Cynnwys

- Key points

- Overview

- User engagement

- Total membership of occupational pension schemes

- Active membership of occupational pension schemes

- Pensioner members by sector

- Members with preserved pension entitlements by sector

- Contribution rates in private sector occupational pension schemes

- Background notes

- Methodoleg

1. Key points

Total membership of occupational pension schemes with two or more members in 2011 was estimated to be 27.2 million, the same as in 2010

The numbers contributing or having contributions paid into a scheme (active members) continues to fall. In 2011 there were 8.2 million active (employee) members of occupational pension schemes compared with 12.2 million at the peak in 1967

Of the active members total, 5.3 million were in public sector schemes and 2.9 million were in private sector schemes

For private sector defined benefit schemes, the average contribution rate in 2011 was 4.9 per cent for members (employees) and 14.2 per cent for employers

For private sector defined contribution schemes, the average contribution rate in 2011 was 2.8 per cent for members (employees) and 6.6 per cent for employers

2. Overview

The Occupational Pension Schemes Survey (OPSS) is an annual survey of occupational pension schemes, and is run by the Office for National Statistics (ONS). The survey was first run in 1953, then in 1956 and 1963, and then every four to five years until 2004 when it became an annual survey. Until its transfer to ONS in 2006, OPSS was run by the Government Actuary’s Department (GAD).

OPSS collects information from occupational pension schemes about scheme membership, benefits and contributions; it includes sections on very small schemes (schemes with two to 11 members) and those that are winding up. OPSS covers both private and public sector occupational pension schemes registered in the United Kingdom. Results from OPSS provide a detailed view of the nature of occupational pension provision in the UK.

This release provides summary data on membership of schemes and contributions paid. More detailed information on scheme membership, the nature of the benefits provided and contributions paid appears in the Occupational Pension Schemes Annual Report. A glossary of pension definitions are in the background notes of this release.

Nôl i'r tabl cynnwys3. User engagement

We are constantly aiming to improve this release and its associated commentary. We would welcome any feedback you might have; please contact us via email: opss@ons.gov.uk or telephone David Matthews on +44 (0)1633 456756.

Nôl i'r tabl cynnwys4. Total membership of occupational pension schemes

Total membership of occupational pension schemes consists of active members (usually current employees who would normally contribute or have contributions paid into a scheme), members receiving pension payments and members with preserved pension entitlements (members who are no longer contributing into a scheme but have accrued rights that will come into payment at normal pension age).

There has been an increase in total membership (of schemes with two or more members) since 1983. In 2011 total membership was 27.2 million compared to 18.9 million in 1983 (Table 1). After a peak of 28.1 million members in 2004 total membership has remained broadly around 27 million.

Membership is evenly distributed over all three membership types: active, 30 per cent; pensions in payment, 34 per cent; and preserved pension entitlements, 36 per cent. Individuals may have more than one of these types of membership.

For example an individual may be in receipt of a pension from a former employer but still working and contributing to a pension. This person would appear in both the pensioner and active member category. As such all estimates of membership are not counts of individuals.

Total estimated membership in 2011 comprised:

8.2 million active (employee) members

9.2 million pensions in payment

9.8 million preserved pension entitlements of former employees who were not yet receiving a pension

Figure 1: Number of members of occupational pension schemes by membership type

Source: Occupational Pension Schemes Survey (OPSS) - Office for National Statistics

Notes:

- This is not a continuous time series.

- The 1983 survey was the first that collected all three occupational pension scheme membership types.

- Due to changes in the definition of the private and public sectors, estimates for 2000 and onwards differ from earlier years. From 2000, organisations such as the Post Office and the BBC were reclassified from the public to the private sector.

- The 2005 survey did not cover the public sector and is therefore not included.

- Changes to methodology for 2006 onwards mean that comparisons with earlier years should be treated with caution.

- Changes to the part of the questionnaire used to estimate pensions in payment and preserved pension entitlements in 2008 mean that comparisons with 2007 and earlier should be treated with caution.

