Cynnwys

- Main points

- Introduction

- Content

- Introduction to national accounts

- GDP revisions

- Reasons for revisions

- Current price GDP level revisions at Blue Book 2016

- Chained volume measure GDP level revisions at Blue Book 2016

- GDP growth rates

- UK revisions performance compared with other countries

- Is GDP biased?

- Business investment revisions

- Conclusions

- Next steps

- Annex A: Background to the national accounts gross domestic product (GDP) and the supply and use approach

- Annex B: Background to the compilation of gross domestic product (GDP)

- Annex C: Sources used in compiling estimates of gross domestic product (GDP)

- Annex D: Gross domestic product (GDP) current price and chained volume measure annual growth by Blue Book

- Annex E: Quarter on quarter gross domestic product (GDP) revisions, chained volume measure for balanced years up to Quarter 4 2014

- Annex F: Major causes of revisions by Blue Book

1. Main points

The total package of improvements to current price gross domestic product (GDP) implemented in Blue Book 2016 increased the size of the UK economy by £38.4 billion on average between 1997 and 2014, or 3.3% of GDP.

The average quarter-on-quarter real GDP growth revision between Quarter 2 (Apr to June) 1997 and Quarter 2 2015 was negative 0.01 percentage points for Blue Book 2016. Over the same period, the absolute revision was 0.1 percentage points.

The latest set of revisions does not change the conclusion reached in the Organisation for Economic Development (OECD) report, which stated that the UK was among the best performing nations when it came to the size of GDP revisions.

Revisions to GDP between the preliminary estimate and the first quarterly national accounts publication continue to be both small in size and unbiased.

Annual supply and use balancing and revisions due to methodological improvements subsequently provide a larger source of revision.

Revisions performance during the 2008 to 2009 economic downturn and subsequent recovery has been broadly comparable with the more stable 1990s period.

The mean squared revisions have remained low. This indicates that the revisions performance even in these unusual times stands up favourably to comparison with historic revisions.

Nôl i'r tabl cynnwys2. Introduction

Revisions to gross domestic product (GDP) are inevitable in the lifetime of economic statistics. It is the role of the Office for National Statistics (ONS) to produce the best possible estimate of GDP using all of the available information at that time. Therefore the only way to avoid subsequent revisions to GDP as more information becomes available would be to either delay publication until all the relevant information has been received, which could be up to 3 years after the reference period, or to publish a first estimate and then ignore any subsequent new data and any methodological improvements. So revisions should be treated as generally a good thing, as long as the reasons for them are documented and understood by users.

It is acknowledged that users of GDP and economic statistics, do not necessarily welcome minor revisions a long time after the event, or where there is a revision in one direction, which is followed almost immediately by a revision in the other direction in a subsequent publication. We achieve a balance between necessary revisions and revisions for minor issues through a published revisions policy, which reflects a National Statistics Quality Review: Review of National Accounts and Balance of Payments recommendation (page 11) by grouping annual benchmark revisions into a single GDP publication and limiting revisions in other quarters.

The previous revisions article was in January 2016 and this article updates the analysis presented in that release, the impact of the revisions as a result of Blue Book 2016 and Quarterly National Accounts Quarter 3 (July to Sept) 2016 datasets.

Nôl i'r tabl cynnwys3. Content

This article will:

- detail the reasons for revisions

- describe Blue Book 2016 GDP levels revisions in both chained volume measure (CVM) and current price (CP) terms

- look in detail at Blue Book 2016 growth rate revisions and summarise UK performance with other countries

- answer the question “Is GDP biased?” using an update of the metrics used to test revisions performance

- describe business investment revisions analysis

- describe the next steps in revisions analysis

4. Introduction to national accounts

Previous revisions articles have described in detail the process used to compile the GDP estimates and these documents have been updated and included as annexes to this article. Annex A gives background information to the 3 approaches to measuring GDP and how they are reconciled in the supply and use framework. Annex B describes in detail the process of compiling GDP and how the methods evolve as more data become available. If you are not familiar with these methods you may find it useful to have the sequence of events in mind when reading this article as it helps to put the reasons for revisions into context.

Why is GDP revised?

The first estimate of quarterly GDP is published approximately 25 days after the end of the quarter, making it one of the fastest in the world. This is known as the preliminary estimate of GDP and is based entirely on the output approach to measuring GDP. This is then updated when the second estimate of GDP is published, containing more detail on the output approach and some aggregate income and expenditure data. Just over 4 weeks later detailed information on income and expenditure components is published as part of the quarterly national accounts (QNA).

As further data become available there are potential revisions to the quarterly GDP figures in subsequent QNA releases, as well as in the annual national accounts Blue Book publication. The Blue Book process enables annual data to be balanced at a much more detailed level and is also the opportunity for major methodological improvements to be introduced.

