Cynnwys

- Abstract

- Introduction

- A review of the literature

- Survey design and sampling

- Deriving management practice scores

- Response rates

- Descriptive results

- Regression analyses

- Conclusions and next steps

- References

- Authors

- Acknowledgements

- Links to related statistics

- Annex 1: Scoring schedule for the Management and Expectations Survey

1. Abstract

In 2017, the Office for National Statistics (ONS) in partnership with the Economic Statistics Centre of Excellence (ESCoE) developed and conducted the Management and Expectations Survey (MES), covering 25,000 enterprises in the production and services industries in Great Britain. The MES collected information on various aspects of businesses’ management practices, as well as a five-bin scale of future expectations of turnover, employment, expenditure and capital investment growth.

Across our broad sample, we found a significant correlation between management practices and labour productivity. We found greater prevalence of structured management practices among services than production industries. We also found more structured practices among larger, foreign-owned, non-family-owned and businesses with more-educated workers than among smaller, domestically-owned, family-owned and firms with less-educated workers.

Since this release, a new wave of the Management and Expectations Survey with data on 2019 and 2020 has been published.

Nôl i'r tabl cynnwys2. Introduction

The UK’s recent productivity performance has been strikingly weak, stimulating a lively debate about the causes and consequences of low productivity growth among academics, policy-makers and in the media. While the rate of labour productivity growth has slowed in a large number of countries, this slowdown appears more pronounced in the UK and the gap between the UK and other developed economies remains stubbornly wide.

Despite the prolonged nature of the recent slowdown and the intensity of debate, there is little consensus around the drivers of the UK’s recent poor performance. In this context, the relationship between management practices and productivity is receiving growing attention, both in terms of the theoretical literature and in empirical studies. To contribute to this debate, the Office for National Statistics (ONS) conducted a pilot Management Practices Survey (MPS) of British manufacturing businesses in 2016. The results of this study showed a statistically significant relationship between management practices and labour productivity.

In 2017, ONS collaborated with the Economic Statistics Centre of Excellence (ESCoE)1 to run a second survey – the Management and Expectations Survey (MES). This was aimed at measuring management practices using a broader set of metrics and across a wider range of industries, including both the production and services industries, which together account for the vast majority of the UK economy. The survey also collected information on business uncertainty by asking firms for forecasts of their expected performance in terms of turnover, employment, expenditure and capital investment for 2017 and 2018.

In this article, we present the initial results of the management practices part of the MES survey. The results of the expectations section will be published at a future date. Our descriptive analysis shows higher prevalence of structured management practices among the services industries than production industries, among foreign-owned firms than domestic firms and among non-family-owned firms than family-owned firms. We also find greater incidence of structured practices in businesses with higher levels of employment.

Consistent with our pilot study2 and with the broader literature, we find a positive statistically significant correlation between management practice scores and labour productivity – measured as gross value added per worker. Our results show that a 0.1 increase in our derived management score is associated with a 9.6% increase in productivity. This translates to a 19% increase in productivity if the average management score increases from the 25th percentile (0.34) to the median (0.53), and a 12% increase in productivity moving from the median to the 75th percentile (0.66). Among the four broad management practices categories, we find that practices relating to continuous improvement and employment management – such as those relating to promotions, performance reviews, training and managing underperformance – were most correlated with productivity.

The analysis presented in this article develops our understanding of the link between management practices and productivity for a broader and more representative population than most other similar studies. The wider literature has explored the causal “drivers” of differences in structured management practices (Bloom and others, 2017) and the impact of management practices in explaining within-country and cross-country total factor productivity (TFP) gaps. We intend to explore these areas in future work.

The rest of this article proceeds as follows:

Section 3 provides a review of the academic literature

Sections 4 and 5 describe the sampling and survey methodologies, including how we derive management practice scores

Section 6 discusses our response rates

Sections 7 presents a descriptive analysis of management practice scores by business characteristics

Section 8 examines variations in management scores across businesses and conditional analysis of the relationship between management practices and productivity

Section 9 sets out our conclusions and next steps

Notes for: Introduction

The Economic Statistics Centre of Excellence (ESCoE) is a consortium of academic institutions commissioned to support ONS with research that addresses the challenges of measuring the modern economy, as recommended by Professor Sir Charles Bean in his Independent Review of UK Economics Statistics.

See ONS 2017a, “Management Practices and productivity among manufacturing businesses in Great Britain: Experimental estimates for 2015”, Office for National Statistics

3. A review of the literature

A body of literature notes the wide dispersion of productivity levels between establishments (Syverson 2004) and enterprises (Bartelsman and Doms 2000, Criscuolo, Haskel and Martin 2003, ONS 2016a, ONS 2017b, OECD 2017), even within narrowly-defined industries (Slater, 1960, Foster, Haltiwanger and Syverson 2008). The reasons for these differences remain a matter of debate, even after accounting for variation in business’ output prices, differences in technology, research (R&D) and employee skill levels as inputs in the production process. A relatively new and growing strand of research in this area finds a correlation between the prevalence of structured management practices and firm performance – including productivity – (Bloom and others 2013, ONS 2017a, Bender and others 2016, Broszeit and others 2016).

These studies also find variation in the prevalence of structured management practices among firms, creating a secondary area of interest – understanding the drivers of these differences. Exploring data on the management practices of British manufacturing businesses (ONS, 2017a), we found firm size to be a significant driver of differences in management scores, controlling for family ownership, multinational status and firm age. Using a similar dataset of German manufacturing establishments, Broszeit and others (2016) found that in addition to size, variations in management practices were also driven by foreign or domestic ownership, exporter status and the qualifications of managers. These results were largely consistent with findings of Bloom and others (2013), using similar establishment level data from the US Management and Organisational Practice Survey.

These studies also found a significant correlation between management practices and labour productivity, albeit at varying levels of magnitude, with Britain and Germany being more comparable than the US1. One noteworthy outcome of the British study (ONS 2017a), is the relatively lower productivity performance – around 20% – of family-owned businesses, which make up almost two-thirds (64%) of the manufacturing population in the study. In their study of dynastic (inter-generational) manufacturing businesses, Lemos and Scur (2018) suggest that reputational constraints (costs) can hinder the adoption of more structured management practices by dynastic family-owned businesses, such as those pertaining to the dismissal of underperforming workers. They claim that these reputational constraints help to explain the family firms’ productivity deficit.

In this article, we provide the first results of the Management and Expectations Survey (MES). This survey builds on the 2016 Management Practice Survey (MPS) with a much larger sample and expanded industry coverage of both the production and services industries. The MES also includes a broader measure of management practices, including practices on performance reviews and employee training and development.

Notes for: A review of the literature

- Using a different measure of management practices, Bryson, A and Forth, J (2018) also found a correlation between management practices and productivity among British businesses.

4. Survey design and sampling

In 2017, the Office for National Statistics (ONS), in partnership with the Economic Statistics Centre of Excellence (ESCoE), developed and conducted the Management and Expectations Survey (MES), building on the experience and outcomes of the pilot Management Practice Survey (MPS) of 2016. The MES was a voluntary postal survey of approximately 25,000 businesses with employment of 10 or more1, drawn from the 2016 Annual Business Survey2 sample, covering both the production and services industries in Great Britain. The MES sample was drawn through random sampling, stratified by three employment size groups (10 to 49, 50 to 249 and 250 or more), industries in sections B to S3 and the 11 NUTS1 regions – including the nine English regions, Wales and Scotland – of Great Britain4.

The MES questionnaire covered a broader and slightly modified set of questions than the MPS5, bringing it in closer alignment to the Management and Organisational Practice Survey (MOPS)6 conducted by the US Census Bureau. The MES survey attempts to measure four aspects of firms’ management practices:

continuous improvement practices – how well does the firm monitor its operations and use this information for continuous improvement?

key performance indicators (KPIs) – how many KPIs the firm has and how often they are reviewed

targets – are the firm’s targets stretching, tracked and appropriately reviewed?

employment practices – is the firm promoting and rewarding employees based on performance, managing employee underperformance and providing adequate training opportunities?

Other features of the MES questionnaire include a new section on organisational practices – aimed at measuring the degree of decentralisation of decision making within firms – and a section on business expectations, measuring projected business performance and probabilities for turnover, expenditure, capital investment and employment, using a “five-bin” scale. This section also includes a question on expectations of future growth of UK real gross domestic product (GDP).

Notes for: Survey design and sampling

Employment is defined as the total number of employees registered on the payroll and working proprietors.

Further details on the Annual Business Survey (ABS) can be found in the ABS Quality and Methodology Information report and the ABS Technical Report.

Excluding section K – financial and insurance activities, and including manufacturing sub-sections CA to CM.

The MES survey covers businesses in Great Britain and is consistent with the scope of ONS’s ABS as the Department for Finance and Personnel Northern Ireland (DFPNI) is responsible for conducting the ABS for businesses in Northern Ireland.

