1. Geographical breakdown of the current account

The tables in this chapter show a geographical breakdown of the current account. The data cover 67 individual countries as well as international organisations. These estimates are generally less firmly based than the world totals, and data for earlier years are less reliable than recent figures. In some cases estimates are unavailable for the first few years.

Changes to the pattern of trading associated with missing trader intra-community (MTIC) fraud can make it difficult to analyse trade by country, as changes in the impact of activity associated with this fraud (which includes carousel fraud) affect both imports and exports. Originally, most carousel chains only involved European Union (EU) member states. From 2004 in particular, some carousel chains included non-EU countries, for example Switzerland. However, the MTIC trade adjustments are added to the EU import estimates as it is this part of the chain that is not generally recorded. For more information on carousel fraud, see the methodological notes relating to chapter 2.

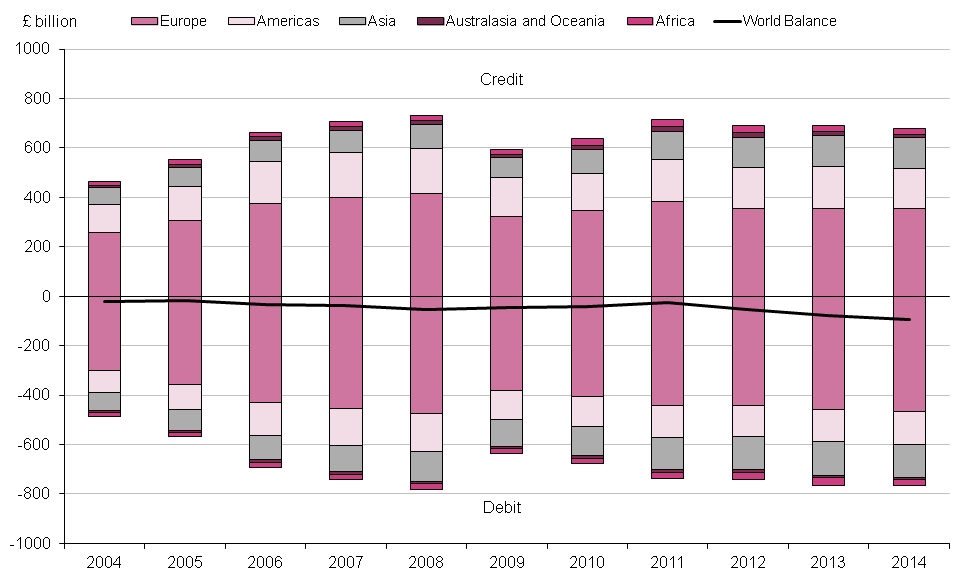

Figure 9.1: UK current account by region, 2004 to 2014

Source: Office for National Statistics

Notes:

- Users should be aware that for presentational purposes the figure displays liabilities as a negative value, unlike the reference tables which display liabilities as a positive value

Download this image Figure 9.1: UK current account by region, 2004 to 2014

.png (29.9 kB)In 2014 the current account deficit widened by £15.0 billion, from £77.9 billion in 2013 to £92.9 billion. This was due to the surplus with the Americas narrowing in 2014 to £28.4 billion from £39.2 billion in 2013. Additionally, the deficit with Europe widened from £101.6 billion in 2013 to £109.5 billion in 2014.

