1. Background

In examining how material living standards change over time, household income and consumption/expenditure have been highlighted as particularly important measures (see for example OECD, 2013a, ONS, 2014, Stiglitz et al., 2009).

The National Accounts, produced under the System of National Accounts (SNA) framework, provides measures of household income, consumption and wealth. However, these data only provide overall aggregates and simple per capita (or per household) averages. No distributional information on income, consumption and savings, critical for the design of economic and social policies, is provided within the National Accounts framework.

Similar to many countries ONS already publish information about the distribution of income and expenditure through "The Effects of Taxes and Benefits on Household Income" and "Family Spending", both of which are based mainly on data derived from the Living Costs and Food Survey (LCF). These publications follow international standards set out in the OECD Guidelines on Income, Consumption and Wealth statistics (OECD, 2013). However, there are a number of differences between macro and micro data in terms of concepts, definitions and data collection methods, all of which will contribute to inconsistencies between the 2 data sources. This means that National Accounts totals and those produced from the survey microdata may diverge from each other.

To respond to growing policy demands for further distributional information, the OECD and Eurostat established a joint Expert Group to explore whether it is possible to devise an internationally comparable methodology to produce distributional measures of household income, consumption and savings that are consistent with national accounts concepts and totals, using existing micro data sources.

We have been active participants in this Expert Group, and this report presents the initial results for the UK, along with a description of the methodology used.

It should be noted that the figures presented within this report are published primarily as a research output. Given the differences between the concepts and methods used with micro and macro statistics in this area, the methodology inevitably involves a number of assumptions. Whilst the data are presented as they might be of broader interest, caution should be taken when interpreting the results.

Feedback on both the details of the methodology used and the usefulness of the exercise as a whole are warmly welcomed. Feedback received will inform any future plans for work in this area.

Nôl i'r tabl cynnwys2. Methodology

The methodology used in the UK for this exercise was based on the methodological guidelines agreed by the Expert Group as a whole, adapted to take into account the availability of data in the UK.

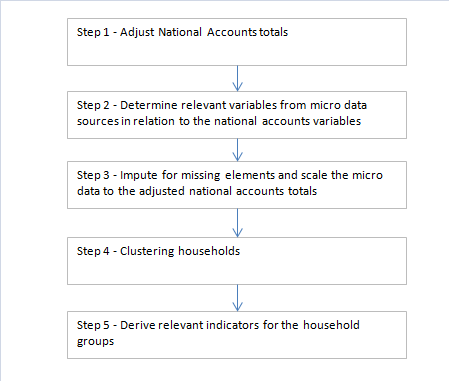

An overview of the process is presented in Figure 1.

Figure 1: Methodological process overview

Download this image Figure 1: Methodological process overview

.png (11.8 kB)Adjustment of National Accounts Totals

The National Accounts aggregates used in this analysis are consistent with those published in our 2015 Blue Book publication on 30 October 2015. To align with other countries participating in the exercise, data from 3 years were used: 2008, 2012 and 2013 (the latter being the most recent available at the time of conducting the analysis).

As distributional information on income, consumption and savings are only relevant to households, the OECD methodological guidelines recommend that a number of adjustments should be made to the National Accounts data. These were:

- removing Non-Profit Institutions Serving Households (NPISHs)

- removing the expenditures of non-resident households on the national territory at the detailed expenditure category

- removing the income and consumption of individuals living in institutional households (such as those living in halls of residence, prisons, nursing homes, etc.) who are not covered by the sample of household surveys

However, the nature of UK National Accounts data means it was not possible for us to apply these adjustments for the current exercise. ONS are running an ongoing project which aims to produce separate accounts for households and NPISH by Autumn 2017. This means that it may be possible to make at least some of these adjustments in a future iteration of this work.

Determine relevant variables from micro data sources

The second step of the process was to determine relevant variables within UK microdata that could be mapped on to the relevant National Accounts income and consumption variables.

It is preferable to use a single source of survey microdata, where possible, in order to ensure internal consistency. For this reason, the main source used was the Living Costs and Food Survey (LCF), along with variables from the Effects of Taxes and Benefits (ETB), which is derived from the LCF. The LCF/ETB was chosen as it provides very detailed information on both income and expenditure, including social transfers in kind (STiK).

