1. Main points

Net investment of £24 billion was reported by insurance companies, pension funds and trusts in Quarter 4 (Oct to Dec) 2017; in terms of context, the five-year quarterly average for this series is net investment of £9 billion.

The net investment in overseas government securities in Quarter 4 2017 (£7 billion), was the largest since the start of this series in 1986.

In Quarter 4 2017, the net investment of £17 billion by these businesses in short-term assets was the largest since Quarter 3 (July to Sept) 2007 (£19 billion).

In 2017, the provisional annual estimate of net investment by insurance companies, pension funds and trusts (£91 billion) was the largest since the start of this series in 1987; this was caused mainly by net investment in other assets (mainly mutual funds) at £42 billion, short-term assets at £35 billion and gilts at £29 billion.

The 2017 provisional annual estimate of net investment by unit trusts and property unit trusts (£76 billion) was the largest since the start of this series in 1984; this was caused mainly by net investment in overseas securities (£37 billion).

2. Things you need to know about this release

This publication considers the investment choices of insurance companies, self-administered pension funds, investment trusts, unit trusts and property unit trusts. Before viewing the MQ5 publication, it is recommended that readers familiarise themselves with the institutional groups covered within.

These institutions control £4 trillion of assets and engage in considerable volumes of investment activity to fund their operations. An understanding of their investments and assets is important to monitor the stability of the financial sector and is used in the compilation of the UK National Accounts.

The MQ5 release includes quarterly net investment data arising from financial transactions (investments) made by these institutions. Also included are quarterly balance sheet data for short-term assets and liabilities, plus quarterly income and expenditure data for insurance companies and self-administered pension funds. All data are reported at current prices (effects of price changes included).

We make every effort to provide informative commentary on the data in this release. As part of the quality assurance process, individual businesses are contacted in an attempt to capture reasons for extreme period-on-period data movements. It can prove difficult to elicit detailed reasons from some businesses to help inform the commentary. Frequently, reasons given for data movements refer to a “change in investment strategy” or a “fund manager’s decision”. Consequently, it is not possible for all data movements to be fully explained.

Data for Quarter 1 (Jan to Mar) 2017 onwards remain provisional and subject to revision until the incorporation of the 2017 annual survey results in December 2018 (see section 8 Revisions).

It is sometimes necessary to suppress figures for certain items to avoid disclosing investment activity by individual institutions. In these cases, the figures are usually combined with those for another item and this will be indicated in the tables by means of a footnote.

All estimates are reported on a current price basis (that is, they are not adjusted to remove the effects of inflation).

A Glossary is available to assist your understanding of the terms used in this release.

Nôl i'r tabl cynnwys3. Net investment by asset type

Provisional estimates for 2017 show that these businesses acquired £1,866 billion and disposed of £1,777 billion longer-term financial instruments. Net investment is the difference between acquisitions and disposals of longer-term assets, as well as changes in holdings of short-term assets, and can therefore be volatile. Table 1 (at the end of this section) displays net investment data by asset type.

Quarter 4 (Oct to Dec) 2017 was the fourth consecutive quarter of net investment (£24 billion (Figure 1)). In terms of context, the five-year quarterly average for this series is net investment of £9 billion. Net investment was reported in short-term assets, UK government sterling securities and other assets.

For 2017 as a whole, net investment reported by the institutions covered in this release is provisionally estimated at £91 billion, the highest since the start of this series in 1987.

Net investment or net disinvestment varies across the quarters of a calendar year and so an increase or decrease in investment from one quarter to the next is not necessarily an indicator of improved or worsening economic activity. A better gauge of investor activity is the composition of investment between types of instruments over a number of quarters, which is more likely to reflect varying investment strategies.

Figure 1: Total net investment

UK, Quarter 1 (Jan to Mar) 2012 to Quarter 4 (Oct to Dec) 2017

Source: Office for National Statistics

Notes:

- Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept), Q4 refers to Quarter 4 (Oct to Dec).

Download this chart Figure 1: Total net investment

Image .csv .xlsShort-term assets

Investment in short-term assets (those maturing within one year of their originating date) can be affected by the level of the net inflows of funds into the businesses concerned (premiums or contributions, for example) and by the relative attractiveness of other investments, both in terms of their potential returns and risk.

In Quarter 4 2017, there was net investment of £17 billion in short-term assets (Figure 2), the largest for this series since Quarter 3 (July to Sept) 2007 (£19 billion). In terms of context, the five-year quarterly average for this series is net investment of £3 billion.

The provisional annual estimate of net investment of £35 billion in short-term assets in 2017, was the largest since 2007 (£41 billion). This may reflect a change in the outlook of the surveyed institutional groups with businesses choosing to favour liquidity at this time. Short-term assets are particularly attractive during periods of uncertainty, as they allow businesses to change their investment strategies as events unfold.

Figure 2: Net investment in short-term assets

UK, Quarter 1 (Jan to Mar) 2012 to Quarter 4 (Oct to Dec) 2017

Source: Office for National Statistics

Notes:

- Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept), Q4 refers to Quarter 4 (Oct to Dec).

