1. Introduction

International trade statistics provide estimates of the value of imports and exports of trade in goods and services between countries. In theory the estimate of the trade flows by each country should match. For example, France’s estimate of its imports from the UK should in theory match the UK’s estimate of its exports to France. However, in practice, there are differences that are known as trade asymmetries.

There have always been discrepancies in the reporting of trade flows and these differences are well documented by international agencies such as the International Monetary Fund (IMF), Eurostat and the Organisation for Economic Cooperation and Development (OECD). As a share of global trade transactions, asymmetries are very small, just 0.1 to 1.0% of the global current account.

UK trade statistics are under close scrutiny and of high importance for the UK’s trade negotiations as the UK leaves the EU. We are delivering a range of developments as part of our UK trade development plan to meet the demands for high-quality informative trade statistics. This work includes analysis and, where possible, explanation and reduction of the UK’s trade asymmetries.

Asymmetries can be caused by a range of conceptual and measurement variations between the estimation practices of different countries. They exist across global trade statistics and have been with us for many years. We will never be able to completely eliminate trade asymmetries, but we are actively assessing the UK’s trade asymmetries in order to better understand the causes and to develop approaches to try to reduce some of them where possible.

The UK is not alone in focussing on this issue: the international community is working together to better understand the reasons for asymmetries and to reduce them through bilateral discussions and other means. We are proactively engaged in this work.

This first article provides a summary of UK trade asymmetries. We explain the global context for work on asymmetries – as no one country can address asymmetries in isolation. The main published data sources from which trade asymmetries can be calculated are described including the different bases for these statistics (which can in itself be a reason for some of the asymmetry). We summarise the headline numbers, provide an introduction to their causes and introductory comments on the type of asymmetries that will prove persistent versus those we can hope to reconcile. We also refer to some of the work that has already been done by international organisations and in the UK we reference the work by Her Majesty’s Revenue and Customs (HMRC) to understand and reduce asymmetries. Finally, we set out our priorities and what we are doing to try to reduce the UK’s trade asymmetries further.

We envisage more articles on this topic in which we will share our progress. For example, we are engaging in bilateral discussions with partners with whom we have larger asymmetries to better understand the reasons and seek ways to reduce our differences. Future articles will provide the forum for us to share some results from these discussions. We envisage publishing the next article around the end of 2017.

Nôl i'r tabl cynnwys2. Background

The world is changing and the task of measuring trade flows across the globe is becoming more difficult. Globalisation and the use of new technologies are making the task of measuring international trade a significant challenge. As such, there has always been and will continue to be differences between the estimates of imports and exports of trade as issued by each partner country. In other words, trade asymmetries are an inevitable symptom of measuring complex trade relationships through different sources and they will be difficult to reduce. However, it is incumbent on national statistical offices, central banks and other agencies to provide information to users that will help inform them about these differences and to steer users in the use of these data. It would be impractical to remove all asymmetries but we will aim at removing the largest differences.

Trade asymmetries exist for many reasons including coverage and methodological differences, timing and valuation differences and discrepancies in the currency conversions of the final estimates. These reasons are well documented by HM Revenue and Customs (HMRC). However, in this article we probe into the reasons why some of the asymmetries will persist in the data and some of the specific causes related to the UK economy.

Globalisation since the 1980s has brought about a significant increase in the volume and complexity of trade. Supply chains are now maintained across multiple national borders with manufacturing parts imported and re-exported from multiple destinations, making it difficult to identify a single “country of origin”.

Currency conversion issues remain a problem for trade statistics. In the trade data collected by HMRC, traders are asked for the value of their exports and imports in sterling. HMRC prescribes exchange rates that must be used in currency conversions and collect currency of invoice for non-EU data. However, it is likely that currency conversions will inevitably be a source of asymmetry. There is always a trade-off between the burden on business from completing the survey forms and collecting data for statistical purposes. The timing and reporting of transactions is unlikely to improve until and unless new data sources and collection methods can be implemented. Additionally, solutions to the problems with the definition and concepts of “trade” for new developments such as e-commerce and the digital economy remain some way off.

Organisations such as the International Monetary Fund (IMF), the Organisation for Economic Cooperation and Development (OECD) and Eurostat have made progress on standardising the reporting of trade statistics. We are engaged with working groups at these organisations and in discussion about how best to reduce asymmetries with our partners. We are also looking at potential new ways of using source data from HMRC on merchandise trade as well as running better surveys on trade in services. However, as the IMF has argued, progress is being rapidly offset by the complexity and growth of supply chains and financial transactions. Today’s survey-based approaches to measuring trade are likely to be replaced by innovative new ways of collecting data – at least in the statistics of many higher-income countries.

It is unclear how effective new data collection processes will be or how quickly they can be implemented. In addition, the need to understand UK trade statistics is more pressing following the EU referendum.

Trade asymmetries are, as a share of global trade volumes, very small (IMF estimates global current account asymmetries vary between 0.1 to 1.0% in most years). Even though they are relatively small as a percentage of total trade, asymmetries can look large expressed in billions of dollars, and between bilateral pairs of trading partners.

This initial article concentrates more on trade in goods than services, largely because more work has been conducted, primarily by HMRC, to understand and explain asymmetries in goods. Also, the measurement of goods, while still complicated, is more straightforward and benefits from more comprehensive surveys and administrative data sources, than services. As such, asymmetries in services will be the focus of a future article.

Interested parties that wish to study international trade data further are directed to the visual tool made available by the Department for Business, Energy and Industrial Strategy (BEIS). Currently the tool is available for trade in goods (TIG) data but the Department for International Trade (DIT) will be launching an upgrade to this tool incorporating trade in services (TIS) data in the summer of 2017.

Nôl i'r tabl cynnwys3. What are trade asymmetries?

When goods and services are traded (imported and exported) between countries, the transactions are reported twice: once by each country in the bilateral relationship. Simplistically the credits (exports) and debits (imports) that each country records should be identical. In reality, this is rarely the case and the discrepancy is known as an “asymmetry”.

The presence of trade asymmetries is well documented in economic literature and monitored by the International Monetary Fund (IMF) and its Balance of Payments Committee (BOPCOM).

Nôl i'r tabl cynnwys4. What are the different measures of asymmetries?

