1. Main points

According to a survey of leading statistical and economic institutions, business and consumer surveys are the most popular source of data for leading indicators (for example, surveys asking business managers about their order books and production plans have proved very useful leading indicators).

Composite indicators are the most popular type of turning point indicators, while indicators based on factor analysis and regime-switching models have recently been successfully developed, and indicators based on manufacturing activity and the yield curve are well-regarded in the US.

The use of novel databases, big data and machine learning is very limited at the moment, but very promising; the Office for National Statistics (ONS) Data Science Campus made important contributions recently with the publication of its faster indicators.

2. Introduction

This research has been funded by the ONS as part of the research programme of the Economic Statistics Centre of Excellence (ESCoE), and this article is authored by Cyrille Lenoël and Garry Young, from the National Institute of Economic and Social Research and the Economic Statistics Centre of Excellence.

Turning points refer to when the economy moves from one phase of the economic cycle to the next. Official business cycle dating committees like the National Bureau of Economic Research (NBER) in the US, the Euro Area Business Cycle Dating Committee (EABCDC) and the proposed UK Business Cycle Dating Committee use a range of economic indicators to determine the peaks and troughs of business cycles. However, they only announce their decisions several months after the turning point occurred.

Identifying economic turning points early is important for decision makers who may have to adapt their policies, especially when their actions take time to work through the economy. What makes the identification of turning points in real time particularly difficult is that economic data are collected and published with a delay of up to several months, which makes them less effective turning point indicators.

Economists and market analysts instead often use surveys of business and households as leading indicators to supplement official economic data. The advent of big data has also made possible the use of real-time databases (like transport, online sales and spending with cards) that provide more up-to-date evidence on current trends in trade and wider economic activity.

The purpose of this study is to gather information on and classify some of the turning points indicators used around the world, in particular defining the methodology for constructing the indicators that are most popular and/or have the most promise. This exercise was facilitated by an online survey sent to the main statistical and economic agencies in other countries. The purpose of the study is not to evaluate the performance of the various indicators, only to report on which are used and how they are presented.

We summarise the literature on turning point methodologies. We then describe the composite turning point indicators that were produced by the Central Statistical Office (CSO), the forerunner of the Office for National Statistics (ONS). We set out some of the different indicators that are released by organisations in other countries and how they are presented and explain how we produced our survey to collect the data.

Nôl i'r tabl cynnwys3. Turning points

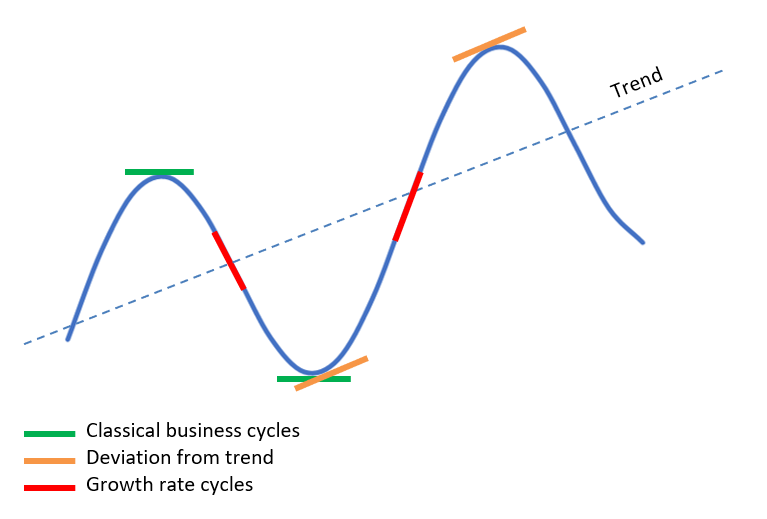

Turning points are defined as the transition points between phases of a business cycle. Burns and Mitchell (1947) said the business cycle "consists of expansions occurring at about the same time in many economic activities, followed by similarly general recessions, contractions and revivals that merge into the expansion phase of the next cycle: this sequence of change is recurrent but not periodic". There are, however, alternative definitions of business cycles: growth rate cycles are defined by periods of accelerations and decelerations in economic growth, and deviations from trend are defined as periods of faster and slower growth than the trend growth. Figure 1 illustrates how turning points are identified according to the definition of the cycle chosen.