Download this chart Figure 1: Number of members of occupational pension schemes by membership type

Image .csv .xls

Table 1: Number of members of occupational pension schemes by membership type

| Millions | ||||||||||||

| 1983 | 1987 | 1991 | 1995 | 2000 | 2004 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | |

| Active members | 11.1 | 10.6 | 10.7 | 10.3 | 10.1 | 9.8 | 9.2 | 8.8 | 9.0 | 8.7 | 8.3 | 8.2 |

| Pensions in payment | 5.0 | 6.0 | 7.0 | 8.5 | 8.2 | 9.0 | 8.2 | 8.5 | 8.8 | 9.0 | 9.0 | 9.2 |

| Preserved pension entitlements | 2.8 | 3.5 | 4.5 | 7.0 | 6.7 | 9.3 | 9.4 | 9.4 | 9.9 | 10.1 | 9.8 | 9.8 |

| Total | 18.9 | 20.1 | 22.2 | 25.8 | 25.0 | 28.1 | 26.7 | 26.7 | 27.7 | 27.7 | 27.2 | 27.2 |

| Source: Office for National Statistics | ||||||||||||

| Notes: | ||||||||||||

| 1. The 1983 survey was the first that collected all three occupational pension scheme membership types. | ||||||||||||

| 2. The total membership figures for 1983 and 1987 are the sum of previously published rounded totals for each membership type. The unrounded figures are unavailable. | ||||||||||||

| 3. Due to changes in the definition of the private and public sectors, estimates for 2000 and onwards differ from earlier years. From 2000, organisations such as the Post Office and the BBC were reclassified from the public to the private sector. | ||||||||||||

| 4. The 2005 survey did not cover the public sector and is therefore not included. | ||||||||||||

| 5. Changes to methodology for 2006 onwards mean that comparisons with earlier years should be treated with caution. | ||||||||||||

| 6. Changes to the part of the questionnaire used to estimate pensions in payment and preserved pension entitlements in 2008 mean that comparisons with 2007 and earlier should be treated with caution. | ||||||||||||

| 7. Components may not sum to totals due to rounding. | ||||||||||||

Download this table Table 1: Number of members of occupational pension schemes by membership type

.xls (39.4 kB)5. Active membership of occupational pension schemes

The active members of an occupational pension scheme are those who, under the rules of the scheme, are currently accruing benefits. They are usually current employees of the sponsoring employer and are contributing or having contributions paid into a scheme. This release includes breakdowns of active membership by sector, benefit structure and status.

Active membership by sector

Since 1991 there has been a decline in active membership. In 2011 there was an estimated 8.2 million active members of occupational pension schemes (Table 2). This is compared to 12.2 million in 1967 and 6.2 million in 1953. Some of the drop in active membership of occupational pension schemes will have been covered by the growth in the number of people contributing to group personal pensions. The Annual Survey of Hours and Earnings pensions release provides information on pension membership for both occupational and contract based pensions.

The decline in active membership has been particularly marked in the private sector. In 2011 there were 2.9 million active members in private sector schemes, compared with 6.5 million in 1991 and 8.1 million at the peak (in 1967). In the private sector there is a mixture of defined benefit and defined contribution schemes, but in the public sector all occupational pension schemes are defined benefit.

Active membership of public sector schemes has risen over the same period despite the reclassification of some large public sector schemes such as the Post Office and the BBC, to the private sector from 2000. There was an estimated 5.3 million active members in 2011 compared with 4.2 million in 1991 and 5.5 million at the peak in 1979.

Figure 2: Number of active members of occupational pension schemes by sector

Source: Occupational Pension Schemes Survey (OPSS) - Office for National Statistics

Notes:

- This is not a continuous time series.

- Due to changes in the definition of the private and public sectors, estimates for 2000 and onwards differ from earlier years. From 2000, organisations such as the Post Office and the BBC were reclassified from the public to the private sector.

- The 2005 survey did not cover the public sector and is therefore not included.

- Changes to methodology for 2006 onwards mean that comparisons with earlier years should be treated with caution.

