1. Introduction

This article contains the latest estimates of the value of human capital. Human capital is defined as the stock of skills, knowledge and experience of an individual or population, which can productively be applied in the economy and is widely referred to as one of the main drivers of economic growth. It plays an important role in delivering productivity. There has been increased interest in both measuring and understanding human capital recently, both in the UK and internationally to better understand the skills of national workforces and the drivers of growth.

In line with the recommendations of the United Nations Economic Commission for Europe (UNECE) Guide on Measuring Human Capital (PDF, 2.8MB), the stock of human capital is calculated by looking at what skills people have and how much they earn, as well as estimating how much longer they will continue to work. As such, the value of human capital is often higher in younger workers, as they have more years in the labour market ahead of them.

Therefore, in interpreting differences between groups or over time in these statistics, it is necessary to consider a range of potential factors. If one group has higher human capital than another, this may be because they have, on average, better qualifications, better education progression rates, higher salaries for any given level of qualifications, or are younger.

It is also possible they could have lower pay for any given level of qualification obtained, and still have higher human capital if the age gap is wide enough. Two people with identical characteristics (sex, qualifications) will have different levels of human capital if one is younger. The younger person has more years’ earning potential and therefore has higher human capital.

The value of human capital solely in terms of its provision to economic benefits is relatively narrow. For this article, we only account for those direct economic benefits as filtered through direct individual earnings. Wider than this, human capital accumulation infers wider benefits to the country, not least beneficial impacts on the health system (in less associated health costs), crime, and citizen engagement. Bearing in mind the limitations of the current methodology, we will publish a plan later in the autumn that will look to improve it and explore alternatives.

Nôl i'r tabl cynnwys2. Main points

In 2017, the UK's real full human capital stock was £20.4 trillion, equivalent to just over 10 times the size of UK gross domestic product (GDP).

The UK’s human capital stock grew by 1.8% in 2017 in current price terms, the lowest annual growth since 2010, while real human capital stock fell by 0.8% in 2017; this was the first fall in human capital stocks since 2012, reflecting slower growth in earnings relative to inflation, as measured by the Consumer Prices Index.

Annual growth in real human capital stock per person in 2017 was lowest among those aged 16 to 25 years and aged 26 to 35 years, at negative 1.1% and negative 0.9% respectively, due to lower earnings growth among these groups.

Overall changes in the UK’s human capital stock mask differing trends across regions and groups of the population; for example, among those with a degree or higher qualification, the average real human capital stock of those living in West Midlands fell the most, by 5% in 2017 to £568,168, the biggest drop in six years, reflecting negative real earnings growth.

By contrast, the average real human capital stock of those living in East Midlands with a degree or higher qualification rose by 9% in 2017 to £564,790.

The value of human capital stock of an average 16- to 25-year-old with a degree or higher qualification has fallen by 8% in real terms between 2004 and 2017; by contrast, the average human capital stock of a 16- to 25-year-old with no qualifications has risen by 1% over the same time period.

In 2004 the pay premium for obtaining a “first and other degrees” was 41% compared with the UK as a whole, and by 2017 it had reduced to 24%.

3. What is human capital?

Human capital is a measure of the “knowledge, skills, competencies and attributes embodied in individuals that facilitate the creation of personal, social and economic well-being” The well-being of nations: the role of human and social capital, OECD (PDF, 1.1MB).

At a whole economy level, we can also consider the contribution of human capital to economic output. Growth in an economy can be driven by increases or improvements in either:

labour – our workforce

capital – the buildings and machines we use to produce goods and services

natural resources – the land and other resources found above and below ground that are extracted for production

technological progress – the ideas and innovations that lead to new products and improve market efficiencies

To consider long-term drivers for the UK economy, we measure not only tangible assets such as buildings, machinery and plant, but the increasingly growing role of intangible assets. This includes the value of research and development, software and intellectual property, as consistent with internationally agreed standards on economic statistics, as well as wider measures for an evolving economy. In this context, human capital refers to labour and captures the intangible worth of individuals’ investment into education and training.

Nôl i'r tabl cynnwys4. Why measure human capital?

The concept of human capital allows analysis into the factors influencing economic growth, as well as wider sustainability and well-being issues. Human capital is widely recognised to influence future potential output and income, as empirical work on economic growth suggests (for example, The impact of human capital on economic growth: a review (PDF, 334KB)) A measure of human capital stock can be a starting point to quantifying any potentially reciprocal impact education has on health, crime and citizen engagement outcomes (Health and Human Capital (PDF 1,718KB), Education, Work and Crime, Does Education Increase Political Participation?). Tracking stock trends also allows analysis of the provision of skills needs for different parts of the economy, whether regional or industry-based, which can link education (and other human capital accumulation) provision to business needs.

Our current methodology brings together analysis of earnings, labour market demographics and educational outcomes into one framework. This allows us to understand how the evolution of these factors has impacted on the stock estimates, and what drives differences in individuals’ human capital stock values over time, as well as persistent step differences.

Sustainability is seen as, “what we leave to future generations; whether we leave enough resources, of all kinds, to provide them with the opportunities at least as large as the ones we have had ourselves” (UN, 2012). The capitals approach states that economic, natural, human and social capitals are all resources that matter for the present and future well-being of individuals. This was highlighted in the report by the Commission of the Measurement of Economic Performance and Social Progress (Report by the Commission of the Measurement of Economic Performance and Social Progress, PDF 3.15MB). Our current estimates can give insight into how the UK’s skills and knowledge resources are evolving, and whether there is a different volume of stock that can productively be used in the economy in the future.

