Cynnwys

- Executive summary

- Introduction

- What are trade asymmetries and how are they measured?

- How big are the UK’s trade asymmetries?

- Deep dive approach, sources and methods

- Asymmetries analysis: initial deep dive results

- Wider work to reduce trade asymmetries

- Conclusions and next steps

- Acknowledgements

- Annexes

1. Executive summary

UK trade statistics continue to be at the heart of decision-making in government and by wider users, particularly as the UK prepares to leave the European Union (EU). Providing a deeper understanding of our trading relationship with other countries is crucially important.

This is the second article in our series exploring UK trade asymmetries. In this analysis we dive deeper into the methods and sources behind our trade estimates and those of our bilateral partners to help explain where there are some differences.

Building on our earlier analysis published in the summer of 2017, we have initially focused on those countries with which we have some large trade asymmetries, notably the US and the Republic of Ireland (referred to as “Ireland” in this article).

We have set out an initial approach to our deeper analysis of trade asymmetries in Section 5. This includes initial analysis of the available data, our engagement and collaboration with counterparts measuring these statistics in other countries – so essential to making progress – and research into data sources and methods. A short summary of the data sources used to estimate UK trade data at Office for National Statistics (ONS) is also included.

Central to this article is the initial progress we have made following strong collaboration and analysis with colleagues at the Bureau of Economic Analysis (BEA) in the US and the Central Statistics Office (CSO) in Ireland. Initial results from this analysis are detailed in Section 6 along with details of development plans within the BEA to further transition to updated international standards.

We have extended our analysis of these two countries to cover more years (2014 to 2016) and we have also converted the asymmetries to pounds sterling rather than US dollars as used in the previous article. Consistent with our earlier work, the analysis is conducted on nominal (current price) data, so the effects of price inflation have not been removed.

Generally, asymmetries in trade in goods are smaller than services and the data sources for trade in goods are stronger than for services. Her Majesty’s Revenue and Customs (HMRC) provide our main source data for trade in goods through the Intrastat (EU) Survey and administrative data (customs declarations) for non-EU countries. These data sources have a high level of coverage and HMRC conduct regular work to reduce trade in goods asymmetries. Therefore, we have looked primarily at asymmetries in services and conducted deeper analysis into particular service types to search for causes of asymmetries in this article (Section 6).

In summary, our latest analysis shows trade in services asymmetries with the US and Ireland as follows:

the largest UK-US asymmetries exist in trade in services (not goods) for which both countries are reporting a trade surplus with the other. In 2016 the UK reported a trade in services surplus with the US of £22.5 billion, while the US reported a trade in services surplus of £10.4 billion with the UK

the total UK-US absolute asymmetry in trade in services was £30.6 billion in 2014, £34.0 billion in 2015 and £32.8 billion in 2016

ONS consistently reported higher exports of services to the US than the BEA has reported in imports from the UK (Figure 1)

the magnitude of the services absolute asymmetry between UK exports and US imports was slightly lower in 2016 (£14.0 billion) than in 2015 (£15.6 billion) and 2014 (£16.2 billion)

the BEA has consistently reported higher exports of services to the UK than the ONS has reported in imports from the US (Figure 2)

the magnitude of the services absolute asymmetry between UK imports and US exports is slightly higher in 2015 (£18.4 billion) and 2016 (£18.8 billion) than in 2014 (£14.4 billion)

the largest UK-Ireland asymmetries exist in trade in services (not goods) for which both countries are reporting a trade surplus with the other

the total UK-Ireland absolute asymmetry in trade in services was £10.9 billion in 2014 (a little lower than in the United Nations (UN) Comtrade dataset analysis of July 2017 where the equivalent estimate was £11.5 billion), £10.3 billion in 2015 and £11.4 billion in 2016

the largest UK-Ireland asymmetries exist between the UK imports and Ireland exports bilateral data (Figure 4); here we see that Ireland’s CSO reports higher exports to the UK than we report as imports from Ireland in most service categories

there was a total services absolute asymmetry between the UK’s estimates of imports and Ireland’s estimates of exports (with Irish estimates being higher) of £10.6 billion in 2014, £9.9 billion in 2015 and £11.2 billion in 2016

Our current analysis digs deeper into the data. The analyses conducted so far have confirmed earlier results and revealed some possible new causes of differences. Where possible we have quantified the differences. So far this has only been possible for some of the differences with the US. It is very important to note that this analysis is not complete so overall conclusions should not be drawn at this stage. It is possible that the ongoing analysis will identify causes of asymmetries that, once quantified, might offset some of the reasons currently quantified and therefore the overall asymmetry might not change.

From the ongoing analysis of asymmetries with the US and Ireland and some of the causes identified so far, early conclusions and areas for further analysis are as follows:

the inclusion by the BEA of the Crown Dependencies1 in UK economic territory, but the exclusion of the Crown Dependencies by ONS. The BEA plans to explore the feasibility of modifying its data collection instruments to exclude the Crown Dependencies from its geographic definition of the UK

ONS and the BEA have moved at a different pace in adopting the latest international guidance. The new standards are the Balance of Payments and International Investment Position Manual Version 6 (BPM6), which have a number of differences from the older BPM5 rules (the US have a number of planned developments to further transition towards BPM6)

financial services is an area where we have seen asymmetries with both the US and Ireland and is therefore an area of focus for future analysis.

the inclusion of financial intermediation services indirectly measured (FISIM) and net spread earnings (NSE) in financial services by the UK, but not by the US. NSE is a measurement of service income from trading activities. FISIM is a measure that aims to capture output generated by intermediation services for which there is no explicit charge. This relates to deposit and lending services whereby the implicit charge for the service is included in the interest rate that is offered to the consumer

the classification of goods or services activity to different sub-categories of trade, for example, classification of items to “other business services” by some countries, but inclusion in more specific service categories by other countries and the classification of the same service to different specific service categories

in general, as the UK exports/US imports asymmetry has the opposite sign to the US exports/UK imports asymmetry most definitional differences help explain the asymmetry on one side, but increase the asymmetry on the other side

the definitional differences that have been identified so far, and for which quantification has been possible, help explain around 30% of the total trade in services asymmetry between UK exports and US imports in 2014 and 2015, and an even greater share in 2016. However, the asymmetry between UK service imports and US service exports would increase by around 5% if the definitional differences for which quantification has been possible were treated consistently by the BEA and ONS

our current findings show that definitional differences only explain a relatively small proportion of the total asymmetry. A larger source of difference is likely to be from statistical differences reflecting the use of different source data by each country

Some of these initial results require further analysis. Deeper analysis of trade asymmetries is ongoing. We are continuing this collaborative analysis with the US and Ireland to develop a fuller picture. We are also building on our early research into asymmetries with Germany and we intend to extend our analysis to further countries such as China, France, the Netherlands, Belgium and Luxembourg for which we have large asymmetries in either goods or services or both or there is a strong user interest. Results and insights from this analysis will be shared through future articles in the series later in 2018.

Notes for: Executive summary

- The Crown Dependencies are the Isle of Man and the Bailiwicks of Jersey and Guernsey.

2. Introduction

UK trade statistics are under close scrutiny and of high importance for the UK’s trade negotiations as the UK leaves the European Union (EU). We are delivering a range of developments as part of our UK trade development plan to meet the demands for high-quality informative trade statistics. This work includes analysis and, where possible, explanation and reduction of the UK’s trade asymmetries.

The first phase of our ongoing analysis and investigations into UK trade asymmetries focused primarily on gaining a better understanding of the published datasets and the context and known reasons for asymmetries. In this article we dive deeper into the UK’s bilateral trade data to understand better some of the differences in data sources and methods that might contribute to the trade asymmetries, particularly with specific countries.

As set out previously, international trade statistics provide estimates of the value of imports and exports of trade in goods and services between countries. In theory the estimate of the trade flows by each country should match. For example, France’s estimate of its imports from the UK should in theory match the UK’s estimate of its exports to France. However, in practice, there are differences that are known as trade asymmetries.

There have always been discrepancies in the reporting of trade flows and these are well documented by international agencies such as the International Monetary Fund (IMF), Eurostat and the Organisation for Economic Co-operation and Development (OECD). As a share of global trade transactions, asymmetries are very small, just 0.1 to 1% of the global current account.

Asymmetries can be caused by a range of conceptual and measurement variations between the estimation practices of different countries. Statistical agencies are likely to have different source data, estimation methods, and methodological and definitional differences. It should also be noted that the “true” value for a given statistic is unknown and could lie between the two country estimates or outside that range. It is also commonly agreed that when estimates are based on business surveys, it is easier to identify firms that export services than those that import services.

