Cynnwys

- Main findings

- Overview

- User engagement

- Summary

- Net direct investment flows abroad by UK companies (net outward flows)

- Net international investment position - level of direct investment abroad by UK companies (net outward positions)

- Net earnings from direct investment abroad by UK companies (net outward earnings)

- Net direct investment in the UK by foreign companies (net inward flows)

- Net international investment position - direct investment in the UK by foreign companies (net inward positions)

- Net earnings from direct investment in the UK by foreign companies (net inward earnings)

- Background notes

- Methodoleg

1. Main findings

The UK’s inward investment position reached a record high in 2012 (£936 billion) and its outward investment position remained similar to 2011 levels (£1,088 billion)

UK companies saw a large decrease in their net investment flows overseas in 2012 (from £60.1 billion in 2011 to £26.5 billion in 2012)

Net investment flows to Europe from UK companies showed a disinvestment of £0.7 billion in 2012, a substantial decrease from £27.3 billion in the previous year

Net investment flows into the UK by foreign companies continued to increase during 2012, from £28.9 billion in 2011 to £35.4 billion in 2012. Net inflows in 2012 were slightly above 2010 figures, but well below those prior to 2009

Net earnings from investments made by UK companies abroad decreased from £100.0 billion in 2011 to £80.2 billion in 2012

Net earnings from investments in the UK by overseas companies decreased slightly from £44.4 billion in 2011 to £42.7 billion in 2012

2. Overview

This statistical bulletin provides data on Foreign Direct Investment (FDI) flows, positions and earnings involving UK companies. The investment figures are published on a net basis, that is, they consist of investments minus disinvestments. Investments can include acquisitions of assets or shares and disinvestments can include the disposal of assets or shares. The data in this bulletin are broken down by region and country. A more detailed analysis, including breakdowns by industry, will be published in a second 2012 FDI Statistical Bulletin on 6 February 2014.

The FDI estimates are analysed and produced to measure investment data for:

The UK’s FDI statistics are produced according to the agreed international standards set out in the third edition of the Organisation for Economic Co-operation and Developments (OECD) Benchmark Definition of FDI (BD3) and the fifth edition of the International Monetary Fund (IMF) Balance of Payments Manual (BPM5).

The OECD and IMF have recently released new versions of their manuals concerning FDI statistics (BD4 and BPM6). These revised manuals reflect the changes that have occurred in international finance since the previous updates. Along with other countries, the UK is currently working to implement these changes.

For more detail on these changes see the guidance and methodology section of the ONS website.

FDI estimates are essential for measuring the UK’s Balance of Payments. FDI earnings figures feed into the Balance of Payments current account, FDI flows form an integral part of the financial account and FDI positions supply direct investment data to the International Investment Position (IIP) account.

Within the UK, FDI estimates are used by a large number of government departments for briefing and policy formation purposes, including HMRC, Cabinet Office, HM Treasury, UK Trade and Investment, the Bank of England, the Department for Business, Innovation and Skills and the Department for International Development.

UK FDI figures are also extensively used for policy, analysis and negotiations by international organisations, including Eurostat, United Nations Conference on Trade and Development (UNCTAD), OECD and IMF, as well as a number of foreign embassies. More widely the FDI estimates are utilised by commercial companies, academics and independent researchers.

Nôl i'r tabl cynnwys3. User engagement

We are constantly aiming to improve this release and its associated commentary. We would welcome any feedback you might have and would be particularly interested in knowing how you make use of these data to inform our work. Please contact us via email: fdi@ons.gov.uk or telephone Ciara Williams on +44 (0)1633 456455.

Nôl i'r tabl cynnwys4. Summary

FDI net investment flows

The net flow of direct investment abroad by UK companies (outward investment) decreased from £60.1 billion in 2011 to £26.5 billion in 2012, a fall of £33.6 billion (current prices). This was a return to similar levels of net outward flows seen in 2009 and 2010 and continues to remain substantially lower than the peaks observed in 2000 and 2007 of £154.2 billion and £159.1 billion respectively.

Net investment flows into the UK (inward investment) increased in 2012 to £35.4 billion, a similar amount to 2010. However, both of these figures are well below flows of net investment into the UK seen between 2005 and 2007.

Figure 1: FDI net investment flows

Source: Office for National Statistics

Notes:

- All values are current prices (see Background Notes).

Download this chart Figure 1: FDI net investment flows

Image .csv .xlsFDI net International Investment Positions (IIP)

The net position of direct investment abroad by UK companies stood at £1,088 billion (£1.1 trillion) by the end of 2012 (current prices). This was similar to levels reported at the end of 2011 and 2008. Outward FDI net positions seem to have recovered from the reduction at the end of 2009 following the 2008/2009 economic downturn.

