Manchester are only available from week ending 16 November 2020.

Download this chart Figure 3: In the week to Monday 21 June 2021, the seven-day average estimate of UK seated diners was at 128% of its level in the equivalent week of 2019

Image .csv .xlsIn the week to Monday 21 June 2021, the seven-day average estimate of UK seated diners was at 128% of the level seen in the equivalent week of 2019. This is a 9-percentage point increase when compared with the previous week's index. The seven-day average estimate of UK seated diners for the week to 21 June 2021 has grown by 71 percentage points when compared with the week to Monday 19 April 2021, just after the re-opening of outdoor hospitality in England on 12 April.

In the same week, the seven-day average estimate of seated diners in London was at 75% of its level in the equivalent week of 2019, a 3-percentage point increase when compared with the previous week's index. The equivalent figure in Manchester was 137%, unchanged from the previous week.

Nôl i'r tabl cynnwys6. Online job adverts

Job adverts by category

These figures are experimental estimates of online job adverts provided by Adzuna, an online job search engine, by category, by UK country and English region. The number of job adverts over time is an indicator of the demand for labour. The Adzuna categories used do not correspond to Standard Industrial Classification (SIC) categories, so these values are not directly comparable with the Office for National Statistics (ONS) Vacancy Survey.

Users should note that from 17 June 2021 onwards, week-on-week changes in online job advert volumes are outlined as percentages, rather than as percentage point changes. Percentage change figures quoted in the commentary will therefore not necessarily match the percentage point changes observed in the charts and accompanying dataset.

Figure 4: On 18 June 2021, the total volume of online job adverts increased slightly by 2% compared with a week ago and remained above pre-pandemic levels at 129% of its February 2020 average

Volume of online job adverts by category, index: 100 = February 2020 average, 4 January 2019 to 18 June 2021, non-seasonally adjusted

Embed code

Notes:

- Further category breakdowns are included in the Online job advert estimates dataset and more details on the methodology can be found in Using Adzuna data to derive an indicator of weekly vacancies.

Download this chart

On 18 June 2021, the total volume of online job adverts in the UK had increased slightly by 2% from the previous week (11 June 2021). After notable growth in most categories over the past eight weeks, online job advert levels have stabilized for the second consecutive week.

Compared with the previous week, and excluding the “unknown” category, the volume of online job adverts had increased in 19 out of the 28 categories, remained unchanged in three categories, and decreased in six categories.

There were notable weekly increases in online job advert volumes in the “legal” and “graduate” categories, which saw increases of 7% and 6%, respectively. The largest week-on-week falls were in the “wholesale and retail” and “domestic help” categories which fell by 4% and 3% when compared with a week ago, respectively.

On 18 June 2021, the total volume of online job adverts remained substantially higher than pre-pandemic levels at 129% of its February 2020 average level. Of the 28 categories, only three were below pre-pandemic levels; the “energy, oil and gas” and “graduate” categories were both at 92% of their February 2020 average levels, while “legal” was at 98%.

Job adverts by region

Figure 5: On 18 June 2021, the volume of online job adverts had increased across all English regions when compared with a week ago

Volume of online job adverts by UK countries and English regions, index: 100 = February 2020 average, 4 January 2019 to 18 June 2021, non-seasonally adjusted

Embed code

Download this chart

On 18 June 2021, the volume of online job adverts had increased in all English regions compared with 11 June 2021. In the same period, Scotland and Northern Ireland both recorded respective week-on-week decreases of 2% and 5% while the number of online job adverts in Wales remained broadly unchanged. The largest week-on-week increases were in the East of England, the North East, London and the East Midlands which all increased by 3% from 11 June 2021.

The volume of online job adverts remained above their February 2020 average levels in all UK countries and English regions on 18 June 2021. They were strongest, when compared with pre-pandemic levels, in the North East and the East Midlands, where online job adverts stood at 174% and 163% of their February 2020 average level, respectively. Meanwhile, they were relatively weakest in London, where the corresponding figure was 107%.

