Cynnwys

- Main points

- Things you need to know about this release

- The total UK trade deficit widened by £3.4 billion to £8.7 billion in the three months to January 2018

- The widening of the trade in goods deficit was due to increases in imports and decreases in exports, from and to non-EU countries, in the three months to January 2018

- Large decreases in fuels export volumes combined with increases in fuels import prices had the largest impact on the widening of the trade in goods deficit, in the three months to January 2018

- The total UK trade deficit widened by £0.6 billion between December 2017 and January 2018

- What are the revisions to trade values since our last release?

- Links to related statistics

- Quality and methodology

1. Main points

The total UK trade (goods and services) deficit widened by £3.4 billion to £8.7 billion in the three months to January 2018; excluding erratic commodities, the deficit widened by £2.6 billion to £8.9 billion.

The £3.4 billion widening of the total trade (goods and services) deficit was due to a £3.2 billion widening of the trade in goods deficit and a £0.2 billion narrowing of the trade in services surplus.

The widening of the trade in goods deficit was due mainly to a £1.3 billion increase in imports (particularly fuels) from non-EU countries, combined with a £1.2 billion decrease in exports (including fuels) to non-EU countries, in the three months to January 2018.

Large decreases in fuels export volumes combined with increases in fuels import prices had the largest impact on the widening of the trade in goods deficit in the three months to January 2018.

Between December 2017 and January 2018, the UK total trade (goods and services) deficit widened by £0.6 billion, due primarily to an increase in goods imports including aircraft and cars from non-EU countries and fuels (refined oil) from EU countries.

Comparing the three months to January 2018 with the same period in 2017, the UK total trade (goods and services) deficit widened by £0.4 billion; due primarily to increases of £5.7 billion and £3.1 billion in goods (particularly fuels) and services imports respectively.

Revisions to the total trade (goods and services) balance are mainly upward from January 2017 to December 2017, due mostly to upward revisions to services exports combined with downward revisions to goods imports.

2. Things you need to know about this release

Unless otherwise stated, all trade values discussed in this release are in current prices. The time series dataset also includes chained volume measures (series for which the effects of inflation have been removed) and these are indexed to form the volume series presented in the publication tables.

Data are supplied by over 30 sources, including several administrative sources; HM Revenue and Customs (HMRC) covering trade in goods is the largest. For trade in services, data are less timely than trade in goods estimates and are sourced mainly from survey data and a variety of administrative sources. The services data are processed quarterly, so monthly forecasts are made to provide a complete trade total. The most recent monthly data can therefore be considered more uncertain.

Trade statistics for any one month can be erratic. For that reason, we recommend comparing the latest three months against the preceding three months and the same three months of the previous year.

Oil and other “erratic” commodities can make a large contribution to trade in goods, but often mask the underlying trend in the export or import values due to their volatility. The “erratics” series includes ships, aircraft, precious stones, silver and non-monetary gold. Non-monetary gold can have a particularly large impact on growth rates, due to the large volumes of gold traded on the London markets. Therefore, we also publish data exclusive of these commodities, which may provide a better guide to the emerging trade picture.

In accordance with the National Accounts Revisions Policy, data in this release have been revised from January 2017 to December 2017 for goods and services data.

The UK Statistics Authority suspended the National Statistics designation of UK trade on 14 November 2014. We have now responded to all of the specific requirements of the reassessment of UK trade and are in the final stages of providing evidence to the Authority. We are undertaking a programme of improvements to UK trade statistics in line with the UK trade development plan that will also address anticipated future demands. While delivering against this plan, we will continue to work with the Office for Statistics Regulation team to regain National Statistics status for UK trade statistics. We welcome feedback on this development plan.

Nôl i'r tabl cynnwys3. The total UK trade deficit widened by £3.4 billion to £8.7 billion in the three months to January 2018

The total trade (goods and services) deficit widened by £3.4 billion to £8.7 billion in the three months to January 2018 (Figure 1). This was due primarily to a £3.2 billion widening of the trade in goods deficit to £36.5 billion; which resulted from a 1.7% (£2.1 billion) increase in goods imports, combined with a 1.3% (£1.2 billion) decrease in goods exports to £86.5 billion.