The net position of direct investment in the UK by overseas companies at the end of 2012 was estimated at £936 billion, an increase on the value reported at the end of 2011 (£793 billion). This has been primarily driven by a decreased level of inter-company borrowing and sustained income yields.

Figure 2: FDI net international investment positions (IIP)

Source: Office for National Statistics

Notes:

- All values are current prices (see Background Notes).

Download this chart Figure 2: FDI net international investment positions (IIP)

Image .csv .xlsFDI net investment earnings

Net earnings from direct investment by UK companies abroad (outward earnings) amounted to £80.2 billion in 2012. This was a decrease of £19.8 billion on the amount earned in 2011 and a return to similar levels seen in 2010. Although there was a decline in the value of UK earnings abroad in 2012, figures still continue to be above those recorded in 2008 and 2009, when the effects of deteriorating economic conditions became visible in the UK FDI data.

Net earnings from FDI in the UK (inward earnings) decreased slightly in 2012 to £42.7 billion (current prices), a decrease of £1.7 billion on the amount reported in 2011. However, UK inward net earnings have continued to recover from the large fall seen in 2008. Net earnings in 2012 remained broadly similar to the value recorded in 2007 and 2011, indicating that there may be a continued preference by overseas companies to invest in the UK.

Figure 3: FDI net investment earnings

Source: Office for National Statistics

Notes:

- All values are current prices (see Background Notes).

Download this chart Figure 3: FDI net investment earnings

Image .csv .xlsThese trends are partly reflected in the destinations of net investment abroad by UK companies seen in ONS estimates in this bulletin. For example, net investment to Europe declined sharply in 2012 compared with 2011, owing to relatively subdued economic conditions. On the other hand, net investment into the UK by overseas companies increased from all regions except Africa and Australasia & Oceania.

Table A: Net investment flows, international investment position and earnings

| Values in £ billion | ||||||

| Direct investment abroad | Direct investment in the UK | |||||

| Flows in 2012 | Positions at end of 2012 | Earnings in 2012 | Flows in 2012 | Positions at end of 2012 | Earnings in 2012 | |

| Europe | -0.7 | 590.1 | 30.8 | 16.5 | 543.7 | 20.8 |

| The Americas | 11.8 | 300.4 | 19.1 | 15.1 | 311.7 | 18.3 |

| Asia | 8.3 | 117.7 | 19.0 | 3.6 | 69.4 | 3.7 |

| Australasia & Oceania | 2.4 | 42.5 | 4.4 | 0.3 | 9.6 | -0.1 |

| Africa | 4.7 | 37.3 | 6.9 | -0.1 | 2.0 | 0.1 |

| World Total | 26.5 | 1,088.0 | 80.2 | 35.4 | 936.4 | 42.7 |

| Source: Office for National Statistics | ||||||

| Notes: | ||||||

| 1. All values are current prices (see Background Notes). | ||||||

| 2. A minus sign indicates net losses. | ||||||

Download this table Table A: Net investment flows, international investment position and earnings

.xls (54.8 kB)How our statistics compare with external sources

The UK experienced mixed economic conditions in 2012 as annual GDP growth slowed from 1.6% in 2010, to 1.2% in 2011 and to 0.1% in 2012.

However, the UK remains one of the most active countries for outward and inward FDI in the world. The latest OECD figures suggest that 4.6% of total world inward FDI was to the UK in 2012, whereas 5.8% of total world outward FDI was from the UK.

The trends in these flows suggest that FDI inflows to the UK have been increasing since 2010, while the value of FDI outflows fell in 2012 from 2011, yet remained higher than the 2009 and 2010 levels.

Global economic activity continued to slow in 2012. The latest International Monetary Fund (IMF) data estimated that world GDP grew by 3.2% in 2012 after growing by 3.9% in 2011 and by 5.2% in 2010. However, unlike those previous years, the slowing rate of economic activity is more widely spread around the world.

The advanced economies grew by 1.5% in 2012, compared with growth of 1.7% in 2011. This is partly reflecting the continuing economic adjustments in some developed economies following the 2008/09 economic downturn. However, growth in the rest of the world also slowed to 4.9% compared with 6.2% in 2011.

The IMF found that a number of emerging markets may be coming off cyclical peaks which would make it harder to sustain the growth rates of previous years.

