Cynnwys

- Introduction

- Methodological and other changes affecting the Sector and Financial Accounts

- Appendix A: Estimated net lending/borrowing by sector

- Appendix B: Estimated revisions to net lending/borrowing by sector and transactions

- Appendix C: Estimated revisions to the real household disposable income and the non-profit institutions serving households saving ratio

- Appendix D: Non-market output and social transfers in kind

- Background notes

1. Introduction

This article is part of a series describing changes to National Accounts and improvements that will be made on 30 June 2016 when the Office for National Statistics (ONS) publish revised estimates including Gross Domestic Product (GDP), the Sector and Financial Accounts and the Balance of Payments.

Changes will be made in line with international standards adopted by all European Union (EU) member states and with worldwide best practice. These and additional improvements that are being made, will ensure that the UK National Accounts continue to provide a reliable framework for analysing the UK economy and comparing it with other countries.

This article focuses on the impact of methodological improvements and other improvements to the Sector and Financial Accounts, providing a summary of each change being implemented alongside the indicative overall impact and revisions to net lending or borrowing and other main aggregates in the financial accounts, balance sheets and non-financial accounts, by transaction and sector.

Other regular improvements include moving the last base year and reference year for chained volume estimates forward by one year, from 2012 to 2013, in Blue Book 2016 and Pink Book 2016. There are also revisions from classification changes and the incorporation of new data from survey data sources and benchmarking of quarterly and annual surveys such as the Foreign Direct Investment survey.

The figures presented in this article are indicative estimates while final quality assurance is being undertaken.

The remainder of the article is structured as follows:

Section 2 – Provides tables showing the indicative overall average impacts and revisions to the net lending/borrowing and other main aggregates in the financial accounts, balance sheets and non-financial accounts, by transaction and sector

Appendix A – Provides charts showing the indicative estimates of the net lending/borrowing and financial net worth positions, showing the impact of the changes to sectors

Appendix B – Provides charts showing the indicative estimates of the aggregate net lending/borrowing and financial net worth revisions by sector as a result of the main changes being implemented

Appendix C – Provides charts showing the indicative estimated aggregate revisions to the real household and the non-profit institutions serving households (NPISH) disposable income (RHDI) and the households and NPISH saving ratio

Appendix D – provides detail of changes to data series for Social Transfers in Kind transaction

2. Methodological and other changes affecting the Sector and Financial Accounts

2.1 Estimates of the impact on net lending/borrowing by sector

This article sets out the average indicative impact of changes from 1997 to 2014.

Table 1 sets out the indicative average impact of the changes being introduced into the Sector and Financial Accounts for 1997 to 2014, when revised figures for the UK National Accounts, consistent with Blue Book 2016 and Pink Book 2016, are published on 30 June 2016.

Table 1: Latest indicative average impact of the changes to the net lending/borrowing for the UK non-financial account (B.9n), financial Account (B.9f) and financial net worth (BF.90) of sectors

| UK, 1997 to 2014, £billion | ||||||||||||

| Sector | Total impact upon net lending / borrowing from the non-financial account (B.9n) | Total impact upon net lending / borrowing from the financial account (B.9f) | Total impact upon financial net worth from the balance sheets (BF.90) | |||||||||

| Methodological changes and other improvements | Other | Estimated net lending(+)/ borrowing average revision | Methodological changes and other improvements | Other | Estimated net lending(+)/ borrowing average revision | Methodological changes and other improvements | Other | Estimated financial net worth average revision | ||||

| Public corporations | 0.0 | -0.1 | -0.1 | 0.0 | -0.1 | -0.1 | 0.0 | -0.2 | -0.2 | |||

| Private non-financial corporations | -0.7 | 2.0 | 1.3 | -0.8 | 1.2 | 0.4 | -28.7 | -1.0 | -29.7 | |||

| Financial corporations | -0.5 | -1.6 | -2.1 | -0.6 | -0.9 | -1.5 | -1.4 | -6.5 | -7.9 | |||

| Central government | 0.0 | 0.0 | 0.0 | 0.0 | 0.1 | 0.1 | 0.1 | 0.2 | 0.3 | |||

| Local government | 0.1 | -0.1 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | -1.8 | -1.8 | |||

| Households & non-profit institutions serving households | -0.1 | 1.4 | 1.3 | 0.0 | 1.1 | 1.1 | 49.1 | 18.1 | 67.2 | |||

| Rest of the world | 0.9 | -0.9 | 0.0 | 0.3 | -0.3 | 0.0 | -19.1 | -8.8 | -27.9 | |||

| Source: Office for National Statistics | ||||||||||||

Download this table Table 1: Latest indicative average impact of the changes to the net lending/borrowing for the UK non-financial account (B.9n), financial Account (B.9f) and financial net worth (BF.90) of sectors

.xls (29.7 kB)2.2 Summary of the methodology and other improvements impacting Sector and Financial Accounts

2.2.1 Imputed rental of owner-occupier dwellings

Imputed rental is an estimate of the housing services consumed by households who are not actually renting their residence. Conceptually it is the amount that non-renters pay themselves for the housing services that they are producing. This is a legitimate and important component since the value represented by housing services should not depend upon whether they are consumed by an owner-occupier or otherwise.

National Accounts: Imputed Rental, published on 23 March 2016, gives details of the methodological changes being introduced in Blue Book 2016.

Table 2 shows the estimated indicative average impact on the sectors and transactions affected by the revised methodology for the period 1997 to 2014.

Table 2: Estimated indicative impact in the non-financial account due to the methodological changes to imputed rentals

| UK, 1997 to 2014 | |||||||

| Sector impacted Non-financial account | Transaction impacted | Average revision to transaction 1997 to 2014 | Average revision to net lending/ borrowing (B.9n) 1997 to 2014 | Net lending/borrowing variance of revisions 1997 to 2014 | Average revision to Households’ saving ratio 1997 to 2014 % | Average revision to real households' disposable income growth 1997 to 2014 | |

| Min | Max | ||||||

| S.11002+S.11003 - Private non-financial corporations | B.2g - Gross operating surplus | 0.0 | 0.0 | 0.0 | 0.0 | N/A | N/A |

| D.42 - Distributed income of corporations, use | 0.0 | ||||||

| S.14+S.15 - Households and non-profit institutions serving households | B.2g - Gross operating surplus | 41.4 | 0.0 | 0.0 | 0.0 | -0.4 | -0.1 |

| D.11 - Wages and salaries, resource | 0.7 | ||||||

| D.42 - Distributed income of corporations, resource | 0.0 | ||||||

| P.3 - Final consumption expenditure, use | 42.0 | ||||||

| S.2 - Rest of the world | B.11 External balance of goods and services | 0.0 | 0.0 | 0.0 | 0.0 | N/A | N/A |

| D.42 - Distributed income of corporations, resource | 0.0 | ||||||

| D.42 - Distributed income of corporations, use | 0.0 | ||||||

| Source: Office for National Statistics | |||||||

Download this table Table 2: Estimated indicative impact in the non-financial account due to the methodological changes to imputed rentals

.xls (28.7 kB)2.2.2 Estimates of value added tax fraud

Scrutiny of estimates of non-complicit Value Added Tax (VAT fraud) has led to improvements which are now being implemented. VAT fraud occurs when individuals or corporations who under or non-report their respective salaries and profits to the tax authorities ("tax evasion") also choose to hold onto the VAT that they charge to non-complicit customers on their under- or unreported activity. It is thought that by paying VAT on these transactions they would reveal the wider evasion. Because current estimates of tax evasion are at basic prices, meaning before the inclusion of taxes on products, this form of VAT fraud is not currently captured in the National Accounts.

