Cynnwys

- Main points

- Statistician’s comment

- Changes to publication schedule for economic statistics

- The Quarterly National Accounts show that the UK economy grew by 0.7% in Quarter 4 2016, unrevised from the second estimate

- Strong growth in consumer spending drives fall in household saving ratio

- Current account deficit narrows sharply in Quarter 4 2016

- There is a mixed picture for economic well-being in Quarter 4 2016

- 3-month on 3-month growth in manufacturing hits a 7-year high of 2.1% in January 2017

- Services output fell slightly in January 2017 but growth on a broader basis remains relatively strong

- Consumer price inflation including owner occupiers’ housing costs (CPIH) increased to 2.3% in February reflecting increased price pressure from energy and other imported goods

- UK unemployment rate has not been lower in over 4 decades

- Real and nominal earnings growth slowed in the 3 months to January 2017

1. Main points

- The latest estimate of gross domestic product (GDP) shows that the UK economy grew by 0.7% in Quarter 4 (Oct to Dec) 2016 and by 1.8% for the whole of 2016, unrevised from previous estimates.

- Household final consumption expenditure increased by 2.9% in Quarter 4 2016 compared with a year earlier and has been a significant driver to growth in GDP throughout 2016.

- Strong growth in consumer spending has continued to drive a fall in household saving ratio.

- The current account deficit narrowed sharply in Quarter 4 2016, mainly due to a significant narrowing in the trade deficit and in the primary income deficit.

- Whole economy indicators of economic well-being were generally positive; with growth in GDP per head, spending per head and net national disposable income, but household incomes declined.

- Production and construction output were broadly flat in January 2017, following 2 months of strong growth across the headline industries, particularly in motor manufacturing.

- Services output fell slightly in January 2017 but growth on a broader basis (the latest 3 months compared with the previous 3 months) remains relatively strong and in line with recent trends.

- Growth in consumer prices including owner occupiers’ housing costs (CPIH) of 2.3% in February 2017 is reflecting a growth in energy prices, food and other imported goods.

- Nominal and real wage growth slowed in the 3 months to January despite unemployment being at its lowest level in over 4 decades.

2. Statistician’s comment

ONS Head of GDP Darren Morgan said:

“Growth in the final quarter remained unrevised at 0.7%, with buoyant contributions from the retail and wholesale sectors in the run up to Christmas.

“Services dropped slightly in January with weak performances from hotels and the motor trade. However, the long term picture is still one of robust growth.

"Although household spending rose at the end of last year, there was a noticeable worsening in people's perception of the general economic situation and their own financial position. However, while at a historic low, the fall in the saving ratio is partly due to changes in imputed factors and the holdings of pension funds, rather than any significant changes in the real incomes of households."

Summary

Overall, most of the broader measures of the UK economy are continuing the trends seen during 2016. For example, consumer spending remains relatively strong, services output is increasing, manufacturing output is rising, particularly in the production of motor vehicles and unemployment is low. Households are however seeing rising prices for goods and services in some key areas such as food and fuel, which is putting downward pressure on real wages and incomes. More data will become available over the coming months, particularly the preliminary estimate of GDP for Quarter 1 at the end of April which will give a more complete picture of the economy in the first few months of 2017.

Nôl i'r tabl cynnwys3. Changes to publication schedule for economic statistics

The Office for National Statistics (ONS) introduced its new economic "theme days" in January, which will ensure that related economic statistics are released together.

This article provides a summary of the data and economic commentary released on each theme day alongside a particular focus on the latest GDP estimate and trends beneath the headline statistics.

More detailed theme day economic commentary is available for:

Nôl i'r tabl cynnwys4. The Quarterly National Accounts show that the UK economy grew by 0.7% in Quarter 4 2016, unrevised from the second estimate

The Quarterly National Accounts (QNA) – which contain revisions covering the period back to Quarter 1 (Jan to Mar) 2016 – indicated that the UK economy grew by 0.7% in the fourth quarter (Oct to Dec) of 2016 and by 1.9% when compared with the same quarter of the previous year (see Figure 1).