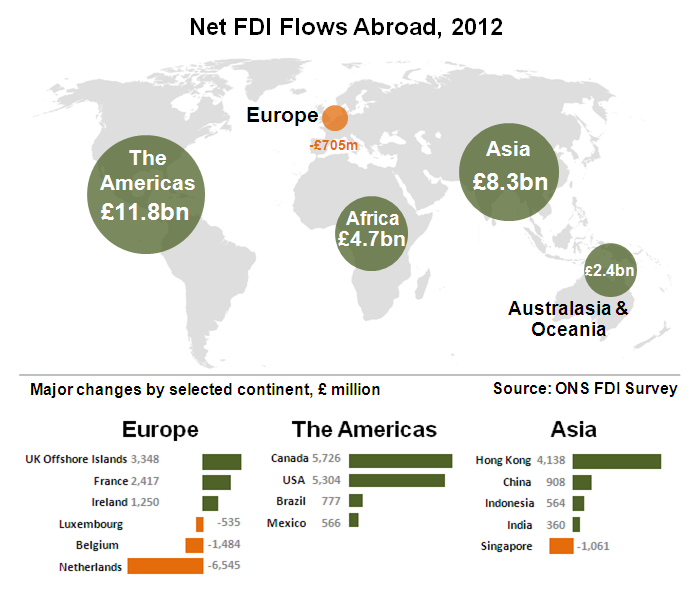

Nôl i'r tabl cynnwys5. Net direct investment flows abroad by UK companies (net outward flows)

The Americas had the largest share of net outflows from the UK (44%) in 2012 followed by Asia then Africa. This is the first time the Americas have become the primary destination for outward net investment from the UK since 2007.

The reduction in the total net outflows from the UK between 2011 and 2012 was caused by slower outward net investment flows to Europe, the Americas and Asia. While net outflows to these dominant economic centres decreased, UK net outflows to Africa and Australasia & Oceania showed relatively large rises.

UK net investment flows to Europe were negative

Outward net investment flows to Europe showed a disinvestment of £0.7 billion in 2012, a substantial decrease from a net investment of £27.3 billion the previous year to a record low.

This figure was driven by sizeable decreases in net outflows to:

Luxembourg (from £7.9 billion in 2011 to a net disinvestment of £0.5 billion in 2012, a decrease of £8.4 billion)

The Netherlands (from a net disinvestment of £1.2 billion in 2011 falling to a net disinvestment of £6.5 billion in 2012, a decrease of £5.3 billion)

UK offshore islands (from £8.5 billion in 2011 to £3.3 billion in 2012, a decrease of £5.2 billion)

Even though there was a decrease in FDI activity within these countries, it is important to consider their importance as a destination for direct investment as they may partly reflect the presence of so-called Special Purpose Entities (SPEs). These can be entities such as financing subsidiaries, shell companies and conduits. They typically do not conduct any significant operations in the country in which they are resident other than to pass through investments from their parent company to an affiliate in another country.

This lower UK investment flows to Europe was reflected in a decrease in the amount of UK net investment to Belgium, falling from £5.6 billion in 2011 to a disinvestment of £1.5 billion (a decrease of £7.1 billion). This was predominantly driven by an increase in inter-company borrowing by large multi-national enterprises (MNEs).

Within Europe, the primary destinations for UK net outflows in 2012 were to Switzerland, France and Ireland.

UK net investment to Switzerland increased from £0.8 billion in 2011 to £4.1 billion in 2012. This was driven by a decrease in inter-company borrowing

UK net investment to France increased from £1.8 billion in 2011 to £2.4 billion in 2012. However, the 2012 figure is still below investment flows in 2007 (£4.5 billion) and 2008 (£6.0 billion)

Ireland saw the third largest net investment from UK companies of £1.3 billion. However, year-on-year net outflows decreased by 62%

UK net investment in the Americas fall in 2012

Net investment outflows from the UK to the Americas fell to £11.8 billion in 2012, down from £14.7 billion in 2011. This figure was driven by sizeable decreases in net outflows to:

The USA (from £12.1 billion in 2011 to £5.3 billion in 2012, a decrease of £6.8 billion)

Brazil (from £1.7 billion in 2011 to £0.8 billion in 2012, a decrease of £0.9 billion)

Mexico (from £1.0 billion in 2011 to £0.6 billion in 2012, a decrease of £0.4 billion)

The value of net outflows to the USA in 2012 remained well below figures seen in 2007 and 2008. The decrease in net investment outflows from the UK to the USA during 2012 was due to narrowing profit margins, net change in inter-company debt positions and large losses in equity capital some of which can be driven by restructuring and fluctuations in exchange rates. This was experienced by a number of large MNEs.

Although Brazil experienced an increase in UK investment activity during 2010 and 2011, UK net investment flows in 2012 are now in line with 2007 and 2008 figures. During 2012, UK net investments to Mexico were more in line with levels seen in 2010, and were higher than 2008.

Other regional variations

Of the remaining regions, Asia saw a decrease in net investment outflows from £20.5 billion in 2011 to £8.3 billion in 2012. The 2012 figure is more in line with values recorded during 2009 and 2010. During 2011, there was strong growth of investment to emerging markets, such as India. However, this spike was caused by some significant acquisitions. For example, Vodafone Group Plc acquired a controlling stake in Vodafone Essar Ltd of India for a press reported value of £2.6 billion. Levels of UK net outflows to India have decreased from £7.1 billion in 2011 to £0.4 billion in 2012.

