1. Main points

UK labour productivity in Quarter 4 (Oct to Dec) 2019, as measured by output per hour, grew by 0.3% compared with the same quarter a year ago; this completes a decade of weak productivity growth referred to as the “productivity puzzle”.

Multi-factor productivity (MFP) in Quarter 4 2019 is estimated to have decreased by 0.3% compared with the same quarter a year ago; this contrasts with trend growth in MFP of 1.5% prior to the economic downturn.

Public service productivity decreased by 1.1% in Quarter 4 2019 compared with the same quarter a year ago, attributed to unusually strong inputs growth of 4.7%.

2. Labour productivity

Productivity is the main driver of economic growth and is an important indicator of the economic health of a nation. It helps define both the scope for raising living standards and the competitiveness of an economy, and is increasingly used to inform government policy.

Productivity is a measure of the relationship between inputs and outputs in the economy; the fewer inputs needed to produce the same output, the more productive the economy is. Labour productivity measures the volume of gross value added (GVA) produced per unit of labour input, with hours worked as the preferred labour input.

Figure 1 shows how the 2008 economic downturn served as a break in the labour productivity series between the historical long-term average growth rates of 2.0% and the weak productivity growth that has followed it. This sustained period of weak growth has been labelled the UK’s “productivity puzzle” and is arguably the defining economic question of our times.

The Royal Statistical Society acknowledged this challenge in December 2019 by awarding the UK Statistic of the Decade accolade to the Office for National Statistics’s (ONS’s) labour productivity series. The series shows an estimated average annual growth of 0.3% in the decade or so since the 2008 economic downturn.

This weakness is maintained in the latest quarter (Quarter 4 (Oct to Dec) 2019), with output per hour growing by 0.3% compared with the same quarter in the previous year. This is attributed to the 7.3% growth in output per hour in the construction sector (although this sector is known to be historically volatile) whereas the manufacturing sector contracted its output per hour by 1.6%.

Figure 1: Output per hour has risen by 0.3% from the same quarter a year ago, the second consecutive quarter

Output per hour, quarter-on-same-quarter a year ago log growth rates, seasonally adjusted, UK, Quarter 1 (Jan to Mar) 1998 to Quarter 4 (Oct to Dec) 2019

Embed code

Notes:

- Percentiles are measurements that indicate the percentage of observations beneath a specified point. The 25th percentile is the value below which 25% of the observations reside.

- Per cent log growth used in the chart will differ slightly from per cent growth in published data sets.

4. Providing wider context

The Office for National Statistics (ONS) is keen to contextualise its data and seeks to understand and explain the “productivity puzzle” phenomenon. As part of this effort, the ONS established a new research centre, the Economic Statistics Centre of Excellence (ESCoE) in collaboration with the National Institute for Economic and Social Research.

Most recently, the ONS has published the first in a series of “explainer” articles by expert academics associated with ESCoE, each providing a view on the measurement of productivity in the UK. The introductory article lists the leading hypotheses used to explain the productivity puzzle. For a theory to be considered a valid single root cause of the puzzle, it must meet two criteria. It must explain why the puzzle is seen to begin in the years following 2008 and it must be able to demonstrate sufficient scale of impact on productivity.

| Structural Arguments | Labour and Managerial Arguments | Measurement Arguments | Capital Arguments | Innovation Arguments | Uncertainty Arguments |

|---|---|---|---|---|---|

| Loss of economies of scale from a fall in international trade | Weak UK management practices | Mismeasurement of products already captured by GDP | Pension fund deficits cause firms to delay capital investment | Slow dispersion of best practice between frontier firms and laggards | Whether UK firms systemically changed the balance between capital and labour inputs |

| Changes in financial regulations | Labour hoarding | Mismeasurement caused by services moving outside the GDP boundary | Banks' inability to lend against intangible assets | A slowdown in the flow of ideas or new technologies | Uncertainty caused by rapid technology change causing firms to delay capital investment |

| North Sea oil and gas | Labour misallocation | Duplication of channels | |||

| Bank forbearance |

Download this table Table 1: Various arguments put forward to explain the weak productivity growth seen since the 2008 economic downturn

.xls .csvTable 1 shows how the productivity puzzle has been accurately named. Each argument is likely to explain some of the productivity puzzle, as the factors they describe all impact the UK economy in some way or another.

