1. Main points

Four distinct types of country are identified in the UK's outward network: investment hubs, ultimate host countries, round-tripping countries, and countries that facilitated the UK's entry into specific markets.

The Netherlands was the main investment hub for UK outward investment, with immediate outward links to 99 countries.

Germany was the most common ultimate host for UK affiliates with 16.9 times more inward links than outward links, and more inward links (4,927) than any other country in the UK's outward network.

Ireland was commonly used to route UK outward investment back into the UK; 84.0% of Ireland's UK-owned outward investment links went directly to the UK.

Hong Kong was the direct intermediary for 19.2% of UK investment links into China.

2. The UK’s outward investment hubs

This article uses an extract from the Bureau van Dijk's Orbis database to provide information on the complete overseas network of UK outward investors. The UK outward network consists of the subsidiaries of all directly UK-owned foreign businesses. A UK business is a shareholder of all businesses included in our analysis with a minimum total share of 10%.

International guidelines for compiling foreign direct investment statistics require investment relationships to be presented using the immediate host country. Multinational enterprises can have complex corporate structures and networks through which this investment is controlled. Therefore, the immediate recipient country does not provide a complete picture of the UK's outward investment network.

Given the complex nature of the UK's outward investment network, it is useful to employ techniques from network science to analyse it. This article uses two network measures – "betweenness centrality" and "degree centrality" – to identify countries that were common host economies for UK outward investment and countries that were the main locations through which those investments were controlled. We define those countries that channel UK investment on route to its ultimate destination as investment hubs.

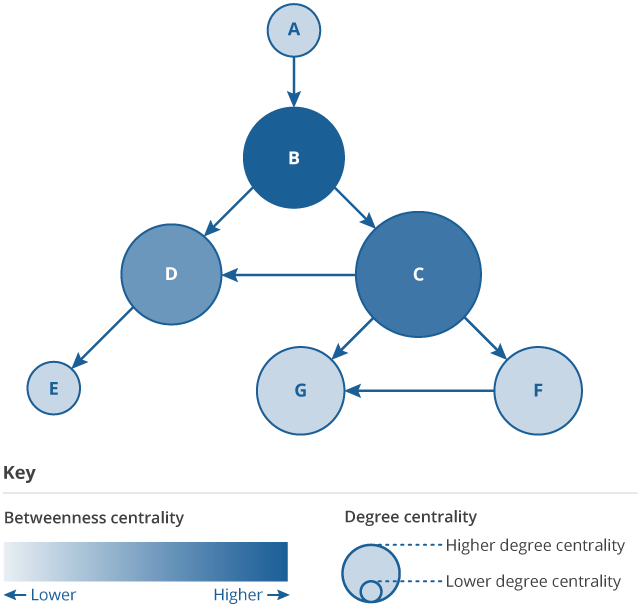

Figure 1 illustrates the concepts of betweenness centrality and degree centrality for a network of businesses. Business B has the highest betweenness centrality because it is on the shortest route between the most pairs of businesses. Business C has the highest degree centrality as it has the most direct connections. In this network both B and C play important roles for controlling UK outward investment, but only by using both network measures are we able to identify both B and C as investment hubs. Further details on the methods used in this article and explicit examples of the centrality measure calculations can be found in the Data sources and quality section.

Figure 1: Business C has the highest degree centrality, but business B has the highest betweenness centrality

Diagram demonstrating a simple example network

Source: Office for National Statistics

Notes:

- The direction of an arrow indicates direction from a shareholder to an affiliate.

- The size of the circles reflect the degree centrality.

- Betweenness centrality is indicated by the level of shading.

Download this image Figure 1: Business C has the highest degree centrality, but business B has the highest betweenness centrality

.png (31.2 kB)The Netherlands' high business centrality indicates that it played an important role in channelling UK outward investment

Betweenness centrality for outward investment highlights countries or businesses that link together different sections of the network. A high betweenness centrality means a country or business plays an important role in linking UK investment to onward destinations. In this article, betweenness centrality is calculated for networks of businesses in business structures. We use the term "business centrality" to refer to the betweenness centrality of businesses in business structures.

Figure 2 shows the average business centrality of the top 15 countries in the UK outward network. Businesses in the Netherlands had the highest average business centrality, followed by Luxembourg, Ireland, UK, United States, and France.

As business centrality is a measure of how often a business is on the shortest route between two businesses, the values in Figure 2 can be approximately interpreted as follows: on average, businesses in the Netherlands were on the most direct route between six pairs of businesses. This indicates that the Netherlands was an important linking country in the UK's outward investment network.

