1. Experimental nature of these statistics

Important Things to Note About These Statistics

It is important to emphasise these are experimental statistics which have been produced in isolation of the normal national accounts production and quality assurance process. There are a number of caveats that users of the data should consider.

The data are not consistent with currently published UK financial account statistics, such as the UK Economic Accounts or the Quarterly or Annual National Accounts, for example, and should not be used in place of the regularly published national statistics. The data has been produced outside of current processing of the national accounts and the data will be revised prior to inclusion in any future annual national accounts. We will continue to evaluate and quality assure these experimental statistics and other new data with the aim of incorporating them into the UK National Accounts over the coming years. These experimental estimates may be subject to change as we develop, quality assure and integrate these data.

Nôl i'r tabl cynnwys2. Main points

Solvency II data have been used to compile financial accounts for the UK insurance sector for the period 2016 onwards; these were compiled as experimental flow of funds statistics.

The stocks of financial liabilities increased by 2% from £1,843 billion at the end of 2016 to £1,879 billion1 at the end of 2017; life technical reserves and pension entitlements represented 48% and 27% of total 2017 liabilities, respectively.

UK insurers’ largest 2017 investments were investment fund shares/units (£605 billion) and debt securities assets (£519 billion).

UK insurers’ exposure to the rest of the world sector accounted for 29% of their investments2 at the end of 2017.

The investment fund shares/units were largely composed of non-UK listed shares and corporate bonds, and UK government securities.

Notes for: Main points

The UK insurance sector liabilities presented in this article were sourced from Solvency II and as such do not include claims of pension funds on pension managers that are imputed in line with national accounts methods.

Derivatives and other financial assets were not considered as investments.

3. Introduction

The Office for National Statistics (ONS), in cooperation with the Bank of England, has concluded that data collected under Solvency II (SII), the Europe-wide insurance regulatory framework1, are suitable for UK national accounts compilation.

Last year, we published experimental financial statistics for the UK insurance sector based on quarterly SII data. We do not publish any data that can be directly compared with the experimental SII-based statistics. As explained in last year’s publication, the UK insurance sector is not currently separately identified in the national accounts. However, it was possible to re-work financial aggregates from SII and from ONS insurance surveys to bring them both onto a more comparable basis. Results of the comparison were very promising, despite coverage differences2 .

This year, in recognition of the demand for improved financial statistics3 following the last financial crisis, these statistics were expanded to include more detailed information on counterparts4 . Using this detailed information, it was possible to compile experimental flow of funds statistics for the insurance sector. This article is part of the experimental enhanced financial accounts publication.

Notes for: Introduction

Solvency II is a European Union Directive (2009/138/EC) that harmonises the insurance sector in the EU. SII sets out prudential and supervisory requirements for almost all insurance and reinsurance companies with head offices in the EU. It was implemented in January 2016, representing the largest change to insurance regulation in the EU for over 30 years. In the UK, the Prudential Regularly Authority was responsible for its implementation. It should be noted that since the SII implementation in 2016, the data quality of various statistics improved over time.

Lloyds of London syndicates are included in SII, but are not covered by ONS insurance surveys.

Bean C., “Independent review of UK economic statistics: Final report”, March 2016.

FSB, “The Financial Crisis and Information Gaps, G20 DGI-2”, Fourth Progress Report, October 2019.

4. Financial balance sheet – liabilities

These experimental statistics suggest stocks of UK insurance sector liabilities were £1,879 billion1 at the end of 2017, technical reserves accounting for over 82% of this figure (Figure 1). Within this, the largest sub-categories were life technical reserves (£892 billion) and pension entitlements (£504 billion).

Figure 1: Liabilities of UK insurers, 2017

Source: Office for National Statistics, Bank of England, Prudential Regulation Authority

Download this chart Figure 1: Liabilities of UK insurers, 2017

Image .csv .xlsNotes for: Financial balance sheet – liabilities

- The UK insurance sector liabilities presented in this article were sourced from SII and thus do not include claims of pensions funds on pensions managers that are imputed in line with national accounts methods.