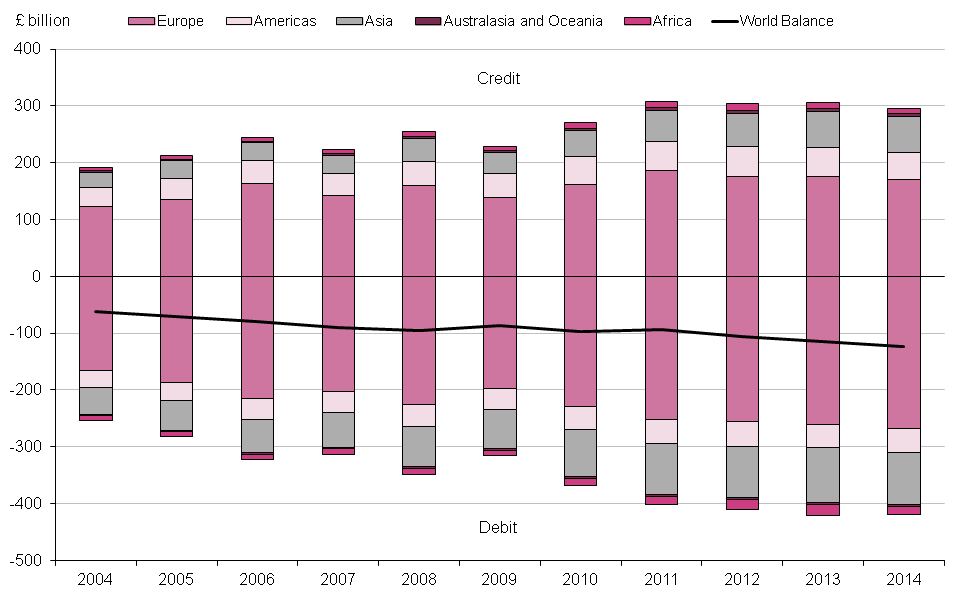

Figure 9.2: UK current account credits by region, 2004 to 2014

Source: Office for National Statistics

Download this chart Figure 9.2: UK current account credits by region, 2004 to 2014

Image .csv .xlsCredits decreased by £13.3 billion, from £692.1 billion in 2013 to £678.8 billion in 2014. This was mainly due to credits decreasing from the Americas and Africa by £8.4 billion and £3.2 billion respectively.

Figure 9.3: UK current account debits by region, 2004 to 2014

Source: Office for National Statistics

Download this chart Figure 9.3: UK current account debits by region, 2004 to 2014

Image .csv .xlsDebits increased by £1.7 billion, from £770.0 billion in 2013 to £771.7 billion in 2014. This was due to debits to Europe increasing by £8.4 billion, partially offset by debits to Africa and Australasia and Oceania decreasing by £5.1 billion and £1.9 billion respectively.

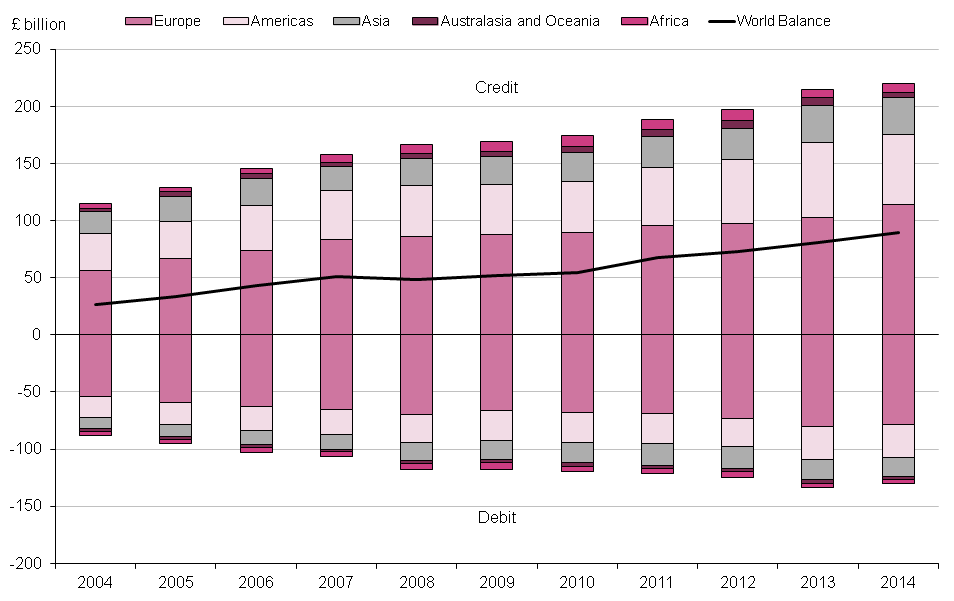

Figure 9.4: UK current account trade in goods by region, 2004 to 2014

Source: Office for National Statistics

Notes:

- Users should be aware that for presentational purposes the figure displays liabilities as a negative value, unlike the reference tables which display liabilities as a positive value

Download this image Figure 9.4: UK current account trade in goods by region, 2004 to 2014

.png (33.3 kB)The deficit on the trade in goods balance widened by £8.4 billion, from £115.2 billion in 2013 to £123.7 billion in 2014. This was due to the deficit with Europe increasing by £10.9 billion, from £86.4 billion in 2013, to £97.3 billion in 2014. Additionally, the surplus with the Americas decreased by £7.4 billion, from £11.3 billion in 2013, to £3.9 billion in 2014. Partially offsetting these were decreases in the deficits with Asia and Africa of £6.8 billion and £3.0 billion, from £33.7 billion and £8.2 billion in 2013 to £26.9 billion and £5.1 billion in 2014 respectively.