Figure 1: GDP growth, quarter-on-quarter and quarter on same quarter a year ago growth rate

UK, Quarter 1 (Jan to Mar) 2008 to Quarter 4 (Oct to Dec) 2016

Source: Office for National Statistics

Download this chart Figure 1: GDP growth, quarter-on-quarter and quarter on same quarter a year ago growth rate

Image .csv .xlsThere was a slight downward revision to quarter-on-quarter gross domestic product (GDP) growth in Quarter 3 (July to Sept) 2016 to 0.5%, however, economic growth in recent quarters remains similar to the previously published growth path. Further details are provided in the section titled “What is driving the revision to Quarter 3 (July to Sept) 2016?” in the main bulletin.

On a calendar year basis, today’s data show that GDP grew by 1.8% in 2016, unrevised from the second estimate of GDP. This is lower than the 2.2% growth seen in 2015 and also lower than the average rate of calendar year GDP growth in the decade prior to the downturn (2.9%).

Economic growth in 2016 reflected strong consumer spending and strong output in consumer-focused industries, while business investment declined

The QNA provide much greater information on the expenditure and income measures of GDP compared with the second estimate published on 22 February 2017. Information regarding the sector and financial accounts is also published today. By expenditure category, on a quarter on same quarter of previous year basis, household final consumption expenditure increased by 2.9% in the final quarter of 2016, higher than the average growth rate observed over the past 5 years (2.3%), but similar to the pre-crisis compound growth rate of 3% observed between 2002 and 2007. Given its large weighting within GDP, this component was the primary driver of GDP growth between the final quarter of 2015 and the final quarter of 2016 (Figure 2). This confirms previous analysis highlighting the strength of consumer-focused industries.

In contrast to consumption, business investment declined by 0.9% over the same period. Since the start of 2016, quarter on same quarter of previous year growth in business investment has been negative, following 23 consecutive quarters of positive growth.

Net exports subtracted 0.5 percentage points from GDP growth on a quarter on same quarter a year ago basis, but was the main driver of growth on a quarter-on-quarter basis, contributing 1.7 percentage points. The movement in net exports primarily reflects non-monetary gold. This component of trade is volatile, but its impact on aggregate GDP is neutral as there is an offsetting movement in the acquisitions less disposals of valuables component of gross capital formation.

Figure 2: Contributions to GDP growth, expenditure components, quarter on same quarter of previous year, chained volume measure

UK, Quarter 1 (Jan to Mar) 2015 to Quarter 4 (Oct to Dec) 2016

Source: Office for National Statistics

Notes:

- Contributions to GDP growth do not sum to the total because the statistical discrepancy is not displayed.

Download this chart Figure 2: Contributions to GDP growth, expenditure components, quarter on same quarter of previous year, chained volume measure

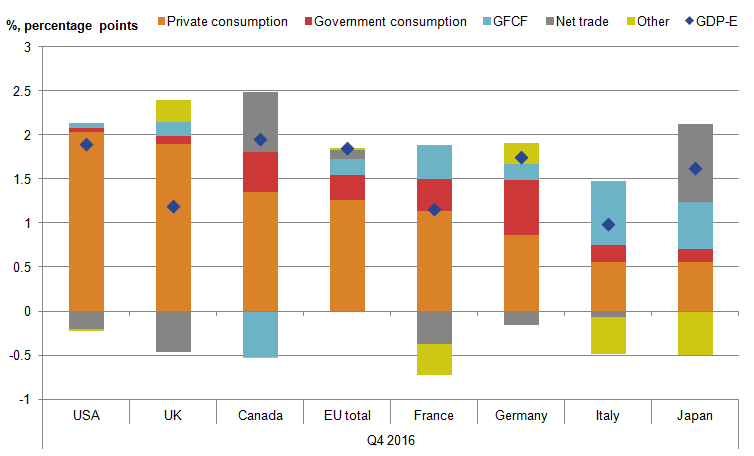

Image .csv .xlsFigure 3 places the consumption-led growth of the UK economy in context by examining the main contributors to quarter on same quarter a year ago growth in the expenditure measure of GDP for comparable economies. Private consumption in the UK contributed 1.9 percentage points to GDP growth, significantly more than other economies with the exception of the USA, which shows a similar pattern.