5. Financial balance sheet – assets

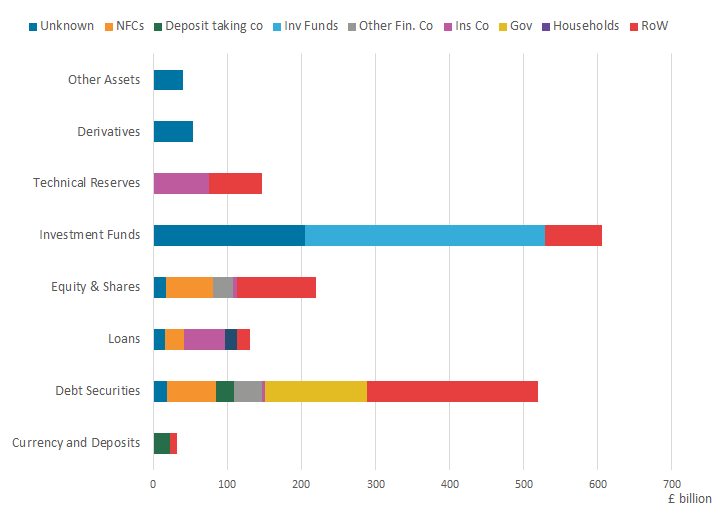

These experimental statistics suggest UK insurers used their technical reserves to invest in a range of different assets (Figure 2).

Investment fund shares/units accounted for 35% of total assets (£605 billion) and were issued by the following sectors:

UK investment funds issued £324 billion

non-resident issuers issued £76 billion

unknown issuers account for £205 billion1

Debt securities represented 30% of total assets (£519 billion) and were issued by the following sectors:

non-resident issuers – £231 billion

UK government – £138 billion

UK non-financial corporations – £66 billion

UK financial corporations – £66 billion

unknown issuers – £18 billion

Listed and unlisted shares together with other equity represented 13% of total assets (£219 billion) and were mainly issued by the following sectors:

non-resident issuers – £106 billion

UK non-financial corporations – £62 billion

UK financial corporations – £32 billion

unknown issuers – £17 billion

Other financial assets included:

technical reserves relating to reinsurance contracts (£147 billion); these relate to insurance ceded in almost equal proportions to UK and non-UK insurers

loans (£131 billion); 43% of these were made to other insurers mainly in the form of deposits to cedants that relate to inter-insurer lending on reinsurance accepted

derivatives (£53 billion) that largely consist of swap contracts used to hedge against transaction risks

Figure 2: Financial assets of UK insurers by type and by issuing sector at the end of 2017

Source: Office for National Statistics, Bank of England, Prudential Regulation Authority

Download this image Figure 2: Financial assets of UK insurers by type and by issuing sector at the end of 2017

.png (10.7 kB) .xls (28.7 kB)Notes for: Financial balance sheet – assets

- SII data show that significant amounts of investment fund shares/units held by insurance companies are sold by fund managers. SII guidance allows this where the issuers of the investment fund shares/units are “unknown”. In addition, amounts of investment fund shares/units issued by investment entities of insurers were also classified as “unknown”. Further work is envisaged to improve the allocation to the corresponding issuers.

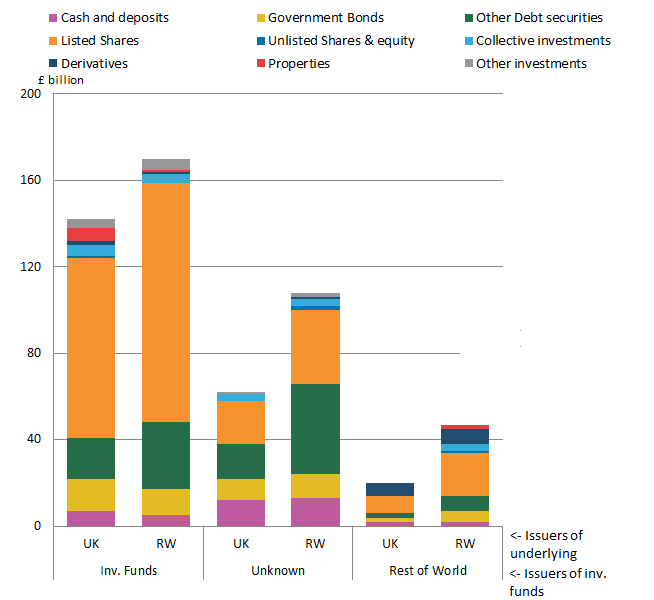

6. UK insurers’ investments – look-through approach

Solvency II (SII) data allow us to look-through collective investment undertakings to the underlying investments in financial and non-financial assets. This approach is beyond the scope of the national accounts and the enhanced financial accounts, but it may improve our understanding of the risk exposure of the UK insurers’ investments.