The MES survey comprised 36 multiple choice questions drawn mostly from the 2015 Management and Organisational Practices Survey (MOPS) of the US Census Bureau and were split into four broad sections: management practices (12 questions), organisation (4 questions), current performance and future expectations (10 questions) as well as questions on business characteristics.

See Buffington, C, Foster, L, Jarmin, R, and Ohlmacher, S (2017) for more information.

5. Deriving management practice scores

The Management and Expectations Survey (MES) questionnaire consists of 121 categorical questions on quantitative and qualitative aspects of business’ management practices. Each question is accompanied by a list of options from which respondents chose options closest to the practices within their firms. For each question, scores were awarded to each option on a scale of 0 to 1, where 0 was the least and 1 the most structured management practice. An overall management score was derived as a simple average of a firm’s score on all individual questions.

As a minor deviation from the Management Practice Survey (MPS)2, the least score – of zero – was awarded to questions that were rightly skipped due to the response given to a prior leading question, as skipping these questions invariably means the firms do not have these practices. Details of the scoring schedule are included in Annex 1.

To ensure that firms were benchmarked against a broadly consistent set of questions, we set two questions as mandatory3 and permitted no more than two question non-response out of the 12 management practice questions. Businesses that did not meet this threshold were excluded from our analysis.

Notes for: Deriving management practice scores

We asked for information on practices of managers and non-managers separately on seven of these 12 questions, and treated these as individual questions in creating an average score for the business.

The process of constructing a management practice score was broadly similar to that of the MPS and consistent with the methodology used for similar questions on the US Management and Organisational Practices Surveys (MOPS).

The mandatory questions were Question 6 - "How many key performance indicators were monitored with this business?" and Question 8 - "In 2016, which one of the following best describes the main time frames for achieving production/services targets within this business?".

6. Response rates

The Management and Expectations Survey (MES) surveyed 25,006 firms, through a voluntary postal survey. Of this number, 4.8% elected to opt out of the voluntary survey, 38.7% replied with usable information, while 56.5% did not respond, including businesses that may have closed over the period.

In Figure 1, we find that our response rates are skewed towards small- and medium-sized firms, with at least 4 in 10 firms with employment below 250 responding to the survey, compared with slightly fewer than 3 in 10 firms with employment of 250 or more. Using a probit regression, we find significant negative associations between employment, turnover and gross value added (GVA) per worker and the probability of firms responding to the MES survey (Table 1).

This trend is consistent with the findings of the pilot Management Practice Survey (MPS), which also showed that larger businesses were less likely to respond to a voluntary survey. This could suggest that our unweighted data may not be representative. However, the analyses presented in the rest of the article are weighted to be representative of the population and are broadly consistent with the literature.

Figure 1: Distribution of response rates by employment size bands

Great Britain, 2016

Source: Office for National Statistics

Notes:

- Unweighted distribution of response rates by employment size bands.

- Our population of interest covers businesses in production and services industries with employment of at least 10, in Great Britain.

- The MES sample excludes firms in section A (Agriculture, forestry and fishing), and section K (Financial and insurance activities).

Download this chart Figure 1: Distribution of response rates by employment size bands

Image .csv .xls

Table 1: Probit regression of Management and Expectations Survey response rate, Great Britain, 2016

| Coefficients | ||||||

| Model (1) Response | Model (2) Response | Model (3) Response | Model (4) Response | Model (5) Response | Model (6) Response | |

|---|---|---|---|---|---|---|

| Log (employment) | -0.110*** | -0.133*** | -0.139*** | |||

| (0.01) | (0.01) | (0.01) | ||||

| Log (turnover) | -0.114*** | -0.038*** | -0.033*** | |||

| (0.00) | (0.01) | (0.01) | ||||

| Log (GVA/worker) | -0.048*** | -0.038*** | ||||

| (0.01) | (0.01) | |||||

| Size: 50-99 | 0.002 | |||||

| (0.03) | ||||||

| Size: 100-249 | -0.141*** | |||||

| (0.03) | ||||||

| Size: 250+ | -0.615*** | |||||

| (0.02) | ||||||

| Industry dummies | No | No | No | No | Yes | Yes |

| chi-squared | 451.9 | 676.5 | 32.3 | 904.8 | 1122.5 | 1145.6 |

| Observations | 25006 | 19514 | 18532 | 19514 | 19510 | 18528 |

| Source: Office for National Statistics | ||||||

| Notes: | ||||||

| 1. Standard errors in parentheses,* p < 0.05, ** p < 0.01, *** p < 0.001. | ||||||

| 2. Data in table are probit regression coefficients, not marginal effects. | ||||||

| 3. Where we have indicated the inclusion of industry dummies, these are at the two digit (division) level, based on the 2007 Standard Industrial Classification. | ||||||

| 4. Our population of interest covers businesses in production and services industries with employment of at least 10, in Great Britain. | ||||||

| 5. The MES sample excludes firms in section A (Agriculture, forestry and fishing) and section K (Financial and insurance activities), and results are weighted to reflect the population of firms. | ||||||

Download this table Table 1: Probit regression of Management and Expectations Survey response rate, Great Britain, 2016

.xls (34.8 kB)7. Descriptive results

Descriptive analyses of management scores

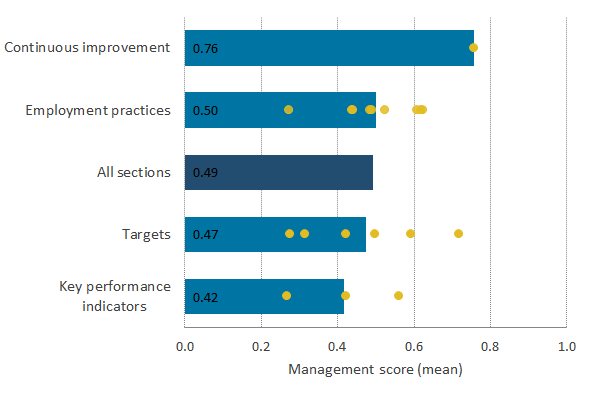

On a scale of 0 to 1, with 0 being the least and 1 the most structured management practices, the average management practice score for our survey population was 0.49. This represents a variation in management practice scores across the four broad categories in our questionnaire (Figure 2).

On average, firms scored the highest (0.76) on practices relating to having processes for continuous improvement, and scored the lowest (0.42) on practices relating to the number of key performance indicators (KPIs) they have and how frequently they review progress against these KPIs. Between these two extremes, we find relatively higher scores (0.50) for employment practices – including practices relating to staff promotion, performance reviews, training days undertaken by staff, and managing staff underperformance – than for target setting and related practices (0.47). Within each category, there are a range of outcomes for the average individual question scores (the yellow dots in Figure 2), details of which are presented in the reference tables published with this article.

Figure 2: Average management practice scores by management practice categories

Great Britain, 2016

Source: Office for National Statistics

Notes:

We refer to the continuous improvement category as production or service delivery on the questionnaire.

The bars represent average management scores for each section, while the dots represent the average score of individual questions within each section.

In our analysis, we treated questions with manager and non-manager splits as two separate questions, with equal weights in calculating an average score for the business.

Our population of interest covers businesses in production and services industries with employment of at least 10, in Great Britain.

The MES sample excludes firms in section A (Agriculture, forestry and fishing), and section K (Financial and insurance activities), and results are weighted to reflect the population of firms.

Download this image Figure 2: Average management practice scores by management practice categories

.png (11.5 kB) .xls (35.8 kB)Distribution of management scores by firm size

The population of businesses in our survey is skewed towards small firms (10 to 49 employment), which account for 80% of this population. Of the remaining businesses, 16% were medium-sized1 (with employment between 50 and 249) and 4% were large firms with at least 250 employment.

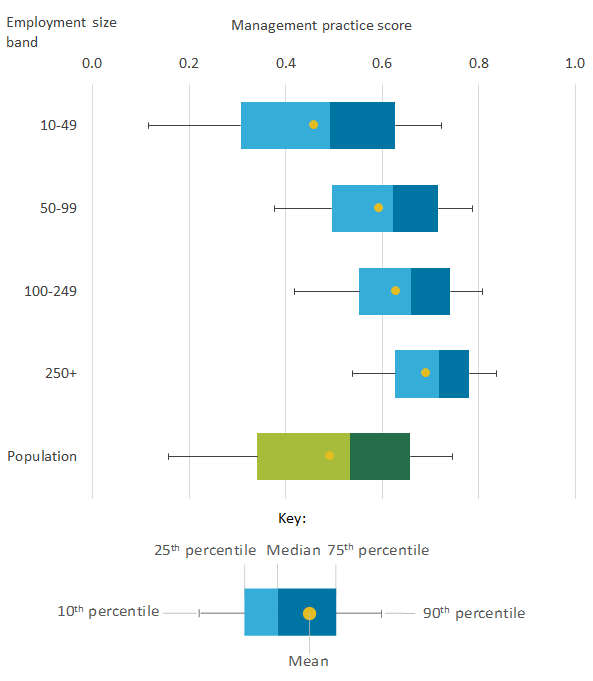

Firm size was found to be significant in explaining variations in management scores2, with larger firms more likely to have a higher prevalence of structured management practices than smaller firms. Consistent with the literature, we found on average an increasing prevalence of structured management practices among larger firms than smaller firms, with average management scores (the yellow dots in Figure 3) increasing across each successive size band.

