Cynnwys

- Main points

- Overview

- The industrial composition of outward FDI stocks can vary considerably between countries

- FDI with the UK ranks highly from the perspective of many other countries

- Movements in FDI earnings can affect the current account balance

- Conclusion

- Acknowledgements

- Quality and methodology

- Annex A: Details of Standard Industrial Classification 2007: SIC 2007 industries for each foreign direct investment industrial grouping

1. Main points

The UK had 15.8% of its outward foreign direct investment (FDI) position in 2015 in mining and quarrying industries; this was the second-largest share among Organisation for Economic Co-operation and Development (OECD) countries after Canada (19.6%) and greater than that of France (7.7%), the US (3.9%) and Germany (0.6%).

Falling implied rates of return on UK FDI in mining and quarrying industries since 2011 have contributed to lowering the overall rate of return on UK outward FDI; similar trends have been observed in the US and Hungary.

The UK had the greatest value of outward and inward FDI positions with the US, Luxembourg, the Netherlands and France in 2016; the UK ranks similarly high for the FDI positions reported by these countries with the UK.

UK net FDI earnings have fallen steadily since 2011, with an impact on the current account; this has been driven by a fall in the implied rate of return on investment in mining and quarrying that was also seen in FDI rates of return for other countries.

The overall impact of UK net FDI earnings on the current account was most similar to that seen in the Netherlands, and slightly less so than that in France.

2. Overview

What is foreign direct investment?

Foreign direct investment (FDI) refers to cross-border investments made by residents and businesses from one country into another, with the aim of establishing a lasting interest in the country receiving investment1. Outward FDI captures the investments made by UK-based companies abroad whereas inward FDI covers investments in the UK made by foreign companies2.

Statistics used in this analysis are sourced from the Organisation for Economic Co-operation and Development (OECD) unless stated otherwise. Office for National Statistics (ONS) and other national statistics compilers provide FDI statistics to international organisations, enabling comparisons using common definitions and currency. UK FDI statistics are also published routinely in the FDI statistical bulletin and balance of payments.

There are three main accounts used for presenting FDI statistics. The FDI position measures the stock of investment that UK companies own overseas (outward FDI) or the stock of investment held by foreign-owned companies in the UK (inward FDI). This stock of FDI can generate earnings that reflect the profits from it; there are outward and inward earnings. There is also a measure of investment flows associated with FDI. These flows include re-invested earnings (unrepatriated earnings), in addition to net acquisitions of shares (such as through company takeovers), inter-company loans, and debt transactions among other things. This article will focus upon the first two concepts since FDI flows can vary considerably from year-to-year, making international comparisons sensitive to the time period used.

The purpose of this article is to frame three aspects of FDI involving the UK within an international context. We begin by comparing the industrial composition of other countries’ FDI stock with that of the UK. This builds on similar analysis from August 2016 that presented this composition for the G7 economies in 2012; this article updates it by covering more countries for 2015 and focusing on FDI in mining and quarrying industries.

The next section looks at FDI with the UK from the perspective of other countries. The highest value of outward and inward FDI positions for the UK are usually with Luxembourg, the Netherlands and the US. However, where does the UK rank from the perspective of each of these countries?

Finally, previous analysis has found that trends in UK net FDI earnings have had an impact on the current account. Falling net FDI earnings have been a factor in the recent downward trend in the UK’s current account balance since 2011. This section investigates whether FDI earnings have had a similar impact on other countries’ current account balances.

Notes for: Overview

A minimum of 10% of the voting power is the basic criterion used to distinguish FDI relationships from portfolio investment.

Inward investment is made in the UK by non-resident companies.

3. The industrial composition of outward FDI stocks can vary considerably between countries

Foreign direct investment (FDI) statistics can be grouped to show the breakdown of overall FDI positions between industries. In the UK, these are defined using the UK Standard Industrial Classification of Economic Activities 2007: SIC 2007, which is fully consistent with international industrial classifications. Those used in this analysis can be found in Annex A, creating the following industrial groupings:

mining and quarrying

manufacturing

wholesale, transport and accommodation

information and communication

financial and insurance

professional and support

other services

supressed and unavailable data (supressed due to disclosure controls or are unpublished)

This section analyses the industrial composition of the stock of outward FDI1 among Organisation for Economic Co-operation and Development (OECD) member countries in 2015. OECD statistics for 2016 were not available for enough countries at the time of writing, therefore this section uses statistics for 2015. The UK figures have been calculated using our Foreign direct investment involving UK companies statistical bulletin. Later, we compare outward FDI in mining and quarrying industries in more detail.

Services industries comprised the larger share of most countries’ outward FDI positions in 2015

The share of UK overseas FDI stocks in the finance and insurance industries was 22.1% in 2015, compared with 17.4% in manufacturing and 15.8% in mining and quarrying. Combining the stock of FDI in manufacturing with that of mining and quarrying indicates that these industries accounted for one-third (33.2%) of the UK’s total outward stock. Looking at the other countries in Figure 1 indicates that these two industries also tend to account for less than half of other countries’ outward FDI stocks. The notable exceptions are the Netherlands (63.8%), Japan (51.3%) and South Korea (50.6%).