The trade deficit in fuels, which widened by £3.1 billion to £5.4 billion, had the largest impact on the trade in goods deficit; followed by a £1.4 billion widening of the unspecified goods deficit. The 21.4% (£2.4 billion) increase in imports of fuels had the largest impact on the increase in goods imports. In addition, the 8.3% (£0.7 billion) decrease in exports of fuels also had a large impact on the decrease in goods exports.

Of fuels imports, oil was the largest contributor, increasing by 17.4% (£1.5 billion): refined oil increased 17.3% (£0.8 billion) and crude oil increased 17.4% (£0.7 billion). Exports of oil also had the largest fall amongst fuels, decreasing by 5.8% (£0.4 billion) – particularly crude oil (12.3%; £0.6 billion).

While we have no direct evidence, the trade deficit in fuels coincides with weakness in the oil and gas extraction sub-industry during December 2017; which was due to the shut-down of the Forties oil pipeline for a large part of this month.

Trade in services also contributed to the widening of the total trade deficit in the three months to January 2018. The trade surplus in services narrowed by £0.2 billion to £27.9 billion, due to larger increases in imports than exports; 2.5% (£1.1 billion) and 1.3% (£0.9 billion) respectively.

When erratic commodities are excluded, the UK trade deficit widened by £2.6 billion to £8.9 billion in the three months to January 2018. The widening was due mainly to trade in goods imports increasing by 1.8% (£2.1 billion) to £117.7 billion, combined with a 2.5% (£1.1 billion) increase in services imports. Total (goods and services) exports increased 0.4% (£0.6 billion) to £153.4 billion. Given the larger increase in total imports than total exports, the trade deficit excluding erratic commodities widened.

The main commodity contributor to the increase in imports excluding erratic commodities was fuels (particularly refined and crude oil), which increased 21.4% (£2.4 billion), alongside smaller decreases in imports of other goods commodities.

Over the last year, the UK’s total trade deficit widened by £0.4 billion between the three months to January 2017 and the three months to January 2018. This was due primarily to increases of 4.8% (£5.7 billion) and 7.5% (£3.1 billion) in goods and services imports respectively. Imports of fuels and unspecified goods increased the most, by £2.2 billion and £1.2 billion respectively. Although total (goods and services) exports increased by 5.6% (£8.4 billion), this increase was more than offset by the larger increase in total (goods and services) imports.

Figure 1: Three-month on three-month UK trade balances, July 2013 to January 2018

Source: Office for National Statistics

Download this chart Figure 1: Three-month on three-month UK trade balances, July 2013 to January 2018

Image .csv .xls4. The widening of the trade in goods deficit was due to increases in imports and decreases in exports, from and to non-EU countries, in the three months to January 2018

The UK trade in goods deficit widened by £3.2 billion to £36.5 billion in the three months to January 2018. This was due primarily to a 1.7% (£2.1 billion) increase in goods imports to £123 billion, combined with a 1.3% (£1.2 billion) decrease in goods exports to £86.5 billion.

Figures 2 and 3 show the value contribution of goods exports and imports to and from EU and non-EU countries respectively in the three months to January 2018.

The increase in goods imports as well as the decrease in goods exports was due mainly to trade with non-EU countries. The increase in imports from non-EU countries was larger than EU imports, increasing by 2.3% (£1.3 billion) and 1.2% (£0.8 billion) respectively. The increases in imports from non-EU and EU countries were due primarily to increases in fuels imports, by 18.2% (£1.5 billion) and 31.2% (£0.8 billion) respectively. The increase in fuels imports (particularly refined oil and crude oil) more than offset decreases in other goods imports from non-EU and EU countries.

In addition, the 2.8% (£1.2 billion) decrease in goods exports to non-EU countries, more than offset a 0.2% (£89 million) increase in exports to EU countries.

The decrease in exports to non-EU countries was due to unspecified goods (including non-monetary gold) and fuels exports, which decreased by 18.7% (£0.5 billion) and 13.8% (£0.5 billion) respectively. Of fuels, crude oil had the largest impact, decreasing by 12.3% (£0.6 billion).