Figure 3 (and all other similar charts in the article) also shows relative management scores for firms in the 10th and 90th percentiles (the lines), and the inter-quartile range – the difference between the 25th and 50th percentiles (light shaded bar) and between the 50th and 75th percentiles (dark shaded bar) – for each size band. We found the widest range of scores, between the 10th and 90th percentiles and the inter-quartile range, among small firms. This narrows as the size band increases. Similar to our pilot study, we also found that the differences in management scores across the size bands were larger at lower percentiles than higher percentiles, with the scores across the size groups at the 90th percentiles more similar than at the 10th percentiles.

Figure 3: Mean and percentile distribution of management practice scores by employment size bands

Great Britain, 2016

Source: Office for National Statistics

Notes:

Key: Line: 10th and 90th percentiles, Light shaded box: Difference between 50th and 25th percentiles, Dark shaded box: Difference between 75th and 50th percentiles, Dots: mean score

Our population of interest covers businesses in production and services industries with employment of at least 10, in Great Britain.

The MES sample excludes firms in section A (Agriculture, forestry and fishing), and section K (Financial and insurance activities), and results are weighted to reflect the population of firms.

Download this image Figure 3: Mean and percentile distribution of management practice scores by employment size bands

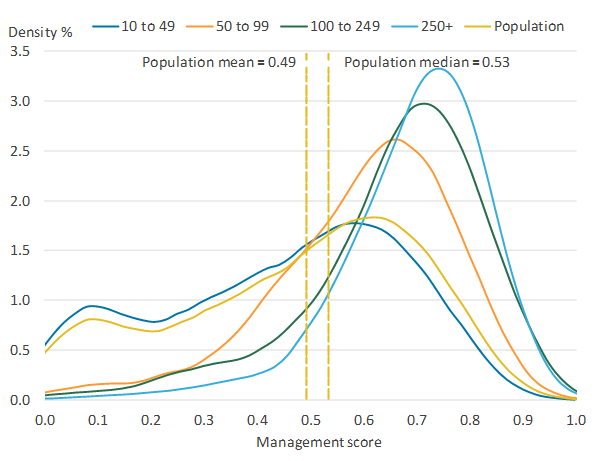

.png (17.4 kB) .xls (33.3 kB)There was a similarity between the profile of scores for the population3 and for small firms (10 to 49) across the distribution, reflecting the dominance of small firms within our population (Figure 3). Likewise, we found this dominance prominent when we compared the distribution of firms by management score for the business population and size bands, using a kernel density chart (Figure 4). Here we found the distribution of firms in the population almost identical to that of small firms, and distinctly different from the profile of medium-sized (50 to 99 and 100 to 249) and large firms (250 or more employment).

Compared with medium-sized and large firms, we found a higher concentration of small firms at the left-hand tail of the management score distribution, where management scores are lower. Conversely, medium-sized and large firms were more concentrated at the right-hand tail of the distribution, indicating more prevalent structured management practices. Note that the cluster of firms at the two lowest management scores was mainly driven by a concentration of small firms with very low prevalence of structured management practices.

Figure 4: Distribution of management scores by employment size bands

Great Britain, 2016

Source: Office for National Statistics

Notes:

Kernel density bandwidth size equals 0.5.

Population mean management score equals 0.49, Population median management score equals 0.53.

The kernel density charts are constrained to management scores between 0 and 1.

Our population of interest covers businesses in production and services industries with employment of at least 10, in Great Britain.

The MES sample excludes firms in section A (Agriculture, forestry and fishing), and section K (Financial and insurance activities), and results are weighted to reflect the population of firms.

Download this image Figure 4: Distribution of management scores by employment size bands

.png (33.3 kB) .xls (46.6 kB)Distribution of management score by ownership type

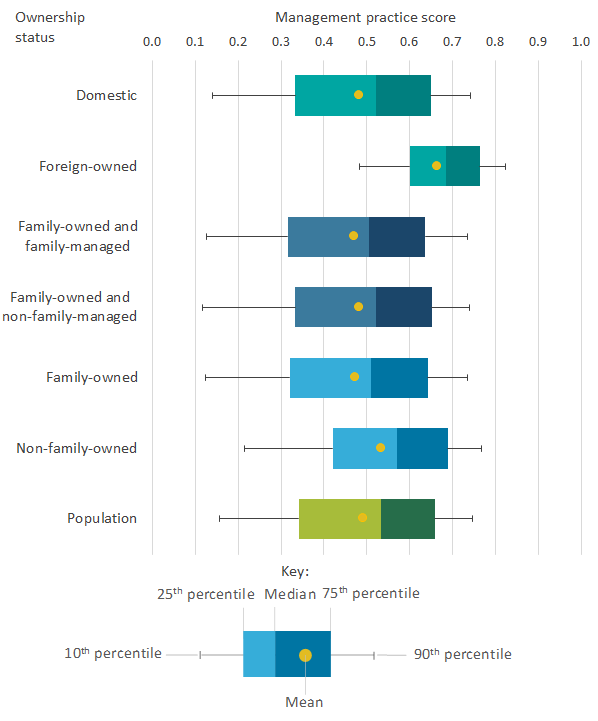

Management scores were found to vary by ownership types. Our 2016 study of manufacturing businesses found lower prevalence of structured management practices among family-owned and UK domestic businesses, compared with non-family-owned firms and multinationals. Consistent with these results, we found similar trends from our broader MES population (Figure 5), with higher average management scores among foreign-owned firms than domestic firms and among non-family-owned firms than family-owned firms. Within family-owned firms, we found a modest difference in average scores between firms that are owned and managed by a member of the owning family and those owned but not managed by a family member.

Distribution of management scores by foreign ownership status

The dispersion of management scores for foreign-owned firms is notably different from that of domestically-owned firms. Compared with domestic firms, foreign-owned firms had higher management scores across all percentiles and a narrower range of scores between the 10th and 90th percentiles and inter-quartile range, indicating relatively similar scores among firms in this category. The management score of a foreign-owned firm in the 10th percentile was around 70% higher than for a domestic firm in the same percentile. However, this difference was smaller at higher percentiles, narrowing to a 10% difference at the 90th percentile.

The relatively higher management scores among foreign-owned firms could partly reflect their higher likelihood to be large – in terms of employment – and arguably better placed to share international best practices, including management practices, relative to domestic firms. Foreign-owned firms, however, only accounted for 5% of our survey population, while most firms (95%) were domestically owned.

Figure 5: Percentile distribution of management scores by ownership type

Great Britain, 2016

Source: Office for National Statistics

Notes:

Key: Line: 10th and 90th percentiles, Light shaded box: Difference between 50th and 25th percentiles, Dark shaded box: Difference between 75th and 50th percentiles, Dots: mean score

Our population of interest covers businesses in production and services industries with employment of at least 10, in Great Britain.

The MES sample excludes firms in section A (Agriculture, forestry and fishing), and section K (Financial and insurance activities), and results are weighted to reflect the population of firms.

Business ownership categories include: domestic, foreign-owned, non-family-owned, family-owned, family-owned and family-managed, family-owned and non-family-managed, and the overall population.

Download this image Figure 5: Percentile distribution of management scores by ownership type

.png (21.7 kB) .xls (33.8 kB)Distribution of management scores by family ownership status

There is an expanding literature on the dynamics and performance of family-owned firms. Family-owned firms are often considered characteristically different from non-family-owned firms, with studies such as Andersson and others (2017) showing the average family-owned firm to be smaller in terms of employment, sales and total assets, older, lower skilled, less involved in multinational enterprises and exports, and less productive compared with non-family-owned firms.

Family-owned firms made up a large share of our business population and are therefore an important demography when trying to understand variations in business performance. Of firms which responded to the question on family ownership – representing 99% of our population –, around two-thirds (66%) were family-owned, while the remaining 34% were not owned by a family. Family-owned firms had a lower mean (0.47) and median score, compared with non-family-owned firms (which have a mean score of 0.53), and a wider leftward dispersion of management scores between the 10th and 90th percentiles (Figure 5). Within family-owned firms, those managed by a family member had marginally lower average scores (0.47) compared with those not managed by a member of the owning family (0.48).