The measures can also be used in the assessment of the impact of an ageing population, changes in retirement ages and in the evaluation of the economic benefits of different levels of education.

Nôl i'r tabl cynnwys5. How we measure human capital stock

Earnings are considered to reflect human capital as it is expected that people with more valuable attributes, such as higher qualification levels, skills and abilities, will earn more in the labour market. Social attributes, personality and health attributes are also reflected in wage rates. For these reasons, human capital in the UK is measured in monetary terms as the total potential future earnings of the working age population. This is often referred to as the output- or income-based approach to measuring human capital stocks and is fully in line with the best practice set out in the United Nations Economic Commission for Europe (UNECE) Guide on Measuring Human Capital (PDF, 2.8MB).

In summary, estimates are constructed by summing, for every age-gender-highest qualification obtained combination, the discounted earnings labour income the rest of their working life will generate. For every age-gender-highest qualification combination, next year’s lifetime earnings are assumed to be the average discounted value of people a year older currently in the labour market, with the same gender and highest qualification. This is adjusted for by the probability of obtaining a higher qualification, and hence increasing your earnings trajectory to that of someone with a higher qualification. It also accounts for the mortality rate of an individual would still be in the workforce. Age, gender and highest qualification obtained are all accounted for as major determinants to current and future labour earnings.

These estimates are necessarily subject to a number of assumptions that affect their final value: the labour productivity rate growth rate (2%), discount rate (3.5%) and age of retirement (age 65 years). Hence the working age is defined as between 16 and 65 years old for this article. The effect that these assumptions have on the final estimate can be found in the sensitivity analysis in Annex 1. Full information on data sources and methodology (including the rationale behind any assumptions) can be found in the measuring human capital methodology report.

As well as measuring the human capital of those currently in employment, we also measure “full” human capital, which captures the human capital of the employed and the unemployed. This is calculated by imputing potential earnings for unemployed people based on earnings incomes of similar employed people (in terms of age, sex, and highest qualification).

Nôl i'r tabl cynnwys6. Value of human capital stock

National capital stock

Figure 1 shows the values of the UK’s full and employed human capital stock, both nominally and in constant 2015 prices, to allow comparison with the previous release.

Figure 1: Full and employed human capital, real and nominal, UK, 2004 to 2017

Source: Office for National Statistics, Annual Population Survey, Labour Force Survey

Notes:

- Real figures in 2015 prices, deflated using the Consumer Prices Index (CPI).

Download this chart Figure 1: Full and employed human capital, real and nominal, UK, 2004 to 2017

Image .csv .xlsIn 2017, the value of the UK’s real full human capital stock was £20.4 trillion, a decrease of 0.8% on last year and the first decrease since 2012. Similarly, employed human capital decreased by 0.3% between 2016 and 2017 to reach £19.9 trillion. The smaller decrease in employed human capital is due to the UK’s growing employment rate.

In contrast, in 2016 there was a 2.0% and 2.4% year-on-year increase in full and employed real human capital respectively. This was very similar to the average growth rates of stock since 2012, at 2.0% and 2.3% respectively.

As total human capital stock contributes to the concept of sustainability (see Stiglitz, Sen, Fitoussi), a decrease in overall stock implies less value of the skills and knowledge available to be used in the UK economy. The decrease in real stock in 2017 reflects the rate of inflation, as measured by the Consumer Prices Index, rising faster than nominal human capital values. Nominal full and employed stock increased by 1.8% and 2.3% respectively between 2016 and 2017. Further analysis on deflating nominal stock and the choice of deflator is presented in Annex 1.

Real human capital stock per working age person also fell in 2017, using both the full and employed valuation. Figure 2 shows annual changes in the value of human capital stock per person since 2005.

Figure 2: Growth rates of full human capital stock per member of the working age population, UK, 2004 to 2017

Source: Office for National Statistics, Annual Population Survey, Labour Force Survey

Notes:

- Real figures in 2015 prices, deflated using the Consumer Prices Index (CPI).

- Per capita figures are divided by the full working age population.

Download this chart Figure 2: Growth rates of full human capital stock per member of the working age population, UK, 2004 to 2017

Image .csv .xlsAs can be seen in Figure 2, there has been a recent decline in growth of stock per capita from a high of 3.5% and 3.9% annually in 2015 for real and nominal stock respectively, to a decrease in the latest period of 1.1% for the real per capita stock, and a growth of 1.4% respectively. The impact of inflation rising higher than nominal stock can again be seen in 2017. However, even nominal stock per capita has slowed its growth down since 2015. To understand these reasons, and to understand more about the drivers behind changes in stock, the next section will look at the decomposition of stock by age and qualifications.