The services industries combined comprised the larger proportion of most countries’ outward FDI stocks in 2015. Financial and insurance services in particular play a large role for many countries. These industries were the largest industrial group in 16 of the 22 countries presented in Figure 1, which includes the UK. Furthermore, 6 of those 16 countries have more than half of the value of their outward FDI stock in financial and insurance industries. The US and Luxembourg are two of them, where financial and insurance industries accounted for 67.3% and 81.1%, respectively, of their total outward FDI stock in 2015, compared with 22.1% for the UK. Some of these proportions reflect global corporate structures and the role of financial centres in FDI.

Figure 1: Outward FDI positions by industry for selected countries

2015

Source: Organisation for Economic Co-operation and Development (OECD) and Office for National Statistics

Notes:

Office for National Statistics values are used for the UK.

Negative FDI positions can occur when notable reverse investment (from subsidiaries to parent companies) takes place; this is most apparent for some industry groups for Poland.

The total of the proportions of all industries per country may not sum to 100 due to rounding and/or negative values.

Download this chart Figure 1: Outward FDI positions by industry for selected countries

Image .csv .xlsFDI in mining and quarrying has been a factor in recent trends for other countries as well as in the UK

The UK had the highest value of outward FDI positions in mining and quarrying industries in 2015 among the G7 countries. Table 1 presents Office for National Statistics (ONS) data for the UK, converted to US dollars, alongside OECD values for the other six countries.

In 2015, the value of the UK’s outward FDI stock in mining and quarrying was 27.3% larger than that of the US, which had the second-highest value of outward FDI in those industries. Furthermore, this also accounted for a much greater proportion of the total outward FDI stock for the UK (15.8%) than for the US (3.9%). Among the G7 countries (and OECD countries), only Canada had a higher proportion (19.6%) of outward FDI stocks in mining and quarrying industries than the UK, despite the lower value of the Canadian stock ($146.9 billion).

Table 1: Outward FDI positions for G7 countries in mining and quarrying industries, 2015

| 2015 | ||

| Value (US$ billion) | Proportion total outward FDI stock (%) | |

|---|---|---|

| UK | 253.1 | 15.8 |

| US | 198.8 | 3.9 |

| Canada | 146.9 | 19.6 |

| France | 97.1 | 7.7 |

| Japan | 94.4 | 7.7 |

| Germany | 8.4 | 0.6 |

| Italy | -1.8 | -0.4 |

| Source: Organisation for Economic Co-operation and Development (OECD) and Office for National Statistics | ||

| Notes: | ||

| 1. Office for National Statistics values are used for the UK, converted to US dollars. | ||

Download this table Table 1: Outward FDI positions for G7 countries in mining and quarrying industries, 2015

.xls (36.4 kB)Our previous analysis2 found that the returns on UK FDI in mining and quarrying industries have fallen by more than that of the overall stock of UK outward FDI between 2011 and 2015. Information on FDI earnings and positions in mining and quarrying industries from 2011 to 2015 was only available for four OECD countries. These are used to calculate the returns presented in Figure 2 alongside equivalent ONS data for the UK. This suggests that the experience of the UK is very similar to that of the US, in that the implied rates of return on mining and quarrying have fallen notably between 2011 and 2015, with a particularly big annual decrease in 2015.

For the UK, the implied rate of return on outward FDI in mining and quarrying decreased from 12.7% in 2011 to 0.1% in 2015, while the implied rate of return for US FDI in mining and quarrying fell from 19.4% to 1.8% over the same period. Among the other three countries in Figure 2, both Australia and Hungary also had a lower implied rate of return in 2015 than in 2011 on outward FDI in mining and quarrying; for Australia, this is due largely to a notable fall in the implied rate of return over 2015.

Figure 2: Implied rates of return on outward FDI in mining and quarrying industries and on the total outward position

2011 to 2015

Source: Organisation for Economic Co-operation and Development (OECD) and Office for National Statistics

Download this chart Figure 2: Implied rates of return on outward FDI in mining and quarrying industries and on the total outward position

Image .csv .xlsIn addition, the implied rate of return on the total outward FDI position has also been decreasing between 2011 and 2015 for all countries presented in Figure 8. This fall has been the greatest for the UK, going from 9.2% in 2011 to 5.3% by 2015, a decrease of 3.9 percentage points. The overall rate of return for the US was 3.0 percentage points lower and the rates of return for Hungary and Chile were 2.2 percentage points and 1.9 percentage points lower respectively. Our previous analysis found that changes in the oil price over this period are likely to have contributed to the fall in FDI earnings and then implied rates of return for mining and quarrying. Likewise, it would seem that for the US and Hungary, this has also been part of the downward trend in overall rates of return on outward FDI.

The proportion of FDI in mining and quarrying could have affected overall returns on outward FDI. Of the five countries presented in Figure 2, the UK had the largest proportion (15.8%) of its outward FDI position in mining and quarrying. Australia was close to the UK’s value with 15.2% of outward FDI positions in these industries in 2015, followed by Hungary with 10.0% and the US with 3.0%. Therefore, the greater the proportion of direct investment positions in mining and quarrying industries, the greater the impact that falling implied rates of return for mining and quarrying could have on the overall rate of return.