Download this chart Figure 2: Number of active members of occupational pension schemes by sector

Image .csv .xls

Table 2: Number of active members of occupational pension schemes by sector

| Millions | |||

| Private sector | Public sector | Total | |

| 1953 | 3.1 | 3.1 | 6.2 |

| 1956 | 4.3 | 3.7 | 8.0 |

| 1963 | 7.2 | 3.9 | 11.1 |

| 1967 | 8.1 | 4.1 | 12.2 |

| 1971 | 6.8 | 4.3 | 11.1 |

| 1975 | 6.0 | 5.4 | 11.4 |

| 1979 | 6.1 | 5.5 | 11.6 |

| 1983 | 5.8 | 5.3 | 11.1 |

| 1987 | 5.8 | 4.8 | 10.6 |

| 1991 | 6.5 | 4.2 | 10.7 |

| 1995 | 6.2 | 4.1 | 10.3 |

| 2000 | 5.7 | 4.4 | 10.1 |

| 2004 | 4.8 | 5.0 | 9.8 |

| 2006 | 4.0 | 5.1 | 9.2 |

| 2007 | 3.6 | 5.2 | 8.8 |

| 2008 | 3.6 | 5.4 | 9.0 |

| 2009 | 3.3 | 5.4 | 8.7 |

| 2010 | 3.0 | 5.3 | 8.3 |

| 2011 | 2.9 | 5.3 | 8.2 |

| Source: Office for National Statistics | |||

| Notes: | |||

| 1. This is not a continuous time series. | |||

| 2. Due to changes in the definition of the private and public sectors, estimates for 2000 onwards differ from earlier years. From 2000, organisations such as the Post Office and the BBC were reclassified from the public to the private sector. | |||

| 3. The 2005 survey did not cover the public sector and is therefore not included. | |||

| 4. Changes to methodology for 2006 onwards mean that comparisons with earlier years should be treated with caution. | |||

| 5. Components may not sum to totals due to rounding. | |||

Download this table Table 2: Number of active members of occupational pension schemes by sector

.xls (38.9 kB)Active membership by benefit structure

The decline in numbers of active members in the private sector over the last 10 years reflects the fall in active membership of private sector defined benefit schemes. Active membership of such schemes fell to an estimated 1.9 million in 2011 from 4.6 million in 2000 (Table 3).

Active membership of private sector defined contribution schemes has remained around 1.0 million since 2000 (the figure for 2011 was 0.9 million).

Figure 3: Number of active members of private sector occupational pension schemes by benefit structure

Source: Occupational Pension Schemes Survey (OPSS) - Office for National Statistics

Download this chart Figure 3: Number of active members of private sector occupational pension schemes by benefit structure

Image .csv .xls

Table 3: Number of active members of private sector occupational pension schemes by benefit structure

| Millions | |||||||||

| 2000 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | |

| Defined benefit | 4.6 | 3.6 | 3.7 | 3.0 | 2.7 | 2.6 | 2.4 | 2.1 | 1.9 |

| Defined contribution | 0.9 | 1.2 | 1.0 | 1.0 | 0.9 | 1.0 | 1.0 | 1.0 | 0.9 |

| Total | 5.7 | 4.8 | 4.7 | 4.0 | 3.6 | 3.6 | 3.3 | 3.0 | 2.9 |

| Source: Office for National Statistics | |||||||||

| Notes: | |||||||||

| 1. Components may not sum to totals due to rounding. | |||||||||

| 2. Changes to methodology for 2006 onwards mean that comparisons with earlier years should be treated with caution. | |||||||||

Download this table Table 3: Number of active members of private sector occupational pension schemes by benefit structure

.xls (36.4 kB)Active membership by status

An occupational pension scheme may be open, closed, frozen or winding up. An open scheme admits new members. A closed scheme does not admit new members but may continue to receive contributions from or on behalf of existing members who continue to accrue pension rights. In general there are no active members in schemes that are frozen or winding up, as members of such schemes can no longer accrue benefits.

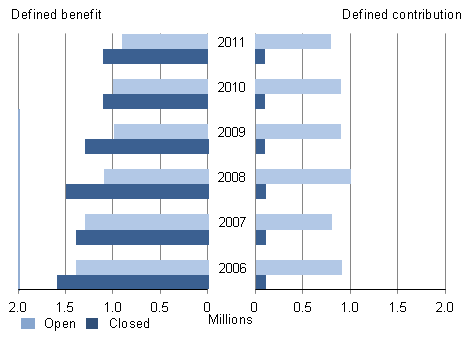

Active membership of open private sector defined benefit schemes fell to 0.9 million in 2011 from 1.4 million in 2006 (Figure 4) while active membership of open private sector defined contribution schemes, dropped to 0.8 million in 2011 from 0.9 million in 2006.