Nôl i'r tabl cynnwys7. Retail footfall

National retail footfall

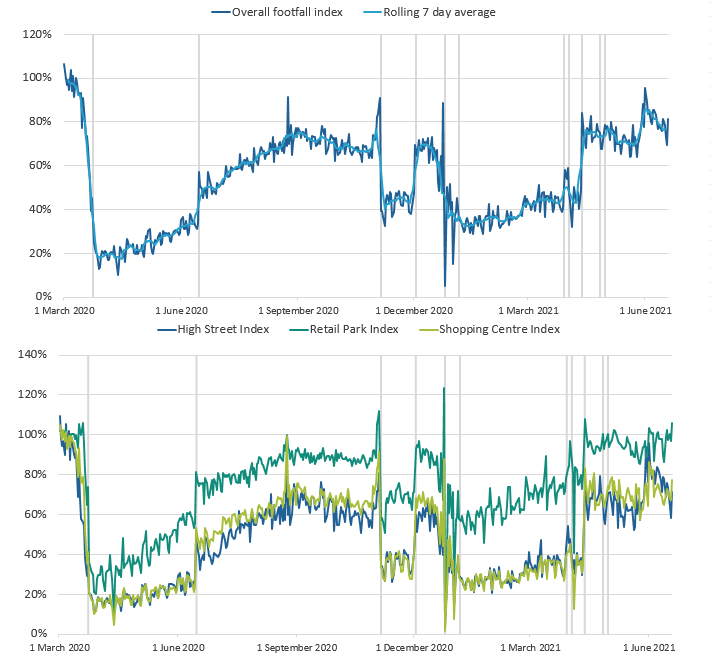

National footfall figures are supplied by Springboard, a provider of data on customer activity. It measures the following for overall UK retail footfall, as well as by high street, retail park, and shopping centre categories:

daily retail footfall as a percentage of its level on the same day of the equivalent week of 2019; for example, Saturday 19 June 2021 is compared with Saturday 15 June 2019

total weekly retail footfall as a percentage of its level in the equivalent week of 2019

the percentage change in weekly footfall compared with the previous week; for example, Week 24 of 2021 is compared with Week 23 of 2021

Springboard's weekly data are defined over a seven-day period running from Sunday to Saturday; Week 24 of 2021 therefore refers to the period Sunday 13 June 2021 to Saturday 19 June 2021

Figure 6: In the week to 19 June 2021, UK retail footfall was at 77% of its level in the equivalent week of 2019

Volume of overall daily retail footfall, percentage compared with the equivalent day of the equivalent week of 2019, 1 March 2020 to 19 June 2021

Source: Springboard and the Department for Business, Energy and Industrial Strategy

Notes:

- The vertical lines indicate notable events. In order, the events are: first national lockdowns begin; restrictions begin to ease across the UK; circuit-breaker lockdown in England; circuit breaker replaced with regional restrictions; Christmas; lockdown begins in England; "stay at home" rule ends in England; Easter; reopening of non-essential retail in England and Wales; reopening of non-essential retail in Scotland; reopening of non-essential retail in Northern Ireland.

- Prior to 3 January 2021, overall and regional daily footfall indices were generated by comparing footfall against its level on the same day of the equivalent week the year before. From this date onwards they were generated by comparing footfall against its level on the same day of the equivalent week in 2019. For a two-day period, from 1 January 2021 to 2 January 2021 daily indices were therefore generated using a 2021 versus 2020 comparison.

Download this image Figure 6: In the week to 19 June 2021, UK retail footfall was at 77% of its level in the equivalent week of 2019

.png (96.0 kB)According to Springboard, overall retail footfall in the week to 19 June 2021 decreased by 3% compared with the previous week (week to 12 June 2021). This is the third consecutive week to see a decrease in retail footfall, following an increase immediately after the easing of lockdown restrictions in April 2021. Despite this, in the latest week to 19 June 2021, retail footfall was at 77% of its level in the equivalent week of 2019, the fourth-highest volume as a proportion of its 2019 level seen since the beginning of the year.

Comparing retail locations, in the same week to 19 June 2021, footfall as a proportion of its level in the equivalent week of 2019 was strongest at retail parks at 100%, whereas the corresponding figures for shopping centres and high streets were 71% and 70%, respectively. Compared with the previous week (week to 12 June 2021), footfall at high streets saw a week-on-week decrease of 5%, whereas footfall at retail parks and shopping centres was broadly unchanged.

