Cynnwys

- Main points

- Things you need to know about this release

- Total trade deficit widened in the three months to March 2019

- The trade in goods deficit widened with both EU and non-EU countries in the three months to March 2019

- Removing the effect of inflation, the trade deficit widened in the three months to March 2019

- Explore UK trade in goods country-by-commodity data for 2018 via our interactive tools

- The total trade deficit widened in the 12 months to March 2019

- The trade in goods deficit widened with both EU and non-EU countries in the 12 months to March 2019

- Links to related statistics

- Quality and methodology

1. Main points

The total trade deficit (goods and services) widened £8.9 billion to £18.3 billion in the three months to March 2019, as the trade in goods deficit widened £6.4 billion to £43.3 billion and the trade in services surplus narrowed £2.5 billion to £25.0 billion.

Rising imports of unspecified goods (including non-monetary gold), chemicals, and machinery and transport equipment were the main reasons for the widening of the trade in goods deficit in the three months to March 2019.

Excluding unspecified goods, which includes non-monetary gold, the total trade deficit rose £1.9 billion to £12.2 billion in the three months to March 2019.

Excluding erratic commodities, such as non-monetary gold, the total trade deficit increased £3.1 billion to £14.5 billion in the three months to March 2019.

The trade in goods deficit widened £1.7 billion to £25.7 billion with EU countries and £4.7 billion to £17.6 billion with non-EU countries in the three months to March 2019.

Removing the effect of inflation, the total trade deficit widened £10.6 billion to £17.5 billion in the three months to March 2019.

The total trade deficit increased £21.6 billion to £44.1 billion in the 12 months to March 2019 as imports of both goods and services grew more than their respective exports.

2. Things you need to know about this release

Data revision policy

In accordance with National Accounts Revisions Policy data in this release have been revised back to January 2019 when compared with our previous trade bulletin on 10 April 2019. Data in this release are consistent with the GDP first quarterly estimate for Quarter 1 (Jan to Mar) 2019 published on 10 May 2019.

National Statistics designation status

The UK Statistics Authority suspended the National Statistics designation of UK trade (PDF 72.8KB) on 14 November 2014. We have now responded to all of the specific requirements of the reassessment of UK trade and are in the final stages of providing evidence to the Authority. We are undertaking a programme of improvements to UK trade statistics in line with the UK trade development plan, including more detail and improvements now published to address anticipated future demands. On 24 October 2018 we published an article outlining our achievements so far and forward look with regards to the transformation of our trade statistics. We continue to work with the Office for Statistics Regulation team to regain National Statistics status for UK trade statistics. We welcome feedback on our new trade statistics, developments and future plans. If you have any comments, please email trade@ons.gov.uk.

UK trade data

Unless otherwise specified, data within this bulletin are in current prices, in other words, they have not been adjusted to remove the effects of inflation.

UK trade data within our monthly trade bulletin are published at around a six-week lag due to the timeliness of source data. For example, the June 2019 publication will include data up to the end of April 2019.

Trade data within this release are aligned and consistent with the latest GDP quarterly estimate, for information on the contribution of trade to GDP in the latest quarter please see GDP first quarterly estimate for Quarter 1 (January to March).

Erratic commodities

Trade statistics for any one month can be erratic. For that reason, we recommend comparing the latest three months against the preceding three months, and the same three months of the previous year.

Oil and other “erratic” commodities can make a large contribution to trade in goods, but often mask the underlying trend in the export or import values due to their volatility. The “erratics” series includes ships, aircraft, precious stones, silver and non-monetary gold. Non-monetary gold can have a particularly large impact due to the large volumes of gold traded on the London markets. Therefore, we also publish data exclusive of these commodities, which may provide a better guide to the emerging trade picture.

Non-monetary gold

In line with international standards, the Office for National Statistics’s (ONS’s) headline trade statistics contain the UK’s imports and exports of non-monetary gold. Non-monetary gold is predominantly gold bullion not owned by central banks. It also includes gold coin, unwrought or semi-manufactured gold scrap not owned by central banks.