In private sector defined benefit schemes only 45 per cent of members were in schemes that were open to new members (open schemes) compared with 90 per cent of members in private sector defined contribution schemes.

Figure 4: Number of active members of private sector occupational pension schemes by status and benefit structure

Source: Occupational Pension Schemes Survey (OPSS) - Office for National Statistics

Download this image Figure 4: Number of active members of private sector occupational pension schemes by status and benefit structure

.png (10.8 kB) .xls (33.3 kB)

Table 4: Number of active members of private sector occupational pension schemes by status and benefit structure

| Millions | |||||||||

| 2000 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | |

| Defined benefit | 4.6 | 3.6 | 3.7 | 3.0 | 2.7 | 2.6 | 2.4 | 2.1 | 1.9 |

| Open | 4.1 | 1.9 | 2.1 | 1.4 | 1.3 | 1.1 | 1.0 | 1.0 | 0.9 |

| Closed | 0.5 | 1.7 | 1.6 | 1.6 | 1.4 | 1.5 | 1.3 | 1.1 | 1.1 |

| Defined contribution | 0.9 | 1.2 | 1.0 | 1.0 | 0.9 | 1.0 | 1.0 | 1.0 | 0.9 |

| Open | 0.8 | 1.0 | 0.9 | 0.9 | 0.8 | 1.0 | 0.9 | 0.9 | 0.8 |

| Closed | 0.1 | 0.2 | 0.1 | 0.1 | 0.1 | 0.1 | 0.1 | 0.1 | 0.1 |

| Total | 5.7 | 4.8 | 4.7 | 4.0 | 3.6 | 3.6 | 3.3 | 3.0 | 2.9 |

| Open | 4.9 | 2.9 | 3.0 | 2.3 | 2.0 | 2.1 | 1.9 | 1.9 | 1.7 |

| Closed | 0.6 | 1.9 | 1.7 | 1.7 | 1.5 | 1.6 | 1.4 | 1.2 | 1.1 |

| Source: Office for National Statistics | |||||||||

| Notes: | |||||||||

| 1. Components may not sum to totals due to rounding. | |||||||||

| 2. Changes to methodology for 2006 onwards mean that comparisons with earlier years should be treated with caution. | |||||||||

Download this table Table 4: Number of active members of private sector occupational pension schemes by status and benefit structure

.xls (31.7 kB)6. Pensioner members by sector

Pensioner members are members of occupational pension schemes who are in receipt of pension payments. The estimates in this section are estimates of the number of pensions in payment from UK occupational pension schemes, rather than estimates of the total number of pensioners in the country receiving benefits from occupational pension schemes. They do not include annuities purchased by members of defined contribution occupational pension schemes on retirement.

Between 2006 and 2011, the total number of occupational pensions in payment rose to 9.2 million from 8.2 million. There was a steady increase in the total number of occupational pensions in payment between 1953 and 2004, from 0.9 to 9.0 million (Table 5).

This number then fell to 8.2 million in 2006, reflecting a fall in the number of private sector pensions in payment from a peak of 5.6 million in 2004 to 4.6 million in 2006. Since 2006 the number of private sector pensions in payment has risen gradually to reach 5.0 million in 2008 staying around this level for the years 2009 to 2011 (the figure for 2011 was 5.0 million).

Figure 5: Number of pensions in payment for occupational pension schemes by sector

Source: Occupational Pension Schemes Survey (OPSS) - Office for National Statistics

Notes:

- This is not a continuous time series.

- Due to changes in the definition of the private and public sectors, estimates for 2000 and onwards differ from earlier years. From 2000, organisations such as the Post Office and the BBC were reclassified from the public to the private sector.

- The 2005 survey did not cover the public sector and is therefore not included.

- Changes to methodology for 2006 onwards mean that comparisons with earlier years should be treated with caution.

