Cynnwys

- Main points

- Your views matter

- Overview

- Net FDI positions by geography, component and industry

- Net FDI earnings by geography, component and industry

- Net FDI flows by geography, component and industry

- FDI economic commentary

- Annex 1: FDI estimates using the asset and liability principle and revisions to previously published estimates

- Quality and methodology

- Background notes

1. Main points

The UK’s international investment position abroad (outward investment) fell from £1,078.7 billion in 2014 to £1,052.1 billion in 2015.

Net earnings from direct investment abroad by UK companies (outward earnings) fell from £68.5 billion in 2014 to £56.9 billion in 2015, the fourth consecutive fall.

Net flows of foreign direct investment (FDI) abroad (outward investment) were negative in 2015, with a disinvestment of £52.9 billion. The level of disinvestment was smaller compared with 2014, when there was a disinvestment of £90.8 billion.

The international investment position held by foreign companies in the UK (inward investment) decreased from £1,013.3 billion in 2014 to £950.3 billion in 2015.

Net earnings from direct investment in the UK (inward investment) decreased from £48.0 billion in 2014 to £47.9 billion in 2015, the second consecutive decline.

Net flows of foreign direct investment into the UK (inward investment) increased from £15.0 billion in 2014 to £21.6 billion in 2015.

Nôl i'r tabl cynnwys2. Your views matter

We are constantly aiming to improve this release and its associated commentary. We would welcome any feedback you might have and would be particularly interested in knowing how you make use of these data to inform our work. For further information please contact us via email: fdi@ons.gov.uk or telephone Sami Hamroush on +44 (0)1633 455087.

Nôl i'r tabl cynnwys3. Overview

This statistical bulletin provides data on foreign direct investment (FDI) flows, positions and earnings involving UK companies. The investment figures are published on a net basis, that is, they consist of investments minus disinvestments. Investments can include acquisitions of assets or shares and disinvestments can include the disposal of assets or shares.

FDI statistics presented in this statistical bulletin have undergone methodological improvements, which address a number of recommendations that were published in July 2016’s National Statistics Quality Review of FDI statistics. In addition to these recommendations, the historical time series presented in the bulletin for periods between 2007 and 2013 have been revised to ensure consistency with the latest international standards and wider national accounts revisions. A detailed note that presents the impact of these improvements has been published alongside this statistical bulletin.

The estimates published for 2015 are based on the Annual Foreign Direct Investment survey. The Balance of Payments estimates to be published on 23 December 2016 will include these data, as it will be utilised to benchmark data currently published for 2015, which are based on the Quarterly FDI survey.

Nôl i'r tabl cynnwys4. Net FDI positions by geography, component and industry

Figure 1: UK outward and inward foreign direct investment (FDI) positions, 2006 to 2015

Source: Office for National Statistics

Notes:

All values are at current prices (see background notes for definition).

Positions definition can be found in the background notes.

Download this chart Figure 1: UK outward and inward foreign direct investment (FDI) positions, 2006 to 2015

Image .csv .xlsThe UK’s international investment position abroad (outward foreign direct investment (FDI) position) decreased from £1,078.7 billion to £1,052.1 billion between 2014 and 2015, the lowest level recorded since 2009 (£1,014.4 billion) (Figure 1) . This marks the second consecutive period of annual decline.

The international investment position held by foreign companies in the UK (inward FDI positions) decreased from £1,013.3 billion to £950.3 billion between 2014 and 2015 (Figure 1) . This marks the first period of annual decline since 2007, having previously followed an upward trend since 2008.

Geographic analysis (Table 3.1)

Figure 2: UK outward and inward foreign direct investment (FDI) positions by continent, 2006 to 2015

Source: Office for National Statistics

Notes:

All values are at current prices (see background notes for definition).

Positions definition can be found in the background notes.

Geographic definitions can be found in the background notes.

Download this chart Figure 2: UK outward and inward foreign direct investment (FDI) positions by continent, 2006 to 2015

Image .csv .xlsOutward

Europe and the Americas remained the dominant areas for UK international investment positions abroad, accounting for 50.1% and 32.6% of total UK outward FDI positions respectively. UK outward FDI positions in Europe experienced a small increase in 2015, having previously followed a downward trend since 2011 (Figure 2) . Within Europe, the Netherlands and Luxembourg continued to be the largest destinations for UK international investment positions abroad with levels recorded in 2015 of £126.4 billion and £92.8 billion respectively.

The UK’s international investment position within the Americas experienced a decline in 2015 for the first time since 2010, falling by £24.7 billion to a level of £342.8 billion. Despite this decline, the level in 2015 remains the second largest recorded value in the time series since 2006 for the Americas (Figure 2). The USA (£237.3 billion) continued to be the largest destination for UK international investment positions abroad within the Americas in 2015.

Inward

Europe and the Americas remained the dominant sources for international investment positions in the UK and accounted for 56.3% and 34.5% of total UK inward FDI positions respectively in 2015. Inward positions from Europe declined in 2015, falling from £600.9 billion in 2014 to £535.3 billion, marking the first decline in inward positions since 2007 (Figure 2). The Netherlands made the largest contribution to this decline within Europe, with the inward FDI position falling by £40.4 billion between 2014 and 2015.

The Inward FDI position held by the Americas increased in 2015, rising from £323.6 billion in 2014 to £327.5 billion and marked the highest level recorded of inward FDI positions from the Americas in the time series 2006 to 2015 (Figure 2). The USA was the largest source for inward FDI positions from the Americas, with a reported inward FDI position of £252.1 billion in 2015. With the exception of 2013, the inward FDI position from the USA has been increasing annually since 2010.

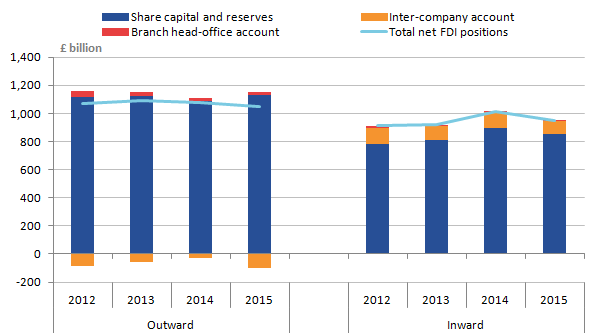

Components analysis (Table 3.2)

Figure 3: UK outward and inward FDI positions by component, 2006 to 2015

Source: Office for National Statistics

Notes:

All values are at current prices (see background notes for definition).

Positions definition can be found in the background notes.

Download this image Figure 3: UK outward and inward FDI positions by component, 2006 to 2015

.png (11.4 kB) .xls (18.9 kB)Outward

Analysing the fall in the UK’s international investment position abroad by component, shows that the decline in 2015 of £26.6 billion was solely driven by a fall in amounts due to UK parent companies on the inter-company account, which fell from a negative position of £27.4 billion in 2014 to a negative position of £96.4 billion in 2015. Offsetting the decline were increases to both UK companies’ share of foreign companies share capital and reserves, and amount due to UK parent companies on branch head office account, which increased by £38.6 billion and £3.8 billion respectively (Figure 3).