Because a significant amount of the world’s trade in non-monetary gold takes place on the London markets, this trade can have a large impact in the size of and change in the UK’s headline trade figures.

Non-monetary gold is one sub-component of the commodity group “unspecified goods”.

More information about the ONS’s recording of non-monetary gold is available.

Trade asymmetries

These data are our best estimates of bilateral UK trade flows, compiled following internationally agreed standards and using a wide range of robust data sources. However, in some cases alternative estimates of bilateral trade flows are available from the statistical agencies for those countries or through central databases such as UN Comtrade. Differences between estimates are known as trade asymmetries and are a known aspect of international trade statistics, affecting bilateral estimates across the globe, not just the UK.

We are heavily engaged in analysis of these asymmetries, developing strong bilateral relationships with other countries to understand, explain and potentially reduce them. We have published a series of analyses showing comparisons and the relative strengths of different estimates, which users may wish to reference to help them better understand the quality of our bilateral trade estimates.

Nôl i'r tabl cynnwys3. Total trade deficit widened in the three months to March 2019

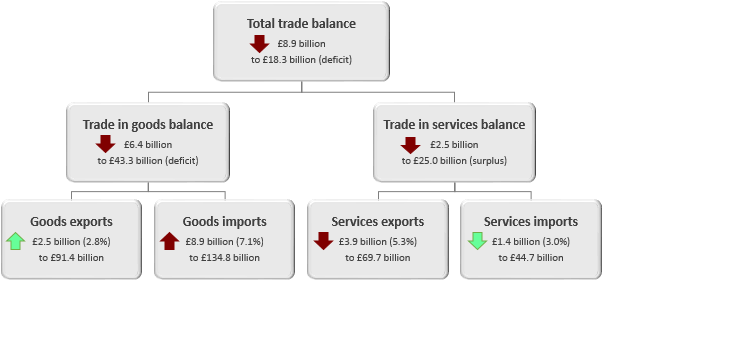

Figure 1 and Table 1 show the change to trade in goods, services and total trade balances, along with exports and imports in the three months to March 2019 compared with the three months to December 2018.

The total trade deficit (goods and services) widened by a record £8.9 billion to a record £18.3 billion in the three months to March 2019, due largely to a £6.4 billion widening in the trade in goods deficit to a record £43.3 billion. Goods exports increased £2.5 billion to £91.4 billion while imports increased £8.9 billion to £134.8 billion.

The trade in services surplus narrowed by £2.5 billion to £25.0 billion in the three months to March 2019; exports of services fell by £3.9 billion to £69.7 billion, while imports fell less, by £1.4 billion to £44.7 billion.

Figure 1: The total trade balance widened due mainly to increased imports of goods

Changes in the UK trade balances, exports and imports, three months to March 2019 compared with three months to December 2018

Source: Office for National Statistics

Notes:

The arrow direction indicates whether a component has increased or decreased, while the colour denotes the impact the direction of a movement has on the trade balance.

For example, an increase in imports is denoted by an upward red (darker) arrow, as a rise in imports has a negative impact on the trade balance, while an increase in exports is denoted by an upward green (lighter) arrow, as a rise in exports has a positive impact on the trade balance.

Download this image Figure 1: The total trade balance widened due mainly to increased imports of goods

.png (20.6 kB)

| Three months to March 2019 compared with three months to December 2018 | |||

|---|---|---|---|

| Exports | Imports | Balance | |

| Total trade | Decreased £1.4 billion (0.8%) to £161.2 billion | Increased £7.5 billion (4.4%) to £179.5 billion | Decreased £8.9 billion to £18.3 billion (deficit) |

| Trade in goods | Increased £2.5 billion (2.8%) to £91.4 billion | Increased £8.9 billion (7.1%) to £134.8 billion | Decreased £6.4 billion to £43.3 billion (deficit) |

| Trade in services | Decreased £3.9 billion (5.3%) to £69.7 billion | Decreased £1.4 billion (3.0%) to £44.7 billion | Decreased £2.5 billion to £25.0 billion (surplus) |

Download this table Table 1: The total trade deficit widened due mainly to a widening in the trade in goods deficit

.xls .csvFigure 2 shows the UK trade balances on a three-month on three-month basis between March 2017 and March 2019.