Distribution of management scores by industry

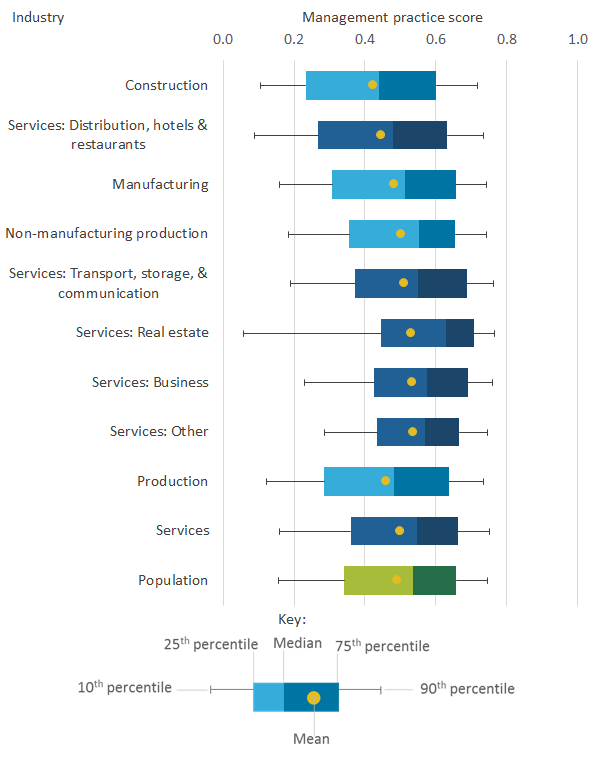

One of the main features of the Management and Expectations Survey (MES) is its broad industry coverage across most production and services industries, where until now similar studies have focused on manufacturing. Variations in management practices across industries would partly reflect variations in the composition of firms within the industries in terms of size and ownership structure among others. At the broad industry level, average management scores were higher in services (0.50) than production industries (0.46), see Figure 6. Services industries accounted for 80% of our business population, exerting a positive skew on the overall population score.

Within these broad categories, there was less variation in average management scores among services than production industries, with all industry groups in services scoring higher than the average population score, except for distribution, hotels and restaurant industries. On the other hand, construction and manufacturing industries – which jointly account for 95% of firms in production industries – scored lower than the average population scores and together with distribution, hotels and restaurants had the lowest scores across all industries.

Figure 6: Percentile distribution of management scores by industry groups

Great Britain, 2016

Source: Office for National Statistics

Notes:

Key: Line: 10th and 90th percentiles, Light shaded box: Difference between 50th and 25th percentiles, Dark shaded box: Difference between 75th and 50th percentiles, Dots: mean score

Our population of interest covers businesses in production and services industries with employment of at least 10, in Great Britain.

The MES sample excludes firms in section A (Agriculture, forestry and fishing), and section K (Financial and insurance activities), and results are weighted to reflect the population of firms.

Key to industry grouping: Population equals Production and Services; Production equals Non-manufacturing production, Manufacturing and Construction; Services equals Distribution, hotels and restaurants, Transport, storage and communication, Business services, Real estate and Other services; Non-manufacturing production equals B (Mining and quarrying), D (Electricity, gas, steam and air conditioning supply) and E (Water supply; Sewerage, waste management and remediation activities); Manufacturing equals C (Manufacturing); Construction equals Section F (Construction); Services: Distribution, hotels and restaurants equals Sections G (Wholesale and retail trade; Repair of motor vehicles and motorcycles) and I (Accommodation and food service activities); Services: Transport, storage and communication equals Sections H (Transportation and storage) and J (Information and communication); Services: Business equals Section M (Professional, scientific and technical activities) and Section N (Administrative and support service activities); Services: Real estate equals Section L (Real estate); and Services: Other equals Sections P (Education), Q (Human health and social work activities), R (Arts, entertainment and recreation) and S (Other service activities).

Download this image Figure 6: Percentile distribution of management scores by industry groups

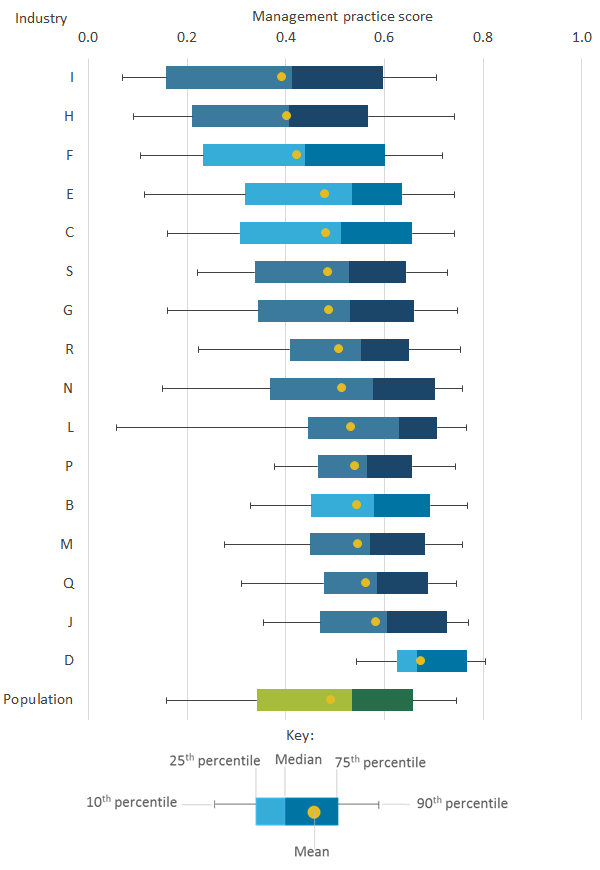

.png (30.2 kB) .xls (37.9 kB)Similar to the trend discussed in previous sections, we found wider variation in management scores at lower tails than higher tails of the percentile distributions. However, these trends mask more varied outcomes at a more detailed industry level presented in Figure 7.

The average score for Non-manufacturing production (0.50) for instance, reflects a combination of relatively lower management scores in industry E (Water supply, sewerage, waste management and remediation activities), at 0.48, and higher average scores for industries B (Mining and quarrying), at 0.55, and D (Electricity, gas, steam and air conditioning supply), at 0.68. Section L (Real estate activities) had the lowest score at the 10th percentile and the widest range between the 10th and 90th percentiles, suggesting a more dispersed range of outcomes compared with other industries. The mean and median for Section L, however, suggest a small number of these firms with very low management scores.

Figure 7: Percentile distribution of management scores by industry sections

Great Britain, 2016

Source: Office for National Statistics

Notes:

Key: Line: 10th and 90th percentiles, Light shaded box: Difference between 50th and 25th percentiles, Dark shaded box: Difference between 75th and 50th percentiles, Dots: mean score

Our population of interest covers businesses in production and services industries with employment of at least 10, in Great Britain.

The MES sample excludes firms in section A (Agriculture, forestry and fishing), and section K (Financial and insurance activities), and results are weighted to reflect the population of firms.

Key to industry sections: B (Mining and quarrying), C (Manufacturing), D (Electricity, gas, steam and air conditioning supply), E (Water supply; Sewerage, waste management and remediation activities), F (Construction), G (Wholesale and retail trade; Repair of motor vehicles and motorcycles), H (Transportation and storage), I (Accommodation and food service activities), J (Information and communication), L (Real estate), M (Professional, scientific and technical activities), N (Administrative and support service activities), P (Education), Q (Human health and social work activities), R (Arts, entertainment and recreation), and S (Other service activities).

Download this image Figure 7: Percentile distribution of management scores by industry sections

.png (29.9 kB) .xls (38.4 kB)Management score, labour productivity and operating profits

In Figures 8 and 9, we use a similar approach to Bloom and others (2013), showing distributional trends between management scores and business outcomes. In Figure 8, we show the average productivity (in index form) of firms within each decile of management practice score. Similarly, in Figure 9, we show the average operating surplus for firms within each of these deciles. Similar to the US study, we found higher productivity levels among firms with higher management scores. Likewise, in Figure 9, we found higher levels of operating surplus – revenue less expenditure – among firms at higher deciles of the management score distribution compared with firms at lower deciles. In subsequent sections, we run conditional analysis to test the relationship between management score and productivity, controlling for a number of business characteristics.

Figure 8: Labour productivity by management score decile

Great Britain, 2016

Source: Office for National Statistics

Notes:

The chart shows gross value added (GVA) per worker by management score decile, normalised to 100 in first decile.

Our population of interest covers businesses in production and services industries with employment of at least 10, in Great Britain.

The MES sample excludes firms in section A (Agriculture, forestry and fishing), and section K (Financial and insurance activities), and results are weighted to reflect the population of firms.

Download this chart Figure 8: Labour productivity by management score decile

Image .csv .xls

Figure 9: Gross operating surplus (GOS) by management score decile

Great Britain, 2016

Source: Office for National Statistics

Notes:

Gross operating surplus (GOS) measures the difference between revenue and expenditure. It is calculated as gross output less the cost of intermediate goods and services, and less compensation of employees and taxes and subsidies on production and imports.

Our population of interest covers businesses in production and services industries with employment of at least 10, in Great Britain.