Extending this analysis to the other OECD countries for which outward FDI earnings and positions in mining and quarrying statistics were available between 2013 and 2015 presents a more mixed picture (Figure 3). Like the UK and US, the rates of return have fallen consistently year-on-year for Germany, Luxembourg and Norway. Japanese outward FDI mining and quarrying earnings were not available for 2013, yet the implied rate of return was lower in 2015 than in 2014. Both Luxembourg and Norway have also seen their respective implied rates of return on mining and quarrying become negative by 2015; this was also the case for Sweden, except the rate of return was higher (less negative) in 2015 than 2014.

Figure 3: Implied rates of return on outward FDI in mining and quarrying industries and on the total outward position

2013 to 2015

Source: Organisation for Economic Co-operation and Development (OECD) and Office for National Statistics

Download this chart Figure 3: Implied rates of return on outward FDI in mining and quarrying industries and on the total outward position

Image .csv .xlsNotes for: The industrial composition of outward FDI stocks can vary considerably between countries

OECD statistics use the directional principle. There could be differences in the values reported in our previous analysis, which used the asset and liability principle to be consistent with the balance of payments; the overall composition of FDI stocks will be consistent irrespective of which principle is used.

Previous analysis presents FDI statistics using the asset and liability measurement principle rather than directional principle used in this article. The trends in headline statistics and implied rates of return will be similar irrespective of the measurement principle used.

4. FDI with the UK ranks highly from the perspective of many other countries

Foreign direct investment (FDI) statistics used in previous analyses have presented FDI relationships from the perspective of the UK. Looking at the geographic components of UK FDI uses data reported by the UK with other countries as the counterpart. This shows that the US, the Netherlands, Luxembourg and France are the countries with which the UK usually has the greatest FDI relationships by value. However, this does not show where the UK ranks in terms of FDI from the perspective of other countries. This section investigates this further by also looking at the FDI positions reported by other countries with the UK as the counterpart economy.

Top 20 countries accounted for 79.9% of the UK’s total outward FDI position in 2016, compared with 105.9% for inwards FDI

The US was the country in which the UK had the greatest value of outward FDI stocks in 2016. This alone accounted for 22.9% of the UK’s total outward FDI position in that year according to Organisation for Economic Co-operation and Development (OECD) statistics. This was also double the second-largest outward FDI stock with the Netherlands, $150.0 billion compared with $329.2 billion in the US. In that year, there was only one other country – Luxembourg – with which the UK had an outward FDI position above $100 billion. Taken together, these three countries accounted for 41.4% of the UK’s outward FDI position in 2016.

Table 2 lists the top 20 countries by value of the UK’s outward FDI position. It shows that these 20 countries accounted for 79.9% of the total outward position, with the rest of the world comprising 20.1%. Among this list, nine countries are members of the European Union and four are offshore financial centres.

Table 2: UK outward foreign direct investment to the top 20 counterpart countries by position value, 2016

| 2016 | |||

| Counterpart economy | UK outward FDI position ($ billion) | Position as a percentage of the total outward FDI position (%) | |

|---|---|---|---|

| 1 | United States | 329.2 | 22.9 |

| 2 | Netherlands | 150.0 | 10.4 |

| 3 | Luxembourg | 116.7 | 8.1 |

| 4 | France | 88.3 | 6.1 |

| 5 | Spain | 68.8 | 4.8 |

| 6 | Ireland | 67.1 | 4.7 |

| 7 | Australia | 50.5 | 3.5 |

| 8 | Jersey | 36.5 | 2.5 |

| 9 | Switzerland | 27.3 | 1.9 |

| 10 | Bermuda | 26.1 | 1.8 |

| 11 | Germany | 25.7 | 1.8 |

| 12 | Sweden | 22.8 | 1.6 |

| 13 | Cayman Islands | 22.0 | 1.5 |

| 14 | Canada | 21.1 | 1.5 |

| 15 | British Virgin Islands | 17.8 | 1.2 |

| 16 | Belgium | 17.5 | 1.2 |

| 17 | India | 17.0 | 1.2 |

| 18 | South Africa | 16.5 | 1.1 |

| 19 | Italy | 15.0 | 1.0 |

| 20 | Russian Federation | 14.4 | 1.0 |

| Remainder | 288.7 | 20.1 | |

| TOTAL | 1439.1 | 100.0 | |

| Source: Organisation for Economic Co-operation and Development (OECD) | |||

Download this table Table 2: UK outward foreign direct investment to the top 20 counterpart countries by position value, 2016

.xls (36.9 kB)The stock of FDI held in the UK by overseas investors is more concentrated than that held by the UK abroad. Like with outward FDI, the US also held the largest stock of FDI in the UK in 2016, at $452.5 billion or 32.6% of the UK’s inward FDI position. This is nearly double the value of the second-largest position held by the Netherlands of $260.9 billion. However, for inward FDI, France had the third-largest stock, being the only other country with a value above $100 billion. The top three countries accounted for over half (61.6%) of the FDI stock held in the UK.