To estimate the impact of VAT fraud, the starting point is estimates of under-reporting and non-reporting of income. Under the reasonable assumption that such income (under appropriate conditions) is also not reported for VAT and vice versa, these estimates imply a level of VAT fraud.

Note that this change has no impact on the central government sector. In particular, the amounts of VAT reported as resources for central government have not changed.

Table 3 shows the estimated indicative average impact on the sectors and transactions affected by the revised methodology for the period 1997 to 2014.

Table 3: Estimated indicative impact in the non-financial account due to the methodological changes to estimates of Value Added Tax fraud

| UK, 1997 to 2014, £billion | ||||||

| Sector impacted Non-financial account | Transaction impacted | Average revision to transaction 1997 to 2014 | Average revision to net lending/ borrowing (B.9n) 1997 to 2014 | Net lending/borrowing variance of revisions 1997 to 2014 | Average revision to Households’ saving ratio 1997 to 2014 % | |

| Min | Max | |||||

| S.11002+S.11003 - Private non-financial corporations | B.2g - Gross operating surplus | 0.1 | 0.0 | 0.0 | 0.0 | N/A |

| D.42 - Distributed income of corporations, use | 0.1 | |||||

| S.14+S.15 - Households and non-profit institutions serving households | B.3g - Mixed Income, Gross | 1.5 | 0.0 | 0.0 | 0.0 | 0.0 |

| D.42 - Distributed income of corporations, resource | 0.1 | |||||

| P.3 - Final consumption expenditure, use | 1.6 | |||||

| Source: Office for National Statistics | ||||||

Download this table Table 3: Estimated indicative impact in the non-financial account due to the methodological changes to estimates of Value Added Tax fraud

.xls (34.8 kB)2.2.3 Gross fixed capital formation improvements made to dwellings

During quality assurance of the gross fixed capital formation system it was identified that an adjustment factor was being incorrectly applied to the VAT rate in all years and this will be corrected with publication of the Blue Book 2016 dataset.

Table 4 shows the estimated indicative average impact on the sectors and transactions affected by the improvements for the period 1997 to 2014.

Table 4: Estimated indicative impact due to changes to gross fixed capital formation for improvements made to dwellings

| UK, 1997 to 2014, £billion | ||||||

| Sector impacted | Transaction impacted | Average revision to transaction 1997 to 2014 | Average revision to net lending/ borrowing (B.9n) 1997 to 2014 | Net lending/borrowing variance of revisions 1997 to 2014 | Average revision to Households’ saving ratio 1997 to 2014 % | |

| Non-financial account | Min | Max | ||||

| S.14+S.15 - Household and non-profit institutions serving households | B.2g - Gross operating surplus | -1.2 | 0.0 | 0.0 | 0.0 | 0.0 |

| P.3 - Final consumption expenditure, use | -1.2 | |||||

| Source: Office for National Statistics | ||||||

Download this table Table 4: Estimated indicative impact due to changes to gross fixed capital formation for improvements made to dwellings

.xls (27.6 kB)2.2.4 Illegal activities

As a result of addressing a Gross National Income (GNI) European System of Accounts (ESA) 1995 reservation concerning the measurement of illegal activities in Blue Book 2014, improvements were implemented to the UK National Accounts and described in the article Inclusion of illegal drugs and prostitution in the UK National Accounts.

In compiling estimates of illegal drugs and prostitution for 2016, Dutch evidence about holidays taken by prostitutes has been taken into account. The Dutch have estimated the total holidays to be 12 weeks a year and the same factor has been applied to the UK estimates.

Table 5 shows the estimated indicative impact on the sectors and transactions affected by the revised methodology for the period 1997 to 2014.

Table 5: Estimated indicative impact to the non-financial account due to the improvements made to illegal activities

| UK, 1997 to 2014, £billion | ||||||

| Sector impacted | Transaction impacted | Average revision to transaction 1997 to 2014 | Average revision to net lending/ borrowing (B.9n) 1997 to 2014 | Net lending/borrowing variance of revisions 1997 to 2014 | Average revision to Households’ saving ratio 1997 to 2014 % | |

| Non-financial account | Min | Max | ||||

| S.14+S.15 - Household and non-profit institutions serving households | B.3g - Gross mixed income | -1 | 0.0 | 0.0 | 0.0 | 0.0 |

| P.3 - Final consumption expenditure, use | -1 | |||||

| Source: Office for National Statistics | ||||||

Download this table Table 5: Estimated indicative impact to the non-financial account due to the improvements made to illegal activities

.xls (27.6 kB)2.2.5 Changes to the treatment of non-market output and social transfers in kind

In order to comply with ESA 2010, non-market output must be sub-divided into payments for non-market output (P.131) and other non-market output provided for free (P.132). Payments received, except where they are classified as taxes or they are at economically significant prices, will now mostly qualify as P.131. Provision of services such as public order and safety (police and fire services etc.) and defence will now qualify as P.132.

Social transfers in kind (D.63) consist of individual goods and services provided freely, or at prices which are not economically significant, to individual household units by non-market producers, namely the General government sector or Non-profit institutions serving households (NPISH) sector (see ESA 2010 paragraph 4.108). ESA 2010 requires D.63 to be subdivided to represent whether the General government sector or NPISH sector directly provide the good and service to the household.

Details of the changes were published in an article Methodological Changes to National Accounts: Transition to ESA 2010 – Changes to treatment of Non-Market Output and Social Transfers in Kind.

As well as the sub-division of Social transfers in kind (D.63), it was found that insurance claims received by the NPISH sector were not included in the calculation of NPISH non-market output (P.13) and Final consumption expenditure (P.3). From Blue Book 2016, both of these expenditure and output measures are presented on a net basis as previously only premiums paid were included in their calculation.

Table 6 shows the estimated indicative impact on the sectors and transactions for the changes to the treatment of non-market output and social transfers in kind.

Table 6: Estimated indicative impact due to changes to the treatment of non-market output and social transfers in kind

| UK, 1997 to 2014, £billion | ||||||

| Sector impacted | Transaction impacted | Average revision to transaction 1997 to 2014 | Average revision to net lending/ borrowing (B.9n) 1997 to 2014 | Net lending/borrowing variance of revisions 1997 to 2014 | Average revision to Households’ saving ratio 1997 to 2014 % | |

| Non-financial account | Min | Max | ||||

| S.1311 - Central government | D.63 - Social transfers in kind, resource | 0.0 | 0.0 | 0.0 | 0.0 | N/A |

| P.31 - Individual consumption expenditure | 0.0 | |||||

| P.32 - Collective consumption expenditure | 0.0 | |||||

| P.42 - Actual collective consumption expenditure | 0.0 | |||||

| S.1313 - Local government | D.63 - Social transfers in kind, resource | -0.3 | 0.0 | 0.0 | 0.0 | N/A |

| P.31 - Individual consumption expenditure | -0.3 | |||||

| P.32 - Collective consumption expenditure | 0.3 | |||||

| P.42 - Actual collective consumption expenditure | 0.3 | |||||

| S.14+S.15 - Household and non-profit institutions serving households | B.2g - Gross operating surplus | -0.3 | -0.3 | -0.4 | 0.5 | 0.0 |

| D.63 - Social transfers in kind, resource | -0.6 | |||||

| D.63 - Social transfers in kind, use | -0.6 | |||||

| P.41 - Actual individual consumption expenditure | -0.3 | |||||

| Source: Office for National Statistics | ||||||

Download this table Table 6: Estimated indicative impact due to changes to the treatment of non-market output and social transfers in kind

.xls (29.7 kB)In every year, the reduction in local government individual consumption expenditure is exactly offset by the increase in local government collective consumption expenditure. These offsetting revisions are an indirect consequence of the social transfers in kind being separately identified and therefore no longer being part of the component called intermediate consumption.