Figure 2: On average, businesses in the Netherlands linked together more businesses than any other country

Average business centrality for the 15 most common countries by business count in the UK’s outward network between January 2019 and October 2020

Source: Office for National Statistics – Bureau van Dijk’s Orbis database

Notes:

- Values are indicative of the average number of pairs of businesses linked together by businesses in each country.

Download this chart Figure 2: On average, businesses in the Netherlands linked together more businesses than any other country

Image .csv .xlsBusinesses in Ukraine and Russia had the lowest average betweenness centrality of the top 15 countries by business count. Where they appeared, businesses in those countries tended not to control complex business structures. On average, business structures containing either Russia or Ukraine contained the fewest businesses. Often the immediate UK parent, and the Russian or Ukrainian affiliate, were the only businesses in the structure.

A high degree centrality categorises the Netherlands, France, and Jersey as UK investment hubs

To further understand the roles of countries in the UK's outward investment network, we consider degree centrality.

Degree centrality is the proportion of other countries in the network to which each country is directly connected. Two countries are directly connected if there is an immediate investment link between them. For example, if a business in France is an immediate shareholder of a business in Belgium, then France and Belgium are directly connected.

As the direction of an outward link matters, it is possible to calculate two different degree centralities: one considering connections going into a country (indegree) and one considering connections going out of a country (outdegree). An indegree of 50%, for example, means 50% of other countries in the network host immediate shareholders of businesses in that country.

Figure 3 compares the indegree and outdegree centrality of different countries. If a country has a higher indegree than outdegree, then it is more likely to be an ultimate destination of investment. If it has a higher outdegree than indegree, it is acting as a hub for channelling UK investment around the world.

Figure 3: The United States and the Netherlands ranked highly for indegree and outdegree, whereas economies like Jersey specialised in outward links

Countries ranked by the number of different countries linking into them (left) and ranked by the number of countries they link out to (right)

Embed code

The Netherlands ranked highly in terms of indegree and outdegree, just as it had a high business centrality. A high outdegree means a country has outward links to many different countries. Specifically, the Netherlands had outward links to 99 different countries, or 54.7% of other countries in the UK’s outward network. The combination of strong links to many different countries (Figure 3) and businesses that play linking roles in individual business structures (Figure 2) shows that the Netherlands was a main hub for channelling UK outward investment.

There were also some economies that played a more nuanced role. Jersey, for example, ranked fourth in terms of the number of countries it has immediate UK-owned subsidiaries in, and it ranked 6th in terms of the number of UK-owned subsidiaries it immediately owned. However, in terms of the number of countries that immediately owned businesses in Jersey, Jersey ranked 32nd. UK-owned businesses registered in Jersey, owned businesses in 54 different countries but UK investment into Jersey came via only 12 different countries. Jersey was a clear example of an economy that acted to redistribute investment from a small number of countries to a wider range of countries.

France also had a much higher outdegree than indegree, with immediate outward links to 67 different countries. Additionally, France had investment links to parts of the network that other countries did not. France was the most common immediate shareholding country of 10 different host countries. Of those 10 countries, 7 were French speaking African countries, and 6 were countries that the UK had no direct link with. Only the UK was the most common shareholding country of more countries than France (149).

Luxembourg, Ireland, and Hong Kong ranked relatively lower in terms of their outdegree (Figure 3) than their business centrality (Figure 2). This suggests that while they commonly contained linking businesses, those linking businesses related to fewer countries compared with the Netherlands or France. This indicates that Luxembourg, Ireland, and Hong Kong played a different role in the network to the Netherlands. In the following section, analysis of the common investment routes in the network will help determine those roles.

In Figure 3, the values of indegree are lower than values of outdegree for corresponding ranks. The highest indegree of all countries other than the UK was the United States (14.9%). Only 27 countries had investment links into the United States, compared with the 99 different countries that the Netherlands had outward links to. The lower values for indegree are because 100 countries in the network had no outward links at all, effectively limiting the pool of different countries that could provide inward links. Therefore, it is more useful to compare the rank of different countries in terms of their indegree and outdegree, than it is to compare the direct values.

Nôl i'r tabl cynnwys3. Common investment routes

Common investment routes help to further understand the roles of different countries in the network, and to identify countries that facilitate UK investment into specific economies.