Table 3 shows that the top 20 inward investors by position value accounted for 105.9% of all FDI held in the UK, with the rest of the world having a negative net FDI position in the UK. The negative values mainly reflect reverse investments from UK-based subsidiaries and branches to non-resident parent companies. There were also nine EU countries among the UK’s top 20 inward investors and six financial centres. This is the same number of EU countries as with outward FDI, but there were more financial centres in the inward FDI top 20 than on the outward list.

Table 3: UK inward foreign direct investment to the top 20 counterpart countries by position value, 2016

| 2016 | |||

| Counterpart economy | UK inward FDI position ($ billion) | Position as a percentage of the total inward FDI position (%) | |

|---|---|---|---|

| 1 | United States | 452.5 | 32.6 |

| 2 | Netherlands | 260.9 | 18.8 |

| 3 | France | 141.2 | 10.2 |

| 4 | Luxembourg | 84.7 | 6.1 |

| 5 | Germany | 81.8 | 5.9 |

| 6 | Jersey | 81.7 | 5.9 |

| 7 | Japan | 56.2 | 4.0 |

| 8 | Switzerland | 53.9 | 3.9 |

| 9 | Spain | 42.0 | 3.0 |

| 10 | Bermuda | 37.2 | 2.7 |

| 11 | Belgium | 33.4 | 2.4 |

| 12 | Cayman Islands | 32.5 | 2.3 |

| 13 | Ireland | 22.4 | 1.6 |

| 14 | Australia | 22.1 | 1.6 |

| 15 | Hong Kong | 19.3 | 1.4 |

| 16 | Sweden | 14.1 | 1.0 |

| 17 | India | 9.5 | 0.7 |

| 18 | British Virgin Islands | 9.1 | 0.7 |

| 19 | Denmark | 8.3 | 0.6 |

| 20 | Guernsey | 8.0 | 0.6 |

| Remainder | -82.5 | -5.9 | |

| TOTAL | 1388.2 | 100.0 | |

| Source: Organisation for Economic Co-operation and Development (OECD) | |||

Download this table Table 3: UK inward foreign direct investment to the top 20 counterpart countries by position value, 2016

.xls (37.4 kB)Some of these FDI relationships reflect the way in which FDI statistics are compiled. International guidelines require inward FDI statistics to record the FDI relationship with the country of the immediate parent company. This is not necessarily the same as the ultimate investing company in some of the larger and more complex multi-national corporate structures. A similar situation exists for outward FDI where the immediate destination is not necessarily the final destination of the FDI investment. Therefore, when FDI is channelled through financial centres – such as the Netherlands and Luxembourg – it can make the values of FDI appear large relative to the size of the economy.

We have produced some Experimental Statistics for inward FDI on an ultimate parent company basis and are collaborating with international partners to develop these measures further.

UK is among the top five FDI counterpart countries for around half of OECD economies

Considering the UK’s importance as an FDI counterpart involves examining the value of FDI positions from the perspective of the reporting country. In this situation, outward FDI with the UK as a counterpart describes the value of FDI that the reporting country has in the UK. Inward FDI with the UK as a counterpart therefore describes the instance where UK businesses have invested in the reporting country.

In 2016, Spain was the only OECD country for which data were available that had its largest proportion of outward FDI in the UK. This represented 16.5% of Spain’s outward FDI position, as shown in Figure 4. The UK was also the second-largest destination for Luxembourg (15.8%), Australia (13.2%), the US (12.8%), Ireland (11.8%), Denmark (10.7%), Canada (9.3%) and Japan (8.7%). There were a further two countries – Belgium and the Netherlands – for which the UK had the third-largest proportion; the FDI position of Belgian companies in the UK was also equivalent to 25.3% of Belgium’s total outward FDI position in 2016. A further six OECD countries had the UK among their top five outward FDI destinations.

Figure 4: Outward FDI positions with the UK as the counterpart for OECD countries

2016

Source: Organisation for Economic Co-operation and Development (OECD)

Notes:

The ranking of the proportion of outward FDI to the UK for each country is shown after the country name. For example, the UK was the third-largest FDI destination for Belgium in 2016.

Statistics for Mexico and the Slovak Republic were not available; those for Austria and Finland were suppressed; and Greece reported a negative outward FDI position with the UK in 2016 making it harder to interpret the results.

Download this chart Figure 4: Outward FDI positions with the UK as the counterpart for OECD countries

Image .csv .xlsThere were more OECD countries with the UK among their top five inward investors than as one of the top five outward investment destinations in 2016. Using available OECD data, the UK was in the top five for 18 of these countries’ inward FDI positions compared with 16 for their outward investments. The UK was the largest inward investor in the US, accounting for 14.9% of the US’s total inward investment position (Figure 5).

There was also only one OECD country – Luxembourg – for which the UK was the second-largest investor, at 13.6% of the total inward stock. Among these OECD countries, the UK was the third-largest inward investor for four countries: Spain, Sweden, France and Australia. There were also only four OECD countries for which the UK was not among the top 10 inward investors: Latvia, Greece, Estonia and Lithuania.