Asymmetries exist across global trade statistics and have been present for many years. It will never be possible to completely eliminate them, but we are actively assessing the UK’s trade asymmetries in order to better understand the causes and to develop approaches to try to reduce some of them where possible.

The UK is not alone in focusing on this issue: the international community is working together to better understand the reasons for asymmetries and to reduce them through bilateral discussions and other means. These discussions allow statistical agencies to share information that could, in due course, lead to changes in the official statistics of one or both agencies that, in turn, reduce the asymmetries. We are proactively engaged in this work and have taken forward a number of collaborative bilateral discussions with some countries who have larger trade asymmetries with the UK.

In addition we have completed an initial review of published work on this topic (Annex 10.1) and further reviewed the available trade data sources (Annex 10.2). As described in our development plan, we also commissioned analysis of global biases in trade data by Professor Thomas Baranga (Harvard University) and we provide a short summary of his published research in this article.

Our initial phase of analysis culminated in the publication of our first article Asymmetries in Trade Data – A UK Perspective on 13 July 2017. In that article we explained the context of the complicated nature of trade asymmetries. We highlighted some of the UK’s largest asymmetries in goods and services data. We demonstrated that there is much more work to do in this space and that we will be working on a range of analysis and developments to try to further understand and potentially reduce our trade asymmetries. This, our second article in the series, explores this analysis further and provides greater insight into the cause of some of the asymmetries.

In this article we focus on our initial deeper analysis with the US and Ireland. In later articles we will build on our early research into asymmetries with Germany and we intend to extend our analysis to further countries such as China, France, the Netherlands, Luxembourg and Belgium.

Nôl i'r tabl cynnwys3. What are trade asymmetries and how are they measured?

When goods and services are traded (imported and exported) between countries, the transactions are reported twice: once by each country in the bilateral relationship. Simplistically the credits (exports) recorded by one country and the debits (imports) recorded by the bilateral partner from that country should be identical. In reality, this is rarely the case and the discrepancy is known as an “asymmetry”.

The presence of trade asymmetries is well-documented in economic literature and monitored by the International Monetary Fund (IMF) and its Balance of Payments Committee (BOPCOM).

There are different ways to measure asymmetries and work on this subject is well-documented by HM Revenue and Customs (HMRC), for example in HMRC’s publication A Reconciliation of Asymmetries in Trade in Goods Statistics Published by the UK and Other European Union Member States and in our first article (Asymmetries in Trade Data – A UK Perspective).

A commonly-used calculation is the absolute asymmetry, which is the absolute difference between one country’s report (the declarant) of a trade flow (exports or imports) and the “mirror” report by the country with whom that country has traded (the partner).

Absolute Asymmetry = |Value (D) – Value (P)|

Where D = Declarant, P = Partner.

Note that absolute asymmetries can be calculated for exports and imports separately.

Unless otherwise stated, for the overall analysis (Section 4) we show the absolute asymmetry or total absolute asymmetry (the sum of the import and export absolute asymmetries) for comparative purposes and so that asymmetries in imports do not offset asymmetries in exports. For the deep dive analysis (Section 6), in which we dig deeper into the imports and exports data we calculate the asymmetry as the difference between the UK report and that of the mirror report to show the direction of the difference (although absolute asymmetries are still referred to in places in that section).

Nôl i'r tabl cynnwys4. How big are the UK’s trade asymmetries?

Initial analysis showed the size of UK trade asymmetries using data from the UN Comtrade database, which led to our further analysis. Here is a brief summary of that analysis highlighting those countries with the largest asymmetries.

Table 1: UK trade in goods and trade in services largest asymmetries in UN Comtrade data for 2014, $billion1

| Source: UN comtrade | Credits (Exports) | Debits (Imports) | UK perspective on Asymmetries | ||||||

|---|---|---|---|---|---|---|---|---|---|

| UK export data [ED] | Mirror (Import) data [EP] | Export Absolute Asymmetry (EA=|ED-EP|) | UK import data [ID] | Mirror (Export) data [IP] | Import Absolute Asymmetry (IA=|ID-IP|) | Total Asymmetry2 (TA=EA+IA) | |||

| Trade in Goods | $ bn | $ bn | $ bn | $ bn | $ bn | $ bn | $ bn | ||

| USA | 64.2 | 55.3 | 8.9 | 58.6 | 53.8 | 4.8 | 13.7 | ||

| France | 32.5 | 26.0 | 6.5 | 43.5 | 40.2 | 3.3 | 9.8 | ||

| Netherlands | 36.7 | 33.4 | 3.3 | 53.6 | 48.5 | 5.0 | 8.3 | ||

| Ireland | 29.3 | 22.9 | 6.4 | 19.4 | 17.8 | 1.6 | 8.0 | ||

| Belgium | 20.8 | 22.1 | 1.4 | 34.0 | 39.4 | 5.3 | 6.7 | ||

| Germany | 52.0 | 50.6 | 1.5 | 100.3 | 104.8 | 4.5 | 6.0 | ||

| Norway | 6.1 | 5.8 | 0.3 | 27.7 | 32.9 | 5.2 | 5.5 | ||

| China, Hong Kong SAR | 12.0 | 10.7 | 1.4 | 3.2 | 7.2 | 4.0 | 5.3 | ||

| Switzerland | 35.1 | 33.7 | 1.4 | 10.6 | 13.8 | 3.2 | 4.6 | ||

| South Africa | 3.9 | 3.3 | 0.6 | 6.0 | 3.5 | 2.6 | 3.2 | ||

| Trade in Services | |||||||||

| USA | 83.4 | 47.9 | 35.5 | 38.6 | 61.2 | 22.6 | 58.1 | ||

| Luxembourg | 5.1 | 12.3 | 7.2 | 2.5 | 14.5 | 11.9 | 19.2 | ||

| Ireland | 15.6 | 15.1 | 0.5 | 8.4 | 26.8 | 18.4 | 18.9 | ||

| France | 19.3 | 25.0 | 5.7 | 19.8 | 30.5 | 10.7 | 16.4 | ||

| Netherlands | 18.2 | 15.8 | 2.4 | 7.1 | 20.5 | 13.4 | 15.8 | ||

| Germany | 19.9 | 25.7 | 5.7 | 16.1 | 25.1 | 9.0 | 14.7 | ||

| Belgium | 5.3 | 9.6 | 4.3 | 4.1 | 10.4 | 6.2 | 10.5 | ||

| China, Hong Kong SAR | 3.8 | 4.5 | 0.7 | 2.8 | 9.2 | 6.5 | 7.2 | ||

| Russian Federation | 3.7 | 6.1 | 2.4 | 1.2 | 4.5 | 3.3 | 5.7 | ||

| Sweden | 5.9 | 6.7 | 0.8 | 2.5 | 5.5 | 3.0 | 3.8 | ||

| Source: Trade in Goods and Services, UN Comtrade Database, 2014 data downloaded 17 March 2017, Overseas Trade Statistics basis for Trade in Goods. | |||||||||

| Notes: | |||||||||

| 1. The table selects the largest trade in goods asymmetries amongst OECD member countries and the UK's top 5 non-OECD trading partners in 2014. | |||||||||

| 2. Sum of absolute export and import asymmetries (totals may not equal sum of components due to rounding). | |||||||||

Download this table Table 1: UK trade in goods and trade in services largest asymmetries in UN Comtrade data for 2014, $billion^1^

.xls (1.0 MB)Table 1 shows countries with which the UK had the largest trade asymmetries as reported in the 2017 article using the UN Comtrade data for 2014, in nominal (current) prices, $ billions.

It is clear from Table 1 that trade asymmetries are larger in services than goods. A possible reason for this is the stronger sources of data that are available for measuring trade in goods (such as HMRC’s overseas trade statistics for the UK) and that trade in tangible goods is easier to measure than intangible services.

Following the article in July 2017, we prioritised two countries that were of particular interest to users and where the UK had some of the largest trade in goods and services asymmetries. The US was chosen as it had the largest total absolute asymmetry in both goods and services. Ireland was of particular interest to users and one of the countries with which we had large asymmetries in both goods and services. Germany, China, France, the Netherlands, Belgium and Luxembourg were also identified as priority countries for future work, having large asymmetries in either goods, services or both, or strong user interest. As outlined earlier, we have focused our deeper analysis on services rather than goods for this article as the asymmetries are generally larger for services.