Decomposing national capital stock

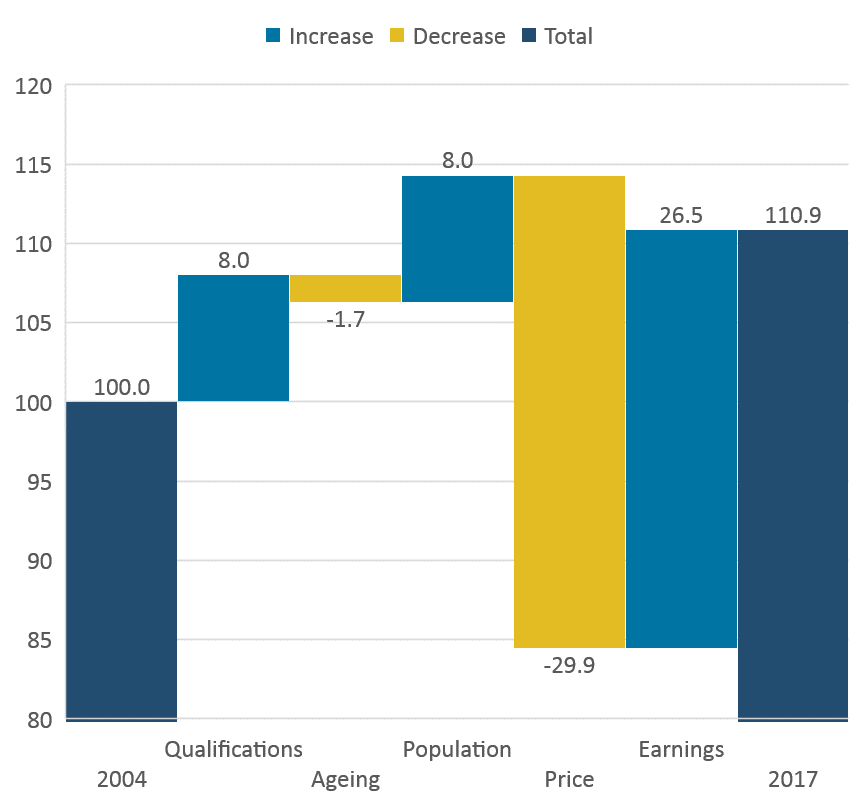

It is possible to decompose the human capital stock changes over time, to explain the contribution of different demographic and labour market factors to these changes. The contributions of these factors to overall changes in human capital between 2004 and 2017 are shown in Figure 3.

Figure 3: Decomposed changes of real full human capital stock, UK, 2004 to 2017

Source: Office for National Statistics, Annual Population Survey, Labour Force Survey

Notes:

- Real figures in 2015 prices, deflated using the Consumer Prices Index (CPI).

- All values are shown as percentage of the 2004 real full human capital stock value.

- New qualification distribution calculated by applying the 2017 qualification distribution of the population, per each age and gender separately to the 2004 population.

- Ageing calculated by applying the 2017 full distribution of the population to the 2004 total population.

- Population increase calculated by applying the 2017 population to the 2004 per capita values by each demographic combination separately.

- Price change calculated by deflating using the CPI.

- Nominal lifetime earnings differences between applying the 2017 and 2004 per capita values for individuals with equivalent characteristics.

Download this image Figure 3: Decomposed changes of real full human capital stock, UK, 2004 to 2017

.png (26.2 kB) .xlsx (10.1 kB)The factor contributing the most to increases in human capital stocks has been increasing nominal lifetime earnings for equivalent individuals. However, this has been offset by rising prices over the same period, meaning that real individual values of human capital stock have decreased over the whole time period for like-for-like individuals.

Improvements to the level and distribution of qualifications held by the working age population led to an 8% increase in the UK’s human capital stock over this period, with a similar rise due to increases in the size of the working age population. Partially offsetting these factors, relative ageing of the working age population decreased the stock by 1.7%. These factors will be further explored later in this article, considering the make-up of different age and qualification population groups over time.

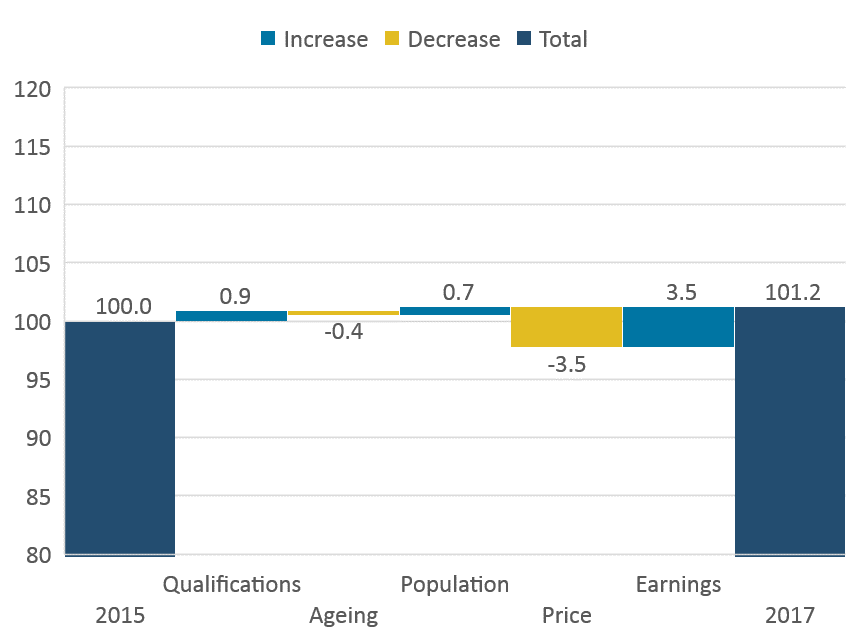

Figure 4 shows the contributions to changes in real human capital stock between 2015 to 2017, to understand which factors have resulted in lower growth more recently.

Figure 4: Decomposed changes of real full human capital stock, UK, 2015 to 2017

Source: Office for National Statistics, Annual Population Survey, Labour Force Survey

Notes:

- Real figures in 2015 prices, deflated using the Consumer Prices Index (CPI).

- All values are shown as percent of the 2015 real full human capital stock value.

- New qualification distribution calculated by applying the 2017 qualification distribution of the population, per each age and gender separately to the 2004 population.

- Ageing calculated by applying the 2017 full distribution of the population to the 2004 total population.

- Population increase calculated by applying the 2017 population to the 2004 per capita values by each demographic combination separately.