The MES sample excludes firms in section A (Agriculture, forestry and fishing), and section K (Financial and insurance Activities), and results are weighted to reflect the population of firms.

Download this chart Figure 9: Gross operating surplus (GOS) by management score decile

Image .csv .xlsNotes for: Descriptive results

Medium-sized businesses in our population comprise 11% with 50 to 99 employment and 5% with 100 to 249 employment.

See ONS 2017a, Broszeit and others (2016) and Bloom and others (2017).

A histogram showing the percentage distribution of management scores can be found in the annex to this article (Figure 10).

8. Regression analyses

Understanding variations in management practices

In this section, we use Ordinary Least Squares (OLS) regressions to examine variations in management scores. Our control variables include firm size represented by the log of employment, age and age squared, dummies for foreign and domestic ownership, family and non-family ownership, family and non-family management as well as location and industry at the division (two digit) level. The Management and Expectations Survey (MES) asks for information on the share of managers and non-managers with degree-level or equivalent qualifications across a few percentage bands. We use these as proxies for education levels within the firm.

In Table 2, we start with a simple model and add explanatory variables to observe the association of these added variables to management scores and how they affect our base model. In column 1, we found a statistically significant positive correlation between management score and firm size. The size of the coefficient decreased as we added more explanatory variables, but remained robust across all specifications. In our most detailed specification (column 6), we found that a 10% increase in employment was associated with a 0.6 increase in management score.

We found statistically significant differences in management scores between foreign and non-foreign owned firms. On average, foreign-owned firms scored 0.07 higher than domestically-owned firms, controlling for size, age, location, industry, manager and non-manager education, family ownership and family management.

Our analysis also found significant differences in scores between firms with degree-level educated managers and non-managers compared with those with none respectively (column 4). Interestingly, differences in scores between firms with degree-level educated managers and those with none peaked at 20% to 49% and declined across higher shares of educated managers. This raises interesting questions, such as, whether structured management practices are less relevant in firms with a broad base of highly-skilled managers?

Table 2: Multivariate analysis of management score by business characteristics, Great Britain, 2016

| Dependent variable is management score | ||||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Log(employment) | 0.081*** | 0.077*** | 0.082*** | 0.064*** | 0.064*** | 0.061*** |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | |

| Family-owned | 0.000 | -0.005 | -0.005 | -0.004 | ||

| (0.01) | (0.01) | (0.01) | (0.01) | |||

| Family-owned and non-family-managed | -0.026 | |||||

| (0.02) | ||||||

| Family-owned and family-managed | 0.002 | |||||

| (0.01) | ||||||

| Foreign owned | 0.083*** | 0.078*** | 0.065*** | 0.063*** | 0.065*** | |

| (0.01) | (0.01) | (0.01) | (0.01) | (0.01) | ||

| Degree_m | 0.085*** | 0.086*** | ||||

| (0.01) | (0.01) | |||||

| Degree_100%_m | 0.052* | |||||

| (0.02) | ||||||

| Degree_> 80%_m | 0.086*** | |||||

| (0.02) | ||||||

| Degree_50-80%_m | 0.100*** | |||||

| (0.02) | ||||||

| Degree_20-49%_m | 0.108*** | |||||

| (0.01) | ||||||

| Degree_<20%_m | 0.077*** | |||||

| (0.01) | ||||||

| Degree_nm | 0.072*** | 0.071*** | ||||

| (0.01) | (0.01) | |||||

| Degree_100%_nm | 0.087* | |||||

| (0.04) | ||||||

| Degree_>80%_nm | 0.108*** | |||||

| (0.02) | ||||||

| Degree_50-80%_nm | 0.069*** | |||||

| (0.02) | ||||||

| Degree_20-49%_nm | 0.078*** | |||||

| (0.02) | ||||||

| Degree<20%_nm | 0.072*** | |||||

| (0.01) | ||||||

| Age | 0.007* | 0.006 | 0.007* | 0.004 | ||

| (0.00) | (0.00) | (0.00) | (0.00) | |||

| Age squared | -0.000*** | -0.000** | -0.000*** | -0.000** | ||

| (0.00) | (0.00) | (0.00) | (0.00) | |||

| Industry dummies | Yes | Yes | Yes | Yes | Yes | Yes |

| Location dummies | No | No | No | No | Yes | Yes |

| R-squared | 0.238 | 0.244 | 0.263 | 0.343 | 0.356 | 0.359 |

| Observations | 7841 | 7810 | 7810 | 7115 | 7115 | 7107 |

| Source: Office for National Statistics | ||||||

| Notes: | ||||||

| 1. Standard errors in parentheses, * p < 0.05, ** p < 0.01, *** p < 0.001. | ||||||

| 2. Family owned firms in this regression include a small number of firms who did not provide further information about the structure of their management. | ||||||

| 3. Where we have indicated the inclusion of industry dummies, these are at the two digit (division) level, based on the 2007 Standard Industrial Classification. A constant is also included in all regressions. | ||||||

| 4. Our population of interest covers businesses in production and services industries with employment of at least 10, in Great Britain. | ||||||

| 5. The MES sample excludes firms in section A (Agriculture, forestry and fishing), and section K (Financial and insurance activities), and results are weighted to reflect the population of firms. | ||||||

Download this table Table 2: Multivariate analysis of management score by business characteristics, Great Britain, 2016

.xls (38.9 kB)In Table 3, we use the detailed model developed previously to examine the relationship between these characteristics and management scores for each employment size band. Across all size bands, we found a strong positive relationship between management score and size in terms of employment, except for medium-sized firms in the 50 to 99 group where the coefficient was not statistically significant and had a negative sign. This is particularly interesting as our descriptive analysis (Figure 3) shows an increasing profile of average management scores across successive size bands.

For firms in the smallest size group (10 to 49), we found that a 10% increase in employment was correlated with an increase in management score of 0.96, decreasing to 0.66 for the 100 to 249 size group and further still to 0.14 for the largest size group (250 or more). This fits with the declining profile observed in the literature1, and could suggest that as firms grow from small to large, they initially implement more structured practices, but require fewer additional practices at much bigger sizes.

We found foreign-owned firms scoring higher than domestic firms across all size groups. However, relative to non-family-owned firms, there was no statistically significant difference in scores with family-owned and managed and family-owned and non-family-managed firms, except for large firms (250 or more), where family-owned and managed firms scored lower than non-family-owned firms.

Age was found to have a relationship with management scores for firms in the 100 to 249 and 250 or more size bands, although the coefficients were small. For managers in large firms (250 or more), all levels of shares of degree-level equivalent qualifications were statistically different from those with none, but less so for small firms (10 to 49). Conversely, for non-managers in small firms, all levels of shares of degree-level equivalent qualifications were statistically different from those with none, but less so for large firms.

Table 3: Multivariate analysis of management score by size bands, Great Britain, 2016

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Management score | Management score | Management score | Management score | |

| Size: 10-49 | Size: 50-99 | Size: 100-249 | Size: 250+ | |

| Log(employment) | 0.096*** | -0.042 | 0.066*** | 0.014*** |

| (0.01) | (0.03) | (0.02) | (0.00) | |

| Family-owned and non-family-managed | -0.039 | 0.011 | 0.006 | -0.007 |

| (0.02) | (0.02) | (0.02) | (0.01) | |

| Family-owned and family-managed | -0.000 | 0.007 | -0.011 | -0.047*** |

| (0.01) | (0.01) | (0.01) | (0.01) | |

| Foreign owned | 0.081*** | 0.061*** | 0.047** | 0.032*** |

| (0.02) | (0.02) | (0.02) | (0.01) | |

| Degree_100%_m | 0.049 | 0.056 | 0.077* | 0.114** |

| (0.03) | (0.03) | (0.04) | (0.04) | |

| Degree_> 80%_m | 0.072** | 0.105** | 0.059 | 0.153*** |

| (0.03) | (0.03) | (0.03) | (0.03) | |

| Degree_50-80%_m | 0.097*** | 0.087** | 0.101** | 0.158*** |

| (0.02) | (0.03) | (0.03) | (0.03) | |

| Degree_20-49%_m | 0.118*** | 0.081** | 0.086** | 0.136*** |

| (0.02) | (0.03) | (0.03) | (0.03) | |

| Degree_<20%_m | 0.070*** | 0.065* | 0.087** | 0.131*** |

| (0.02) | (0.03) | (0.03) | (0.03) | |

| Degree_100%_nm | 0.086* | 0.090* | 0.118* | 0.024 |

| (0.04) | (0.04) | (0.06) | (0.05) | |

| Degree_>80%_nm | 0.106*** | 0.071* | 0.118*** | 0.052 |

| (0.03) | (0.03) | (0.03) | (0.03) | |

| Degree_50-80%_nm | 0.056* | 0.067* | 0.064* | 0.063** |

| (0.02) | (0.03) | (0.03) | (0.02) | |

| Degree_20-49%_nm | 0.074*** | 0.070** | 0.063* | 0.049* |

| (0.02) | (0.03) | (0.03) | (0.02) | |

| Degree<20%_nm | 0.067*** | 0.063*** | 0.021 | 0.04 |

| (0.01) | (0.02) | (0.02) | (0.02) | |

| Age | 0.004 | 0.003 | 0.010* | 0.006*** |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Age squared | -0.000* | -0.000 | -0.000* | -0.000** |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Industry dummies | Yes | Yes | Yes | Yes |