Table 1 shows the 10 most common immediate investment routes in the UK’s outward network that do not directly include the UK. Links directly involving the UK are excluded from Table 1 to allow focus on other countries in the network, as the UK dominates the table otherwise. The links in Table 1 were still UK owned, but appear further down the business structure.

| Parent to host country | Number of immediate links ¹ ² | Percentage of parent country’s immediate outward links | Percentage of host country’s immediate inward links |

|---|---|---|---|

| Hong Kong to China | 88 | 40.4 | 19.2 |

| Netherlands to Germany | 76 | 6.2 | 1.5 |

| United States to Canada | 48 | 19.9 | 16.4 |

| Netherlands to Spain | 46 | 3.7 | 2.5 |

| Netherlands to Poland | 46 | 3.7 | 3.4 |

| Netherlands to France | 44 | 3.6 | 2.9 |

| Jersey to United States | 41 | 14.4 | 2.4 |

| Luxembourg to Germany | 40 | 8.9 | 0.8 |

| Netherlands to Belgium | 36 | 2.9 | 7.6 |

| Netherlands to Italy | 33 | 2.7 | 1.2 |

Download this table Table 1: Hong Kong provides 19.2% of UK owned inward links into China, demonstrating its importance in UK investment to China

.xls .csvIn Section 2, it was asserted that the Netherlands was an investment hub for linking UK investment around the world. This point is further illustrated in Table 1. Of the 10 common investment routes in Table 1, 6 involved the Netherlands as a parent country. This highlights how frequently UK investment was channelled through the Netherlands on its way to its ultimate destination.

Table 1 also identifies countries that facilitated UK investment into specific countries. Hong Kong, for example, was important for linking UK investment to China, as it accounted for 19.2% of all UK-owned links into China. Similarly, the UK's relationship with the United States provides investment links into Canada, which accounted for 16.4% of all UK-owned inward links into Canada. For comparison, immediate investment links from the UK made up 69.2% and 61.4% of immediate investment links into China and Canada respectively.

Germany was the most common host country for UK affiliates

By analysing countries in terms of the number of direct inward investment links (Figure 4), we can identify the ultimate destinations of UK investment.

Not only did Germany have the highest number of direct inward links from the UK, but Germany had the highest number of inward links in the network (4,927), more even than the UK. Germany also had 16.9 times more inward links than outward links, a higher ratio than any of the other top 15 countries by business count.

Similarly, Germany had a relatively low business centrality (Figure 2) indicating that its businesses rarely linked to further businesses and suggesting that when investment arrived in Germany, it mostly remained there. From this evidence, it appears that Germany was the main ultimate host for UK affiliates between January 2019 and October 2020.

Figure 4: Germany was the most common ultimate host for UK affiliates with the most direct links from the UK, and the most inward links in total

Number of direct inward links into the top 15 countries by business count in the UK’s outward network between January 2019 and October 2020

Source: Office for National Statistics – Bureau van Dijk’s Orbis database

Notes:

- Direct links between businesses in the same country are not included.

- “UK parent” indicates that the immediate shareholder is registered in the UK.

- “Non-UK parent” indicates that the immediate shareholder is registered outside the UK.

Download this chart Figure 4: Germany was the most common ultimate host for UK affiliates with the most direct links from the UK, and the most inward links in total

Image .csv .xlsIreland’s high business centrality and low outdegree can be explained by its engagement in round-tripping

The UK’s outward network also included “round-tripping”, whereby UK companies invested back into the UK through foreign affiliates. Of all immediate investment links including the UK, 4.8% of them were inward links.

Figure 5 shows the number of direct inward links into the UK from 10 of the top 15 countries by business count. The Netherlands, Ireland and Luxembourg were the biggest return investors into the UK in terms of number of links, accounting for 39.8% of round-tripping links into the UK. Czechia, Poland, Russia, and Ukraine were not included because of the limited round-tripping from those countries. The UK was not included because immediate links from the UK to the UK are not round-tripping links.

Figure 5: Of all UK-owned direct inward links to the UK, 39.8% came from either the Netherlands, Ireland, or Luxembourg

Number of outward links into the UK from 10 of the top 15 countries by business count between January 2019 and October 2020

Source: Office for National Statistics – Bureau van Dijk’s Orbis database

Download this chart Figure 5: Of all UK-owned direct inward links to the UK, 39.8% came from either the Netherlands, Ireland, or Luxembourg

Image .csv .xlsThe Netherlands, Luxembourg, and Ireland were second, third and fourth respectively in terms of their UK-owned outward links to all countries. However, of these three countries, only the Netherlands had a high outdegree centrality as can be seen in Figure 2. One reason Ireland had a low outdegree, but many outward links, was that on 84.0% of occasions where Ireland was the parent country, the affiliate business was based in the UK. For Luxembourg this was 55.0% and for the Netherlands 26.3%.