Download this chart Figure 2: Net investment in short-term assets

Image .csv .xlsUK government sterling securities (gilts)

UK gilts (gilt-edged market securities) are fixed income or index-linked bonds issued by the UK government. On the primary gilt market, the purchaser of a gilt lends the government money in return for regular interest payments and the promise that the nominal value of the gilt will be repaid (redeemed) on a specified future date. These assets may then be bought and sold by investors in the secondary market. Gilts are very liquid assets that offer virtually risk-free returns.

The institutions covered by this release reported net investment in gilts in Quarter 4 2017 of £2 billion (Figure 3), the eighth consecutive quarter of net investment in these assets. In terms of context, the five-year quarterly average for this series is net investment of £5 billion.

Looking at the annual picture, the 2017 provisional estimate of net investment of £29 billion in gilts was the fifth consecutive year of net investment. This was preceded by net disinvestment in 2011 and 2012, which may suggest that some market participants (particularly pension funds) have been switching back to gilts in recent years possibly due to the relative attractiveness of gilts compared with other asset types.

In recent times, the market for gilts has been notably influenced by the Bank of England's quantitative easing programme. On 4 August 2016, the Monetary Policy Committee voted to extend the programme of quantitative easing to £435 billion and to make up to £10 billion of corporate bond purchases over an 18-month period. The gilt portion of this extension ended in January 2017 and it reinvested funds from maturing assets in February and September of 2017. Generally, the additional demand for gilts from the Central Bank would likely result in net disinvestment by other institutions, notwithstanding issues of new gilts. These effects are not immediately apparent in the overall net investment data for this asset type.

UK gilts can be an attractive investment option because they are very secure, reflecting the fact that the British government has never failed to make an interest or principal payment when they are due. The demand for government bonds can increase in periods of economic uncertainty and geopolitical risk, with the popularity of this investment leading to an increase in the price of gilts and a fall in their yields.

The demand for gilts can also be driven by market expectations. For example, if the market anticipates that the central bank is going to announce expansionary monetary policy measures like quantitative easing, demand for these assets can grow, leading to an increase in the price of bonds and a fall in their yield. If you are interested in additional information about gilts that is not already covered in this release, please visit the UK Debt Management Office or Bank of England. In the event of future interest rate rises, then we may see a decrease in the price and a rise in the yield of gilts.

Figure 3: Net investment in UK government sterling securities (gilts)

UK, Quarter 1 (Jan to Mar) 2012 to Quarter 4 (Oct to Dec) 2017

Source: Office for National Statistics

Notes:

- Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept), Q4 refers to Quarter 4 (Oct to Dec).

Download this chart Figure 3: Net investment in UK government sterling securities (gilts)

Image .csv .xlsUK corporate securities and overseas securities

These asset categories comprise ordinary shares, corporate bonds and preference shares. In addition, non-UK government securities are included as part of overseas securities.

The 2017 provisional annual estimates suggest that businesses preferred to invest in fixed-income instruments (such as corporate bonds and government bonds) compared with ordinary shares. This was particularly evident in overseas securities and also in UK corporate securities and may indicate that these businesses saw fixed-income investments to be a relatively attractive and stable investment option, when compared with ordinary shares, during 2017. Stock markets were generally at a high level during 2017 and as share prices have risen, investors may have elected to diversify by increasing their bond exposure.

UK corporate securities

In Quarter 4 2017 there was net disinvestment of £9 billion in UK corporate securities (Figure 4). This was caused mainly by net disinvestment of £10 billion in UK ordinary shares.

In terms of context, the five-year quarterly average for this series is net disinvestment of £5 billion.

The 2017 provisional annual estimate of net investment in other UK corporate securities (mainly corporate bonds) of £4 billion was the largest for this series since 2013 (£5 billion). This contrasts with a provisional estimate of net disinvestment in 2017 of £30 billion in UK ordinary shares, the largest for this series since 2011 (£32 billion).

Figure 4: Net investment in UK corporate securities

UK, Quarter 1 (Jan to Mar) 2012 to Quarter 4 (Oct to Dec) 2017

Source: Office for National Statistics

Notes:

- Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept), Q4 refers to Quarter 4 (Oct to Dec).

Download this chart Figure 4: Net investment in UK corporate securities

Image .csv .xlsOverseas securities

In Quarter 4 2017, there was net disinvestment of £2 billion (Figure 5) in overseas securities. This was caused mainly by net disinvestment of £9 billion in ordinary shares, offset in part by net investment of £7 billion in overseas government securities.

In terms of context, the five-year quarterly average for this series is net investment of £1 billion.

The 2017 provisional annual estimate of net investment in overseas securities (£11 billion) follows net disinvestment of £32 billion in 2016. This turnaround was caused mainly by net investment in other overseas corporate securities (£15 billion), the largest since 2012 (£21 billion). Also contributing to the turnaround was overseas government securities with a provisional 2017 net investment figure of £17 billion, this is the highest level of net investment for this series since records began in 1986. Both of these investments have been offset in part by net disinvestment in overseas ordinary shares (£21 billion).