Figure 1: Turning points are the transition points between phases of a business cycle

An illustration of turning points according to business cycles definitions

Source: Economic Statistics Centre of Excellence (ESCoE)

Download this image Figure 1: Turning points are the transition points between phases of a business cycle

.png (32.5 kB)What is striking from the results of this survey is that the rapid expansion of data sources and improvement in forecasting methodology has not made predicting turning points in real time much easier. A stylised fact in the business cycle literature is that it is more difficult to predict peaks than troughs of business cycles. In a study of 10 US economic analysts between 1948 and 1961, Fels and Hinshaw (1968) estimated that the analysts expected a trough with a probability of at least 50% as soon as one month before it happened, but the probability of a peak only reached 50% three months after the peak actually happened. In that period, the US economy experienced four recessions. Geoffrey Moore wrote in 1950: "if the user of statistical indicators could do no better than recognize contemporaneously the turns in general economic activity denoted by our reference dates, he would have a better record than most of his fellows".

Close to 70 years later, it is still difficult to identify turning points. For example, the Survey of Professional Forecasters (SPF), the oldest quarterly survey of macroeconomic forecasts in the US, contains the forecasts of an average of 40 forecasters who forecast US gross domestic product (GDP) up to five quarters ahead. To focus specifically on peaks, we extract from the survey the forecasts for a decline in GDP between the latest quarter and one to five quarters ahead.

We compare the proportion of the total forecasts predicting such a decline to how frequently such a decline in GDP actually occurred over the period between Quarter 4 (Oct to Dec) 1968 and Quarter 3 (July to Sept) 2019. If forecasters had a good understanding of turning points in real time, one would expect the two measures to be close to each other on average.

Figure 2 shows that forecasters have a good track record at forecasting the frequency of downturns one quarter ahead but exhibit a widening forecast error the further ahead they try to forecast. The proportion of forecasts predicting a decline in GDP between the latest quarter and five quarters ahead is 3.5%, which is much lower than the frequency of 10% when such a decline occurred. This forecast error may reflect an optimism bias by the forecasters. They may think downturns are less frequent and, when they occur, that they will not be as severe as they turned out to be.1

Figure 2: Forecasters have bias in predicting declines in US GDP

A survey of forecasters predicting a decline in real gross domestic product between the latest quarter and one to five quarters ahead, actual versus predicted

Source: Survey of Professional Forecasters (SPF)

Notes:

- Comparison of the proportion of all professional forecasts in the Survey of Professional Forecasters (SPF) predicting a decline in real gross domestic product (GDP) between the latest quarter and one to five quarters ahead with how frequently such declines actually happened.

- Forecasts and GDP numbers are taken between Quarter 4 (Oct to Dec) 1968 and Quarter 3 (July to Sept) 2019.

Download this chart Figure 2: Forecasters have bias in predicting declines in US GDP

Image .csv .xlsSPF respondents also provide their probabilities of a decline in real GDP one quarter ahead. Figure 3 is the average probability across all forecasters, referred to by the Philadelphia Fed as the “anxious index”. One characteristic of this index is that it tends to go up significantly just before a recession begins, and as such it can be considered a useful contemporaneous turning point indicator. In contrast to indicators based on the predictions of economic forecasters, which partly reflect the forecasters’ judgement, this article focuses on data-based indicators that feed into those forecasts.

Figure 3: The "anxious index" tends to go up significantly before a recession begins

The average probability of a decline in real gross domestic product one quarter ahead

Source: Federal Reserve Bank of Philadelphia

Notes:

- Q1 equals Quarter 1 (January to March), Q2 equals Quarter 2 (April to June), Q3 equals Quarter 3 (July to September) and Q4 equals Quarter 4 (October to December).

Download this chart Figure 3: The "anxious index" tends to go up significantly before a recession begins

Image .csv .xls4. Turning point methodologies

James Hamilton (2011) wrote a survey of the academic literature on identifying business cycle peaks. He highlighted why it is difficult to identify turning points in real time. While the main determinants of long-term economic growth are generally identified to be population, capital and technology, there is much less consensus on what the causes of short-term fluctuations in business activity could be. Recessions have been caused by financial crises, housing market crises, war, or aggressive monetary or fiscal policy. Without an economic model incorporating such channels, it is necessary to rely on statistical inference, and such models typically only work well if the next recession looks like the previous ones.

Business cycle analysis has a long history at the National Bureau of Economic Research (NBER) in the US. The indicator approach to business cycle analysis and forecasting originated in the 1930s with the work of Arthur Burns and Wesley Mitchell. Mitchell and Burns (1938) screened for indicators that would ideally have five characteristics:

- long-enough time-series

- constant lead time to the reference series

- smooth series

- easily recognisable cyclical movements

- a plausible economic explanation why it would be related to the business cycle

They called the indicators that best matched those characteristics "indicators of cyclical revivals".

