Cynnwys

- Main points for May 2016

- Main figures for May 2016

- Understanding and working with UK trade statistics

- Summary of latest UK trade statistics

- Longer-term perspective

- Value of UK trade in goods

- Trade in goods – analysis by area

- Trade in goods – geographical analysis

- Volume of trade in goods, excluding oil and erratic

- Export and import prices for trade in goods (not seasonally adjusted)

- Trade in oil

- Trade in services

- Where to find more information about UK trade statistics

- Revisions to trade statistics

- Accuracy of the statistics

- Other quality information

- Records sheet

- Background notes

1. Main points for May 2016

UK trade shows import and export activity and is a main contributor to the overall economic growth of the UK. All data are shown on a seasonally adjusted, balance of payments basis, at current prices unless otherwise stated.

The UK’s deficit on trade in goods and services was estimated to have been £2.3 billion in May 2016, a widening of £0.3 billion from April 2016. Exports decreased by £2.0 billion and imports decreased by £1.7 billion.

The deficit on trade in goods was £9.9 billion in May 2016; widening by £0.5 billion from April 2016. This widening reflected a larger decrease in exports (down £2.1 billion to £23.7 billion) than the decrease in imports (down £1.6 billion to £33.5 billion).

Between the 3 months to February 2016 and the 3 months to May 2016, the total trade deficit for goods and services narrowed by £2.5 billion to £8.2 billion.

The deficit on trade in goods narrowed by £2.7 billion to a deficit of £30.6 billion between the 3 months to February 2016 and the 3 months to May 2016. Exports increased by £4.5 billion (6.5%) and imports increased by £1.7 billion (1.7%).

In the 3 months to May 2016, the UK’s trade in goods deficit with the EU narrowed by £0.1 billion to £22.5 billion as exports increased by more than imports. In the 3 months to May 2016, the UK’s trade in goods deficit with the countries outside the EU narrowed by £2.6 billion to £8.2 billion, attributed to an increase in exports (6.8%).

Between the 3 months to February 2016 and the 3 months to May 2016, the trade in services surplus narrowed by £0.2 billion to £22.4 billion.

Nôl i'r tabl cynnwys2. Main figures for May 2016

Table 1: Balance of UK trade in goods and services, May 2015 and March 2016 to May 2016

| £ billion | ||||||

| Balance of trade in goods | Balance of trade in services | Total trade balance | ||||

| EU | Non-EU | Total | ||||

| 2015 | May | -6.4 | -1.6 | -8.0 | 6.6 | -1.3 |

| 2016 | Mar | -8.3 | -3.1 | -11.3 | 7.3 | -4.0 |

| Apr | -6.9 | -2.5 | -9.4 | 7.5 | -2.0 | |

| May | -7.3 | -2.6 | -9.9 | 7.6 | -2.3 | |

| Source: Office for National Statistics | ||||||

Download this table Table 1: Balance of UK trade in goods and services, May 2015 and March 2016 to May 2016

.xls (25.6 kB)

Figure 1: Balance of UK trade, May 2014 to May 2016

Source: Office for National Statistics

Download this chart Figure 1: Balance of UK trade, May 2014 to May 2016

Image .csv .xls3. Understanding and working with UK trade statistics

Short guide to UK trade

UK trade shows the extent of import and export activity and is an important contributor to the overall economic growth of the UK. Trade is measured through both imports and exports of goods and/or services. Data are supplied by over 30 sources including several administrative sources, HM Revenue and Customs (HMRC) being the largest.

This monthly release contains tables showing the total value of trade in goods together with index numbers of volume and price. Figures are analysed by broad commodity group (values and indices) and according to geographical area (values only). In addition, the UK trade statistical bulletin also includes early monthly estimates of the value of trade in services.

This bulletin focuses on trade in goods as it is easier to quantify and measure due to the coverage and comprehensiveness of the administrative data sources available. Trade in services is more difficult to measure, and source data is provided mainly on a quarterly or annual basis, principally from ITIS (International Trade in Services survey). Monthly estimates are derived using this quarterly data; therefore the data are less robust on a monthly basis compared with goods.

As more information becomes available on trade in services this bulletin will focus on the values, volumes and geographic breakdown on a 3 month cycle described below:

| Month | Trade in services detail |

|---|---|

| March, June, October, December | Focus on the estimated quarterly change in exports and imports of services by the main types of service |

| January, April, July, October | Focus on trade in services in volume terms |

| February, May, October, November | Focus on trade in services with EU and selected non-EU countries |

Our website

The UK trade methodology web pages can now be found on our website. These have been developed to provide detailed information about the methods used to produce UK trade statistics. Any recent user requested trade data are included on our website.

Understanding UK trade

We make every effort to provide informative commentary on the data in this release. Where possible, the commentary draws on evidence from other sources of information to help explain possible reasons behind the observed changes. However, in some instances it can prove difficult to draw out detailed reasons for movements; consequently, it is not possible for all data movements to be fully explained.

Trade statistics for any one month can be erratic. For that reason, it is recommended to compare the latest 3 months against the preceding 3 months and the same 3 months of the previous year.

When examining the trade in goods data, oil and “erratics”, (which are high value, low volume products), are removed from some analysis as they are extremely influential on trade in goods as a whole. Therefore we publish data inclusive and exclusive of these categories. We also provide a separate analysis of oil because it is subject to erratic price fluctuations and therefore volume data is provided in metric tonnes as well as value (£ million).

Strengths and weaknesses of the data

Strengths

Quality of trade in goods data

The quality of the source data for trade in goods is high in terms of the timeliness, comprehensiveness and coverage, and this level of quality compares well internationally. The data are used across government, business and academia and feed into a number of other outputs and publications; including GDP and balance of payments. The Bank of England uses the total figures to make policy decisions, whereas government departments such as the Foreign and Commonwealth Office are interested in the individual country detail.

We have frequent communication with our suppliers to discuss quality, including regular meetings, telephone conversations and email correspondence. Service level agreements are in place to define the level of quality expected in the data received and these are reviewed annually. Data suppliers have their own internal quality assurance processes to meet the quality standards outlined in the service level agreements and we work closely with them to understand these. Suppliers are required to advise us of any changes to the collection or processing of the data to ensure our expectations are still met.