Figure 5: Net investment in overseas securities

UK, Quarter 1 (Jan to Mar) 2012 to Quarter 4 (Oct to Dec) 2017

Source: Office for National Statistics

Notes:

- Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept), Q4 refers to Quarter 4 (Oct to Dec).

Download this chart Figure 5: Net investment in overseas securities

Image .csv .xlsOther assets

The category “other assets” covers UK and overseas investment in:

- mutual fund investments

- insurance-managed funds

- UK government securities denominated in foreign currency

- local authority and public corporation securities

- loans

- fixed assets

- insurance policies and annuities

- direct investment

- other assets not elsewhere classified

In Quarter 4 2017, there was net investment of £16 billion (Figure 6) in other assets. In terms of context, the five-year quarterly average for this series is net investment of £6 billion.

The 2017 provisional annual estimate of net investment in other assets (£42 billion) was the largest since the start of this time series in 1987. This was caused mainly by net investment by long-term insurance in mutual funds.

Figure 6: Net investment in other assets

UK, Quarter 1 (Jan to Mar) 2012 to Quarter 4 (Oct to Dec) 2017

Source: Office for National Statistics

Notes:

- Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept), Q4 refers to Quarter 4 (Oct to Dec).

Download this chart Figure 6: Net investment in other assets

Image .csv .xls

Table 1: Net investment by asset type UK, Quarter 1 (Jan to Mar) 2012 to Quarter 4 (Oct to Dec) 2017

| £ billion | ||||||

| Total | Short-term assets | UK government sterling securities | UK corporate securities | Overseas securities | Other assets | |

|---|---|---|---|---|---|---|

| 2012 | 55.6 | 15.0 | -10.2 | -10.0 | 46.5 | 14.3 |

| 2013 | 48.4 | 24.9 | 12.6 | -20.4 | 18.1 | 13.3 |

| 2014 | 12.5 | 5.9 | 10.2 | -22.6 | -0.7 | 19.8 |

| 2015 | 27.6 | 4.5 | 0.8 | -20.6 | 18.8 | 24.1 |

| 2016 | -5.7 | -8.5 | 37.8 | -17.3 | -31.9 | 14.2 |

| 2017 | 91.1 | 34.9 | 29.6 | -25.9 | 10.8 | 41.9 |

| Q1 2012 | 17.1 | 10.7 | -7.6 | -4.4 | 13.9 | 4.5 |

| Q2 2012 | 8.4 | -0.3 | -1.9 | -2.3 | 9.7 | 3.2 |

| Q3 2012 | 18.3 | 3.0 | -2.0 | 1.6 | 13.0 | 2.7 |

| Q4 2012 | 11.8 | 1.6 | 1.3 | -4.8 | 9.9 | 3.9 |

| Q1 2013 | 5.4 | 16.5 | 0.6 | -6.6 | -6.3 | 1.2 |

| Q2 2013 | 21.1 | 2.8 | 7.1 | -1.6 | 9.6 | 3.2 |

| Q3 2013 | 15.2 | 7.3 | 3.1 | -9.3 | 9.4 | 4.7 |

| Q4 2013 | 6.7 | -1.7 | 1.9 | -3.0 | 5.3 | 4.1 |

| Q1 2014 | 18.8 | 6.6 | 6.6 | -6.6 | 6.0 | 6.3 |

| Q2 2014 | 3.8 | 1.9 | 6.2 | -2.9 | -4.6 | 3.2 |

| Q3 2014 | 9.8 | 6.7 | 3.2 | -3.6 | -1.1 | 4.5 |

| Q4 2014 | -19.8 | -9.3 | -5.7 | -9.5 | -1.1 | 5.8 |

| Q1 2015 | 6.4 | 12.6 | -3.2 | -8.8 | 3.0 | 2.7 |

| Q2 2015 | 6.1 | -10.9 | 3.9 | -9.6 | 4.7 | 18.0 |

| Q3 2015 | 14.5 | -1.4 | 1.0 | 1.8 | 9.9 | 3.2 |

| Q4 2015 | 0.6 | 4.1 | -0.9 | -4.0 | 1.2 | 0.1 |

| Q1 2016 | -17.9 | -17.2 | 0.6 | -7.6 | -3.5 | 9.9 |

| Q2 2016 | 19.3 | 11.1 | 18.3 | -0.8 | -12.4 | 3.0 |

| Q3 2016 | 5.2 | 7.4 | 6.4 | -4.4 | -7.5 | 3.2 |

| Q4 2016 | -12.2 | -9.8 | 12.5 | -4.6 | -8.5 | -1.8 |

| Q1 2017 | 12.3 | 11.0 | 4.8 | -14.6 | -3.3 | 14.4 |

| Q2 2017 | 37.3 | 7.5 | 11.8 | -3.7 | 14.4 | 7.4 |

| Q3 2017 | 17.3 | -0.2 | 10.5 | 1.2 | 1.6 | 4.2 |

| Q4 2017 | 24.2 | 16.6 | 2.5 | -8.8 | -1.9 | 15.9 |

| Source: Office for National Statistics | ||||||

| Notes: | ||||||

| 1. Components may not sum to totals due to rounding. | ||||||

| 2. Data for Quarter 1 2017 onwards remain provisional and subject to revision until the incorporation of the 2017 annual survey results in December 2018. | ||||||