Both of these annual revisions can potentially lead to changes in the quarterly profile of GDP. Data revisions usually occur only during the first and second Blue Books, which supply and use balance any given year, with subsequent Blue Book revisions being almost completely due to methodological improvements.

Nôl i'r tabl cynnwys5. GDP revisions

The published GDP revisions policy sets out the framework for revisions and this policy, combined with the timing of GDP releases, is designed to strike an appropriate balance between timeliness and accuracy. The Independent review of UK economic statistics made reference to this tension and suggested areas where alternative data sources in the future might increase the accuracy while not reducing the timeliness (see paras 2.12 to 2.17). We are actively considering this issue, but it will take time to realise improvements in this area. In the interim, based on current data sources and methodologies, it is recognised that ONS has struck a reasonable balance between timeliness and accuracy.

Factored into the revisions policy are user needs for short-term indicators, reliable estimates generated through benchmarking to more robust annual sources and the need for a consistent and coherent picture of the economy. GDP revisions can be categorised according to reason, although it is subsequently very difficult to quantify specifically the amount of revision due to any one reason in any given period as several reasons will almost certainly apply to each vintage of GDP.

Revisions to a source

This occurs when there are late returns to a statistical survey or we become aware of mis-reporting. These factors are particularly relevant to the preliminary estimate of GDP, which is largely based on ONS monthly surveys. Annex C provides a full list of all the sources used in the production of GDP, including the monthly surveys which ask for turnover data from over 42,000 businesses each month covering manufacturing, retailing, construction and a wide range of services sector businesses.

Replacing nowcasts with data

Annex B explains that the preliminary estimate of GDP is based on output, the source of which is largely the ONS monthly surveys. However, for some industries it is more appropriate to use a nowcast (an estimate for the current period) at the preliminary estimate with the actual data source becoming available in time for either the second or third estimate of GDP. The short-term sources for expenditure and income components also become available in the same timescale. As announced in the Quarterly National Accounts Quarter 3 (July to Sept) 2015 release, we have now implemented a National Statistics Quality Review: Review of National Accounts and Balance of Payments recommendation (page 11):

“In addition, annual benchmark information is incorporated multiple times each year. This adds up to a considerable workload, and this could be reduced by exploring the possibility of having only one benchmarking activity each year, fewer quarters open for revision and working towards limiting the frequency in the GDP quarterly release programme.”.

For example, all available annual benchmarks were taken on at the same time in the December 2016 Quarterly National Accounts round.

The supply and use table compilation process

Annually supply and use annual data is reviewed to make use of a further set of mainly annual data sources.

Revised seasonal adjustment factors

The impact of seasonal adjustment is reviewed during each production cycle, with additional information leading to a reassessment of the seasonal impact. This may change quarterly growths within a year.

Updating the output weights

At each Blue Book the gross value added (GVA) weights used to construct the output approach are progressed by one year. For Blue Book 2016 the last base year was moved from 2012 to 2013. This means that output GDP for 2013 and later is now based upon the GVA pattern given by the supply and use balance of 2013 rather than 2012 as previously. The revisions due to this process tend to be small, but nevertheless this updating of GVA weights to better reflect the industrial mix in the economy is an important part of the Blue Book process.

New methods (continuous improvement)

The methods used to compile GDP are the subject of continuous improvement as new sources become available or international best practice is developed.

New international standards

Economic statistics in the UK are compiled in line with international frameworks, standards and definitions, which themselves are updated to reflect changes to the economy that we are trying to measure. Up to and including Blue Book 2013, GDP was calculated in line with European System of Accounts (ESA) 95, which was introduced in Blue Book 1998. Following the updated System of National Accounts manual in 2008 (SNA 2008), the ESA was updated in September 2014 to ESA 2010. Meeting new international standards, as was the case in Blue Book 2014 when ESA 2010 was introduced, will often lead to revisions. These tend to be upwards for reasons that will be explained later in this article.

Note: This categorisation excludes any corrections arising from errors in statistical processing. These are monitored separately as part of the ONS correction process.

The timing of introducing new methodologies into estimates of GDP is inter-related with the National Accounts revisions policy. If a new concept or method is introduced this will typically lead to the data for a number of years being revised and may require the re-balancing of the supply and use tables (SUTs). This process happens during the annual update of the UK National Accounts or Blue Book. In the 2016 Blue Book, SUTs were reworked back to 1997 to incorporate new data sources and methods as well as incorporating further ESA 2010 changes. Major causes of Blue Book revisions over time are listed in Annex F.

Nôl i'r tabl cynnwys6. Reasons for revisions

The main changes which impacted on the level of current price GDP in Blue Book 2016 are described briefly as follows.