When data is received by the trade team we conduct our own initial quality assurance. Further quality analysis is then conducted at several stages of processing; this is detailed in a process map and quality assurance plan. If there are any quality concerns we work closely with the supplier to address these.

We have regular discussions with users on the quality of our data and provide comprehensive explanations of the terms, methodology and processes we use. Eurostat is an important customer influence and helps improve the quality of our data through task force meetings and by producing quality guidelines.

Timeliness of publications

The UK trade publication is very timely (generally 40 days after the period to which it refers), helping to inform policy and to assess UK economic performance.

Weaknesses

Quality and timeliness of trade in services data

Where trade in goods has one main data supplier, there are a large number of suppliers of trade in services data. Additionally, a number are voluntary, so it can be difficult to establish and maintain the same quality assurance processes and relationships with these businesses or suppliers.

Due to the collection methods and complexities of quantifying trade in services, data is less timely than trade in goods estimates. The data is processed quarterly, so monthly forecasts are made to provide a complete trade total.

Monthly volatility

Trade statistics for any one month can be erratic. For that reason, we recommend comparing the latest 3 months against the preceding 3 months and the same 3 months of the previous year. However we also recognise the importance to users of an early estimate of trade therefore we continue to produce a monthly estimate.

UK trade National Statistics suspension

Due to a series of errors during 2014, the UK Statistics Authority suspended the National Statistics designation of UK trade on 14 November 2014. The Authority's reassessment of UK trade against the Code of Practice for Official Statistics has been completed. We are committed to meeting the requirements and regaining National Statistics status for UK trade as soon as possible and will keep you informed of progress.

One of the recommendations of the reassessment was to consult with users on the use of UK trade statistics. The results of this user engagement survey can be found on our website.

To provide feedback on the bulletin please contact us via email trade@ons.gov.uk.

The trade development plan has now been launched.

UK trade re-assessment update

We have now addressed some of the requirements of the re-assessment of UK trade and are in the final stages of providing evidence on the remaining requirements. In doing so, we are working with the Assessment Team to evaluate whether any additional evidence will be required as a result of the independent review of UK economic statistics, led by Professor Sir Charles Bean.

Due to user demand we have included a UK trade EU section which includes an EU exports, imports and percentages of World total table.

Definitions and explanations

A glossary of terms is published in the UK trade glossary and the UK Balance of Payments - The Pink Book, 2015.

Nonmonetary gold

According to internationally agreed standards, nonmonetary gold held in allocated accounts is recorded as a good; therefore, gold of this type which is being stored as a financial asset is recognised under trade in goods when ownership changes between a resident and non-resident.

Data are collected by the Bank of England from the London Bullion Market on holdings of nonmonetary gold. Working alongside the Bank of England and the London Bullion Market Association, we have implemented a method for smoothing the source data, effectively minimising volatility whilst enabling the underlying trend of the gold market to be reflected in the trade balance.

Estimates for trade in nonmonetary gold still remain volatile compared with other commodities and, as such, it is classified under erratics.

Use of the data

UK trade is a main economic indicator due to the importance of international trade to the UK economy. It is also a very timely statistic, providing an early indicator of what is happening more generally in the economy.

In addition, it is a major component of 2 other main economic indicators: UK gross domestic product (GDP) and the UK balance of payments. This means that there is a threefold potential for UK trade statistics to inform the government’s view of the UK economy, as well as the views of others, such as economists, city analysts, academics, the media and international organisations.

Notes on tables

Rounding:

The sum of constituent items in tables does not always agree exactly with the totals shown due to rounding.

Symbols:

.. Not applicable

- Nil or less than half the final digit shown

4. Summary of latest UK trade statistics

Monthly analysis

The deficit on trade in goods and services in May 2016 was £2.3 billion, compared with a deficit of £2.0 billion in April 2016. The trade position reflects exports minus imports; the widening of the deficit was attributed to a decrease in both exports and imports between April 2016 and May 2016.

Between April 2016 and May 2016, total exports decreased by £2.0 billion to £43.1 billion (4.4%); this decrease comprised a £2.1 billion (8.2%) fall in the exports of goods and a £0.1 billion (0.7%) rise in the export of services. Total imports decreased by £1.7 billion to £45.4 billion (3.5%) over the same period, reflecting a £1.6 billion decrease in imports of goods.

The deficit on trade in goods was £9.9 billion in May 2016, widening by £0.5 billion from April 2016. This widening reflected a decrease in exports (down £2.1 billion to £23.7 billion) and a decrease in imports (down £1.6 billion to £33.5 billion). The decrease in exports was mainly attributed to a £1.2 billion decrease in unspecified goods*, a £0.4 billion decrease in chemicals and a £0.4 billion decrease in machinery. The decrease in imports was mainly attributed to a £0.5 billion decrease in both chemicals and ship and aircraft (combined), and a £0.3 billion decrease imports of machinery.

Exports of goods to EU countries decreased by £0.3 billion between April 2016 and May 2016. There was a £0.2 billion decrease in exports of oil and a £0.1 billion decrease in chemicals. Imports of goods from EU countries increased by £0.1 billion, to £18.8 billion in May 2016.

Between April 2016 and May 2016, exports of goods to countries outside the EU decreased by £1.8 billion. There was a £1.3 billion decrease in exports of unspecified goods* and a £0.3 billion decrease in chemicals. Imports from countries outside the EU decreased by £1.8 billion. The decrease was mainly attributed to a £0.4 billion decrease in machinery, and a decrease in both chemicals and fuels of £0.3 billion.

*Unspecified goods includes parcel post and low value trade – and – most notably, non monetary gold

3 monthly analysis

Between the 3 months to February 2016 and the 3 months to May 2016, the total trade deficit (goods and services) narrowed by £2.5 billion to £8.2 billion. The trade position reflects exports minus imports; the narrowing of the deficit was attributed to a larger increase in exports than imports.