The decrease in fuels exports (particularly fuels other than oil) to EU countries, by 4.8% (£0.3 billion), partially offset increases in other goods exports to the EU. Increases in EU exports were due mainly to material manufactures and miscellaneous manufactures exports, which increased by 6.6% (£0.3 billion) and 2.8% (£0.2 billion) respectively.

While we have no direct evidence, the trade deficit in fuels coincides with weakness in the oil and gas extraction sub-industry during December 2017; which was due to the shut-down of the Forties oil pipeline for a large part of this month.

The combined effect of exports decreasing as imports increased, meant that the deficit with non-EU countries widened by £2.5 billion to £12.1 billion in the three months to January 2018. This follows a £2.2 billion narrowing of the deficit in the three months to October 2017, when exports increased as imports decreased.

As a result of larger increases in imports than exports, the deficit with EU countries widened by £0.7 billion to £24.4 billion. This is the second consecutive three-month period where the deficit with EU countries widened.

Figure 2: Contribution of goods exports to total EU and non-EU exports, three-months to January 2018 on previous three-months to October 2017

Source: Office for National Statistics

Download this chart Figure 2: Contribution of goods exports to total EU and non-EU exports, three-months to January 2018 on previous three-months to October 2017

Image .csv .xls

Figure 3: Contribution of goods imports to total EU and non-EU imports, three-months to January 2018 on previous three-months to October 2017

Source: Office for National Statistics

Download this chart Figure 3: Contribution of goods imports to total EU and non-EU imports, three-months to January 2018 on previous three-months to October 2017

Image .csv .xlsWhen excluding erratic commodities, the latest three-month balance patterns are unchanged for both the non-EU and EU trade in goods deficits1. The non-EU trade deficit widened by £2.1 billion to £11.1 billion, while the EU deficit widened by £0.3 billion to £25.6 billion in the three months to January 2018.

Notes for: The widening of the trade in goods deficit was due to increases in imports and decreases in exports, from and to non-EU countries, in the three months to January 2018

- Data can be found using series identifiers SDCR and SDED in the MRET time series dataset

5. Large decreases in fuels export volumes combined with increases in fuels import prices had the largest impact on the widening of the trade in goods deficit, in the three months to January 2018