| Location dummies | Yes | Yes | Yes | Yes |

| R-squared | 0.334 | 0.279 | 0.268 | 0.255 |

| Observations | 2902 | 1208 | 1027 | 1970 |

| Source: Office for National Statistics | ||||

| Notes: | ||||

| 1. Standard errors in parentheses, * p < 0.05, ** p < 0.01, *** p < 0.001. | ||||

| 2. Family-owned firms in this regression include a small number of firms who did not provide further information about the structure of their management. | ||||

| 3. Where we have indicated the inclusion of industry dummies,these are at the two digit (division) level, based on the 2007 Standard Industrial Classification. A constant is also included in all regressions. | ||||

| 4. Our population of interest covers businesses in production and services industries with employment of at least 10, in Great Britain. | ||||

| 5. The MES sample excludes firms in section A (Agriculture, forestry and fishing), and section K (Financial and insurance activities), and results are weighted to reflect the population of firms. | ||||

Download this table Table 3: Multivariate analysis of management score by size bands, Great Britain, 2016

.xls (38.9 kB)In Table 4, we run similar regressions as previously, on the four broad sections of management practices that include practices relating to continuous improvement, key performance indicators (KPIs), target setting and related practices, as well as employment-related practices such as performance reviews, staff training and managing underperformance.

The results showed positive correlation between management scores and employment size across all management practice categories. However, there were variations across some of the regressors for certain categories. The coefficients for family-owned and non-family-managed was negative across all management categories and statistically significant for continuous improvement and KPI-related practices.

Furthermore, management scores for foreign-owned firms were on average higher than for domestically-owned firms for KPI, target-related and employment-related practices, but not statistically different for continuous improvement. In broad terms, firms with degree-level qualified managers and non-managers were less different to those with none on continuous improvement practices than the other three management categories.

Table 4: Multivariate analysis of management score by management practices sections, Great Britain, 2016

| Dependent variable is management score | ||||

|---|---|---|---|---|

| Continuous improvement | KPI practices | Target practices | Employment practices | |

| Log(employment) | 0.027*** | 0.050*** | 0.037*** | 0.084*** |

| (0.01) | (0.00) | (0.01) | (0.01) | |

| Family-owned and non-family-managed | -0.056* | -0.036* | -0.044 | -0.006 |

| (0.02) | (0.02) | (0.02) | (0.02) | |

| Family-owned and family-managed | -0.005 | -0.002 | -0.013 | 0.015 |

| (0.02) | (0.01) | (0.02) | (0.01) | |

| Foreign owned | 0.02 | 0.040** | 0.120*** | 0.041* |

| (0.02) | (0.01) | (0.01) | (0.02) | |

| Degree_100%_m | 0.008 | 0.059* | 0.071* | 0.04 |

| (0.03) | (0.03) | (0.03) | (0.03) | |

| Degree_> 80%_m | 0.027 | 0.075** | 0.094** | 0.090*** |

| (0.03) | (0.02) | (0.03) | (0.02) | |

| Degree_50-80%_m | 0.075*** | 0.089*** | 0.109*** | 0.099*** |

| (0.02) | (0.02) | (0.02) | (0.02) | |

| Degree_20-49%_m | 0.044* | 0.095*** | 0.111*** | 0.116*** |

| (0.02) | (0.02) | (0.02) | (0.02) | |

| Degree_<20%_m | 0.023 | 0.076*** | 0.067*** | 0.089*** |

| (0.02) | (0.02) | (0.02) | (0.02) | |

| Degree_100%_nm | 0.061 | 0.083* | 0.063 | 0.108* |

| (0.04) | (0.04) | (0.05) | (0.04) | |

| Degree_>80%_nm | 0.06 | 0.084** | 0.104*** | 0.123*** |

| (0.03) | (0.03) | (0.03) | (0.03) | |

| Degree_50-80%_nm | 0.045 | 0.049* | 0.065* | 0.082*** |

| (0.03) | (0.02) | (0.03) | (0.02) | |

| Degree_20-49%_nm | 0.032 | 0.069*** | 0.064* | 0.096*** |

| (0.02) | (0.02) | (0.03) | (0.02) | |

| Degree<20%_nm | 0.03 | 0.057*** | 0.074*** | 0.080*** |

| (0.02) | (0.01) | (0.02) | (0.01) | |

| Age | -0.007 | 0.006 | 0.004 | 0.005 |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Age squared | 0.000 | -0.000* | -0.000* | -0.000** |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Industry dummies | Yes | Yes | Yes | Yes |

| Location dummies | Yes | Yes | Yes | Yes |

| R-squared | 0.132 | 0.201 | 0.241 | 0.341 |

| Observations | 7095 | 7107 | 7107 | 7107 |

| Source: Office for National Statistics | ||||

| Notes: | ||||

| 1. Standard errors in parentheses, * p < 0.05, ** p < 0.01, *** p < 0.001. | ||||

| 2. Please refer to the scoring schedule in Annex 1 of this paper for the questions included in each section. | ||||

| 3. Family owned firms in this regression include a small number of firms who did not provide further information about the structure of their management. | ||||

| 4. Where we have indicated the inclusion of industry dummies, these are at the two digit (division) level, based on the 2007 Standard Industrial Classification. A constant is also included in all regressions. | ||||

| 5. Our population of interest covers businesses in production and services industries with employment of at least 10, in Great Britain. | ||||

| 6. The MES sample excludes firms in section A (Agriculture, forestry and fishing) and section K (Financial and insurance activities), and results are weighted to reflect the population of firms. | ||||

Download this table Table 4: Multivariate analysis of management score by management practices sections, Great Britain, 2016

.xls (38.9 kB)Analysing the relationship between management practices and labour productivity

The industry coverage of the Management and Expectations Survey (MES), covering most industries in production and services, makes it unique in analysing the relationship between management practices and labour productivity on such a broad representative sample. In Table 5, we run a regression on labour productivity – log of gross value added (GVA) per worker – controlling for management score, employment size, family ownership and management, foreign ownership, age and the share of degree-level skilled managers and non-managers. We also include industry and location (region) dummies.

Across all models in Table 5, we found a significant positive correlation between management practice scores and labour productivity. Our most detailed model (column 6) shows that a 0.1 increase in management score was associated with a 9.6% increase in GVA per worker and was significant at the 0.1% level. This translates to a 19% increase in productivity between the management score at the 25th percentile (0.34) and the median (0.53), and a 12% increase in labour productivity between the median and the 75th percentile (0.66). One interesting outcome in our regression is the negative relationship between size (logarithm of employment) and productivity. This would require further analysis, but may suggest some collinearity between management scores and employment.

Contrary to the results of our manufacturing pilot, we found no significant relationship between family ownership and productivity, as well as for family and non-family related management; although the signs on these coefficients are negative as in the previous work, the coefficient for family-owned and non-family-managed is larger than for family-managed firms. Also in divergence from the results of our pilot, we found foreign ownership to be correlated with productivity, with foreign-owned firms around 35% more productive than non-foreign-owned firms2. We also found age to be correlated with labour productivity, satisfying our previous hypothesis that more mature businesses may have more structured practices because they have had longer to implement them. They are also likely to be more productive, either because they have had time to build up their stock of capital, which we have not included directly, or through competitive selection, where only more productive businesses survive in the medium or long term.

We found that the indicators of degree-level qualifications for managers and non-managers were statistically significant (columns 4 and 5). The results show that firms with degree-level qualified managers were 15% more productive than firms with no degree-level managers, and similarly firms with degree-level qualified non-managers are relatively more productive than those without (column 5). However, the detailed model in column 6 shows that relative to firms with no degree-level qualified managers, the productivity of firms with degree-level qualified managers was only significantly different to firms with fewer than 20% of managers qualified at degree level. We found more incidence of significant differences in productivity among non-manager degree-level indicators, suggesting there were higher productivity returns from more educated workers than managers.