- Price change calculated by deflating using the CPI.

- Nominal per capita stock value change calculated by looking at the difference between applying the 2017 and 2004 per capita values to each demographic combination separately.

Download this image Figure 4: Decomposed changes of real full human capital stock, UK, 2015 to 2017

.png (23.4 kB) .xlsx (10.1 kB)In the last period between 2015 and 2017, the effects of individuals’ lifetime earnings are broadly comparable to those of price changes, at 3.53% and 3.52% of the 2015 value of human capital respectively, meaning that the two largely cancel each other out. However, over this more recent period, there is a relatively large negative effect from ageing, accounting for 33% of the total change in real stock, compared with an average of 16% of the total change between 2004 and 2017. Improvements to attainment rates accounted for the same percentage of the total change in the recent period as that for the full time period between 2004 and 2017, at 74% of the total change.

Human capital stock by age

By breaking down the stock values by age groups, it is possible to consider the effect of changes to the workforce and how skills are distributed. Due to the measurement of a person’s human capital stock as their discounted lifetime labour earnings income (see methodology note for more details), the older someone is, by definition, the smaller their remaining available productive stock. However, for a given age group, how the per person stock value has changed over time can provide useful insights, as presented in Figure 5.

Figure 5: Real full human capital stock values per capita, by age group, UK, 2004 to 2017

Source: Office for National Statistics, Annual Population Survey, Labour Force Survey

Notes:

- Real figures in 2015 prices, deflated using the Consumer Prices Index (CPI).

- Index is set at 2004 = 100.

- Age groups constant over time, meaning as people age, different populations are in each category, which may have different sex and highest qualification compositions within them over time.

Download this chart Figure 5: Real full human capital stock values per capita, by age group, UK, 2004 to 2017

Image .csv .xlsThere is a relatively steady stock valuation for the youngest age group (those aged 16 to 25 years) over the whole time period between 2004 to 2017. Average stock values have not recovered since the highs of 2007, when an individual’s human capital stock was £864,852 in constant 2015 prices.

In contrast, older age groups’ stocks have shown the highest growth, with the three age groups of 36 to 45, 46 to 55 and 56 to 65 years showing an increase in real per person stock of over 10% in the last 13 years. This variation in growth rates is particularly prominent between 2011 to 2017, when the average stock of individuals aged 35 years or over grew by 7.0%, while the stock of those aged 16 to 35 years only grew by 3.6%.

This finding is broadly consistent with evidence on employee earnings. Figure 6 shows gross weekly earnings from the Annual Survey of Hours and Earnings by broader age group. It is worth noting this only shows employees, not the self-employed, and earnings are reported by employers, not self-reported, so differences in actual values are to be expected, but the general trends hold.

Figure 6: Change in real gross weekly earnings, by age group, UK, 2004 and 2017 (£)

Source: Office for National Statistics, Annual Survey of Hours and Earnings

Notes:

- Real figures in 2015 prices, deflated using the Consumer Prices Index (CPI).

- Changes worked out as real earnings in 2017 minus real earnings in 2004.

- Figures for 16- to 17-year-olds include employees not on adult rates of pay.

Download this chart Figure 6: Change in real gross weekly earnings, by age group, UK, 2004 and 2017 (£)

Image .csv .xlsAs can be seen for employees, real earnings have decreased for younger categories up to age 50 years (apart from those aged 18 to 21 years), whose real earnings have increased by £2.40 compared with 18- to 21-year-olds in 2004. In contrast, those aged 60 years and over on average earned £37.90 more in real gross weekly earnings in 2017 than those aged 60 years and over in 2004.

The age contrast in human capital stock per capita is also reflected in the most recent period, with 16 to 25 and 26 to 35 age groups’ per capita stock values decreasing between 2016 and 2017 by 1.1% and 0.9% respectively, while 56- to 65-year-olds’ average stock value increased by 1.3%.

When considering human capital stock values by qualifications and age concurrently, we can understand the impact of changes of different age groups in education attainment rates, given the differing demographics. As the further discussion in Annex 1 shows, the changes in long-term trends are due mostly to the demographics of a more qualified workforce in older age groups, which could be due to the ageing of a more qualified workforce, combined with net migration effects impacting on various qualifications differently.

Figure 7 shows how demographic trends have played a part in the differences in age groups we have seen. Each bar shows, for a specific age-group population, the change in the share of that population between 2004 and 2017, for those having obtained a specific highest qualification.

Figure 7: Change in share of highest qualification obtained as part of overall population in an age group, UK, between 2004 and 2017

Source: Office for National Statistics, Annual Population Survey, Labour Force Survey

Notes:

- Real figures in 2015 prices, deflated using the Consumer Prices Index (CPI).

- The share of a population is worked as the number of people in an age group having obtained a particular highest qualification, divided by the number of people in that age group.

- The change in shares is worked out as the share in 2017 minus the share in 2004.

Download this chart Figure 7: Change in share of highest qualification obtained as part of overall population in an age group, UK, between 2004 and 2017

Image .csv .xlsAcross all age groups, the share of those with a degree has increased and the share of those with no qualifications and other qualifications has decreased. However, this has not been achieved equally. Of 26- to 35-year-olds, the share of those with no qualifications has only declined by 4.3 percentage points over the whole time period, while for 56- to 65-year-olds, it has declined by 14.0 percentage points.

On the other scale, the increase to the share of those having obtained a degree or equivalent has grown by the least for 16- to 25-year-olds, at 6.1 percentage points; while for 35- to 45-year-olds, it has increased by 20.4 percentage points. Their shares now stand at 40.1% and 39.3% respectively.