During 2012, UK net investment flows to Hong Kong and Singapore increased by 19% and 78% respectively, although net outflows from the UK to Singapore increased from a net disinvestment of £4.7 billion to a net disinvestment of £1.1 billion. These countries are known as offshore financial centres and can be used as vehicles to pass funds through to a third country. This type of activity can sometimes distort the UK outward FDI figures. The increase in movement seen between the UK and these Asian countries was in contrast to the trend seen within Europe, where there has been a large fall in outflows to the Netherlands and Luxembourg – traditional SPE destinations.

Net outflows to Africa saw a substantial increase between 2011 and 2012, climbing from a net disinvestment of £3.2 billion in 2011 to a net investment of £4.7 billion in 2012. This was mainly driven by an increase in UK net investment to South Africa at £5.1 billion, a record high. Australasia & Oceania saw an increase in investment, from £0.8 billion in 2011 to £2.4 billion in 2012. This was mainly driven by an increase in net outflows to Australia.

Nôl i'r tabl cynnwys6. Net international investment position - level of direct investment abroad by UK companies (net outward positions)

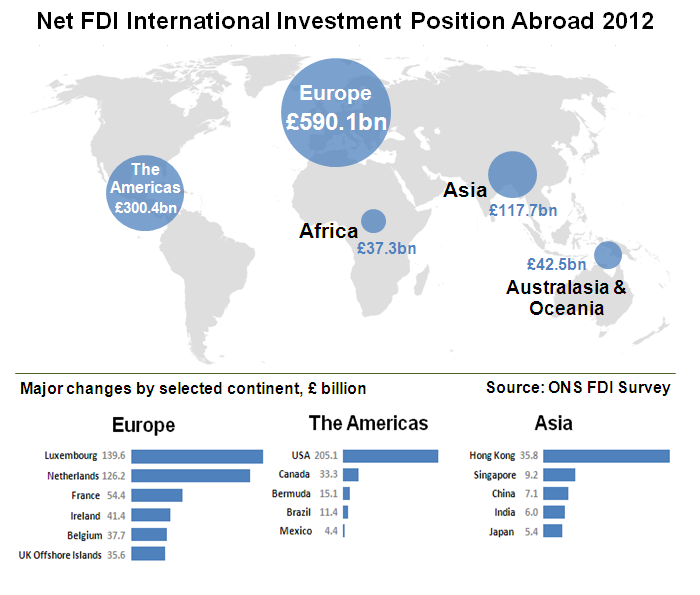

Net FDI International Investment Position Abroad 2012

Download this image Net FDI International Investment Position Abroad 2012

.png (81.8 kB)Europe continued to report the highest level of net position abroad at the end of 2012, although the value is marginally lower than the position at the end of 2011. This accounted for 54% of the UK’s outward investment position at the end of 2012. Within Europe, the most dominant locations of net outward positions were the Netherlands and Luxembourg, accounting for £126.2 billion (12% of the world total) and £139.6 billion (13% of the world total) respectively.

The Americas remained one of the most favoured locations for UK direct investment abroad with the USA continuing to be the country within this region with the largest level of outward investment. At the end of 2012, outward levels in the USA stood at £205.1 billion, a marginal decrease when compared with the previous year. This is equivalent to 19% of the overall level of direct investment abroad at the end of 2012.

The largest change in the value of outward positions between 2011 and 2012 within the Americas was seen in Canada, where levels increased by £5.7 billion, from £27.6 billion at the end of 2011 to £33.3 billion at the end of 2012. The net outward position figures for both Brazil and Mexico fell by £2.7 billion and £0.6 billion respectively over the same period.

Net outward position values to Asia fell from £121.6 billion at the end of 2011 to £117.7 billion at the end of 2012. This was driven by large decreases in net outward position values to India but offset by increases to Hong Kong. With respect to Hong Kong, it should be noted that this country contains SPEs, which could distort the net outward positions figures.

UK net outward positions to both Africa and Australasia & Oceania rose by £6.5 billion and £5.3 billion respectively.

Where has the UK strengthened its overseas position?