| 3. Q1 is Quarter 1 January to March, Q2 is Quarter 2 April to June, Q3 is Quarter 3 July to September and Q4 is Quarter 4 October to December. | ||||||

Download this table Table 1: Net investment by asset type UK, Quarter 1 (Jan to Mar) 2012 to Quarter 4 (Oct to Dec) 2017

.xls (31.2 kB)4. Net investment by institutional group

Net investment data for each of the institutional groups covered by this release are displayed in Table 2 (at the end of this section).

Long-term insurance companies

These are companies that provide either protection in the form of life assurance or critical illness policies, or investment in the form of pension provision.

Long-term insurance companies showed net investment of £4 billion in Quarter 4 (Oct to Dec) 2017 (Figure 7). The five-year quarterly average for this series is net disinvestment of £1 billion.

The 2017 provisional annual estimate of net investment by these businesses in mutual funds (£41 billion) was the largest since the start of this time series in 2000.

Figure 7: Net investment by long-term insurance companies

UK, Quarter 1 (Jan to Mar) 2012 to Quarter 4 (Oct to Dec) 2017

Source: Office for National Statistics

Notes:

- Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept), Q4 refers to Quarter 4 (Oct to Dec).

Download this chart Figure 7: Net investment by long-term insurance companies

Image .csv .xlsGeneral insurance companies

These are companies that undertake other types of insurance such as motor, home and travel. This type of insurance is usually over a shorter period, most commonly 12 months.

General insurance companies showed net investment in Quarter 4 2017 of £0.2 billion (Figure 8). The five-year quarterly average for this series is net disinvestment of £0.5 billion.

Figure 8: Net investment by general insurance companies

UK, Quarter 1 (Jan to Mar) 2012 to Quarter 4 (Oct to Dec) 2017

Source: Office for National Statistics

Notes:

- Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept), Q4 refers to Quarter 4 (Oct to Dec).

Download this chart Figure 8: Net investment by general insurance companies

Image .csv .xlsSelf-administered pension funds

These are funds established by pension scheme trustees to facilitate and organise the investment of employees’ retirement funds.

Self-administered pension funds reported net investment in Quarter 4 2017 of £7 billion (Figure 9). In terms of context, the five-year quarterly average for this series is net investment of £5 billion.

In 2017, the provisional annual estimate of net investment by self-administered pension funds (£40 billion) was the largest since the start of this series in 1964. This was caused mainly by net investment in gilts of £33 billion in 2017. This follows on from a net investment in gilts of £41 billion in 2016, which was the largest since the start of the series in 1964.

By contrast, the 2017 provisional estimate of net disinvestment (£19 billion) by these businesses in overseas ordinary shares was the largest since the start of this series in 1963, following net disinvestment of £12 billion in 2016. This, along with the increased move towards gilts, may indicate that these businesses were pursuing a relatively liquid investment portfolio in recent years.

Figure 9: Net investment by self-administered pension funds

UK, Quarter 1 (Jan to Mar) 2012 to Quarter 4 (Oct to Dec) 2017

Source: Office for National Statistics

Notes:

- Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept), Q4 refers to Quarter 4 (Oct to Dec).

Download this chart Figure 9: Net investment by self-administered pension funds

Image .csv .xlsInvestment trusts

Investment trusts acquire financial assets with money subscribed by shareholders or borrowed in the form of loan capital. Investment trusts are not trusts in the legal sense, but are limited companies with two special characteristics: their assets consist of securities and they are debarred by their articles of association from distributing capital gains as dividends. Shares of investment trusts are traded on the London Stock Exchange and increasingly can be bought direct from the company.

In Quarter 4 2017, investment trusts reported net investment of £0.3 billion, broadly in keeping with the five-year quarterly average for this series.

Unit trusts and property unit trusts

Unit trusts include open-ended investment companies (OEICs) but do not cover other unitised collective investment schemes or those based offshore. They are set up under trust deeds, the trustee usually being a bank or insurance company. The funds in the trusts are managed not by the trustees, but by independent management companies. Units representing a share in the trusts’ assets can be bought from the managers or resold to them at any time.

Property unit trusts invest predominantly in freehold or leasehold commercial property yet may hold a small proportion of their investments in the securities of property companies.

In Quarter 4 2017, unit trusts and property unit trusts reported net investment of £19 billion (Figure 10). The five-year quarterly average for this series is net investment of £10 billion.