Imputed rental

Imputed rental is an estimate of the housing services consumed by households who are not actually renting their residence. Conceptually it is the amount that non-renters pay themselves for the housing services that they are producing. This is a legitimate and important component of GDP since the value represented by housing services should not depend upon whether they are consumed by an owner occupier or otherwise.

In this improvement, Living Costs and Food Survey data were replaced with a much more comprehensive data source from the Valuation Office Agency (VOA) and using the average rental stratified by both region and dwelling type. These data are conceptually much closer to what we are trying to measure. VOA data cover England only, with similar data for Scotland and Wales being provided by their respective governments. More limited data from Northern Ireland is also used. Additionally improvements have been made to the Consumer Price Indices for Housing (CPIH) used to deflate imputed rental current price data.

It must be emphasised that this is predominately a current price change and a change in the deflator. Unlike most current price revisions within Blue Book, the majority of the revision seen will not feed through directly into chained volume measure (CVM) estimates – though some change will still be seen due to the change in method. The reason for this is that the current price estimates are being calculated using a new rental price multiplied by a very similar volume of dwellings and then the CVM estimates are produced by deflating using the new CPIH values, which also use the VOA data as a basis for their deflators. Further information can be found in an Imputed Rent article.

Exhaustiveness and concealed income activity adjustment

As part of a gross national income (GNI) ESA 1995 reservation, improvements were implemented to the exhaustiveness adjustment for concealed income in Blue Book 2015, as described in the article Methodological improvements to National Accounts for Blue Book 2015: Exhaustiveness. The revisions for 2008 onwards in Blue Book 2016 are a result of the annual reassessment of the tax gaps analysis by Her Majesty’s Revenue and Customs (HMRC), which in turn leads to revisions in our estimates of concealed income. There are also some smaller revisions pre-2008 as a result of a reassessment of how best to include concealed income adjustments within the supply and use tables, which required a small rebalancing.

Value Added Tax fraud

Scrutiny of estimates of non-complicit Value Added Tax (VAT) fraud has led to improvements. VAT fraud is thought to occur when individuals or corporations who under or non-report their respective salaries and profits to the tax authorities ("Tax evasion") also choose to hold onto the VAT that they charge to non-complicit customers on their under or unreported activity. It is thought that by paying VAT on these transactions they would reveal the wider evasion. Because current estimates of tax evasion are at basic prices, meaning before the inclusion of taxes on products, this form of VAT fraud is not currently captured in the national accounts. To estimate the impact of VAT fraud, we start from the estimates of under-reporting and non-reporting of income. Under the reasonable assumption that such income (under appropriate conditions) is also not reported for VAT and vice versa, these estimates imply a level of VAT fraud.

Insurance claims by non-profit institutions serving households (NPISH)

As part of addressing a GNI ESA 1995 reservation, improvements were implemented to the measurement of non-profit institutions serving households (NPISH) in Blue Book 2015, as described in the article Methodological improvements to National Accounts for Blue Book 2015:Non-Profit Institutions Serving Households. Further scrutiny has identified a small inconsistency in the treatment of insurance within the NPISH sector. Previous treatment included the insurance premiums and supplements paid by NPISH within the national accounts, but not the claims received by the NPISH sector. This has now been completed.

Illegal activities

As part of addressing a GNI ESA 1995 reservation, improvements were implemented to the measurement of illegal activities in Blue Book 2014, as described in the article Inclusion of illegal drugs and prostitution in the UK national accounts. As a further refinement, allowance was made to reduce the estimates made for prostitution in household final consumption expenditure by a factor to reflect the holiday taken by prostitutes. Statistics Netherlands have estimated the total holidays to be 12 weeks per year and the same factor has been applied to the UK estimates.

Gross fixed capital formation for improvements made to dwellings

During quality assurance of the gross fixed capital formation system, an error in processing was identified. An adjustment factor was incorrectly being applied to the VAT rate in all years and this is now being corrected.

Gross fixed capital formation for agriculture data

Discussions with the Department for Environment, Food and Rural Affairs (Defra) identified a processing error in the calculation of gross fixed capital formation for the agricultural sector. Disposals were not being deducted correctly, leaving a net figure which was being artificially inflated. This has been corrected.

Own account construction

During Blue Book 2014, a GNI ESA 1995 reservation for own account construction (within gross fixed capital formation) was addressed as described in the article Changes stemming from improved comparability of Gross National Income measurement. At the time of implementation, the data up to 2010 in the reservation used a benchmark for self-build data, which had a base year of 2006. AMA Research Ltd has now provided us with information, which allows us to produce a more timely annual benchmark figure for self-build homes for all years from 2007 to 2013.