Inward

In contrast to the outward positions, all components of the inward international investment position in the UK showed declines in 2015. Foreign companies’ share of UK companies’ share capital and reserves decreased the most, falling by £36.1 billion to a position of £856.1 billion in 2015. Amount due to foreign parent companies on the inter- company account also made a notable contribution to the decline in 2015, falling from an inward position of £117.4 billion in 2014 to £92.3 billion in 2015 (Figure 3).

Industry analysis (Table 3.3)

Figure 4: UK outward and inward foreign direct investment (FDI) positions by industry, 2006 to 2015

Source: Office for National Statistics

Notes:

All values are at current prices (see background notes for definition).

Positions definition can be found in the background notes.

Industry definitions can be found in the background notes.

Download this chart Figure 4: UK outward and inward foreign direct investment (FDI) positions by industry, 2006 to 2015

Image .csv .xlsOutward

The decline in the UK’s international investment position abroad was seen in both the production and services industries in 2015, with falls of £16.8 billion and £18.3 billion respectively (Figure 4).

Within the production industries, mining and quarrying experienced the largest decline, falling from a total international investment position abroad of £190.3 billion in 2014 to £158.6 billion in 2015. The time series between 2012 and 2015 shows that, in recent years, the mining and quarrying industry consistently made the largest contribution to the overall investment position within the production industries.

The UK’s investment position abroad from within the services industries has been declining annually in recent years. The financial services industry made the largest contribution to the overall services total and was the industry driving the decline in 2015, falling from an outward investment position of £257.5 billion in 2014 to £236.3 billion. The transport and storage industries also saw a notable decline in their investment position abroad, falling from £15.6 billion in 2014 to £7.4 billion in 2015.

Inward

The decline in the international investment position in the UK was witnessed in both the production and services industries in 2015, with decreases of £37.8 billion and £26.2 billion respectively (Figure 4).

The decrease in the international investment position within the production industries was driven by a fall in mining and quarrying, which decreased from a total position of £95.9 billion in 2014 to £80.3 billion in 2015. The food products, beverage and tobacco products industry also saw a notable decline in its international investment position, falling from a position of £57.0 billion in 2014 to £42.2 billion in 2015. For both these industries, the levels seen in 2015 are the lowest recorded values in the time series between 2012 and 2015.

The fall in the international investment position within the services industries was primarily driven by the retail and wholesale trade, repair of motor vehicles and motor cycles industry, which fell from an investment position of £125.2 billion in 2014 to £113.2 billion in 2015. Declines were also experienced from the other services, and administrative and support service activities industries, with positions falling by £8.6 billion and £8.3 billion respectively. Offsetting the decline was the financial services industries, which saw their investment position in the UK increase from £278.0 billion in 2014 to £285.5 billion in 2015.

Nôl i'r tabl cynnwys5. Net FDI earnings by geography, component and industry

Figure 5: UK outward and inward foreign direct investment (FDI) earnings, 2006 to 2015

Source: Office for National Statistics

Notes:

All values are at current prices (see background notes for definition).

Earnings definition can be found in the background notes.

Download this chart Figure 5: UK outward and inward foreign direct investment (FDI) earnings, 2006 to 2015

Image .csv .xlsThe value of the net direct investment earnings UK businesses and residents generated on their direct investment abroad (outward foreign direct investment (FDI) earnings) decreased from £68.5 billion in 2014 to £56.9 billion in 2015 (Figure 5). Outward FDI earnings have been declining annually since 2012 and the level recorded in 2015 marks the lowest level recorded in the time series since 2006.

The value of net direct investment earnings generated in the UK by overseas investors (inward FDI earnings) decreased from £48.0 billion in 2014 to £47.9 billion in 2015 (Figure 5). This marks the second consecutive period of decline since 2014 and is in contrast to the upward trend experienced between 2010 and 2013.

Geographic analysis (Table 4.1)

Figure 6: UK outward and inward foreign direct investment (FDI) earnings by continent, 2006 to 2015

Source: Office for National Statistics

Notes:

All values are at current prices (see background notes for definition).

Earnings definition can be found in the background notes.

Geographic definitions can be found in the background.

Download this chart Figure 6: UK outward and inward foreign direct investment (FDI) earnings by continent, 2006 to 2015

Image .csv .xlsOutward

In 2015, Europe became the region where the majority of UK outward FDI earnings were generated. UK earnings from Europe increased from £22.4 billion in 2014, to £24.0 billion in 2015; this followed a fall in outward earnings in 2014 of £8.5 billion (Figure 6). Within Europe, Germany and France made the largest contributions to the increase in UK outward FDI earnings, increasing by £2.3 billion and £1.9 billion respectively in 2015.

The Americas was the second largest region where UK outward FDI earnings were generated in 2015, however, earnings from the America s fell by £7.5 billion in 2015 to a level of £15.3 billion, similar to the 2015 level recorded with Asia of £14.0 billion (Figure 6). Within the Americas, the USA made the largest contribution to the decline in outward earnings followed by Bermuda, falling by £5.3 billion and £1.8 billion respectively.

Inward

Europe and the Americas remained the dominant areas from where the majority of earnings generated in the UK by overseas investors originated, accounting for 47.2% and 42.2% of total inward FDI earnings respectively.

Despite Europe remaining the dominant region for inward FDI earnings in 2015, it did experience a decline of £3.8 billion, falling to £22.6 billion in 2015 (Figure 6). Within Europe, the Netherlands saw the largest fall in inward FDI earnings, declining from £6.6 billion in 2014 to £3.1 billion in 2015, a fall of £3.5 billion. Germany and Spain also experienced notable declines in inward FDI earnings, falling by £1.2 billion and £1.1 billion respectively.

Inward FDI earnings from the Americas showed growth in 2015 with earnings increasing from £16.9 billion in 2014 to £20.2 billion (Figure 6). The USA accounted for the majority of the increase, with inward FDI earnings increasing from £12.7 billion in 2014 to £17.5 billion in 2015. Canada partially offset the increase with inward FDI earnings falling from £1.3 billion in 2014 to £0.3 billion in 2015, the lowest value recorded in the time series between 2006 and 2015.

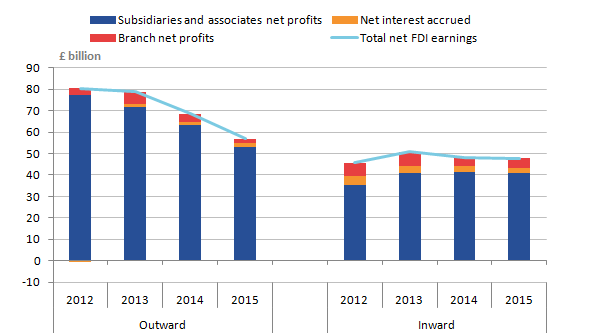

Component analysis (Table 4.2)

Figure 7: UK outward and inward FDI earnings by component, 2006 to 2015

Source: Office for National Statistics

Notes:

All values are at current prices (see background notes for definition).