Nôl i'r tabl cynnwys5. Deep dive approach, sources and methods

Our deep dive approach to asymmetries analysis has been conducted in a number of stages summarised in Table 2.

Table 2: Summary of deep dive approach to asymmetries analysis

| 1 | Analyse bilateral trade data (goods and services) obtained from international databases, for example, UN Comtrade, Eurostat Comext, OECD, etc. | ||||||

| 2 | Compare published bilateral information on trade data sources and methods, for example, as published on bilateral partner website. | ||||||

| 3 | Establish contact with trade statisticians and/or economists in partner country National Statistical Institution (NSI) and/or National Central Bank (NCB) (as appropriate) and set up series of bilateral discussion meetings for collaborative analysis of asymmetries. | ||||||

| 4 | Exchange trade data at the lowest level available at which bilateral partners are permitted to share data, along with detailed information on trade data sources and collection and compilation methods. | ||||||

| 5 | Work collaboratively to analyse differences in data, sources, methods, classification of trade items, etc., and quantify differences where possible. | ||||||

| 6 | Share results of asymmetries analysis conducted by each bilateral partner, agree data and information to be published, and sign off. | ||||||

| 7 | Continue collaborative work with bilateral partner to agree potential developments or revisions to estimates where feasible in line with respective country’s revision and production practices as appropriate. | ||||||

| Source: Office for National Statistics | |||||||

Download this table Table 2: Summary of deep dive approach to asymmetries analysis

.xls (28.2 kB)Firstly, the deep dive approach to asymmetries analysis begins with an analysis of the bilateral trade data available on international websites, and, where available, on the websites of National Statistical Institution (NSI) and/or National Central Bank (NCB), taking account of the different classification bases of the trade data published by different sources (for example, adherence to BPM5 compared with BPM6, goods trade based on physical movement compared with change of economic ownership, etc.). The websites of bilateral partner organisations are searched for information on trade data sources and methods and these are compared.

Other relevant information such as previous research into asymmetries by bilateral countries is sought and reviewed. See Annex 10.1 for a literature review conducted for related material pertinent to the analysis within this article.

Following an initial analysis of the size of the asymmetry and relevant material, contact is established with trade statisticians and/or economists in bilateral partner NSI and/or NCB (as appropriate) and a series of bilateral discussion meetings are set up to undertake collaborative work on asymmetries analysis.

As the analysis progresses, trade data are shared at the lowest level that is available and can be shared within the Code of Practice for Official Statistics, that is, no disclosive data are shared. A comparison is then carried out of the bilateral data in order to identify the magnitude of asymmetries, to highlight those goods and/or services that display the largest asymmetries and to pinpoint the priority areas for further analysis. Information on data sources (including survey questionnaires and administrative data assessments) and data collection and compilation methods, is exchanged and compared in order to identify differences that may account for asymmetries in the trade data, and where possible, differences are estimated numerically.

Table 3 provides a summary of the UK’s trade data sources used in the comparisons carried out with bilateral partners.

Table 3: Summary of UK trade data sources

| Category | Description | Data sources | |||

|---|---|---|---|---|---|

| Trade in goods | Various categories of merchandise trade | Mainly HMRC (Intrastat/Extrastat); small number of other sources, for example, London Bullion Market (LBM) | |||

| Manufacturing services on physical inputs owned by others | Fees charged for the processing, assembly, labelling and packing of goods | International Trade in Services (ITIS) survey. Quarterly ITIS has a sample size of around 2,100 businesses and Annual ITIS has a sample size of approx 16,500 businesses. The quarterly survey has an 85% response rate at week 20 results as does the annual final delivery. The surveys are estimated to cover approximately 55% of exports of services and 43% of imports of services. The final results are published annually . | |||

| Maintenance and repair services n.i.e. (not included elsewhere) | Fees charged by foreign businesses for maintenance and repair work on goods owned by the business (imports). | ITIS survey | |||

| Maintenance and repair work on goods owned by foreign residents (exports) | |||||

| Transport | A number of sources for each mode of transport including: | ||||

| Sea, air and other transport services. It includes the movement of passengers and freight, and other related transport services, including chartering of ships or aircraft with crew, cargo handling, storage and warehousing, towing, pilotage and navigation, maintenance and cleaning, and commission and agents’ fees associated with passenger/freight transportation | Sea - Chamber of Shipping (CoS), International Passenger Survey (IPS). | ||||

| Air – Airlines, National Air Traffic Services and Civil Aviation Authority (CAA) | |||||

| Rail – Eurotunnel and freight operators. | |||||

| Road – international road haulage survey and other sources. | |||||

| Pipeline – Department for Business, Energy and Industrial Strategy. | |||||

| Postal and courier services - ITIS survey and Royal Mail Group. | |||||

| Travel | Services provided to UK residents during trips of less than one year abroad and provided to non-residents during similar trips in the UK | IPS (IPS conducts 250,000 face-to-face interviews a year with passengers passing through ports, and is estimated to cover 12% of exports and 27% or imports of services). | |||

| HMRC - personal imports of cars | |||||

| Construction | Covers work done on construction projects and installations by employees of an enterprise in locations outside the resident economic territory of the enterprise | ITIS survey | |||

| Insurance and pension services | Insurance and pension services cover the provision of various types of insurance to non-residents by resident insurance enterprises and vice versa. Insurance services include freight insurance on goods being imported or exported, direct insurance (such as, life, accident, fire, marine, and aviation) reinsurance, pensions and standardised guarantees | ITIS survey and other sources including data from Lloyds of London and other industry bodies | |||

| Financial services | Financial intermediary and auxiliary services other than those of insurance companies and pension funds. Includes transactions in financial instruments, other services related to financial activity, such as advisory, custody and asset management services | Estimates for monetary financial institutions (MFIs) are based on returns from the Bank of England. | |||

| Non-MFIs data comes predominantly from surveys, including the ITIS survey and Securities Dealers Survey (FSS). | |||||

| Charges for the use of intellectual property n.i.e. | Intangible, non-produced, non-financial assets and proprietary rights (such as trademarks, franchises, brands, design rights, copyrighted literary works, sound recordings, films, television programs, databases and patents) and other intellectual property that are the end result of research and development. | ITIS survey | |||

| Telecommunications, computer and information services | Computer and information services covers computer, news agency and other information provision related service transactions. | ITIS survey | |||

| Telecommunications (telephone, telex, fax, email, satellite, cable and business network services). | |||||

| Other business services | A range of services including other trade-related services, operational leasing (rental) without operators and miscellaneous business, professional and technical services | A number of sources including the ITIS survey, Chamber of Shipping, Commercial Bar Association (overseas earnings of UK barristers) and the | |||

| Law Society (estimated earnings of solicitors) | |||||

| Personal, cultural and recreational services | Audio-visual and related services, medical services as well as laboratory and similar services, training and educational services, heritage and recreational services i nclude, sporting, gambling and recreational activities; fees and prizes for athletes; s ocial, domestic and other personal services | ITIS survey (excluding gambling) | |||

| Gambling Commission (remote gambling services only) | |||||

| Government goods and services n.i.e. | Government services include all transactions by embassies, consulates, military units and defence agencies with residents of staff or military personnel in the economies in which they are located. Other services included are transactions by other official entities such as aid missions and services, government tourist information and promotion offices, and the provision of joint military arrangements and peacekeeping forces | Government departments and other sources including foreign embassies and United States Air Force bases in the UK. | |||

| Source: Office for National Statistics | |||||

| Notes: | |||||

| 1. For further details see Pink Book Methodological Notes (BPM6) and the Quality Assurance of Administrative Data Used in Trade Statistics. | |||||

Download this table Table 3: Summary of UK trade data sources

.xls (26.1 kB)The results of the asymmetries analysis produced by the bilateral partners involved in the deep dives are shared and the data and information to be published is agreed and signed-off by each bilateral partner.

The first countries to be analysed using the deep-dive approach are the US and Ireland. The deep-dive analyses began with bilateral discussions with the US, followed by Ireland. Bilateral discussions with Germany are scheduled to commence in February 2018.

It should be noted that the deep dive analysis for the US and Ireland is not complete so users should use caution in drawing conclusions from the results at this stage.