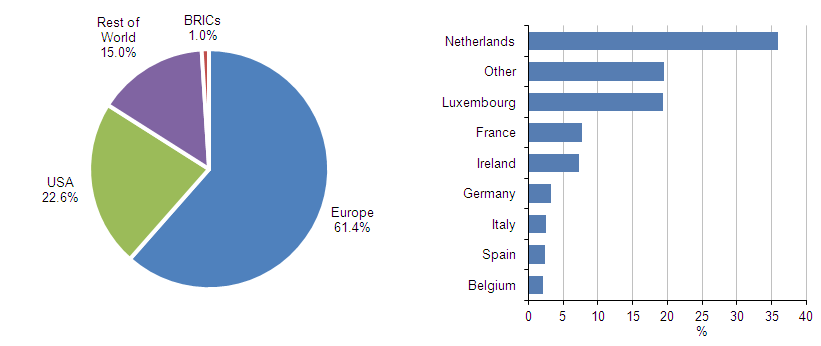

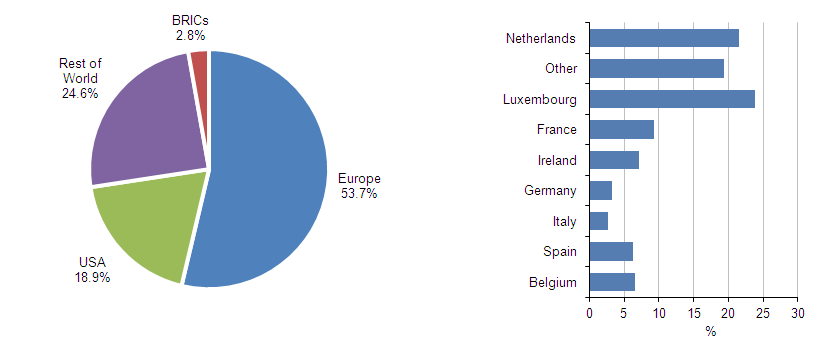

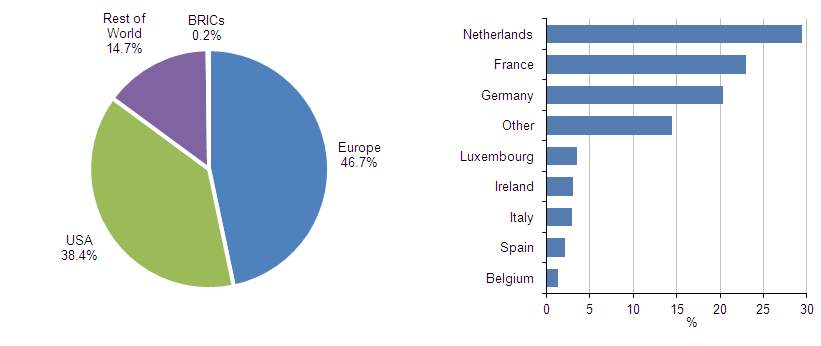

Since 2003, the stock of UK overseas FDI has altered its regional composition. The stock of FDI in the BRIC economies – Brazil, Russia, India and China – and the rest of the world has increased as a proportion of the UK’s total outward investment position. This suggests some diversification away from more traditional investment destinations of Europe and the US.

The picture has also changed among the European countries. In 2003, the share of the UK’s outward position was dominated by investment in the Netherlands. In recent years, the stock of UK FDI has grown faster to Germany, France and Spain. This may be an indication of caution on the part of UK companies and they may be using less risky investment strategies in order to spread out their investment position.

Figure 4: Net FDI international investments abroad, 2003

Source: Office for National Statistics

Notes:

- All values are current prices (see Background Notes).

Download this image Figure 4: Net FDI international investments abroad, 2003

.png (19.9 kB)

Figure 5: Net FDI international investments abroad, 2012

Source: Office for National Statistics

Notes:

- All values are current prices (see Background Notes).

Download this image Figure 5: Net FDI international investments abroad, 2012

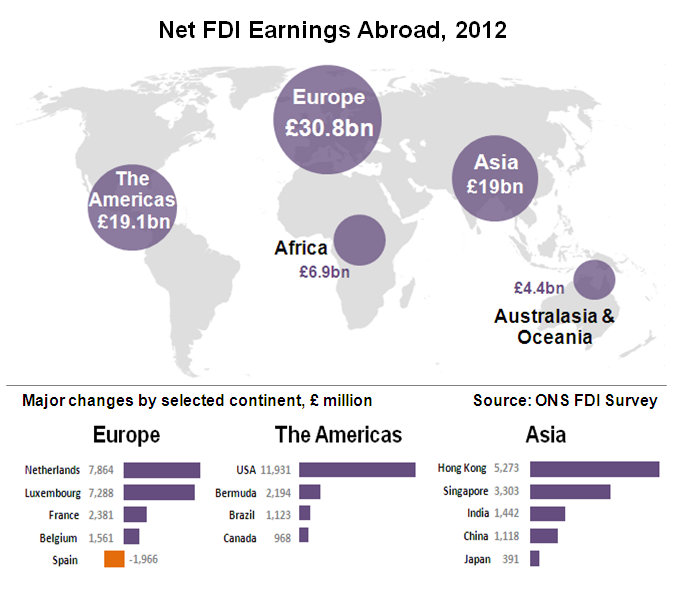

.png (20.0 kB)7. Net earnings from direct investment abroad by UK companies (net outward earnings)

Europe continued to report the highest level of net earnings in 2012. This accounted for 38% of the UK outward net earnings in 2012. Within Europe, the most dominant locations for net earnings abroad were the Netherlands and Luxembourg, accounting for £7.9 billion (10% of the world total) and £7.3 billion (9% of the world total) respectively.