The trade in goods deficit widened by £6.4 billion to reach a record deficit of £43.3 billion in the three months to March 2019 due largely to increased imports of unspecified goods (including non-monetary gold), which rose £6.0 billion. Imports of unspecified goods increased on a monthly basis between December 2018 and March 2019, much of the increase was due to a rise in imports of non-monetary gold.

Excluding erratic commodities, the total trade deficit widened by £3.1 billion to £14.5 billion in the three months to March 2019. Removing unspecified goods, which includes non-monetary gold, the total trade deficit widened £1.9 billion to £12.2 billion in the three months to March 2019.

Chemical imports increased £1.8 billion in the three months to March 2019, due largely to a £1.3 billion increase in imports of medicinal and pharmaceutical products. The increase in imports of medicinal and pharmaceutical products in the three months to March 2019 were consistent with an increase in activity ahead of the UK’s originally intended departure date from the European Union, but we were unable to quantify the effect of this. Similar increases in activity have been seen elsewhere in the economy, for further information see GDP first quarterly estimate, UK: January to March 2019.

Imports of machinery and transport equipment increased by £1.2 billion, due mainly to a £0.8 billion increase in imports of cars. The increase in imports was partially offset by falling imports of fuels, which fell by £1.6 billion.

Exports of goods increased £2.5 billion in the three months to March 2019. Electrical machinery, and ships and aircraft, both contributed £0.6 billion to the £1.8 billion increase in exports of machinery and transport equipment. Exports of chemicals increased £1.0 billion, £0.4 billion of which was due to a rise in exports of medicinal and pharmaceutical products; exports of organic, inorganic and other chemicals, toilet and cleansing preparations all increased £0.1 billion.

Services exports fell £3.9 billion in the three months to March 2019. The largest contributors to the fall in services exports were other business services, charges for the use of intellectual property, and telecommunications, computer and information services. Imports of services decreased £1.4 billion in the three months to March 2019, partially offsetting the fall in exports. The largest contributors to the fall in imports were telecommunications, computer and information services, and financial services.

Figure 2: The trade in goods deficit widened for the fourth consecutive quarter

UK trade balances, three-month on three-month, March 2017 to March 2019

Source: Office for National Statistics

Download this chart Figure 2: The trade in goods deficit widened for the fourth consecutive quarter

Image .csv .xls4. The trade in goods deficit widened with both EU and non-EU countries in the three months to March 2019

Figure 3 shows the changes in trade in goods exports, imports and balances with EU and non-EU countries between the three months to December 2018 and the three months to March 2019.

The trade in goods deficit widened £1.7 billion to £25.7 billion with EU countries and £4.7 billion to £17.6 billion with non-EU countries in the three months to March 2019.

Exports to non-EU countries decreased £0.2 billion to £45.0 billion, while imports from non-EU countries increased £4.5 billion to £62.7 billion in the three months to March 2019. Imports of unspecified goods (including non-monetary gold) from non-EU countries increased £6.0 billion, due largely to increased imports of non-monetary gold, offset in part by falling imports of fuels, which fell £1.3 billion.

Falling exports of goods to non-EU countries were due mainly to falling exports of unspecified goods and fuels. Exports of unspecified goods fell by £0.7 billion while fuel exports fell £0.5 billion, offset in part by a £0.6 billion increase in exports of chemicals.