2.2.6 Improvements to own account construction

A GNI ESA 1995 reservation for own account construction (within gross fixed capital formation) was addressed during Blue Book 2014 and is described in the article Changes stemming from improved comparability of Gross National Income measurement. At the time of implementation, the data up to 2010 used a benchmark for self-builds data with a base year of 2006. We are now able to produce a more timely annual benchmark figure for self-build homes for all years from 2007 to 2013.

Table 7 shows the estimated indicative impact on the non-financial account for the sectors and transactions affected by the revised methodology for the period 1997 to 2014.

Table 7: Estimated indicative impact on the non-financial account due to improvements to own account construction

| UK, 1997 to 2014, £billion | |||||||

| Sector impacted | Transaction impacted | Average revision to transaction 1997 to 2014 | Average revision to net lending/ borrowing (B.9n) 1997 to 2014 | Net lending/borrowing variance of revisions 1997 to 2014 | Average revision to Households’ saving ratio 1997 to 2014 % | Average revision to real households' disposable income 1997 to 2014 | |

| Non-financial account | Min | Max | |||||

| S.14+S.15 - Households and non-profit institutions serving households | B.2g - Gross operating surplus | -0.3 | 0.0 | 0.0 | 0.0 | 0.0 | 0.4 |

| P.51g - Gross fixed capital formation | -0.3 | ||||||

| Office for National Statistics | |||||||

Download this table Table 7: Estimated indicative impact on the non-financial account due to improvements to own account construction

.xls (28.2 kB)2.2.7 Improvements to the Sector and Financial Accounts resulting from the UK Flow of Funds developments

In late 2014, ONS began working in partnership with the Bank of England to improve the coverage, quality and granularity of flow of funds statistics for the UK. In November 2015, ONS and the Bank jointly published the most comprehensive review of financial statistics for some years. The review highlighted strengths in the current estimates, but also areas where the quality of current statistics could be improved or undergo further review.

There will be improvements made to the Sector and Financial Accounts in June 2016. The 3 improvements being implemented are:

estimation of deposits with monetary financial institutions

levels of UK listed shares and mutual funds

levels of UK bonds

Details of the improvements were published in The UK Flow of Funds Project: Comprehensive review of the UK Financial Accounts.

2.2.7.1 Estimation of deposits with monetary financial institutions

During the review of the financial accounts, a discrepancy was found between the estimates of balance sheet levels of transferable deposits with monetary financial institutions, published as part of the National Accounts and the source data from the Bank of England.

Table 8 shows the estimated indicative impact of the improvements of deposits with monetary financial institutions on sectors and transactions.

Table 8: Estimated indicative impact to the balance sheet due to improvements to the estimation of transferable deposits with monetary financial institutions

| UK, 1997 to 2014, £billion | ||||||

| Sector impacted | Transaction impacted | Average revision to transaction 1997 to 2014 | Average revision to net lending/ borrowing (BF.90) 1997 to 2014 | Financial net worth variance of revisions | ||

| Balance sheet | Min | Max | ||||

| S.12 - Financial corporations | AF.22 - Transferable deposits, assets | 119.4 | 0.0 | 0.0 | 0.0 | |

| AF.22 - Transferable deposits, liabilities | 119.4 | |||||

| Source: Office for National Statistics | ||||||

Download this table Table 8: Estimated indicative impact to the balance sheet due to improvements to the estimation of transferable deposits with monetary financial institutions

.xls (27.6 kB)The average revision to the assets and liabilities of £119.4 billion when looked at as a proportion of the AF.22 assets and liabilities are 0.9% and 0.3% respectively.

2.2.7.2 Estimation of bonds, UK listed shares and mutual funds

An issue was identified between the levels of UK listed shares and mutual funds reported in the National Accounts and by the London Stock Exchange. ONS processes bonds and shares within the same system and consequently, when an issue was identified with the processing of shares, estimates of bonds were reviewed for due diligence. Investigatory analysis confirmed that some UK bonds were also not captured during the processing of the data.

Tables 9, 10 and 11 show the estimated indicative impact for the levels of UK listed shares, mutual funds and bonds on sectors and transactions for the non-financial account, financial account and financial net worth on the Balance Sheet.

Table 9: Estimated indicative impact due to improvements to the levels of UK listed shares and mutual funds and the levels to bonds for the non-financial account

| UK, 1997 to 2014, £billion | ||||||

| Sector impacted | Transaction impacted | Average revision to transaction 1997 to 2014 | Average revision to net lending/ borrowing (B.9n) 1997 to 2014 | Net lending/borrowing variance of revisions 1997 to 2014 | Average revision to Households’ saving ratio 1997 to 2014 % | |

| Non-financial account | Min | Max | ||||

| S.11001 - Public non-financial corporations | D.42 - distributed income of corporations, resource | 0.0 | 0.0 | 0.0 | 0.0 | N/A |

| S.11002+S.11003 - Private non-financial corporations | D.41 - Interest, resource | 0.0 | -0.1 | -0.9 | 0.0 | N/A |

| D.42 - distributed income of corporations, resource | 0.0 | |||||

| D.41 - Interest, use | 0.1 | |||||

| S.12 - Financial corporations | D.41 - Interest, resource | -0.2 | -0.5 | -2.9 | 0.0 | N/A |

| D.42 - Distributed income of corporations, resource | 0.0 | |||||

| D.4431 - Dividends, resource | 0.0 | |||||

| D.4432 - Retained earnings, resource | 0.0 | |||||

| D.41 - Interest, use | 0.2 | |||||

| D.42 - Distributed income of corporations, use | 0.0 | |||||

| D.4431 - Dividends, use | 0.0 | |||||

| D.4432 - Retained earnings, use | 0.0 | |||||

| S.1313 - Local government | D.42 - distributed income of corporations, resource | 0.0 | 0.0 | 0.0 | 0.0 | N/A |

| S.14+S.15 - Households and non-profit institutions serving households | D.41 - Interest, resource | 0.0 | 0.1 | 0.0 | 0.8 | 0.0 |

| D.42 - Distributed income of corporations, resource | 0.1 | |||||

| D.4431 - Dividends, resource | 0.0 | |||||

| D.4432 - Retained earnings, resource | 0.0 | |||||

| D.41 - Interest, use | 0.0 | |||||

| S.2 - Rest of the world | D.41 - Interest, resource | 0.6 | 0.5 | 0.0 | 3.3 | N/A |

| D.42 - Distributed income of corporations, resource | -0.1 | |||||

| Source: Office for National Statistics | ||||||

Download this table Table 9: Estimated indicative impact due to improvements to the levels of UK listed shares and mutual funds and the levels to bonds for the non-financial account

.xls (22.5 kB)