Earnings definition can be found in the background notes.

Download this image Figure 7: UK outward and inward FDI earnings by component, 2006 to 2015

.png (12.1 kB) .xls (19.5 kB)Outward

Analysing the fall in net FDI earnings abroad by component in 2015 shows the decline of £11.5 billion is largely attributed to UK companies’ share of foreign companies’ net profits, which declined from £63.3 billion in 2014 to £53.0 billion in 2015 (Figure 7). This component began to decline in 2012 and 2015 marks the lowest recorded value in the time series between 2006 and 2015. UK companies’ share of foreign branches’ net profits also showed a decline in 2015, falling from £4.0 billion in 2014 to £2.2 billion in 2015, marking the second consecutive period of annual decline.

Inward

The fall in net FDI earnings in the UK is more subdued than in outward FDI earnings for 2015, whereby net FDI earnings in the UK fell by £0.1 billion in 2015, compared with a fall of £11.5 billion on outward FDI earnings (Figure 7). The annual decline in net inward FDI earnings was driven by a fall in foreign companies’ share of UK companies’ net profits, falling from £41.5 billion in 2014 to £40.7 billion in 2015. Net interest accrued to foreign parent companies also declined in 2015, falling from £2.9 billion in 2014 to £2.4 billion in 2015. Offsetting the decline in net inward FDI earnings was UK branches’ net profits, which increased from £3.6 billion in 2014 to £4.8 billion in 2015.

Industry analysis (Table 4.3)

Figure 8: UK outward and inward foreign direct investment (FDI) earnings by industry, 2006 to 2015

Source: Office for National Statistics

Notes:

All values are at current prices (see background notes for definition).

Earnings definition can be found in the background notes.

Industry definitions can be found in the background notes.

Download this chart Figure 8: UK outward and inward foreign direct investment (FDI) earnings by industry, 2006 to 2015

Image .csv .xlsOutward

The decline in net outward FDI earnings of £11.5 billion in 2015 was solely attributable to the production industries, which saw net outward FDI earnings fall from £31.8 billion in 2014 to £18.2 billion in 2015, a fall of 43% (Figure 8). Within the production industries, the decline in 2015 was primarily driven by the mining and quarrying industry, which saw net outward FDI earnings fall from £15.0 billion in 2014 to £0.1 billion in 2015, a fall of £14.9 billion.

Net outward earnings from within the services industries showed growth in 2015, rising from £27.5 billion in 2014 to £28.6 billion (Figure 8). The other services industries increased the most, rising by £1.2 billion to a net earnings total of £6.4 billion in 2015 Offsetting the increase with the services industries was financial services, which continued to show an annual decline in 2015, falling from £15.3 billion in 2014 to £13.9 billion.

Inward

The decline in net inward FDI earnings in 2015 of £0.1 billion was primarily driven by a decline in inward FDI earnings from within the production industries, where net inward FDI earnings fell from £14.1 billion in 2014 to £12.6 billion in 2015 (Figure 8). Net inward earnings from within the production industries have been declining annually in recent years. Within the production industries, transport equipment saw the largest decline in net FDI inward earnings, falling from £3.2 billion in 2014 to £2.2 billion in 2015. Other notable declines were experienced within the food products, beverages and tobacco products, and mining and quarrying industries, with falls of £0.7 billion and £0.5 billion respectively.

Net inward FDI earnings from within the services industries increased from £32.7 billion in 2014 to £33.8 billion in 2015 (Figure 8). The financial services, and information and communication industries contributed most towards the increase in 2015, with increases of £1.8 billion and £1.7 billion respectively. Offsetting the increase within the services industries was professional, scientific and technical services, which fell by £3.9 billion in 2015.

Nôl i'r tabl cynnwys6. Net FDI flows by geography, component and industry

Figure 9: UK outward and inward foreign direct investment (FDI) flows, 2006 to 2015

Source: Office for National Statistics

Notes:

All values are at current prices (see background notes for definition).

Flows definition can be found in the background notes.

Download this chart Figure 9: UK outward and inward foreign direct investment (FDI) flows, 2006 to 2015

Image .csv .xlsNet flows of direct investment abroad by UK companies (outward foreign direct investment (FDI) flows) remained negative in 2015, with a disinvestment of £52.9 billion (Figure 9). The negative flows in 2015 were smaller than the £90.8 billion disinvestment recorded in 2014. Direct investment flows abroad peaked in 2007 at £167.9 billion before falling notably in 2008 (£107.8 billion) and 2009 (£18.6 billion).

Net investment flows into the UK (inward FDI flows) increased from £15.0 billion in 2014 to £21.6 billion in 2015 and marks the first annual increase in inward FDI flows since 2013 when inward FDI flows began to decline (Figure 9).

Geographic analysis (Table 2.1)

Figure 10: UK outward and inward foreign direct investment (FDI) flows by geography, 2006 to 2015

Source: Office for National Statistics

Notes:

All values are at current prices (see background notes for definition).

Flows definition can be found in the background notes.

Geographic definitions can be found in the background notes.

Download this chart Figure 10: UK outward and inward foreign direct investment (FDI) flows by geography, 2006 to 2015

Image .csv .xlsOutward

While net FDI flows abroad recorded further disinvestment in 2015, the level of disinvestment was £37.8 billion smaller than levels recorded in 2014.

Outward FDI flows to the Americas made the largest contribution to the decline in 2015, falling from £8.4 billion in 2014 to a negative flow of £20.2 billion (Figure 10). Canada and the USA experienced the largest declines in this region, with falls of £12.6 billion and £12.4 billion respectively.

Asia made the second largest contribution to the decline in outward flows, falling from £8.7 billion in 2014 to a disinvestment of £11.8 billion in 2015 and was primarily driven by Gulf Arabian countries falling to a disinvestment of £8.5 billion in 2015.

Europe partially offset the decline in net outward flows with the value of disinvestment (negative flow) falling from £107.8 billion in 2014 to a disinvestment of £10.8 billion in 2015. Within Europe, Luxembourg was the country responsbile for the sharp fall in outward flows in 2014 falling to a disinvestment of £76.9 billion and also the country responsible for the improvement in outward flows in 2015 with a total disinvestment of £8.1 billion.

Inward

Net investment flows into the UK (inward FDI flows) increased from £15.0 billion in 2014 to £21.6 billion in 2015. The Americas made the largest contribution to the increase in inward FDI flows, rising by £19.3 billion to £27.2 billion in 2015 (Figure 10). Within the Americas, inward FDI flows from the USA showed the largest increase, with a reported figure of £20.1 billion in 2015 marking the highest recorded value since 2011 (£40.1 billion).