The largest change in 2012 came from Europe where the net earnings from direct investment by UK companies decreased by £14.9 billion, returning to a similar figure seen in 2010.

Net earnings from Asia, Africa and Australasia & Oceania all increased; however, these increases were partially offset by a decrease in net earnings from the Americas (£7.5 billion).

UK-owned companies operating in the USA were the single largest source of net earnings, accounting for 15% of the overall total. The USA was followed closely by those operating in the Netherlands and Luxembourg, contributing 10% and 9% respectively. Each of these countries saw large decreases in net earnings in 2012 and they played a major role in contributing to the falling world net outward earnings. Spain also saw a large downward swing in net earnings abroad by UK companies in 2012. Outward net earnings fell from a figure of £0.5 billion in 2011 to a negative net earnings value of £2.0 billion in 2012.

These decreases were offset by net earnings of £4.0 billion by UK-owned companies operating in Australia.

Rate of return analysis

One useful indicator related to direct investment earnings is the rate of return. This is normally defined as income on direct investment equity as a percentage of the overall direct investment position. As rates of return increase, it implies that direct investment enterprises are more profitable and can be used, in combination with consideration of many other factors, in drawing inferences about the competitiveness of different economies.

Overall, the rate of return for outward direct investment abroad by UK companies was 7% in 2012, down on both 2011 (9%) and 2010 (8%) figures. There was some substantial variation in rates of return across geographic areas and countries in 2012. Rates of return for UK outward investment in both Africa and Asia were both around 19% and 16% respectively, while the overall rate of return from direct investment in The Americas (6%) and Europe (5%) was considerably lower.

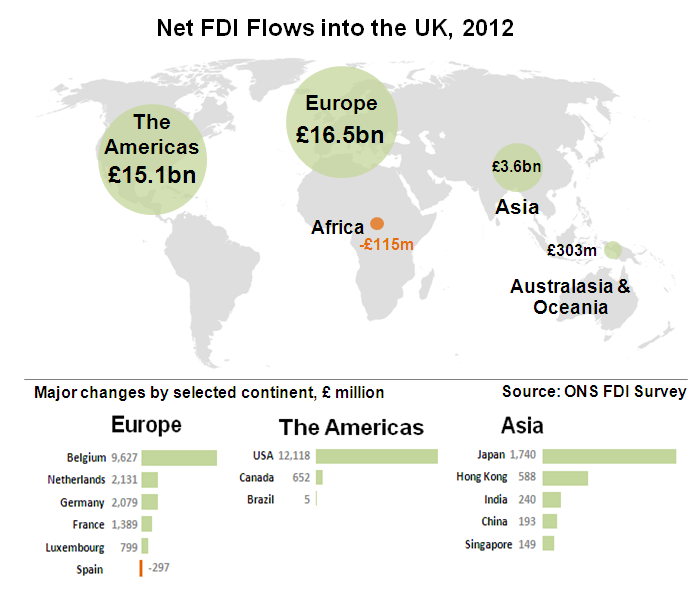

Nôl i'r tabl cynnwys8. Net direct investment in the UK by foreign companies (net inward flows)

European companies continue to be investment leaders in the UK

Europe continued to hold the largest share of net inflows to the UK (47%) in 2012 followed by the Americas and then Asia. Europe saw an increase in net inflows between 2011 and 2012. Net inflows to the UK were £16.5 billion during 2012, compared with £12.7 billion reported in 2011. This net investment figure remains much lower than pre-downturn estimates.

European net inflows to the UK during 2012 were driven by:

Sustained growth in Belgium (due to M&A activity)

Increases in investment from Germany (from a net disinvestment of £4.2 billion in 2011 to a net investment of £2.1 billion in 2012, a £6.3 billion increase)

Increases in investment from Luxembourg (from a net disinvestment of £4.7 billion in 2011 to net investment of £0.8 billion in 2012, a £5.5 billion increase)

These increases were offset by a large decrease in the net inflows from the Netherlands, falling from £12.1 billion in 2011 to £2.1 billion in 2012, a £10 billion decrease. This was primarily due to increased inter-company borrowing offset by low dividend payments. The UK also saw a relatively large decrease in the amount of net inflows from Spain, falling from an investment of £2.6 billion in 2011 to disinvestment of £0.3 billion in 2012, a £2.9 billion decrease.