Transport for London capital stock changes

As part of Blue Book 2015 changes, some of the subsidiaries of Transport for London previously recorded as public non-financial corporations were reclassified as Local government bodies. This was explained in the article Classification changes to National Accounts for Blue Book 2015. To complete the required actions within national accounts, adjustments have been made to the capital stocks series back to 2008 to incorporate this reclassification.

Natural gas imports from Norway

Her Majesty’s Revenue and Customs (HMRC) have improved the method for collecting data for the compilation of natural gas traded with non-EU partners. This change only affects non-EU imports of natural gas. At Blue Book 2016 this change was taken back to 2011.

Nôl i'r tabl cynnwys7. Current price GDP level revisions at Blue Book 2016

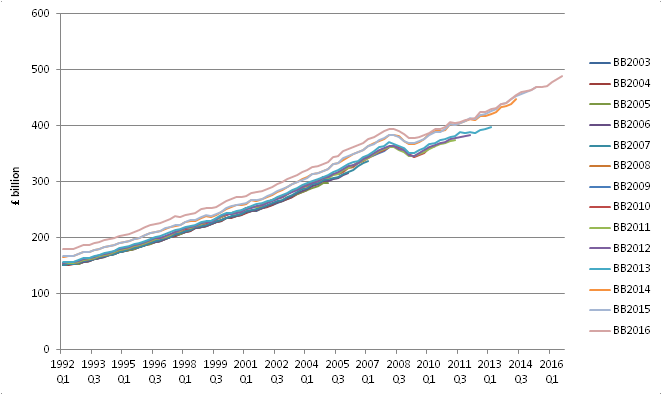

The main difference between the Blue Book 2015 and the Blue Book 2016 current price lines appears before 2010. This is, in the main, due to the improvement to the measurement for imputed rental (Figure 1).

Figure 1: Current price quarterly GDP

UK, Quarter 1 (Jan to Mar) 1991 to Quarter 3 (July to Sept) 2016 (BB2003 to BB2016)

Source: Office for National Statistics

Download this image Figure 1: Current price quarterly GDP

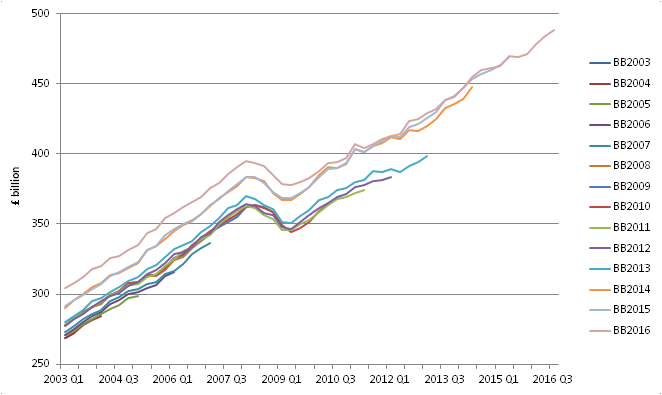

.png (28.7 kB) .xls (90.1 kB)Figure 2 shows that the main difference between the Blue Book 2014 and the Blue Book 2015 current price lines appears from 2012 onwards and this is mainly due to a combination of the exhaustiveness adjustments for concealed income and under-coverage of unincorporated businesses. In Blue Book 2016, there was a level shift from previous estimates prior to 2010 due to the imputed rental improvements but it retained the similar levels from 2010 onwards. Between 1997 and 2014, the current price GDP level was revised by a range of positive £4.7 billion to positive £55.4 billion per year, although the largest revisions occurred between 1997 and 2009 (see Table 1 in the dataset).

Figure 2: Current price quarterly GDP

UK, Quarter 1 (Jan to Mar) 2003 to Quarter 3 (July to Sept) 2016 (BB2003 to BB2016)

Source: Office for National Statistics

Download this image Figure 2: Current price quarterly GDP

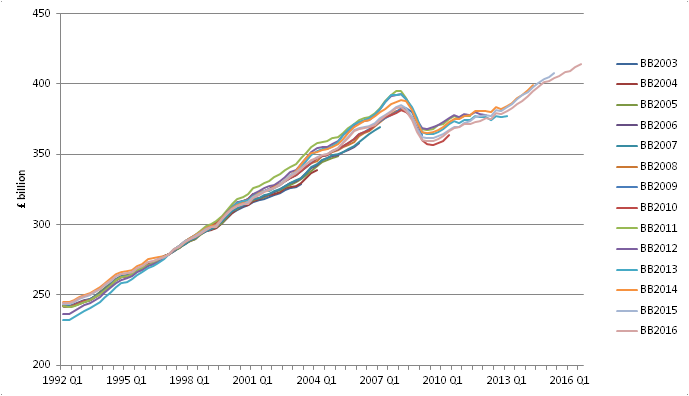

.png (38.6 kB) .xls (78.3 kB)8. Chained volume measure GDP level revisions at Blue Book 2016

Current price revisions will, in most cases, feed through to affect real chained volume measure (CVM) GDP as well, although there are a few exceptions. As previously described, the improvement to imputed rental is one such change where, because the main impact is on the prices being used, the current price revisions are larger than the CVM revisions, which can be seen in Figure 3.The data in this figure are all set equal in 1997 to avoid the level shifts which artificially occur when moving the reference year on as part of each Blue Book process.