In 2017, the provisional annual estimate of net investment by unit trusts and property unit trusts (£76 billion) was the largest since the start of this series in 1984. This was caused mainly by net investment of £37 billion in overseas securities, which was the largest since the start of this series in 1986, and net investment in short-term assets (£18 billion), the largest since the start of this series in 1980.

Figure 10: Net investment by unit trusts and property unit trusts

UK, Quarter 1 (Jan to Mar) 2012 to Quarter 4 (Oct to Dec) 2017

Source: Office for National Statistics

Notes:

- Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept), Q4 refers to Quarter 4 (Oct to Dec).

Download this chart Figure 10: Net investment by unit trusts and property unit trusts

Image .csv .xls

Table 2: Net investment by institutional group UK, Quarter 1 (Jan to Mar) 2012 to Quarter 4 (Oct to Dec) 2017, £ billion

| £ billion | ||||||||||||||||

| Total | Long-term insurance companies | General insurance companies | Self-administered pension funds | Investment trusts | Unit trusts and property unit trusts | Consolidation adjustment1 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2012 | 55.6 | 3.7 | 1.6 | 19.7 | -0.2 | 53.5 | -22.6 | |||||||||

| 2013 | 48.4 | -17.3 | 0.8 | 18.8 | 0.6 | 50.9 | -5.4 | |||||||||

| 2014 | 12.5 | -14.6 | -10.0 | 10.3 | 0.8 | 48.7 | -22.7 | |||||||||

| 2015 | 27.6 | -5.0 | 4.6 | 13.6 | 0.2 | 30.5 | -16.3 | |||||||||

| 2016 | -5.7 | 3.9 | -6.3 | 20.4 | 1.4 | -2.8 | -22.3 | |||||||||

| 2017 | 91.1 | 11.1 | 0.6 | 39.9 | -3.5 | 76.1 | -33.0 | |||||||||

| Q1 2012 | 17.1 | 2.3 | 1.7 | 4.9 | 0.1 | 11.1 | -3.0 | |||||||||

| Q2 2012 | 8.4 | 2.1 | -1.3 | -3.4 | 0.1 | 9.4 | 1.6 | |||||||||

| Q3 2012 | 18.3 | -2.4 | 0.4 | 9.8 | -0.4 | 15.0 | -4.0 | |||||||||

| Q4 2012 | 11.8 | 1.8 | 0.8 | 8.4 | 0.1 | 18.0 | -17.2 | |||||||||

| Q1 2013 | 5.4 | -1.4 | -1.4 | -4.0 | 0.5 | 17.1 | -5.5 | |||||||||

| Q2 2013 | 21.1 | -0.4 | 1.3 | 6.5 | -0.2 | 14.8 | -1.0 | |||||||||

| Q3 2013 | 15.2 | -4.7 | 0.7 | 10.5 | 0.1 | 6.7 | 1.9 | |||||||||

| Q4 2013 | 6.7 | -10.8 | 0.2 | 5.8 | 0.1 | 12.3 | -0.8 | |||||||||

| Q1 2014 | 18.8 | -0.3 | 1.1 | 9.7 | 0.1 | 16.8 | -8.6 | |||||||||

| Q2 2014 | 3.8 | -5.9 | -4.0 | 9.2 | 0.3 | 11.5 | -7.3 | |||||||||

| Q3 2014 | 9.8 | -1.0 | -1.5 | -0.1 | 0.4 | 16.4 | -4.4 | |||||||||

| Q4 2014 | -19.8 | -7.4 | -5.6 | -8.4 | 0.0 | 4.0 | -2.4 | |||||||||

| Q1 2015 | 6.4 | -3.4 | -0.6 | 6.9 | -0.9 | 5.5 | -1.1 | |||||||||

| Q2 2015 | 6.1 | -2.2 | 2.0 | 6.7 | 0.8 | 3.0 | -4.1 | |||||||||

| Q3 2015 | 14.5 | 2.6 | 2.0 | 1.1 | 0.2 | 12.8 | -4.3 | |||||||||

| Q4 2015 | 0.6 | -1.9 | 1.2 | -1.1 | 0.1 | 9.2 | -6.8 | |||||||||

| Q1 2016 | -17.9 | -8.2 | -5.8 | 8.1 | 0.5 | -4.8 | -7.7 | |||||||||

| Q2 2016 | 19.3 | 0.1 | 1.0 | 16.8 | 1.1 | 6.9 | -6.6 | |||||||||

| Q3 2016 | 5.2 | 9.9 | 0.6 | 3.5 | -0.7 | -4.0 | -4.2 | |||||||||

| Q4 2016 | -12.2 | 2.2 | -2.2 | -8.0 | 0.5 | -0.9 | -3.8 | |||||||||

| Q1 2017 | 12.3 | 5.0 | -2.3 | 7.1 | -2.0 | 14.8 | -10.4 | |||||||||

| Q2 2017 | 37.3 | 1.8 | 1.0 | 20.9 | -1.6 | 24.3 | -9.0 | |||||||||

| Q3 2017 | 17.3 | 0.3 | 1.7 | 5.2 | -0.2 | 18.4 | -8.1 | |||||||||

| Q4 2017 | 24.2 | 4.0 | 0.2 | 6.7 | 0.3 | 18.6 | -5.5 | |||||||||

| Source: Office for National Statistics | ||||||||||||||||

| Notes: | ||||||||||||||||

| 1. The consolidation adjustment is an adjustment to remove inter-sectoral flows between the different types of institution covered. The adjustment includes (i) investment in authorised unit trust units, open-ended investment companies and investment trust securities by insurance companies, pension funds and trusts and (ii) investment by pension funds in insurance managed funds and property unit trust units. | ||||||||||||||||

| 2. Components may not sum to totals due to rounding. | ||||||||||||||||