Offsetting the increase in inward FDI flows from the Americas in 2015 was Europe, which saw the value of inward FDI flows continuing to fall in 2015 with a disinvestment of £12.1 billion. The decline was driven by the Netherlands, where flows fell by £19.8 billion in 2014 to disinvestment of £22.6 billion in 2015.

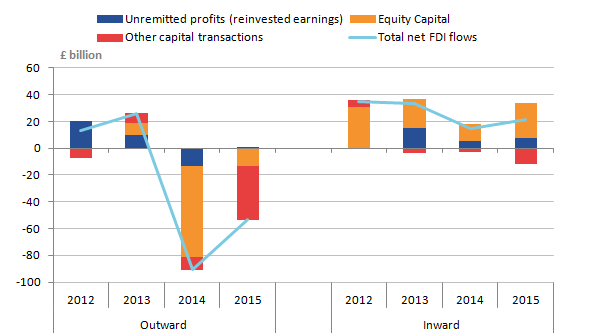

Component analysis (Table 2.2)

Figure 11: UK outward and inward FDI flows by component, 2006 to 2015

Source: Office for National Statistics

Notes:

All values are at current prices (see background notes for definition).

Flows definition can be found in the background notes.

Download this image Figure 11: UK outward and inward FDI flows by component, 2006 to 2015

.png (14.6 kB) .xls (18.4 kB)Outward

Analysing net FDI flows abroad by component shows that in 2015, other capital transactions made the largest negative contribution to overall investment flows, with increased disinvestment (negative flows) from £9.8 billion in 2014 to £40.2 billion in 2015. This is in contrast to 2014, when the driving component of disinvestment in outward FDI flows was equity capital. Equity capital flows in 2015 recorded disinvestment of £13.2 billion, notably smaller than £67.6 billion disinvestment recorded in 2014. Outward flows of unremitted profits increased by £13.9 billion in 2015 from a negative flow of £13.4 billion in 2014 to £0.5 billion in 2015 (Figure 11).

Inward

Inward FDI flows appear more stable compared with outward flows. In 2015, net flows into the UK increased by £6.6 billion to £21.6 billion. This was driven by an increase in equity capital, which rose from £13.2 billion in 2014 to £26.2 billion in 2015. Offsetting the increase in equity capital was a decline in other capital transactions, which increased from a disinvestment of £3.2 billion in 2014 to a disinvestment of £11.9 billion in 2015 (Figure 11).

Industry analysis (Table 2.3)

Figure 12: UK outward and inward foreign direct investment (FDI) flows by industry, 2006 to 2015

Source: Office for National Statistics

Notes:

All values are at current prices (see background notes for definition).

Flows definition can be found in the background notes.

Industry definitions can be found in the background notes.

Download this chart Figure 12: UK outward and inward foreign direct investment (FDI) flows by industry, 2006 to 2015

Image .csv .xlsOutward

The improvement in outward FDI flows in 2015 was driven by the services industries, which saw flows fall from a £105.8 billion disinvestment in 2014 to an £11.3 billion disinvestment in 2015 (Figure 12). Within the services industries, information and communication made the largest contribution to the fall in overall disinvestment (negative flows), with disinvestment in this industry grouping falling from a £77.4 billion in 2014 to £3.3 billion in 2015.

The increase seen within the services industries was partly offset by the production industries, which saw a decline in outward FDI flows in 2015 of £62.4 billion, falling to a disinvestment of £50.2 billion. Within the production industries, the mining and quarrying industry made the largest contribution to the decline, falling by £54.8 billion.

Inward

The increase in inward FDI flows is primarily driven by the services industries, which experienced an increase in inward FDI flows from £3.5 billion in 2014 to £38.4 billion in 2015 (Figure 12). The financial services, and information and communication technology industries made the largest contributions to the increase within the services sector, increasing by £11.6 billion and £11.1 billion respectively in 2015. Other notable increases in 2015 were seen in the retail and wholesale trade, repair of motor vehicles and motor cycles industry, where flows increased by £6.2 billion, and the other services industries, with an increase of £4.3 billion.

Offsetting the increase in the services industries were declines in the production industries, which fell from £10.2 billion in 2014 to a disinvestment flow of £18.4 billion. Within the production industries, the mining and quarrying industry saw the largest decline in 2015, falling by £21.1 billion to a disinvestment flow of £18.2 billion.

Nôl i'r tabl cynnwys7. FDI economic commentary

Looking at the reported earnings on foreign direct investment (FDI) involving the UK demonstrates that the difference between inward and outward earnings has continued to narrow in 2015. Figure 13 shows that this trend started in 2011, when UK earnings from overseas investment was £53.5 billion higher than earnings generated by overseas investors in the UK. In 2015, the difference had reduced to £9.1 billion, which appears to be more as a result of UK earnings from overseas falling; the value of earnings on FDI in the UK has been stable at around £45 billion to £50 billion in most years since 2006.

Figure 13: Foreign direct investment (FDI) earnings involving the UK, 2006 to 2015

Source: Office for National Statistics

Notes:

All values are at current prices (see background notes for definition).

Earnings definition can be found in the background notes.

Download this chart Figure 13: Foreign direct investment (FDI) earnings involving the UK, 2006 to 2015

Image .csv .xlsRates of return on FDI are calculated with reference to the inward or outward international investment position. This frames earnings relative to the size of the investment stock. The value of the UK’s outward FDI position has been relatively constant since 2008, averaging £1,078 billion between 2008 and 2015. Therefore the downward trend in outward earnings since 2011 implies that the rate of return on these investments overseas has been falling; the implied rate of return on UK outward investment fell from 8.9% in 2011 to 5.4% in 2015.

In contrast to outward investment, the value of inward investment positions have followed a broadly upward trend since 2007, increasing from £561 billion in 2007 to £950 billion in 2015 – although the value of inward positions experienced a fall in 2015. Similarly to outward investment, rates of return on inward investment are lower than they were in 2011; however, these have been more resilient, averaging approximately 5.1% since 2012. The increased investment and more resilient rate of return helps to explain why inward earnings have been more stable over this period.

There are many reasons why the value of earnings for UK FDI overseas has been falling in recent years. Some of these will reflect different economic conditions in those countries where UK FDI is concentrated, while movements in specific exchange rates over the years are also a factor. A further reason identified in these data has been the fall in earnings within industries involved in the extraction and processing of raw materials. For instance, outward FDI earnings from the mining and quarrying industries have followed a downward trend in recent years and experienced a further substantial decline in 2015, falling from £15.0 billion in 2014 to £0.1 billion. This decline coincides with a period when global commodity prices, most notably crude oil prices, had been falling.

International comparisons

Organisation for Economic Co-operation and Development (OECD) data1 estimates that the UK outward investment position was worth US $1,564 billion in 2015 and the inward position was worth $1,554 billion. This is the second largest outward international investment position in the world in 2015 in value terms. When considered as a percentage of GDP, inward and outward FDI positions are both equivalent to 55% of UK GDP. For the outward position, this is higher than the shares of France, Germany, Italy, Japan and United States among the G7 countries; Canada’s outward FDI share in GDP (69%) is higher than that of the UK.