Figure 5: Inward FDI positions with the UK as the counterpart for OECD countries

2016

Source: Organisation for Economic Co-operation and Development (OECD)

Notes:

The ranking of the proportion of inward FDI from the UK to each country is shown after the country name. For example, the US received its largest proportion of FDI from the UK in 2016.

Statistics for Mexico and the Slovak Republic were not available; those for Austria and Finland were suppressed; and Hungary reported a negative outward FDI position with the UK in 2016 making it harder to interpret the results.

Download this chart Figure 5: Inward FDI positions with the UK as the counterpart for OECD countries

Image .csv .xlsThe analysis of OECD countries’ FDI relationships with the UK reveals that the UK is an important FDI partner for around half of them. The UK has among the largest shares of outward and inward FDI positions with the US, the Netherlands, Luxembourg and France; for each of these, the UK was among their top four FDI counterpart countries in 2016. There are also some differences too in that Spain had its largest share of outward FDI in the UK, and the UK was also second-largest for Australia, Ireland, Denmark, Canada and Japan. For inward FDI from the UK, Spain, Sweden, France and Australia all received their third-largest shares of inward investment from the UK.

Nôl i'r tabl cynnwys5. Movements in FDI earnings can affect the current account balance

The current account measures the UK’s interaction with the rest of the world. The current account balance is the difference of all transactions of UK residents and non-residents. It comprises net:

trade in goods and services

primary income, which includes foreign direct investment (FDI) earnings

secondary income

Aside from net FDI earnings, net primary income is comprised of compensation of employees and other primary income – such as earnings from rent and taxes – and subsidies on production and on the import of goods. Secondary income represents the provision (or receipt) of an economic value by one party without directly receiving (or providing) a counterpart item of economic value. A current account balance is in surplus if the transactions of UK residents abroad (credits) exceed the value of non-residents’ transactions in the UK (debits), and in deficit if overall debits exceed credits.

Roughly the same number of OECD countries had lower net FDI earnings in 2016 than in 2011 as those that had higher net FDI earnings

Our previous analysis showed that net FDI earnings in the UK have fallen since 2011, which also contributed to a fall in the UK’s current account balance. This article investigates whether net FDI earnings have had a similar impact on other countries’ current account balances. Data were available for 25 of the 36 Organisation for Economic Co-operation and Development (OECD) members1 in 2016. Out of these countries, 12 had lower net FDI earnings in 2016 than 2011. These were:

- Austria

- France

- Germany

- Greece

- Latvia

- Mexico

- the Netherlands

- Portugal

- Slovenia

- Sweden

- UK

- US

This was roughly equal to the 11 countries for which net FDI earnings were higher in 2016 than in 2011. These were:

- Australia

- Chile

- Czech Republic

- Denmark

- Estonia

- Hungary

- Iceland

- Japan

- Lithuania

- New Zealand

- Switzerland

This leaves two countries – South Korea and Turkey – where the value of net FDI earnings in 2016 was very close to the value recorded in 2011.

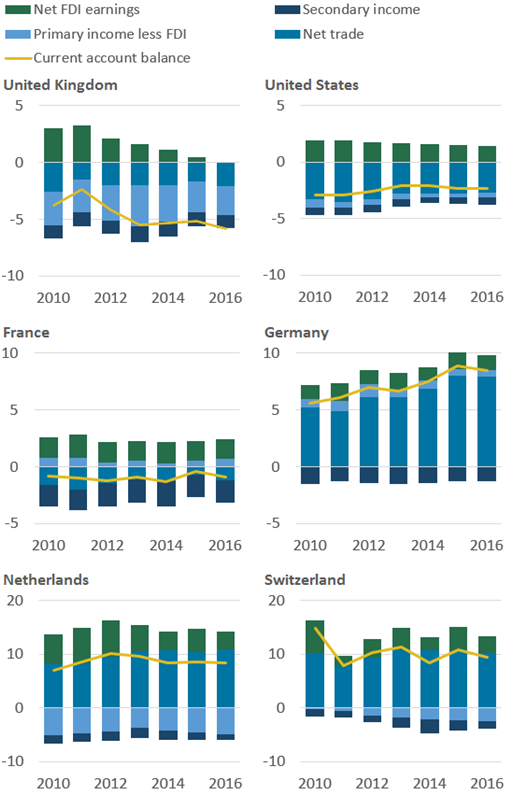

This article uses a selection of these countries with graphs showing each country’s balance of payments split into its main components. The current accounts are calculated as a percentage of gross domestic product (GDP) to frame the current account relative to the size of the different economies. Figure 6 compares five other countries that have seen downwards trends in net FDI earnings with the UK.