Other regional variations

In 2012, the UK received increased net investment from the Americas, rising from £11.6 billion in 2011 to £15.1 billion in 2012. This was dominated by large net inward flows from the USA of £12.1 billion, which remained relatively similar to estimates seen in 2011.

Nôl i'r tabl cynnwys9. Net international investment position - direct investment in the UK by foreign companies (net inward positions)

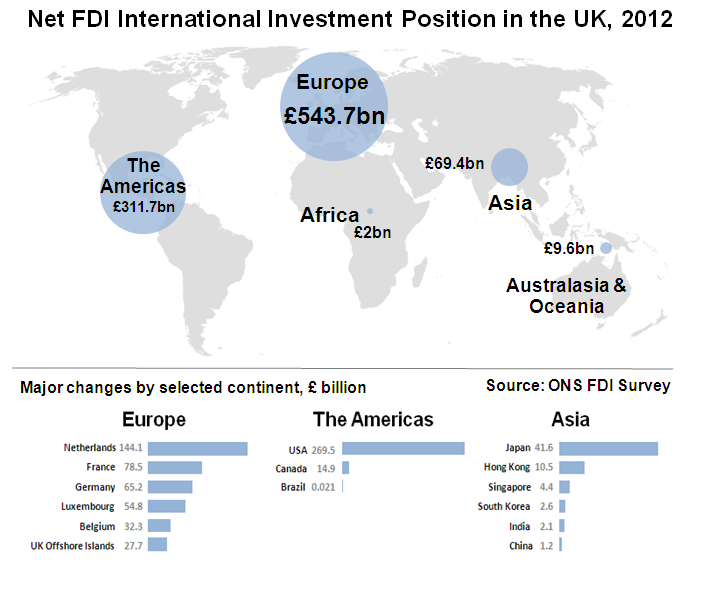

Net FDI International Investment Position in the UK, 2012

Download this image Net FDI International Investment Position in the UK, 2012

.png (81.0 kB)Europe continued to report the highest level of net inward investment positions in the UK at the end of 2012. This accounted for 58% of the UK’s inward investment position at the end of 2012. Within Europe, the most dominant locations for levels of net inward positions were the Netherlands and France, accounting for £144.1 billion (15% of the world total) and £78.4 billion (8% of the world total) respectively.

Overall, the rise in the level of net inward investment positions in the UK at the end of 2012 was primarily attributed to an increase in the value from Europe. Net inward positions rose by £96.1 billion, from £447.6 billion at the end of 2011 to £543.7 billion at the end of 2012.

The UK’s largest net inward investment positions within Europe were held by:

- Netherlands (£144.1 billion)

- France (£78.4 billion)

- Germany (£65.2 billion)

- Luxembourg (£54.8 billion)

These accounted for approximately 37% of the total level at the end of 2012.

International reporting standards require net inward direct investment to be reported according to the immediate investing country rather than the ultimate source of investment. As noted in the section on net outward investment, a consequence of this is that the relative importance of certain countries such as the Netherlands and Luxembourg may be partly due to the presence of high numbers of ‘Special Purpose Entities’ (companies whose primary purpose is to ‘pass through’ investment) in those economies.

Belgium witnessed one of the largest changes in its UK net position by the end of 2012, reporting a value of £32.3 billion, an increase of £16.1 billion from the previous year.

The Americas continued to hold a strong position in the UK economy increasing its net inward position from £263.5 billion at the end of 2011 to £311.7 billion at the end of 2012. Within the Americas, the USA remained a prime inward investor in the UK, with companies from the USA holding net inward investment positions of £269.5 billion at the end of 2012. This accounted for approximately 29% of the total UK net inward investment position, an increase of £50.3 billion from the previous year. This was mainly due to companies increasing their equity capital and reducing their inter-company debt positions.

Asia marginally increased its net investment position in the UK by £3.0 billion between the end of 2011 and the end of 2012. Between 2009 and 2012, Asia’s net inward position within the UK grew year on year, however, between 2011 and 2012, this growth rate slowed. Although, Asia’s net position in the UK increased overall in 2012, this upward trend was not consistent across all Asian countries. For example, Japan increased its investment stock in the UK economy by increasing its net inward position by £10.1 billion; however, Hong Kong saw its levels of investment in the UK decline by £10 billion.

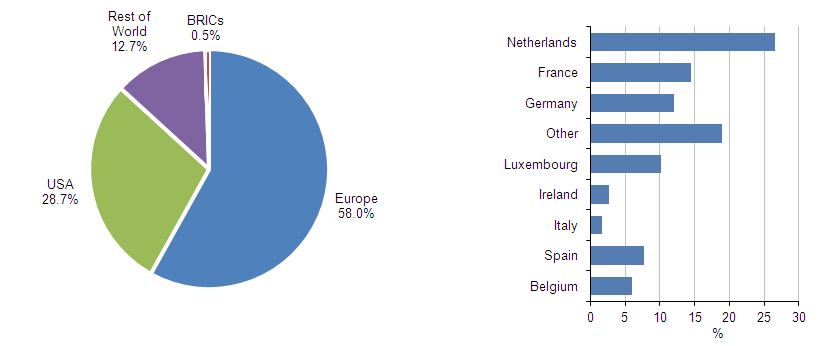

How have investment positions in the UK changed?