Exports to EU countries increased £2.7 billion to £46.4 billion in the three months to March 2019 while imports increased £4.4 billion to £72.1 billion. Increased imports from EU countries were due largely to imports of chemicals, and machinery and transport equipment.

Chemical imports from the EU increased £1.9 billion, which was due largely to increased imports of medicinal and pharmaceutical products, which increased £1.5 billion in the three months to March 2019. Imports of medicinal and pharmaceutical products from EU countries have shown strong growth on a monthly basis to March 2019. Imports of machinery and transport equipment increased £1.5 billion as car imports increased £0.8 billion.

Machinery and transport equipment was the largest contributor to the increase in exports to EU countries, increasing £1.8 billion in the three months to March 2019. Electrical machinery and mechanical machinery made up £0.4 billion and £0.3 billion of the increase respectively, while exports of ships and aircraft increased £0.8 billion.

Figure 3: The widening of the total trade in goods deficit was due largely to a widening of the trade in goods deficit with non-EU countries

Changes in UK goods exports, imports and trade balance with EU and non-EU countries, three months to March 2019 compared with three months to December 2018

Source: Office for National Statistics

Download this chart Figure 3: The widening of the total trade in goods deficit was due largely to a widening of the trade in goods deficit with non-EU countries

Image .csv .xls5. Removing the effect of inflation, the trade deficit widened in the three months to March 2019

This section presents volume and price estimates of the UK trade balances, exports and imports, using chained volume measures (CVMs) and implied deflators (IDEFs). A CVM is a “real” measure in that it has had the effect of inflation removed. An IDEF shows the implied change in average prices for the respective components of the trade balance, for example, the IDEF for imports will show the average price movement for imports.

Figure 4 shows the UK trade balances on a CVM basis, three-month on three-month from March 2017 to March 2019. In volume terms, the total trade deficit (goods and services) widened by a record £10.6 billion to a record £17.5 billion in the three months to March 2019, as the trade in goods deficit widened £8.9 billion to a record £43.3 billion and the trade in services surplus narrowed £1.6 billion to £25.8 billion.

Goods exports increased £3.6 billion to £83.0 billion while imports increased by a record £12.5 billion to £126.3 billion in the three months to March 2019. Services exports fell £3.5 billion to £66.4 billion while services imports fell £1.9 billion to £40.6 billion.

The total trade deficit widened by more in volume terms compared with current prices, due largely to falls in import prices. In current prices, fuels offset some of the increases in imports elsewhere, however, much of this offset was due to price movements. The IDEF for fuels imports fell 8.5% in the three months to March 2019, broadly reflecting falls in oil prices over the period.

Figure 4: The widening of the trade deficit in real terms was due mainly to a widening of the trade in goods deficit

Total trade balances, chained volume measures, three-month on three-month, March 2017 to March 2019

Source: Office for National Statistics

Download this chart Figure 4: The widening of the trade deficit in real terms was due mainly to a widening of the trade in goods deficit

Image .csv .xlsFigure 5 shows CVMs and IDEFs for goods imports on a three-month on three-month basis between March 2017 and March 2019.

The largest contributor to the increase in goods imports in volume terms was unspecified goods (including non-monetary gold), which increased £7.0 billion in the three months to March 2019, due largely to increased imports of non-monetary gold. Imports of machinery and transport equipment also increased £1.8 billion.

Imports of chemicals increased £2.2 billion, as imports of medicinal and pharmaceutical products increased by £1.8 billion from EU countries in volume terms. The increase in imports of medicinal and pharmaceutical products from EU countries in the three months to March 2019 were consistent with an increase in activity ahead of the UK’s originally intended departure date from the European Union, but we were unable to quantify the effect of this. Similar increases in activity have been seen elsewhere in the economy, for further information see GDP first quarterly estimate, UK: January to March 2019.