The deficit on trade in goods narrowed by £2.7 billion to a deficit of £30.6 billion between the 3 months to February 2016 and the 3 months to May 2016. Exports of goods increased by £4.5 billion (6.5%), to £73.3 billion. This increase reflected a £1.4 billion increase in exports of unspecified goods*; a £0.8 billion increase in machinery; a £1.1 billion increase in aircraft to a record 3 monthly high of £4.3 billion; and a £0.4 billion increase in cars to a record 3 monthly high of £7.3 billion. Imports increased by £1.7 billion (1.7%) due to a £1.8 billion increase in machinery; a £0.8 billion increase in material manufactures; a £0.7 billion increase in aircraft; a £0.5 billion increase in food, beverages and tobacco; a £0.3 billion increase in miscellaneous manufactures; and a £0.4 billion increase in oil. These increases were offset by a £2.6 billion decrease in imports of unspecified goods* and a £0.7 billion decrease in both and cars and chemicals.

Between the 3 months to February 2016 and the 3 months to May 2016, exports of goods to EU countries increased by £2.0 billion due to exports of cars, increasing by £0.6 billion to a record 3 monthly high of £3.3 billion; machinery increasing by £0.4 billion; chemicals increasing by £0.3 billion; and a £0.2 billion increase in aircraft to a record 3 monthly high of £1.9 billion. For the same period, imports from the EU increased by £1.9 billion. This increase reflected a £1.0 billion increase in machinery; a £0.4 billion increase in food, beverages and tobacco; and a £0.7 billion increase in material manufactures. These increases were offset by a decrease in chemicals of £0.9 billion. This resulted in a small narrowing of the trade in goods deficit with EU countries by £0.1 billion.

There was a trade in goods deficit with non-EU countries of £8.2 billion in the 3 months to May 2016, a narrowing of £2.6 billion from the 3 months to February 2016. Exports of goods to countries outside the EU rose by £2.5 billion; this was the result of a £1.4 billion increase in unspecified goods*; a £0.9 billion increase in aircraft to a record 3 monthly high of £2.4 billion; and a £0.4 billion increase in machinery. These increases were offset by a £0.3 billion fall in material manufactures and a £0.2 billion fall in cars. Imports of goods from countries outside the EU fell by £0.2 billion; most notably there was an increase in imports of both machinery and aircraft which increased by £0.8 billion each. This increase was offset by a decrease in unspecified goods* of £2.8 billion.

*Unspecified goods includes parcel post and low value trade, and, most notably, non monetary gold.

Revisions

Annual

As previously announced, the revision period for this publication is back to January 1998, in line with the open revisions period for the 2016 Blue Book and Pink Book.

Monthly

The total trade (goods and services) deficit for April 2016 has been revised down by £1.3 billion. This is attributed to a £1.5 billion downwards revision to imports of EU goods.

Nôl i'r tabl cynnwys5. Longer-term perspective

International comparisons

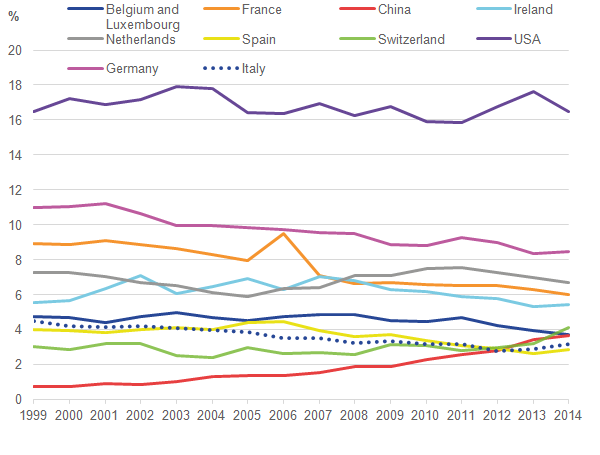

The UK’s export position in the global economy has slightly weakened over the last 15 years (1999 to 2014). The UK’s share of world exports fell from 5.6% in 1999 to 3.6% in 2014, as indicated in Longer-term perspective section of the UK trade: April 2016 bulletin. However, the UK has seen improved trade activity with some of its trading partners, as illustrated in Figure 2. In particular, exports to China and Switzerland have improved, but from low starting points (1% and 3% respectively) and remain low proportionally, at around 4%. China and Switzerland’s shares of UK exports are now comparable to that held by Belgium and Luxembourg, and marginally above those held by Italy and Spain. The USA – the UK’s biggest single country export destination – has maintained a relatively stable share of UK exports of around 16% to 18% over the period 1999 to 2014.

Figure 2: UK's top 10 export market destinations, 1999 to 2014

Source: Office for National Statistics

Download this image Figure 2: UK's top 10 export market destinations, 1999 to 2014

.png (29.6 kB) .xlsx (19.1 kB)In contrast to its main non-EU trading partners, the UK’s main EU trading partners have seen a gradual decline in their share of UK exports, with the exception of the Netherlands, whose share has been broadly flat at around 7% since 1999, and Ireland whose share has been around 6% over the period. The shares of UK exports accounted for by Germany and France have seen the largest decline in comparison to other EU partners, coming down from 11% in 1999 to 8.5% in 2014 for Germany, and from 8.9% to 6% for France. The gradual decline in UK export shares of some EU member states is consistent with the worsening trade deficit the UK has with the EU – UK imports from the EU have increasingly exceeded UK exports to the EU. This was covered in more detail in the Trade section of the – Economic Review: February 2016.

UK trade with the EU

In 2015, exports of goods and services to the EU accounted for 44% of the total exports. The proportion is closer to half for exports of goods (47.0%) and just under two-fifths (39.0%) for trade in services. The share of exports has fallen by more than 10 percentage points over the last 15 years.