Nôl i'r tabl cynnwys6. Asymmetries analysis: initial deep dive results

6.1 Deep dive analysis: US

Analysis of UK-US bilateral trade asymmetries in July 2017 using UN Comtrade data for 2014 showed absolute asymmetries in trade in goods of 13.7 billion and in trade in services of $58.1 billion (Table 1). These were the largest absolute asymmetries amongst any of the countries we analysed. Furthermore, for trade in services, both countries are reporting a trade surplus with the other. In 2016 the UK reported a trade in services surplus with the US of £22.5bn, while the US reported a trade in services surplus of £10.4bn with the UK. Given the relative size of the asymmetries in services compared with goods and ongoing initiatives in both countries to enhance trade in services statistics, it was decided to prioritise investigations into the asymmetries in trade in services.

We have established strong collaborative bilateral engagement and analysis of the trade in services asymmetries with our counterparts at the Bureau of Economic Analysis (BEA) in the US. As part of this we have shared data and methodological documents and held regular audio conferences to identify sources of difference. This section shows the results of this ongoing analysis.

Our analysis has been extended relative to the July 2017 article in various ways. In our recent analysis we have compared published data by the BEA and Office for National Statistics (ONS), rather than using the UN Comtrade database. This enables a comparison of the latest data using the framework underlying the latest international guidelines for producing and presenting trade in services statistics1. Using published data by the BEA and ONS the total UK-US absolute asymmetry in trade in services was $50.4 billion in 2014, so slightly lower than in the UN Comtrade dataset analysed in July 2017.

We have also extended our analysis of UK-US asymmetries to look across a greater number of years and use pounds sterling as the currency of comparison, rather than US dollars, in order to be consistent with the work on bilateral asymmetries with other countries. Finally, we have extended our analysis to compare data at a service type level in order to help identify the main sources of difference.

The latest data from the BEA and ONS show that the absolute asymmetry in services is £30.6 billion in 2014, £34.0 billion in 2015 and £32.8 billion in 2016. The export and import absolute asymmetries are reasonably similar in magnitude. Figures 1 and 2 show how each asymmetry varies over time and the main service types which contribute to it.

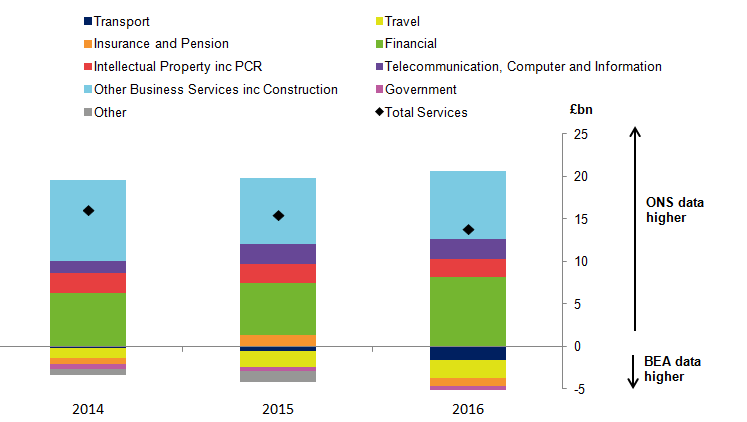

Figure 1: Trade in services asymmetry between UK exports to the US (ONS data) and US imports from the UK (BEA data), £ billion

UK exports (ONS) less US imports (BEA) by service type, 2014 to 2016

Source: Office for National Statistics - data consistent with Pink Book 2017 dataset. Bureau of Economic Analysis - US International Services Table 2.3, US Trade in Services, by Country or Affiliation and by Type of Service, released on 24th October 2017

Notes:

- BEA data converted into sterling using Bank of England average exchange rate. Asymmetry calculated as ONS – BEA data.

Download this image Figure 1: Trade in services asymmetry between UK exports to the US (ONS data) and US imports from the UK (BEA data), £ billion

.png (15.4 kB) .xlsx (726.4 kB)

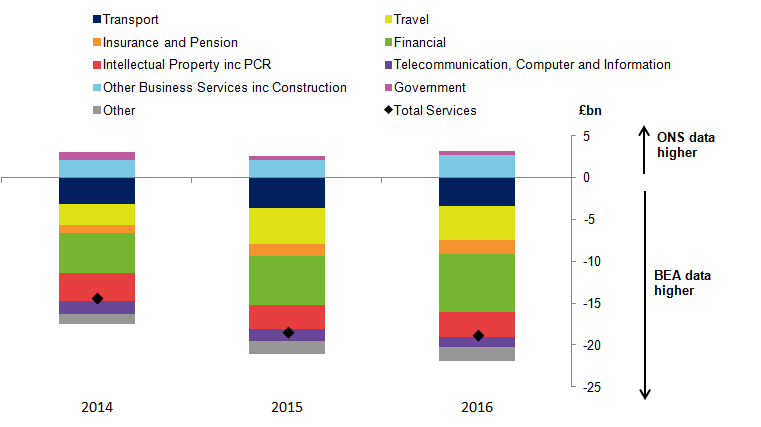

Figure 2: Trade in services asymmetry between UK imports from the US (ONS data) and US exports to the UK (BEA data), £ billion

UK imports (ONS) less US exports (BEA) by service type, 2014 to 2016

Source: Office for National Statistics - data consistent with Pink Book 2017 dataset. Bureau of Economic Analysis - US International Services Table 2.3, US Trade in Services, by Country or Affiliation and by Type of Service, released on 24th October 2017

Notes:

- BEA data converted into sterling using Bank of England average exchange rate. Asymmetry calculated as ONS – BEA data.

Download this image Figure 2: Trade in services asymmetry between UK imports from the US (ONS data) and US exports to the UK (BEA data), £ billion

.png (15.3 kB) .xlsx (726.4 kB)For the periods shown in this report, ONS has consistently reported higher exports to the US than the BEA has reported in imports from the UK (Figure 1). The magnitude of the asymmetry between UK exports and US imports was slightly lower in 2016 (£14.0 billion) than in 2015 (£15.6 billion) and 2014 (£16.2 billion). In each year, financial services and other business services including construction were the main service types in which UK exports exceed US imports.

For the periods shown in this report, the BEA has consistently reported higher exports to the UK than ONS has reported in imports from the US (Figure 2). The magnitude of the absolute asymmetry between US exports and UK imports is slightly higher in 2015 (£18.4 billion) and 2016 (£18.8 billion) than in 2014 (£14.4 billion). The main service types where US exports exceeded UK imports were: financial services; intellectual property including personal, cultural and recreational (PCR) services; transport and travel services. UK imports exceeded US exports in other business services including construction.

The comparison by service type presented in Figures 1 and 2 use the publicly-available data, but the discussions between the BEA and ONS have begun to identify certain components that are classified in one service type by ONS and in another service type by the BEA. These methodological differences will not help explain the trade asymmetry at a total services level, as the component is included somewhere in total services, but can help explain asymmetries between service types. The methodological differences that have currently been identified are shown in Table 4. This list of methodological differences should not be seen as comprehensive, but only those that have been identified so far in discussions.

Table 4: Currently identified methodological differences where BEA and ONS classify a particular type of trade in different service categories

| UK Exports/US Imports (£bn) | UK Imports/US Exports (£bn) | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Component | Service category where ONS classify component | Service category where BEA classify component | 2014 | 2015 | 2016 | 2014 | 2015 | 2016 | Source for quantification | |||||||||

| Personal, cultural and recreational (PCR) services | PCR services. Seperately identified. | Within intellectual property and other business services. Not seperately identified. | 1.5 | 1.4 | 1.3 | 0.2 | 0.3 | 0.2 | ONS | |||||||||

| Construction services | Construction services. Seperately identified. | Within other business services. Seperately identified. | 0.3 | 0.1 | 0.2 | 0.2 | 0.1 | 0.1 | ONS | |||||||||

| Outright sales/purchases of patents | Within research and development services within other business services. Not seperately identified. | Within intellectual property. Not seperately identified. | .. | .. | .. | .. | .. | .. | ONS | |||||||||

| Source: Office for National Statistics - data consistent with Pink Book 2017 dataset | ||||||||||||||||||

| Notes: | ||||||||||||||||||

| 1. .. Indicates that data might be disclosive and have therefore been omitted. | ||||||||||||||||||

Download this table Table 4: Currently identified methodological differences where BEA and ONS classify a particular type of trade in different service categories

.xls (24.6 kB)The presence of methodological differences should be considered by users when comparing data for a particular service type as it may explain part of any asymmetry. For instance, the outright sales and purchases of patents are included within other business services by ONS but are classified within intellectual property services by the BEA. This activity should be treated as part of research and development services within other business services, according to BPM6. The BEA currently includes construction services within other business services. PCR services are predominately within BEA estimates of intellectual property, but other elements of PCR services are within BEA estimates of other business services. In order to aid comparison with the BEA in Figures 1 and 2 we have grouped the separate ONS estimates for construction and other business services together and similarly we have grouped the separate ONS estimates for intellectual property and PCR services together.