Exports decreased by £10.8 billion, from £306.2 billion in 2013 to £295.4 billion in 2014. This was mainly due to exports decreasing to the Americas, Europe and Africa by £5.4 billion, £4.1 billion and £1.6 billion respectively. Partially offsetting these was an increase of £1.1 billion in the exports to Asia.

Imports decreased by £2.4 billion, from £421.5 billion in 2013 to £419.1 billion in 2014. This was due to imports decreasing to Asia and Africa by £5.8 billion and £4.7 billion respectively. Partially offsetting these was an increase of £6.8 billion and £2.0 billion in the imports to Europe and the Americas respectively.

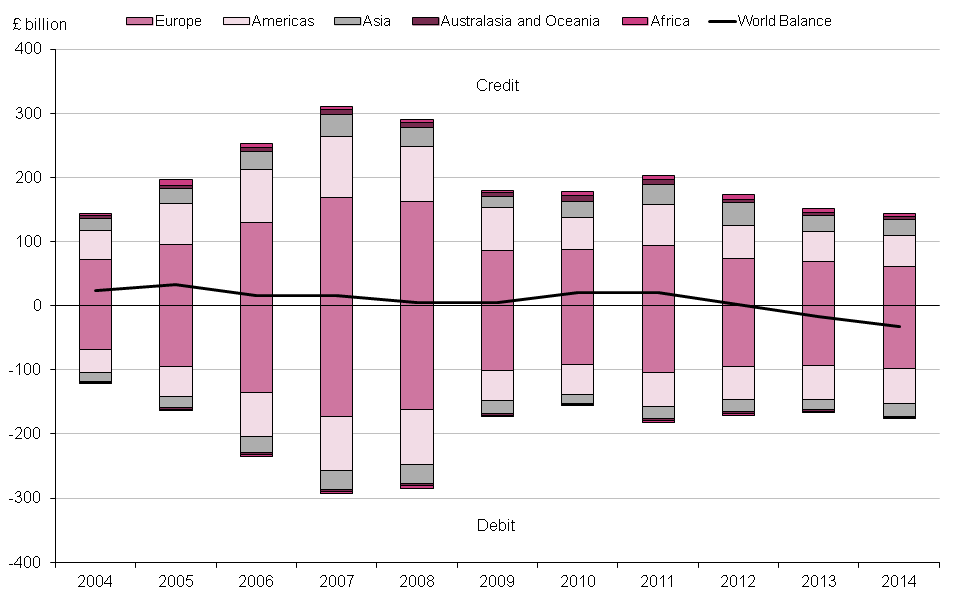

Figure 9.5: UK current account trade in services by region, 2004 to 2014

Source: Office for National Statistics

Notes:

- Users should be aware that for presentational purposes the figure displays liabilities as a negative value, unlike the reference tables which display liabilities as a positive value

Download this image Figure 9.5: UK current account trade in services by region, 2004 to 2014

.png (29.9 kB)The surplus on the trade in services balance widened by £8.1 billion, from £81.0 billion in 2013 to £89.1 billion in 2014. This was mainly due to the surplus with Europe increasing by £12.5 billion, from £22.6 billion in 2013 to £35.1 billion in 2014. Partially offsetting this was a decrease in the surplus with Americas of £3.4 billion, from £36.5 billion in 2013 to £33.1 billion in 2014.

Exports increased by £4.9 billion, from £214.8 billion in 2013 to £219.8 billion in 2014. This was mainly due to exports increasing to Europe by £11.3 billion. Partially offsetting this were decreases of £3.7 billion and £1.7 billion with exports to the Americas and Australasia and Oceania.

Imports decreased by £3.2 billion, from £133.8 billion in 2013 to £130.6 billion in 2014. This was due to imports decreasing by £1.2 billion from both Europe and Asia.