It is also notable that the share of those with “other” qualifications has decreased for all age groups by between 2.6 to 4.6 percentage points. In addition, higher education shares have increased for the 16- to 25-year-old age group by 0.4 percentage points, while they have marginally decreased for the 26- to 35-year-old and 36- to 45-year-old age groups at negative 1.6 and negative 1.2 percentage points respectively.

For younger age groups, there has been a smaller increase in share of people with higher qualifications, and this has been offset by decreases in human capital returns from higher levels of education (A-levels, equivalent or higher, and even those with GCSEs for the 16 to 25 years age group). For younger age groups, real lifetime earnings have decreased and the gap between the older and younger groups has expanded.

As human capital stock is a measure of a population’s skills and knowledge as usefully used by the economy, at least in the way we currently measure it, it is worth considering how stock trends relate to estimates of skills. Looking at the Organisation for Economic Co-operation and Development (OECD) Survey for Adult Skills (PIAAC), which measures the literacy, numeracy and problem-solving skills of adults across the OECD countries, the UK’s performance (represented by England only in the OECD data) by age can be evaluated.

The survey results relate to 2012 and show that older-aged individuals have comparable or above OECD-average literacy and numeracy skills, but younger individuals are below average. Specifically, Table 1 summarises the relatives to the OECD average for overall literacy and numeracy skill scores.

Table 1: Skills score differences to OECD average for different ages, England, 2012

| Age group | Literacy skill score difference to OECD average | Numeracy skill score difference to OECD average |

|---|---|---|

| 16-24 year olds | -10 | -11 |

| 55-65 year olds | 15 | 11 |

| Source: OECD | ||

Download this table Table 1: Skills score differences to OECD average for different ages, England, 2012

.xls (35.8 kB)Regional human capital

Looking at human capital regionally, Figure 8 presents overall human capital stock per region of residence.

Figure 8: Regional full human capital stock by region, UK, 2004 to 2017

Source: Office for National Statistics, Annual Population Survey, Labour Force Survey

Notes:

- Real figures in 2015 prices, deflated using the Consumer Prices Index (CPI).

- Regional estimates of human capital follow a different methodology (see annex) and hence the total estimates do not sum to the national-level estimates.

Download this chart Figure 8: Regional full human capital stock by region, UK, 2004 to 2017

Image .csv .xlsThere is a consistent regional difference in rankings of contributions to human capital. For example, London’s share of overall human capital has slowly climbed between a low of 18.0% in 2006 and 20.5% in 2016, dropping down to 20.2% in 2017. Also, the stock for London and the South West decreased the most in the last year, both by 0.9%, while the East Midlands increased the most, by 4% to £1.3 trillion in 2017.

It is a similar picture when the population differences are taken into account, though the rankings of different regions change, as can be seen in the per capita figures in Figure 9.

Figure 9: Regional real discounted lifetime earnings per individual, UK, 2017

Source: Office for National Statistics, Annual Population Survey, Labour Force Survey

Notes:

- Real figures in 2015 prices, deflated using the Consumer Prices Index (CPI).

- Regional estimates of human capital follow a different methodology (see annex) and hence the total estimates do not sum to the national-level estimates.

- Per capita figures for each region are worked out as the human capital value of a region divided by the population of that region.

Download this chart Figure 9: Regional real discounted lifetime earnings per individual, UK, 2017

Image .csv .xlsLondon’s per capita figures were 38.1% higher than the UK’s average in 2017, while only the South East and East of England were higher than the UK’s average at any point in the last 14 years. The increase in the East Midlands’ stock in 2017 is shown here to be due to its per capita stock value, rather than a population effect. At a country level, Northern Ireland had a per capita stock of £445,373 in 2017, while Wales, Scotland and England had 11.7%, 22.2% and 35.6% higher per capita stocks respectively.

As with national figures, regional differences are explained both by differences in demographics, qualification attainment rates and in differential wage rates. The regions of London, the South East and the East of England have a younger and more highly educated population. However, over and above that there are higher wages. This is also since different occupations are concentrated in different regions.

The next section will focus on changes in London and the East Midlands between 2016 and 2017 specifically, to understand why different trends are seen. In fact, both changes in regional stock were driven mostly by changes to stock of those with the highest qualifications obtained.

For the East Midlands, the increase in real stock of those with a degree was £50.1 billion between 2016 and 2017, compared with £49.9 billion for the region as a whole. In contrast, for London’s graduates, there was a decrease in real stock of £48.4 billion, compared with £35.8 billion overall between the same period. Figure 10 looks at overall annual earnings for the East Midlands.

Figure 10: Average female and male graduate annual earnings income for the East Midlands, 2016 and 2017

Source: Office for National Statistics, Annual Population Survey, Labour Force Survey

Notes:

- Nominal Figures.

- Regional estimates of human capital follow a different methodology (see annex) and hence the total estimates do not sum to the national-level estimates.

- Average earnings income is averaged across age groups, interpolated and treated for outliers, so may not be consistent with other survey outputs.

Download this chart Figure 10: Average female and male graduate annual earnings income for the East Midlands, 2016 and 2017

Image .csv .xlsFor the East Midlands, the average earnings income of younger male graduates has dropped between 2016 and 2017, while it has increased for older graduates. This increase in older people’s earnings also translates into higher human capital stock for all younger ages, given the potential lifetime earnings model methodology. Interestingly, female graduates at all ages increased their overall earnings, but there were still higher increases for older age groups.

Looking at London’s highest qualified individuals’ average earnings between 2016 and 2017, there is a more mixed picture, as shown in Figure 11.