In some cases, relevant information was not available from LCF/ETB, but was available from another survey source. For this reason, 2 additional sources were used for a small number of income components:

As highlighted above, the income concepts used in micro and macro statistics differ from each other. Therefore, in many cases, it was not possible to map between the 2 using a single variable. Additionally, in some cases not all of a National Accounts concept could adequately be reproduced from microdata.

A concise explanation of the variables used to map from the micro to the macro data is provided in the reference table downloads

Impute and scale the microdata to the adjusted national accounts totals

In line with recommendations of the OECD expert group, 1 of 4 methods were applied:

A: The transaction values in micro sources were scaled up or down so that their totals match the corresponding totals in national accounts.

B: Indirect method based on proxies. Missing or unreliable micro information was estimated by using the distribution of a different component as a proxy, therefore assuming that the 2 are distributed in the same way. Adjustments is made at the micro level before benchmarking aggregates to the national accounts totals.

C: Indirect method based on external data. Missing or unreliable micro information was estimated using exogenous information (for example, socio-demographic information) available at the individual and at the household levels and making assumptions (in case no micro information at all is available), before applying the distribution to SNA totals.

D: The national accounts total was distributed among all households at the end of the calculation process in a manner that the inclusion or exclusion of the component does not have an impact on the commonly used distributional indicators.

Wherever possible, method A was used. However, where distributional information from microdata was either not available or not reliable, one of the indirect methods was used. In particular, it is important to note that some National Accounts variables have no equivalent in income microdata, either due to their conceptual nature or practical considerations. For example, Financial Intermediation Services Indirectly Measured (FISIM) and investment income attributed to insurance policy holders both have no counterpart in the microdata and therefore indirect estimation was required.

By using 1 of these 4 broad methods, the microdata were scaled to the National Accounts figures by adjusting the amount reported by each household by the same amount. This implicitly assumes that the distributional information in the microdata provides an accurate representation of the underlying distribution of the National Accounts variable, which might not be the case where there are differences between the micro and macro totals.

Grouping households on the basis of the adjusted micro data

The next step was to cluster the households in the microdata into quintiles (or fifths) based on their income. This was done on the basis of their equivalised disposable income, as defined in the OECD Handbook on Income, Consumption and Wealth micro statistics (OECD, 2013). In this context, disposable income is the amount of money that households have available for spending and saving after direct taxes (such as income tax and council tax) have been accounted for, but before housing costs. Equivalisation adjusts the income to take into account the size and composition of the household. Income in this exercise was equivalised using the modified OECD scale (165.7 Kb Pdf).

To group the households into quintiles, households were ranked by their equivalised disposable income and allocated to quintiles such that each quintile contained 20% of households (with sampling weights applied).

Derive indicators for household groups

The final step was to calculate totals for each quintile for each of the National Accounts components.

Nôl i'r tabl cynnwys3. Results

Coverage of survey based estimates of National Accounts aggregates

Table 1: Coverage of survey based estimates of National Accounts aggregates for income, 2013

| UK | ||||

| Component | National Accounts Total | Microsource Total | Discrepancy | Coverage Rate (%) |

| Macro resources (received): | ||||

| Operating surplus | 130,150 | 68,060 | 62,090 | 52 |

| Mixed income | 110,469 | 63,274 | 47,195 | 57 |

| Wages and salaries | 711,054 | 663,206 | 47,848 | 93 |

| Net property income received | 149,811 | 34,396 | 115,415 | 23 |

| Social benefits other than STiK | 332,504 | 231,013 | 101,491 | 69 |

| Social transfers in kind | 273,509 | 179,603 | 93,906 | 66 |

| Macro uses (paid): | ||||

| Current taxes on income and wealth | 195,524 | 142,923 | 52,601 | 73 |

| Employers actual social contributions | 136,091 | 59,606 | 76,485 | 44 |

| Households social contributions | 67,528 | 62,945 | 4,583 | 93 |

| Source: Office for National Statistics | ||||

Download this table Table 1: Coverage of survey based estimates of National Accounts aggregates for income, 2013

.xls (27.1 kB)Table 1 shows the coverage rate for the microdata (as a percentage of the macro figure) for the main income components for 2013. Table 2 presents the same information for the main components of expenditure. More detailed information, as well as rates for the other years studied, are presented in the reference tables.