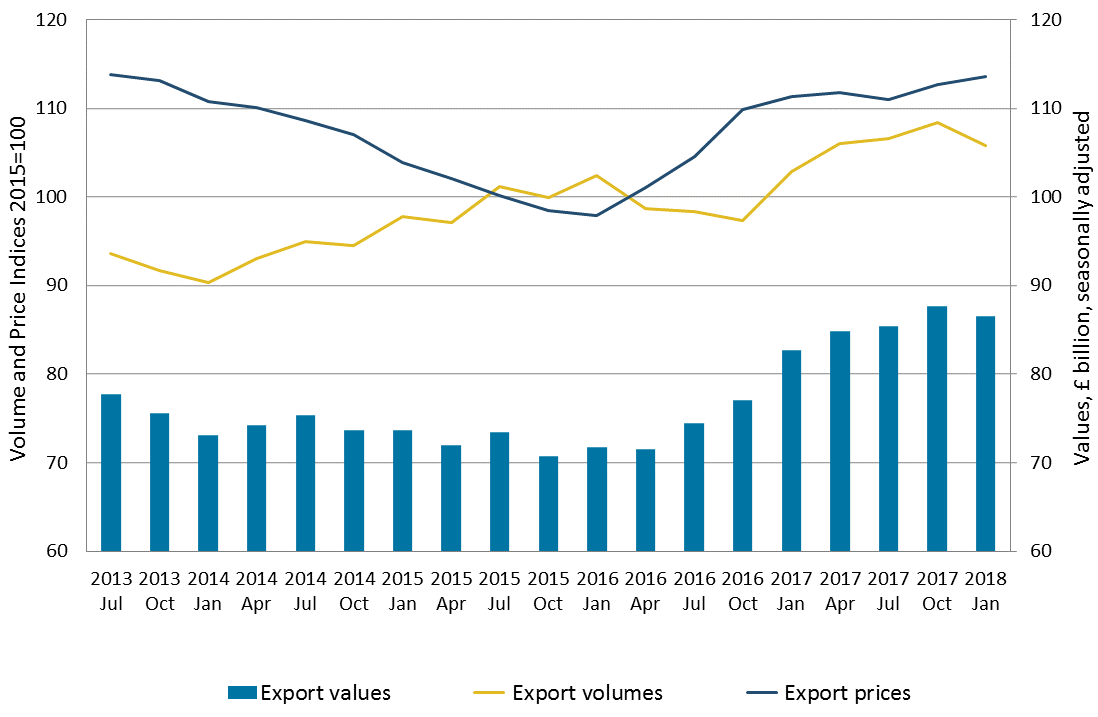

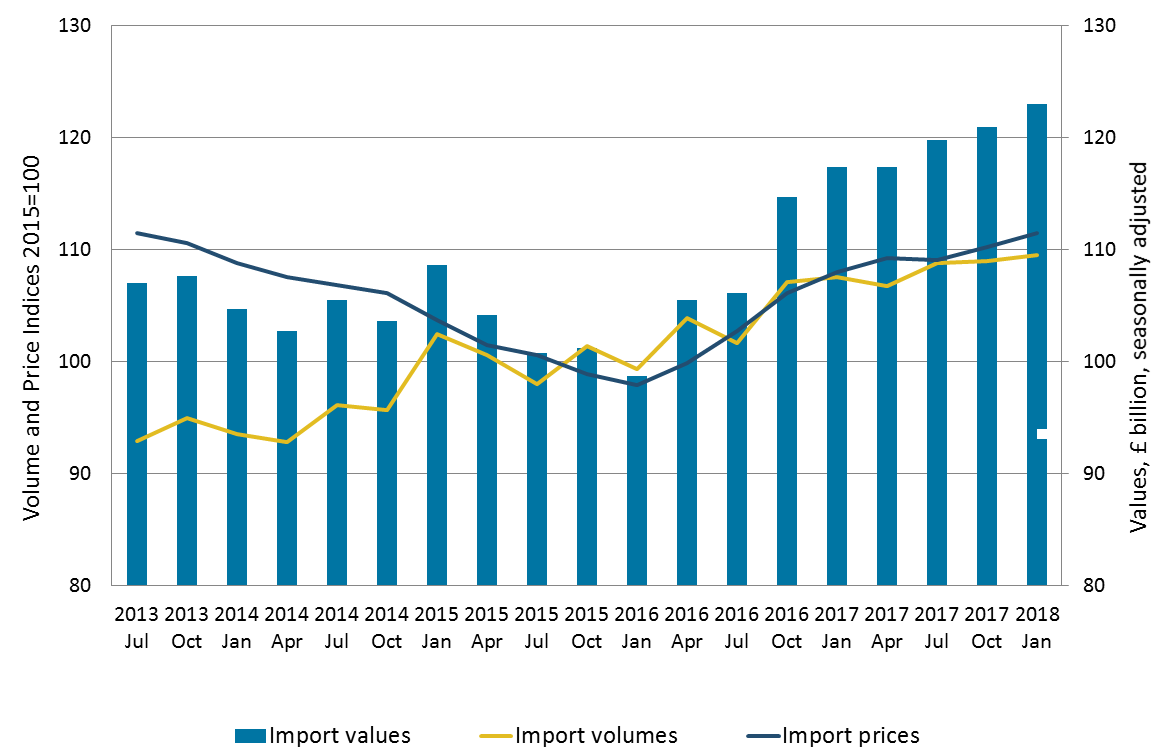

Figures 4 and 5 show the three-month on three-month UK goods export and import values, volumes and prices respectively from July 2013 to January 2018.

The £1.2 billion decrease in the value of total goods exports to £86.5 billion was due primarily to volume decreases in the three months to January 2018. Total goods export volumes decreased by 2.5% while total goods export prices rose by 0.9%. The decrease in export volumes follows a 1.8% increase in exports volumes in the three months to October 2017.