Table 2: UK trade with EU and percentages of world total, 2000 to 2015

| £ million | |||||||||||||

| Trade with European Union | 2000 | 2005 | 2010 | 2015 | |||||||||

| Exports of goods | L87S | 113,108 | 123,069 | 145,173 | 133,524 | ||||||||

| Percentage of world total | 60.1% | 58.0% | 53.7% | 46.9% | |||||||||

| Exports of services | L854 | 33,462 | 54,510 | 70,960 | 88,909 | ||||||||

| Percentage of world total | 40.9% | 42.2% | 40.8% | 39.4% | |||||||||

| Total exports of goods and services | L84Y | 146,570 | 177,579 | 216,133 | 222,433 | ||||||||

| Percentage of world total | 54.3% | 52.0% | 48.6% | 43.6% | |||||||||

| Imports of goods | L87U | 118,548 | 161,921 | 189,072 | 222,992 | ||||||||

| Percentage of world total | 53.5% | 57.4% | 51.4% | 54.2% | |||||||||

| Imports of services | L868 | 37,797 | 52,975 | 57,787 | 67,977 | ||||||||

| Percentage of world total | 55.0% | 55.4% | 48.4% | 49.4% | |||||||||

| Total imports of goods and services | L864 | 156,345 | 214,896 | 246,859 | 290,969 | ||||||||

| Percentage of world total | 53.9% | 56.9% | 50.7% | 53.0% | |||||||||

| Source: UK economic accounts (UKEA), Office for National Statistics | |||||||||||||

Download this table Table 2: UK trade with EU and percentages of world total, 2000 to 2015

.xls (27.6 kB)Rotterdam effect

In this context users should note the “Rotterdam effect”, where goods initially exported to one country are subsequently re-exported to another country. This might overstate the share of exports going to a particular country, in this case the Netherlands, and therefore overstate the share of exports going to the EU.

It is not possible to quantify the Rotterdam effect precisely, but an article exploring this issue was published in 2015. The article used 2013 data to estimate the effect, and made an assumption that 50% of all goods exports to the Netherlands were re-exported to non-EU countries. Using this assumption, the Rotterdam effect would account for around 4 percentage points of the UK’s exports of goods. These effects were calculated to illustrate the possible size of the Rotterdam effect. The Rotterdam effect applies only to trade in goods. The 4 percentage points estimate therefore applies to the share of the exports of goods only.

When considering the total exports of goods and services to the EU – the 44.0% figure quoted in Table 2 – the Rotterdam effect is estimated at around 2 percentage points. It is also important to note that the Rotterdam effect could also affect the UK’s imports. However, these estimates were calculated to illustrate the possible size of the Rotterdam effect and do not imply that a different data series should be produced or used.

Nôl i'r tabl cynnwys6. Value of UK trade in goods

Monthly commentary

In May 2016, the UK’s deficit on trade in goods was £9.9 billion, widening by £0.5 billion from April 2016.

Exports decreased by £2.1 billion (8.2%) to £23.7 billion in May 2016, from £25.8 billion in April 2016.

In detail:

chemicals fell by £0.4 billion

machinery fell by £0.4 billion

unspecified goods fell by £1.2 billion

Imports decreased by £1.6 billion (4.7%) to £33.5 billion in May 2016, from £35.2 billion in April 2016.

In detail:

oil fell by £0.3 billion

chemicals fell by £0.5 billion

machinery fell by £0.3 billion

miscellaneous manufactures fell by £0.4 billion

ships fell by £0.2 billion

aircraft fell by £0.2 billion

3 Monthly analysis

In the 3 months to May 2016, the deficit on trade in goods was £30.6 billion, narrowing by £2.7 billion from the 3 months to February 2016.

Exports increased by £4.5 billion (6.5 %) to £73.3 billion in the 3 months to May 2016, compared with £68.8 billion in the 3 months to February 2016.

In detail:

unspecified goods rose by £1.4 billion

chemicals rose by £0.4 billion

machinery rose by £0.8 billion

cars rose by £0.4 billion to a record £7.3 billion

Imports increased by £1.7 billion (1.7 %) to £103.9 billion in the 3 months to May 2016, compared with £102.2 billion in the 3 months to February 2016.

In detail:

oil rose by £0.4 billion

machinery rose by £1.8 billion

miscellaneous manufactures rose by £0.3 billion

aircraft rose by £0.7 billion

food, beverages and tobacco rose by £0.5 billion

At the main commodity level, the data are shown in Table 3.

Table 3: Change in UK trade main commodity value, May 2016

| Monthly change 1 | 3 monthly change 2 | ||||

| Exports | Imports | Exports | Imports | ||

| Oil (see section on "trade in oil") | -29 | -333 | +102 | +445 | |

| Cars | -8 | -29 | +442 | -719 | |

| Consumer goods other than cars | -89 | -419 | +155 | +124 | |

| Intermediate goods | -256 | -281 | +404 | +1701 | |

| Capital goods | -188 | -116 | +423 | +1129 | |

| Chemicals | -415 | -459 | +382 | -720 | |

| Semi-manufactured goods other than chemicals | -57 | -241 | -207 | +829 | |

| Source: Office for National Statistics | |||||

| Notes | |||||

| 1. Monthly change is May 2016 compared with April 2016. | |||||

| 2. 3 monthly change is March 2016 to May 2016 compared with December 2015 to February 2016. | |||||

Download this table Table 3: Change in UK trade main commodity value, May 2016

.xls (26.1 kB)

Figure 3: Value of UK trade in goods, May 2014 to May 2016

Source: Office for National Statistics

Download this chart Figure 3: Value of UK trade in goods, May 2014 to May 2016

Image .csv .xls

Figure 4: Value of UK trade in goods excluding oil, May 2014 to May 2016

Source: Office for National Statistics

Download this chart Figure 4: Value of UK trade in goods excluding oil, May 2014 to May 2016

Image .csv .xlsWhere to find data about UK trade in goods

The value of trade in goods figures are available in Table 1 and commodity figures are available in Tables 8, 9 and 10 of the dataset of the tables.

Nôl i'r tabl cynnwys7. Trade in goods – analysis by area

In May 2016, the deficit on trade in goods with EU countries widened by £0.4 billion to £7.3 billion. The deficit on trade in goods with non-EU countries widened by £47 million to £2.6 billion (Figure 5).

Figure 5: Balance of UK trade in goods - EU and non-EU countries, May 2014 to May 2016

Source: Office for National Statistics

Notes:

- Please note that the labels on this chart were corrected 13.50 8 July 2016.

Download this chart Figure 5: Balance of UK trade in goods - EU and non-EU countries, May 2014 to May 2016

Image .csv .xlsEU analysis

Between April 2016 and May 2016, exports to the EU decreased by £0.3 billion (2.5%) to £11.4 billion. This was attributed to a decrease in exports to the Netherlands of £0.3 billion.

Between April 2016 and May 2016, imports from the EU increased by £0.1 billion (0.6%) to £18.8 billion. This was attributed to increases in imports from Germany and Spain of £0.2 billion each. These increases were partially offset by decreases in imports from Belgium and the Luxombourg of £0.2 billion.