Figure 5: Goods imports grew by £12.5 billion in volume terms in the three months to March 2019

Trade in goods imports, chained volume measures, three-month on three-month, March 2017 to March 2019

Source: Office for National Statistics

Download this chart Figure 5: Goods imports grew by £12.5 billion in volume terms in the three months to March 2019

Image .csv .xls6. Explore UK trade in goods country-by-commodity data for 2018 via our interactive tools

Explore the 2018 trade in goods data using our interactive tools. Our data breaks down UK trade in goods with 234 countries by 125 commodities.

Use our map to get a better understanding of what goods the UK traded with a particular country. Select a country by hovering over it or using the drop-down menu.

Embed code

Notes:

For more information about our methods and how we compile these statistics, please see Trade in goods, country-by-commodity experimental data: 2011 to 2016. Users should note that the data published alongside this release are no longer experimental.

These data are our best estimate of these bilateral UK trade flows. Users should note that alternative estimates are available, in some cases, via the statistical agencies for bilateral countries or through central databases such as UN Comtrade.

Interactive maps denote country boundaries in accordance with statistical classifications set out within Appendix 4 of the Balance of Payments (BoP) Vademecum (PDF, 1.1MB).

What about trade in a particular commodity in 2018? What percentage of UK car exports went to the EU? Where did UK imports of tea and coffee come from last year?

Use our interactive tools to understand UK trade of a particular commodity in 2018.

Select a commodity from the drop-down menu, or click through the levels to explore the data.

Embed code

Embed code

Notes:

For more information about our methods and how we compile these statistics, please see Trade in goods, country-by-commodity experimental data: 2011 to 2016. Users should note that the data published alongside this release are no longer experimental.

These data are our best estimate of these bilateral UK trade flows. Users should note that alternative estimates are available, in some cases, via the statistical agencies for bilateral countries or through central databases such as UN Comtrade.

Interactive maps denote country boundaries in accordance with statistical classifications set out within Appendix 4 of the Balance of Payments (BoP) Vademecum (PDF, 1.1MB).

Nôl i'r tabl cynnwys7. The total trade deficit widened in the 12 months to March 2019

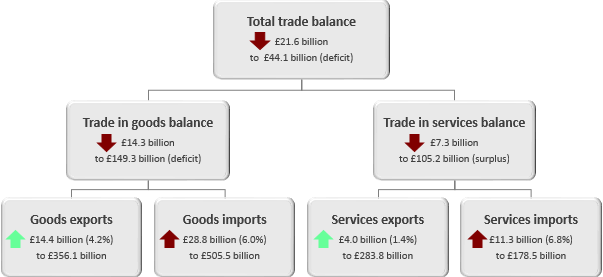

Figure 6 shows the changes to trade in goods, services and total trade balance, along with exports and imports in the 12 months to March 2019 compared with the 12 months to March 2018.

The total UK trade deficit (goods and services) widened £21.6 billion to £44.1 billion in the 12 months to March 2019, as imports of both goods and services increased more than their respective exports.

The trade in goods deficit widened £14.3 billion to £149.3 billion in the 12 months to March 2019, as imports of goods increased £28.8 billion to £505.5 billion compared with exports, which rose by £14.4 billion to £356.1 billion. The largest contributor to the increase in both exports and imports was fuels, which increased £9.2 billion for imports and £8.0 billion for exports.

The trade in services surplus narrowed £7.3 billion to £105.2 billion in the 12 months to March 2019, as imports increased £11.3 billion to £178.5 billion while exports grew by a lesser £4.0 billion to £283.8 billion. The main contributors to the increase in imports of services were other business, financial, travel and transport services.

Figure 6: The trade deficit widened in the 12 months to March 2019 as imports of both goods and services increased more than exports

Change to UK trade balances, exports and imports, 12 months to March 2019 compared with 12 months to March 2018

Source: Office for National Statistics

Notes:

The arrow direction indicates whether a component has increased or decreased, while the colour denotes the impact the direction of a movement has on the trade balance.