There are different ways to measure asymmetries and work on this subject is well documented by HM Revenue and Customs (HMRC), for example in HMRC’s publication A Reconciliation of Asymmetries in Trade-in-Goods Statistics Published by the UK and Other European Union Member States.

Absolute asymmetry

This is the absolute difference between one country’s report (the declarant) of a trade flow (exports or imports) and the “mirror” report by the country with whom that country has traded (the partner).

= |Value (D) – Value (P)|

Note that absolute asymmetries can be calculated for exports and imports separately.

Although the absolute asymmetry may sometimes look significant in nominal terms (£ billion), as a proportion of total trade between the two countries the asymmetries can be relatively small. Therefore, they are often reported as a percentage of gross transactions1.

Total asymmetry

This is the sum of the import and export absolute asymmetries (Eurostat definition). As this is the sum of the absolute asymmetries (in which there is no regard for sign) the asymmetries in exports will not in any way be netted off by the asymmetries in imports or vice versa as would be the case with some other measures of asymmetries (for example, if the asymmetries with regard to sign were added).

Relative asymmetry

This looks at the difference between the two estimates of the trade flow (exports or imports) or sometimes the difference between the two estimates of the balance (exports less imports) between two countries with respect to another variable. The choice of relative variable varies depending on what is to be shown. Common examples of relevant statistics against which the comparisons might be made are: the mean of the two estimates of the trade flow, the gross trade transactions (imports plus exports for the specific bilateral relationship) and the total transactions for goods and services for all bilateral relationships for the relevant period.

In Tables 2 and 3 we show the absolute asymmetries for exports and imports separately rather than for the balance (exports less imports) so that it is clear where the differences occur. Looking only at the asymmetry for the balance (exports less imports) as we do in Figures 1 and 2 is interesting, but alone would not tell us whether there are differences in the estimates of exports, imports or both. We also show the total asymmetry and, to complete the “UK perspective”, we show the UK’s bilateral asymmetries as a share of the UK’s current account transactions for goods or services respectively. This way we can see how important each bilateral asymmetry is from the perspective of the UK current account. This provides a steer on where to focus our efforts to further understand and try to reduce the asymmetries.

Notes for: What are the different measures of asymmetries?

- Using net rather than gross transactions as our denominator would cancel out the missing export and import data, producing something akin to a net “asymmetry”.

5. Trade outputs published on different bases

This section describes some of the main international trade concepts, measurement approaches and some of the published datasets and explains the different bases for these data.

Different concepts and measurement approaches to trade

There are a number of different concepts and approaches to measuring trade:

Overseas trade statistics (OTS) basis

This measures goods imports and exports as they move across borders. So, for example, if a good moves across the UK border it will be an import or export as measured on an OTS basis.

Balance of payments (BoP) basis

This measures goods imports and exports on the basis of a change in economic ownership. So if a good is bought or sold by a UK company and respectively sold or bought by an overseas company, it is classified as an import or export as measured on a BOP basis. This approach mirrors national accounts, which are founded on the principle of economic ownership.

General and special trade

The special trade basis excludes those goods that have been brought into a country but are not in free circulation. For example, if the goods are moved into a bonded warehouse. General trade has a broader definition, capturing those goods.

Cost, insurance and freight (CIF)

By convention the value of imported goods has included the value of cost, insurance and freight associated with their import in OTS data.

Free on board (FOB)

The value of exports does not include the CIF costs, and hence they are recorded on a “free on board” basis in OTS data. This needs to be taken account of when considering trade asymmetries that is, in order to compare a UK export flow with a mirror report by another country of the same flow, we have to adjust the import value by deducting CIF.

Those less familiar with international trade data may find the multiplicity of estimates available difficult to navigate. Standard international sources appear to offer multiple versions of UK trade data. For example:

- Office for National Statistics (ONS) Pink Book (BoP basis)

- HM Revenue and Customs (HMRC) (OTS basis for goods)

- United Nations (UN) Comtrade

- Eurostat database

- Organisation for Economic Cooperation and Development (OECD) data

- World Trade Organisation (WTO) data

- International Monetary Fund (IMF) data

- other national statistics offices or institutes (NSI or NSO) or national central bank (NCB) mirror data

In this section we explain the main differences between some of these versions of UK trade data and decide which dataset to use for estimating asymmetries in this first article. It is important to note that it is valid to record and publish the data on different bases. However, the choice of dataset can matter significantly with asymmetries appearing in some cases much larger depending on which data source is chosen. The table below provides a summary of some of the main published trade data sources and what is included.

Table 1: Trade in Goods Asymmetries for the UK in UN Comtrade Data for 2014, $ billion

| Source | OTS, Balance of payments or both | Goods or services1 or both | UK or mirror data or both | |

| HMRC OTS | OTS | Goods | UK | |

| ONS Pink Book | Both | Both | UK | |

| UN Comtrade | OTS for Goods, BOP for Services | Both 2 | Both | |

| Eurostat Comext database | Both (aggregate trade across all partner countries) | Both | Both | |

| Other national statistics institute (NSI) or national central bank (NCB) mirror data | BoP | Both | Mirror | |

| Source: Office for National Statistics | ||||

| Notes: | ||||

| 1. Services are always on an economic ownership basis – there is no OTS measure of services | ||||

| 2. Only a limited number of countries provide services data | ||||

Download this table Table 1: Trade in Goods Asymmetries for the UK in UN Comtrade Data for 2014, $ billion

.xls (28.2 kB)Ideally, we would like to consider asymmetries using mirror data from all of our trading partners, compiled on the same basis as we compile our UK reports. However, even though significant international efforts have been made to standardise statistics through the development and implementation of consistent standards (ESA 2010 and BPM6), trade statistics are still subject to variation in measurement and compilation practices. Internationally this is particularly the case for services that are compiled using a diverse range of sources of variable quality and these quality concerns lead some statistics agencies to withhold publication of lower-level data or there can be delays in releasing such data.

There is no combined dataset of all countries showing UK reported data and mirror data for trade in goods and services on a BoP basis. Therefore for this initial article it has not been possible to source and review detailed mirror data for trade in goods or services on a balance of payments basis. More analysis in this area will be part of our ongoing development work set out later in this article.