Table 10: Estimated indicative impact due to improvements to the levels of UK listed shares and mutual funds and the levels to bonds for the financial account

| UK, 1997 to 2014, £billion | |||||||||||

| Sector impacted Financial account | Transaction impacted | Average revision to transaction 1997 to 2014 | Average revision to net lending/ borrowing (B.9f) 1997 to 2014 | Net lending/borrowing variance of revisions 1997 to 2014 | |||||||

| Min | Max | ||||||||||

| S.11002+S.11003 - Private non-financial corporations | F.32 - Long-term debt securities, asset | -0.6 | -0.8 | -11.6 | 0.0 | ||||||

| F.32 - Long-term debt securities, liability | 0.1 | ||||||||||

| S.12 - Financial corporations | F.32 - Long-term debt securities, liability | 0.6 | -0.6 | -6.2 | 0.0 | ||||||

| F.51 - Equity, asset | 0.0 | ||||||||||

| F.51 - Equity, liability | 0.0 | ||||||||||

| S.14+S.15 - Households and non-profit institutions serving households | F.51 - Equity, asset | 0.0 | 0.0 | 0.0 | 0.0 | ||||||

| S.2 - Rest of the world | F.32 - Long term debt securities, asset | 1.3 | 1.3 | 0.0 | 13.8 | ||||||

| F.51 - Equity, asset | 0.0 | ||||||||||

| Source: Office for National Statistics | |||||||||||

Download this table Table 10: Estimated indicative impact due to improvements to the levels of UK listed shares and mutual funds and the levels to bonds for the financial account

.xls (20.5 kB)

Table 11: Estimated indicative impact due to improvements to the levels of UK listed shares and mutual funds and the levels to bonds for the balance sheet

| UK, 1997 to 2014, £billion | |||||

| Sector impacted | Transaction impacted | Average revision to transaction 1997 to 2014 | Average revision to financial net worth (BF.90) 1997 to 2014 | Financial net worth variance of revisions 1997 to 2014 | |

| Balance sheet | Min | Max | |||

| S.11002+S.11003 - Private non-financial corporations | AF.51 - Equity, asset | 1.4 | -23.5 | -202.2 | 0.0 |

| AF.32 - Long-term debt securities, liability | 2.8 | ||||

| AF.51 - Equity, liability | 22.1 | ||||

| S.12 - Financial corporations | AF.51 - Equity, asset | 10.8 | -1.4 | -30.6 | 22 |

| AF.32 - Long-term debt securities, liability | 3.9 | ||||

| AF.51 - Equity, liability | 7.1 | ||||

| AF.52 - Investment funds shares units, liability | 1.2 | ||||

| S.14+S.15 - Households and non-profit institutions serving households | AF.51 - Equity, asset | 6.3 | 7.4 | 0.0 | 64.5 |

| AF.52 - Investment Fund Shares/Units, asset | 1.2 | ||||

| S.2 - Rest of the world | AF.32 - Long term debt securities, asset | 6.7 | 17.4 | 0.0 | 115.7 |

| AF.51 - Equity, asset | 10.7 | ||||

| Source: Office for National Statistics | |||||

Download this table Table 11: Estimated indicative impact due to improvements to the levels of UK listed shares and mutual funds and the levels to bonds for the balance sheet

.xls (29.2 kB)2.2.9 Natural gas imports from Norway

Her Majesty’s Revenue and Customs (HMRC) have amended the methodology for collecting data for the compilation of natural gas traded with non-EU partners. This change only affects non-EU imports of natural gas and has already been applied in the UK Trade statistical release for 2014 onwards. At Blue Book 2016, this change is being implemented back to 2011. Details of this change are published on HMRC’s website.

Table 12 shows the estimated indicative impact on the sectors and transactions for the Norway natural gas imports improvements.

Table 12: Estimated indicative impact due to improvements to natural gas imports from Norway for the non-financial account

| UK, 1997 to 2014, £billion | |||||

| Sector impacted | Transaction impacted | Average revision to transaction 1997 to 2014 | Average revision to net lending/ borrowing (B.9n) 1997 to 2014 | Net lending/borrowing variance of revisions 1997 to 2014 | |

| Non-financial account | Min | Max | |||

| S.11002+S.11003 - Private non-financial corporations | B.2g - Gross operating surplus | -0.4 | -0.4 | -3.1 | 0.0 |

| S.2 - Rest of the world | B.2g - Gross operating surplus | 0.4 | 0.4 | 0.0 | 3.1 |

| Source: Office for National Statistics | |||||

Download this table Table 12: Estimated indicative impact due to improvements to natural gas imports from Norway for the non-financial account

.xls (19.5 kB)2.2.10 Correction to gross fixed capital formation for agricultural data

Discussions with the Department for Environment, Food and Rural Affairs (Defra) have identified a processing error in the calculation of gross fixed capital formation for the agricultural sector; disposals were not being deducted correctly, leaving an artificially inflated net figure. This will be corrected in the Blue Book 2016 publication, the earliest opportunity to do so.

Table 13 shows the estimated indicative impact on the sectors and transactions affected by the improvements for the period 1997 to 2014.

Table 13: Estimated indicative impact to the non-financial account due to the correction to gross fixed capital formation for agricultural data

| UK, 1997 to 2014, £billion | ||||||

| Sector impacted | Transaction impacted | Average revision to transaction 1997 to 2014 | Average revision to net lending/ borrowing (B.9n) 1997 to 2014 | Net lending/borrowing variance of revisions 1997 to 2014 | Average revision to Households’ saving ratio 1997 to 2014 % | |

| Non-financial account | Min | Max | ||||

| S.11002+S.11003 - Private non-financial corporations | B.2g - Gross operating surplus | -1.1 | 0.0 | 0.0 | 0.0 | N/A |

| P.51g - Gross fixed capital formation | -1.1 | |||||

| S.14+S.15 - Households and non-profit institutions serving households | B.2g - Gross operating surplus | -0.1 | 0.0 | 0.0 | 0.0 | 0.0 |

| P.51g - Gross fixed capital formation | -0.1 | 0.0 | 0.0 | 0.0 | 0.0 | |

| Source: Office for National Statistics | ||||||

Download this table Table 13: Estimated indicative impact to the non-financial account due to the correction to gross fixed capital formation for agricultural data

.xls (28.7 kB)2.2.11 Improvements to private non-financial corporations balance sheet

As part of Blue Book 2015, loans by the European Investment Bank (EIB) to Network Rail were reclassified to the public sector. This was implemented by subtracting the loans from the private non-financial corporations (PNFC) balance sheet (long-term loans from the rest of the world) and moving them to the central government balance sheet. However, these loans had previously been classified as short-term loans on the PNFC balance sheet. The treatment of these loans has now been improved, so that they are consistently classified throughout as long-term loans.

This has the impact of decreasing short-term loan liabilities and increasing long-term loan liabilities on the PNFC balance sheet, with the issuer of the loan (the Rest of the World sector) having corresponding changes in assets. The changes have no impact on central government.

Tables 14 and 15 shows the estimated indicative impact on the sectors and transactions for the improvements to the PNFC balance sheet.