| 3. Data for Quarter 1 2017 onwards remain provisional and subject to revision until the incorporation of the 2017 annual survey results in December 2018. | ||||||||||||||||

| 4. Q1 is Quarter 1 January to March, Q2 is Quarter 2 April to June, Q3 is Quarter 3 July to September and Q4 is Quarter 4 October to December. | ||||||||||||||||

Download this table Table 2: Net investment by institutional group UK, Quarter 1 (Jan to Mar) 2012 to Quarter 4 (Oct to Dec) 2017, £ billion

.xls (32.3 kB)5. Income and expenditure by institutional group

Rather than provide analysis on total income and expenditure for the institutional groups, it is considered more beneficial to users, based on their feedback, if commentary is concentrated on particular components. For insurance companies, the focus is on premiums and claims, while contributions (net of refunds) and payments are the focus for self-administered pension funds (see Table 3, at the end of this section).

Long-term insurance companies

In Quarter 4 (Oct to Dec) 2017, the value of claims was £51 billion. In terms of context, the five-year quarterly average for this series is £41 billion.

The value of premiums in Quarter 4 2017 was £44 billion. The five-year quarterly average for this series is £32 billion.

The value of claims exceeded the value of premiums in each of the years since 2008, reversing the trend of premiums exceeding the value of claims, evident between 2003 (when records for these series began) and 2007.

Figure 11: Long-term insurance companies’ premiums and claims

UK, Quarter 1 (Jan to Mar) 2012 to Quarter 4 (Oct to Dec) 2017

Source: Office for National Statistics

Notes:

- Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept), Q4 refers to Quarter 4 (Oct to Dec).

Download this chart Figure 11: Long-term insurance companies’ premiums and claims

Image .csv .xlsGeneral insurance companies

In Quarter 4 2017, the value of premiums was £9 billion in keeping with the five-year quarterly average for this series.

In Quarter 4 2017, the value of claims was £6 billion. The five-year quarterly average for this series is £6 billion.

Figure 12: General insurance companies’ premiums and claims

UK, Quarter 1 (Jan to Mar) 2012 to Quarter 4 (Oct to Dec) 2017

Source: Office for National Statistics

Notes:

- Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept), Q4 refers to Quarter 4 (Oct to Dec).

Download this chart Figure 12: General insurance companies’ premiums and claims

Image .csv .xlsSelf-administered pension funds

Contributions to self-administered pension funds (net of refunds) in Quarter 4 2017 were £11 billion in line with the five-year quarterly average for this series.

In recent years there seems to be a pattern for pension managers to make one-off “special contributions” in Quarter 1 (Jan to Mar) of a given year, to reduce the deficits in their funds. This would lead to generally higher net contributions in this quarter compared with other quarters of the year (Figure 13). A possible explanation for this pattern is that companies with defined benefit schemes, while compiling their end of year accounts, are better placed to determine the level of additional input they can provide to address pension fund deficit. Estimates of these one-off employers' special contributions were relatively high in the first quarter of each year since 2012. In Quarter 1 2017, pension funds made special contributions of £5 billion.

Payments (comprising pensions payable gross of income tax, lump sums payable on retirement and death benefits) by self-administered pension funds in Quarter 4 2017 were £14 billion. The five-year quarterly average for this series is £13 billion.

Figure 13: Self-administered pension funds’ contributions (net of refunds) and payments

UK, Quarter 1 (Jan to Mar) 2012 to Quarter 4 (Oct to Dec) 2017

Source: Office for National Statistics

Notes:

- Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept), Q4 refers to Quarter 4 (Oct to Dec).