As a result, for this initial article we have had to make choices about which datasets to focus on, striking a balance between availability of partner country data and choosing data that are comparable (that is, conceptually on the same bases) across multiple countries. While there are limitations, the UN Comtrade database, which shows data for goods on an OTS basis, provides the widest and most easily accessible aggregate trade in goods and services data comparable across bilateral partner countries and so this database has been used for the majority of data comparisons and analysis in this article.

5.1 Trade in goods

The main distinction between different sources of trade in goods data is between ”overseas trade statistics” (OTS), which are essentially measures of the physical movement of goods across borders, and ”balance of payments”, which takes account of where there has been a change in economic ownership, through some additional adjustments to bring OTS estimates in line with the national accounts and balance of payments concepts.

In the UK, the bulk of trade in goods data used in official balance of payments estimates are collected by HMRC through the Intrastat (EU) Survey and administrative data (customs declarations) for non-EU countries. Trade data collected from customs declarations (and surveys) are known as merchandise trade data or data that are on an OTS basis. If goods from the UK are sent overseas for processing or servicing, they move across borders and are recorded in the customs data. However, for the purposes of measuring national income (gross national product (GNP) or gross national income (GNI)) we are interested only in trade where a change of economic ownership takes place as this is the trade that contributes to our national income.

HMRC OTS data are provided to the UN and then published in the UN Comtrade database along with many other bilateral partner countries. The UK and other country data are converted to US dollars ($) using an average annual exchange rate, created by weighting the monthly exchange rate with the monthly volume of trade. From May 2016 onwards the UK data on the Comtrade database are presented on a “special trade” basis. Prior to this, the UK data was on a “general trade” basis. So, depending on which time period is looked at, some of the cause of the asymmetries could be a difference between the presentation on either a general or special trade basis.

HMRC also provide trade in goods data on an OTS basis to Eurostat (again, this is on a special trade basis). Other EU member states also provide their equivalent data to Eurostat. Eurostat convert these data to euros using a monthly exchange rate and publish the data in the Eurostat database.

Aside from general and special trade methodologies, the Comtrade and Comext databases also can have differences in the basis of partner country allocation for imports. In Comtrade the trade partner is ”country of origin” (where collected by nations), but in Comext for all intra-EU trade it is “country of despatch”. This difference can have significant impacts upon the bilateral trade balances of two countries.

As noted earlier, HMRC also publishes detailed trade in goods data on an OTS basis in pounds sterling.

International balance of payments statistics including international trade in goods and services are compiled on a change of economic ownership basis as set out in the Balance of Payments and International Investment Position Manual Version 6 (BMP6) – the international standard that the UK came in line with in 2014. This means that we must adjust the HMRC goods data collected on an OTS basis, that is, as goods that cross the UK border, to a change of economic ownership basis. Other countries must also compile their balance of payments data on a change of economic ownership basis. This process involves multiple adjustments including adding trade that has changed economic ownership, but has not crossed the UK’s border and conversely removing trade that has crossed the UK’s border, but has not changed economic ownership. Table 2.4 in Pink Book 2016 shows the value of these adjustments in aggregate as well as the OTS data from HMRC (excluding HMRCs estimate of non-monetary gold, which we estimate separately from a different source). These adjustments are described in more detail in our published balance of payments Methodological notes (BPM6).

Movements in trade are difficult to estimate where there is a change of economic ownership, but not a movement of the goods across the border of the reporting country. As such, producers of official statistics will use different data sources and methods for this estimation. This is likely to be a source of some of the asymmetries observed when using the balance of payments data published by NSOs and NSIs or NCBs that include these balance of payments adjustments.

5.2 Trade in services

In the UK we use over 30 different data sources to estimate trade in services including our detailed and recently improved quarterly international trade in services survey. Our Quality Assurance of Administrative Data (QAAD) report published on 10 February 2017 provides more detail on the quality of our services source data.

Internationally there are fewer published datasets on different bases for UK trade in services statistics than there are for goods. Trade in services statistics are measured on a BoP basis; the concept of OTS (physical movement) is not relevant for services because trade in services are intangible. The main datasets available for services are:

- ONS Pink Book (BoP basis)

- UN Comtrade

- Eurostat Comext database

- OECD data

- other national statistics offices or institutes (NSI or NSO) or national central bank (NCB) mirror data

6. How big are the UK’s trade asymmetries?

6.1 UK trade in goods asymmetries

Table 2 shows the UK’s trade in goods exports and imports data as presented in the United Nations (UN) Comtrade database (that is, on an overseas trade statistics (OTS) basis) for 2014 reported by HMRC and the mirror data reported by bilateral countries1. The export and import absolute asymmetries are shown along with the total asymmetry and the total asymmetry as a percentage of the UK current account goods transactions.

Table 2: Trade in Goods Asymmetries For the UK in UN Comtrade Data For 2014, $ billion,

| OECD and top 5 trading partners in 2014 | ||||||||

| Credits (Exports) | Debits (Imports) | UK perspective on Asymmetries | ||||||

| UK export data [ED] | Mirror (Import) data [EP] | Export Absolute Asymmetry (EA=|ED-EP|) | UK import data [ID] | Mirror (Export) data [IP] | Import Absolute Asymmetry (IA=|ID-IP|) | Total Asymmetry1 (TA=EA+IA) | Comtrade total asymmetry as % of UK current account goods transactions | |