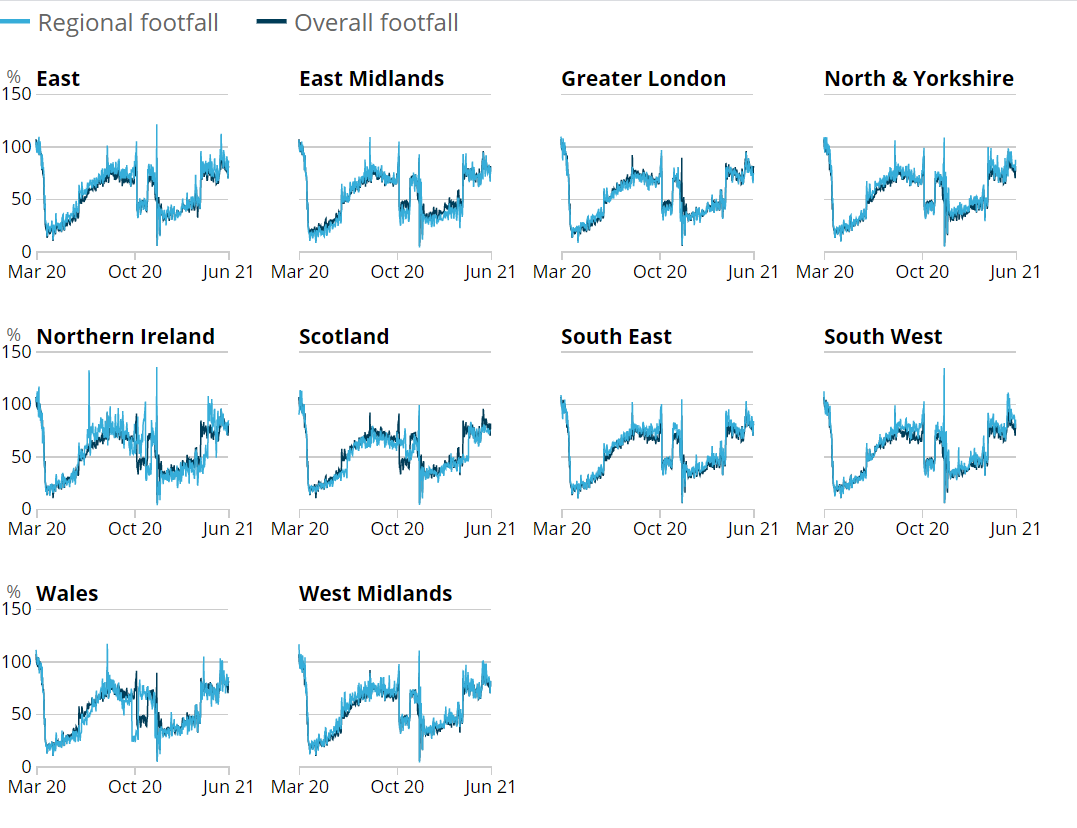

Regional retail footfall

Figure 7: In the week to 19 June 2021, retail footfall was strongest in South West England compared with other UK regions for a third consecutive week, at 86% of its level in the equivalent week of 2019

Volume of daily retail footfall, percentage of the level recorded on the same day of the equivalent week of 2019, UK countries and English regions, 1 March 2020 to 19 June 2021

Source: Springboard and the Department for Business, Energy and Industrial Strategy

Download this image Figure 7: In the week to 19 June 2021, retail footfall was strongest in South West England compared with other UK regions for a third consecutive week, at 86% of its level in the equivalent week of 2019

.png (116.6 kB)According to Springboard, in the week to 19 June 2021, retail footfall saw week-on-week percentage decreases across all UK countries and English regions, except for Wales. The largest weekly percentage decrease in retail footfall was in Greater London, where it fell by 6%. South East England and the East of England both saw weekly decreases of 4%. Meanwhile, retail footfall in Wales saw a weekly increase of 5%.

In the same week, retail footfall when compared with levels seen in the equivalent week of 2019 was strongest in South West England, Wales and the North & Yorkshire at 86%, 83%, and 82%, respectively.

In contrast, retail footfall was weakest in Greater London, Scotland and the East Midlands. Their retail footfall levels in the week to 19 June 2021 were at 73%, 76% and 76% of the equivalent week of 2019, respectively.

Nôl i'r tabl cynnwys9. Road traffic in Great Britain

According to Department for Transport (DfT) non-seasonally adjusted road traffic data, the volume of all motor vehicle traffic on Monday 21 June 2021 was at 97% of the level seen on Monday of the first week of February 2020. This has decreased slightly by 2 percentage points from Monday 14 June 2021 but remains substantially higher (13 percentage points) than 29 March 2021, when the "stay at home" restrictions ended in England.

Compared with last week, the volume of road traffic on Monday 21 June 2021 for light commercial vehicles and cars decreased slightly by 2 percentage points to 109% and 93% of their levels seen on the same day of the first week of February 2020. Over the same period, road traffic for heavy goods vehicles remained broadly unchanged at 108% of its level in the first week of February 2020.