The slightly stronger 1997 position shown in Blue Book 2016 means that when the adjustment is made to the figure to set 1997 equal, the later periods actually end up being scaled down. However, the overall shape of the Blue Book 2016 line is very similar to that of Blue Book 2015.

Figure 3: Chained volume measure GDP

UK, Quarter 1 (Jan to Mar) 1992 to Quarter 3 (July to Sept) 2016 (BB2003 to BB2016)

Source: Office for National Statistics

Download this image Figure 3: Chained volume measure GDP

.png (35.4 kB) .xls (41.5 kB)Blue Book 2016 also left almost completely unrevised the shape and depth of the economic downturn of 2008 to 2009 (now negative 6.3% peak to trough, rather than negative 6.1% at Blue Book 2015). Since 2013, GDP has grown steadily, with the economy exceeding pre-downturn peak levels in Quarter 3 (July to Sept) 2013, one quarter later than in Blue Book 2015.

Figure 4: Chained volume measure GDP

UK, Quarter 1 (Jan to Mar) 2008 to Quarter 3 (July to Sept) 2016 (BB2015 vs BB2016)

Source: Office for National Statistics

Download this chart Figure 4: Chained volume measure GDP

Image .csv .xls9. GDP growth rates

As discussed in section 5, revisions to the first quarterly estimates of GDP growth are usually due to more information becoming available, whereas the subsequent annual revisions are due to new data sources and improvements in methodology.

For completeness the updated quarter on a year ago growth rates of chained volume measure (CVM) GDP at each vintage from initial publication (T) to the revised position 5 years later (T + 60 months) have been included as Figure 5. T + 60 was chosen as it equates to between 3 and 4 annual Blue Book revisions and will be sufficient for all data revisions to have been included, leaving only further definitional and methodological revisions to follow.

The data to create Figure 5 are included in the Real Time GDP database, which publishes successive estimates of CVM GDP in £ millions for each quarter since Quarter 1 (Jan to Mar) 1955. This database is just one part of an expanding set of regular analyses of growth rate revisions for the period since 1992, which are published after each GDP release. These databases allow transparency and give users the tools to analyse revisions for themselves. In 2013, we launched a current price GDP real time database with estimates in £ millions back to 1989 and in 2014, we released the first real time databases for the income and expenditure components of GDP. Output revision triangles are also now published for the Index of Construction, in addition to both the Index of Production and the Index of Services.

Figure 5: Chained volume measure GDP

UK, percentage growth quarter on the same quarter a year ago

Source: Office for National Statistics

Download this chart Figure 5: Chained volume measure GDP

Image .csv .xlsFigure 5 gives a general impression of the scale of revisions but is quite cluttered and a clearer representation of how data and methodological improvements revise GDP in the period between the first estimate and 5 years later can be shown by using the same figure but with just these 2 lines on it, as illustrated in Figure 6.

Figure 6: Chained volume measure GDP

UK, percentage growth quarter on the same quarter a year ago, T and T + 60 months

Source: Office for National Statistics

Download this chart Figure 6: Chained volume measure GDP

Image .csv .xlsFigures 5 and 6 confirm that for the most part revisions to GDP are small and do not, on the whole, alter the overall economic history portrayed in the initial growth rate estimates. However, there is some suggestion that revisions are larger around turning points, for example, the mid 1970s, 1979 to 1980, 1988 to 1989 and 1998.

The same analysis can be produced from the real time GDP database for quarter-on-quarter growth rates in CVM GDP, shown in Figure 7.

Figure 7: Chained volume measure GDP

UK, percentage growth quarter on quarter

Source: Office for National Statistics

Download this chart Figure 7: Chained volume measure GDP

Image .csv .xlsOnce again, if we limit the figure to only have the first estimate and the estimate after 5 years, the pattern of revisions to quarter-on-quarter growth can be seen more clearly. It appears that there is less volatility in the T + 60 month estimates than in the initial estimate made in period T and this will be in part due to the process of supply and use balancing annual data and then producing successive quarterly paths through the time periods within the annual constraints. This figure also shows 2 quite different pictures of GDP growth through the time-span, with much less volatility in the period from the 1990s to current day, reflecting a range of improvements to the measurement of GDP introduced following the Pickford Review of 1989; see "A decade of improvements to economic statistics”, Jenkins and Brand, 2000 for more details.