Definitional differences can help explain the total services asymmetry as well as the asymmetry for a particular service type. These differences are where one country includes a type of activity in their services trade, whilst the other reporter excludes this activity from their services trade and may or may not include it in other accounts. Depending on the nature of the definitional difference, adjusting for it may reduce or increase the asymmetry.

Table 5 shows the definitional differences that have currently been identified through discussions with the BEA and an indicative estimate of the magnitude of each difference, where available. The definitional differences list should not be seen as comprehensive, but only those that have been identified in conversations so far.

Table 5: Currently identified definitional differences between ONS and BEA trade figures which affect total services trade and indicative estimates

| UK Exports/US Imports (£bn) | UK Imports/US Exports (£bn) | |||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Difference | Services category it affects | Conceptual basis | 2014 | 2015 | 2016 | 2014 | 2015 | 2016 | Source for quantification | |||||||||||

| BEA include Crown Dependencies in definition of UK, ONS exclude | All | Crown Dependencies should be excluded | Quantification is not possible at this level of detail currently | |||||||||||||||||

| Manufacturing services on physical inputs owned by others are included in services trade by ONS and in goods trade by BEA | Manufacturing services on physical inputs owned by others | Should be included in services trade | 0.3 | 0.2 | 0.1 | +0.0 | +0.0 | 0.1 | ONS | |||||||||||

| Passenger sea transport is included in services trade by ONS, not captured by BEA | Transport | Should be included in services trade | Quantification is not possible at this level of detail currently | |||||||||||||||||

| Construction imports related to work done in the US are included by ONS, not captured by BEA | Construction | Should be included in services trade | 0.2 | .. | 0.1 | ONS | ||||||||||||||

| Pensions trade is included in services trade by ONS, not captured by BEA | Insurance and pension services | Should be included in services trade | .. | .. | .. | .. | .. | .. | ONS | |||||||||||

| Financial Intermediation Services Indirectly Measured (FISIM) included in services trade by ONS and implictly included in income in the balance of payments statistics by BEA | Financial services | Should be included in services trade | 1.7 | 1.7 | 1.9 | 0.8 | 0.9 | 1.0 | ONS | |||||||||||

| Net Spread Earnings (NSE) included in services exports by ONS, not captured by BEA | Financial services | Should be included in services trade | 2.7 | 2.8 | 2.9 | ONS | ||||||||||||||

| Outright sales/purchases of franchises and trademarks are included in services trade by BEA and in the capital account by ONS | Intellectual Property | Should be included in the capital account | -0.0 | -0.0 | -0.0 | -0.1 | -0.0 | -0.0 | ONS | |||||||||||

| Total of currently identified definitional differences | 4.6 | 4.7 | 4.9 | 0.9 | 0.9 | 1.1 | ||||||||||||||

| Reference | ||||||||||||||||||||

| Total trade in services asymmetry in published figures | 16.2 | 15.6 | 14.0 | -14.4 | -18.4 | -18.8 | ||||||||||||||

| Source: Office for National Statistics - data consistent with Pink Book 2017 dataset. Bureau of Economic Analysis - US International Services Table 2.3, US Trade in Services, by Country or Affiliation and by Type of Service, released on 24th October 2017 | ||||||||||||||||||||

| Notes: | ||||||||||||||||||||

| 1. .. Indicates that data might be disclosive and have therefore been omitted. Components may not sum to totals due to rounding. | ||||||||||||||||||||

| 2. The estimates for a particular activity are given a positive sign where the ONS includes the activity in trade in services and the BEA excludes the activity in trade in services. The estimates for a particular activity are given a negative sign where the ONS excludes the activity in trade in services and the BEA includes the activity in trade in services. Therefore the signs are consistent with the total asymmetry shown (ONS - BEA data). Therefore the sum of each of the differences shows how much of the total asymmetry has been estimated. | ||||||||||||||||||||

| 3. Where estimates are between £0 and £0.05bn, a value of +£0.0bn is shown. Where estimates are between £0 and -£0.05bn, a value of -£0.0bn is shown. | ||||||||||||||||||||

| 4. NSE estimates shown are calculated using monetary financial institutions data only. | ||||||||||||||||||||

Download this table Table 5: Currently identified definitional differences between ONS and BEA trade figures which affect total services trade and indicative estimates

.xls (28.7 kB)Many of the definitional differences are hard to quantify as the information is often not collected at such a fine level of detail or with specific trading partners. As such, modelling and apportionment have been used to construct many of the estimates shown in Table 5 and so the estimates should be seen as indicative. Estimates may be revised in future work.

Furthermore, the estimates in Table 5 are based on data from one reporting institution and any adjustment of the data by the other reporting institution could be misleading. For example, Table 5 shows an ONS estimate of UK FISIM2 exports to the US as the BEA currently does not calculate or include FISIM in their services trade statistics. If the BEA were to calculate FISIM imports from the UK it is unlikely that the numbers would match exactly ONS FISIM exports to the US; there may be an asymmetry. Therefore it could be misleading to adjust current BEA figures by the current ONS estimate of FISIM exports. In general, if the institution which doesn’t currently include a particular activity, started to estimate it, that quantification may well prove different from the data currently available by the other reporting institution. As such, any adjustment of a country’s figures using another country’s data could give a misleading steer of what would actually be reported if the country was to start collecting data on this type of activity.

Despite these difficulties the estimates in Table 5 can be seen as an approximate estimate of how much of the total asymmetry each reason may explain. For example, FISIM exports to the US were estimated by ONS to be £1.9 billion in 2016. As FISIM is included in trade in services by ONS but excluded by the BEA, FISIM can explain around £1.9 billion of the total £14.0 billion asymmetry between UK service exports to the US and US service imports from the UK in 2016. However, when comparing US exports with the UK and UK imports from the US, the difference in FISIM inclusion between the BEA and ONS adds to the size of the asymmetry because the BEA estimate of service exports to the UK already exceeds the ONS estimate of service imports from the US.

In general, as the UK exports/US imports asymmetry has the opposite sign to the US exports/UK imports asymmetry most definitional differences help explain the asymmetry on one side but increase the asymmetry on the other side.

Together, the definitional differences that have been identified so far and for which quantification has been possible, help explain around 30% of the total trade in services asymmetry between UK exports and US imports in 2014 and 2015, and an even greater share in 2016. However, the asymmetry between UK service imports and US service exports would increase by around 5% if the definitional differences for which quantification has been possible were treated consistently by the BEA and ONS. Future discussions may identify further definitional differences but as emphasised previously these could reduce or increase the asymmetry.

Our current finding that definitional differences only explain a small proportion of the total asymmetry is consistent with previous work on asymmetries between the BEA and Statistics Canada (PDF, 383KB). This work found that definitional differences only accounted for a small proportion of the asymmetry between the US and Canadian trade in services data in 2010 and 2011. The largest source of differences between US and Canadian trade in services data were statistical differences, reflecting “the use of different source data in the United States and Canada, the difficulty in determining country attribution because of insufficient data, the preliminary nature of some data (particularly for the most recent year), and the use of sample data between benchmarks.” In future discussions with the BEA we will further compare data sources and methods that may help identify statistical differences for the UK-US trade in services asymmetry. However, fully reconciling between data sources may prove difficult given, for example, barriers to sharing disclosive microdata.

Alongside work to understand asymmetries in the current official data, development work by both the BEA and ONS may change the official data, potentially reducing asymmetries if each account is produced on a more consistent basis, in line with international guidelines.

The BEA is pursuing several efforts to further align its trade in services statistics with international guidelines, which will also improve comparability between the US accounts and those of its trading partners. Changes which BEA is pursuing include3:

reclassifying certain transactions related to intellectual property

introducing a PCR services category

introducing measures of manufacturing services on physical inputs owned by others

introducing measures of implicit financial services including FISIM and NSE

expanding the type of service detail published for categories such as research and development, intellectual property, and financial services

In addition, stemming in part from this reconciliation exercise, the BEA will explore the feasibility of modifying its data collection instruments to exclude the British Crown Dependencies from its geographic definition of the UK.

