Cynnwys

- Main points

- Things you need to know about this release

- What is the overall picture in 2016?

- Around half of UK trade in services in 2016 was with Europe

- Professional, scientific and technical activities were the dominant industry grouping for UK trade in services in 2016

- Services between related enterprises was a main service traded globally by the UK in 2016

- Quality and methodology

1. Main points

Total UK exports of services (excluding travel, transport and banking) showed record growth in 2016, rising from £123.2 billion in 2015 to £142.7 billion in 2016, an increase of 15.8%.

Total UK imports of services (excluding travel, transport and banking) also showed record growth in 2016 and rose by £10.2 billion to a total of £68.7 billion, an increase of 17.4%.

The information and communication sector showed the largest growth in 2016 for both UK exports and imports of services in 2016, rising by £6.5 billion and £5.1 billion respectively.

The European Union was the geographic area that saw the largest increases in total UK exports and imports of services with rises of £9.2 billion and £5.0 billion respectively in 2016.

UK exports of financial services products made the largest contribution to the rise in 2016 increasing from £14.9 billion in 2015 to £18.4 billion.

2. Things you need to know about this release

The 2016 International Trade in Services (ITIS) publication provides a detailed breakdown of annual trade in services estimates, analysing data by country, product and industry. These data are sourced from our International Trade in Services survey.

The ITIS survey is the main source of UK services trade data, although it is important to note that the survey does not cover the whole of the UK services economy. The travel, transport and banking industries of the economy are not covered by the ITIS survey, as these data are obtained from other sources such as the International Passenger Survey and the Bank of England. Estimates for the overall level of trade in services, including these industries, are published in our annual Pink Book and monthly UK trade publications.

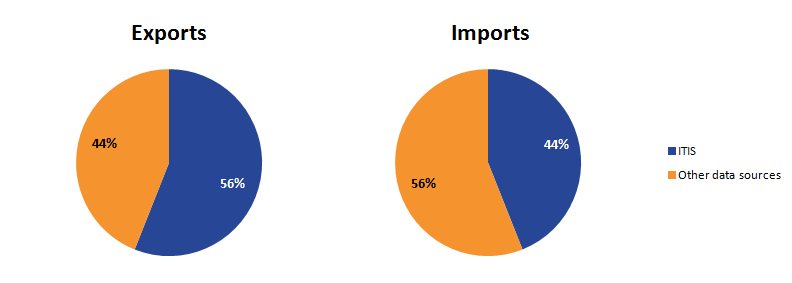

Based on the 2016 estimates, the ITIS survey data contributed approximately 56% and 44% respectively to the total trade in services export and import estimates for the whole of the UK. The contribution of the ITIS survey data to the overall trade in services total has remained stable in recent years, with increases seen in 2016 to the UK exports and imports contribution, from ITIS, of 2% and 3% respectively.

Figure 1: Percentage contribution of international trade in services to total trade in services, UK, 2016

Source: Office for National Statistics

Download this image Figure 1: Percentage contribution of international trade in services to total trade in services, UK, 2016

.png (12.4 kB) .xls (25.6 kB)Statistics presented in this bulletin include some estimates for businesses operating in the financial services industry and values of exports and imports of financial services products. The exclusion of banks and other related financial intermediaries does mean that these estimates only capture part of UK trade in financial services.

Reported trade for the “financial services” industries only captures the exports and imports of businesses involved in non-banking activities, such as:

businesses operating and supervising financial markets

security and commodity contract brokers who deal on behalf of others

auxiliary financial services such as transaction processing, settlement and advisory services

businesses involved in auxiliary insurance and pension activities such as risk, evaluation and sales

fund management services

Financial services products exported or imported by businesses operating in industries unrelated to financial services are also included.

Nôl i'r tabl cynnwys3. What is the overall picture in 2016?

Total UK exports of services (excluding the travel, transport and banking sectors) have followed an upward trend since comparable records began. This trend continued into 2016, with UK exports of services reaching a peak of £142,657 million. Growth in UK services exports in 2016 was the largest recorded in both value and percentage terms, having risen by £19,426 million or 15.8%.

Total UK imports of services (excluding the travel, transport and banking sectors) have also followed an upward trend since the comparable time series began. UK services imports continued to increase in 2016, rising by £10,210 million to £68,718 million, an increase of 17.4%.