The changes in the Netherlands’ net FDI earnings and the current account balance are the most similar to that of the UK. The Netherlands also saw net FDI earnings decrease by more than 3 percentage points, going from 6.8% of Dutch gross domestic product (GDP) in 2012 to 3.4% of GDP in 2016. The Netherlands has also seen its current account balance fall alongside net FDI earnings, going from a surplus of 10.2% in 2012 to a smaller surplus of 8.4% by 2016. Therefore, net FDI earnings in the Netherlands were 3.4 percentage points of GDP lower in 2016 than in 2012 and the current account balance was 1.8 percentage points of GDP lower over the same period.

For the UK, net FDI earnings were 3.4 percentage points of GDP lower in 2016 than in 2011, going from 3.3% in 2011 to negative 0.1% by 2016. Likewise, the overall current account deficit was 3.4 percentage points higher over the same period, 2.4% of UK GDP in 2011 compared with 5.8% of GDP in 2016. Therefore, despite the Netherlands having a current account surplus and the UK having a deficit, both balances have both fallen by more than 1 percentage point of GDP since 2012 or 2011.

The current accounts of France and the US both had lower net FDI earnings in 2016 than in 2011. However, the magnitude of these changes is much lower compared with that of the UK (and the Netherlands). French net FDI earnings were 0.3 percentage points of GDP lower in 2016 than in 2011, whereas that of the US was 0.5 percentage points lower.

The difference is that for both France and the US, the other components of the current account did change to offset the relatively lower amount of net FDI earnings. Therefore, while both countries also had negative current account balances, they were relatively constant over this period. The French current account deficit was equivalent to 1.0% of French GDP in 2011 and 0.9% of GDP in 2016 – a decrease of 0.1 percentage points of French GDP, despite the deficit having been 1.3% of GDP in 2014. The US current account deficit in 2016 (2.3% of US GDP) was 0.6 percentage points lower than in 2011 (2.9% of GDP).

Figure 6: Current account balances and components for the UK and five other OECD countries

Percentage of gross domestic product (GDP), 2010 to 2016

Source: Organisation for Economic Co-operation and Development (OECD)

Notes:

- The current account total percentages may not sum exactly from the components due to rounding.

Download this image Figure 6: Current account balances and components for the UK and five other OECD countries

.png (86.8 kB) .xlsx (71.1 kB)By contrast, even though net FDI earnings for Germany and Switzerland were lower in 2016 than in 2011 and 2010 respectively, the experiences of these countries are also different. Switzerland’s net FDI earnings have varied from year to year, yet there is also some evidence that net FDI earnings have had an impact on the country’s current account balance. The Swiss balance increases in years in which net FDI earnings increase and the other way around when earnings fall, yet net FDI earnings have not been falling consistently over the period.

Germany is the only country in Figure 1 where net FDI earnings appear to have had little impact on the current account balance. Indeed, the German current account increased from a surplus of 6.1% of German GDP in 2011 to 8.5% of GDP by 2016, even though net FDI earnings fell slightly, from 1.6% of GDP to 1.3% of GDP across the same period.

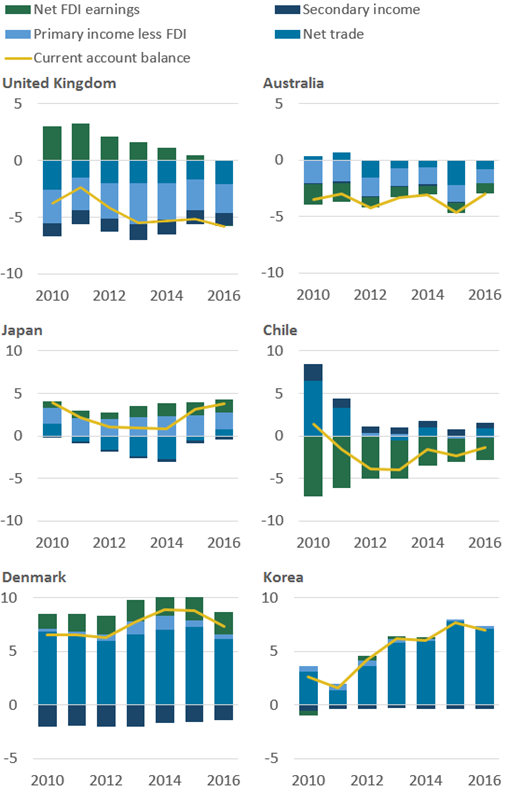

There are also some countries where changes in net FDI earnings have been quite different to that of the UK. Figure 7 extends this analysis to Australia, Japan, Chile, Denmark and South Korea. Australia and Chile had negative net FDI earnings, implying that foreign investors generated higher earnings in their economies than domestic investors received from abroad. Furthermore, both countries’ net FDI earnings became less negative between 2010 and 2016, which contributed positively to the current account balance.

Elsewhere, Denmark has also seen net FDI earnings increase slightly over the same period while those in Japan have been relatively constant. The role of net FDI earnings is notably small in South Korea, equivalent to 0.0% of Korean GDP in 2016 compared with net trade of 7.2% of GDP.

Figure 7: Current account balances and components for the UK and another five other OECD countries

Percentage of gross domestic product (GDP), 2010 to 2016

Source: Organisation for Economic Co-operation and Development (OECD)

Notes:

- The current account total percentages may not sum exactly from the components due to rounding.