Download this chart Figure 13: Self-administered pension funds’ contributions (net of refunds) and payments

Image .csv .xls

Table 3: Income and expenditure by institutional group UK, Quarter 1 (Jan to Mar) 2012 to Quarter 4 (Oct to Dec) 2017, £ billion

| £ billion | ||||||

| Long-term insurance | General insurance | Self-administered pension funds | ||||

|---|---|---|---|---|---|---|

| Premiums | Claims | Premiums | Claims | Contributions (net of refunds) | Payments | |

| 2012 | 113.6 | 146.8 | 37.4 | 24.1 | 48.6 | 51.4 |

| 2013 | 108.2 | 152.0 | 37.3 | 24.2 | 47.3 | 53.9 |

| 2014 | 116.8 | 153.5 | 36.0 | 22.7 | 41.1 | 51.6 |

| 2015 | 127.5 | 161.9 | 35.6 | 22.5 | 40.6 | 53.6 |

| 2016 | 130.0 | 163.8 | 34.6 | 21.7 | 47.4 | 54.6 |

| 2017 | 159.8 | 187.6 | 35.9 | 23.4 | 49.2 | 54.4 |

| Q1 2012 | 27.4 | 35.0 | 9.5 | 6.3 | 16.5 | 12.5 |

| Q2 2012 | 28.6 | 37.4 | 9.8 | 5.7 | 10.4 | 13.0 |

| Q3 2012 | 26.6 | 36.6 | 9.3 | 5.9 | 10.4 | 12.6 |

| Q4 2012 | 30.9 | 37.8 | 8.7 | 6.3 | 11.4 | 13.4 |

| Q1 2013 | 23.7 | 34.7 | 9.6 | 6.0 | 16.0 | 13.0 |

| Q2 2013 | 30.6 | 38.8 | 9.6 | 6.0 | 10.0 | 13.2 |

| Q3 2013 | 26.6 | 39.4 | 9.2 | 6.0 | 10.2 | 13.6 |

| Q4 2013 | 27.3 | 39.1 | 8.8 | 6.3 | 11.0 | 14.0 |

| Q1 2014 | 30.4 | 34.3 | 9.1 | 5.7 | 11.8 | 12.3 |

| Q2 2014 | 29.3 | 39.0 | 9.6 | 5.8 | 9.3 | 12.9 |

| Q3 2014 | 27.3 | 36.9 | 8.8 | 5.6 | 9.3 | 13.1 |

| Q4 2014 | 29.8 | 43.3 | 8.6 | 5.5 | 10.7 | 13.2 |

| Q1 2015 | 25.3 | 34.6 | 9.1 | 5.8 | 12.0 | 12.7 |

| Q2 2015 | 28.2 | 47.9 | 9.2 | 5.5 | 9.3 | 13.2 |

| Q3 2015 | 35.5 | 39.6 | 8.3 | 5.6 | 9.1 | 13.6 |

| Q4 2015 | 38.4 | 39.8 | 9.1 | 5.7 | 10.3 | 14.2 |

| Q1 2016 | 31.4 | 44.9 | 8.5 | 5.4 | 17.3 | 13.6 |

| Q2 2016 | 30.9 | 38.3 | 8.7 | 5.2 | 9.6 | 13.6 |

| Q3 2016 | 29.5 | 37.0 | 8.8 | 5.3 | 9.7 | 14.0 |

| Q4 2016 | 38.3 | 43.6 | 8.6 | 5.9 | 10.8 | 13.4 |

| Q1 2017 | 35.1 | 43.3 | 9.1 | 6.1 | 14.2 | 13.3 |

| Q2 2017 | 37.4 | 47.5 | 8.8 | 5.3 | 13.0 | 13.5 |

| Q3 2017 | 42.8 | 46.1 | 8.9 | 6.0 | 10.7 | 13.8 |

| Q4 2017 | 44.5 | 50.7 | 9.1 | 6.0 | 11.3 | 13.8 |

| Source: Office for National Statistics | ||||||

| Notes: | ||||||

| 1. Components may not sum to totals due to rounding. | ||||||

| 2. Data for Quarter 1 2017 onwards remain provisional and subject to revision until the incorporation of the 2017 annual survey results in December 2018. | ||||||

| 3. Q1 is Quarter 1 January to March, Q2 is Quarter 2 April to June, Q3 is Quarter 3 July to September and Q4 is Quarter 4 October to December. | ||||||

Download this table Table 3: Income and expenditure by institutional group UK, Quarter 1 (Jan to Mar) 2012 to Quarter 4 (Oct to Dec) 2017, £ billion