In terms of flows, the UK is typically among the top 10 countries in the world for inward investment and was the tenth largest destination for inward flows in 2015. The US received the highest value of FDI inflows in the world for the first time since 2009; China received the second highest value of inflows, having been the largest recipient in 2014. The UK has traditionally been an active investor overseas; however, the negative flows in 2014 and 2015 has resulted in the UK becoming an overall disinvestor in the rest of the world.

Notes for FDI economic commentary

- Accessed on 16 November 2016. Data from the OECD can be presented in US dollars to facilitate comparisons between countries.

8. Annex 1: FDI estimates using the asset and liability principle and revisions to previously published estimates

Background information

The latest foreign direct investment (FDI) estimates produced in this statistical bulletin include revised annual estimates for 2014 and new estimates for 2015.

The upcoming Balance of Payments publication, to be published on 23 December 2016, will incorporate the latest 2015 estimates and therefore revise the previously published estimates that were based on the quarterly survey.

Differences between the quarterly and annual surveys reflect differences in the sample size: the quarterly outward and inward surveys sample 680 and 970 enterprise groups respectively; these increase to 2,100 and 3,500 enterprise groups on the annual survey. The quarterly survey provides information on the quarterly path and a timely first estimate of FDI, whereas the annual survey, which is less timely, utilises a larger sample size and allows companies to base their returns on fully-audited annual accounts, instead of management accounts that are used to provide the quarterly returns. We carry out an annual FDI benchmarking process to reconcile quarterly and annual estimates; therefore, quarterly and annual 2015 estimates in balance of payments will also revised within the Balance of Payments publication on 23 December 2016.

Revisions to 2014 estimates that are reported in this release reflect late survey returns that have been received since last year’s publication. In line with the National Accounts Revisions Policy, revised estimates for 2014 will not be incorporated into balance of payments statistics until September 2017.

It is worth noting that statistics presented in this statistical bulletin and balance of payments are not directly comparable due to the 2 alternative measurement principles used when compiling FDI statistics: the directional principle and the asset and liability principle. The directional principle is used for the statistics presented in this statistical bulletin; while the asset and liability principle is used for the statistics presented in the balance of payments and Pink Book. While the 2 measurement principles are different, estimates of net earnings, positions and flows are broadly comparable. Further details relating to the differences between the 2 principles can be found in an OECD paper.

This section aims to provide you with early sight of the asset and liability estimates for 2014 and 2015, along with an indication of the size of revisions that will be made to FDI estimates in upcoming balance of payments publications.

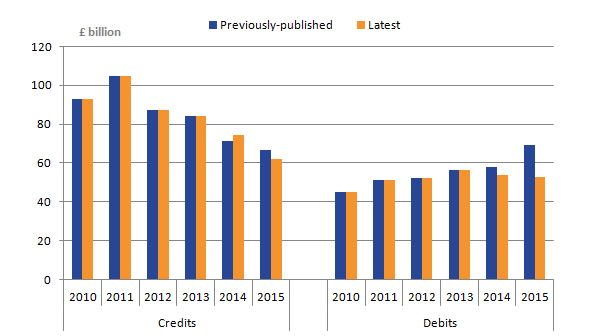

FDI earnings

The value of earnings UK companies receive from overseas investments are referred to as credits when measured using the asset and liability principle, while earnings foreign companies receive from UK-based investments are referred to as debits.

UK FDI credits have traditionally exceeded debits. Since 2011, however, FDI credits have followed a downward trend, while debits increased slightly over the same period. According to previously published estimates, net FDI earnings (credits minus debits) entered negative territory in 2015. The latest estimates published in this statistical bulletin revise net FDI earnings for 2015 upwards, from negative £2.9 billion to £9.1 billion. The upward revision mainly reflects changes to FDI debits, which were revised downwards from £69.4 billion to £52.7 billion (Figure 14). The downward revision to FDI debits in 2015 reflects smaller profits being reported by companies on the annual survey compared with the estimates that had been produced for them based on the smaller quarterly sample.

Net FDI earnings are also revised upwards in 2014, from £13.3 billion to £20.4 billion, reflecting an upward revision to credits from £71.2 billion to £74.2 billion and a downward revision to debits from £57.9 billion to £53.8 billion.

Figure 14: FDI earnings involving the UK, previously-published and latest estimates, 2010 to 2015

Source: Office for National Statistics

Notes:

- All values are at current prices (see background notes for definition).

Download this image Figure 14: FDI earnings involving the UK, previously-published and latest estimates, 2010 to 2015

.png (7.3 kB) .xls (23.0 kB)The downwards revision to net FDI earnings in 2015 and to a lesser extent in 2014, improves the contribution made by FDI to the UK’s overall current account balance. It is worth noting however, that broad trends previously reported are unchanged – specifically, the fall in FDI net earnings due to falling credits and more resilient debits.

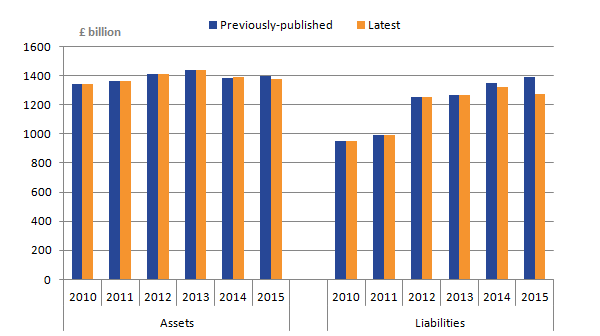

FDI positions

The stock of investment UK companies hold overseas are referred to as assets when measured using the asset and liability principle, while stocks of investment foreign companies hold in the UK are referred to as liabilities.

The value of UK FDI assets has traditionally exceeded the value of liabilities; however, in recent years, the UK’s net FDI position (assets minus liabilities) has narrowed. The previously published estimate for net FDI positions for 2015 was £6.9 billion, which is revised upwards to £101.1 billion according to the latest estimates published in this bulletin. The driver of this was a downward revision to FDI liabilities from £1,389.8 billion to £1,275.5 billion. A proportion of this downward revision reflects methodological improvements that have been made to the 2015 FDI population, which hasn’t been possible to retrospectively implement for previous years. These improvements have particularly impacted the value of FDI liabilities, with little impact on other inward FDI variables such as FDI debits or flows. In light of this, a degree of caution is advised when interpreting the decline in the value of FDI liabilities between 2014 and 2015. However, it is worth noting that the fall in FDI liabilities between 2014 and 2015 does also reflect a genuine decrease in company responses to the survey between the 2 periods.

Latest estimates of net FDI positions for 2015 are also revised upwards when compared with previously published estimates, with a revision from £34.2 billion to £63.9 billion. The revision almost entirely reflects a downward revision in FDI liabilities from £1,349.7 billion to £1,323.7 billion (Figure 15).