Download this image Figure 7: Current account balances and components for the UK and another five other OECD countries

.png (91.2 kB) .xlsx (67.9 kB)The impact of net FDI earnings on the current accounts of these countries has been relatively diverse too. The Australian current account balance was relatively flat between 2010 and 2016, which is comparable with some of the countries presented in Figure 1. Higher (less negative) net FDI earnings tended to offset decreases in other parts of the Australian current account balance. Denmark and South Korea are two countries with higher current account balance values in 2016 than in 2011, while Japan’s current account balance has been affected by falling net trade in each year from 2011 to 2014. Overall, the 10 other countries presented alongside the UK in Figures 6 and 7 suggest that the changes to net FDI earnings in the UK between 2011 and 2016 have been particularly large.

The Netherlands’ experiences have the closest resemblance to that of the UK for trends in net FDI earnings on the current account balance

The contribution of each component of the current account to the overall change in the balance can be calculated by looking at the annual change from one year to the next. This can be seen in Figure 8 for the UK. The fall in the value of net FDI was the largest contributor to the change in the UK’s current account balance in four of the five years between 2012 and 2016. Indeed, net FDI earnings was the only component where the value fell in 2015 (by $19.9 billion).

Furthermore, the $30.4 billion fall in net FDI earnings in 2012 accounted for more than half of the fall in a year where net trade and net other primary income also lowered the current account balance. The contribution of net trade has also been negative between 2012 and 2014, yet unlike net FDI earnings, net trade made a positive contribution to the change in the current account balance in 2015.

Figure 8: Annual change in the UK current account balance and components

2011 to 2016

Source: Organisation for Economic Co-operation and Development (OECD)

Notes:

- The current account total percentages may not sum exactly from the components due to rounding.

Download this chart Figure 8: Annual change in the UK current account balance and components

Image .csv .xlsNet FDI earnings have also made negative contributions to the current account balance for the Netherlands. FDI earnings were the only negative contribution to the current account balance in 2012 and then made the single largest absolute contribution to the change in the current account balance in 2013 and 2014 (Figure 9). However, in 2015, the change in net FDI earnings in the Netherlands was slightly positive ($0.2 billion), implying that net trade was the only component that contributed to the fall in the current account balance in that year.

Net FDI earnings in 2016 were negative for the Netherlands and mainly offset the increase in net trade over the year. There are distinct similarities between the impact that net FDI earnings have had on the Netherlands and UK current account balances, even if it was less of a factor for the Netherlands in 2015.

Figure 9: Annual change in the Netherlands current account balance and components

2011 to 2016

Source: Organisation for Economic Co-operation and Development (OECD)

Notes:

- The current account total percentages may not sum exactly from the components due to rounding.

Download this chart Figure 9: Annual change in the Netherlands current account balance and components

Image .csv .xlsLike the UK, France also had the only negative contribution to the current account balance coming from FDI in 2015. The annual changes in French net FDI earnings were negative in 2012, 2015 and 2016, albeit only $1.1 billion lower in the last year.

For 2013 and 2014, French FDI earnings were slightly positive compared with the negative changes for the UK. However, a notable difference to the experience of the UK is that French net FDI earnings was not the largest change among the current account components in any of the years presented in Figure 10. Furthermore, the French current account balance has remained relatively constant since changes in net FDI earnings tended to be dominated by changes to the other components.

Figure 10: Annual change in the French current account balance and components

2011 to 2016

Source: Organisation for Economic Co-operation and Development (OECD)

Notes:

- The current account total percentages may not sum exactly from the components due to rounding.

Download this chart Figure 10: Annual change in the French current account balance and components

Image .csv .xlsTrend in the value of FDI credits and debits in the UK was different to that of the Netherlands and France

Our previous analysis has shown that the value of UK FDI credits had fallen considerably between 2011 and 2016, while that of FDI debits has been relatively constant. Figure 11 presents OECD data for the UK alongside the equivalent series for the Netherlands and France. Using these statistics reveals that UK FDI credits have fallen from $167.6 billion in 2011 to $78.7 billion in 2016, a decrease of $89.0 billion. Over the same period, the value of UK FDI debits were very similar, at $81.9 billion in 2011 and $81.0 billion in 2016.

Figure 11: FDI credits and debits for the United Kingdom, Netherlands and France

2010 to 2016

Source: Organisation for Economic Co-operation and Development (OECD)

Download this chart Figure 11: FDI credits and debits for the United Kingdom, Netherlands and France

Image .csv .xlsThe trends in both FDI credits and debits for the Netherlands and France were different to those for the UK. The values of net FDI earnings in the Netherlands have fluctuated from year-to-year, yet it appears that debits have been on a slight upward trend while the value of Dutch credits have been falling gradually. This can be seen with the values of the average annual growth rates for the Netherlands earnings between 2012 and 2016; credits fell by 2.4% per year on average whereas debits grew by 0.6% per year on average. This compares with average growth rates of negative 13.8% for UK credits and negative 0.1% for UK debits across the same period.