Data from the International Trade in Services (ITIS) survey has traditionally shown that the UK has run a trade in services balance surplus, where the value of exports exceeds the value of imports. The larger increase in the value of UK services exports relative to imports in 2016 resulted in the surplus increasing to £73,939 million.

Figure 2: Total international trade in services (excluding travel, transport and banking), UK, 2001 to 2016

Source: Office for National Statistics

Notes:

- All values are at current prices (see the Quality and methodology section for a definition).

Download this chart Figure 2: Total international trade in services (excluding travel, transport and banking), UK, 2001 to 2016

Image .csv .xls4. Around half of UK trade in services in 2016 was with Europe

Europe has traditionally been a major destination for UK exports of services, accounting for slightly below half of total services exports in 2016. The value of UK exports (excluding the travel, transport and banking sectors) to Europe have followed an upward trend in recent years and showed record growth in 2016 of 17.8%, rising by £10,567 million to a peak of £70,085 million.

Growth in UK exports to Europe has been more subdued in recent years, with annual increases of 2.7% (2014) and 1.4% (2015). Most of the increase in 2016 was attributable to the European Union (EU), where UK exports rose by £9,169 million to a level of £53,267 million. In terms of individual countries, the increase in exports was driven by three main countries: Germany, the Republic of Ireland and France.

The Americas and Asia were the second- and third-largest destinations for UK services exports in 2016, accounting for 28% and 17% respectively. Both regions experienced increases in 2016, with the Americas rising by £5,622 million to £39,675 million and Asia rising by £3,326 million to £24,778 million.

Similarly to exports, Europe is also a major source of UK services imports, accounting for above half of the total value in 2016. The value of UK imports of services originating from Europe increased by £5,227 million to £36,710 million in 2016. The increase was driven by a rise in imports from the EU, which rose by £5,013 million to £30,879 million. Germany, the Netherlands and the Republic of Ireland were the main individual countries driving the increase.

Other important regions for UK services imports were the Americas and Asia, which accounted for 27% and 16% of the total value respectively in 2016. UK imports from the Americas saw a £3,237 million rise to £18,650 million in 2016, while imports from Asia rose by £1,597 million to £10,662 million.

Figure 3: UK international trade in services (excluding travel, transport and banking) exports by continent, 2016

Source: Office for National Statistics

Notes:

- All values are at current prices (see the Quality and methodology section for a definition).

- Geographical groupings can be found in the Quality and methodology section.

Download this chart Figure 3: UK international trade in services (excluding travel, transport and banking) exports by continent, 2016

Image .csv .xls5. Professional, scientific and technical activities were the dominant industry grouping for UK trade in services in 2016

UK exports of services by industry

Over half of the UK’s total services exports (excluding the travel, transport and banking industries) were from businesses operating in the professional, scientific and technical (£38,503 million) and information and communication (£36,531 million) industries in 2016. The two industry groupings also reported the largest growth in 2016, with exports from the information and communication industries rising by £6,535 million, while exports from the professional, scientific and technical industries rose by £2,743 million.

The types of services exported by UK businesses operating in the professional, scientific and technical industries were varied, but exports of “services between related enterprises”, “legal services”, “the provision of research and development services”, and “engineering services” were the dominant products within the grouping. Together they accounted for nearly half of all services exported by the professional, scientific and technical industries. Services between related enterprises cover the export and import of services products between companies within the same multinational group that are not captured in the other broad product categories, such as intercompany charges for services provided to a parent company by a subsidiary.

Compared with the previous year, the main services types seeing growth in exports within this industry grouping were “financial services” and “business management and management consulting services”.

Figure 4: UK international trade in services (excluding travel, transport and banking) exports by industry, 2016

Source: Office for National Statistics

Notes:

- All values are at current prices (see the Quality and methodology section for a definition).

Download this chart Figure 4: UK international trade in services (excluding travel, transport and banking) exports by industry, 2016

Image .csv .xlsUK imports of services by industry

The information and communication industries have been the largest grouping in terms of importing services into the UK since 2013, with the value of imports reaching £21,241 million in 2016, or slightly below one-third of all services imports. The professional, scientific and technical activities industries were the second-largest grouping, with imports of £16,592 million in 2016, or slightly below one-quarter of total services imports.