Table 5: Multivariate analysis of labour productivity, Great Britain, 2016

| Dependent variable: Log(GVA/worker) | ||||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Management score | 1.454*** | 1.136*** | 1.101*** | 0.981*** | 0.977*** | 0.961*** |

| (0.16) | (0.14) | (0.14) | (0.15) | (0.15) | (0.16) | |

| Log(employment) | 0.001 | -0.023 | -0.077** | -0.077** | -0.081** | |

| (0.02) | (0.02) | (0.02) | (0.02) | (0.03) | ||

| Family-owned | -0.08 | -0.049 | -0.041 | |||

| (0.06) | (0.06) | (0.06) | ||||

| Family-owned and non-family-managed | -0.144 | |||||

| (0.08) | ||||||

| Family-owned and family-managed | -0.017 | |||||

| (0.06) | ||||||

| Foreign owned | 0.366*** | 0.328*** | 0.317*** | 0.357*** | ||

| (0.06) | (0.07) | (0.07) | (0.07) | |||

| Degree_m | 0.143* | 0.148* | ||||

| (0.06) | (0.06) | |||||

| Degree_100%_m | -0.042 | |||||

| (0.10) | ||||||

| Degree_> 80%_m | 0.073 | |||||

| (0.11) | ||||||

| Degree_50-80%_m | 0.048 | |||||

| (0.09) | ||||||

| Degree_20-49%_m | 0.055 | |||||

| (0.08) | ||||||

| Degree_<20%_m | 0.251*** | |||||

| (0.07) | ||||||

| Degree_nm | 0.170** | 0.155** | ||||

| (0.06) | (0.06) | |||||

| Degree_100%_nm | 0.353* | |||||

| (0.15) | ||||||

| Degree_>80%_nm | 0.242 | |||||

| (0.14) | ||||||

| Degree_50-80%_nm | 0.282* | |||||

| (0.11) | ||||||

| Degree_20-49%_nm | 0.308*** | |||||

| (0.09) | ||||||

| Degree<20%_nm | 0.145* | |||||

| (0.06) | ||||||

| Age | 0.061** | 0.063*** | 0.057** | |||

| (0.02) | (0.02) | (0.02) | ||||

| Age squared | -0.002** | -0.002** | -0.002** | |||

| (0.00) | (0.00) | (0.00) | ||||

| Industry dummies | No | Yes | Yes | Yes | Yes | Yes |

| Location dummies | No | No | No | No | Yes | Yes |

| R-squared | 0.075 | 0.368 | 0.374 | 0.403 | 0.411 | 0.412 |

| Observations | 7416 | 7416 | 7388 | 6731 | 6731 | 6723 |

| Source: Office for National Statistics | ||||||

| Notes: | ||||||

| 1. Standard errors in parentheses, * p < 0.05, ** p < 0.01, *** p < 0.001. | ||||||

| 2. Family owned firms in this regression include a small number of firms who did not provide further information about the structure of their management. | ||||||

| 3. Where we have indicated the inclusion of industry dummies, these are at the two digit (division) level, based on the 2007 Standard Industrial Classification. A constant is also included in all regressions. | ||||||

| 4. Our population of interest covers businesses in production and services industries with employment of at least 10, in Great Britain. | ||||||

| 5. The MES sample excludes firms in section A (Agriculture, forestry and fishing) and section K (Financial and insurance activities), and results are weighted to reflect the population of firms. | ||||||

Download this table Table 5: Multivariate analysis of labour productivity, Great Britain, 2016

.xls (39.4 kB)In Table 6, we examine the relationship between our four management practices categories and labour productivity. Controlling for all available business characteristics in our earlier model, we found a correlation between productivity and continuous improvement practices at the 5% significance level and a correlation with employment-related practices at the 0.1% level of significance – column 1 of Table 6. In column 2, we introduced interaction terms between each management category and firm size. We found a strong positive coefficient for the interaction between employment practices and employment, and a weak positive coefficient for continuous improvement and employment interaction. This suggests that larger firms are more likely to earn a premium from these practices than smaller firms.

Finally, in column 3, we regressed each individual question on productivity to examine the relationship between them. We found statistically significant positive relationships between productivity and continuous improvement practices (Q5), the number of key performance indicators (KPIs) monitored by the business (Q6), performance bonus of non-managers related to targets (Q11-non-managers), and promotion practices for managers (Q12-managers). We also found a positive and significant relationship between training practices for non-managers (Q14-non-managers) and productivity.

These findings are not necessarily causal, but indicate a correlation between these management practices and higher levels of productivity. We have previously also suggested that firms which engage in these management practices may also have other characteristics in common, which together makes them more productive than others.

Table 6: Multivariate analysis of labour productivity by management practices sections and questions, Great Britain, 2016

| (1) | (2) | (3) | ||

|---|---|---|---|---|

| Log (GVA/worker) | Log (GVA/worker) | Log (GVA/worker) | ||

| Continuous improvement | 0.378* | |||

| (0.16) | ||||

| Continuous improvement x Log(employment) | 0.101* | |||

| (0.04) | ||||

| KPI practices | 0.063 | |||

| (0.12) | ||||

| KPI practices x Log(employment) | 0.015 | |||

| (0.03) | ||||

| Target practices | 0.168 | |||

| (0.11) | ||||

| Target practices x Log(employment) | 0.057 | |||

| (0.03) | ||||

| Employment practices | 0.497*** | |||

| (0.13) | ||||

| Employment practices x Log(employment) | 0.147*** | |||

| (0.04) | ||||

| Log(employment) | -0.083*** | -0.293*** | -0.082*** | |

| (0.02) | (0.05) | (0.02) | ||

| Family-owned and non-family-managed | -0.132 | -0.137 | -0.169* | |

| (0.08) | (0.08) | (0.08) | ||

| Family-owned and family-managed | -0.016 | -0.01 | -0.018 | |

| (0.06) | (0.06) | (0.06) | ||

| Foreign owned | 0.368*** | 0.342*** | 0.366*** | |

| (0.07) | (0.07) | (0.07) | ||

| Age | 0.059** | 0.059** | 0.048** | |

| (0.02) | (0.02) | (0.02) | ||

| Age squared | -0.002** | -0.002** | -0.002** | |

| (0.00) | (0.00) | (0.00) | ||

| Q5 Management score | 0.371** | |||

| (0.14) | ||||

| Q6 Management score | 0.191* | |||

| (0.10) | ||||

| Q11B Management score | 0.188* | |||

| (0.08) | ||||

| Q12A Management score | 0.189** | |||

| (0.06) | ||||

| Q14B Management score | 0.301** | |||

| (0.10) | ||||

| Industry dummies | Yes | Yes | Yes | |

| Location dummies | Yes | Yes | Yes | |

| Degree_m | Yes | Yes | Yes | |

| Degree_nm | Yes | Yes | Yes | |

| All individual questions | No | No | Yes | |

| R-squared | 0.416 | 0.413 | 0.413 | |

| Observations | 6714 | 6714 | 6324 | |

| Source: Office for National Statistics | ||||

| Notes: | ||||

| 1. Standard errors in parentheses, * p < 0.05, ** p < 0.01, *** p < 0.001. | ||||

| 2. In column 3 we included scores for all individual questions in the model, but only show the coefficients of those with statistical significance. | ||||

| 3. Where we have indicated the inclusion of industry dummies, these are at the two digit (division) level, based on the 2007 Standard Industrial Classification. A constant is also included in all regressions. | ||||

| 4. Our population of interest covers businesses in production and services industries with employment of at least 10, in Great Britain. | ||||

| 5. The MES sample excludes firms in section A (Agriculture, forestry and fishing) and section K (Financial and insurance activities), and results are weighted to reflect the population of firms. | ||||

Download this table Table 6: Multivariate analysis of labour productivity by management practices sections and questions, Great Britain, 2016

.xls (38.4 kB)Notes for: Regression analysis

See ONS (2016b) and Bloom and others (2017)

It should be noted that the Management Practices Survey (MPS) identified multinationals as businesses with units in other countries (including UK-owned businesses with foreign affiliates), while foreign-owned firms in this article refers to businesses that are not UK owned.

9. Conclusions and next steps

Management practices and their association with productivity is gaining prominence within the research community and among policy-makers. However, most research on management practices have so far focused on manufacturing industries. The Management and Expectations Survey (MES) developed by Office for National Statistics (ONS) and the Economic Statistics Centre of Excellence (ESCoE) is one of a few surveys aimed at measuring the prevalence of structured management practices for a broad range of businesses in production and services industries.

Our results from this broad population of firms are broadly consistent with the wider literature. We found higher prevalence of structured management practices among services industries than production industries, among larger firms than smaller firms, among foreign-owned firms than domestically-owned firms, and among non-family-owned businesses than family-owned businesses. Our conditional analysis found a statistically significant correlation between management practices and labour productivity, with an increase in management score of 0.1 associated with a 9.6% increase in productivity.

The MES dataset has the potential to support extensive research on other drivers of variations in management practices such as exploring location effects. There is also scope to investigate industry variations in management practices at more disaggregated levels. Further work in this area also includes an analysis of the relationships between levels of decentralisation of decision making and productivity.

Nôl i'r tabl cynnwys10. References

Andersson FW, Johansson D, Karlsson J, Lodefalk M, Poldahl A (2017), ‘The characteristics of family firms: exploiting information on ownership, kinship, and governance using total population data’, Small Business Economics.