Between the 3 months to February 2016 and the 3 months to May 2016, exports to the EU increased by £2.0 billion (6.2%) to £34.7 billion. This was attributed to an increase in exports to France of £0.7 billion and an increase to Italy, the Netherlands, Ireland, Spain and Germany of £0.2 billion each.

Between the 3 months to February 2016 and the 3 months to May 2016, imports from the EU increased by £1.9 billion (3.4%) to £57.2 billion. This was attributed to increases in imports from Spain and Germany of £0.4 billion each and Belgium, Italy, Denmark and Poland at £0.2 billion each.

At the commodity level, the data are shown in Table 4.

Table 4: Change in UK trade main commodity value (EU), May 2016

| £ million | |||||

| Monthly change1 | 3 monthly change2 | ||||

| Exports | Imports | Exports | Imports | ||

| Oil (see section on "trade in oil") | -213 | -30 | +40 | +220 | |

| Cars | +11 | +58 | +594 | -792 | |

| Consumer goods other than cars | +125 | +88 | +91 | +222 | |

| Intermediate goods | -79 | +30 | +217 | +1163 | |

| Capital goods | -81 | +11 | +261 | +685 | |

| Chemicals | -133 | -129 | +254 | -913 | |

| Semi-manufactured goods other than chemicals | +11 | -31 | +73 | +668 | |

| Source: Office for National Statistics | |||||

| Notes: | |||||

| 1. Monthly change is May 2016 compared with April 2016. | |||||

| 2. 3 monthly change is March 2016 to May 2016 compared with December 2015 to February 2016. | |||||

Download this table Table 4: Change in UK trade main commodity value (EU), May 2016

.xls (26.1 kB)Non-EU analysis

Between April 2016 and May 2016, exports to non-EU countries decreased by £1.8 billion (12.9%) to £12.2 billion. This was attributed to a decrease in exports to Switzerland of £0.8 billion, the USA of £0.7 billion and China of £0.2 billion.

Between April 2016 and May 2016, imports from non-EU countries decreased by £1.8 billion (10.7%) to £14.8 billion. This was attributed to decreases in imports from South Korea and the USA of £0.3 billion, from Switzerland, Norway and Russia of £0.2 billion each.

Between the 3 months to February 2016 and the 3 months to May 2016, exports to non-EU countries increased by £2.5 billion (6.8 %) to £38.6 billion. This was attributed to increases in exports to Switzerland and China of £1.2 billion each and Saudi Arabia and the USA at £0.3 billion each. These increases were partially offset by decreases to Canada, Norway and India of £0.2 billion each.

Between the 3 months to February 2016 and the 3 months to May 2016, imports from non-EU countries decreased by £0.2 billion (0.3 %) to £46.7 billion. This was attributed to decreases in imports from Canada at £1.8 billion and the USA at £0.6 billion. These decreases were partially offset by an increase in imports from Switzerland and South Korea of £0.5 billion each and China of £0.4 billion.

At the commodity level, the data are shown in Table 5.

Table 5: Change in UK main commodity value (non-EU), May 2016

| Monthly change1 | 3 monthly change2 | ||||

| Exports | Imports | Exports | Imports | ||

| Oil (see section on 'trade in oil') | +184 | -303 | +62 | +225 | |

| Cars | -19 | -87 | -152 | +73 | |

| Consumer goods other than cars | -214 | -507 | +64 | -98 | |

| Intermediate goods | -177 | -311 | +187 | +538 | |

| Capital goods | -107 | -127 | +162 | +444 | |

| Chemicals | -282 | -330 | +128 | +193 | |

| Semi-manufactured goods other than chemicals | -68 | -210 | -280 | +161 | |

| Source: Office for National Statistics | |||||

| Notes: | |||||

| 1. Monthly change is May 2016 compared with April 2016. | |||||

| 2. 3 monthly change is March 2016 to May 2016 compared with December 2015 to February 2016. | |||||

Download this table Table 5: Change in UK main commodity value (non-EU), May 2016

.xls (26.1 kB)Where to find data about UK trade in goods – analysis by area

Trade in goods by area figures are available in Table 2 and value of trade in goods with selected EU and non-EU trading partner figures are available in Tables 11 and 12 of the dataset of the tables.

Nôl i'r tabl cynnwys8. Trade in goods – geographical analysis

Monthly analysis

The USA was the UK’s top export partner with exports of £3.8 billion in May 2016, decreasing by £0.7 billion when compared with April 2016.

Germany was the UK’s top import partner with imports of £5.1 billion in May 2016, increasing by £0.2 billion when compared with April 2016.

Table 6: Change in UK monthly trade with significant partner countries1, May 2016 compared with April 2016

| Exports (£ million) | Imports (£ million) | ||||||||

| May 2016 value | 1 month change | May 2016 value | 1 month change | ||||||

| 1 | USA | 3,800 | -670 | 1 | Germany | 5,142 | +198 | ||

| 2 | Germany | 2,609 | -1 | 2 | China | 3,272 | +49 | ||

| 3 | France | 1,615 | -124 | 3 | USA | 2,619 | -280 | ||

| 4 | Irish Republic | 1,484 | +115 | 4 | Netherlands | 2,532 | -144 | ||

| 5 | Netherlands | 1,232 | -308 | 5 | France | 1,988 | +112 | ||

| 6 | China | 1,216 | -159 | 6 | Belgium and Luxembourg | 1,797 | -157 | ||

| 7 | Belgium and Luxembourg | 984 | -18 | 7 | Spain | 1,397 | +163 | ||

| 8 | Spain | 834 | +60 | 8 | Italy | 1,388 | +33 | ||

| 9 | Italy | 763 | -5 | 9 | Irish Republic | 1,010 | -24 | ||

| 10 | Switzerland | 397 | -772 | 10 | Norway | 708 | -242 | ||

| Source: Office for National Statistics | |||||||||

| Notes | |||||||||

| 1. Significant trading partners defined as top 10 export markets and import sources 2015 (see attached table 14). | |||||||||

| 2. USA includes Puerto Rico. | |||||||||

Download this table Table 6: Change in UK monthly trade with significant partner countries^1^, May 2016 compared with April 2016

.xls (27.1 kB)

Figure 6: Significant UK partner countries, 1 month balances, May 2016

Source: Office for National Statistics

Download this chart Figure 6: Significant UK partner countries, 1 month balances, May 2016

Image .csv .xls3 Monthly Analysis

In the 3 months to May 2016, the USA was the UK’s top export partner with exports of £11.3 billion, increasing by £0.3 billion when compared with the 3 months to February 2016.