The following articles in the series will provide a summary or assessment of different aspects of productivity measurement, either using the available data to provide evidence to discount or support the main theories, or highlighting where a data gap exists. They will serve as a test of whether the ONS’s published measures give any insight to the strengths and weaknesses of these arguments.

Nôl i'r tabl cynnwys5. Productivity decades analysis

Using data from the Bank of England’s A millennium of microeconomic data dataset and the Office for National Statistics’s (ONS’s) latest estimates of output per hour worked, Figure 2 places the last decade of productivity growth in a greater historical context.

The last decade has been aberration from the viewpoint of the last 50 years, during which productivity growth has stayed close to its 2% trend up until 2007. However, Figure 2 shows that the period 2010 to 2019, when productivity growth averaged 0.5%, is not such an anomaly in UK history, despite productivity growth last being this weak in the 1890s.

Figure 2: The period 2010 to 2019 exhibited weak productivity growth not seen since the turn of the 19th century

Annual productivity growth, 10-year moving average, UK, 1770 to 2019

Source: Bank of England, Office for National Statistics

Notes:

- Bank of England data used before 1971, Office for National Statistics used from 1971 onwards.

Download this chart Figure 2: The period 2010 to 2019 exhibited weak productivity growth not seen since the turn of the 19th century

Image .csv .xlsThe 1760 to 2019 dataset provides further insight into the productivity puzzle. Namely, that some version of a productivity puzzle (a persistent slowdown of annual productivity growth) has troubled the UK on occasion over its history and that in each case productivity growth has recovered in time. Whether productivity growth does return to its pre-downturn 2% trend, and if it does, how it accomplishes this, are some of the important questions stemming from the productivity puzzle.

Nôl i'r tabl cynnwys6. Multi-factor productivity

Estimates of multi-factor productivity (MFP) provide a different view of productivity to our labour productivity estimates. MFP attempts to control for the changes in the various inputs used to create the economic output and how these inputs are combined to deliver output. These inputs include changes to capital services (such as machinery and software), changes to the composition of the labour market (for example, the number of workers with university degrees) and changes to labour input in terms of hours.

The MFP estimate the Office for National Statistics (ONS) publishes is our estimate of how much more is being produced given the same inputs. MFP represents how efficiently the factors of production are combined to produce an output. If an industry shows negative MFP it might mean that it has not been able to harness new technology. Changes in MFP and capital inputs can therefore explain movements in labour productivity. This is further explained in our simple guide to MFP.

MFP in the market sector in Quarter 4 (Oct to Dec) 2019 decreased by 0.3% compared with the same quarter a year ago and MFP in 2019 is estimated to be 1.3% below its pre-2008 economic downturn level.

Figure 3: Market sector output per hour has barely increased in the last 12 years

Decomposition of cumulative quarterly growth of output per hour worked, Quarter 1 (Jan to Mar) 2008 to Quarter 4 (Oct to Dec) 2019, UK, market sector

Source: Office for National Statistics

Notes:

- Labour productivity growth is the cumulative quarter-on-quarter log change in market sector gross value added (GVA) per hour worked.

- Columns show contributions of components, calculated by weighting log changes in each component by its factor income share.

- MFP is calculated by residual.

Download this chart Figure 3: Market sector output per hour has barely increased in the last 12 years

Image .csv .xlsThe weakness in labour productivity growth over the past decade is highlighted in Figure 3, which also shows how the increase in labour composition has been the main driver of positive labour productivity growth. This contrasts with the weak MFP growth and weak “capital deepening” (capital services per hour worked) since the 2008 downturn. In fact, since 2012, the UK has experienced “capital shallowing”; the growth of capital services has been slower than the growth in hours worked.