- Changes to the part of the questionnaire used to estimate pensions in payment in 2008 mean that comparisons with 2007 and earlier should be treated with caution.

Download this chart Figure 5: Number of pensions in payment for occupational pension schemes by sector

Image .csv .xls

Table 5: Number of pensions in payment for occupational pension schemes by sector

| Millions | |||

| Private sector | Public sector | Total | |

| 1953 | 0.2 | 0.7 | 0.9 |

| 1956 | 0.3 | 0.8 | 1.1 |

| 1963 | 0.7 | 1.1 | 1.8 |

| 1967 | 1.0 | 1.3 | 2.3 |

| 1971 | 1.3 | 1.6 | 2.9 |

| 1975 | 1.3 | 2.1 | 3.4 |

| 1979 | 1.4 | 2.3 | 3.7 |

| 1983 | 2.1 | 2.9 | 5.0 |

| 1987 | 2.9 | 3.1 | 6.0 |

| 1991 | 3.8 | 3.2 | 7.0 |

| 1995 | 5.0 | 3.5 | 8.5 |

| 2000 | 5.2 | 3.0 | 8.2 |

| 2004 | 5.6 | 3.4 | 9.0 |

| 2006 | 4.6 | 3.5 | 8.2 |

| 2007 | 4.8 | 3.7 | 8.5 |

| 2008 | 5.0 | 3.9 | 8.8 |

| 2009 | 5.1 | 3.9 | 9.0 |

| 2010 | 5.0 | 4.0 | 9.0 |

| 2011 | 5.0 | 4.2 | 9.2 |

| Source: Office for National Statistics | |||

| Notes: | |||

| 1. Due to changes in the definition of the private and public sectors, estimates for 2000 and onwards differ from earlier years. From 2000, organisations such as the Post Office and the BBC were reclassified from the public to the private sector. | |||

| 2. The 2005 survey did not cover the public sector and is therefore not included. | |||

| 3. Changes to methodology for 2006 onwards mean that comparisons with earlier years should be treated with caution. | |||

| 4. Changes to the part of the questionnaire used to estimate pensions in payment in 2008 mean that comparisons with 2007 and earlier should be treated with caution. | |||

| 5. Components may not sum to totals due to rounding. | |||

Download this table Table 5: Number of pensions in payment for occupational pension schemes by sector

.xls (38.9 kB)7. Members with preserved pension entitlements by sector

When active employee members leave the employment of the scheme’s sponsoring employer, they usually have a choice of what to do with the benefits accrued in the scheme. The default position for members with more than two years’ service is a preserved pension entitlement, where the rights remain in the scheme and a pension comes into payment at normal pension age. These estimates do not represent the number of individuals with preserved pension entitlements but show the number of preserved pensions.

The total number of preserved pension entitlements fell slightly to 9.8 million in 2010 and 2011 from 10.1 million in 2009.

The number of members with preserved pension entitlements has risen in both the public sector and the private sector since 1991. The public sector number rose to 3.4 million in 2011 from 1.2 million in 1991. The private sector number fell to 6.3 million in 2011 from 6.7 million in 2008 but rose from 3.3 million in 1991.

Figure 6: Number of preserved pension entitlements in occupational pension schemes by sector

Source: Occupational Pension Schemes Survey (OPSS) - Office for National Statistics

Notes:

- This is not a continuous time series.

- Private and public sector breakdowns are not available for preserved pension entitlements before 1991.

- Due to changes in the definition of the private and public sectors, estimates for 2000 and onwards differ from earlier years. From 2000, organisations such as the Post Office and the BBC were reclassified from the public to the private sector.

- The 2005 survey did not cover the public sector and a total figure is therefore not available.

- Changes to methodology for 2006 onwards mean that comparisons with 2005 and earlier should be treated with caution.

- Changes to the part of the questionnaire used to estimate preserved pension entitlements in 2008 mean that comparisons with 2007 and earlier should be treated with caution.