Germany was the UK’s top import partner with imports of £15.4 billion, increasing by £0.4 billion when compared with the 3 months to February 2016.

Table 7: Change in UK 3 monthly trade with significant partner countries1, February to May 2016 compared with December 2015 to February 2016

| Exports (£ million) | Imports (£ million) | ||||||||

| March to May 2016 | 3 monthly change | March to May 2016 | 3 monthly change | ||||||

| 1 | USA | 11,336 | +322 | 1 | Germany | 15,413 | +393 | ||

| 2 | Germany | 7,856 | +231 | 2 | China | 9,573 | +436 | ||

| 3 | France | 4,978 | +719 | 3 | USA | 8,770 | -564 | ||

| 4 | China | 4,377 | +1,232 | 4 | Netherlands | 8,045 | +25 | ||

| 5 | Netherlands | 4,272 | +151 | 5 | France | 6,012 | +19 | ||

| 6 | Irish Republic | 4,205 | +229 | 6 | Belgium and Luxembourg | 5,634 | +187 | ||

| 7 | Belgium and Luxembourg | 2,938 | +131 | 7 | Italy | 4,162 | +213 | ||

| 8 | Switzerland | 2,914 | +1,225 | 8 | Spain | 3,997 | +434 | ||

| 9 | Spain | 2,377 | +178 | 9 | Irish Republic | 3,115 | -56 | ||

| 10 | Italy | 2,330 | +180 | 10 | Norway | 2,688 | -265 | ||

| Source: Office for National Statistics | |||||||||

| Notes: | |||||||||

| 1. Significant trading partners defined as top 10 export markets and import sources 2015 (see attached Table 14). | |||||||||

| 2. USA includes Puerto Rico. | |||||||||

Download this table Table 7: Change in UK 3 monthly trade with significant partner countries^1^, February to May 2016 compared with December 2015 to February 2016

.xls (27.1 kB)

Figure 7: Significant UK partner countries, 3-monthly balances, March to May 2016

Source: Office for National Statistics

Download this chart Figure 7: Significant UK partner countries, 3-monthly balances, March to May 2016

Image .csv .xlsWhere to find data about UK trade in goods – geographical analysis

Trade in goods by area figures are available in Table 2 and value of trade in goods with selected EU and non-EU trading partner figures are available in Tables 11 and 12 of the dataset of the tables.

Nôl i'r tabl cynnwys9. Volume of trade in goods, excluding oil and erratic

Between April 2016 and May 2016, the volume of exports decreased by 12.0%.

Between April 2016 and May 2016, the volume of imports decreased by 1.2%.

In the 3 months to May 2016, the volume of exports increased by 4.5% when compared with the 3 months to February 2016.

In the 3 months to May 2016, the volume of imports increased by 0.7% when compared with the 3 months to February 2016.

At the commodity level, the data are shown in Table 8.

Table 8: Change in UK main commodity volume, May 2016

| Monthly change 1 | 3 monthly change 2 | |||

| Exports percentage change | Imports percentage change | Exports percentage change | Imports percentage change | |

| Food, beverages and tobacco | 0.0 | +0.9 | +2.3 | 0.0 |

| Basic materials | 0.0 | -4.7 | +0.9 | +6.3 |

| Semi-manufactured goods; of which | -8.7 | -7.4 | -3.5 | -0.9 |

| Chemicals | -10.3 | -7.8 | -2.6 | -1.5 |

| Finished manufactured goods; of which | -5.1 | -6.5 | +7.2 | +5.6 |

| Cars | -4.8 | +1.3 | +13.4 | +5.3 |

| Consumer goods other than cars | -7.9 | -6.0 | +0.8 | -0.3 |

| Intermediate goods | -11 | -6.0 | +1.7 | +6.3 |

| Capital goods | -5.8 | -0.9 | +5.8 | +3.1 |

| Source: Office for National Statistics | ||||

| Notes: | ||||

| 1 Monthly change is May 2016 compared with April 2016. | ||||

| 2 3 monthly change is March 2016 to May 2016 compared with December 2015 to February 2016. | ||||

Download this table Table 8: Change in UK main commodity volume, May 2016

.xls (26.1 kB)10. Export and import prices for trade in goods (not seasonally adjusted)

In May 2016, compared with April 2016, export prices increased by 0.2% and import prices decreased by 0.1%. Excluding the oil price effect, export prices decreased by 0.5% and import prices decreased by 0.7%.

In the 3 months to May 2016, when compared with the 3 months to February 2016, export prices increased by 5.8% and import prices decreased by 0.9%. Excluding the oil price effect, export prices increased by 5.0% and import prices decreased by 2.5%.

Figure 8: UK trade in goods export and import prices, May 2014 to May 2016

Source: Office for National Statistics

Notes:

Download this chart Figure 8: UK trade in goods export and import prices, May 2014 to May 2016

Image .csv .xls11. Trade in oil

In May 2016, the balance of trade in oil was in deficit by £0.3 billion, a narrowing of £0.3 billion from April 2016. Oil exports decreased by £29.0 million to £1.5 billion and oil imports decreased by £0.3 billion to £1.8 billion.

In the 3 months to May 2016, the balance on trade in oil was in deficit by £1.4 billion; widening by £0.3 billion from the 3 months to February 2016. Oil exports increased by £0.1 billion to £4.4 billion and oil imports increased by £0.4 billion to £5.8 billion.

Figure 9: Balance on UK trade in oil, May 2014 to May 2016

Source: Office for National Statistics

Download this chart Figure 9: Balance on UK trade in oil, May 2014 to May 2016

Image .csv .xlsWhere to find data about trade in oil

The trade in oil figures are available in Tables 1 and 7 of the dataset of the tables.

Nôl i'r tabl cynnwys12. Trade in services

Information on trade in services is mainly obtained from Quarterly surveys, in some cases underpinned by larger annual surveys. This means that the latest months are uncertain.