The 21.4% decrease in fuels (oil) export volumes had a large impact on the fall in total goods export volumes. When excluding oil, total goods export volumes decreased by 0.8%. The value decrease in fuels exports was due largely to the 21.4% decrease in fuels export volumes, while fuels export prices increased by 15.4%.

The £2.1 billion increase in the value of total goods imports to £123 billion was due mainly to price increases in the three months to January 2018. Total goods import prices increased by 1.1%, while total goods import volumes rose by 0.5%. The increase in import prices is the second consecutive three-month increase in import prices; this followed a 0.2% decrease in import prices in the three months to July 2017.

The 15.5% increase in fuels (oil) import prices had a large impact on the increase in total goods import prices. When excluding oil, total goods import prices decreased by 0.3%. The value increase in fuels imports was due largely to price movements: fuels import prices increased by 15.5% while fuels import volumes increased by 7.8%.

While we have no direct evidence, the trade deficit in fuels coincides with weakness in the oil and gas extraction sub-industry during December 2017; which was due to the shut-down of the Forties oil pipeline for a large part of this month.

The combined effect of decreased total goods export volumes as total goods import volumes increased, alongside larger increases in total goods import prices than export prices, was a £3.2 billion widening of the trade in goods deficit to £36.5 billion. This coincides with an increase in the value of sterling in the three months to January 2018.

While simple economic theory suggests an increase in the value of sterling should result in an increase in export prices (exports decreasing in competitiveness) and a decrease in import prices, in practice the impact of a sterling change is likely to be much more complex. Our Economic review has detailed the economic theory of the expected impact of sterling exchange rate movements on export and import volumes and prices.

Although the increase in total goods import prices may appear contrary to economic theory, while increases in export prices are in line with economic theory, it is important to note that prices are reported in sterling for the UK rather than foreign currency terms. As detailed in the Economic review, changes in prices (on a sterling basis) are likely to be largely attributable to the amount of trade conducted on a foreign currency basis (with EU and non-EU countries) as price changes are lagged in the short-term – therefore, it is possible there may be no change in the price in foreign currency terms.

Figure 4: Three-month on three-month UK goods export values, volumes and prices, July 2013 to January 2018

Source: Office for National Statistics

Download this image Figure 4: Three-month on three-month UK goods export values, volumes and prices, July 2013 to January 2018

.png (47.6 kB) .xlsx (10.4 kB)

Figure 5: Three-month on three-month UK goods import values, volumes and prices, July 2013 to January 2018

Source: Office for National Statistics

Download this image Figure 5: Three-month on three-month UK goods import values, volumes and prices, July 2013 to January 2018

.png (50.7 kB) .xlsx (10.4 kB)The volume of goods exported to non-EU countries decreased 3.4% and non-EU goods import volumes increased 0.7% in the three months to January 2018. This follows a 3.6% increase in exports to non-EU countries and a 1.5% decrease in non-EU imports in the three months to October 2017. Non-EU export and import prices increased by 0.4% and 1.5% respectively, for the second consecutive three-month period.

When excluding oil, non-EU export volumes decreased by 1.5%, which coincides with the 21.4% decrease in total fuels (oil) export volumes. Similarly excluding oil, non-EU export and import prices decreased by 0.5% and 0.8% respectively, which coincides with total fuels (oil) export and import sterling prices increasing 15.4% and 15.5% respectively in the three months to January 2018.

The volume of goods exported to other EU countries decreased 1.4% and goods volumes imported from the EU increased 0.4%, for the second consecutive three-month period respectively. EU export and import prices increased 1.4% and 0.7% respectively. This follows a 0.2% decrease in EU exports prices and a 1.5% increase in EU import prices in the three months to July 2017.

When excluding oil, EU export volumes decreased by 0.1%, which coincides with the 21.4% decrease in total fuels (mainly oil) export volumes. Similarly excluding oil, EU export prices decreased by 0.2% and import prices increased by 0.1%, which coincides with the large increases in total fuels (mainly oil) export and import sterling prices in the three months to January 2018.