In terms of the type of services imported, UK businesses within the information and communication industries mainly imported “telecommunication services”, “computer services”, and “services between related enterprises”, which together accounted for above half of the industry grouping’s imports in 2016. Growth in the industry grouping’s imports in 2016 was mainly attributable to imports of “services between related enterprises”, which more than doubled to £3,413 million.

Figure 5: UK international trade in services (excluding travel, transport and banking) imports by industry, 2016

Source: Office for National Statistics

Notes:

- All values are at current prices (see the Quality and methodology section for a definition).

Download this chart Figure 5: UK international trade in services (excluding travel, transport and banking) imports by industry, 2016

Image .csv .xls7. Quality and methodology

Basic quality information

The International trade in services Quality and Methodology Information report contains important information on:

the strengths and limitations of these data and how they compare with related data

users and uses of these data

how the output was created

the quality of the output including the accuracy of data

Accuracy

Sampling error is the error caused by observing a sample instead of the whole population. While each sample is designed to produce the “best” estimate of the true population value, a number of equal-sized samples covering the population would generally produce varying population estimates. Sampling error is affected by a number of factors including sample size.

Sample surveys are used instead of censuses, because the process would be too lengthy and costly to be viable. Standard errors are an estimate of the sampling error and provide a measure of the precision of the estimate. A low standard error indicates a precise estimate. To aid comparison, the standard error is also expressed as a percentage of the total value. This quantity is called the coefficient of variation and it allows the standard errors to be put into context.

In addition to sampling errors, there is the potential for non-sampling error that cannot be easily quantified. For example, undetected deficiencies may occur in the survey register and errors may be made by the contributors when completing the survey questionnaires.

Table 1: Standard errors, 2016

| Exports | Imports | ||||||

|---|---|---|---|---|---|---|---|

| Industries | Estimate (£ million) | Standard error (£ million) | Relative Standard error (%) | Estimate (£ million) | Standard error (£ million) | Relative Standard error (%) | |

| Total ITIS | 142,657 | 1,767 | 1 | 68,718 | 572 | 1 | |

| Manufacturing | 14,248 | 99 | 1 | 8,522 | 105 | 1 | |

| Wholesale & Retail | 13,806 | 391 | 3 | 6,690 | 286 | 5 | |

| Information & Communication | 36,531 | 447 | 1 | 21,241 | 357 | 2 | |

| Professional, Scientific & Technical | 38,503 | 1,094 | 3 | 16,592 | 202 | 1 | |

| Administrative & Support Services | 8,482 | 647 | 8 | 3,330 | 223 | 8 | |

| Arts, Entertainment & Recreation | 4,375 | 44 | 1 | 1,932 | 15 | 1 | |

| Source: Office for National Statistics | |||||||

Download this table Table 1: Standard errors, 2016

.xls (28.2 kB)In addition to this sample, we also select approximately 9,000 businesses via the Annual Business Survey and have included results from the quarterly International Trade in Services (ITIS) survey collected for each of the quarters of 2016.

Non-response bias is a potential issue for all statistical surveys. Non-response bias occurs where the answers of respondents may have differed from the potential answers of non-responders. The risk of non-response bias is minimised by efforts to maximise response rates. Estimation techniques can attempt to correct for any bias that might be present. Despite this, it is not easy, on any survey, to quantify the extent to which non-response bias remains a problem. However, there is no evidence to suggest that non-response bias presents a particular issue for the ITIS survey.

Imputation methods are used to estimate values for all businesses in the sample that did not return data. Estimation methods are used to estimate values for all non-sampled businesses within the population to produce an overall estimate for the population.

The response rate for the 2016 annual survey is shown in Table 2.

Table 2: International Trade in Services survey response rates, UK, 2016

| UK | |

|---|---|

| 2016 Results | |

| Sample size | 15,637 |

| Forms with response | 13,584 |

| Forms non response | 2,053 |

| Overall response rate (%) | 87 |

| Source: Office for National Statistics | |

Download this table Table 2: International Trade in Services survey response rates, UK, 2016

.xls (25.6 kB)Notes to tables

The tables present ITIS estimates through a variety of formats. Some tables compare figures over several years but the majority provide the most recent geographic information by industry or product. The tables provide information in as much detail as possible without disclosing the details of any individual companies. Any disclosive data are replaced by the following symbol throughout the tables “..”. It is important to note that within the geographical tables, amounts are shown against the geographical area from which they were received, irrespective of where they were first earned.