Figure 10: Value of UK trade in services, May 2014 to May 2016

Source: Office for National Statistics

Download this chart Figure 10: Value of UK trade in services, May 2014 to May 2016

Image .csv .xlsEU and non-EU analysis

Between Quarter 4 (October to December) 2015 and Quarter 1 (January to March) 2016, exports of services to EU countries rose by £0.3 billion to £23.5 billion. Imports from the EU rose by £0.4 billion to £17.5 billion over the same period.

The balance of trade in services with non-EU countries narrowed by £0.4 billion between Quarter 4 (October to December) 2015 and Quarter 1 (January to March) 2016, to £16.3 billion. This decrease reflected a fall in exports of £0.7 billion and a decrease in imports of £0.4 billion.

In Quarter 1 (January to March) 2016, the largest trade in services surplus was with the USA (£5.7 billion), this was lower than the surplus with EU countries of £5.9 billion.

Figure 11: Trade in services, balance with total EU and selected non-EU countries, quarter 1 (Jan to March) 2016

Source: Office for National Statistics

Download this chart Figure 11: Trade in services, balance with total EU and selected non-EU countries, quarter 1 (Jan to March) 2016

Image .csv .xlsRevisions

Between the May 2016 and April 2016 UK trade publications, the Quarter 1 (January to March) 2016 surplus for trade in services has been revised up by £1.3 billion, which reflected an upwards revision of £1.9 billion in exports and an upwards revision of £0.5 billion in imports. The main contributors for the upwards revision in exports were other business services (£1.5 billion) and travel services (£0.4 billion). The main contributor for the upwards revision in imports was other business services (£0.5 billion).

In the May 2016 UK trade publication, the data series has been revised from 1997 onwards. This reflects annual process of balancing the national accounts as a whole, take on methodology changes and latest annual data source revisions.

In the May 2016 publication, exports of services were estimated at £225.5 billion for 2015, revised down from £226.0 billion in the April 2016 publication. The overall decrease to exports between the UK trade publications in May 2016 and April 2016 of £0.5 billion for 2015 is primarily due to downward revisions in telecommunication, computer and information services (£3.3 billion), transport services (£2.4 billion) and insurance services (£2.3 billion); these were offset by upward revisions in other business services (£6.2 billion) and and travel services (£2.0 billion). Exports were measured in the May 2016 publication at £218.8 billion for 2014, revised down from £219.7 billion in the April 2016 publication. The overall decrease between the UK trade publications in May 2016 and April 2016 of £0.9 billion for 2014 is primarily due to downward revisions in transport services (£2.1 billion) and telecommunication, computer and information services (£1.5 billion); these were partially offset by upward revisions in insurance services (£2.1 billion) and financial services (£1.1 billion).

In the May 2016 publication, imports of services were estimated at £137.7 billion for 2015, revised up from £137.3 billion in the April 2016 publication. The overall increase to imports between the UK trade publications in May 2016 and April 2016 of £0.4 billion for 2015 is primarily due to an upward revision in other business services of £3.6 billion; this was partly offset by downward revisions in transport services (£1.1 billion), telecommunication, computer and information services (£0.9 billion), financial services (£0.7 billion) and construction services (£0.6 billion). Imports were measured in the May 2016 publication at £132.4 billion for 2014, revised up from £130.9 billion in the April 2016 publication. The overall increase between the UK trade publications in May 2016 and April 2016 of £1.5 billion for 2014 is primarily due to upward revisions in financial services (£2.5 billion) and insurance services (£0.7 billion); these were partially offset by downward revisions in transport services (£0.9 billion), charges for use of intellectual property services (£0.5 billion), construction services (£0.5 billion), travel services (£0.4 billion) and telecommunication, computer and information services (£0.3 billion).

Where to find data about trade in services

The trade in services figures are available in Table 1 CONT. of the dataset of the tables.

A further breakdown of non-EU countries can found in the Quarter 1 (January to March) 2016 United Kingdom Economic Accounts.

Nôl i'r tabl cynnwys13. Where to find more information about UK trade statistics

Other regularly published UK trade releases

Supplementary quarterly data analysed by product according to the UK trade in goods by classification of product by activity (CPA 2008) are also available.

The latest release on 14 June 2016 covered the period Quarter 1 (January to March) 2016 and the data is consistent with UK trade April 2016. Following an internal review of our publications and a wider survey of users there is no longer a statistical bulletin associated with the release.

The data will be updated at the next publication on 14 September 2016 to be fully consistent with the Pink Book and Blue Book datasets.

The complete run of data in the tables of this statistical bulletin are also available to view and download in other electronic formats free of charge using our time series data website service. You can download the complete statistical bulletin in a choice of zipped formats, or view and download your own selections of individual series.

HM Revenue and Customs (HMRC) publish Overseas trade statistics on the same day as we release the UK trade data each month. These aggregate estimates will differ slightly from those that are published by us as part of the Balance of Payments (BoP), as the 2 sets of data are compiled to different sets of rules. The BoP publication shows a high level picture of UK trade in goods, whereas the OTS publication shows a detailed picture of the UK’s trade in goods by commodity and partner country.

Recently published reports on UK trade topics

We have published a methodology article estimating the value of service exports abroad from different parts of the UK. This work has been undertaken to meet user needs for sub-national estimates for exports of services. The article provides annual estimates for 2011 to 2014, including breakdowns by region, commodity and industry, which at this stage are considered experimental. We welcome feedback on the article and the proposed methodology.

The Economic Review published 6 April 2016 contains information on trade as a percentage of GDP.

The Economic Review published 3 February 2016 includes analysis of trade with EU and non-EU countries.

On 29 January 2016 annual International trade in services survey results for 2014 were published. This release gives information on the industry of the businesses engaged in trade in services.

Historic articles published on UK trade

On 30 October 2015 we published the annual Balance of Payments Pink Book 2015 which as well as containing more detailed information on trade also provided an overview of the trade deficit in relation to the current account deficit.

In our Economic Review published on 3 September 2015 there is further commentary on UK export performance.

On 1 September 2015, we published an article on the economic performance of the UK’s motor vehicle manufacturing industry.