Figure 9.6: UK current account primary income by region, 2004 to 2014

Source: Office for National Statistics

Notes:

- Users should be aware that for presentational purposes the figure displays liabilities as a negative value, unlike the reference tables which display liabilities as a positive value

Download this image Figure 9.6: UK current account primary income by region, 2004 to 2014

.png (29.1 kB)The deficit on the primary income balance widened by £16.3 billion, from £16.8 billion in 2013 to £33.1 billion in 2014. This was due to the deficit with Europe increasing by £11.4 billion, from £24.3 billion to £35.7 billion and the surplus with Asia narrowing by £4.5 billion, from £9.6 billion in 2013 to £5.0 billion in 2014.

Credits decreased by £7.6 billion, from £152.1 billion in 2013 to £144.5 billion in 2014. This was mainly due to credits decreasing from Europe by £7.3 billion, from £69.1 billion in 2013 to £61.9 billion in 2014.

Debits increased by £8.7 billion, from £168.9 billion in 2013 to £177.6 billion in 2014. This was due to debits to Asia and Europe increasing by £5.1 billion and £4.2 billion respectively. Slightly offsetting these, debits to Australasia and Oceania decreased by £1.0 billion, from £2.2 billion in 2013 to £1.3 billion in 2014.

Figure 9.7: UK current account secondary income by region, 2004 to 2014

Source: Office for National Statistics

Notes:

- Users should be aware that for presentational purposes the figure displays liabilities as a negative value, unlike the reference tables which display liabilities as a positive value

Download this image Figure 9.7: UK current account secondary income by region, 2004 to 2014

.png (34.2 kB)The deficit on the secondary income balance narrowed by £1.6 billion, from £26.8 billion in 2013 to £25.2 billion in 2014. This was due to the deficit with Europe decreasing by £1.9 billion, from £13.6 billion to £11.6 billion in 2014.

Credits increased by £0.2 billion, from £19.0 billion in 2013 to £19.2 billion in 2014. This was due to credits increasing from Europe by £0.5 billion, from £8.5 billion in 2013 to £9.0 billion in 2014. This was offset by credits from the Americas decreasing by £0.3 billion, from £6.5 billion in 2013 to £6.2 billion in 2014.

Debits decreased by £1.4 billion, from £45.8 billion in 2013 to £44.4 billion in 2014. This was due to debits to Europe decreasing by £1.4 billion, from £22.1 billion in 2013 to £20.7 billion in 2014.

Figure 9.8: UK current account with the EU28, 2004 to 2014

Source: Office for National Statistics

Notes:

- Users should be aware that for presentational purposes the figure displays liabilities as a negative value, unlike the reference tables which display liabilities as a positive value

Download this chart Figure 9.8: UK current account with the EU28, 2004 to 2014

Image .csv .xlsThe current account deficit with the EU28 widened by £17.9 billion, from £89.1 billion in 2013 to £107.0 billion in 2014. This was due to the deficits with France, Germany and Belgium widening in 2014, and the surplus with Luxembourg switching to a deficit in 2014.

Credits decreased by £8.1 billion, from £297.1 billion in 2013 to £289.0 billion in 2014. This was due to a decrease in credits from:

France by £4.1 billion

the Netherlands by £3.5 billion

Germany by £2.1 billion

Luxembourg by £1.4 billion

Partially offsetting these were an increase in credits from:

- Italy by £2.0 billion

Debits increased by £9.7 billion, from £386.3 billion in 2013 to £396.0 billion in 2014. This was due to debits increasing to:

Spain by £4.0 billion

Germany by £3.4 billion

Luxembourg by £2.8 billion

Italy by £1.7 billion

Partially offsetting these, debits decreased to:

the Netherlands by £4.1 billion

Denmark by £1.0 billion

Figure 9.9: UK trade in goods account with the EU28, 2004 to 2014

Source: Office for National Statistics

Notes:

- Users should be aware that for presentational purposes the figure displays liabilities as a negative value, unlike the reference tables which display liabilities as a positive value

Download this chart Figure 9.9: UK trade in goods account with the EU28, 2004 to 2014

Image .csv .xlsThe trade in goods deficit with the EU28 widened by £11.7 billion, from £67.1 billion in 2013 to £78.9 billion in 2014. This was due to widening deficits with most countries, most notably with Spain (by £3.1 billion), France (by £2.8 billion), Belgium (by £2.7 billion) and Germany (by £2.6 billion). These compare with a slight narrowing to the deficit with Denmark of £1.3 billion in 2014.