| $ bn | $ bn | $ bn | $ bn | $ bn | $ bn | $ bn | % | |

| USA | 64.2 | 55.3 | 8.9 | 58.6 | 53.8 | 4.8 | 13.7 | 1.2 |

| France | 32.5 | 26.0 | 6.5 | 43.5 | 40.2 | 3.3 | 9.8 | 0.8 |

| Netherlands | 36.7 | 33.4 | 3.3 | 53.6 | 48.5 | 5.0 | 8.3 | 0.7 |

| Ireland | 29.3 | 22.9 | 6.4 | 19.4 | 17.8 | 1.6 | 8.0 | 0.7 |

| Belgium | 20.8 | 22.1 | 1.4 | 34.0 | 39.4 | 5.3 | 6.7 | 0.6 |

| Germany | 52.0 | 50.6 | 1.5 | 100.3 | 104.8 | 4.5 | 6.0 | 0.5 |

| Norway | 6.1 | 5.8 | 0.3 | 27.7 | 32.9 | 5.2 | 5.5 | 0.5 |

| China, Hong Kong SAR | 12.0 | 10.7 | 1.4 | 3.2 | 7.2 | 4.0 | 5.3 | 0.5 |

| Switzerland | 35.1 | 33.7 | 1.4 | 10.6 | 13.8 | 3.2 | 4.6 | 0.4 |

| South Africa | 3.9 | 3.3 | 0.6 | 6.0 | 3.5 | 2.6 | 3.2 | 0.3 |

| United Arab Emirates | 10.5 | 9.2 | 1.4 | 1.8 | 3.6 | 1.8 | 3.2 | 0.3 |

| Israel | 1.8 | 2.3 | 0.5 | 1.7 | 4.0 | 2.2 | 2.8 | 0.2 |

| India | 6.4 | 4.8 | 1.6 | 10.7 | 9.7 | 1.1 | 2.7 | 0.2 |

| Sweden | 9.0 | 10.0 | 1.1 | 12.5 | 11.5 | 1.0 | 2.1 | 0.2 |

| Poland | 6.3 | 5.5 | 0.8 | 12.7 | 13.7 | 1.0 | 1.8 | 0.2 |

| Italy | 14.4 | 13.6 | 0.8 | 28.5 | 27.5 | 0.9 | 1.7 | 0.1 |

| Canada | 6.7 | 8.3 | 1.6 | 13.7 | 13.8 | 0.0 | 1.6 | 0.1 |

| Slovakia | 0.8 | 1.0 | 0.2 | 3.2 | 4.4 | 1.3 | 1.5 | 0.1 |

| Japan | 7.1 | 6.4 | 0.7 | 10.5 | 11.2 | 0.7 | 1.4 | 0.1 |

| Czechia | 3.4 | 3.3 | 0.1 | 7.7 | 8.9 | 1.2 | 1.2 | 0.1 |

| Mexico | 1.7 | 2.5 | 0.8 | 2.0 | 1.8 | 0.2 | 1.0 | 0.1 |

| Brazil | 3.8 | 3.3 | 0.5 | 4.2 | 3.8 | 0.4 | 0.9 | 0.1 |

| Turkey | 6.1 | 5.9 | 0.2 | 10.6 | 9.9 | 0.7 | 0.9 | 0.1 |

| Denmark | 4.6 | 4.7 | 0.1 | 7.4 | 8.0 | 0.6 | 0.7 | 0.1 |

| Rep. of Korea | 6.9 | 7.4 | 0.5 | 6.2 | 6.1 | 0.1 | 0.7 | 0.1 |

| Australia | 6.1 | 5.5 | 0.6 | 3.2 | 3.3 | 0.0 | 0.6 | 0.1 |

| Portugal | 2.2 | 2.4 | 0.2 | 3.7 | 3.9 | 0.2 | 0.4 | 0.0 |

| Finland | 2.6 | 2.4 | 0.3 | 3.9 | 3.8 | 0.1 | 0.4 | 0.0 |

| Luxembourg | 0.4 | 0.4 | 0.0 | 0.9 | 0.5 | 0.3 | 0.3 | 0.0 |

| Estonia | 0.4 | 0.7 | 0.2 | 0.3 | 0.4 | 0.1 | 0.3 | 0.0 |

| Austria | 2.7 | 2.7 | 0.1 | 5.2 | 5.0 | 0.2 | 0.3 | 0.0 |

| Spain | 14.5 | 14.7 | 0.2 | 22.0 | 21.9 | 0.1 | 0.3 | 0.0 |

| Latvia | 0.6 | 0.3 | 0.2 | 0.7 | 0.7 | 0.0 | 0.2 | 0.0 |

| Hungary | 2.0 | 1.8 | 0.2 | 4.0 | 4.0 | 0.0 | 0.2 | 0.0 |

| New Zealand | 1.1 | 1.1 | 0.0 | 1.4 | 1.3 | 0.2 | 0.2 | 0.0 |

| Chile | 0.8 | 0.8 | 0.1 | 0.8 | 0.7 | 0.1 | 0.2 | 0.0 |

| Slovenia | 0.4 | 0.5 | 0.1 | 0.5 | 0.6 | 0.1 | 0.2 | 0.0 |

| Greece | 1.6 | 1.6 | 0.0 | 1.2 | 1.3 | 0.1 | 0.2 | 0.0 |

| Iceland | 0.3 | 0.3 | 0.0 | 0.6 | 0.6 | 0.0 | 0.0 | 0.0 |

| Source: Trade in Goods, UN Comtrade Database, 2014 data downloaded 17 March 2017, Overseas Trade Statistics basis. Current Account source = ONS. | ||||||||

| Notes: | ||||||||

| 1. Sum of absolute export and import asymmetries (totals may not equal sum of components due rounding) | ||||||||

Download this table Table 2: Trade in Goods Asymmetries For the UK in UN Comtrade Data For 2014, $ billion,

.xls (1.1 MB)Table 2 shows the Organisation for Economic Cooperation and Development (OECD) countries and the UK’s top five trading partners in 2014 for UK trade in goods asymmetries by size of total asymmetry. In 2014, on an OTS basis, using data from the UN Comtrade database, the UK’s largest total trade in goods asymmetries were with the USA at $13.7 billion, followed by France ($9.8 billion), the Netherlands ($8.3 billion), Ireland ($8 billion2), Belgium ($6.7 billion) and Germany ($6 billion). However, relative to the total current account goods transactions for the UK these asymmetries are all less than 1% with the exception of the USA (1.2%).

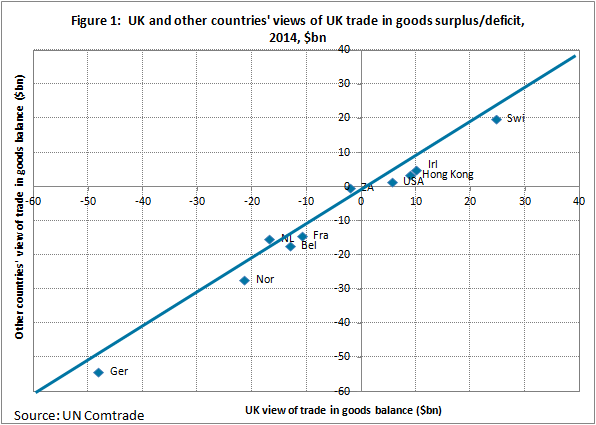

Figure 1 shows the UK’s trade in goods balance as reported by the 10 countries with the largest total asymmetries with the UK from Table 2 plotted against the UK’s view of the same trade flow. Therefore, those countries close to the diagonal reference line have close agreement with the UK in terms of the size and direction of the balance. Those in the top right-hand quadrant report that the UK has a surplus with the partner country and those in the bottom left-hand quadrant report that the UK has a deficit with the partner country. Countries in either the top-left or bottom-right quadrants would be reporting a different view of the direction of the balance, but this is not the case for any of these 10 countries for trade in goods.