Table 14: Estimated indicative impact due to improvements to the private non-financial corporations balance sheet from Network Rail on the financial account

| UK, 1997 to 2014, £billion | |||||

| Sector impacted | Transaction impacted | Average revision to transaction 1997 to 2014 | Average revision to net lending/ borrowing (B.9f) 1997 to 2014 | Net lending/borrowing variance of revisions 1997 to 2014 | |

| Financial account | Min | Max | |||

| S.11002+S.11003 - Private non-financial corporations | F.41 - Short-term loans, liability | 0.1 | 0.0 | 0.0 | 0.2 |

| F.424 - Other long-term loans, liability | -0.1 | ||||

| S.1311 - Central government | F.424 - Other long-term loans, assets | 0.0 | 0.0 | -0.2 | 0.0 |

| S.2 - Rest of the world | F.41 - Short-term loans, assets | 0.1 | 0.0 | 0.0 | 0.0 |

| F.424 - Other long-term loans, asset | -0.1 | ||||

| Source: Office for National Statistics | |||||

Download this table Table 14: Estimated indicative impact due to improvements to the private non-financial corporations balance sheet from Network Rail on the financial account

.xls (20.5 kB)

Table 15: Estimated indicative impact due to improvements to the private non-financial corporations balance sheet due to Network Rail

| UK, 1997 to 2014, £billion | |||||

| Sector impacted | Transaction impacted | Average revision to transaction 1997 to 2014 | Average revision to financial net worth (BF.90) 1997 to 2014 | Financial net worth variance of revisions 1997 to 2014 | |

| Balance sheet | Min | Max | |||

| S.11002+S.11003 - Private non-financial corporations | AF.41 - Short-term loans, liability | -0.7 | 0.1 | 0.0 | 0.4 |

| AF.424 - Other long-term loans, liability | 0.6 | ||||

| S.1311 - Central government | AF.424 - Other long-term loans, liability | 0.1 | -0.1 | -0.5 | 0.0 |

| S.2 - Rest of the world | AF.41 - Short-term loans, assets | -0.7 | 0.0 | 0.0 | 0.0 |

| AF.424 - Other long-term loans, asset | 0.7 | ||||

| Source: Office for National Statistics | |||||

Download this table Table 15: Estimated indicative impact due to improvements to the private non-financial corporations balance sheet due to Network Rail

.xls (20.0 kB)2.2.12 Holdings of property

An error was identified in the estimate of holdings of property for both UK assets (direct investment abroad) and UK liabilities (direct investment in the UK). Data from 1999 to the latest period are affected. Revised figures for all series will be published within the Quarterly National Accounts and Balance of Payments on 30 June 2016.

Tables 16 and 17 show the estimated indicative impact on the sectors and transactions of the error correction for the estimate of holdings of property for UK assets and UK liabilities.

Table 16: Estimated indicative impact of the error correction for the estimate of holdings of property to the financial account

| UK, 1997 to 2014, £billion | |||||

| Sector impacted | Transaction impacted | Average revision to transaction 1997 to 2014 | Average revision to net lending/ borrowing (B.9f) 1997 to 2014 | Net lending/borrowing variance of revisions 1997 to 2014 | |

| Financial account | Min | Max | |||

| S.12 - Financial corporations | F.51 - Equity, asset | 0.0 | 0.0 | 0.0 | 0.0 |

| S.2 - Rest of the world | F.51 - Equity, liability | 0.0 | 0.0 | 0.0 | 0.0 |

| Source: Office for National Statistics | |||||

Download this table Table 16: Estimated indicative impact of the error correction for the estimate of holdings of property to the financial account

.xls (27.1 kB)

Table 17: Estimated indicative impact of the error correction on the estimate of holdings of property to the financial balance sheet

| UK, 1997 to 2014, £billion | |||||

| Sector impacted | Transaction impacted | Average revision to transaction 1997 to 2014 | Average revision to financial net worth (BF.90) 1997 to 2014 | Financial net worth variance of revisions 1997 to 2014 | |

| Balance sheet | |||||

| Min | Max | ||||

| S.11002+S.11003 - Private non-financial corporations | AF.51 - Equity, liability | 5.1 | -5.1 | -9.1 | -1.6 |

| S.12 - Financial corporations | AF.51 - Equity, asset | 0.0 | 0.0 | -0.3 | 0.1 |

| S.14+S.15 - Household and non-profit institutions serving households | AF.51 - Equity, asset | 41.6 | 41.6 | 10.9 | 74.3 |

| S.2 - Rest of the world | AF.51 - Equity, asset | 5.1 | -36.5 | -67.7 | -9.3 |

| AF.51 - Equity, liability | 41.6 | ||||

| Source: Office for National Statistics | |||||

Download this table Table 17: Estimated indicative impact of the error correction on the estimate of holdings of property to the financial balance sheet

.xls (20.5 kB)2.2.13 The treatment of Eurostar equity sale in National Accounts

In March 2015, the UK Government announced that it had reached agreement for the sale of its stake in Eurostar International Limited ("Eurostar") for £757 million. The Government sold its entire 40% equity stake in Eurostar for £585 million and received a further £172 million from the redemption by Eurostar of the preference share it held. Although the sale was announced in March 2015, the cash transactions did not take place until May 2015.

Prior to the sale, London and Continental Railways Limited (currently classified as a Public Corporation) had transferred its ownership of Eurostar equity to HM Treasury in June 2014. This transaction has not yet been recorded in the National Accounts and will be implemented along with the transaction of the equity sale.

Tables 18 and 19 show the estimated indicative impact on the sectors and transactions for the treatment of Eurostar equity sale in the National Accounts.

Table 18: Estimated indicative impact due to improvements for the treatment of Eurostar equity sale for the financial account

| UK, 1997 to 2014, £billion | |||||

| Sector impacted | Transaction impacted | Average revision to transaction 1997 to 2014 | Average revision to net lending/ borrowing (B.9f) 1997 to 2014 | Net lending/borrowing variance of revisions 1997 to 2014 | |

| Financial Account | Min | Max | |||

| S.11002+S.11003 - Private non-financial corporations | F.51 - Equity, liability | 0.0 | 0.0 | -0.5 | 0.0 |

| S.1311 - Central government | F.51 - Equity, asset | 0.0 | 0.0 | 0.0 | 0.5 |

| Source: Office for National Statistics | |||||

Download this table Table 18: Estimated indicative impact due to improvements for the treatment of Eurostar equity sale for the financial account

.xls (19.5 kB)

Table 19: Estimated indicative impact due to improvements for the treatment of Eurostar Equity Sale for the balance sheet

| UK, 1997 to 2014, £billion | |||||

| Sector impacted | Transaction impacted | Average revision to transaction 1997 to 2014 | Average revision to financial net worth (BF.90) 1997 to 2014 | Financial net worth variance of revisions 1997 to 2014 | |

| Balance sheet | Min | Max | |||

| S.11002+S.11003 - Private non-financial corporations | AF.51 - Equity, liability | 0.1 | -0.1 | -0.5 | 0.0 |

| S.1311 - Central government | AF.51 - Equity, asset | 0.1 | 0.1 | 0.0 | 0.5 |

| Source: Office for National Statistics | |||||

Download this table Table 19: Estimated indicative impact due to improvements for the treatment of Eurostar Equity Sale for the balance sheet

.xls (19.5 kB)2.2.14 Correction of owner-occupied financial intermediation services indirectly measured (FISIM)

In the implementation of the methodological improvement to imputed rental, an issue in the sectorisation of intermediate consumption, including FISIM, was identified. An element of owner-occupied FISIM which should only be treated as intermediate consumption by households in the calculation of household gross operating surplus had previously been allocated to the PNFC sector. In addition, historic balancing adjustments applied to the household gross operating surplus estimates were removed. In Blue Book 2016, intermediate consumption and historic balancing adjustments have been corrected in the calculation of household gross operating surplus.

Tables 20 and 21 below show the estimated indicative impact on the sectors and transactions for correction to owner-occupied FISIM and removal of the historic balancing adjustment being applied to household gross operating surplus.