Table 2: Coverage of survey based estimates of National Accounts aggregates for consumption, 2013 UK

| UK | ||||

| Component | National Accounts Total | Microsource Total | Discrepancy | Coverage Rate (%) |

| Food and non-alcoholic beverages | 96,199 | 82,018 | 14,181 | 85 |

| Alcoholic beverages, tobacco and narcotics | 43,526 | 16,803 | 26,723 | 39 |

| Clothing and footwear | 58,905 | 31,085 | 27,820 | 53 |

| Housing, water, electricity, gas and other fuels | 258,913 | 181,548 | 77,365 | 70 |

| Furnishings, households equipment and routine maintenance of the house | 49,300 | 45,920 | 3,380 | 93 |

| Health | 19,121 | 11,711 | 7,410 | 61 |

| Transport | 150,124 | 94,616 | 55,508 | 63 |

| Communications | 21,975 | 20,171 | 1,804 | 92 |

| Recreation and culture | 104,353 | 88,848 | 15,505 | 85 |

| Education | 17,882 | 12,254 | 5,628 | 69 |

| Restaurants and hotels | 101,277 | 56,268 | 45,009 | 56 |

| Miscellaneous goods and services | 135,949 | 54,870 | 81,079 | 40 |

| Final domestic consumption expenditure | 1,057,524 | 696,111 | 361,413 | 66 |

| Actual final consumption | 1,339,555 | 875,714 | 463,841 | 65 |

| Source: Office for National Statistics | ||||

Download this table Table 2: Coverage of survey based estimates of National Accounts aggregates for consumption, 2013 UK

.xls (26.6 kB)There is considerable variation in the coverage rates for these components, which vary from 23% to 93%. There are a number of reasons why the coverage rate is less than 100%. Perhaps the most important, which will affect virtually all components, is that the 2 sets of figures are based on 2 different populations. The survey based estimates are based only on household surveys. By contrast, as explained in the methodology section, the National Accounts aggregates include those living in institutional households (for example, residential care, halls of residence and prisons) as well as Non Profit Institutions Serving Households (NPISH). Other reasons for lower coverage rates include conceptual differences, meaning all or part of a National Accounts component is not present in the microdata, as well as issues related to measurement.

For example, the apparent coverage in the micro data of “Net Property Income Received” is particularly low. The biggest single reason for this is that there are some components of the National Accounts measure, such as investment income attributed to insurance policyholders and investment income payable on pension entitlements, for which there is no counterpart in household income microdata. Additionally, for those components where there are survey equivalents, such as interest and dividends received by households, the values in the micro sources are lower. One possible explanation is that a significant proportion of this income is received by a relatively small number of wealthy households. This means that their coverage in sample based household surveys is relatively low. This may also be accompanied by possible under-reporting for those households who do respond.

On the consumption side, one of the main discrepancies is between reported expenditure on “alcoholic beverages and tobacco”. This is largely explained by households under-reporting their expenditure on these items in surveys. The National Accounts estimates largely rely on administrative records from HMRC, which provide a better picture of overall expenditure in this area (though are unable to provide any distributional information).

These differences in coverage between the macro and micro totals are far from unique to the UK. Based on earlier data from this exercise, the OECD published a paper comparing rcoverage for 21 countries (including the UK). This showed both considerable differences in average coverage across the different components, but also a relatively high degree of similarities across countries for the same components. This is to be expected given that many of the issues highlighted above will be applicable to all countries (see Fesseau et al, 2013).

Distribution of National Accounts aggregates by income quintile

Figure 2: Disposable Income and Adjusted Disposable Income by equivalised disposable income quintile as a percentage of total, 2013

UK

Source: Office for National Statistics

Notes:

- Q1 = Quintile 1 Q2 = Quintile 2 Q3 = Quintile 3 Q4 = Quintiel 4 Q5 = Quintile 5

Download this chart Figure 2: Disposable Income and Adjusted Disposable Income by equivalised disposable income quintile as a percentage of total, 2013

Image .csv .xlsIn 2013, based on the results of this exercise, the poorest fifth of households received the equivalent of 9% of total disposable income, according to the National Accounts definition. By contrast, the richest fifth of households were estimated to have received 38%. Considering adjusted disposable income, which includes the value of social transfers in kind (STIK) such as education and healthcare, reduces the disparity between the quintiles, with the poorest and richest fifth sharing 12% and 34% of the total respectively.