Figure 1: UK and other countries' view of UK trade in goods surplus/deficit, 2014, $bn

Source: UN Comtrade

Download this image Figure 1: UK and other countries' view of UK trade in goods surplus/deficit, 2014, $bn

.png (24.9 kB) .xls (8.7 kB)It can be seen from Figure 1 that the top 10 countries by size of total goods asymmetry (on an OTS basis from the Comtrade database) are in relatively close agreement in terms of size and direction of the trade in goods balance.

6.2 UK trade in services asymmetries

Table 3 shows the UK’s trade in services exports and imports data as presented in the UN Comtrade database for 2014 as reported by the Office for National Statistics (ONS) and the mirror data reported by bilateral countries. The export and import absolute asymmetries are shown along with the total asymmetry and the total asymmetry as a percentage of the UK current account services transactions.

Table 3: UK Trade in Services Asymmetries, 2014

| UN Comtrade Data, 2014, $ billion | Credits (Exports) | Debits (Imports) | UK perspective on Asymmetries | |||||

| Bilateral partner country | UK export data [ED] | Mirror data [EP] | Export Absolute Asymmetry (EA=|ED-EP|) | UK import data [ID] | Mirror data [IP] | Import Absolute Asymmetry (IA=|ID-IP|) | Total Asymmetry1 (TA=EA+IA) | Total asymmetry as % of UK current account services transactions |

| USA | 83.4 | 47.9 | 35.5 | 38.6 | 61.2 | 22.6 | 58.1 | 10.0 |

| Luxembourg | 5.1 | 12.3 | 7.2 | 2.5 | 14.5 | 11.9 | 19.2 | 3.3 |

| Ireland | 15.6 | 15.1 | 0.5 | 8.4 | 26.8 | 18.4 | 18.9 | 3.3 |

| France | 19.3 | 25.0 | 5.7 | 19.8 | 30.5 | 10.7 | 16.4 | 2.8 |

| Netherlands | 18.2 | 15.8 | 2.4 | 7.1 | 20.5 | 13.4 | 15.8 | 2.7 |

| Germany | 19.9 | 25.7 | 5.7 | 16.1 | 25.1 | 9.0 | 14.7 | 2.5 |

| Belgium | 5.3 | 9.6 | 4.3 | 4.1 | 10.4 | 6.2 | 10.5 | 1.8 |

| China, Hong Kong SAR | 3.8 | 4.5 | 0.7 | 2.8 | 9.2 | 6.5 | 7.2 | 1.2 |

| Russian Federation | 3.7 | 6.1 | 2.4 | 1.2 | 4.5 | 3.3 | 5.7 | 1.0 |

| Sweden | 5.9 | 6.7 | 0.8 | 2.5 | 5.5 | 3.0 | 3.8 | 0.7 |

| Source: Trade in Services, UN Comtrade Database, 2014 data downloaded 17 March 2017. Current Account source = ONS. | ||||||||

| Notes: | ||||||||

| 1. Sum of absolute export and import asymmetries (totals may not equal sum of components due to rounding) | ||||||||

Download this table Table 3: UK Trade in Services Asymmetries, 2014

.xls (23.6 kB)Table 3 shows the top 10 UK trade in services asymmetries by size of total asymmetry. The UK’s largest asymmetries in services data in 2014 were with the USA, showing a total asymmetry of $58.1 billion. It is noticeable that six of the seven largest trade in services total asymmetries are with the same countries that have the largest trade in goods total asymmetries (see previous section). This again provides a clear direction and focus for our bilateral conversations and analysis going forward.

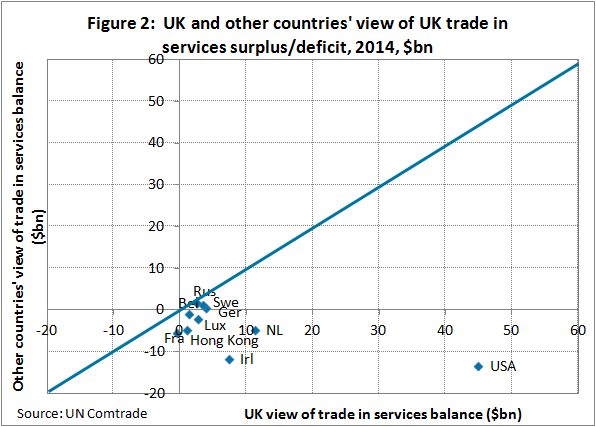

Figure 2 shows the UK’s trade in services balance as reported by the 10 countries with the largest total asymmetries with the UK from Table 3 plotted against the UK’s view of the same trade flow. As with Figure 1, those countries close to the diagonal reference line have close agreement with the UK in terms of the size and direction of the balance. Those in the top right-hand quadrant report that the UK has a surplus with the partner country and those in the bottom left-hand quadrant report that the UK has a deficit with the partner country. Countries in either the top-left or bottom-right quadrants are reporting a different view of the direction of the balance.

Figure 2: UK and other countries' view of UK trade in services surplus/deficit, 2014, $bn

Source: UN Comtrade

Download this image Figure 2: UK and other countries' view of UK trade in services surplus/deficit, 2014, $bn

.png (25.2 kB) .xls (17.9 kB)Notably, Luxembourg, Ireland, Hong Kong, Belgium, the Netherlands and the USA mirror statistics report trade in services surpluses with the UK, whereas our UK data show us to have a surplus with them. The largest of these differences is with the USA reporting a trade in services surplus with the UK of $13.3 billion compared with our UK data reporting us to have a surplus with the USA of $44.8 billion. We have already engaged in bilateral discussions with the US Bureau of Economic Analysis (BEA) to better understand some of the causes of these discrepancies. Further work in this area is a priority for us as detailed later in this article and services asymmetries in general will be focussed on more in future articles.