Figure 8: Chained volume measure GDP

UK, percentage growth quarter on quarter at T and T + 60 months

Source: Office for National Statistics

Download this chart Figure 8: Chained volume measure GDP

Image .csv .xlsThe other observation which can be made from Figure 8 is that the T + 60 month line looks to have stronger growth than the original T line, especially through any periods with initially quite negative growth. This can be explained by the latter revisions being caused by methodological improvements and changes to the national accounts framework, which tend to improve the accounts which can add to both GDP levels and, sometimes, to growth.

Indeed this was picked up by the Independent review of UK economic statistics, which gave similar possible explanations for the tendency for GDP to be revised up beyond the 3 to 4 year window of source data revisions; the review suggested that the upward revisions seen beyond the 3 to 4 Blue Book data revisions could be because:

“…new industries or business models are poorly captured by extant statistical methodology. But over time, as the new industries become better appreciated, so the methodology will be updated to capture them, resulting in an increase in measured activity. In this sense, GDP is a constantly moving target.”

Furthermore the review also noted that this was particularly relevant to the UK where a:

“larger proportion of UK output, relative to other countries, is driven by new and innovative activities...”

The other explanation given by the review team is that:

“The UK has been slower that some other countries to implement the legislated European statistical standards….with the result that recent revisions include a catch-up element.”

This is true, the UK has taken a number of years to address all the ESA 95 GNI reservations (most were received in 2012), but this situation will not happen again in the future as all ESA 2010 reservations, when raised, will have a strict 4 year window for being completed.

There is another reason why the UK revisions perform less well than some other countries when looking beyond the initial data revisions, and that is the switch in Blue Book 2011 from using the Retail Prices Indices (RPI) to the Consumer Prices Indices (CPI) as the main sources of deflators for the expenditure approach to GDP. The RPI is generally higher than the CPI in any given period, so when you deflate using the CPI you get greater CVM GDP growth.

We decided to switch to using the CPI to deflate in order to bring it into line with international best practice, and this caused upwards revisions to growth across most periods up to 2011, which were not seen in any other country during the same time period. As described in the article International comparisons of GDP revisions the research suggests that if the impact of the switch in deflation is removed from the total revisions picture then the UK revisions performance is much more in line with that of other countries over the last 15 years.

Nôl i'r tabl cynnwys10. UK revisions performance compared with other countries

The Organisation for Economic Co-operation and Development (OECD) has produced various analyses on revisions performance across various countries. In their Revisions of quarterly GDP in selected OECD countries article of July 2015, the UK revisions performance is mentioned for being particularly good:

“‘France, Italy, Norway and the United Kingdom record the lowest mean revisions for both quarter on quarter and year on year growth rates, Canada, France, Germany, Italy, Spain, Switzerland, the United Kingdom and the United States show the lowest revisions (average mean absolute revision below 0.25%-point).”

One of the tests OECD applies is around predicting turning points. The OECD looks at the first published quarterly GDP growth rate and compares this with the latest estimate to see what percentage of first estimates have a different sign from the final estimates (for an early estimate to be useful it needs to provide quick signals of where the economy is heading). For the UK, over the last 131 quarterly estimates the sign of the initial estimates has ultimately been changed in 12 of these estimates, meaning that the sign of the initial estimate is correct 90.8% of the time. This is in line with the average across all the countries studied by the OECD, which also found that on average 90% of initial estimates were of the correct sign.

Nôl i'r tabl cynnwys11. Is GDP biased?

When looking at revisions to quarterly estimates of GDP growth the focus should first be on the period where new output source data could cause revisions. Table 2 in the dataset shows, for the period since Quarter 1 (Jan to Mar) 2007, the revision between the preliminary estimate for a quarter and the third estimate published around 13 weeks after the end of the quarter.

It can be seen from the table that revisions over this time period are small, typically 0.1 percentage points in either direction with no evidence of bias. In fact 33 out of the 39 quarters have only been revised by a maximum of plus or minus 0.1 percentage points and the average revision over the period is 0.01 percentage points.

The economic circumstances can also add an extra focus to the quarterly revisions; for instance, a revision of 0.1 or even 0.2 percentage points in either direction is not material when the economy is growing by between 0.6% and 0.8% a quarter, but when quarterly growth is closer to zero, a movement of 0.1 percentage points in either direction can be interpreted as changing the story completely although, of course, this is not the case. Individual quarters can also be influenced by special events such as the Olympics or an extra bank holiday for the Queen’s Diamond Jubilee and to lessen the natural volatility we recommend that commentators focus more on the longer run trend of GDP rather than on individual movements between successive quarters.

A longer run time series of quarterly GDP revisions, including the latest estimate for each quarter is shown in Annex E in the dataset. As explained in Annex B, the amount of information contained in each successive estimate of GDP (from the output approach) increases from 44% in the preliminary estimate to over 90% by the time of the third estimate, but this does not lead to significant revisions.