Inversion of the yield curve

A very simple and popular leading indicator of recessions is an inversion of the yield curve. Recessions have often been associated with the yield curve moving from a positive to a negative slope. A positive slope of the yield curve comes from the fact that investors require a premium for holding longer maturity bonds (the term premium) or expect the short-term rates to be higher in the future. A negative slope is a more unusual event - it has occurred less than 10% of the time in the US in the past 65 years - reflecting the fact that the economy is probably in a transitory phase and this period may signal that a recession is likely to happen soon.

Laurent (1988) first showed that the spread in yield between longer-dated Treasury notes and short-dated T-bills could help predict future real gross national product (GNP) growth. Comparing the role of the yield spread to other financial and economic indicators, Estrella and Mishkin (1998) concluded that while the stock market has good predictive power in forecasting recessions one quarter ahead, the yield spread dominates at longer time-horizons, in particular one year ahead.1

Coincident and leading indicators

Stock and Watson (1989) made a significant contribution to business cycle analysis by providing a formal framework for defining coincident and leading indicators as well as defining one of the first recession indices. Their model formalised the popular idea that the reference cycle was best measured by looking at co-movements across several aggregate time series. Their proposed Coincident Economic Index (CEI) was an estimate of the value of a single unobserved variable, also called dynamic factor, supposed to represent the state of the economy in the business cycle. Any movement in a particular coincident series, such as industrial production, might therefore be decomposed into movements of the dynamic factor plus an idiosyncratic component. Stock and Watson defined a Recession Index as an estimate of the probability that the dynamic factor would decline for at least six consecutive months.

Composite leading indicators

These were also developed outside the US for European and other countries. Carstensen et al. (2011) compared how different composite leading indicators performed at predicting euro-area industrial production for different forecast horizons. They used statistical tests of model performance. They found that for one-month-ahead forecasts, the European Commission business climate indicator and the Organisation for Economic Co-operation and Development (OECD) composite leading indicator performed well; for six-month forecasts, the OECD composite leading indicator performed very well; and for 12-month forecasts, the DZ Bank Euro indicator was the only one composite indicator that could beat the benchmark autoregressive model containing a single lag.

Bridge models

These combine the quarterly data from the National Statistics with monthly data produced early in order to produce a forecast of gross domestic product (GDP) in the current quarter or next. Bridge models have been used, for example, to forecast French or euro-area GDP. A slightly more elaborate method of combining mixed-frequency data is to use a dynamic factor model with mixed frequency. The advantage of factor models is that they formalise the definition of business cycles as defined by an underlying trend that pushes a large range of economic indicators all in the same direction.

The European Commission developed climate indicators that similarly extract a trend from a variety of component indicators. Mixed-frequency models provide an analytical framework to forecast GDP, inflation and employment, but quantitative studies have found that simpler models based on averaging higher-frequency data sometimes gave as good results.

Regime-switching

A distinctive set of turning point models are based on regime-switching, which assumes that the economy can have several regimes and suddenly jump from one to the other. While the jump from one regime to another may be sudden, the observable economic variables tend to move much more slowly because of frictions. Neftçi (1982) defined a sequential probability model, where the probability of a turning point is calculated sequentially using current information together with the previously estimated posterior probability. Neftçi tested his model on the US index of leading indicators for the period from 1971 to 1975 and found that it predicted recessions more accurately than the heuristic rule of three consecutive declines in the index.

Big data and machine learning techniques

With new and large databases being increasingly available, the opportunity has arisen to use big data and machine learning techniques to predict economic turning points, creating a new strand of research. With a large number of explanatory variables, standard techniques such as ordinary least squares, maximum likelihood or Bayesian inference with uninformative priors magnify estimation uncertainty and produce inaccurate out-of-sample predictions. Therefore, inference methods aimed at dealing with dimensionality have become increasingly popular.

These methodologies can be divided into two broad classes. Sparse modelling focus on selecting a small set of explanatory variables with the highest predictive power. Alternatively, dense modelling recognises that all possible explanatory variables might be important for predicting, and it tries to assign a weight to each of them, even if their individual impact might be small. Factor analysis or ridge regressions are standard examples of dense statistical modelling.