Figure 3: International comparison of GDP (expenditure) contributions, chained volume measure, quarter on previous year growth

UK, Quarter 4 (Oct to Dec) 2016

Source: Office for National Statistics

Notes:

- Due to inconsistencies in the international data, the 'other' category is calculated as: (GDP - Private consumption - Government consumption- GFCF - Net trade).

- All data shows the expenditure measure of GDP growth. These rates differ from the headline GDP growth rate for Quarter 4 2016 which is an average of the expenditure, income and output approaches.

Download this image Figure 3: International comparison of GDP (expenditure) contributions, chained volume measure, quarter on previous year growth

.png (19.0 kB) .xls (30.7 kB)5. Strong growth in consumer spending drives fall in household saving ratio

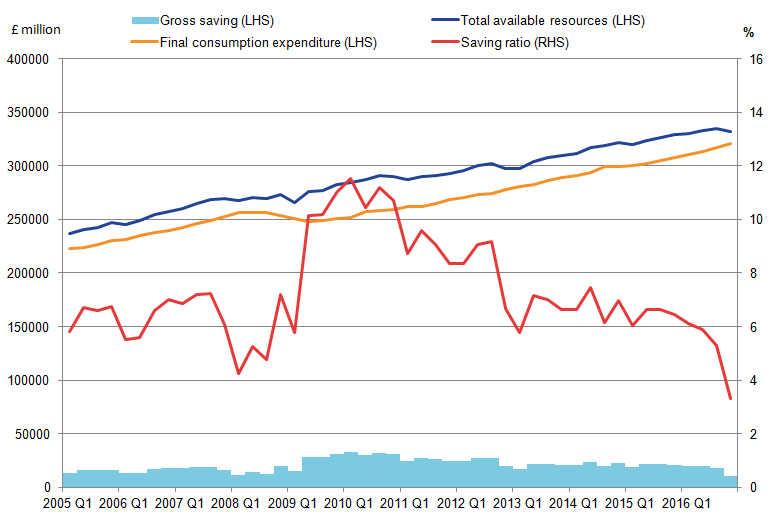

The household and non-profit institutions serving households (NPISH) saving ratio is calculated as final consumption expenditure divided by total available resources (Figure 4). The saving ratio fell to 3.3% in Quarter 4 2016, the lowest rate on record. The saving ratio has been declining since Quarter 3 2015 which primarily reflects stronger growth in consumer spending outweighing the rate of growth in household disposable income. Strong growth in consumer spending comes on the back of robust labour market activity, while the slowing in household disposable income growth largely reflects a fall in other investment income from property income.

Figure 4 also shows that the saving ratio rose sharply following the financial crisis (Quarter 1 2008 to Quarter 2 (Apr to June) 2009), but has been declining since Quarter 3 2015. The saving ratio can be volatile (as gross saving is a small difference between 2 large numbers – total resources and final consumption expenditure) and is often revised.

Figure 4: UK final consumption expenditure, total available resources, gross saving and saving ratio, seasonally adjusted

UK, Quarter 1 (Jan to Mar) 2005 to Quarter 4 (Oct to Dec) 2016

Source: Office for National Statistics

Notes:

- Total available household resources = gross disposable income plus adjustment for the change in pension entitlements.

- Saving ratio = gross saving (total resources minus final consumption expenditure) divided by total resources.