European Free Trade Association (EFTA) comprises of Iceland, Liechtenstein, Norway and Switzerland. The sum of constituent items in tables may not always agree exactly with the totals shown due to rounding. The following symbols have been used throughout:

“..” is used for figures suppressed to avoid disclosure of information relating to individual enterprises

“–” is used for nil or less than half the final digit shown

Values shown are in current prices, which refer to the price at which the services were either bought or sold in the market.

Guidance on interpreting international trade in services statistics

The ITIS survey collects data relating to the amounts spent on both the imports and exports of UK businesses and collects geographical information as to where the services have either been imported from or exported to.

Types of transactions covered

Product: The statistical output from the ITIS survey covers the value of transactions between the UK and residents in other countries in respect of 52 products. The 2013 ITIS questionnaire was revised in accordance with new international regulations. A breakdown showing the service products collected up to 2012 and from 2013 onwards can be found in Table 3.

Table 3: International Trade in Services (ITIS) questionnaire codes 2012 to 2013 onwards, UK

| Questionnaire breakdown up to and including 2012 | Questionnaire breakdown 2013 onward |

|---|---|

| 01. Agricultural Services | 01. Agricultural, forestry and fishing services |

| 02. Mining Services | 02. Mining and oil gas extraction services |

| 03. Waste treatment and depollution | 03. Waste treatment and depollution services |

| 04. Other on-site processing services | 04. Manufacturing services on goods owned by others |

| 05. Maintenance and repair services | |

| 05. Accountancy, auditing, bookkeeping and tax consulting services | 06. Accountancy, auditing, bookkeeping and tax consulting services |

| 06. Advertising | 07. Advertising, market research and public opinion polling services |

| 07. Management consulting | 08. Business management and management consulting services |

| 08. Public relations services | 09. Public relations services |

| 09. Recruitment and training | 10. Recuritment services |

| 10. Other business management services (see 7) | 08. Business management and management consulting services |

| 11. Legal services | 11. Legal services |

| 12. Market research and public opinion polling (see 6) | 07. Advertising, market research and public opinion polling services |

| 13. Operational leasing services | 12. Operating leasing services |

| 14. Procurement | 13. Procurement services |

| 15. Property management | 14. Property management services |

| 16. Research & Development | 16. Provision of R&D services |

| 17. Provision of product development and testing activities | |

| 17. Services between related enterprises | 51. Transactions between related businesses not included elsewhere |

| 18. Other business and professional services | 15. Other business and professional services |

| 19. Postal and courier services | 21. Postal and courier services |

| 20. Telecommunication services | 22. Telecommunication services |

| 21. Computer services | 23. Computer services |

| 22. News agency services | 25. News agency services |

| 23. Publishing services | 24. Publishing services |

| 24. Other information provision services | 26. Information services |

| 25. Construction in the UK | 27. Construction in the UK |

| 26. Construction outside the UK | 28. Construction outside the UK |

| 27. Financial services | 29. Financial services |

| 28. Auxilliary services | 36. Auxilliary services |

| 29. Claims | 32. Freight insurance claims |

| 30. Premiums | 33. Freight insurance premiums |

| 31. Claims | 30. Life insurance claims |

| 32. Premiums | 31. Life insurance premiums |

| 33. Claims | Removed |

| 34. Premiums | Removed |

| 35. Claims | 34. Other direct insurance claims |

| 36. Premiums | 35. Other direct insurance premiums |

| No equivalent | 37. Pension service receipts |

| No equivalent | 38. Pension service charges |

| No equivalent | 39. Standardised guarantee service claims |

| No equivalent | 40. standardised guarantee service premiums |

| 37. Merchanting | 41. Merchanting |

| 38. Other trade-related services | 42. Other trade-related services |

| 39. Audio-visual and related services | 43. Audio-visual and related services |

| 40. Health services | 44. Health services |

| 41. Training and educational services | 45. Training and educational services |