For example, Buckles et al. (2018) showed, using big data, that aggregate fertility tended to be a leading indicator of recessions in the US; the growth rate for conceptions generally begins to fall several quarters prior to economic decline. Researchers from the Federal Reserve Bank of Chicago extended the Chicago Fed National Activity Index (CFNAI) to define what they called a "big data" index of US economic activity using a technique called collapsed dynamic factor analysis to aggregate around 500 macroeconomic time-series.

One of the applications of machine learning in the turning point context is to predict recessions. Techniques such as support vector machines, Dynamic Time Warping, boosting algorithms, random forest and neural networks have been applied to various degree of success.Researchers from the Data Science Campus analysed port and shipping operations using big data from AIS (a satellite positioning system) and CERS (Consolidated European Reporting System, which contains details such as destination port and expected time of arrival for the voyage of each ship). They successfully developed a machine-learning model to classify the behaviour of ships and used it to predict ship delays at port arrival. While this model is interesting in its own right, what is even more interesting is how such models could be extended. The authors wrote that the AIS and CERS data "could be used to explore, understand and capture these relationships between GDP and freight transport volumes. Supervised machine learning techniques could then be applied to produce early indicators of GDP and support GDP based decision-making in the period between formal quarterly releases."

One of the most challenging features of predicting turning points is how to deal with data revisions. As most official statistics are made of surveys and self-reported revenues by households, businesses and other entities, the statistics are often revised as more data become available and errors and omissions are dealt with by reconciliation. The revisions do not only occur in the following weeks or months following the first publication of statistics, but also sometimes in the following years. This fact makes forecasting akin to trying to aim at a moving target, without ever knowing if you really hit it.

Galvão and Kara (2019) considered the impact of GDP data revisions on predicting turning points for the UK. The found, for example, that a peak identified in Quarter 3 (July to Sept) 2011 suggesting a recession in late 2011 or early 2012 vanishes as data revisions are incorporated later on. They suggested instead looking at a wider range of monthly statistics and indicators to predict the business cycle phase in real time.

Notes for: Turning point methodologies

- International evidence is more mixed than for the US, as the yield spread performed well predicting recessions in Germany and Canada but performed less well in Japan and Italy. Lenoel (2018) discussed whether quantitative easing and the zero-lower bound may have reduced the ability of the yield curve to predict recessions in the US.

5. The CSO or ONS system of cyclical indicators

While the Office for National Statistics (ONS) does not currently publish any composite cyclical indicators, the predecessor of the ONS, the Central Statistical Office (CSO) used to publish composite indicators. Starting in 1975, the CSO regularly published a suite of cyclical indicators and their composite indices split into leading, coincident and lagging indicators as they were published in May 1976. Two things may surprise the modern economic statistician. One is that gross domestic product (GDP) entered the roughly coincident indicator in its three calculated forms (expenditure, output and income approaches), apparently to give it more weight in the index and average out any statistical discrepancies. Another one is that orders and investments were considered lagging indicators.

The methodology of constructing the composite indices was derived from the work of Burns and Mitchell at the National Bureau of Economic Research (NBER). Each component series was detrended, smoothed and rescaled. The indices were computed as the equally weighted sum of their constituent series. When some data were missing for some constituents' series, it was estimated. The underlying cycle was given by a five-year moving average since this was taken to represent the length of the cycle. The CSO (1983) assessed the performance of the indicators and concluded that they performed well at anticipating and tracking the end of the 1979 to 1981 recession in the UK. This was later confirmed by Artis et al. (1995) who evaluated the performance of the shorter and longer leading indicators to forecast turning points. They found, using data from 1957 to 1992, that "the CSO leading indicators contain[ed] important predictive information", in particular the longer leading composite indicator, which was composed of four financial and economic variables, tended to lead turning points by four to six months.

However, there were several concerns with the methodology, which led the ONS to stop publishing this suite of indicators in the late 1990s. One issue was that the indicators needed to be reviewed on a regular basis: an indicator that gave an early signal ahead of one recession may not work so well ahead of another recession if the nature of the recession is different. Another issue, highlighted by Yeend (1998) in his review of the indicators, was that "the implicit assumption of a fixed five-year cycle to calculate the trend could be misleading if the latest cycle [was] atypical."

If such composite indicators were to be revived by the ONS, it would have to make use of the latest methodological advances and therefore would probably be different from the one published previously.