Download this image Figure 4: UK final consumption expenditure, total available resources, gross saving and saving ratio, seasonally adjusted

.png (25.1 kB) .xls (32.3 kB)The fall in the household saving ratio (calculated as gross saving divided by total available resources) is mirrored in the net lending or borrowing data. Figure 5 presents the net lending or borrowing position of various sectors in the UK economy and shows that the household sector was a net borrower in 2015 and 2016, following several years as a net lender in the post-financial crisis period. In 2016, the public sector and private financial corporations were also net borrowers, although public sector net borrowing as a share of nominal GDP has declined to its lowest since 2007. A counterpart to recent net borrowing patterns is rest of the world net lending to the UK. This corresponds to the broader UK balance of payments position.

Figure 5: Net lending (+) / borrowing (-) by sector as a % of nominal GDP

UK, 1996 to 2016

Source: Office for National Statistics

Download this chart Figure 5: Net lending (+) / borrowing (-) by sector as a % of nominal GDP

Image .csv .xls6. Current account deficit narrows sharply in Quarter 4 2016

The UK’s current account deficit as a percentage of GDP narrowed by 2.9 percentage points in Quarter 4 (Oct to Dec) 2016 to 2.4%. Figure 6 shows that the narrowing in the current account deficit was mainly due to a significant narrowing in the trade deficit and in the primary income deficit. The latter can be partially attributed to an increase in earnings on direct investments abroad, resulting in the smallest primary income deficit as a percentage of GDP seen since mid-2013.

Figure 6: The UK current account balance as a % of GDP

UK, Quarter 1 (Jan to Mar) 2006 to Quarter 4 (Oct to Dec) 2016

Source: Office for National Statistics

Download this chart Figure 6: The UK current account balance as a % of GDP

Image .csv .xlsThe overall trade balance as a percentage of GDP narrowed by 2 percentage points in Quarter 4 2016 compared with the previous quarter - largely driven by an £7.6 billion increase in goods exports. Of this £7.6 billion, £2.5 billion can be attributed to increases in exports of erratic commodities (e.g. non-monetary gold, aircraft), with a further £1.6 billion attributed to exports of oil. Of the additional £3.5 increase in exports other than erratic and oil series, there was a large increase to the exports of machinery (£1.0 billion).

The overall narrowing in the UK’s current account deficit also coincided with a substantial depreciation in the sterling effective exchange rate, falling 17.0% between Quarter 4 2015 and Quarter 4 2016. Further information on the impact of a sterling devaluation on the Balance of Payments and International Investment Position can be found in the latest bulletin.

Nôl i'r tabl cynnwys7. There is a mixed picture for economic well-being in Quarter 4 2016

This quarter’s data paint a mixed picture for economic well-being in the UK. Overall, whole economy indicators were positive; with growth in gross domestic product (GDP) per head and net national disposable income per head. This hasn’t translated fully to households though; with incomes declining this quarter due mainly to a rise in prices. Despite the fall in income per person, spending increased and returned to the pre-2008 downturn level for the first time. Finally, economic sentiment worsened this quarter with consumers’ confidence in the general economic situation falling and consumers also feeling less favourable about their own financial situation.

Nôl i'r tabl cynnwys8. 3-month on 3-month growth in manufacturing hits a 7-year high of 2.1% in January 2017

While production output fell slightly in January 2017 (negative 0.4%), 3-month on 3-month growth in manufacturing hit a 7-year high of 2.1% (the highest rate since May 2010). The monthly fall in production was driven by a contraction in manufacturing activity (which accounts for 70.0% of total production), particularly in the volatile pharmaceuticals industry, which saw a 13.5% drop in January following an increase of 8.2% in December 2016.

The strength in manufacturing over the past 7 years has been driven by the production of motor vehicles, trailers and semi-trailers, which contributed 3.5 percentage points to the total 5.9% in 3-monthly manufacturing growth since May 2010.

The recent strength in UK motor vehicle production is also reflected in recent trade figures, with the latest data showing that passenger motor vehicles were the UK’s second highest exported commodity behind mechanical machinery in 2016. Figure 7 shows manufacturing output and export turnover of the motor vehicle industry on a 12-month rolling average basis. The upward trend in the production and exports of motor vehicles is also strongly corroborated by data from the Society of Motor Manufacturers and Traders (SMMT), which shows registrations of new vehicles in the UK trending up since 2012.