Figure 15: FDI positions involving the UK, previously-published and latest estimates, 2010 to 2015

Source: Office for National Statistics

Notes:

- All values are at current prices (see background notes for definition).

Download this image Figure 15: FDI positions involving the UK, previously-published and latest estimates, 2010 to 2015

.png (8.3 kB) .xls (22.5 kB)The upward revision to net FDI positions in 2015 and to a lesser extent in 2014, improves FDI’s contribution to the UK’s overall international investment position in the balance of payments. For 2015, the revisions to the net FDI positions also revise the trend previously seen, where the UK’s net FDI position improves for the first time on an annual basis since 2010.

Nôl i'r tabl cynnwys9. Quality and methodology

1. Basic quality information

The Foreign direct investment Quality and Methodology Information document contains important information on:

the strengths and limitations of the data and how it compares with related data

users and uses of the data

how the output was created

the quality of the output including the accuracy of the data

2. Main issues specific to this release

The estimates in this statistical bulletin are based on annual foreign direct investment (FDI) surveys for 2015. This publication incorporates a more comprehensive breakdown of the FDI results, which were previously released as an Office for National Statistics (ONS) statistical bulletin each February titled “Foreign Direct Investment Involving UK Companies (MA4)”. Provisional estimates for 2015, derived from quarterly surveys, have also been published in the quarterly balance of payments statistical bulletins; however, estimates produced based on the annual surveys provide firmer and more detailed figures that will be incorporated into the upcoming Balance of Payments publication, published 23 December 2016.

FDI statistics presented in this statistical bulletin have undergone methodological improvements that address a number of recommendations that were published in July 2016’s National Statistics Quality Review of FDI statistics – including the reintroduction of standard errors estimates that are presented in this section.

In addition to the above changes, the historical time series presented in the bulletin for periods between 2007 and 2013 have been revised to ensure consistency with the latest international standards and wider national accounts revisions. A detailed note that presents the impact of these improvements has been published alongside this statistical bulletin.

3. Guidance on interpreting foreign direct investment statistics and making international comparisons

Exchange rates: Enterprises are asked to return values in sterling, as entered in their accounts, rounded to the nearest £0.1 million. Where conversion from a foreign currency is involved, they are asked to use the same rate of exchange as in their own accounts. The effect of exchange rates should not be underestimated as these can also have a large impact on the differences between positions figures when making comparisons with other countries.

Valuation of equity: Enterprises are asked to return market values and book values where possible. Enterprises are asked to refrain from using any other valuation method such as historical cost. Book values are likely to be notably different from current market values as book values tend to reflect values at earlier periods when assets were acquired or subsequently re-valued. The effect of using different valuation methods should not be underestimated as these can also have a large impact on the differences between positions figures when making comparisons with other countries.

SPEs (Special Purpose Entities): These companies, that have been set up for pass through investment purposes, are very difficult to identify and as a consequence there can be huge discrepancies in data with countries such as Luxembourg and the Netherlands. Current methodology stipulates that we measure cross-border transactions only but merely identify whether the partner country is an SPE or not. We do not ask where the next destination is and this can show distortions in the figures.

Table 1: Definitions of geographic and economic areas

| Europe | ||||

| EU | Austria | Belgium | Bulgaria | Croatia |

| Cyprus | Czech Republic | Denmark | Estonia | |

| Finland | France | Germany | Greece | |

| Hungary | Irish Republic | Italy | Latvia | |

| Lithuania | Luxembourg | Malta | Netherlands | |

| Poland | Portugal | Romania | Slovakia | |

| Slovenia | Spain | Sweden | ||

| EFTA | Iceland | Liechtenstein | Norway | Switzerland |

| Other European Countries | Albania | Andorra | Belarus | Bosnia and Herzegovina |

| Faroe Islands | Gibraltar | Macedonia, the Former Yugoslav Republic of | Moldova | |

| Montenegro | Russian Federation | San Marino | Serbia | |

| Turkey | UK Offshore Islands (Guernsey, Jersey, other Channel Islands & Isle of Man | Ukraine | Vatican City State | |

| The Americas | ||||

| Anguilla | Antigua and Barbuda | Argentina | Aruba | |

| Bahamas | Barbados | Belize | Bermuda | |

| Bolivia | Bonaire, Sint Eustatius and Saba | Brazil | British Virgin Islands | |

| Canada | Cayman Islands | Chile | Colombia | |

| Costa Rica | Cuba | Curacao | Dominica | |

| Dominican Republic | Ecuador | El Salvador | Falkland Islands | |

| Greenland | Grenada | Guatemala | Guyana | |

| Haiti | Honduras | Jamaica | Mexico | |

| Montserrat | Nicaragua | Panama | Paraguay | |

| Peru | St Kitts and Nevis | Saint Lucia | Sint Maarten | |

| St Vincent and the Grenadines | Suriname | Trinidad and Tobago | Turks and Caicos Islands | |

| Uruguay | US Virgin Islands | USA inc. Puerto Rico | Venezuela | |

| Asia | ||||

| Other Near and Middle East Countries | ||||

| Armenia | Azerbaijan | Palestinian Territory | Georgia | |

| Israel | Jordan | Lebanon | Syria | |

| Gulf Arabian Countries | ||||

| Bahrain | Iraq | Kuwait | Oman | |

| Qatar | Saudi Arabia | United Arab Emirates | Yemen | |

| Other Asian Countries | ||||

| Afghanistan | Bangladesh | Bhutan | Brunei Darussalam | |

| Burma/Myanmar | Cambodia | China | Hong Kong | |

| India | Indonesia | Iran | Japan | |

| Kazakhstan | Kyrgyzstan | Laos | Macao | |

| Malaysia | Maldives | Mongolia | Nepal | |

| North Korea | Pakistan | Philippines | Singapore | |

| South Korea | Sri Lanka | Taiwan | Tajikistan | |

| Thailand | Timor - Leste | Turkmenistan | Uzbekistan | |

| Viet Nam | ||||

| Australasia and Oceania | ||||

| American Samoa | Antarctica | Australia | Bouvet Island | |

| Christmas Island | Cocos (Keeling) Islands | Cook Islands | French Polynesia | |

| French Southern and Antarctic Lands | Fiji | Guam | Heard Island and Macdonald Islands | |

| Kiribati | Marshall Islands | Micronesia, Federated States of | Nauru | |

| New Caledonia | New Zealand | Niue | Norfolk Island | |

| Northern Mariana Islands | Palau | Papua New Guinea | Pitcairn | |

| Samoa | Solomon Islands | South Georgia and South Sandwich Islands | Tokelau | |