Ayoubkhani D (2014), ‘A Comparison between Annual Business Survey and National Accounts Measures of Value Added’, Office for National Statistics

Bartelsman EJ and Doms M (2000), ‘Understanding productivity: lessons from longitudinal microdata, Finance and Economics’, Discussion Series 2000 to 2019, Board of Governors of the Federal Reserve System (US)

Bender S, Bloom N, Card D, Van Reenen J and Wolter S (2016), ‘Management Practices, Workforce Selection, and Productivity’, CEP Discussion Paper Number 1,416, March 2016

Bloom N, Brynjolfsson E, Foster L, Jarmin R, Saporta-Eksten I and Van Reenen J (2013), ‘Management in America’, Working Papers 13 to 01, Center for Economic Studies, US Census Bureau

Bloom N, Brynjolfsson E, Foster L, Jarmin R, Patnaik M and Saporta-Eksten I (2017), ‘What Drives Differences in Management?’, Centre for Economic Performance, Discussion Paper Number 1,470

Broszeit S, Fritsch U, Görg H and Marie-Christine L (2016), ‘Management practices and productivity in Germany’, IAB Discussion Paper Number 32/2016, Nuremberg: Institute for Employment Research

Bryson A and Forth J (2018), ‘The Impact of Management Practices on SME Performance’, NIESR Discussion Paper Number 488

Buffington C, Foster L, Jarmin R and Ohlmacher S (2017), ‘The Management and Organizational Practice Survey (MOPS): An Overview’, US Census Bureau

Criscuolo C, Haskel J and Martin R (2003), ‘Building the evidence base for productivity policy using business data linking’, Economic Trends, 600: pages 39 to 51

Foster L, Haltiwanger J and Syverson C (2008), ‘Reallocation, firm turnover, and efficiency: selection on productivity or profitability’, American Economic Review

Lemos R, and Scur D (2018), ‘All in the Family? CEO Choice and Firm Organization’, CEP Discussion Paper Number 1,528, January 2018

Organisation for Economic Co-operation and Development (OECD) (2017), ‘OECD Compendium of Productivity Indicators 2017’, OECD Publishing, Paris

Office for National Statistics (2016a), ‘Economic Review: January 2016’, Office for National Statistics

Office for National Statistics (2016b), ‘Experimental data on the management practices of manufacturing businesses in Great Britain: 2016’, Office for National Statistics

Office for National Statistics (2017a), ‘Management practices and productivity among manufacturing businesses in Great Britain: experimental estimates for 2015’, Office for National Statistics

Office for National Statistics (2017b), ‘Labour productivity measures from the Annual Business Survey: 2006 to 2015’, Office for National Statistics

Slater, WEG (1960), ‘Productivity and technical change’, Cambridge University Press, Cambridge

Syverson C (2004), ‘Product substitutability and productivity dispersion’, Review of Economics and Statistics

Nôl i'r tabl cynnwys12. Acknowledgements

The authors wish to express their gratitude to John Van Reenen for his contribution to the development of the Management and Expectations Survey. We also wish to thank Richard Heys for providing comments on the paper, and Seamus Wright for his help with the analysis.

Nôl i'r tabl cynnwys14. Annex 1: Scoring schedule for the Management and Expectations Survey

This section presents the scoring schedule for the Management and Expectations Survey in Table 7 and also presents the percentage distribution of management scores in Figure 10.

Table 7: Scoring schedule for the Management and Expectations Survey (MES), Great Britain, 2016

| Question | Score | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Section B - Continuous improvement | |||||||||

| 5. In 2016, which one of the following comes closest to the approach your business generally took when problems with your production/service arose? | |||||||||

| a. We resolved them but did not take further action | 1/3 | ||||||||

| b. We resolved them and took action to try to ensure they did not happen again | 2/3 | ||||||||

| c. We resolved them and took action to make sure that they did not happen again, and had a continuous improvement process to anticipate problems like these in advance | 1 | ||||||||

| d. No action was taken | 0 | ||||||||

| Section C - Key performance indicators | |||||||||

| 6. In 2016, how many key performance indicators were monitored within this business? | |||||||||

| a. 1-2 key performance indicators | 1/3 | ||||||||

| b. 3-9 key performance indicators | 2/3 | ||||||||

| c. 10 or more key performance indicators | 1 | ||||||||

| d. No key performance indicators | 0 | ||||||||

| 7. In 2016, how frequently was progress against the key performance indicators reviewed by managers and non-managers within this business? | |||||||||

| a. Annually | 1/6 | ||||||||

| b. Quarterly | 1/3 | ||||||||

| c. Monthly | 1/2 | ||||||||

| d. Weekly | 2/3 | ||||||||

| e. Daily | 5/6 | ||||||||

| f. Hourly or more frequently | 1 | ||||||||

| g. Never | 0 | ||||||||

| Section D - Targets | |||||||||

| 8. In 2016, which one of the following best describes the main time frames for achieving production targets within this business? | |||||||||

| a. Main time frame was less than one year | 1/3 | ||||||||

| b. Main time frame was one year or more | 2/3 | ||||||||

| c. Combination of time frames of less than and more than one year | 1 | ||||||||

| d. No targets | 0 | ||||||||

| 9. In 2016, how easy or difficult was it for this business to achieve its production targets? | |||||||||

| a. Possible without much effort | 0 | ||||||||

| b. Possible with some effort | 1/2 | ||||||||

| c. Possible with normal amount of effort | 3/4 | ||||||||

| d. Possible with more than normal effort | 1 | ||||||||

| e. Possible with extraordinary effort | 1/4 | ||||||||

| 10. In 2016, who was aware of the production targets within this business? | |||||||||

| a. All | 1 | ||||||||

| b. Most | 2/3 | ||||||||

| c. Some | 1/3 | ||||||||

| d. None | 0 | ||||||||

| 11. In 2016, what were performance bonuses for managers and non-managers usually based on within this business? | |||||||||

| a. Their own performance measured by targets | 1 | ||||||||

| b. Their shift or team performance as measured by targets | 4/5 | ||||||||

| c. Their site's performance as measured by targets | 3/5 | ||||||||

| d. The business' performance as measured by targets | 2/5 | ||||||||

| e. Performance bonuses were not related to targets | 1/5 | ||||||||

| f. No performance bonuses | 0 | ||||||||

| Section E - Employment practices | |||||||||

| 12. In 2016, how were managers and non-managers usually promoted within this business? | |||||||||

| a. Based solely on performance and ability | 1 | ||||||||

| b. Based partly on performance and ability and partly on other factors, such as length of service, restructuring | 2/3 | ||||||||

| c. Based mainly on factors other than performance and ability, such as length of service, restructuring | 1/3 | ||||||||

| d. None were promoted | 0 | ||||||||

| 13. In 2016, approximately what proportion of managers and non-managers within this business had a performance review? | |||||||||

| a. All | 1 | ||||||||

| b. More than half but not all | 3/4 | ||||||||

| c. Around half | 1/2 | ||||||||

| d. Some but fewer than half | 1/4 | ||||||||

| e. None | 0 | ||||||||

| 14. In 2016, on average, how many days training and development have managers and non-managers undertaken within this business? | |||||||||

| a. Less than a day | 0 | ||||||||

| b. 1 day | 1/4 | ||||||||

| c. 2 - 4 days | 1/2 | ||||||||

| d. 5 - 10 days | 3/4 | ||||||||

| More than 10 days | 1 | ||||||||

| 15. In 2016, what best describes the timeframe within which an action was taken to address under-performance among managers and non-managers? | |||||||||

| a. Within 6 months of identifying under-performance | 1 | ||||||||

| b. After 6 months of identifying under-performance | 1/2 | ||||||||

| c. No action was taken to address under-performance | 0 | ||||||||

| d. There was no under-performance | 0 | ||||||||

| 16. In 2016, who would normally make decisions over whether to recruit permanent full-time employees? | |||||||||

| a. Only the owner(s) and/or Managing Director (or equivalent) | 0 | ||||||||

| b. Mostly the owner(s) and/or Managing Director, with some input from their employees | 1/3 | ||||||||

| c. Jointly the owner(s) and/or Managing Director and other employees | 2/3 | ||||||||

| d. Other employees | 1 | ||||||||

| Source: Office for National Statistics | |||||||||

| Notes: | |||||||||

| 1. In the questionnaire, we referred to the first section as Production or Service delivery rather than Continuous improvement. | |||||||||

Download this table Table 7: Scoring schedule for the Management and Expectations Survey (MES), Great Britain, 2016

.xls (43.0 kB)

Figure 10: Percentage distribution of management scores

Great Britain, 2016

Source: Office for National Statistics

Notes:

Our population of interest covers businesses in production and services industries with employment of at least 10, in Great Britain.

The MES sample excludes firms in section A (Agriculture, forestry and fishing), and section K (Financial and insurance activities), and results are weighted to reflect the population of firms.