| 42. Other personal, cultural and recreational services | 46. Heritage and recretional services |

| 43. Use of franchise and similar rights fees | 18b. Charges or payments for the use of the above, but without transfer of ownership |

| 44. Other royalties and license fees | 19b. Charges or payments for the use of the above, but without transfer of ownership |

| 45. Purchases ans sales of franchises and similar rights | 20b. Charges or payments for the use of the above, but without transfer of ownership |

| 46. Purchases ans sales of other royalties and licenses | 18a. Outright sales and purchases of the above, resulting in transfer of ownership |

| 19a. Outright sales and purchases of the above, resulting in transfer of ownership | |

| 20a. Outright sales and purchases of the above, resulting in transfer of ownership | |

| 42. Other personal, cultural and recreational services | 47. Social, domestic and other personal services |

| 47.Architectural | 48. Architectural services |

| 48. Engineering | 49. Engineering services |

| 49.Surveying (see 50) | 50. Scientific and other technical services (including surveying) |

| 50. Other technical services (see 49) | |

| 51. Other trade in services | 52. Other trade in services |

| Source: Office for National Statistics | |

Download this table Table 3: International Trade in Services (ITIS) questionnaire codes 2012 to 2013 onwards, UK

.xls (32.3 kB)Industry: The industry analysis enables estimation for the total international transactions in services by economic classification for well-defined areas of the economy using Standard Industrial Classification (SIC) information. Data from 2009 in this publication have been published in SIC 2007 classification, which is an internationally-recognised classification. This provides a framework for the collection, tabulation, presentation and analysis of data about economic activities. Prior to 2009, SIC 2003 classification was used.

Geographical: Both industry and product information are analysed geographically. The tables within this publication show the countries to which services are exported and from which services are imported. The geographical groupings used in the tables can be found in Table 4.

Table 4: Geographical groupings for the International Trade in Services survey

| Europe | The Americas | Asia | Australasia & Oceania | Africa |

|---|---|---|---|---|

| SPECIFIED COUNTRIES | SPECIFIED COUNTRIES | SPECIFIED COUNTRIES | SPECIFIED COUNTRIES | SPECIFIED COUNTRIES |

| Austria | Brazil | China | Australia | Nigeria |

| Belgium | Canada | Hong Kong | New Zealand | South Africa |

| Bulgaria | Mexico | India | ||

| Channel Islands | USA | Indonesia | OTHER COUNTRIES | OTHER COUNTRIES |

| Croatia | Israel | American Oceania | Algeria | |

| Cyprus | OTHER COUNTRIES | Japan | Antarctica | Angola |

| Czech Republic | Anguilla | Malaysia | Australian Oceania | Benin |

| Denmark | Antigua & Barbuda | Pakistan | Fiji | Botswana |

| Estonia | Argentina | Philippines | Kiribati | British Indian Ocean |

| Finland | Aruba | Saudi Arabia | Marshall Islands | Burkina Faso |

| France | Bahamas | Singapore | Micronesia | Burundi |

| Germany | Barbados | South Korea | Nauru | Cameroon |

| Greece | Belize | Taiwan | New Zealand Oceania | Cape Verde |

| Hungary | Bermuda | Thailand | Northern Mariana Islands | Central African Republic |

| Iceland | Bolivia | Palau | Chad | |

| Irish Republic | British Virgin Islands | OTHER COUNTRIES | Papua New Guinea | Comoros |