Figure 3 breaks down disposable income into its main components for each income quintile in 2013. For the bottom 2 quintiles, the largest single component of disposable income is social transfers other than STiK. This is also the only disposable income component for which, according to this analysis, the proportion of the total received by the bottom fifth of households (18%) is higher than that received by the richest fifth (16%). It was the second poorest fifth of households who were the biggest recipients of income from this source, receiving 24% of the total.

By contrast, these figures suggest that 68% of net property income was received by the richest fifth of households, compared with just 2% received by the poorest fifth of households. The top fifth of households also received half (50%) of the total value of wages and salaries and mixed income, as well as paying 60% of current taxes on income and wealth.

Figure 3: Income Components by Equivalised disposable income quintile, 2013

Source: Office for National Statistics

Notes:

- Q1 = Quintile 1 Q2 = Quintile 2 Q3 = Quintile 3 Q4 = Quintiel 4 Q5 = Quintile 5

Download this chart Figure 3: Income Components by Equivalised disposable income quintile, 2013

Image .csv .xls

Figure 4: Final national consumption expenditure and Actual Final Consumption by equivalised disposable income quintile as a percentage of total, 2013

UK

Source: Office for National Statistics

Notes:

- Q1 = Quintile 1 Q2 = Quintile 2 Q3 = Quintile 3 Q4 = Quintiel 4 Q5 = Quintile 5

Download this chart Figure 4: Final national consumption expenditure and Actual Final Consumption by equivalised disposable income quintile as a percentage of total, 2013

Image .csv .xlsWhen turning to look at consumption expenditure (Figure 4), the results of this exercise indicate that the richest fifth of households carried out 31% of final national consumption expenditure in 2013, compared with 13% by the poorest fifth of households. As with income, once the value of social transfers in kind are taken into account, the size of disparities across the income distribution are reduced slightly. For actual final consumption, the proportions for the poorest and richest fifth were 15% and 28% respectively.

The breakdown of final consumption expenditure by its main components is presented in Figure 5. How the share of consumption expenditure varies across the income distribution varies for different expenditure categories. For example, the data indicate that 9% of consumption expenditure on recreation and culture is undertaken by the poorest fifth of households, compared with 38% by the richest fifth. By contrast, the disparities across the quintiles are smaller for categories such as expenditure on food and non-alcoholic beverages, with the poorest fifth of households spending 16% of the total, compared with 25% for the richest fifth.

Expenditure on education is notable for the fact that the data suggests that 36% of total consumption expenditure in this area is undertaken by the poorest fifth of households, around the same proportion as the richest fifth (37%). By contrast, spending by the middle 3 quintiles is relatively low. This is likely due to the relatively high number of households containing students in the bottom income group.

Figure 5: Household Consumption Components by Equivalised disposable income quintile, 2013

UK

Source: Office for National Statistics

Notes:

- Q1 = Quintile 1 Q2 = Quintile 2 Q3 = Quintile 3 Q4 = Quintiel 4 Q5 = Quintile 5

Download this chart Figure 5: Household Consumption Components by Equivalised disposable income quintile, 2013

Image .csv .xlsMore detailed results, for 2013 and the other years studied, are presented in the reference tables.

Changes in disparities over time

Figure 6: Ratio of income share of top 20% of households to bottom 20%, 2008, 2012 and 2013

UK

Source: Office for National Statistics

Download this chart Figure 6: Ratio of income share of top 20% of households to bottom 20%, 2008, 2012 and 2013

Image .csv .xlsFigure 6 shows the ratio of the income share of the richest fifth of households to that of the poorest fifth of households, using quintiles based on equivalised disposable income. This shows a fall in the ratio for disposable income, from 4.9 in 2008 to 4.1 in 2013, suggesting that income disparities reduced over this period. Where adjusted disposable income is the measure used, the ratio is lower in all years. There was a small fall over the period examined, with the richest fifth receiving 3.2 times more than the poorest fifth in 2008, falling to 2.9 times more in 2013.