For example, an increase in imports is denoted by an upward red (darker) arrow, as a rise in imports has a negative impact on the trade balance, while an increase in exports is denoted by an upward green (lighter) arrow, as a rise in exports has a positive impact on the trade balance.

Download this image Figure 6: The trade deficit widened in the 12 months to March 2019 as imports of both goods and services increased more than exports

.png (18.9 kB)

| 12 months to March 2019 compared with 12 months to March 2018 | |||

|---|---|---|---|

| Exports | Imports | Balance | |

| Total trade | Increased £18.5 billion (3.0%) to £639.9 billion | Increased £40.1 billion (6.2%) to £684.0 billion | Decreased £21.6 billion to £44.1 billion (deficit) |

| Trade in goods | Increased £14.4 billion (4.2%) to £356.1 billion | Increased £28.8 billion (6.0%) to £505.5 billion | Decreased £14.3 billion to £149.3 billion (deficit) |

| Trade in services | Increased £4.0 billion (1.4%) to £283.8 billion | Increased £11.3 billion (6.8%) to £178.5 billion | Decreased £7.3 billion to £105.2 billion (surplus) |

Download this table Table 2: The trade deficit widened in the 12 months to March 2019 as imports of both goods and services increased more than exports

.xls .csv8. The trade in goods deficit widened with both EU and non-EU countries in the 12 months to March 2019

Figure 7 shows the changes in goods exports, imports and trade balances with EU countries and non-EU countries in the 12 months to March 2019 compared with the 12 months to March 2018.

The £14.3 billion widening in the trade in goods deficit in the 12 months to March 2019 was due mainly to trade with non-EU countries. The trade in goods deficit widened £11.7 billion with non-EU countries and by a lesser £2.6 billion with EU countries in the 12 months to March 2019.

The widening of the trade in goods deficit with non-EU countries in the 12 months to March 2019 was due mainly to imports increasing by more than exports. Imports from non-EU countries increased £16.4 billion while exports increased by a lesser £4.6 billion.

The largest contributors to the increase in imports from non-EU countries were fuels and unspecified goods, which increased £8.2 billion and £5.3 billion respectively in the 12 months to March 2019. Increasing exports to non-EU countries were driven by increases in exports of fuels and chemicals, which increased £2.9 billion and £1.0 billion respectively.

Imports of goods from EU countries increased £12.4 billion, partially offset by exports, which increased £9.8 billion.

The increase in exports to EU countries was driven by increased exports of fuels, and machinery and transport equipment of £5.0 billion and £3.2 billion respectively. Imports of machinery and transport equipment increased £4.0 billion, while imports of material manufactures and miscellaneous manufactures increased £2.3 billion and £1.8 billion respectively.

Figure 7: The widening of the trade in goods deficit was due mainly to trade with non-EU countries

Changes in UK goods exports, imports and trade balance with EU and non-EU countries, 12 months to March 2019 compared with 12 months to March 2018

Source: Office for National Statistics

Download this chart Figure 7: The widening of the trade in goods deficit was due mainly to trade with non-EU countries

Image .csv .xls10. Quality and methodology

Trade is measured through both exports and imports of goods and services. Data are supplied by over 30 sources including several administrative sources, HM Revenue and Customs (HMRC) being the largest for trade in goods.

This monthly release contains tables showing the total value of trade in goods together with chained volume measures (CVMs) and implied deflators (IDEFs). Figures are analysed by broad commodity group (CP, CVMs and IDEFs) and according to geographical area (CP only). In addition, the UK trade statistical bulletin also includes early monthly estimates of the value of trade in services.

Further qualitative data and information can be found in the attached datasets. This includes data on:

Detailed methodological notes are published in the UK Balance of Payments, The Pink Book 2018.

The UK trade methodology web pages have been developed to provide detailed information about the methods used to produce UK trade statistics.

The UK trade Quality and Methodology Information report contains important information on:

the strengths and limitations of the data and how it compares with related data

uses and users of the data

how the output was created

the quality of the output including the accuracy of the data