Figure 7: UK motor vehicle production, exports and new car registrations

January 2010 to January 2017, UK

Source: Office for National Statistics, Society of Motor Manufacturers & Traders

Download this chart Figure 7: UK motor vehicle production, exports and new car registrations

Image .csv .xlsConstruction activity and new orders show falls in the most recent data, but are still above levels seen last year

While construction output fell by 0.4% in January 2017, it rose by 1.8% on a 3-month on 3-month basis following consecutive rises in November and December. In addition, the latest data revealed an upward revision to annual construction output growth for 2016 – up 0.9 percentage points to 2.4%. This revision was due to upward revisions across all 4 quarters and in particular, a revision of Quarter 4 (Oct to Dec) growth from 0.2% to 1.0%.

Total construction new orders decreased by 2.8% in Quarter 4 2016, reflecting a fall in all sectors except for public work. Despite the quarterly fall, the annual volume of new orders is now at its highest level since 2008.

Nôl i'r tabl cynnwys9. Services output fell slightly in January 2017 but growth on a broader basis remains relatively strong

Alongside Quarterly National Accounts, new data are available for the services industries. Following 7 consecutive months of positive growth, services output remained broadly flat in January 2017, with a slight fall of 0.1%. Falls in transport, storage and communication, and distribution, hotels and restaurants (down 1.2% and 0.7% respectively) slightly outweighed rises in both business services and finance, and government and other services (up 0.5% and 0.2% respectively).

The latest services data are consistent with other short-term indicators of economic activity released earlier this month, with both production and construction output falling slightly in January (down 0.4%), but recording 3-month on 3-month growth of 1.9% and 1.8% respectively. In the most recent 3 months to January, services output rose by 0.6% compared with the 3 months to October 2016.

Figure 8 shows movements in all 4 main components of the services industries, as well as in wholesale trade, retail trade and repair of motor vehicles (a sub-component of distribution, hotels and restaurants). Despite a monthly fall in January for transport, storage and communication, and distribution, hotels and restaurants, all 4 main components recorded rises on a 3-monthly basis, with the largest contributor to growth coming from business services and finance (accounting for 0.2 percentage points of the 0.6% growth in overall services).

Figure 8 also strongly corroborates the recent strength seen in UK production and exports of motor vehicles, with growth in the wholesale trade, retail trade and repair of motor vehicles outpacing overall growth in services over the past 3 years. While overall services output has grown 9.3% since January 2014, wholesale trade, retail trade and repair of motor vehicles has grown by 23.6%, although growth did slow considerably in 2016.

Figure 8: Index of services by selected components

UK January 2014 to January 2017

Source: Office for National Statistics

Download this chart Figure 8: Index of services by selected components

Image .csv .xls10. Consumer price inflation including owner occupiers’ housing costs (CPIH) increased to 2.3% in February reflecting increased price pressure from energy and other imported goods

Figure 9 shows the contributions to the 12-month growth in CPIH from owner occupiers’ housing costs (OOH), services and goods of varying import intensities. Energy is separately identified and goods are classified in ranges of import intensity from 0 to 10% to 40% and over. We use the rental equivalence method to measure OOH, which reflects the imputed rental value of properties. Previous analysis in the prices economic commentary showed that OOH tends to track the movements of the Index of Private Housing Rental Prices (IPHRP) for England excluding London.

The graph shows that OOH tends to have a positive contribution to CPIH, apart from in 2010. The 12-month growth rate for IPHRP was falling for most of 2010 in the aftermath of the economic downturn. In 2015, the positive 12-month growth rate for IPHRP led to a positive contribution to CPIH from OOH, which kept the CPIH 12-month growth rate above 0% throughout 2015, while the CPI remained around 0%.

Figure 9: Contributions to 12-month CPIH growth by services, energy and import intensity of goods

UK, January 2008 to February 2017

Source: Office for National Statistics

Notes:

- Energy includes electricity, gas and other household fuels as well as fuels and lubricants for motor vehicles.