6.3 International analysis of trade asymmetries

Some of the UK trade asymmetries described above are large, but it is important to remember that all countries have trade asymmetries. Within the EU, all countries use the same framework for compiling trade statistics. Nonetheless, large asymmetries still exist.

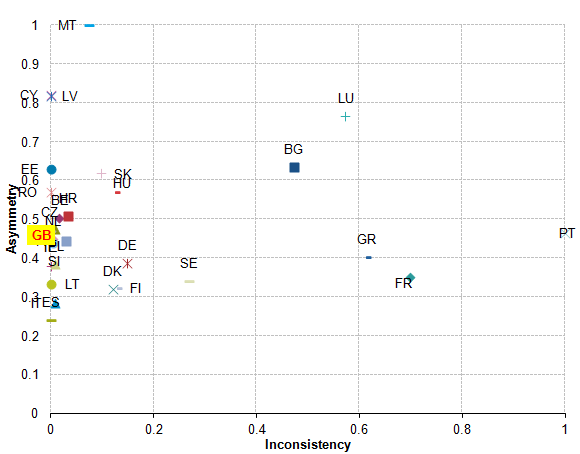

Eurostat recently produced an analysis of trade in services, which showed that the UK’s trade asymmetries were similar to other countries (Figure 3).

The analysis also looked at inconsistencies between the national accounts measures of trade and how they are reported in the balance of payments statistics. Our UK National Accounts are fully aligned with the balance of payments statistics so we have no inconsistency. Other countries do have inconsistencies, making comparing trade data even more challenging.

In Figure 3 the size of the asymmetry is shown on the vertical y-axis and the extent of the inconsistency between the national accounts and balance of payments statistics are shown on the horizontal x-axis. The graph is based on normalised values (between 0 and 1) with the outlier showing as a value of 1 in each axis. The underlying measures are differences in % of total transaction volume in services for 2014. For example, we see that the UK (shown as GB in the graph) has no inconsistency, but an asymmetry of between 0.4 and 0.5.

Figure 3: Eurostat analysis of trade in services inconsistencies and asymmetries, 2014

Source: Eurostat

Download this image Figure 3: Eurostat analysis of trade in services inconsistencies and asymmetries, 2014

.png (13.0 kB) .xls (18.9 kB)Notes for: How big are the UK’s trade asymmetries?

HMRC do not attempt to adjust mirror flows when conducting UK asymmetry analysis, so for comparability we are following the same approach. The mirror data presented here is not adjusted for the CIF-FOB valuation difference (explained earlier). Eurostat report that the invoice to statistical value adjustment most EU member states undertake (in intra-EU trade) is predominantly less than 1.0%.

Note that much of this asymmetry with Ireland using UN Comtrade data will be due to differences in presentation between country of dispatch and country of origin. The asymmetries are smaller when comparing data from the EU Comext database.

7. Reasons for trade asymmetries

7.1 High-level overview of different reasons

We present in this section some of the known reasons and causes of trade asymmetries.

HM Revenue and Customs (HMRC) provides a useful summary of the general issues that often lead to asymmetries in trade data in an Overview of Asymmetries.

The main reasons are as follows:

Valuation differences (for example, differences in methods of estimating value of exports (CIF) and imports (FOB); differences in declaration thresholds; exchange rate fluctuations).

Differences in the classification of items within the accounts.

Discrepancies in the time of recording transactions.

Differences in coverage and methodology (for example, differences in survey methods; exclusions of particular types of goods or services; differences in disclosure control rules and so on).

Unallocated trade or country allocation – under-reporting or misallocation of trade to a partner. This might include difficulties recording “country of origin” for re-imports and re-exports, or phenomena such as the “Rotterdam Effect” (see UK Trade in Goods estimates and the ‘Rotterdam Effect’).

Exchange rate conversion – when the UK submits trade data to Eurostat or UN Comtrade, it does so in UK pounds sterling, and the publishing agency converts this data into euros or dollars respectively. Much of the UK trade being reported, especially for oil or commodities, will have originally occurred in other currencies – dollars or euros perhaps. We would expect this to lead to greater potential discrepancies in years of increased exchange-rate volatility such as 2016.

In addition, here are some UK-specific issues already identified:

All countries are now expected to compile trade statistics according to the latest international standards (BPM6). While this includes adjustments of goods data to a change of ownership basis as detailed earlier, the revision to BPM6 from the previous version (BPM5) brought significant changes to the reporting of trade statistics such as the change in how merchanting is recorded. In BPM6 merchanting is recorded within trade in goods whilst it was previously a service. It is likely to take time for this change to be handled consistently by all producers of national statistics. The coverage and quality of concepts where the goods do not physically cross UK borders, as is the case with merchanting, are likely to be a persistent cause of asymmetries.

For trade in goods data collection HMRC has special below-threshold procedures for EU data that is sourced through the Intrastat survey. This means that for trade below a certain value the HMRC estimates the value of exports and imports. This accounts for around 3% by value for dispatches (exports) and 7% by value for arrivals (imports) of total trade in goods.

For trade in services we believe a major challenge is country misallocation. The data sources were originally designed to collect detailed product information and the country information in some cases has been of less good quality. However, from the first quarter of 2017 we almost doubled the sample size of our quarterly International Trade in Services (ITIS) survey and re-optimised the sample for country allocation, which will improve the country estimates (similar improvements are planned for our equivalent annual ITIS survey).

As detailed earlier, we compile data for the trade in services statistics from over 30 different sources and make available information on the quality of these data through the published Quality assurance of administrative data (QAAD). Similarly, other countries will need to draw on many data sources for services and this difference in data source will lead to asymmetries.

Imports of services via the internet and UK resident’s expenditure abroad are weaker areas due to the difficulty collecting these data. This is a problem for all countries. We are investigating potential new data sources to enhance these areas such as credit card data.

Bilateral discussions with partner countries are also beginning to help explain some of the asymmetries. Further details are provided in section 8.

7.2 Illustrative example

Example of persistent asymmetries

This describes an example for the UK of the type of work done to resolve asymmetries – and in doing so illustrates why we expect some asymmetries to persist.