Nôl i'r tabl cynnwys6. The indicators from our survey

We sent an online questionnaire to a sample of leading international statistical and economic institutions about their use of real-time turning point indicators. If they used any, we asked in particular about the methodology, how long they have been using them, the challenges they had to overcome when producing those indicators and what feedback they had from users. We also asked them if they had done any quantitative analysis of the performance and reliability of those indicators. Each institution1 was allowed to respond with a maximum of five indicators, and the same set of questions was asked for each indicator. We then collected the results, followed up with direct questions if there were points to clarify, and presented the results in a report to be published as a discussion paper. Table 1 shows the list of real-time turning point indicators that we collected from the responses to the survey.

| Institution | Indicator | Main methodology |

|---|---|---|

| CBS | Business Cycle Tracer | Representation over 4 quadrants (above/below trend and increasing/decreasing) of a range of indicators |

| CBS | Business Cycle Tracer Indicator | Composite indicator |

| CBS | Economic Radar | Radar representation of 6 indicators |

| INSEE | Indicator of economic reversal | Markov switching dynamic model |

| DZ Bank | Euro-Indicator | Composite leading indicator |

| OECD | Composite Leading Indicators | Composite leading indicators |

| The Conference Board | Leading Economic Indicator | Composite leading indicators |

| The Conference Board | Consumer Confidence Index | Composite index |

| The Conference Board | Employment Trends Index | Composite index |

| The Conference Board | Help Wanted OnLine | Big Data index |

| The Conference Board | CEO Confidence | Survey measure |

| European Commission | Economic Sentiment Indicator | Survey composite index |

| European Commission | Economic Sentiment Indicator Radar | Radar representation of 6 indicators |

| European Commission | Economic Climate Indicator | Principal component index of survey measures |

| European Commission | Economic Climate Indicator Tracer | Representation over 4 quadrants (expansion/downswing/contraction/ upswing) of the ECI and its first differences |

| ONS | VAT Diffusion index | Diffusion index |

| ONS | VAT Returns behaviour | Level time-series |

| ONS | shipping indicators | Big Data index |

| ONS | road traffic | Big Data index |

| Federal Reserve | US Industrial Production | Industrial Production |

| Instituto Nacional de Estadística y Geografí | Flash GDP | Flash GDP |

Download this table Table 1: Survey results: turning point indicators

.xls .csvFigure 4 shows that surveys seem to be the most popular source of data for leading indicators. For example, surveys asking business managers about their order books and production plans have proved very useful leading indicators. The use of novel databases, big data and machine learning seems not to be widespread yet, despite its publicity and promising prospects. It may be because such methods are still in the development stage and have not yet reached the large production scale that could be expected eventually. Evidence for this is that the indicators developed by the Office for National Statistics (ONS) using innovative data and methodology are still considered "experimental" and "Research Output", and it will probably still be some time before such indicators are integrated in the standard suite of ONS outputs.

Figure 5 shows that composite indicators are the most popular type of turning point indicators which allow the use of information from different data sources to extract common trends and reduce the volatility of the underlying data. While the ONS has produced diffusion indices (a type of composite index), for example for the Value Added Tax (VAT) returns data, it has not produced a summary indicator like that constructed by The Conference Board in the US, and this is one area the ONS could possibly develop to show how its innovative series can be used in practice. One downside, however, of summary indicators is that they tend to ignore the dispersion of the indicators, and the appropriate weighting method for combining indicators may be time or economic shock varying. Actually, the predecessor of the ONS, the Central Statistical Office (CSO), used to publish a suite of cyclical indicators, including leading indices, but those were discontinued, as explained in Section 4.

Figure 4: Surveys seem to be the most popular source of data for leading indicators

Survey respondents on how leading indicators are constructed

Source: Economic Statistics Centre of Excellence (ESCoE) – International survey of real-time turning point indicators

Download this chart Figure 4: Surveys seem to be the most popular source of data for leading indicators

Image .csv .xls

Figure 5: Composite indicators are the most popular type of turning point indicators

Survey respondents on how turning point indicators are constructed

Source: Economic Statistics Centre of Excellence (ESCoE) – International survey of real-time turning point indicators

Download this chart Figure 5: Composite indicators are the most popular type of turning point indicators

Image .csv .xlsNotes for: The indicators from our survey

- The survey questions were agreed in advance with Office for National Statistics (ONS) colleagues, who also provided information on contacts in other statistical offices who might be asked to complete the survey. The survey was sent to 11 institutions, and we received answers from nine of them: four national statistics offices (Centraal Bureau voor de Statistiek (CBS) from the Netherlands, Institut national de la statistique et des études économiques (Insee) from France, the ONS from the United Kingdom and Instituto Nacional de Estadística y Geografía from Mexico), two international organisations (European Commission and Organisation for Economic Co-operation and Development (OECD)), one central bank (Federal Reserve, United States), one bank (DZ Bank, Germany) and another private institution (The Conference Board). Two central banks didn’t respond on time (Bank of England and European Central Bank).