| Isle of Man | Cayman Islands | Abu Dhabi | Pitcairn | Congo |

| Italy | Chile | Afghanistan | Polar regions | Cote d’Ivoire |

| Latvia | Columbia | Armenia | Solomon Islands | Djibouti |

| Liechtenstein | Costa Rica | Azerbaijan | Tonga | Egypt |

| Lithuania | Cuba | Bahrain | Tuvalu | Equatorial Guinea |

| Luxembourg | Dominica | Bangladesh | Vanuatu | Eritrea |

| Malta | Dominican Republic | Bhutan | Samoa | Ethiopia |

| Netherlands | Ecuador | Brunei | Gabon | |

| Norway | El Salvador | Cambodia | Gambia | |

| Poland | Falkland Islands | Dubai | Ghana | |

| Portugal | Grenada | Georgia | Guinea | |

| Romania | Guatemala | Iran | Guinea Bissau | |

| Russia | Guyana | Iraq | Kenya | |

| Slovakia | Haiti | Jordan | Lesotho | |

| Slovenia | Honduras | Kazakhstan | Liberia | |

| Spain | Jamaica | Kuwait | Libya | |

| Sweden | Montserrat | Kyrgyzstan | Madagascar | |

| Switzerland | Nicaragua | Laos | Malawi | |

| Turkey | Netherlands Antillies | Lebanon | Mali | |

| Panama | Macao | Mauritania | ||

| OTHER COUNTRIES | Paraguay | Maldives | Mauritius | |

| Albania | Peru | Mongolia | Morocco | |

| Andorra | St Kitts & Nevis | Myanmar (Burma) | Mozambique | |

| Belarus | St Lucia | Nepal | Namibia | |

| Bosnia-Hercegovina | St Maaten | North Korea | Niger | |

| Gibraltar | St Vincent & The Grenadines | Oman | Rwanda | |

| Macedonia | Surinam | Palestinian Territory | Sao Tome & Principe | |

| Moldova | Trinidad & Tobago | Qatar | Senegal | |

| Montenegro | Turks & Caicos Islands | Sharjah | Seychelles & Dependencies | |

| San Marino | Uruguay | Sri Lanka | Sierra Leone | |

| Serbia | US Virgin Islands | Syria | Somalia | |

| Ukraine | Venezuela | Tajikistan | St Helena & Dependencies | |

| Vatican City State | West Indies | Turkmenistan | Sudan | |

| United Arab Emirates | Swaziland | |||

| Uzbekistan | Tanzania | |||

| Vietnam | Togo | |||

| Yemen | Tunisia | |||

| Uganda | ||||

| Zambia | ||||

| Zimbabwe | ||||

| Source: Office for National Statistics | ||||

Download this table Table 4: Geographical groupings for the International Trade in Services survey

.xls (33.8 kB)Earnings from third country trade, that is, from arranging the sale of goods between two countries other than the UK and where the goods never physically enter the UK are included. This activity is known as merchanting. Earnings from commodity trading are also included. As with merchanting, the service element is the profit or loss.

Types of transactions not covered

The purpose of the ITIS survey is to record international transactions that impact on the UK’s Balance of Payments, hence companies are asked to exclude from their earnings trade expenses such as the cost of services purchased and consumed abroad. Trade in services exports or imports that are invoices for the export or import of goods are excluded as they are already counted in the estimates for trade in goods.

The ITIS survey currently selects for the whole of the economy, with a number of exceptions, such as:

travel

transport

banking and other financial institutions

higher education

charities

most activities within the legal profession

Coverage

The figures for the European Union (EU) relate to the 27 member states of the EU from 2013 onwards. Trade with EU institutions is also included in the EU totals and excluded from the international organisations totals.

Please note that all tables in this publication only include data collected via the ITIS and Annual Business Survey surveys.

The film and television (FTV) industries are included in the published data from 2009 onwards. For 2008, FTV figures were collected via a separate survey and data were published in the International transactions of the UK film and television industries statistical bulletin 2008.

The ITIS survey is just one component of trade in services (TIS) estimates. Data for TIS in this report are consistent with the UK Balance of Payments, which can be found in Pink Book Chapter 3.

By analogy with trade in goods we refer to the type of service traded as a “product analysis” – the products being consistent with the sixth edition of the Balance of Payments Manual. The second type of analysis is referred to as the “industry analysis” – covering well-defined areas of the economy.

Both types of tables, industry and product, have been analysed on a geographical basis by showing the countries to which services are exported and from which they are imported. Both of these types of analyses are preceded by geographical analysis of imports and exports of total international trade in services.

The industry analysis allows us to estimate the total international transactions in services for well-defined areas of the economy. It also tells us the exporting or importing country in relation to the UK.

Discussing business statistics online

There is a Business and Trade Statistics community on the StatsUserNet website. StatsUserNet is the Royal Statistical Society’s interactive site for users of official statistics. The community objectives are to promote dialogue and share information between users and producers of official business and trade statistics about the structure, content and performance of businesses within the UK. Anyone can join the discussions by registering via either of the previous links.

Nôl i'r tabl cynnwys