6.2 Deep dive analysis: Ireland

Analysis of UK-Ireland bilateral trade asymmetries using UN Comtrade data for 2014 (Table 1) showed trade in goods asymmetries of $8 billion (the fourth largest by absolute value from those countries we analysed) and trade in services asymmetries of $18.9 billion (third largest).

As noted in our first article, much of the trade in goods asymmetry with Ireland using UN Comtrade data will be due to differences in presentation between country of dispatch and country of origin. The asymmetries are smaller when comparing data from the EU Comext database.

This placed our analysis of asymmetries with Ireland as a priority for further and deeper analysis with a particular focus on services.

We have established strong collaborative bilateral engagement and analysis of these asymmetries with our counterparts at the Central Statistics Office (CSO) in Ireland. This has included an initial review of data sources and methodological documentation and regular bilateral audio and video conferences. This analysis is ongoing, but a short summary of progress so far follows.

UK-Ireland trade in services asymmetries

The largest UK-Ireland asymmetries exist in trade in services for which both countries are reporting a trade surplus with the other. We look into this more deeply by service type in this section to try to identify the main areas of difference.

We have used published data by Eurostat instead of the CSO’s published official data for this analysis. The CSO have confirmed that Eurostat’s data are consistent with data published by the CSO, but have the advantage for our analysis of being presented using Balance of Payments and International Investment Position Manual: BPM6 classifications, whereas the CSO’s official published data are presented on a national basis for their users. We have compared these data with our own (ONS) published data that are presented on a BPM6 basis.

Using these data rather than UN Comtrade the total UK-Ireland absolute asymmetry in trade in services was £10.9 billion in 2014 (a little lower than in the UN Comtrade dataset analysis of July 2017 where the equivalent estimate was £11.5 billion), £10.3 billion in 2015 and £11.4 billion in 2016.

Figures 3 and 4 show how each asymmetry varies over time and the main service types that contribute. The asymmetry shown in Figures 3 and 4 is the difference between the UK report and the Ireland report (UK – Ireland), thus keeping the direction of the difference to show which is larger.

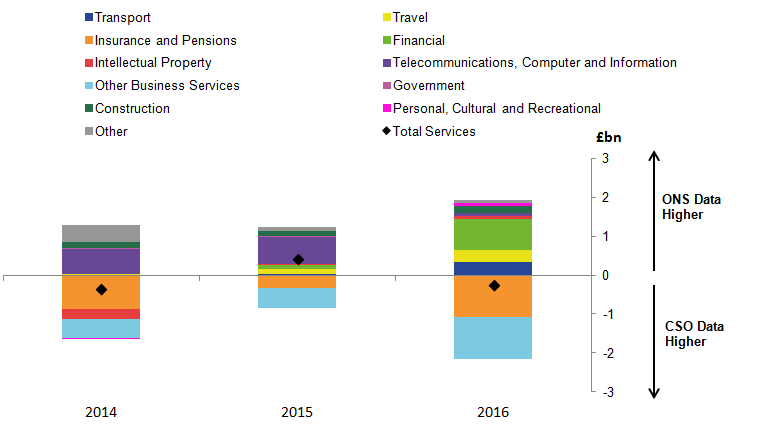

Figure 3: Trade in Services asymmetry between UK exports to Ireland (ONS data) and Ireland imports from the UK (CSO data), £ billion

UK exports (ONS) less Ireland imports (CSO) by service type, 2014 to 2016

Source: Office for National Statistics - data consistent with Pink Book 2017 dataset. Central Statistics Office - data accessed from Eurostat database on 18th January 2018

Notes:

CSO data converted into sterling using Bank of England average exchange rate. Asymmetry calculated as ONS – CSO data (sourced from Eurostat).

The CSO estimate for financial services imports has been suppressed in 2014 due to disclosure reasons so ONS financial services exports are included in the 'other' category in this year alongside service types not separately identified in the chart.

Download this image Figure 3: Trade in Services asymmetry between UK exports to Ireland (ONS data) and Ireland imports from the UK (CSO data), £ billion

.png (15.8 kB) .xlsx (726.6 kB)

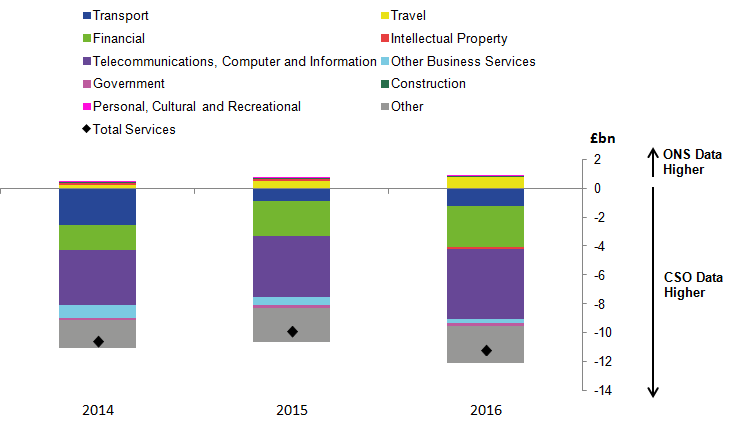

Figure 4: Trade in services asymmetry between UK imports from Ireland (ONS data) and Ireland exports to the UK (CSO data), £ billion

UK imports (ONS) less Ireland exports (CSO) by service type, 2014 to 2016

Source: Office for National Statistics - data consistent with Pink Book 2017 dataset. Central Statistics Office - data accessed from Eurostat database on 18th January 2018

Notes:

- CSO data converted into sterling using Bank of England average exchange rate. Asymmetry calculated as ONS – CSO data (sourced from Eurostat).

Download this image Figure 4: Trade in services asymmetry between UK imports from Ireland (ONS data) and Ireland exports to the UK (CSO data), £ billion

.png (15.3 kB) .xlsx (726.8 kB)A comparison of Figures 3 and 4 shows that the largest asymmetries exist in the UK imports/ Ireland exports bilateral data (Figure 4). Here we see that Ireland’s CSO reports higher exports to the UK than we report as imports from Ireland in most service categories.

There was a total services absolute asymmetry between the UK’s estimates of imports and Ireland’s estimates of exports (with Irish estimates being higher) of £10.6 billion in 2014, £9.9 billion in 2015 and £11.2 billion in 2016. The service types with the largest differences in 2016 were: telecommunication, computer and information services (£4.8 billion); financial services (£2.9 billion) and transport services (£1.2 billion). Other services also accounted for £2.5 billion of the £11.2 billion total in 2016.

We have started more detailed analysis of the potential reasons for these differences, but it should be noted that this analysis is in its infancy and much further and deeper investigations are still required. The initial results are reported in this section.

Telecommunication, computer and information services are measured on the same conceptual basis by ONS and the CSO, that is, according to BPM6. The CSO’s main source of data for these services is their Balance of Payments surveys. The International Trade in Services Survey (PDF, 262KB) is the main source for ONS’s estimates. Examination of CSO surveys shows that Irish exports of computer services to the UK are predominantly direct sales to UK businesses by Irish resident, ultimately US-owned companies.

Within this service type our analysis has shown that postal and courier services (pick-up, transport and delivery of letters, postcards, printed matter, parcels and packages) is being included in this category by the CSO whereas we include these services under transport services following international guidance. However, the values are relatively small. This difference in classification alone would not affect the total asymmetry, although differences in the estimates would have some effect. The Irish exports of transport services include economic transactions between Irish transport companies and UK residents, even though the direction of travel may be between the UK and a third country (see CSO Balance of Payments compilation methodology (PDF, 239KB)).

Financial services are a further area in which the asymmetries are quite large between ONS and the CSO. Since 2008, the data required from licensed banks (credit institutions) and from investment funds (including money market funds) to meet balance of payments-related data requirements are being collected quarterly by the Central Bank of Ireland under its legislation as well as European legislation. The CSO surveys of financial enterprises aim at exhaustive coverage and are conducted on a quarterly basis. They cover insurance, treasury services and asset management, etc. Within ONS, estimates of financial services are based primarily on returns from the Bank of England (for monetary financial institutions), international trade in services (ITIS) and ONS’s financial surveys.

As detailed elsewhere, financial services is an area where we have seen asymmetries with other countries as well as Ireland. We will be focusing on this area for future analysis. In terms of differences with Ireland, so far we have identified that we use a resident interbank loan rate for the measurement of financial intermediation services indirectly measured (FISIM), not a non-resident interbank loan rate (as detailed in international guidance and used by the CSO). This is due to London’s position as a major global financial centre in which there are sizeable intrabank loans and deposits, which are often just used for liquidity/cashflow management purposes, rather than reflecting true funding. Therefore, we have agreement with Eurostat that this use of a resident interbank loan rate is appropriate for the UK (see Grovell and Wisniewski, 2014 (PDF, 85KB) and Akritidis, 2017 (PDF, 1.58MB)).