| Tonga | Tuvalu | US Minor Outlying Islands | Vanuatu | |

| Wallis and Futuna | ||||

| Africa | ||||

| Algeria | Angola | Benin | Botswana | |

| British Indian Ocean Territory | Burkina Faso | Burundi | Cameroon | |

| Cape Verde | Central African Republic | Chad | Comoros | |

| Congo | Democratic Republic of the Congo (Zaire) | Djibouti | Egypt | |

| Equatorial Guinea | Eritrea | Ethiopia | Gabon | |

| Gambia | Ghana | Guinea | Guinea Bissau | |

| Ivory Coast (Cote d'Ivoire) | Kenya | Lesotho | Liberia | |

| Libya | Madagascar | Malawi | Mali | |

| Mauritania | Mauritius | Morocco | Mozambique | |

| Namibia | Niger | Nigeria | Rwanda | |

| Sao Tome and Principe | Senegal | Seychelles | Sierra Leone | |

| Somalia | South Africa | South Sudan | St Helena, Ascension and Tristan da Cunha | |

| Sudan | Swaziland | Tanzania | Togo | |

| Tunisia | Uganda | Zambia | Zimbabwe | |

| OECD | ||||

| Australia | Austria | Belgium | Canada | |

| Chile | Czech Republic | Denmark | Estonia | |

| Finland | France | Germany | Greece | |

| Hungary | Iceland | Irish Republic | Israel | |

| Italy | Japan | Luxembourg | Mexico | |

| Netherlands | New Zealand | Norway | Poland | |

| Portugal | Slovakia | Solvenia | South Korea | |

| Spain | Sweden | Switzerland | Turkey | |

| USA inc. Puerto Rico | ||||

| Central and Eastern Europe | ||||

| Albania | Bosnia and Herzegovina | Croatia | Macedonia, former Yugoslav Republic of | |

| Montenegro | Serbia | |||

Download this table Table 1: Definitions of geographic and economic areas

.xls (35.3 kB)

Table 2: Industry Allocation

| SIC 2007 code and description | ||

| Production industries | ||

| Agriculture, forestry and fishing | ||

| 010 | Crop and Animal and Production, hunting and related services activities | |

| 020 | Forestry and Logging | |

| 030 | Fishing and Aquaculture | |

| Mining and quarrying (including oil and gas production) | ||

| 050 | Mining of coal and lignite | |

| 060 | Extraction of crude petroleum and natural gas | |

| 070 | Mining of metal ores (ferrous and non ferrous incl. Uranium and Thorium) | |

| 080 | Mining and Quarrying - other | |

| 090 | Mining and oil gas extraction - support service activities daily | |

| Manufacturing Industries | ||

| Food products, Beverages and Tobacco products | ||

| 100 | Manufacture of food products | |

| 110 | Manufacture of beverages | |

| 120 | Manufacture of tobacco products | |

| Textiles and wood activities | ||

| 130 | Manufacture of textiles | |

| 140 | Manufacture of wearing apparel | |

| 160 | Manufacture of wood and wood products (except furniture), straw articles and plaiting materials | |

| 170 | Manufacture of paper and paper products | |

| 180 | Printing and reproduction of recorded media | |

| Petroleum, chemicals, pharmaceutical rubber and plastic products | ||

| 190 | Manufacture of coke and refined petroleum products | |

| 200 | Manufacture of chemicals and chemical products (non pharmaceutical) | |

| 210 | Manufacture of basic pharmaceuticals products and& pharmaceutical preparations | |

| 220 | Manufacture of rubber and plastic products | |

| Metal and machinery products | ||

| 240 | Manufacture of basic metals (incl. first processing, e.g. tubes, pipes, hollow profiles etc) | |

| 250 | Manufacture of fabricated metal products (excl machinery & equipment) | |

| 280 | Manufacture of machinery not elsewhere classified | |

| Computer, electronic and optical products | ||

| 260 | Manufacture of computer, consumer electronic and optical products | |

| 261 | Manufacture of electronic components | |

| 262 | Manufacture of loaded electronic boards | |

| 263 | Manufacture of communication equipment | |

| 264 | Manufacture of consumer electronics | |

| 265 | Manufacture of instruments and appliances for measuring, testing and navigation: watches and clocks | |

| 266 | Manufacture of irradiation, electro medical and electrotherapeutic equipment | |

| 267 | Manufacture of optical instruments and photographic equipment | |

| 268 | Manufacture of magnetic and optical media | |

| Transport Equipment | ||

| 290 | Manufacture of motor vehicles, trailers and semi trailers | |

| 300 | Manufacture of other transport equipment | |

| 301 | Building and shipping and boats | |

| 302 | Manufacture of railway locomotives and rolling stock machinery | |

| 303 | Manufacture of air and spacecraft and related | |

| 304 | Manufacture of military | |

| 309 | Manufacture of transport equipment not fighting vehicles elsewhere classified | |

| Other manufacturing | ||

| 150 | Manufacture of leather and other related products | |

| 230 | Manufacture of other non metallic mineral products | |

| 270 | Manufacture electrical equipment (incl. domestic appliances) | |

| 310 | Manufacture of furniture (domestic and non domestic) | |

| 320 | Manufacturing of other articles not elsewhere specified (toys, jewellery, musical instruments, sports goods, dental supplies, brooms and brushes) | |

| 330 | Repair, maintenance and installation of machinery and equipment | |

| Electricity, Gas, Water and waste | ||

| 350 | Supply of electricity, gas, steam and air conditioning | |

| 360 | Water collection, treatment and supply services | |

| 370 | Sewerage services | |

| 380 | Waste collection,treatment, disposal recycling services | |

| 390 | Remediation and other waste management services not elsewhere specified | |

| Services Industries | ||

| Construction | ||

| 410 | Construction of buildings (residential, non residential, commercial, development of building projects | |

| 420 | Civil engineering (roads, railways, utilities and water projects, other civil engineering projects) | |

| 430 | Specialised construction activities (demolition and site preparation, wet and dry trade activities, other construction activities) | |

| Retail and wholesale trade, repair of motor vehicles and motorcycles | ||

| 450 | Wholesale and retail trade, repair of motor vehicles and motorcycles and accessories | |

| 460 | Wholesale trades (excl motor vehicles and motorcycles) | |

| 470 | Retail trade (excl motor vehicles and motorcycles) | |

| Transportation and storage | ||

| 490 | Transport on land (incl.pipelines) | |

| 500 | Transport on water (sea, coastal and inland) | |

| 510 | Transport in the air (passenger and freight) | |

| 520 | Transport support activities (warehousing, operation of terminals and stations, cargo handling) | |

| 530 | Postal & courier activities | |

| Information and communication | ||

| 580 | Publishing activities (books, newspapers, periodicals directories, software) | |

| 590 | Motion picture, video and TV production, sound recording and publishing activities | |

| 600 | Programming and broadcasting activities of radio and TV (over air or via satellite, cable or internet) | |

| 610 | Telecommunications activities (wired, wireless, satellite and other telecommunications activities) | |

| 620 | Computer programming, consultancy and related activities (games, software development, programming,computer facilities management) | |

| 630 | Information services activities (data processing and hosting, web portals, news agencies, other information activities) | |