Since 2003, the make up of the UK’s investment partners has remained relatively stable. However, the contribution that each country makes has seen some change. The USA’s net investment position in the UK has declined in the last decade, leaving Europe and the rest of the world to increase their standing in the UK economy.

Figure 6: Net FDI international investment positions into the UK, 2003

Source: Office for National Statistics

Notes:

- All values are current prices (see Background Notes).

Download this image Figure 6: Net FDI international investment positions into the UK, 2003

.png (19.1 kB)

Figure 7: Net FDI international investment positions into the UK, 2012

Source: Office for National Statistics

Notes:

- All values are current prices (see Background Notes).

Download this image Figure 7: Net FDI international investment positions into the UK, 2012

.png (19.6 kB)10. Net earnings from direct investment in the UK by foreign companies (net inward earnings)

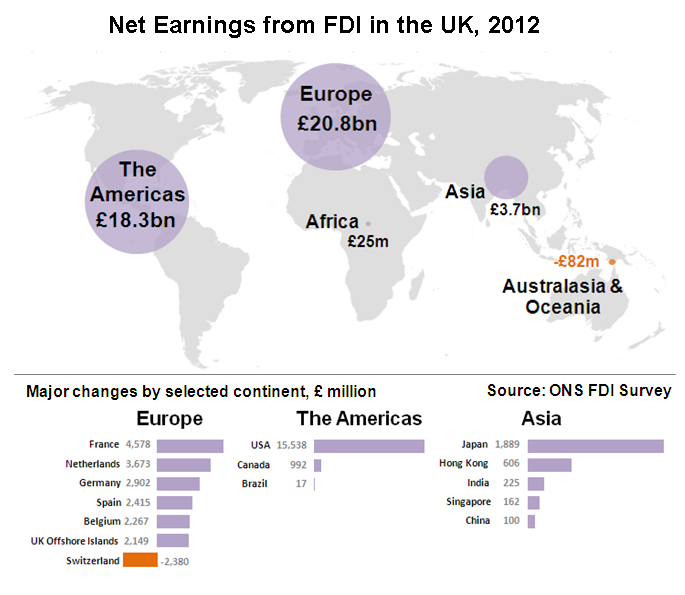

Net Earnings from FDI ini the UK, 2012

Download this image Net Earnings from FDI ini the UK, 2012

.png (104.9 kB)Europe continued to report the highest level of net earnings in 2012. This accounted for 49% of UK net inward earnings in 2012. Within Europe, the most dominant locations for net inward earnings were France and the Netherlands accounting for £4.6 billion (11% of the world total) and £3.7 billion (9% of the world total) respectively.

In 2012, foreign owned UK companies saw net earnings decrease slightly between 2011 and 2012. This effect could be seen across most regions showing a small decline in their net earnings from investments within the UK in 2012.

UK companies owned by European parents reported the highest share of net earnings on UK investments in 2012, with a value of £20.8 billion, however this was a decrease from £21.1 billion in 2011.

This was driven by decreases in:

France (decreasing from £5.1 billion in 2011 to £4.6 billion in 2012)

Germany (decreasing from £3.8 billion in 2011 to £2.9 billion in 2012)

The Netherlands (decreasing from £4.2 billion in 2011 to £3.7 billion in 2012)

Switzerland (decreasing from £0.8 billion in 2011 to a net disinvestment of £2.4 billion in 2012)

Net earnings from companies owned by parent companies in the Americas saw a decrease of £1.8 billion on earnings on their UK investments during 2012. This again was driven by a decrease in net earnings on investments made by companies within the USA, decreasing from £17.9 billion in 2011 to £15.5 billion in 2012.

Net earnings of Asian owned UK companies increased by £0.9 billion to net earnings of £3.7 billion in 2012. This increase was again driven by increased net earnings on investments made by Japanese companies during 2012.

Rate of return analysis

As noted in the section on outward investment, one useful indicator related to direct investment earnings is the rate of return defined as income on direct investment equity as a percentage of the overall direct investment position.

As rates of return increase, it implies that direct investment enterprises are more profitable and can be used, in combination with consideration of many other factors, in drawing inferences about the competitiveness of different economies. Overall the implied rate of return for inward investment into the UK decreased to 4%, down from 6% seen in the previous year and remains lower than the 2010 value of 5%.

Nôl i'r tabl cynnwys