Download this chart Figure 6: Number of preserved pension entitlements in occupational pension schemes by sector

Image .csv .xls

Table 6: Number of preserved pension entitlements in occupational pension schemes by sector

| Millions | ||||||||||

| 1991 | 1995 | 2000 | 2004 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | |

| Private sector | 3.3 | 5.2 | 5.2 | 7.1 | 6.5 | 6.3 | 6.7 | 6.6 | 6.6 | 6.3 |

| Public sector | 1.2 | 1.8 | 1.5 | 2.2 | 2.9 | 3.1 | 3.2 | 3.5 | 3.2 | 3.4 |

| Total | 4.5 | 7.0 | 6.7 | 9.3 | 9.4 | 9.4 | 9.9 | 10.1 | 9.8 | 9.8 |

| Source: Office for National Statistics | ||||||||||

| Notes: | ||||||||||

| 1. Private and public sector breakdowns are not available for preserved pension entitlements before 1991. | ||||||||||

| 2. Due to changes in the definition of the private and public sectors, estimates for 2000 and onwards differ from earlier years. From 2000, organisations such as the Post Office and the BBC were reclassified from the public to the private sector. | ||||||||||

| 3. The 2005 survey did not cover the public sector and a total figure is therefore not available. | ||||||||||

| 4. Changes to methodology for 2006 onwards mean that comparisons with 2005 and earlier should be treated with caution. | ||||||||||

| 5. Changes to the part of the questionnaire used to estimate preserved pension entitlements in 2008 mean that comparisons with 2007 and earlier should be treated with caution. | ||||||||||

| 6. Components may not sum to totals due to rounding. | ||||||||||

Download this table Table 6: Number of preserved pension entitlements in occupational pension schemes by sector

.xls (31.7 kB)8. Contribution rates in private sector occupational pension schemes

Contribution rate questions are only asked of those in the private sector. Most member and employer contributions are made as a percentage of salary excluding bonuses. However, fixed amount payments can be made as part of the schedule of normal (or regular) contributions. On the other hand, when schemes make ‘special’ cash payments, for instance as part of deficit reduction, these payments are not considered normal contributions and information on such payments are not collected by the survey.

Private sector defined benefit schemes had higher contribution rates than defined contribution schemes in 2011, as in previous years:

for defined benefit schemes, the average contribution rate was 4.9 per cent for members (employees) and 14.2 per cent for employers

for defined contribution schemes, the average contribution rate was 2.8 per cent for members (employees) and 6.6 per cent for employers

Part of the difference between defined benefit and defined contribution schemes’ contribution rates relates to differences in contracting out status.

In private sector ‘career average’ schemes revaluing in line with prices, average employer contribution rates were lower (at 11.5 per cent) than for defined benefit schemes as a whole. Average member contribution rates in such career average schemes were slightly higher (5.4 per cent).

Figure 7: Weighted-average contribution rates to private sector occupational pension schemes by benefit structure and contributor

Source: Occupational Pension Scheme Survey (OPSS) - Office for National Statistics

Notes:

- Includes schemes where standard contributions were zero.

- Excludes normal contributions paid as fixed amounts.

- Includes rates for open, closed and frozen schemes

- Excludes schemes with fewer than 12 members.

Download this chart Figure 7: Weighted-average contribution rates to private sector occupational pension schemes by benefit structure and contributor

Image .csv .xls

Table 7: Weighted-average contribution rates to private sector occupational pension schemes by benefit structure and contributor

| % | ||||||

| 2010 | 2011 | |||||

| Member | Employer | Total | Member | Employer | Total | |

| Defined benefit schemes | 5.1 | 15.8 | 20.8 | 4.9 | 14.2 | 19.2 |

| Career average schemes | 5.4 | 11.8 | 17.2 | 5.4 | 11.5 | 16.9 |

| Defined contribution schemes | 2.7 | 6.2 | 8.9 | 2.8 | 6.6 | 9.4 |

| Source: Office for National Statistics | ||||||

| Notes: | ||||||

| 1. Includes schemes where standard contributions were zero. | ||||||

| 2. Excludes normal contributions paid as fixed amounts. | ||||||

| 3. Includes rates for open, closed and frozen schemes. | ||||||

| 4. Excludes schemes with fewer than 12 members. | ||||||

| 5. Components in tables may not sum to totals due to rounding. | ||||||