Figure 11: Average female and male graduate annual earnings income for London, 2016 and 2017

Source: Office for National Statistics, Annual Population Survey, Labour Force Survey

Notes:

- Nominal Figures.

- Regional estimates of human capital follow a different methodology (see annex) and hence the total estimates do not sum to the national-level estimates.

- Average earnings income is averaged across age groups and interpolated, as well as being treated for outliers, so may not be consistent with other survey outputs.

Download this chart Figure 11: Average female and male graduate annual earnings income for London, 2016 and 2017

Image .csv .xlsThe reverse picture is seen for male graduates, as younger graduates earned slightly more in 2017 than 2016, while the older graduates earned less. The biggest increase in average earnings was for the 30- to 34-year-old age group, which increased average nominal earnings by £250, while those aged 60 years and over earned on average £2,700 less.

The conclusions are that graduate earnings, and the changes for different ages of male graduates particularly, have impacted on human capital stock estimates for London and the East Midlands due to their differing trends. Female graduate earnings are generally lower in every age category for both regions and there has also been less pronounced change in their annual earnings.

It is worth complementing this analysis with regional earnings by industry data from the Annual Survey of Hours and Earnings. The East Midlands experienced higher than average earnings growth in the financial and insurance activities, and other service activities industries in 2017, outgrowing the UK’s average growths in those industries by 9.5 and 8.3 percentage points respectively.

London, on the other hand, experienced its biggest relative earnings decreases in the real estate activities (negative 13.5% compared with negative4.0% for the UK) and human health and social work activities (negative 5.6% compared with 0.5% for the UK) industries for 2017. London’s biggest per capita human capital stock decrease in 2017 was for those with a degree or higher qualification (at negative 3.0% growth) but given the higher incidence of graduates in the population (45.0% compared with 29.8% for the UK as a whole), it is likely there will be a higher graduate intensity across industries in London.

Industry by qualification analysis

To supplement extra analysis from human capital estimates, we have extracted information on pay premia from our quality-adjusted labour input dataset. This accounts for differential remuneration by qualification level (separately identifying undergraduate to masters and doctorate level) and industry, controlling for hours worked and occupations. The estimates are derived primarily from Labour Force Survey (LFS) data. However, due to some features in the LFS, data from ASHE and national accounts are combined with the data from LFS to get the estimates presented in the tables.

Also, as a caution in interpreting these data, for some industries, the sample sizes are small and this is reflected in the year-on-year variation. An example would be post-graduates and doctorates working in agriculture earning 60% less than the average for all workers in 2017, when they earned 15% less than the average for all workers in 2015. The more reliable estimates are derived for larger industries where the sample size is large enough to produce less volatile estimates.

Generally, the pay premia for both educational categories seem to have declined over time and the difference in the pay premia between undergraduate and post-graduate degrees has declined as well. One explanation for this could be a large increase in the proportion of the population with a university degree. Nonetheless, we can say that workers belonging to “first degree or other” or to “masters and doctorates” categories earn more than the average worker. However, there are exceptions where workers in certain industries, in those two educational categories earn less than the average for all workers, so they exhibit negative pay premia.

In 2004 the pay premia for “first and other degrees” was 41% and by 2017, it had reduced to 24%. The same has happened for “masters and doctorates”; the pay premia has declined from 69% in 2004 to 48% in 2017. There has been a reduction in the pay premia every year other than 2015 for the “first or other degree” education category when premia for workers with post-graduate degrees has exhibited more up and down movements between 2004 and 2017.

Over the whole time period, for “first degree or other” or to “masters and doctorates” educational levels, there are four industries where the average pay over the period 2004 to 2017 is below the average for all workers. These four industries are:

agriculture, forestry and fishing (A)

accommodation and food service activities (I)

real estate activities (L)

arts, entertainment and recreation (R)

For both educational levels in mining and quarrying (B) and financial and insurance activities (K) industries, the average earnings are two times higher than the average for all workers over the period 2004 to 2017. There are also several industries, such as electricity, gas, steam and air conditioning supply (D) and transport and storage (H), where the average earnings over the period 2004 to 2017 are more than 40% above the average for all workers.

On average over the period 2004 to 2017, workers with no qualifications, workers with GCSE or equivalent and workers with A-levels or trade partnership exhibited negative pay premia. Workers with certificates of education or equivalent earned positive pay premia, averaging 9% above the average for all workers over the period.

Occupations and length of employment

For the first time, feasibility analysis has been conducted into human capital stock of individuals by their current occupation, as well as by the length of their current employment. Figure 12 shows the experimental results for 2017.

Figure 12: Real employed human capital stock by occupation, UK, 2017

Source: Office for National Statistics, Annual Population Survey, Labour Force Survey

Notes:

- Occupational estimates of human capital follow a different methodology (see annex) and hence the total estimates do not sum to the national-level estimates.

- Occupations are self-identified, though consistent with the Standard Occupation Classification 2010 (SOC10).

Download this chart Figure 12: Real employed human capital stock by occupation, UK, 2017

Image .csv .xlsThose currently in professional occupations such as science, health, education and business professionals contribute 28% of the UK’s stock, at £4.7 trillion; while associate professional and technical occupations, such as technicians, designers and those in the forces, contribute 18% of the stock. At the other end of the scale, process, plant and machine operatives, and caring, leisure and other service occupations each contribute 5% to the overall stock. These contributions to the overall stock have stayed very similar since 2011, from which point we have been able to estimate them. Similarly, the per capita stock values have remained comparatively the same, illustrated in Table 2 for 2017.