As previously noted, UK insurers invested £605 billion in investment fund shares/units (Figure 2). Figure 3 provides details of assets1 underlying these investment fund shares/units:

listed shares represented 50% (£276 billion) of assets held by these investment funds, of which £165 billion were issued overseas

corporate bonds accounted for 21% (£114 billion), of which £79 billion were issued overseas

government securities accounted for 10% (£55 billion), of which more than half were issued overseas

Figure 3: Look-through approach to underlying investments within investment fund shares/units at the end of 2017

Source: Office for National Statistics, Bank of England, Prudential Regulation Authority

Download this image Figure 3: Look-through approach to underlying investments within investment fund shares/units at the end of 2017

.png (17.4 kB) .xls (40.4 kB)Notes for: UK insurers’ investments – look-through approach

- In 2017, the data collected using the look through approach covered 91% of all investment fund shares/units in which UK insurers invested.

7. Methods and data validation

To compile financial accounts statistics for the insurance corporations sector, the Office for National Statistics (ONS) carefully analysed and selected Solvency II (SII) reporting insurers that could be classified into the UK insurance sector. Data from around 10 insurers that act mainly as pension fund managers were excluded from the experimental statistics in line with national accounts requirements under the European System of Accounts (ESA) 2010.

Detailed bridge tables were developed to map SII data to ESA 2010 and a summary of these tables is provided in this section.

Technical reserves liabilities and counterparts

The SII definition is broadly consistent with ESA 2010, however, the following changes were applied:

| Type of technical reserves | ESA code | Changes to SII to align with ESA 2010 definitions |

| Non-life | AF.61 | In line with ESA 2010, a small amount of term insurance was reclassified from long-term insurance (see following text) |

| Life | AF.62 | Long-term technical reserves were split into AF.62 and AF.63 using detailed firm-level data on policy types from the annual SII template. Term insurance (including protection and heath policies) was reclassified into non-life |

| Pension entitlements | AF.63 | |

| Claims of pension funds on pension managers | AF.64 | Compiled by the ONS Pension Team |

Download this table

.xls .csvInsurers’ liabilities were mapped separately to the policyholders (counterparts) of technical reserves related to reinsurance, direct life and non-life insurance. The policyholders of direct non-life technical reserves were mapped based on the breakdown by type of insurance policy, for example, health, income protection, motor and aviation.

Assets and counterparts

SII provides detailed information on assets by type – for example, debt securities, shares, equities and investment funds. These are collected in a quarterly open template in which insurers give details of all their asset holdings by currency, classified according to the Complementary Identification Code – CIC1 . For each security holding, counterpart information is provided including issuer’s country and industrial allocation2 .

We have developed a mapping between CIC and ESA 2010 financial instrument codes as well as a mapping of the issuers’ industrial classification to ESA 2010 institutional sectors.

The following tools and processes were used for data validation:

a reference database of entities and their sectoral allocation was developed for monetary financial institutions (MFIs), special purpose entities (SPEs), insurance companies, public non-financial companies and selected governmental bodies; this was done using lists of UK entities regulated by the Prudential Regulation Authority (PRA) and Financial Conduct Authority (FCA) together with information from commercial data providers and the ONS Business Register (IDBR)

loans to deposit-taking corporations were reclassified to transferable deposits

investment funds listed on stock exchanges were reclassified into non-money market investment fund shares

currency denomination and international securities identification number (ISIN) codes were used to determine country of residency where not provided

allocations of SII counterparts were replaced by more reliable source data for the following instruments:

listed shares using commercial data (Refinitiv3 , CREST, Equiniti)

money market fund shares could not be reconciled with information available from the UK Investment Management Association, thus it was decided to classify all counterparts to the unknown

Liabilities other than technical reserves

Most insurers’ liabilities other than technical reserves can be allocated to ESA 2010 instrument classifications from the SII quarterly balance sheet. The equity liabilities are estimated using additional SII information on insurers’ own funds.

Notes for: Methods and data validation

CIC is the standard asset classification schema for insurance supervision.

NACE revision 2 is the European standard (industrial) classification of productive economic activities.

It was previously a division of Thomson Reuters.

8. Conclusion

We will continue to evaluate and quality assure these new data and adapt methodology when new sources become available to the enhanced financial accounts (EFA) project. We will continue to take steps towards their inclusion within the UK National Accounts.

Nôl i'r tabl cynnwys