- Services does not include owner occupiers' housing costs (OOH).

Download this chart Figure 9: Contributions to 12-month CPIH growth by services, energy and import intensity of goods

Image .csv .xlsSimilar to previous analysis the latest data show that while services price inflation has consistently contributed around 0.8 to 1.8 percentage points of the headline 12-month CPIH growth rate in recent years, the contribution (positive or negative) from energy-related goods and relatively more import-intensive goods (20 to 30%, 30 to 40% and 40% and over groups) has been more varied. Energy continues to be the main driver of the recent increase in CPIH (mostly from fuels and lubricants), contributing 0.47 percentage points to CPIH 12-month growth in February 2017, up from negative 0.33 percentage points a year earlier.

For the first time since March 2014, all groups shown in Figure 9 have a positive contribution to CPIH, following over 2 years of deflation of the 20 to 30% and 30 to 40% groups. Much of this can be attributed to the moderation of food price deflation over the past few months and the subsequent return to food price inflation in the latest month. As mentioned in the prices economic commentary, the main positive contributions to the 12-month rate for food were fish and fruit (which are both within the 30 to 40% group) and bread and cereals (which are within the 20 to 30% group).

Nôl i'r tabl cynnwys11. UK unemployment rate has not been lower in over 4 decades

Headline labour market indicators point to a strong performance in the 3 months to January 2017. Estimates from the Labour Force Survey, show that there were 31.85 million people in work, 305,000 more than for a year earlier and 92,000 more than for August to October 2016. There was an increase in full-time employment (a rise of 136,000) partly offset by a decrease in total part-time employment (a fall of 44,000). The employment rate is 74.6%, the joint highest since comparable records began in 1971. The unemployment rate is 4.7%, down from 5.1% for a year earlier (Figure 10). It has not been lower since June to August 1975.

Figure 10: Quarterly change in employment and unemployment rate, seasonally adjusted

UK, November to January 2009 to November to January 2017

Source: Office for National Statistics

Download this chart Figure 10: Quarterly change in employment and unemployment rate, seasonally adjusted

Image .csv .xlsThe participation rate (the proportion of people aged over 16 who were economically active) has increased marginally to 63.6% in the 3 months to January 2017. This means that 61,000 more people have joined the labour force in the 3 months to January 2017. A fall in unemployment rate is driven by an increase in the participation rate. Similarly, an increase in participation rate was accompanied by a 0.1 percentage points increase in activity rate (the proportion of people aged between 16 and 64 who were economically active) to 78.4% in the 3 months to January 2017.

The headline employment growth and unemployment numbers are useful in providing a simplified snapshot of how labour markets are evolving. A broader set of statistics complement this snapshot with a richer set of information. For example, the long-term unemployment rate (those unemployed for over 12 months) has fallen by 0.1 percentage points and is now approaching its pre-crisis average. The ratio of redundancies to employment remains at a low level compared with historical averages. Another important indicator of the labour market is the number of vacancies, which has remained relatively flat compared with the previous year. Vacancies increased marginally by 4,000 in the 3 months to February 2017 driven by a rise in vacancies in the services and construction sectors.

Recent analysis examines the relationship between vacancies and unemployment as an indication of the matching efficiency in the labour markets.

Nôl i'r tabl cynnwys12. Real and nominal earnings growth slowed in the 3 months to January 2017