Similar figures published for a small range of other OECD countries, suggest that these ratios are broadly typical. For the 8 other OECD countries for which data are available, the ratios for adjusted disposable income ranged from 2.4 in Slovenia (in 2008) to 5.4 in the United States (in 2010). The one country outside this range was Mexico, where, on average, the richest fifth of households received an adjusted disposable income in 2010, which was 13.3 times higher than the one received by the poorest fifth (Fesseau & Mattonetti, 2013).

Figure 7: Ratio of consumption expenditure share of top 20% of households to bottom 20%, 2008, 2012 and 2013

UK

Source: Office for National Statistics

Download this chart Figure 7: Ratio of consumption expenditure share of top 20% of households to bottom 20%, 2008, 2012 and 2013

Image .csv .xlsFigure 7 shows that in 2008 the richest fifth of households in the UK showed a level of actual final consumption which was 1.9 times higher than the level of consumption of the poorest fifth, a ratio which was largely unchanged in 2013 (1.8 times). This ratio of slightly under 2 is very similar to that shown in a number of other OECD countries (including the Netherlands, United States and New Zealand). Overall, in the 8 countries for which similar data is available, the ratio ranged from 1.3 in Slovenia (in 2008) to 4.0 in Mexico (in 2010).

Saving is the difference between adjusted disposable income and actual consumption, plus the change in net equity of households in pension funds. Figure 8 presents savings as a percentage of adjusted disposable income for each income quintile for the 3 years covered by this exercise. In all 3 years studied, the savings rate was negative for the poorest fifth of households, varying from minus 24% in 2008, to minus 11% in 2012 and minus 12% in 2013. By contrast, the savings rate for the richest fifth of households was between 28% and 32% in all 3 years.

This pattern is consistent with the results that are available for other countries (Fesseau & Mattonetti, 2013), with all countries with comparable data (Australia, South Korea, Mexico, Netherlands, New Zealand, Slovenia and the United States), showing a negative savings for the poorest fifth of households, with negative savings rates in excess of minus 50% in some countries (New Zealand 2006/08, Mexico, 2010 and United States, 2010).

Consumption expenditure in excess of income in a given year does not necessarily mean that households are getting into or increasing debt. They may, for example, be able to rely on savings accumulated in previous years. Also, it should be noted that the national accounts do not take into account transfers between households, which may impact on savings rates.

One notable feature of the UK data is that, in 2008, the average savings rate for the second and middle quintiles were negative (minus 10% and minus 4% respectively), but in 2012 and 2013 they became positive (varying between 5% and 8%). This is explained by nominal levels of adjusted disposable income for the lower quintiles increasing at a faster rate than actual consumption.

Figure 8: Savings as % of adjusted disposable income, by equivalised disposable income quintile, 2008, 2012 and 2013

UK

Source: Office for National Statistics

Notes:

- Q1 = Quintile 1 Q2 = Quintile 2 Q3 = Quintile 3 Q4 = Quintiel 4 Q5 = Quintile 5

Download this chart Figure 8: Savings as % of adjusted disposable income, by equivalised disposable income quintile, 2008, 2012 and 2013

Image .csv .xls4. Conclusions

The analysis conducted for this exercise, coordinated by the OECD, shows the potential to complement existing National Accounts data by producing distributional analysis based on the same concepts. This could allow for better insights into the changing economic well-being of households, and analysis of the relationship between economic growth and the position of households.

However, as highlighted in the methodology section, a number of assumptions are needed to produce the relevant estimates, due to the different concepts used in National Accounts and the normal distributional analysis of income and consumption microdata. The differences in coverage rates in the microdata based estimates of the National Accounts aggregates indicates that caution should be demonstrated in interpreting the figures.

Further work, at the national and international level, to improve sources and methodologies, and to assess the robustness of the outputs, is needed before this form of analysis can be interpreted with confidence. The aim of this paper is to support that process by sharing these initial outputs in order to seek feedback both the details of the methodology used and the usefulness of the exercise as a whole.

To provide feedback, please email hie@ons.gov.uk.

Nôl i'r tabl cynnwys