Table 2: Real discounted lifetime earnings per individual by occupation, UK, 2017

| Occupation | Human capital stock in 2015-constant prices per person, 2017 |

|---|---|

| Managers, directors and senior officials | 750,482 |

| Professional occupations | 749,822 |

| Associate professional and technical occupations | 678,610 |

| Administrative and secretarial occupations | 415,123 |

| Skilled trades occupations | 527,726 |

| Caring, leisure and other service occupations | 305,580 |

| Sales and customer service occupations | 397,370 |

| Process, plant and machine operatives | 441,252 |

| Elementary occupations | 316,508 |

| Source: Annual Population Survey, Labour Force Survey | |

Download this table Table 2: Real discounted lifetime earnings per individual by occupation, UK, 2017

.xls (28.2 kB)Until 2015, professional occupations had a higher stock value than managers, directors and senior officials. Administrative and secretarial occupations’ average stock has increased the most, at 8.3% between 2011 and 2017; while over the same period, average stock of professional, and associate professional and technical occupations has decreased, by 0.4% and 1.5% respectively.

Looking at length of employment, Figure 13 shows 2017 human capital stock by age and the length of continuous employment at the current workplace.

Figure 13: Contributions to 2017 nominal human capital stock by length of employment, UK, 2017

Source: Office for National Statistics, Annual Population Survey, Labour Force Survey

Notes:

- Nominal Figures.

- Length of employment estimates of human capital follow a different methodology (see annex) and hence the total estimates do not sum to the national-level estimates.

Download this chart Figure 13: Contributions to 2017 nominal human capital stock by length of employment, UK, 2017

Image .csv .xlsFor the youngest age group, 29% of their contribution to the overall stock value is from individuals who have been in the same job between two and five years, while 12% is from individuals working less than up to a year in the same workplace. For 26- to 35-year-olds, this changes to 31% and 5% respectively. Already for 36- to 45-year-olds, 34% of their contribution to the UK’s human capital is from individuals who have been in one continuous workplace for 10 years or more. Workplace retention accounts for a significant amount of human capital stock, as those working in the same place for five years or more contributed 37% to the UK’s human capital stock in 2017.

Nôl i'r tabl cynnwys8. Methodology

Full information on data sources and methodology (including the rationale behind any assumptions) can be found in the measuring human capital methodology document (PDF, 209KB).

Regional and occupation methodology

Regional estimates methodology, as well as for the first-time experimental occupation estimates, are derived by taking account of a specific differentiating factor that would also impact earnings across such a breakdown. For example, it is likely that for the same age, gender and highest qualification obtained, someone in a managerial occupation will on average get paid a different wage to someone who is in a sales service occupation. This should be reflected when an individual’s future earnings are calculated.

Essentially, it involves estimating human capital at the level of interest (region or occupation) using only information from that level. It provides an estimate of human capital that not only reflects the population size, the distribution of the population (by age, sex and highest qualification) within the decomposed breakdown, but also levels of earnings, employment rates and education attainment transition rates broken down. In addition, mortality rates are also differentiated for regional estimates.

These more granular estimates are produced using the same approach as the national estimates – the output- or income-based approach. A variable to account for the granularity is obtained from the Annual Population Survey (APS). This allows the estimation of number of people, earnings (when employed) and enrolment rates for different levels of education.

Given the fewer observations of individuals when grouped into age, sex and highest qualification level categories at the broken-down level, individuals were grouped into age bands. These were grouped into five-year age bands. The recursive method of working out discounted lifetime earnings involved imputing age-band averages onto every age within an age group. The recursion is run on every age.

However, one drawback of this approach is to create a distorted age-income profile with only nine different levels of earnings income for 48 age-years. To better reflect the curved nature of the national age-income profile, we impute fitted values of income for each age based on the output of a polynomial regression of order two. This methodology is based on the Gang Liu's paper from the Organisation for Economic Co-operation and Development on Human Capital, published in 2013 (“Measuring the stock of human capital for international and inter-temporal comparisons”). Specifically, the regression model is calculated as follows:

where income is the average earnings income of the age-group.

Length of employment methodology

For deriving estimates by length of employment, a simpler methodology was applied. Essentially, no differential impact to different length of employment was accounted for. This is because age is already a determining factor of earnings. Hence, the individuals’ lifetime labour earnings were re-distributed across the sampled individuals and re-aggregated up using a variable accounting for the length of time in current employment.

Sensitivity analysis

Estimates of human capital are sensitive to several assumptions. Holding everything else constant, each assumption can be varied individually to show the impact. The three main assumptions analysed here are:

the discount rate

the labour productivity growth rate

the upper age boundary

The results are shown in Table 3.

Table 3: Employed and full human capital in UK, 2017 (£ trillion, 2015 prices)

| 2015 Prices | |||

|---|---|---|---|

| Real Labour income growth rate | Discount Rate | Age | Full Human Capital |

| 0 | 3.5 | 65 | £15.64 |

| 0.25 | 3.5 | 65 | £16.14 |

| 0.5 | 3.5 | 65 | £16.67 |

| 0.75 | 3.5 | 65 | £17.22 |

| 1 | 3.5 | 65 | £17.79 |

| 2 | 3.5 | 65 | £20.42 |

| 3 | 3.5 | 65 | £23.65 |

| 4 | 3.5 | 65 | £27.66 |

| 2 | 0 | 65 | £36.10 |

| 2 | 1 | 65 | £30.15 |

| 2 | 2 | 65 | £25.55 |

| 2 | 2.5 | 65 | £23.63 |

| 2 | 3 | 65 | £21.93 |

| 2 | 3.5 | 65 | £20.42 |

| 2 | 4 | 65 | £19.07 |

| 2 | 4.5 | 65 | £17.85 |

| 2 | 5 | 65 | £16.76 |

| Source: Office for National Statistics, Annual Population Survey, Labour Force Survey | |||

| Notes: | |||

| 1. Labour productivity growth rate in main estimates equals 2%. | |||

| 2. Discount rate in main estimates equals 3.5%. | |||

| 3. Figures in 2015 prices, deflated using the Consumer Prices Index (CPI). | |||

| 4. Upper age limit in main estimates equals age 65 years. | |||

Download this table Table 3: Employed and full human capital in UK, 2017 (£ trillion, 2015 prices)