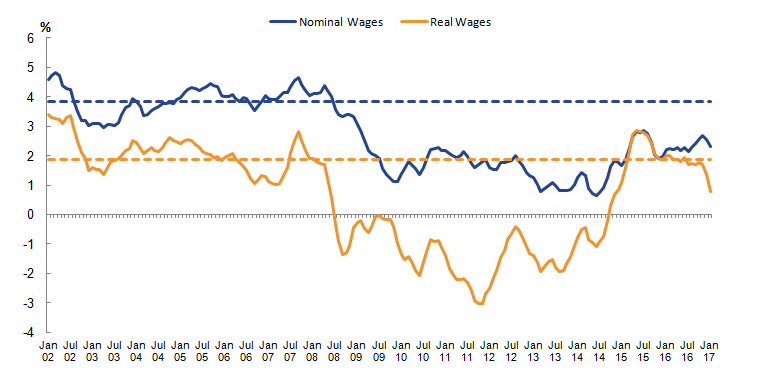

Figure 11 shows rates of nominal and real wage growth over a 15-year period from January 2002. Wages have been adjusted for inflation using the Consumer Prices Index (CPI) as this series is available prior to 2005 whereas CPI including owner occupiers’ housing costs (CPIH) is available using the current methodology only from 2005.

These data show that regular weekly earnings for employees (excluding bonuses) in Great Britain increased by 2.3% in the 3 months to January 2017 compared with a year earlier. This is the weakest rate of growth since August 2016 and down from 2.6% in the 3 months to December 2016. Weekly earnings, including bonuses, grew at 2.2% in the same period and are the weakest since April 2016.

Once adjusted for inflation (measured by CPI) average weekly earnings increased by 0.7% including bonuses and 0.8% excluding bonuses, compared with a year earlier. This is the weakest growth in real earnings since November 2014.

Figure 11: Regular average weekly earnings growth, seasonally adjusted, 3 month on 3 month a year ago: real and nominal

January 2002 to January 2017, Great Britain

Source: Office for National Statistics

Notes:

- Dashed lines indicate pre-crisis averages (calculated over 2002 to 2007).

- Real wages are calculated using CPI rather than CPIH as a deflator as at the time of the most recent labour market release the real wages series still used CPI. Since then we have chosen to make CPIH our preferred measure of consumer price inflation, and the real wages series will be updated to reflect this in the next labour market release.

Download this image Figure 11: Regular average weekly earnings growth, seasonally adjusted, 3 month on 3 month a year ago: real and nominal

.png (19.2 kB) .xls (48.6 kB)Workforce jobs growth has been concentrated in health and social work and professional and scientific services

The breakdown by industry of job growth in the UK has been in line with broad economic trends. To understand year-on-year (December 2015 to December 2016) job growth by industry (Figure 12), analysis should be placed in the macroeconomic context. Trends in employment in construction have matched recent performance in the housing market in the UK, including continued strong demand for housing particularly in London and the wider south east. The more interesting dynamics emerge when industries are traditionally associated with foreign demand are considered. Accommodation and food service (positive 51,000), associated with the tourism sector, saw marked gains in workforce jobs while manufacturing, associated with potentially greater export demand from the recent depreciation of sterling, marked a more modest increase of 7,000 workforce jobs.

Figure 12: Workforce jobs growth by industry

December 2015 to December 2016, UK, seasonally adjusted

Source: Office for National Statistics

Notes:

- Workforce jobs figures are a measure of jobs rather than people and include estimates of the self-employed by industry.

- Data for December 2016 are provisional.

- Data are available from ONS dataset JOBS02.

Download this chart Figure 12: Workforce jobs growth by industry

Image .csv .xlsMining and quarrying (negative 5,000); public administration and defence and compulsory social security (negative 11,000) and financial and insurance activities (negative 26,000) saw a decrease in workforce jobs. These losses were offset by marked gains in human health and social work (positive 88,000); professional, scientific and technical activities (positive 65,000); construction (positive 60,000); administrative and support service activities (positive 56,000) and information and communication (positive 53,000).

Overall, increase in workforce jobs has been largely concentrated in services, led by human health and social work, and professional and scientific services. The increase in professional, scientific and technical activities marks a continuing strength and the competitive advantage that the UK has in this sector, which is largely concentrated in London and the south east. For example, 13.7% of workforce jobs in London are in the professional, scientific and technical industry, compared with a UK average of 8.7% workforce jobs in December 2016. Bucking the trend has been the finance and insurance sector, where workforce job losses amounted to 26,000, albeit from a relatively high base.

Nôl i'r tabl cynnwys