| Financial services | ||

| 641 | Banks (64.11 and 64.191) | |

| 642 | Building societies (64.192) | |

| 643 | Non Financial holding companies only (64.201/4) | |

| 644 | Financial holding companies only (64.205) | |

| 645 | Other financial services trusts and funds | |

| 651 | Life insurance only (65.11) | |

| 652 | General insurance, reinsurance and pensions funding (65.12, 65.2, 65.3) | |

| 661 | Security dealing for others only (66.12) | |

| 662 | Financial services (services auxiliary to financial services and insurance activities excl security dealing) | |

| 663 | Fund managers | |

| Professional, scientific and technical activities | ||

| 691 | Legal activities | |

| 692 | Accounting activities | |

| 701 | Head office activities | |

| 702 | Management consultancy activities (public relations, financial management, consultancy and management activities) | |

| 710 | Architectural and engineering activities (architecture, urban planning, engineering consultancy, testing and analysis) | |

| 720 | Scientific research and development (biotechnology, natural sciences, engineering, social sciences and humanities) | |

| 731 | Advertising | |

| 732 | Market research (market research, opinion polls, media representation) | |

| 740 | Design, photography, translation and other professional, scientific and technical services | |

| 750 | Veterinary activities | |

| Administration and support service activities | ||

| 770 | Rental and leasing activities (motor vehicles, personal and household goods, intellectual property - excl copyrighted works) | |

| 780 | Employment activities (employment agencies, entertainment castings, other human resources activities) | |

| 790 | Travel agencies, tour operators, other reservation service activities | |

| 800 | Security and investigation activities (investigation, private security, security systems) | |

| 810 | Services to buildings and landscape activities (facilities support, cleaning, disinfection and extermination,landscaping) | |

| 820 | Office administrations, support and other business support activities (document preparation, call centres, conference organisers, collection agencies,packaging, other support activities) | |

| Other Services | ||

| 550 | Accommodation (hotels, holiday accommodation, hostels, camping, other) | |

| 560 | Food and beverage service activities (restaurants, take aways, catering, pubs, clubs, other food service activities not elsewhere specified) | |

| 680 | Real estate activities | |

| 840 | Public administration, compulsory social security | |

| 850 | Education (primary, secondary and higher education, driving schools, sports education, cultural education, educational support) | |

| 860 | Human health defence, activities (hospitals, nursing homes, general and specialist medical practice, dental practice) | |

| 870 | Residential care activities | |

| 880 | Social work activities without accommodations (elderly, children, other social work activities) | |

| 900 | Creative arts and entertainment activities (performing arts, operation of arts facilities, artistic creation, support of performing arts) | |

| 910 | Libraries, archives, museums and other cultural activities (botanical, zoological nature reserve sites, historical buildings and sites | |

| 920 | Gambling and betting activities | |

| 930 | Sports, amusement and recreation activities (sports facilities, racehorse owners, fitness facilities, amusement parks and other recreational activities) | |

| 940 | Activities of membership organisations (business organisations, trade unions, other membership organisations) | |

| 950 | Repair of computers, personal and household goods | |

| 960 | Other personal service activities (washing and dry cleaning, hairdressers, funerals, physical well being, other activities) | |

| 970 | Activities of households as employers of domestic personnel | |

| 980 | Undifferentiated goods and services producing activities of private households for own use | |

| 990 | Activities of extraterritorial organisations and bodies | |

Download this table Table 2: Industry Allocation

.xls (48.1 kB)4. Accuracy

Sampling error is the error caused by observing a sample instead of the whole population. While each sample is designed to produce the “best” estimate of the true population value, a number of equal sized samples covering the population would generally produce varying population estimates.

Sample surveys are employed rather than censuses, because the census process is too lengthy and costly to be viable for these surveys. Standard errors are an estimate of the sampling error and provide a measure of the precision of the estimate. A lower standard error indicates a more precise estimate.

In addition to sampling errors, there is also the potential for non-sampling error. This cannot be easily quantified. One potential source of non-sampling error is from non-response, which relates to the failure to obtain data from the sample. Low response rates may introduce bias if respondents are not fully representative of those selected in the sample. Various efforts are made to minimise non-response. Written reminders are sent to non-responding businesses and these are followed up with telephone, fax and email reminders. In addition, there is the possibility of using the legal powers of the Statistics of Trade Act to enforce a response, though ONS prefers to work together with businesses to produce the necessary information.

The response rates for the 2015 annual surveys are shown in Table 3.

Table 3: Response Rates 2015

| Outward FDI | Inward FDI | |

| Selected Sample Size | 1,955 | 3,250 |

| Numbers co-operating fully or partially | 1,407 | 2,631 |

| Non-responders | 548 | 619 |

| Overall response rate (%) | 72 | 81 |

| Source: Office for National Statistics | ||

Download this table Table 3: Response Rates 2015

.xls (18.4 kB)Non-response bias is a potential issue for all statistical surveys. Non-response bias occurs when the answers of respondents differ from the potential answers of those who did not respond. The risk of non-response bias is minimised by efforts to maximise response rates and the use of estimation techniques that can attempt to correct for any bias that may be present. Despite this, it is not easily possible, on any survey, to quantify the extent to which non-response bias remains a problem. However, there is no evidence to suggest that non-response bias presents a particular issue for the FDI surveys.

Imputation methods are used to estimate values for all businesses in the sample that did not return data. Estimation methods are used to estimate values for all non-sampled business within the population, in order to produce an estimate for the population.

The method used to calculate standard errors for FDI statistics has been under review in recent years. FDI standard errors for 2015 have been re-introduced in this edition of the publication. Further information on the work undertaken to re-introduce standard errors can be found in an article “Methodological improvements to foreign direct investment statistics: December 2016”.

Table 4: Standard Errors

| Annual Inward 2015 | Annual Outward 2015 | ||||||

| Published estimate (£ million) | Standard Error (£ million) | Coefficient of Variation (%) | Published estimate ( £ million) | Standard Error (£ million) | Coefficient of Variation (%) | ||

| Total earnings | 47,872 | 1,410 | 2.9 | 56,946 | 178 | 0.3 | |

| Total flows | 21,599 | 3,114 | 14.4 | -52,946 | 1,491 | - | |

| Total position | 950,315 | 8,706 | 0.9 | 1,052,081 | 1,331 | 0.1 | |

| Source: Office for National Statistics | |||||||

| Note: | |||||||

| 1. Coefficients of variation are not available for negative estimates | |||||||

Download this table Table 4: Standard Errors

.xls (27.1 kB)5. Revisions

Data for 2014 have been revised in this statistical bulletin and will not be revised any further. Data for 2015 will remain provisional until December 2017, when the next FDI statistical bulletin will be released.

6. Notes to tables

The sum of the constituent items in tables may not always agree exactly with the totals shown due to rounding of the figures.

Symbols used in the tables are:

.. Figure suppressed to avoid disclosure of information relating to individual enterprises.

– Denotes nil or less than £500,000.

Discontinuities present in 2006 due to private property, bank holding companies and public corporations data being included in the total only.

Nôl i'r tabl cynnwys