MFP analysis also allows us to compare the gap between actual productivity growth and the pre-downturn trend growth and decompose the productivity gap into component parts.

We estimate that straight after the downturn, the productivity gap was almost wholly driven by MFP, with negative capital deepening, estimating to contribute around one-third of the gap since 2012. However, the share of hours worked by workers with degrees or postgraduate degrees has been increasing since the downturn. Compared with 2008, labour composition in 2019 has grown by 3.3%. This means that labour composition in the UK has been higher for the post-downturn period, and therefore labour composition is estimated not to have contributed to the productivity puzzle.

Nôl i'r tabl cynnwys7. Unit labour costs

Unit labour costs (ULCs) capture the full costs of labour incurred in the production of a unit of economic output; they reflect the relationship between the cost of labour and the value of the corresponding output. If increases in labour costs are not reflected in the volume of output, this can put upward pressure on the prices of goods and services. Hence, ULCs are a closely watched indicator of domestically generated inflationary pressure in the economy. They are usually expressed as a ratio of the total labour compensation per hour worked, to the output per hour worked.

In Quarter 4 (Oct to Dec) 2019, ULCs increased by 2.4% compared with the same quarter in the previous year, and this reflects fairly stable ULCs growth since Quarter 2 (Apr to June) 2016. Compared with the recent history of this series, which experienced volatility as the level of growth swung between negative 1% and positive 4%, this reduction in volatility is a clear change in the time trend.

Experimental estimates of sectional unit labour costs (SULCs) show SULCs in the manufacturing sector grew by 6.2% compared with the same quarter a year ago, while SULCs in the services sector grew by 1.9%. The strong and consistent growth seen in manufacturing SULCs is a result of labour costs per hour increasing at a faster rate than output per hour.

Figure 4: Whole economy unit labour costs (ULC) increased by 2.3% compared with the same quarter a year ago, concluding a decade of strong ULC growth

Whole economy unit labour costs, quarter on year growth rates, seasonally adjusted, UK, Quarter 1 (Jan to Mar) 2008 to Quarter 4 (Oct to Dec) 2019

Source: Office for National Statistics

Notes:

- Labour costs per hour estimates will differ from those in our Index of Labour Costs per hour bulleting, due to differences in methodology.

Download this chart Figure 4: Whole economy unit labour costs (ULC) increased by 2.3% compared with the same quarter a year ago, concluding a decade of strong ULC growth

Image .csv .xls8. Public service productivity

Alongside our other measures of productivity, we also publish experimental measures of total public service productivity – published on a quarterly basis up to and including Quarter 4 (Oct to Dec) 2019. The Office for National Statistics (ONS) also publishes an annual estimate of total public service productivity, which is badged as a National Statistic. The quarterly series offers a more timely measure, as the annual series has a significant time lag.

Compared with the same quarter in the previous year, productivity for total public services fell by 1.1% in Quarter 4 2019. Over this period, inputs increased by 4.7% while output increased by 3.6%, causing productivity to fall. This follows a rise in Quarter 3 (July to Sept) 2019 as productivity was revised upwards from a fall of 0.2% to growth of 0.1%.

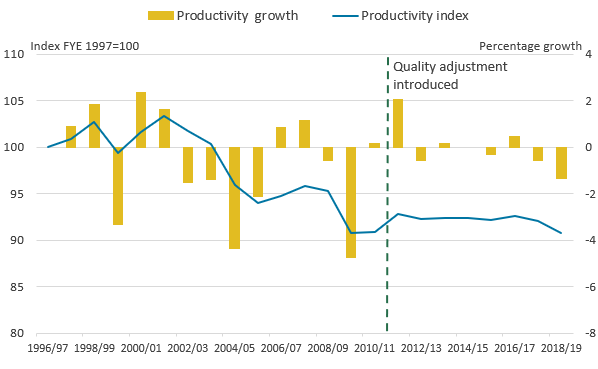

However, Figure 5 shows total public service productivity fell by 0.2% in 2019, the first annual fall in productivity since 2010. Inputs were estimated to have grown by 3.8%, greater than the estimated growth in output of 3.6%. This estimate should be treated with caution until the annual estimate for 2019 is available, in which output is adjusted for changes in the quality of services delivered, and data sources and methodology vary. Nonetheless, public service productivity is estimated to have increased by a total of 5.0% between 2010 and 2019 (an average of 0.5%) per year.