The number of quarters used to monitor revisions performance and the particular quarters selected will both have an impact on the analysis produced. For instance, if we look only at the period from Quarter 1 (Jan to Mar) 2008 to Quarter 4 (Oct to Dec) 2010 (the latest downturn and recovery), the average absolute revision between M1 and M3 is 0.17 percentage points, rather than the 0.09 percentage points over the longer time span in Table 4. This is, at least in part, because it is generally recognised that it is harder to accurately estimate quarterly movements during the turning points in an economic cycle.

In previous articles other metrics have been used to assess potential bias and it was said then that it was too early to access the performance of GDP revisions at measuring the 2008 to 2009 economic downturn and recovery. More data are now available during and post the downturn, including supply and use balances for 2013 for the first time and the profile of 2011 and 2012 has been reassessed through balancing.

Many different approaches can be used to summarise revisions and this article updates 3 of the methods used originally in the Brown et al paper.

The first way to analyse revisions is to look at the simple mean (arithmetic) average revision for the estimate of GDP for the period T, between the maturity T + i and the maturity T + j.

Figure 9 presents the mean revisions between the first published estimate and those published 24 months later over 5 sub-samples from the real time GDP dataset. These are calculated as quarter-on-quarter growth rates for chained volume measure (CVM) GDP.

The figure shows that the mean revisions have fluctuated over time and in the period Quarter 1 1995 to Quarter 4 2004 they were lower than in earlier periods at under 0.05 percentage points, which is insignificant from zero. This may be because the economy grew at a steady rate in this period and revisions due to data (rather than methodology improvements) are more likely to be smaller when the economy is behaving in a predictable manner.

Figure 9: Mean revisions to chained volume measure GDP

UK, quarter on quarter growth between T and T + 24 months

Source: Office for National Statistics

Download this chart Figure 9: Mean revisions to chained volume measure GDP

Image .csv .xlsIn the 2014 revisions article, the latest period had a negative mean revision, which reflected the difficulties in estimating growth when the UK entered the period of negative growth and that the turning point to negative growth had been difficult to pinpoint. However, with the later years now added and their upward revisions to growth as discussed earlier in this article, we now have a small positive mean revision of positive 0.004%, which shows both the sensitive nature of this type of analysis and the sometimes misleading results that can be obtained when negatives and positives cancel out.

To remove this effect of offsetting positive and negative revisions giving an average close to zero it is better to look at the absolute level of the average revision, as seen in Figure 10.

Figure 10: Mean absolute revisions to chained volume measure GDP

UK, quarter on quarter growth between T and T + 24 months

Source: Office for National Statistics

Download this chart Figure 10: Mean absolute revisions to chained volume measure GDP

Image .csv .xlsAlthough Figure 10 is to a much larger scale than Figure 9, it is the relative position of the bars on Figure 10 that is more important. While the bar for the latest groups of years seems to perform better than any other period in Figure 9, here the latest period has a slightly larger mean absolute revision than during the stable economic period of Quarter 1 1995 to Quarter 4 2004. This shows that there have been slightly more revisions in absolute terms in the latest period, reflecting the more challenging nature of predicting economic growth during the recent period than during the previous 10 years of steady growth. Nevertheless, the scale of revision still compares very favourably with the revisions performance during the earlier groups of years.

The variance in the GDP estimates can be shown alongside the mean squared revisions to indicate how the revision compares with the size of GDP movement. Figure 11 shows that while the variance of the T + 60 month data is larger in the period since Quarter 1 2005 than over the 2 previous periods, the mean squared revision has remained low.

Figure 11: Comparison of the T to T + 60 mean squared revision with the variance of the T + 60 maturity

UK, quarter on quarter growth of chained volume measure GDP

Source: Office for National Statistics

Download this chart Figure 11: Comparison of the T to T + 60 mean squared revision with the variance of the T + 60 maturity

Image .csv .xlsAgain, by focusing on T + 24 months rather than T + 60 months the analysis is able to include the recent economic recovery and the focus is on data revisions rather than on long- term methodological changes.

Figure 12: Comparison of the T to T + 24 mean squared revision with the variance of the T + 24 maturity

UK, quarter on quarter growth of chained volume measure GDP

Source: Office for National Statistics

Download this chart Figure 12: Comparison of the T to T + 24 mean squared revision with the variance of the T + 24 maturity

Image .csv .xlsFigure 12 shows a much larger variability in the period Quarter 1 2005 to Quarter 3 (July to Sept) 2014 as the economic downturn and recovery is now fully included within the analysis but this variability is still low compared with historic levels. This increased variability is reflecting the range of positive and negative growth rates seen as the UK entered and gradually exited from the economic downturn showing that the economy was harder to measure accurately. Reassuringly the mean squared revision has remained relatively low. This indicates that the revisions performance even in these unusual times stands up favourably to comparison with historic revisions. So while the early estimates of GDP may not be as robust during periods of greater volatility or at turning points in the economy as they were during long periods of stable growth it does seem increasingly likely that the methods used to estimate GDP have performed well under the circumstances.