.xls (31.7 kB)6. Holdings at market values

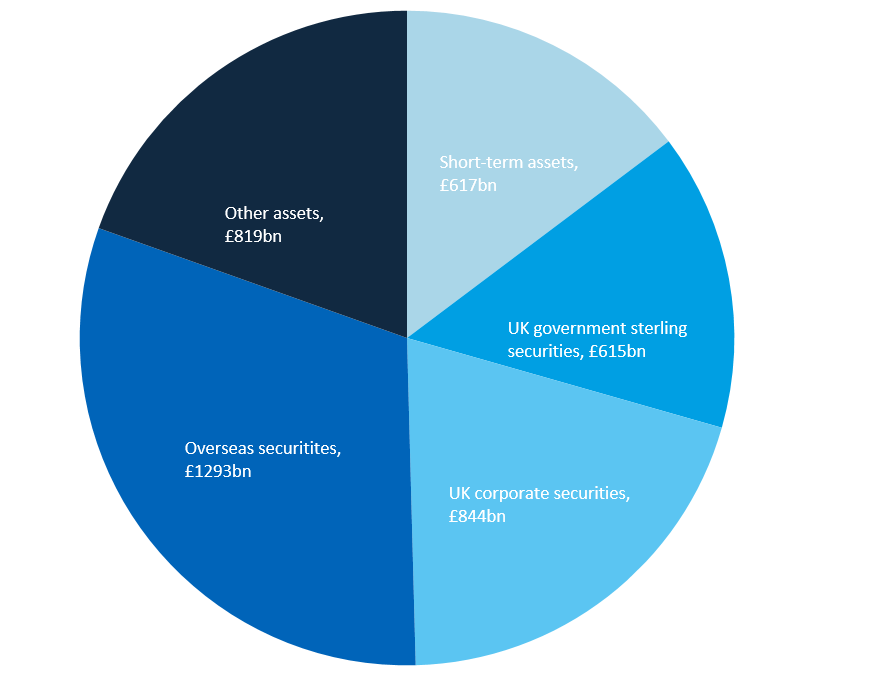

The most recently available annual balance sheet data, providing information on the market value of asset holdings, is for 2016 (Figure 14). Market value is the quoted price at which assets are bought or sold, at a given time. Increase or decrease in the total holdings of assets reflects both the revaluation of assets held through the year and the balance between the sales of some assets and the purchase of others (net investment or transactions).

The total assets held by insurance companies, pension funds and trusts (at market values) has increased each year since 2008 and at the end of 2016 was valued at £4,188 billion.

Figure 14: Values of holdings at market values by asset type

UK, 2016

Source: Office for National Statistics

Download this image Figure 14: Values of holdings at market values by asset type

.png (27.2 kB) .xls (31.7 kB)The Quarter 3 (July to Sept) 2018 release, due to be published in December 2018, will contain annual 2017 balance sheet information.

Nôl i'r tabl cynnwys7. Accessing MQ5 data

There are several ways to view the data underlying this release.

The MQ5: Investment by insurance companies, pension funds and trusts dataset shows data from both the quarterly and annual series:

- Tables A to D combine information from the different institutions

- Section 1 combines information from the long-term and general insurance surveys

- Section 2 covers information from the surveys of long-term insurance companies

- Section 3 covers information from the surveys of general insurance companies

- Section 4 covers information from the surveys of self-administered pension funds

- Section 5 covers information from the surveys of investment trusts

- Section 6 covers information from the surveys of unit trusts and property unit trusts

If you are interested in a particular series or groups of series covering a longer period of time (pre-2010), then you can access the Investment by Insurance Companies, Pension Funds and Trusts time series dataset.

There is scope to expand coverage of these datasets and/or add further datasets. We are keen to hear your views – please email us at financial.inquiries@ons.gov.uk.

Nôl i'r tabl cynnwys8. Revisions

A revisions policy is available to assist users with their understanding of the cycle and frequency of data revisions. You are strongly advised to read this policy before using these data for research or policy-related purposes.

Data for 2017 remain provisional and subject to revision, until the incorporation of the 2017 annual survey results in December 2018. Data for the first three quarters of 2017 have been revised, partly as a result of late questionnaires being received and partly as a result of disaggregate data revisions. For Quarter 3 (July to Sept) 2017, net investment has been revised downwards from net investment of £25 billion to net investment of £17 billion.

Revisions to data provide one indication of the reliability of main indicators. A spreadsheet is available giving a revisions triangle of estimates of net investment from 1996 to date.

Nôl i'r tabl cynnwys9. Response rates

The figures in this release are based on a system of quarterly and annual surveys collecting data on income and expenditure, transactions in financial assets and the balance sheet in separate surveys. Response rates in Quarter 4 (Oct to Dec) 2017 are broadly in line with previous quarters’ response rates.

Table 4: Overall response rate by survey Quarter 4 (Oct to Dec) 2017

| Q4 2017 | % | |||||||||

| Transactions | ||||||||||

| Long-term insurance companies | 94 | |||||||||

| General insurance companies | 89 | |||||||||

| Self-administered pension funds | 80 | |||||||||

| Unit trusts | 97 | |||||||||

| Investment trusts | 91 | |||||||||

| Property unit trusts | 83 | |||||||||

| Income and expenditure | ||||||||||

| Long-term insurance companies | 94 | |||||||||

| General insurance companies | 85 | |||||||||

| Self-administered pension funds | 82 | |||||||||

| Source: Office for National Statistics | ||||||||||

Download this table Table 4: Overall response rate by survey Quarter 4 (Oct to Dec) 2017

.xls (26.6 kB)10. Quality and methodology

The Investment by insurance companies, pension funds and trusts (MQ5) Quality and Methodology Information report contains important information on:

- the strengths and limitations of the data and how it compares with related data

- uses and users of the data

- how the output was created

- the quality of the output including the accuracy of the data