On 26 June 2015, we published a short story on the importance of EU to UK trade and investment.

On 9 June 2015, we published a short story on the importance of China to the UK economy, including the value of the UK trade with China.

On 6 February 2015, we published an article on the Rotterdam effect and its potential impact on the UK trade in goods estimates.

On 23 January 2015, we published a short story exploring the reasons behind the UK trade deficit.

Published user requested data and analysis

Additional statistical data and analyses for UK trade statistics that have not been included in our standard publications are available at the user requested data and analysis pages on our website.

Methodological articles

Detailed methodological notes are published in the UK Balance of Payments - The Pink Book, 2015.

Nôl i'r tabl cynnwys14. Revisions to trade statistics

Trade in goods revisions

The revision period for goods is back to January 1998, in line with the open revisions period for the 2016 Blue Book and Pink Book.

Trade in services revisions

The revision period for services is back to January 1997, in line with the open revisions period for the 2016 Blue Book and Pink Book.

The National accounts revision policy can be found on our website.

Methodology changes

Gas

HMRC Trade Statistics have amended the data source used in the compilation of Natural Gas traded with non-EU partners from 2011 onwards. Imports of gas have been revised upwards by approximately £3.0 billion in each year 2011 to 2013. This change had already been incorporated from 2014 onwards.

Imputed rental on second homes (cross border-property income)

Wider national accounts changes to imputed rental have impacted on the imports and exports of housing services arising from imputed rental of second homes by non-residents which part of travel services. The revision to trade balance from 1997 onwards vary between -£0.4 billion and +£0.6 billion.

Exhaustiveness

Improved estimates of non-complicit Value Added Tax (VAT fraud) has an indirect effect on trade in services. Exports of services have been revised up by less than £0.1 billion each year.

Nôl i'r tabl cynnwys15. Accuracy of the statistics

Accuracy: Trade in goods figures for the most recent months are provisional and subject to revision in the light of:

late trader data

revisions to seasonal adjustment factors which are re-estimated every month

Trade in services estimates have been derived from a number of monthly and quarterly sources. For components where no monthly data are available, estimates have been derived on the basis of recent trends. The results should be used with appropriate caution, as they are likely to be less reliable than those for trade in goods.

Reliability: Revisions to data provide one indication of its reliability. Table 9 shows summary information on the size and direction of the revisions that have been made to the data covering a 5-year period. A statistical test has been applied to the average revision to find out if it is statistically significantly different from zero. An asterisk (*) shows that the test is significant.

Table 9: Revisions analysis, UK trade, May 2016

| £ million | |||

| Revisions between first publication and estimates 12 months later | |||

| Value in latest period | Average over the last 5 years (mean revision) | Average over the last 5 years without regard to sign (average absolute revision) | |

| Total trade exports (IKBH) | 43,090 | 1,035* | 1,047* |

| Total trade imports (IKBI) | 45,353 | 961* | 962* |

| Total trade balance (IKBJ) | -2,263 | 66 | 832 |

| Source: Office for National Statistics | |||

Download this table Table 9: Revisions analysis, UK trade, May 2016

.xls (25.6 kB)16. Other quality information

UK trade re-assessment

The UK Statistics Authority suspended the National Statistics designation of UK trade on 14 November 2014. The Authority's re-assessment of UK trade against the Code of Practice for Official Statistics has been completed.

One of the recommendations of the re-assessment was to consult with users on the use of UK trade statistics. The results of this user engagement survey can be found on our website.

UK trade re-assessment update

ONS has now addressed some of the requirements of the re-assessment of UK trade and is in the final stages of providing evidence on the remaining requirements. In doing so, we are working with the Assessment Team to evaluate whether any additional evidence will be required as a result of the Independent review of UK economic statistics, led by Professor Sir Charles Bean.

Trade development plan

The trade development plan has now been launched.

EMU enlargement

As of 1 January 2015, Lithuania joined the European Monetary Union (EMU). Therefore the EMU totals in this UK trade release include Lithuania.

EMU coverage

The coverage of EMU countries was extended to cover Cyprus and Malta from October 2008, Slovakia from January 2009, Estonia from January 2011, Latvia from January 2014 and Lithuania from January 2015. Some EU and non-EU breakdowns of commodity data for chained volume measures which are available on request may be less reliable than the current price data. Please consult Katherine Kent on +44 (0)1633 455829 if you are considering using them.

Data have been combined for the United States and Puerto Rico and for Dubai, Abu Dhabi and Sharjah (the United Arab Emirates) from January 2009 onwards. Estimates are separately available for the United States and Dubai up to the end of 2008 on request.

Erratics

Non-monetary gold is now included in the erratics series; along with ships, aircraft, precious stones and silver. In compliance with the BPM6 changes, non-monetary gold which is held as a store of wealth is now recorded within trade in goods.

Deflation

It is common for the value of a group of financial transactions to be measured in several time periods. The values measured will include both the change in the volume sold and the effect of the change of prices over that year. Deflation is the process whereby the effect of price change is removed from a set of values.

Chain-linked indices (chained volume measures), which are indexed to form the volume series in this bulletin, differ from fixed base indices in that the growth from one year to the next is estimated by weighting the components using the contribution to value of trade in the immediately preceding year (effectively re-basing every year). This series of annually re-weighted annual growths is then “chain-linked” to produce a continuous series.

The implied price deflators, derived by comparing current price data to chained volume measures data are not the same as the price indices published in this statistical bulletin, because the former are current weighted while the latter are base (2012) weighted.

Changes in trade associated with VAT MTIC fraud mean that comparisons of volume and prices (both including and excluding trade associated with VAT MTIC fraud) should be treated with a great deal of caution.

Interpreting the data

In months where quarterly and 3-monthly ending percentage changes for index data coincide, there may be small differences between the data for methodological reasons. Quarterly data are the indexed form of an underlying constant price (for volume indices) or consistent quantity (for price indices) series. 3-month ending data are the average of the index data in that period.

Seasonal adjustment

Seasonal adjustment aims to remove effects associated with the time of the year or the arrangement of the calendar so that movements within a time series may be more easily interpreted.

Nôl i'r tabl cynnwys17. Records sheet

The UK trade record information for May 2016 can be accessed on our website.

Nôl i'r tabl cynnwys