Gold

Erratics and non-monetary gold flows are traditionally a source of large month-on-month movements and revision in the UK trade statistics. London is a major centre for global trade in gold – with 80% of global trading taking place in London, and some of the largest gold vaults in the world.

In the trade statistics we distinguish between monetary and non-monetary gold (NMG). Monetary gold is any gold owned by the Bank of England and is treated not as a good but as a financial asset. Any gold not owned by the Bank or other monetary authorities is viewed by HMRC as non-monetary gold and therefore classified as a good.

Table 4: Asymmetries in UK-China Trade in Goods for Commodity Code 711

| 2013 | 2014 | |||||||

| $bn | UK exports | UK imports | Export | Import | Export | Import | ||

| UK reporter | 2013 | 2014 | 2013 | 2014 | Asymmetry | Asymmetry | Asymmetry | Asymmetry |

| China | 0.2112 | 4.9 | 0.6 | 0.5 | -0.2 | 0.5 | 4.6 | 0.3 |

| China, Hong Kong | 7.6 | 5.9 | 0.5 | 0.6 | 1.1 | -0.6 | 0.2 | -0.4 |

| China reporter | Exports to the UK | Imports from UK | ||||||

| China | 0.1368 | 0.2 | 0.4 | 0.3 | ||||

| China, Hong Kong | 1.1 | 1.0 | 6.5 | 5.7 | ||||

| Source: UN Comtrade data, Trade in Goods. | ||||||||

| Notes: | ||||||||

| 1. Commodity code SIC classification: "Pearls, precious stones, metals and coins etc" is mainly gold | ||||||||

Download this table Table 4: Asymmetries in UK-China Trade in Goods for Commodity Code 71^1^

.xls (28.2 kB)Gold in the London vaults can change ownership without moving across borders. It is bought and sold by investors or central banks whilst remaining in the same “safe storage”. Gold can also move across borders without changing ownership – for example, since the recent rise in gold prices, more and more gold has been shipped to Switzerland where the standard 10 kg bars are turned into smaller bars and returned to the vaults in London.

So how should we measure gold in the OTS trade in goods statistics?

Eurostat determine how trade in goods figures should be compiled by all members of the EU. Prior to 2014, the UK had excluded non-monetary gold from the OTS trade statistics – HMRC would exclude all the movement of NMG before providing trade in goods data to us. However, in other European countries, NMG was being included. Therefore, to comply with European Statistics Legislation, a revision was made to the trade in goods data time series spanning back to 2005 to include NMG. Given the size of non-monetary gold, this was a significant source of asymmetry with EU countries that was resolved within the Eurostat statistics by the change.

However, in other versions of the trade statistics we still see some countries excluding NMG as the UK previously did. So NMG continues to be a source of asymmetry especially with non-EU countries.

Nôl i'r tabl cynnwys8. International and UK work to reduce trade asymmetries

There are three types of approach to tackling asymmetries:

- Common reporting frameworks aimed at standardising trade surveillance. These have quite recently been harmonised, especially for trade in services (introduced only in 2014 through ESA 2010). Many lower-income countries have limited resources to implement new frameworks.

- Bottom-up reconciliation exercises between trading partners. These are resource-intensive, bilateral exercises undertaken by pairs of countries.

- Top-down approaches to reconciliation (notably the Eurostat “Global Model” approach) such as the use of mirror data from partner countries or estimates of bias in asymmetries giving rule-of-thumb indications and possible adjustments. These include the adjustment applied by the Organisation for Economic Cooperation and Development (OECD) and Eurostat and a new top-down approach currently being investigated by ONS and Baranga.

8.1 Common reporting frameworks

Common reporting frameworks include the International Monetary Fund’s (IMF’s) Balance of Payments and International Investment Position Manual (BPM6), Eurostat’s European System of National and Regional Accounts (ESA 2010) and the System of National Accounts (SNA 2008). Implementation of BPM6 is voluntary and for many low- and middle-income countries, challenging to resource.

Standardisation of reporting is a big step forward and international efforts will go some way to reducing asymmetries. However, this approach alone does not address many of the operational issues that national statistics agencies face when compiling trade reports from multiple sources of survey data (for price and volume). These surveys are likely to be insufficient to ever fully capture the complexity of globalised trade.

Work on asymmetries has a long history. The IMF, which is charged with the international guidelines and standards for reporting of trade between nations, established its “BOPCOM” committee more than 23 years ago. Considerable effort has been invested into standardised reporting but progress has struggled to keep up with the growth in complexity of trade.

A recent paper by the IMF, ‘Think Globally, Act Bilaterally’, now advises member states to tackle asymmetries through renewed bilateral efforts.

8.2 Bottom-up reconciliations

The UK has participated in a number of bilateral discussions to understand the sources of asymmetries, most recently with France, Mexico, Switzerland (in 2016), the US, Canada, Israel and Ireland (in 2017). Further discussions are currently underway with a number of Organisation for Economic Cooperation and Development (OECD) partners and we anticipate these bilateral discussions will be the main vehicle through which we identify further reasons for discrepancies and possible improvements that can be made to reduce them.

Further bilateral discussions with our US colleagues at the Bureau of Economic Analysis (BEA) and the US Census Bureau will be an integral part of our approach to better understanding our trade asymmetries with the USA (shown to be the largest when comparing bilateral data using total asymmetries calculated using data from the UN Comtrade database for 2014 as detailed in section 6). Previous discussions have already helped us understand at a high level how some of the asymmetries can be explained. For example, when using data from UN Comtrade we have a difference in coverage whereby the US BEA present data for the UK including the Channel Islands whereas we exclude them. We have also identified some measurement differences such as our respective measurement of financial services such as financial intermediation services indirectly measured (FISIM) – see Part III: International Transactions Accounts of BEA’s concepts and methods guide, U.S. International Economic Accounts: Concepts and Methods. There will be other causes of UK-USA trade asymmetries. We will be continuing to work together collaboratively in the coming months to understand these differences and potentially identify other causes. We will both be seeking improvements and ways to reduce our asymmetries. Initial results from these further bilateral discussions will be covered in our next asymmetries article around the end of 2017.

HM Revenue and Customs (HMRC) also take part in a bi-annual Eurostat-led asymmetries exercise for goods. Recent discussion with Germany proved useful for both countries whilst HMRC has had successes outside the EU with changes in measurement of natural gas imported from Norway, for example.