Table 20: Estimated indicative impact in the non-financial account due to the correction of owner-occupied FISIM on household gross operating surplus

| UK, 1997 to 2014, £billion | ||||||

| Sector impacted | Transaction impacted | Average revision to transaction 1997 to 2014 | Average revision to net lending/ borrowing (B.9n) 1997 to 2014 | Net lending/borrowing variance of revisions 1997 to 2014 | Average revision to Households’ saving ratio 1997 to 2014 % | |

| Non-financial account | Min | Max | ||||

| S.11002+S.11003 - Private non-financial corporations | B.2g - Gross operating surplus | -0.7 | -0.7 | -1.7 | 0.0 | N/A |

| S.14+S.15 - Households and non-profit institutions serving households | B.2g - Gross operating surplus | 0.7 | 0.7 | 0.0 | 1.7 | 0.1 |

| Source: Office for National Statistics | ||||||

Download this table Table 20: Estimated indicative impact in the non-financial account due to the correction of owner-occupied FISIM on household gross operating surplus

.xls (28.2 kB)

Table 21: Estimated indicative impact in the Non-financial account due to the removal of the historic balancing adjustment being applied to household gross operating surplus

| UK, 1997 to 2014, £billion | ||||||

| Sector impacted | Transaction impacted | Average revision to transaction 1997 to 2014 | Average revision to net lending/ borrowing (B.9n) 1997 to 2014 | Net lending/borrowing variance of revisions 1997 to 2014 | Average revision to Households’ saving ratio 1997 to 2014 % | |

| Non-financial account | Min | Max | ||||

| S.11002+S.11003 - Private non-financial corporations | B.2g - Gross operating surplus | 0.9 | 0.9 | -3.3 | 2.0 | N/A |

| S.14+S.15 - Households and non-profit institutions serving households | B.2g - Gross operating surplus | -0.9 | -0.9 | -2.0 | 3.3 | -0.1 |

| Source: Office for National Statistics | ||||||

Download this table Table 21: Estimated indicative impact in the Non-financial account due to the removal of the historic balancing adjustment being applied to household gross operating surplus

.xls (27.6 kB)2.2.15 Tax evasion

In Blue Book 2015, changes in the measurement of exhaustiveness led to improvements in the estimation of concealed income, which forms part of wider adjustments that are applied to account for any production, income and expenditure that is not picked up in source data. Hidden activity generating concealed income forms part of output and intermediate consumption in the production approach to Gross Domestic Product (GDP), while concealed income itself forms part of compensation of employees (CoE), mixed income (MI) and gross operating surplus (GOS) in the income approach.

In Blue Book 2016, the National Accounts concealed income/activity model has been revised in line with updated HMRC estimates of missing Corporation and Income Tax publication in their 'Measuring tax gaps 2015' publication.

Table 22 shows the estimated indicative impact on the sectors and transactions due to the improvements in the estimation of tax evasion.

Table 22: Estimated indicative impact in the non-financial account due to the improvements in the estimation of tax evasion

| UK, 1997 to 2014, £billion | ||||||

| Sector impacted | Transaction impacted | Average revision to transaction 1997 to 2014 | Average revision to net lending/ borrowing (B.9n) 1997 to 2014 | Net lending/borrowing variance of revisions 1997 to 2014 | Average revision to Households’ saving ratio 1997 to 2014 % | |

| Non-financial account | Min | Max | ||||

| S11002+S11003 - Private non-financial corporations | B.2g Gross operating surplus | -0.4 | -0.3 | -2.0 | 0.2 | N/A |

| P.51g Gross fixed capital formation | -0.1 | |||||

| S.14+S.15 - Households and non-profit institutions serving households | B.3g - Gross mixed income | 0.1 | 0.3 | -0.2 | 2.0 | 0.0 |

| D.11 - Wages and salaries, use | -0.1 | |||||

| P.3 - Final consumption expenditure, use | -0.1 | |||||

| P.51g Gross fixed capital formation | -0.3 | |||||

| Source: Office for National Statistics | ||||||

Download this table Table 22: Estimated indicative impact in the non-financial account due to the improvements in the estimation of tax evasion

.xls (28.7 kB)2.2.16 Foreign Direct Investment revisions

The National Accounts utilises information from the quarterly Foreign Direct Investment (FDI) and annual FDI surveys. In the short-term, the quarterly survey is used within the National Accounts and then later revised when the more comprehensive annual survey data become available, known as the FDI benchmark process. This benchmark process is an annual reconciliation between the quarterly and annual surveys utilised in the production of FDI data. The quarterly survey for outward and inward FDI has 680 and 970 sampled enterprise groups respectively; these increase to 2,100 and 3,500 enterprise groups respectively on an annual basis. The increased sample size and responses being taken from audited annual accounts, rather than quarterly management accounts, can result in revisions. This annual process ensures that the National Accounts and annual Foreign Direct Investment publications are coherent.

These annual FDI revised estimates for years 2013 and 2014 will be incorporated into the National Accounts on 30 June 2016. This will lead to revisions to the Sector and Financial Accounts, most notably private non-financial corporations.

2.3 Classification changes and other small changes impacting the accounts

There have been classification changes impacting the net lending/borrowing in the non-financial, financial accounts and balance sheets. These include the inclusion of the following.

Government standardised guarantees for the Help to Buy scheme: standardised guarantees are a new concept in ESA 2010. Most guarantees are considered contingent liabilities under ESA 2010 and only recorded in the National Accounts when they are called. However, guarantees which are issued in large numbers and along identical lines are considered standardised guarantees and for these a provision is estimated and recorded in the accounts in a similar way to that recorded for insurance. The government announced its intention to offer mortgage guarantees under the Help to Buy scheme in April 2013 and these guarantees have been classified as standardised guarantees. The impact of this inclusion is to record a government financial liability (in AF.66) of £41 million at the end of 2015 (£27 million at the end of 2014) and decrease government net borrowing in 2015 by £36 million (£24 million in 2014), as a result of the guarantee premia received.

Crossrail business rate supplement: this is a tax which has been levied by the Greater London Authority on non-domestic properties in London since April 2010 in order to help fund the Crossrail project. The levy has been classified as a local government tax on production and the impact of its introduction into the National Accounts is to reduce local government net borrowing by around £220 million a year since 2010.

Both of the above changes have been previously included within figures published in the Public Sector Finances. Other changes, to both National Accounts and Public Sector Finances, include the following:

Improvements to Transport for London capital stock changes

In September 2015, National Accounts data were revised to take account of some parts of Transport for London being reclassified from the public non-financial corporations sector to the local government sector. It was not possible to implement the necessary changes to the capital stocks figures at that time, and therefore these changes are being implemented on 30 June 2016. The impact is between £10million and £50million per year from 2008 onwards. There is no impact net lending/borrowing for Local Government or Public Corporations.

Other regular changes to the Sector and Financial Accounts are incorporated in the ‘other’ changes and include moving the last base year and reference year for chained volume estimates forward from 2012 to 2013 and the incorporation of new data from survey data sources.

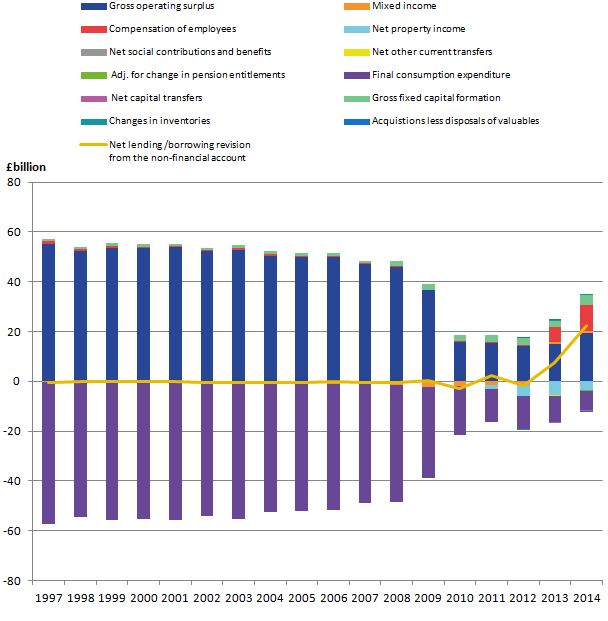

Nôl i'r tabl cynnwys3. Appendix A: Estimated net lending/borrowing by sector

The figures show the previously published, estimated current position and associated impact of changes for the non-financial and financial accounts net lending/borrowing position and the financial balance sheet financial net worth by sector.