Figure 8: The volume of motor vehicle traffic on Monday 21 June 2021 was at 97% of the level seen in the first week of February 2020, a slight decrease of 2 percentage points from a week ago

Daily road traffic index: 100 = same traffic as the equivalent day of the week in the first week of February 2020, 1 March 2020 to 21 June 2021, non-seasonally adjusted

Embed code

Notes:

- The blue shaded areas refer to periods when restrictions across the UK were in effect. In order, these were: first national lockdown in the UK (23 March 2020) to easing of restrictions with non-essential shops reopening in England (15 June 2020); second lockdown in England (5 November 2020) to lockdown being replaced with three-tier system in England (2 December 2020); third lockdown announced in Scotland and England (4 January 2021) to “stay at home” restrictions ending in England (29 March 2021).

Download this chart

The daily DfT estimates are indexed to the first week of February 2020 and the comparison is with the same day of the week. The data provided are useful as an indication of traffic change rather than actual traffic volumes. More information on the methods, quality and economic analysis for these indicators can be found in the DfT methodology article.

Nôl i'r tabl cynnwys10. Data

UK spending on credit and debit cards

Dataset | Released 24 June 2021

Experimental indicator for monitoring UK retail purchases derived from the Bank of England's CHAPS data.

Shipping indicators

Dataset | Released 17 June 2021

Experimental weekly and daily ship visits dataset covering UK ports.

Traffic camera activity

Dataset | Released 24 June 2021

Experimental daily traffic camera counts data for busyness indices covering the UK.

Online job advert estimates

Dataset | Released 24 June 2021

Experimental job advert indices covering the UK online job market.

Company Incorporations and Voluntary Dissolutions

Dataset | Released 24 June 2021

The number of weekly Companies House Incorporations and Voluntary Dissolution applications accepted.

Online weekly price changes

Dataset | Released 24 June 2021

Experimental estimates of online price changes for a selection of food and drink products from several large UK retailers.

11. Glossary

Faster indicator

A faster indicator provides insights into economic activity using close-to-real-time big data, administrative data sources, rapid response surveys or Experimental Statistics, which represent useful economic and social concepts.

Company incorporations

Incorporations are when a company is added to the Companies House register of limited companies. This can also include where an existing business applies to become a limited company, where it was not one before.

Voluntary dissolution applications

A voluntary dissolution application is when a company applies to begin dissolution proceedings. As such, they effectively chose to be removed from the Companies House register. For a company to be eligible to voluntarily dissolve, it should not have completed any trading activity for a period of three months.

Nôl i'r tabl cynnwys12. Measuring the data

Office for Statistics Regulation (OSR) publishing review

The Office for Statistics Regulation (OSR) is undertaking a review into whether the 9:30am release time stated in the Code of Practice for Statistics meets the needs of users. During the pandemic, exemptions were granted to allow the release of market sensitive statistics at 7:00am. OSR welcomes views about the release time of official statistics by Friday 25 June 2021. Please send comments to: regulation@statistics.gov.uk.

UK Coronavirus (COVID-19) Restrictions

A full overview of coronavirus (COVID-19) restrictions for each of the four UK constituent countries can be found here:

These restrictions should be considered when interpreting the data featured throughout this bulletin.

Nôl i'r tabl cynnwys13. Strengths and limitations

Information on the strengths and limitations of the indicators in this bulletin is available in the Coronavirus and the latest indicators of the UK economy and society methodology.

Nôl i'r tabl cynnwys

8. Social impact of the coronavirus

This section includes some provisional results from the Opinions and Lifestyle Survey (OPN) covering the period 16 to 20 June 2021. The survey went out to 6,024 adults in Great Britain and had a response rate of 69%.

Further information to help understand the impact of the coronavirus (COVID-19) pandemic on people, households, and communities in Great Britain will be available in Coronavirus and the social impacts on Great Britain due to be published on 25 June 2021.

Travelling to work

In the period 16 to 20 June 2021, the proportion of working adults in Great Britain who in the past seven days:

travelled to work (either exclusively or in combination with working from home) remained unchanged compared with the previous week (9 to 13 June) at 64%

worked exclusively from home was similar to the previous week at 22% (23% in the previous week)

neither travelled to work, nor worked from home was similar to the previous week at 14% (13% in the previous week)

Shopping

Of the 96% of adults that reported they had left home in the past seven days, the proportion that did so to shop for food and medicine remained similar to the previous week at 82% (84% in the previous week).

The proportion of these adults who shopped for things other than food and medicine in the last seven days was unchanged from the previous week at 44%.

From 9 June 2021, there has been a change to how the question regarding people's reasons for leaving home is asked to try to reduce burden on survey respondents. Although the same response options to those provided in previous weeks of the survey remain, we advise caution in comparing estimates collected on or after 9 June 2021 with those published prior to 9 June 2021.

Nôl i'r tabl cynnwys