Nôl i'r tabl cynnwys12. Business investment revisions

Interest from our customers has been raised in the revisions made to business investment, therefore this section looks in more detail at this component of GDP. By definition, business investment is net investment by private and public corporations. These include investments in:

- transport

- information and communication technology (ICT) equipment

- other machinery and equipment

- cultivated assets

- intellectual property products (IPP, which includes investment in software, research and development, artistic originals and mineral exploration)

- buildings and other structures

It does not include investment by central or local government, investment in dwellings, or the costs associated with the transfer of non-produced assets (such as land).

A summary of the revisions analysis (Figure 13) indicates that the mean revision between the provisional and revised business investment release between Quarter 4 (Oct to Dec) 2011 and Quarter 3 (July to Sept) 2016 was 0.09% and the absolute average revision was 0.97%. Revisions between provisional and revised can occur for a variety of reasons, most commonly, they occur due to late responses to the Quarterly Acquisitions and Disposals of Capital Assets survey or changes to the data originally returned. Revisions can also occur, however, due to forecasts replacing actual data and revisions to seasonal adjustment factors re-estimated at each release.

Figure 13: Comparison of M2 estimate with M3 estimate

UK, data series identifier NPEL, business investment quarterly growth rates (CVM, SA)

Source: Office for National Statistics

Notes:

- No month 2 estimates were published for Q1 2013 and Q2 2014

- M2 = Provisional Business Investment

- M3 = Revised Business Investment

Download this chart Figure 13: Comparison of M2 estimate with M3 estimate

Image .csv .xlsFigure 14 shows revisions between the provisional business investment release and the equivalent estimate 3 years later. As we can see, there are often larger revisions around times of economic uncertainty such as Quarter 2 (Apr to June) 2010 and Quarter 2 2011 respectively. Revisions generally occur because of methodological improvements introduced at annual Blue Book publications where the opportunity is taken to introduce improvements and conduct seasonal adjustment reviews. Between Quarter 4 2008 and Quarter 3 2013, business investment was revised on average by negative 0.59% and on an absolute basis by 3.56%. This shows that estimates after their initial publication can be further revised as later data becomes available and methodological improvements are introduced.

Data prior to 2008 has been sourced with permission from the Bank of England and data from 2008 onwards are based on data held by ONS.

Figure 14: Comparison of M3 estimate with estimate 3 years later

UK, data series identifier NPEL, business investment quarterly growth rates (CVM, SA)

Source: Office for National Statistics

Download this chart Figure 14: Comparison of M3 estimate with estimate 3 years later

Image .csv .xls13. Conclusions

Revisions are a necessary part of the GDP process to meet user requirements for timely estimates, which reflect internationally agreed standards and definitions. Good revisions management requires regular updates on the reasons for revisions, including articles such as these and access to the underlying revisions databases to enable users of GDP data to produce their own such analyses.

Revisions to GDP quarter-on-quarter growth between the preliminary estimate and the first quarterly national accounts publications continue to be both small in size and unbiased, showing that there would be no benefit to users from delaying the preliminary GDP release to wait for greater data content, under current methodologies and with the current data sources, but we are looking at alternative data sources, which might lead to a reassessment of the timing of GDP releases.

Annual supply and use balancing and revisions due to methodological improvements provide a larger source of revision, and it would be helpful to users if ONS could separate out data revisions from methodological revisions. In the impact articles for Blue Book 2016, we provided users with detailed analyses of the types of revisions, which were very well received. This is now an established part of the annual process.

This article has also been able to update the picture of revisions performance during the 2008 to 2009 economic downturn and recovery. Adding the more recent periods has shown that revisions performance during these more volatile and difficult to predict economic times has been broadly comparable with the more stable 1990s period.

Nôl i'r tabl cynnwys14. Next steps

Work includes:

- gross value added (GVA) output revisions triangles: Revisions triangles at an industry level for GVA; it is proposed that revisions triangles for the 10 industry sectors be published and work is ongoing to look at the feasibility of producing this information to the existing GDP publication timetable

- business investment revisions triangles: Following interest from customers, revisions triangles will become available presenting the revisions to business investment growth rates over time; a real time database will also be published showing the change in levels – it is expected that this information will be published for the first time in the February 2017 Business Investment statistical bulletin

- performance of GDP: The publication of an article discussing the performance of GDP during the economic downturn of 2008 to 2009