3.1 Public corporations

Figure 1: Public corporations' net lending/borrowing from the non-financial account

UK, 1997 to 2014

Source: Office for National Statistics

Download this chart Figure 1: Public corporations' net lending/borrowing from the non-financial account

Image .csv .xls

Figure 2: Public corporations' net lending/borrowing from the financial account

UK, 1997 to 2014

Source: Office for National Statistics

Download this chart Figure 2: Public corporations' net lending/borrowing from the financial account

Image .csv .xls

Figure 3: Public corporations' financial net worth

UK, 1997 to 2014

Source: Office for National Statistics

Download this chart Figure 3: Public corporations' financial net worth

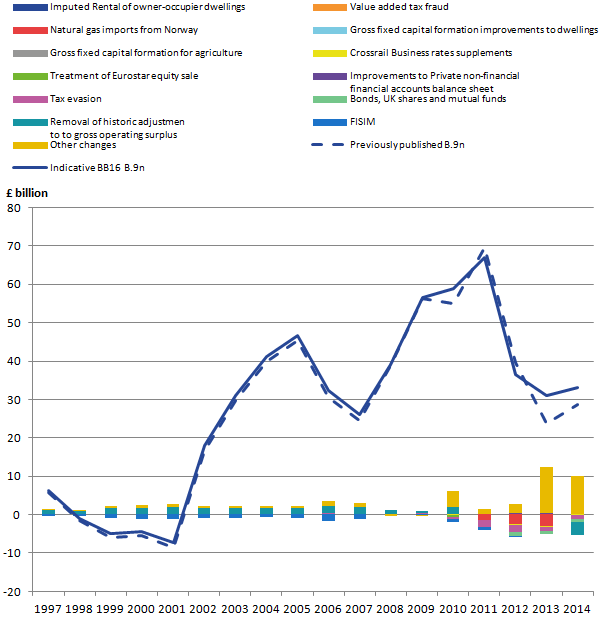

Image .csv .xls3.2 Private non-financial corporations’

Figure 4: Private non-financial corporation’s net lending/borrowing from the non-financial account,

UK, 1997 to 2014

Source: Office for National Statistics

Download this image Figure 4: Private non-financial corporation’s net lending/borrowing from the non-financial account,

.png (28.7 kB) .xls (31.7 kB)

Figure 5: Private non-financial corporation’s net lending/borrowing from the financial account

UK, 1997 to 2014

Source: Office for National Statistics

Download this chart Figure 5: Private non-financial corporation’s net lending/borrowing from the financial account

Image .csv .xls

Figure 6: Private non-financial corporation’s financial net worth

UK, 1997 to 2014

Source: Office for National Statistics

Download this chart Figure 6: Private non-financial corporation’s financial net worth

Image .csv .xls3.3 Financial corporations’

Figure 7: Financial corporations' net lending/borrowing from the non-financial account

UK, 1997 to 2014

Source: Office for National Statistics

Download this chart Figure 7: Financial corporations' net lending/borrowing from the non-financial account

Image .csv .xls

Figure 8: Financial corporations' net lending/borrowing from the financial account,

UK, 1997 to 2014

Source: Office for National Statistics

Download this chart Figure 8: Financial corporations' net lending/borrowing from the financial account,

Image .csv .xls

Figure 9: Financial corporations' financial net worth

UK, 1997 to 2014

Source: Office for National Statistics

Download this chart Figure 9: Financial corporations' financial net worth

Image .csv .xls3.4 Central government

Figure 10: Central government net lending/borrowing from non-financial account

UK, 1997 to 2014

Source: Office for National Statistics

Download this chart Figure 10: Central government net lending/borrowing from non-financial account

Image .csv .xls

Figure 11: Central government net lending/borrowing from the financial account

UK, 1997 to 2014

Source: Office for National Statistics

Download this chart Figure 11: Central government net lending/borrowing from the financial account

Image .csv .xls

Figure 12: Central government financial net worth

UK, 1997 to 2014

Source: Office for National Statistics

Download this chart Figure 12: Central government financial net worth

Image .csv .xls3.5 Local government

Figure 13: Local government net lending/borrowing from non-financial account

UK, 1997 to 2014

Source: Office for National Statistics

Download this chart Figure 13: Local government net lending/borrowing from non-financial account

Image .csv .xls

Figure 14: Local government net lending/borrowing from financial account

UK, 1997 to 2014

Source: Office for National Statistics

Download this chart Figure 14: Local government net lending/borrowing from financial account

Image .csv .xls

Figure 15: Local government financial net worth

UK, 1997 to 2014

Source: Office for National Statistics

Download this chart Figure 15: Local government financial net worth

Image .csv .xls3.6 Household and NPISH

Figure 16: Households and NPISH net lending/borrowing from the non-financial account

UK, 1997 to 2014

Source: Office for National Statistics

Download this image Figure 16: Households and NPISH net lending/borrowing from the non-financial account

.png (29.2 kB) .xls (31.2 kB)

Figure 17: Household and NPISH net lending/borrowing from the financial account

UK, 1997 to 2014

Source: Office for National Statistics

Download this chart Figure 17: Household and NPISH net lending/borrowing from the financial account

Image .csv .xls

Figure 18: Household and NPISH financial net worth

UK, 1997 to 2014

Source: Office for National Statistics

Download this chart Figure 18: Household and NPISH financial net worth

Image .csv .xls3.7 Rest of the world

Figure 19: Rest of the world net lending/borrowing from non-financial account

UK, 1997 to 2014

Source: Office for National Statistics

Download this chart Figure 19: Rest of the world net lending/borrowing from non-financial account

Image .csv .xls

Figure 20: Rest of the world net lending/borrowing from financial account

UK, 1997 to 2014

Source: Office for National Statistics

Download this chart Figure 20: Rest of the world net lending/borrowing from financial account

Image .csv .xls

Figure 21: Rest of the world financial net worth

UK, 1997 to 2014

Source: Office for National Statistics

Download this chart Figure 21: Rest of the world financial net worth

Image .csv .xls4. Appendix B: Estimated revisions to net lending/borrowing by sector and transactions

The figures show estimated revisions to the non-financial and financial accounts net lending/borrowing position and the financial net worth by sector and transactions.