Exports decreased by £6.5 billion, from £154.1 billion in 2013 to £147.6 billion in 2014. This was mainly due to exports decreasing to:

the Netherlands by £2.9 billion

France by £2.2 billion

Belgium by £1.5 billion

Imports increased by £5.2 billion, from £221.2 billion in 2013 to £226.5 billion in 2014. This was due to imports increasing from:

Spain by £3.4 billion

Germany by £3.2 billion

Italy by £1.5 billion

Belgium by £1.2 billion

Partially offsetting these were decreases in imports from:

the Netherlands by £3.5 billion

Denmark by £1.3 billion

Figure 9.10: UK trade in services account with the EU28, 2004 to 2014

Source: Office for National Statistics

Notes:

- Users should be aware that for presentational purposes the figure displays liabilities as a negative value, unlike the reference tables which display liabilities as a positive value

Download this chart Figure 9.10: UK trade in services account with the EU28, 2004 to 2014

Image .csv .xlsThe trade in services surplus with the EU28 widened by £5.5 billion, from £11.6 billion in 2013 to £17.1 billion in 2014. This was mainly due to the surpluses with the Netherlands, Ireland and Italy increasing by £3.0 billion, £0.8 billion and £0.8 billion in 2014 respectively.

Exports increased by £4.5 billion, from £76.8 billion in 2013 to £81.3 billion in 2014. This was mainly due to exports increasing to:

Italy by £1.3 billion

the Netherlands by £0.8 billion

Ireland by £0.8 billion

Spain by £0.7 billion

Imports decreased by £1.1 billion, from £65.2 billion in 2013 to £64.2 billion in 2014. This was mainly due to imports from the Netherlands decreasing by £2.1 billion, from £6.5 billion in 2013 to £4.3 billion in 2014. Partially offsetting this was an increase of £0.6 billion in the imports from Italy.

Figure 9.11: UK primary income account with the EU28, 2004 to 2014

Source: Office for National Statistics

Notes:

- Users should be aware that for presentational purposes the figure displays liabilities as a negative value, unlike the reference tables which display liabilities as a positive value

Download this chart Figure 9.11: UK primary income account with the EU28, 2004 to 2014

Image .csv .xlsThe deficit on the primary income balance with the EU28 widened by £13.6 billion, from £20.6 billion in 2013 to £34.2 billion in 2014. This was mainly due to the deficit increasing with Luxembourg (by £3.9 billion), Ireland (by £3.0 billion), France (by £2.7 billion) and Germany (by £2.3 billion). Additionally, the Netherlands switched from a surplus of £0.7 billion in 2013 to a deficit of £2.2 billion in 2014.

Credits decreased by £6.6 billion, from £58.6 billion in 2013 to £51.9 billion in 2014. This was due to credits decreasing from:

Germany by £2.0 billion

France by £2.0 billion

the Netherlands by £1.4 billion

Luxembourg by £1.3 billion

Debits increased by £7.0 billion, from £79.2 billion in 2013 to £86.2 billion in 2014. This was due to debits increasing to:

Luxembourg by £2.6 billion

Ireland by £2.1 billion

the Netherlands by £1.6 billion

France by £0.7 billion

Figure 9.12: UK secondary income account with the EU28, 2004 to 2014

Source: Office for National Statistics

Notes:

- Users should be aware that for presentational purposes the figure displays liabilities as a negative value, unlike the reference tables which display liabilities as a positive value

Download this chart Figure 9.12: UK secondary income account with the EU28, 2004 to 2014

Image .csv .xlsThe deficit on the secondary income balance with the EU28 narrowed by £2.0 billion, from £13.0 billion in 2013 to £11.0 billion in 2014. This was due to the deficit with EU institutions decreasing by £2.1 billion, from £12.0 billion in 2013 to £9.8 billion in 2014.

Credits increased by £0.5 billion, from £7.6 billion in 2013 to £8.2 billion in 2014. This was due to credits from EU institutions increasing by £0.7 billion, from £3.9 billion in 2013 to £4.6 billion in 2014. Partially offsetting this were small decreases in credits from most countries.

Debits decreased by £1.5 billion, from £20.7 billion in 2013 to £19.2 billion in 2014. This was due to debits to EU institutions decreasing by £1.4 billion, from £15.9 billion in 2013 to £14.5 billion in 2014.

Nôl i'r tabl cynnwys