Further analysis is required to estimate the effect this has on the asymmetry and to better understand the rates used by other countries, not only Ireland. CSO examination of their financial services exports to the UK suggests that much of this data relates to exports of financial services relating to their investment funds industry.

Transport services also show quite large asymmetries between the UK and Ireland. Analysis of data sources and methods differences for transport services between the UK and Ireland are continuing and have not yet shown conclusive reasons for the differences.

Although not within one of the services with larger asymmetries highlighted earlier, we have also found that royalties received from the entertainment industry (concerning mainly film distributions and musical services) are included within intellectual property by ONS following international guidance, but in personal, cultural and recreation services by the CSO.

Initial analysis and discussions with the CSO have highlighted some relatively small definitional and methodological differences as detailed previously. Even though both the CSO and ONS have strong data sources and compilation processes, it is likely that differences in data sources (for example, different survey samples) are likely to be a main cause of the asymmetries. However, it should be noted that this work is at an early stage and that this analysis is ongoing. We will report further progress in future articles.

6.3 Deep dive analysis: Germany

Analysis of UK-Germany bilateral trade asymmetries in July 2017 using UN Comtrade data for 2014 showed absolute asymmetries in trade in goods of $6.0 billion and in trade in services of $14.7 billion (Table 1). These were the sixth-largest trade in goods asymmetries and also the sixth-largest trade in services asymmetries amongst the countries we analysed.

We are now in the process of extending our analysis relative to July 2017 to compare published data by the German Bundesbank and ONS, rather than using the UN Comtrade database. This will enable a comparison of the latest data using the latest international classifications. We are extending our analysis to look at a greater number of years and to use pounds sterling as the currency of comparison rather than US dollars, in order to be consistent with the work on asymmetries with other bilateral countries. We are also extending our analysis to compare data at a lower level in order to prioritise areas for the deep-dive analysis.

We have established contacts at the German Bundesbank and scheduled our first bilateral asymmetries video conference, which is to take place in early February 2018. We will report the results of our bilateral asymmetries UK-Germany deep dive analysis in our third asymmetries article.

6.4 Deep dive analysis: China

There is a high user interest in UK trade activity with China. Therefore, we are including an analysis of trade asymmetries with China in our work. It should be noted that while trade in goods estimates between the UK and China are published by both bilateral partners and ONS publishes estimates of trade in services with China, our research so far suggests China does not publish an estimate of its trade in services with the UK.

As noted in the first asymmetries article (ONS, July 2017), much of the trade in goods asymmetry between the UK and China is in Harmonised System (HS) commodity code 71, “natural or cultured pearls, precious or semi-precious stones, precious metals, metals clad with precious metal, and articles thereof, imitation jewellery, coin” and is due mainly to trade in non-monetary gold (UK exports/China imports). Non-monetary gold is the sale of gold bullion by organisations other than the monetary authorities/central banks. It is particularly challenging to measure from a change of ownership perspective and is volatile.

Since the first article was published, the UK has initiated communication and identified contacts for trade statistics within the National Bureau of Statistics of China, the Chinese Customs Agency and the Ministry of Commerce of China, and plans to build upon the communication channels established to date in order to lay the groundwork for future collaboration with regard to bilateral trade statistics asymmetries analyses.

6.5 Deep dive conclusions

The main summary analysis points and conclusions so far from the ongoing deeper analysis are:

the largest UK-US asymmetries exist in trade in services (not goods) for which both countries are reporting a trade surplus with the other. In 2016 the UK reported a trade in services surplus with the US of £22.5 billion, while the US reported a trade in services surplus of £10.4 billion with the UK

the total UK-US absolute asymmetry in trade in services was £30.6 billion in 2014, £34.0 billion in 2015 and £32.8 billion in 2016

ONS consistently reported higher exports of services to the US than the BEA has reported in imports from the UK (Figure 1)

the magnitude of the services absolute asymmetry between UK exports and US imports was slightly lower in 2016 (£14.0 billion) than in 2015 (£15.6 billion) and 2014 (£16.2 billion)

the BEA has consistently reported higher exports of services to the UK than ONS has reported in imports from the US (Figure 2)

the magnitude of the services absolute asymmetry between UK imports and US exports is slightly higher in 2015 (£18.4 billion) and 2016 (£18.8 billion) than in 2014 (£14.4 billion)

the largest UK-Ireland asymmetries exist in trade in services (not goods) for which both countries are reporting a trade surplus with the other

the total UK-Ireland absolute asymmetry in trade in services was £10.9 billion in 2014 (a little lower than in the United Nations (UN) Comtrade dataset analysis of July 2017 where the equivalent estimate was £11.5 billion), £10.3 billion in 2015 and £11.4 billion in 2016

the largest UK-Ireland asymmetries exist between the UK imports and Ireland exports bilateral data (Figure 4); here we see that Ireland’s CSO reports higher exports to the UK than we report as imports from Ireland in most service categories

there was a total services absolute asymmetry between the UK’s estimates of imports and Ireland’s estimates of exports (with Irish estimates being higher) of £10.6 billion in 2014, £9.9 billion in 2015 and £11.2 billion in 2016

From the ongoing analysis of asymmetries with the US and Ireland, some of the causes identified so far, early conclusions and areas for further analysis are as follows:

the inclusion by the BEA of the Crown Dependencies1 in UK economic territory, but the exclusion of the Crown Dependencies by ONS; the BEA plans to explore the feasibility of modifying its data collection instruments to exclude the Crown Dependencies from its geographic definition of the UK

ONS and the BEA have moved at a different pace in adopting the latest international guidance; the new standards are the Balance of Payments and International Investment Position Manual Version 6 (BPM6), which have a number of differences from the older BPM5 rules (the US have a number of planned developments to further transition towards BPM6)

financial services is an area where we have seen asymmetries with both the US and Ireland and is therefore an area of focus for future analysis

the inclusion of financial intermediation services indirectly measured (FISIM) and net spread earnings (NSE) in financial services by the UK, but not by the US; NSE is a measurement of service income from trading activities; FISIM is a measure that aims to capture output generated by intermediation services for which there is no explicit charge; this relates to deposit and lending services whereby the implicit charge for the service is included in the interest rate that is offered to the consumer

the classification of goods or services activity to different sub-categories of trade, for example, classification of items to “other business services” by some countries, but inclusion in more specific service categories by other countries and the classification of the same service to different specific service categories

in general, as the UK exports/US imports asymmetry has the opposite sign to the US exports/UK imports asymmetry most definitional differences help explain the asymmetry on one side, but increase the asymmetry on the other side

the definitional differences that have been identified so far and for which quantification has been possible, help explain around 30% of the total trade in services asymmetry between UK exports and US imports in 2014 and 2015, and an even greater share in 2016; however, the asymmetry between UK service imports and US service exports would increase by around 5% if the definitional differences for which quantification has been possible were treated consistently by the BEA and ONS

our current findings show that definitional differences only explain a relatively small proportion of the total asymmetry; a larger source of difference is likely to be from statistical differences reflecting the use of different source data by each country

It is very important to note that this analysis is not complete so overall conclusions should not be drawn at this stage. It is possible that the ongoing analysis will identify causes of asymmetries that, once quantified, might offset some of the reasons currently quantified and therefore the overall asymmetry might not change.

Some of these initial results require further analysis. Deeper analysis of trade asymmetries is ongoing. We are continuing this collaborative analysis with the US and Ireland to develop a fuller picture. We are also building on our early research into asymmetries with Germany and we intend to extend our analysis to further countries such as China, France, the Netherlands, Belgium and Luxembourg for which we have large asymmetries in either goods or services or both or there is a strong user interest. Results and insights from this analysis will be shared through future articles in the series later in 2018.

Notes for: Asymmetries analysis: initial deep dive results

These guidelines are presented in the sixth edition of the Balance of Payments and International Investment Position Manual (BPM6), released by the International Monetary Fund and in the Manual on Statistics of International Trade in Services 2010, released by the inter-agency Task Force on Statistics of International Trade in Services.

Financial Intermediation Services Indirectly Measured (FISIM) is a measure that aims to capture output generated by intermediation services for which there is no explicit charge. This relates to deposit and lending services whereby the implicit charge for the service is included in the interest rate that is offered to the consumer. Further details regarding the calculation of FISIM by the ONS can be found in FISIM in the UK revisited.