4.1 Public corporations’

Figure 22: Public corporations' net lending/borrowing from the non-financial account

UK, 1997 to 2014

Source: Office for National Statistics

Download this chart Figure 22: Public corporations' net lending/borrowing from the non-financial account

Image .csv .xls

Figure 23: Public corporations' net lending/borrowing from the financial account

UK, 1997 to 2014

Source: Office for National Statistics

Download this chart Figure 23: Public corporations' net lending/borrowing from the financial account

Image .csv .xls

Figure 24: Public corporations' financial net worth

UK, 1997 to 2014

Source: Office for National Statistics

Download this chart Figure 24: Public corporations' financial net worth

Image .csv .xls4.2 Private non-financial corporations’

Figure 25: Private non-financial corporations' net lending/borrowing from the non-financial account

UK, 1997 to 2014

Source: Office for National Statistics

Download this chart Figure 25: Private non-financial corporations' net lending/borrowing from the non-financial account

Image .csv .xls

Figure 26: Private non-financial corporation’s net lending/borrowing from the financial account

UK, 1997 to 2014

Source: Office for National statistics

Download this chart Figure 26: Private non-financial corporation’s net lending/borrowing from the financial account

Image .csv .xls

Figure 27: Private non-financial corporation’s financial net worth

UK, 1997 to 2014

Source: Office for National statistics

Download this chart Figure 27: Private non-financial corporation’s financial net worth

Image .csv .xls4.3 Financial corporations’

Figure 28: Financial corporations' net lending/borrowing from the non-financial account

UK, 1997 to 2014

Source: Office for National statistics

Download this chart Figure 28: Financial corporations' net lending/borrowing from the non-financial account

Image .csv .xls

Figure 29: Financial corporations' net lending/borrowing from the financial account

UK, 1997 to 2014

Source: Office for National statistics

Download this chart Figure 29: Financial corporations' net lending/borrowing from the financial account

Image .csv .xls

Figure 30: Financial corporations' financial net worth

UK, 1997 to 2014

Source: Office for National statistics

Download this chart Figure 30: Financial corporations' financial net worth

Image .csv .xls4.4 Central government

Figure 31: Central government net lending/borrowing from non-financial account

UK, 1997 to 2014

Source: Office for National statistics

Download this chart Figure 31: Central government net lending/borrowing from non-financial account

Image .csv .xls

Figure 32: Central government net lending/borrowing from the financial account

UK, 1997 to 2014

Source: Office for National statistics

Download this chart Figure 32: Central government net lending/borrowing from the financial account

Image .csv .xls

Figure 33: Central government financial net worth

UK, 1997 to 2014

Source: Office for National statistics

Download this chart Figure 33: Central government financial net worth

Image .csv .xls4.5 Local government

Figure 34: Local government net lending/borrowing from non-financial account

UK, 1997 to 2014

Source: Office for National statistics

Download this chart Figure 34: Local government net lending/borrowing from non-financial account

Image .csv .xls

Figure 35: Local government net lending/borrowing from financial account

UK, 1997 to 2014

Source: Office for National statistics

Download this chart Figure 35: Local government net lending/borrowing from financial account

Image .csv .xls

Figure 36: Local government financial net worth

UK, 1997 to 2014

Source: Office for National statistics

Download this chart Figure 36: Local government financial net worth

Image .csv .xls4.6 Household and NPISH

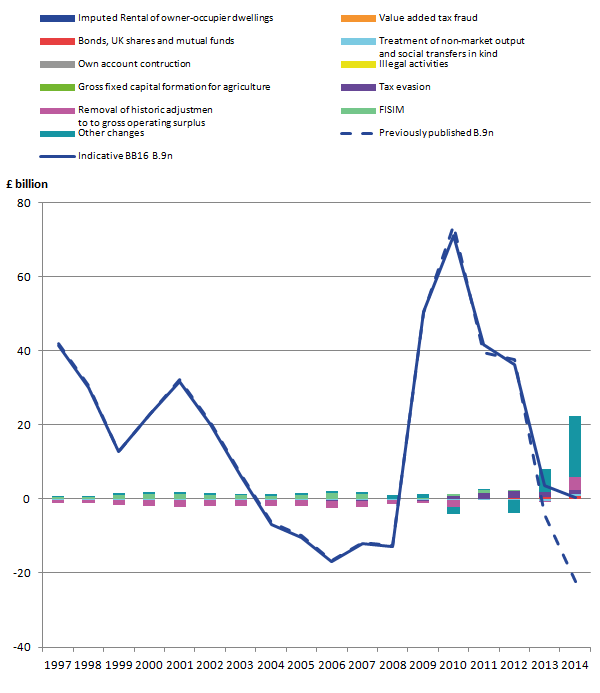

Figure 37: Households and non-profit institutions serving households net lending/borrowing from the non-financial account

UK, 1997 to 2014

Source: Office for National Statistics

Download this image Figure 37: Households and non-profit institutions serving households net lending/borrowing from the non-financial account

.png (20.8 kB) .xls (41.0 kB)

Figure 38: Household and NPISH net lending/borrowing from the financial account

UK, 1997 to 2014

Source: Office for National statistics

Download this chart Figure 38: Household and NPISH net lending/borrowing from the financial account

Image .csv .xls

Figure 39: Households and NPISH financial net worth

UK, 1997 to 2014

Source: Office for National Statistics

Download this chart Figure 39: Households and NPISH financial net worth

Image .csv .xls4.7 Rest of the world

Figure 40: Rest of the world net lending/borrowing from non-financial account

UK, 1997 to 2014

Source: Office for National statistics

Download this chart Figure 40: Rest of the world net lending/borrowing from non-financial account

Image .csv .xls

Figure 41: Rest of the world net lending/borrowing from financial account,

UK, 1997 to 2014

Source: Office for National Statistics

Download this chart Figure 41: Rest of the world net lending/borrowing from financial account,

Image .csv .xls

Figure 42: Rest of the world financial net worth

UK, 1997 to 2014

Source: Office for National statistics

Download this chart Figure 42: Rest of the world financial net worth

Image .csv .xls5. Appendix C: Estimated revisions to the real household disposable income and the non-profit institutions serving households saving ratio

5. Real household disposable income (RHDI)

5.1 Revisions to the real disposable income (RHDI) range from -0.3% in 1997 to 0.9% in 2014. The average revision to RHDI was -0.1% for 1997 to 2014.

Figure 43: Real household disposable income

UK, 1997 to 2014

Source: Office for National statistics

Download this chart Figure 43: Real household disposable income

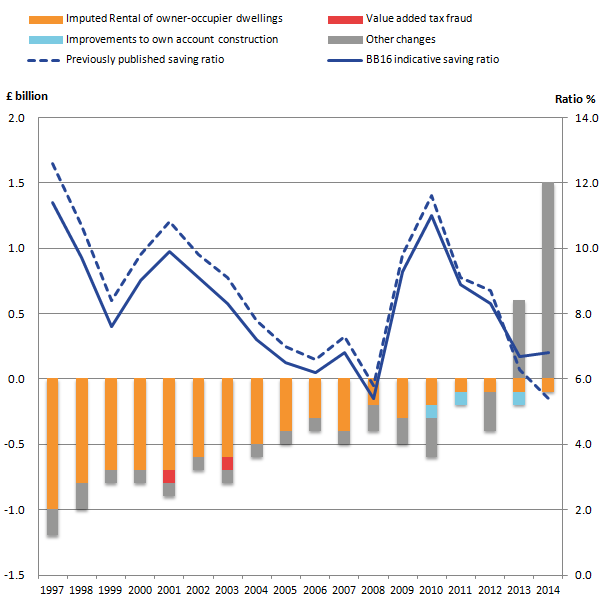

Image .csv .xls5.2. Saving Ratio

Revisions to the saving ratio range from -1.2% in 1997 to 1.4% in 2014. The average revision to the saving ratio was -0.5%.

The revisions to imputed rental are the main source of the revisions to the household and non-profit institutions serving households saving ratio. The revisions to imputed rental are broadly balanced across all three measures of GDP as this imputed value is the amount that non-renters pay themselves (expenditure) for the housing services that they are producing (output) whilst deriving an income from doing so (income). For the saving ratio, this means that income, (via gross operating surplus) and expenditure (via household final consumption expenditure) are being revised by similar but not equal amounts. The result is that the saving ratio falls in all years from 1997 to 2012.

Figure 44: Indicative estimate of the households and non-profit institutions serving households saving ratio

UK, 1997 to 2014