.xls (37.9 kB)Sensitivity analysis shows that, for 2017, decreasing the assumption of labour income growth by 1 percentage point, to 1%, decreases the estimated value of the employed human capital stock by £2.63 trillion. On the other hand, an increase by 1 percentage point leads to a £3.23 trillion rise in overall stock. Changing the discount rate by 1 percentage point leads to changes of a similar magnitude but in the opposite direction in the estimates of the human capital stock.

Looking at even lower rates of labour income growth, assuming 0% labour income growth further impacts on the human capital stock by a further £2.15 trillion, compared to a 1% labour income growth. Marginal changes to the income growth assumption have a higher impact on the stock estimate, if the level of growth is higher. Hence, increasing labour income growth from 0% to 0.25% results in a £0.5 trillion increase, while an increase from 0.75% to 1% results in a £0.58 trillion increase.

Nôl i'r tabl cynnwys9. Annex 1

Alternative price deflations

Another way to consider the price effect of human capital is to compare the stock against earnings. Earnings may be said to more closely resemble a price of human capital stock. If we consider average earnings weighted by different parts of the population, these would consider “quality” changes in the value of stock, such as a price index should. If we instead study earnings of a baseline of human capital, we can see how much the quality of human capital influences its growth, removing any general wage increase not associated with human capital improvement.

Figure 14 compares indexes of deflated full human capital stock by the Consumer Prices Index, as well as deflated by the average weekly earnings index, and the minimum wage for 16- to 17-year-olds, as a proxy for human capital before any significant investment of human capital accumulation, such as aged 16 years and over education, has been completed. These are also compared with an index of the UK’s real net capital stock.

Figure 14: Alternative deflations of full human capital stock index, UK, 2004 to 2017

Source: Office for National Statistics, Annual Population Survey, Labour Force Survey, National minimum wage parliament policy briefing

Notes:

- Real human capital stock figures in 2015 prices, deflated using different price indices.

- Index 2004 = 100.

Download this chart Figure 14: Alternative deflations of full human capital stock index, UK, 2004 to 2017

Image .csv .xlsIt is interesting to note the different patterns that emerge from these alternative deflations. Given the lower index when deflating by average weekly earnings than when deflating by the minimum wage (except in 2006), this implies the average human capital stock per person over the whole period has decreased. A wider gap developed between 2010 and 2015, implying the quality of stock decreased, before recovering somewhat in 2016, and again decreasing in 2017.

The index deflated by the Consumer Prices Index follows a more volatile path, but all measurements show that generally the volume of human capital has grown less than net capital stock, which accounts for the major tangible and intangible capital assets in the economy, as measured by national accounts. The rest of the article continues with defining real human capital by deflating by the Consumer Prices Index, but this is an area of planned future development.

Figure 15: Growth rate of real human capital stock per person by highest qualification obtained and age group, UK, change between 2004 and 2017

Source: Office for National Statistics, Annual Population Survey, Labour Force Survey

Notes:

- Real figures in 2015 prices, deflated using the Consumer Prices Index (CPI).

- Per capita figures derived by dividing the human capital values by the population in a particular qualification-age-group category.

- Education levels determined from different Labour Force Survey variables at different time periods.

Download this chart Figure 15: Growth rate of real human capital stock per person by highest qualification obtained and age group, UK, change between 2004 and 2017

Image .csv .xlsGenerally, there has been a decrease in real stock values for all those with A-levels or higher qualifications between 2004 and 2017, with the exception of the two age groups above age 45 years having obtained higher education. Similarly, almost all age groups in 2017 with GCSEs or lower qualifications have increased their real stock value relative to equivalent individuals in 2004, apart from the 16 to 25 years age group with GCSEs.

The stock of an average 16- to 25-year-old with at least a degree in 2017 has decreased by 8% relative to an equivalent individual in 2004, while the stock of a 16- to 25-year-old with no qualifications has risen by 1% over the same time period. In fact, the per capita stock of any individual in 2017 with a degree is 11.8% lower than in 2004, while the relative stock of someone with no qualifications is higher by an equivalent amount of 11.8% between the same period. However, individuals with a degree in 2017 still have an average discounted lifetime earnings value 102.4% higher than those with no qualifications. Additionally, having a degree gives an average lifetime earnings premium of 23.2% over having A-levels as their highest qualification, which equates to £117,281 in 2015 prices.

Bringing these findings together with those in Figure 7, it is the combination of differing demographic changes, and relative increases and decreases of per capita lifetime earnings by qualification, that explains the different trends of the different age groups’ average stock values. A larger increase of proportions of individuals with higher qualifications for older age groups relative to younger ones has resulted in increases in their average stocks per person. Effectively, the average person in these older age groups is more qualified than in earlier years, which results in a higher lifetime earnings premium.

Nôl i'r tabl cynnwys