8.3 Top-down approaches to data-reconciliation

One approach to reconciliation of the data is the use of mirror data from partner reporting. It has been adopted by the US, who use Canadian import data in place of US exports to Canada in order to produce a consistent set of reports for bilateral trade flows (see Reconciliation of the United States-Canadian Current Account, 2010 and 2011) and remove the reporting burden on the exporter. Whilst this has the obvious short-coming of not addressing the underlying measurement issues, it is cost effective, pragmatic and reliably produces a single set of trade estimates for the same trade flow. A similar approach is being implemented by the EU for intra-EU trade through the Micro-data exchange approach.

8.4 UK development work to reduce asymmetries

We are working on asymmetry issues at a number of levels. It is important to recall that some trade asymmetries will persist and the effects from some other causes of asymmetry will take a long time to reduce. However, we are delivering against an ambitious trade development plan and this section provides a summary of our work and anticipated improvements aimed at delivery within the next 12 to 18 months.

As stated earlier, we consider further bilateral discussions, particularly with trading partners with whom we have large total asymmetries, to be the priority area of focus for us with respect to reducing asymmetries. We are already engaged in collaborative discussions with some of our bilateral partners, for example the US, and have further bilateral discussions planned through 2017. We will report our progress and developments from these discussions in the next article on trade asymmetries planned for publication around the end of 2017. Any possible improvements that can be applied to reduce the asymmetries will be implemented as soon as practical within the UK trade development plans.

We are investigating the feasibility of using HM Revenue and Customs (HMRC) EC sales data, which are administrative data collected by HMRC showing the aggregate value of exports of services to VAT registered companies in EU countries, to improve the country allocation of trade in services. We will report progress on our initial investigations in the next article.

We are improving the quality and reliability of data for services through a range of developments. We have broadened the sample coverage of the International Trade in Services Survey (ITIS), with improved coverage from Quarter 1 (Jan to Mar) 2017. However, the services survey only collects value data and the difficulties of matching this in a meaningful way with a separate price survey is likely to persist for some time. Work on improving trade deflators is also underway with a review of other national statistics office (NSO) and national statistics institutes (NSI) practices through summer to autumn 2017, from which we expect to identify possible ways to improve the deflation of UK trade in services statistics that could be implemented in 2018.

Also, we are reviewing the balance of payments (BoP) adjustments that we apply to overseas trade statistics (OTS) trade in goods data to convert these to the change of economic ownership basis required for the balance of payments and national accounts. As detailed earlier there are multiple adjustments applied and this difference between OTS and BoP is difficult to estimate so this work will take some time. We will prioritise within the adjustments and aim to have identified and implemented some improvements by the end of 2018.

In the longer term, another potential option for trade in goods is to collect the business partner ID or attach IDs to the value chains of multinational enterprises and then engage in micro-data exchanges to improve the consistency of measurement of transactions by these complex organisations.

Lastly, we have been working with Dr Thomas Baranga (Harvard) on a new method for reconciling OTS goods data with that of trading partners using the biases estimated by Baranga to assess suitability of mirror data. Similar in approach to the reconciliation method used by the Organisation for Economic Cooperation and Development (OECD), Baranga proposes that the “bias” in a country’s trade statistics is measured relative to the OECD “average” report. Using these bias estimates, the mirror data of trading partners can be ranked for “reliability” and with greater weight placed on data from countries ranked as more reliable than those with a lower weight. Such an approach does not address the underlying measurement problems in trade and we have not yet worked through how this information might be used to inform the compilation process. However, early results from Baranga suggest that the UK looks to be a relatively accurate reporter, particularly of exports. This research will be published in full in a forthcoming Economic Statistics Centre of Excellence Discussion Paper.

Nôl i'r tabl cynnwys9. Conclusion

Trade asymmetries have existed in bilateral trade data across the globe for many years and some asymmetries will persist. As a share of global trade transactions, asymmetries are very small, just 0.1 to 1.0% of the global current account. However, some bilateral trade asymmetries can be large, expressed as total asymmetries in billions of pounds.

International work to understand and reduce asymmetries has been ongoing for some time and has had successes. Also, in the UK, HMRC is engaged in a biannual exercise to reduce trade in goods asymmetries and has published detailed material and reports on this subject. Additionally, our specific work through bilateral discussions has begun to provide further explanation for trade asymmetries. This work combined with the analysis in this article has identified some priority areas in which to focus our developments.

For example, to better understand and potentially reduce trade in services asymmetries with the US, we are prioritising further bilateral discussions with the Bureau of Economic Analysis (BEA) and we will continue our bilateral discussions more widely.

We will build on improvements already made to our International Trade in Services Survey (ITIS) survey by seeking new and alternative data sources for services.

Recognising the challenge of adjusting trade in goods data from an overseas trade statistics (OTS) to a balance of payments (BoP) basis, we are reviewing our balance of payments adjustments and we will continue to investigate the potential of alternative reconciliation analysis such as the measurement of bias in global asymmetries.

We anticipate developing a deeper understanding of the causes of trade asymmetries and to further reduce some of the asymmetries over the next 12 to 18 months and we will report our progress in this area through future articles.

Nôl i'r tabl cynnwys10. References

2015, IMF. Revisiting Global Asymmetries—Think Globally, Act Bilaterally. Prepared by Paul Austin, Silvia Matei and Cornelia Hammer, Balance of Payments Division, STA.

IMF Twenty-eighth meeting of the IMF committee on Balance of Payments Statistics.

The IMF BOPCOM Scope of the research agenda for external sector statistics. Working party on international trade in goods and trade in services statistics. STD/CSSP/WPTGS/RD(2017)5. March 2017.

2004, Libby Cox ONS

The IMF Committee on Balance of Payments Statistics Annual Report 2014.

2016, Marko Javorsek. Asymmetries in international merchandise trade statistics: A case study of selected countries in Asia and the Pacific . ARTNeT Working Paper Series No. 156, 2016, Bangkok, ESCAP. Available at: www.artnetontrade.org

ASIA-PACIFIC RESEARCH AND TRAINING NETWORK ON TRADE Working Paper NO. 156 | 2016

World Bank Trade in Services Data – Documentation.

Nôl i'r tabl cynnwys