Figure 5: Productivity is volatile from Quarter 1 2018 to Quarter 4 2019 but declines overall

Total public service productivity, UK, 1997 to Quarter 4 (Oct to Dec) 2019

Source: Office for National Statistics

Notes:

- Estimates from 1997 to 2017 are based on the latest annual public service productivity release.

- Estimates from Quarter 1 2018 to Quarter 4 2019 (in grey) are the experimental quarterly estimates in this article and are annualised (in yellow) for 2018 and 2019.

- Estimates of productivity for the experimental period are indirectly seasonally adjusted, calculated using seasonally adjusted inputs and seasonally adjusted output.

Download this chart Figure 5: Productivity is volatile from Quarter 1 2018 to Quarter 4 2019 but declines overall

Image .csv .xls10. Regional productivity

The Subregional productivity publication is the source of annual Office for National Statistics (ONS) labour productivity data for Nomenclature of Territorial Units for Statistics (NUTS): NUTS 2 and NUTS 3 subregions as well as for city regions and enterprise partnership regions.

In the February 2020 edition, an analysis of the changes in labour productivity between 2010 and 2018 was included in the publication showing, for example, that labour productivity increased in 105 out of 168 NUTS 3 regions in Great Britain but declined in 63. Amongst city regions there was productivity growth in 15 out of 18 cities over the same period.

For the first time, the publication also included experimental data for local authorities. Figure 7 shows the local authorities in Great Britain with the highest and lowest gross value added (GVA) per hour worked for 2018. It shows that labour productivity in the local authorities with the highest levels (Hounslow, Tower Hamlets and Runnymede) was three times greater than in the local authority with the lowest level (Powys).

Figure 7: Gross value added per hour worked – highest- and lowest-ranking local authority districts in the UK, smoothed, current prices, 2018

Source: Office for National Statistics

Download this chart Figure 7: Gross value added per hour worked – highest- and lowest-ranking local authority districts in the UK, smoothed, current prices, 2018

Image .csv .xlsIn many cases, local authorities with relatively high labour productivity are those with either a major manufacturing site (for example, car or aerospace production), a large utilities sector, or a focus on high-skill service sectors, reflecting the high labour productivity in these types of industries. Meanwhile, local authorities with the lowest productivity are typically in more rural or geographically isolated locations.

However, while noting that industry structure can make an impact on the productivity of a local authority, it is not the only explanatory factor. As explained in the Understanding spatial labour productivity in the UK article, differences across the country in productivity within industry sectors also play a significant role in the cross-country differences between areas. This can be seen in Figure 8, which shows that half of NUTS 1 regions experienced negative output per hour growth in 2018.

Figure 8: Half of all NUTS 1 regions experienced negative output per hour growth

Output per hour annual log growth rates by NUTS 1 region, UK, 2018

Embed code

Figure 8 comes from the February 2020 Regional labour productivity, including industry by region, UK: 2018 publication. This release included experimental statistics, which looked at how NUTS 1 regions deviated from “expected” output per hour and growth in output per hour in the different industries of the UK economy.

The “expected” level of productivity and productivity growth is determined by the region’s overall output per hour combined with the industry’s overall output per hour. For example, it is expected that a high-productivity industry like the financial sector in a high-productivity region like London would have higher output per hour than most industries in most regions.

The analysis shows that industry K, finance and insurance, showed a 19% deviation from its expected level in London. This perhaps reflects the more specialised nature of the financial activity that occurs in London.

Nôl i'r tabl cynnwys