For more information see “U.S. International Services Trade in Services in 2016 and Services Supplied Through Affiliates in 2015” in BEA’s Survey of Current Business.

The Crown Dependencies are the Isle of Man and the Bailiwicks of Jersey and Guernsey.

7. Wider work to reduce trade asymmetries

7.1 International Trade in Services Survey developments

As shown in Section 5, one of the main sources of trade in services data in the UK is the International Trade in Services Survey (ITIS). This provides estimates of imports and exports of trade in services to and from the UK for a wide range of service types excluding travel, transport and financial services.

From the first quarter of 2017, the quarterly ITIS sample was almost doubled to around 2,100 forms. At the same time, the sample was optimised by geography and broad industry grouping, therefore improving the quality of granular country and industry estimates. Detailed quarterly statistics resulting from these improvements have been published. These data will improve the geographic breakdown of UK trade in services statistics. It is too early to say, given a longer time series will be needed, but these improvements may have a positive impact on the size of UK trade asymmetries.

7.2 International asymmetries reconciliation

There are three types of approach to tackling asymmetries:

common reporting frameworks aimed at standardising trade surveillance; these have quite recently been harmonised, especially for trade in services (in 2014 through the European System of Accounts 2010: ESA 2010 and BPM6), some countries have limited resources to implement new frameworks

bottom-up reconciliation exercises between trading partners; these are resource-intensive, bilateral exercises undertaken by pairs of countries as used in our recent analysis in the UK

top-down approaches to reconcilliation1 such as the use of mirror data from partner countries or estimates of bias in asymmetries giving rule-of-thumb indications and possible adjustments; these include the adjustment applied by the OECD and Eurostat and a new top-down approach currently being investigated by ONS and Baranga (see Section 7.4)

In addition to harmonising trade reporting frameworks (for example, ESA 2010, BPM6), international organisations (for example, Eurostat, OECD) have for many years been encouraging countries to engage in bottom-up reconciliation exercises in order to understand and reduce trade asymmetries. For example, at the annual OECD Working Party on Trade in Goods and Services (WPTGS), the OECD facilitates bilateral asymmetries discussions between countries and the UK has participated in these meetings, as well as numerous meetings and working groups established by Eurostat.

At a recent meeting of the Eurostat Balance of Payments Working Group (November 2017), a number of papers on trade asymmetries were presented, including a paper by the German national bank proposing a change to the measurement of trade in goods based on “invoice values” to resolve disparities in Cost of Insurance and Freight(CIF)/Free on Board (fob) adjustments (PDF, 4.57MB). Eurostat also recently produced a report, Investigating Bilateral Asymmetries in EU-US Trade Statistics (PDF, 698KB), the results of joint work by Eurostat and the US Bureau of Economic Analysis on bilateral trade in services asymmetries.

The OECD has implemented an approach to resolve asymmetries in trade in goods data in order to produce a balanced trade dataset, (Merchandise trade statistics without asymmetries). The OECD approach is a step-by-step method to produce a balanced trade in goods dataset, comprising four stages: data preparation (collection, harmonisation, conversion to a common “free on board” (FOB) valuation), data adjustment (unallocated and confidential trade, Hong Kong re-exports, Swiss non-monetary gold, etc), trade balancing (by HS 6-digit product) and classification conversion (HS 6-digit product to CPA 2.1 2-digit).

7.3 UK trade and wider developments

We are continuing to work on a range of developments to UK trade statistics to provide greater analytical capacity, capability and more granular trade statistics for our users. This includes the development of new systems, better use of current data sources, data linking to develop estimates of trade by industry on top of the more granular trade by country and commodity and investigations into the potential use of new data sources (for example, EU sales).

We are also reviewing our data sources and methods for our balance of payments adjustments (used to adjust trade in goods data from a physical movement to a change in economic ownership basis).

It is possible that these developments such as improved balance of payments adjustments or use of EU sales data will have a positive effect on UK trade asymmetries. However, further analysis of the causes of asymmetries and how current or future developments link to those causes is needed before the potential impact on asymmetries will be better understood.

As well as developments to trade statistics, we are also making source data and methodological improvements to data for some of the service types highlighted in this report. For example, we are introducing new survey data into the accounts in 2019 that will better estimate certain financial companies (those that are not banks, insurance companies or pension funds). These changes, together with methodological and data improvements made by partner countries, should help reduce trade asymmetries in these service types.

7.4 Asymmetries bias analysis

A statistical model which aims to reconcile trade in goods asymmetries (PDF, 1.07MB) (Baranga, 2018) was published in January 2018 in a discussion paper by the UK’s Economic Statistics Centre of Excellence (ESCoE). The paper sets out the use of a new method to reconcile countries’ reports of their bilateral trade, in which reconciled estimates comprise a weighted average of exporter and importer reports, with weights chosen to minimise the variance of the error in the reconciliation estimate. Countries that appear to report their trade more precisely on average, of which the UK is one, are given more weight.

We will fully digest the contents of the paper and consider its implications as part of our ongoing analysis of trade asymmetries. This will be considered along with the conclusions of a further paper planned by Baranga covering work currently underway to reconcile asymmetries in trade in services data.

Notes for: Wider work to reduce trade asymmetries

- Notably the Eurostat “Global Model” approach.

8. Conclusions and next steps

Trade asymmetries are a global issue. The international community of statisticians and national accountants are working together to better understand the causes of asymmetries and to find ways to reduce them.

In this article we have explained some of the definitional, methodological and statistical reasons for asymmetries. Our work to dig deeper into our larger asymmetries, with the support of our bilateral partners such as the US Bureau of Economic Analysis (BEA) and the Irish Central Statistics Office (CSO), is beginning to show some early results. Where possible we have begun to estimate the effects of these differences.

As this analysis progresses and as we expand our analysis to more countries, we will build on the evidence and information, which will provide our users with more clarity about the differences between our data and that of our bilateral partners.

We will continue to report our findings through this series of articles on asymmetries in trade data.

Nôl i'r tabl cynnwys9. Acknowledgements

The authors (Adrian Chesson, Marilyn Thomas and Jeremy Rowe) would like to express their gratitude to the following colleagues at Office for National Statistics for their important contributions to this work:

Rhys Morris, Tino Hamadziripi, Kate Wright, James Wignall, Katie O’Farrell and Daniel Robertson.

We are also grateful to the officials at the US Bureau of Economic Analysis and the Central Statistics Office in Ireland for their collaboration, research and analysis that has made this work possible.

Nôl i'r tabl cynnwys10. Annexes

10.1 Trade asymmetries literary review

Issues in goods and services asymmetries

Trade in goods

Issues in trade in goods asymmetries have been well-highlighted in previous articles by HM Revenue and Customs (HMRC). HMRC categorise the asymmetries (PDF, 192KB) in terms of methodological discrepancies (for example, difficulty in recording leased goods), valuation discrepancies (for example, adjustments relating to cost insurance and freight) and partner countries discrepancies (for example, goods in transit allocated to the wrong country by an intermediate member state).

A recent HMRC analysis of trade in goods (PDF, 1.11MB) asymmetries (on an overseas trade statistics (OTS) basis using HMRC and EU Comtext data) found that the top three EU member states with the largest share of total absolute asymmetries with the UK were Germany, the Netherlands and Belgium. In all three years these three countries made up half of the share of total absolute asymmetries. ONS’s Asymmetries in Trade Data: A UK Perspective article, published in July 2017, also details further UK-specific issues in trade in goods asymmetries, for example, Balance of Payments and International Investment Position Manual (BPM6) changes to merchanting and below threshold items, and carries out an analysis of bilateral asymmetries using UN Comtrade data.

Trade in services

The BPM6 manual (PDF, 3.0MB), produced by the International Monetary Fund (IMF), which uses the more detailed Extended Balance of Payments Services classification: EBOPS 2010 category level, is considered best practice for producing trade in service statistics and is enforced by Eurostat. However, when reviewing asymmetries (PDF, 684KB), United Nations Statistical Division consultant Vladimir Markhonko notes that producing bilateral trade in services data is resource-intensive, with difficulties possible on issues related to disclosure and incompleteness of information. Bilateral data sources may be incomplete or lack detail for countries to identify sources of asymmetries. For practical reasons, some countries do not use the BPM6 category definitions. The US currently do not use BPM6 methods for all categories, as discussed in the US section of this article.