The export value decreases in fuels (mainly oil) to non-EU and EU countries, 13.8% (£0.5 billion) and 4.8% (£0.3 billion) respectively, had a large impact on the 1.3% (£1.2 billion) decrease in the total trade in goods export value. This was due mainly to a 21.4% decrease in total fuels export volumes.

In addition, the import value increase in fuels (mainly oil) from non-EU and EU countries, 18.2% (£1.5 billion) and 31.2% (£0.8 billion) respectively, had a large impact on the 1.7% (£2.1 billion) increase in the total trade in goods import value. This was due mainly to a 15.5% increase in total fuels import prices.

As a result of the decreases in export volumes to non-EU and EU countries alongside the respective increases in import prices, these movements had a large contribution to the total trade in goods deficit widening (by £3.2 billion to £36.5 billion).

Nôl i'r tabl cynnwys6. The total UK trade deficit widened by £0.6 billion between December 2017 and January 2018

The total trade (goods and services) deficit widened by £0.6 billion to £3.1 billion between December 2017 and January 2018. This was due primarily to trade in goods imports increasing 3.5% (£1.4 billion) to £41.8 billion. The increase in goods imports was due mainly to aircraft (£0.4 billion) and cars (£0.2 billion) from non-EU countries and fuels (£0.4 billion), particularly refined oil, from EU countries.

Excluding erratic commodities, the total trade deficit widened by £1.0 billion to £3.5 billion between December 2017 and January 2018. This was due mainly to a 3.9% (£1.5 billion) increase in goods imports to £40.2 billion, which was larger than increases in total goods and services exports (£0.5 billion). The main contributors to the increase in imports were cars (£0.2 billion) from non-EU countries, and fuels (£0.4 billion) and road vehicles other than cars (£0.2 billion) from EU countries.

Nôl i'r tabl cynnwys7. What are the revisions to trade values since our last release?

In accordance with the National Accounts Revisions Policy, trade in goods and services data in this release have been revised from January 2017 to December 2017 (Figure 6).

Revisions to the total trade (goods and services) balance are relatively small and upward (narrowing of the deficit) from January 2017 to June 2017, although July 2017 to December 2017 saw larger revisions with the largest upward revision occurring in December (£2.4 billion). This was due primarily to a £2.2 billion downward revision to goods imports alongside a £1.1 billion upward revision to services exports. These revisions were slightly offset by downward goods exports (£0.4 billion) and upward services imports (£0.5 billion) revisions.

Trade in goods revisions over the period are due mainly to downward revisions to imports of unspecified goods (£1.7 billion), slightly offset by downward revisions to exports of unspecified goods (£0.2 billion).

The trade in services balance revisions are consistently upward each month over the period due to larger upward revisions to exports than imports. Revisions to services are due mainly to late survey returns from the International Trade in Services (ITIS) survey: particularly data related to other business services, and royalties and intellectual property services.

Figure 6: Revisions to UK trade balances, January 2017 to December 2017

Source: Office for National Statistics

Download this chart Figure 6: Revisions to UK trade balances, January 2017 to December 2017

Image .csv .xls9. Quality and methodology

Trade is measured through both imports and exports of goods and/or services. Data are supplied by over 30 sources including several administrative sources, HM Revenue and Customs (HMRC) being the largest.

This monthly release contains tables showing the total value of trade in goods together with index numbers of volume and price. Figures are analysed by broad commodity group (values and indices) and according to geographical area (values only). In addition, the UK trade statistical bulletin also includes early monthly estimates of the value of trade in services.

Further qualitative data and information can be found in the attached datasets. This includes data on:

Detailed methodological notes are published in the UK Balance of Payments, The Pink Book 2017.

The UK trade methodology web pages have been developed to provide detailed information about the methods used to produce UK trade statistics.

The UK trade Quality and Methodology Information report contains important information on:

the strengths and limitations of the data and how it compares with related data

uses and users of the data

how the output was created

the quality of the output including the accuracy of the data