7. An example of turning point indicators

The French statistics office, Institut national de la statistique et des études économiques (Insee), has developed an indicator to identify in real time if the French economy's overall situation is about to change, based on different outlook surveys published internally. This indicator ranges from negative one to positive one. Changes of signs of the indicator indicate that the economy is likely to be in reversal. When the indicator is close to positive 1 (negative 1), it shows a favourable (unfavourable) business climate. The area between negative 0.3 and positive 0.3 is considered uncertain business climate.

Figure 6 compares the indicator with the periods of recessions. There exists no official committee in France for dating business cycles - like the National Bureau of Economic Research (NBER) in the US - so we had to compute the peaks and troughs ourselves using a standard Bry-Boschan methodology. One can see that for the last three recessions, the indicator turned very negative ahead of two of those recessions (1992 to 1993 and 2012 to 2013) but turned only contemporaneously in the 2008 to 2009 recession. Another apparent feature of the indicator is that it occasionally turns negative even when there is no recession but just slower growth periods, like it did in the period between 1995 and 2003.

Figure 6: The turning point indicator turned very negative ahead of two of the last three French recessions but only contemporaneously in the 2008 to 2009 recession

A turning point indicator for France

Source: Institut national de la statistique et des études économiques (Insee) and author’s calculations

Notes:

- Recessions were computed with the Bry–Boschan (1971) methodology.

Download this chart Figure 6: The turning point indicator turned very negative ahead of two of the last three French recessions but only contemporaneously in the 2008 to 2009 recession

Image .csv .xlsThe methodology is based on Markov switching dynamic model and is explained in Gregoir and Lenglart (2000). The indicator uses some balances of opinion in the sectors of industry manufacturing, building construction and services. Each balance of opinion is modelled with an auto regressive process. The series that are then considered are the signs (positive 1 or negative 1) of the innovations.

Such a reversal indicator can be used in combination with a business climate index. The business climate gives a quantitative assessment of the situation, whereas the reversal index indicates if the situation is likely to be reversed. Similar indicators have been developed for reversals in more specific sectors of the economy, like the services, construction and industrial sectors.

Nôl i'r tabl cynnwys8. Conclusions

There are many ways to look at turning points. Official business cycle dating committees use a range of economic indicators to determine the peaks and troughs of business cycles, but they only announce their decisions several months after the turning point occurred. To determine turning points in real time requires the use of leading or coincident indicators that extract from economic or financial data information about which phase of the business cycle the economy is in.

The Office for National Statistics (ONS) has recently made an important contribution to conjunctural analysis by publishing gross domestic product (GDP) at a monthly frequency with a lag of about six weeks. To a large extent, this negates the need for more timely indicators, especially if they need a lot of interpretation. Nevertheless, while the ONS is not in the business of forecasting, it could provide a useful public service by compiling the statistics and indicators on which such forecasts could be based. These would inform policymakers, businesses and the public about the state of the economy. The new indicators would need to be clearly focused, based on robust methodologies and involve as little judgement as possible to learn from the lessons of the abandoned Central Statistical Office (CSO) and ONS cyclical indicators.

This survey shows that the ONS is leading other institutions in the development of innovative statistics based on new data sources. The use of new databases like shipping, road traffic and Value Added Tax (VAT) returns in the faster indicators is promising and should be explored further. The Conference Board also uses online job adverts for one of its indicators of the labour market. The ONS could expand its set of real-time or near-real-time indicators to add more data sources like payments, weather and online job adverts.

One area where the ONS has not made much progress is in the development of composite indicators. Our survey shows that they are very popular tools to understand the state of the economy because they give a summary indicator. The composite indicators produced by The Conference Board and the Organisation for Economic Co-operation and Development (OECD) seem to reach a large audience, but they have been criticised because their methodology involves some judgement in the selection of the component series and they need to be periodically revisited.

Other methodologies identified in this review are factor analysis and regime-switching models. As there is a lot of uncertainty in the measurements in real time, probabilistic inference should play a central role. New methodologies related to big data and machine learning are expected to contribute to the development of more timely and accurate turning point indicators.

Nôl i'r tabl cynnwys