The trends in French FDI earnings were both stable since 2010, with the values remaining relatively constant. The average growth rates for FDI earnings were 0.5% and 13.5% for French credits and debits respectively. The annual growth rate in debits in 2012 was 79.2%, which increases the average over the period and makes any comparisons more difficult to interpret.

The analysis of the impact that net FDI earnings have had on different countries’ current account balances indicates that the experience of the Netherlands was the most similar to that of the UK. The value of UK and Dutch net FDI earnings and current account balances have each decreased by more than 1 percentage point of their respective GDP since 2011 and 2012 respectively.

Additionally, the contribution of changes in Dutch net FDI earnings have been large in some years, which corresponds with lower current account balances in 2013 and 2014. Differences start to emerge in the trends for net FDI earnings in that it was lower FDI credits that affected UK net FDI earnings the most, whereas it was more the convergence of Dutch debits to credits that contributed to lower net earnings.

There are also similarities with France where net FDI earnings were also lower in 2016 than in 2011. However, the impact on the UK’s current account has been more pronounced than that of France. Furthermore, the other components of the current accounts have also tended to offset any decreases in net FDI earnings in France and the Netherlands to a greater extent than in the UK, mitigating any impact of FDI earnings on the current account balance.

Notes for: Movements in FDI earnings can affect the current account balance

- Latvia and Lithuania are included in this analysis even though OECD membership was not confirmed until 2016 and 2018 respectively.

6. Conclusion

This article provides more information on three aspects of foreign direct investment (FDI) involving the UK. We found that the UK had one of the higher proportions of its outward FDI position in mining and quarrying industries. Furthermore, implied rates of return on FDI in these industries were also lower in 2015 than 2011 for the US and Hungary, which in turn would have contributed to downward trends in these countries’ overall implied rates of return on outward FDI.

A second investigation showed that the UK is equally important to the US, the Netherlands, Luxembourg and France, as each of these countries are in UK FDI. The UK was the top investor in the US in 2015 and was the fourth-largest inward investor in France in 2015. Otherwise, the UK was the second- or third-largest counterpart country for these countries for outward FDI, or in both directions for Luxembourg and the Netherlands. However, the UK ranked highly for a number of other Organisation for Economic Co-operation and Development (OCED) countries. This includes first for FDI from Spain in to the UK, and second in to the UK for Australia, Denmark, Canada and Japan. For UK FDI in to other countries, the UK was also the third-largest investor in Spain, Sweden and Australia.

The recent impact that net FDI earnings have had on the UK’s current account balance was notable among OECD countries. This analysis also found that the experience of the Netherlands was the most similar to that of the UK, and less so with France. Looking at the recent trends in FDI credits and debits showed that for the UK, falling net FDI earnings were due largely to lower FDI credits between 2011 and 2016. However, for the Netherlands, the values of FDI credits and debits have been converging over the period. Our previous analysis highlighted the role that falling commodity prices may have had on UK FDI credits over that period, which would have affected mining and quarrying industries in particular. Of these three countries, the UK had the greater proportion of outward FDI stock in mining and quarrying, although those of the Netherlands and France were also above 7% of their respective total outward positions in 2015. Therefore, lower commodity prices are likely to have affected FDI credits for all three countries, where the UK may have been particularly impacted.

Nôl i'r tabl cynnwys7. Acknowledgements

Authors: Nadia Davenport, Andrew Jowett, Luke Lockley and Victoria West.

The authors would like to acknowledge the contributions from Pauline Beck, Callum Cunningham and Sami Hamroush.

Nôl i'r tabl cynnwys8. Quality and methodology

The Foreign direct investment Quality and Methodology Information report contains important information on:

the strengths and limitations of these data and how they compare with related data

uses and users of these data

how the output was created

the quality of the output including the accuracy of data

9. Annex A: Details of Standard Industrial Classification 2007: SIC 2007 industries for each foreign direct investment industrial grouping

Annex A: Details of Standard Industrial Classification 2007 (SIC 2007) industries for each foreign direct investment industrial grouping used

| Industry grouping | Section(s) within SIC07 |

|---|---|

| Mining and Quarrying | B - Mining and quarrying |

| Manufacturing | C - Manufacturing |

| Wholesale, Transportation and Accommodation | G - Wholesale and retail trade; repair of motor vehicles and motorcycles |

| H - Transportation and storage | |

| I - Accommodation and food service activities | |

| Information and Communication | J - Information and communication |

| Financial and Insurance | K - Financial and insurance activities |

| Professional and Support | M - Professional, scientific and technical activities |

| N - Administrative and support service activities | |

| Other | A - Agriculture, forestry and fishing |

| D - Electricity, gas, steam and air conditioning supply | |

| E - Water supply, sewerage, waste management and remediation activities | |

| F - Construction | |

| L - Real estate activities | |

| O - Public administration and defence; compulsory social security | |

| P - Education | |

| Q - Human health and social work activities | |

| R - Arts, entertainment and recreation | |

| S - Other service activities | |

| T - Activities of households as employers; undifferentiated goods- and services-producing activities of households for own use | |

| U - Activities of extra-territorial organisations and bodies | |

| Source: Office for National Statistics | |