Further work is required to understand Ireland’s high involvement in round-tripping. For example, given Ireland’s relationship with Northern Ireland, the parts of the UK that host the return investment could be an important factor.

Nôl i'r tabl cynnwys4. The roles of countries in the UK’s outward network

From our analysis we have identified four types of country in the UK's outward network. The four types we define as:

investment hubs – countries with a much higher number of outward links and outdegree than the average in the UK's outward network – these are important for linking UK investment around the world; the network average number of outward links not including the UK was 73.1 immediate outward links and the network average outdegree not including the UK was 3.6% of countries.

round-tripping countries – countries with a high business count and more than 50% of their outward links going directly into the UK

ultimate destinations – countries that receive a high number of inward links both compared to other countries and compared to their own outward links

countries that facilitate the UK's entry into specific markets – these countries act as the immediate investor for more than 10% of UK-owned investment links into a specific country

The UK's main investment hub was the Netherlands

The Netherlands scored highly for business centrality, degree centrality and in terms of its involvement in common investment routes. Other important network hubs were Jersey and France, who both linked UK outward investment to many different countries.

Figure 6 shows the distribution of immediate outward links from the Netherlands across different countries. Outward links from the Netherlands linked UK investment to countries all over the world. There are 17 countries that the Netherlands had more than 20 immediate affiliates in, distributed across Europe, Asia, and North America.

Figure 6: UK-owned outward links from the Netherlands connected the highest number of countries

The distribution of UK-owned outward links from the Netherlands to countries around the world between January 2019 and October 2020

Source: Office for National Statistics – Bureau van Dijk’s Orbis database

Notes:

- For clarity, countries in the European Union, and non-EU European countries have been grouped and labelled as EU and Non-EU Europe respectively.

- Links of fewer than 20 connections are grouped in the Rest of the World.

- Percentage of outward links is calculated using the total number of outward links from the Netherlands, not including internal links.

Download this chart Figure 6: UK-owned outward links from the Netherlands connected the highest number of countries

Image .csv .xlsIreland and Luxembourg are the clearest examples of round-tripping countries

While many countries in the UK’s outward network were involved in round-tripping, most of Ireland and Luxembourg’s outward links were round-tripping links. Figure 7 shows the distribution of immediate outward links from both countries, clearly showing the high proportion of Ireland’s outward links that return to the UK.

Figure 7: Of Ireland’s UK-owned outward links, 84.0% went directly to the UK

The distribution of UK owned outward links from round-tripping countries around the world between January 2019 and October 2020

Source: Office for National Statistics – Bureau van Dijk’s Orbis database

Notes:

- For clarity, countries in the European Union have been grouped and labelled as EU.

- Links of fewer than 20 connections are grouped in the Rest of the World.

- Percentage of outward links is calculated using the total number of outward links from each parent country, not including internal links.

Download this chart Figure 7: Of Ireland’s UK-owned outward links, 84.0% went directly to the UK

Image .csv .xlsHong Kong facilitated UK investment into China, while the United States facilitated UK investment into Canada

There were a number of countries that provided common intermediate outward links. For example, Jersey and Guernsey commonly acted as intermediaries between the UK and the United States. After direct links from the UK, Jersey and Guernsey were respectively second and third in terms of the number of UK-owned direct links into the United States. However, the proportion of the United States’ inward links provided by Jersey (2.4%) or Guernsey (1.4%) was low compared with the total inward links to the United States. Therefore, we could not say that Jersey or Guernsey were important for facilitating UK investment into the United States.

Hong Kong is the best example of a country that facilitated UK investment into a specific economy. Hong Kong provided 19.2% of China’s immediate inward links. A high proportion of its outward links also went to Singapore, demonstrating the important role of Hong Kong in linking UK investment into East Asia (Figure 8).

Figure 8: More than 50% of Hong Kong’s outward links go to either China or Singapore

The distribution of UK-owned outward links from countries that specialise in linking to particular countries between January 2019 and October 2020

Source: Office for National Statistics – Bureau van Dijk’s Orbis database

Notes:

- For clarity, countries in the European Union have been grouped and labelled as EU.

- Links of fewer than 20 connections are grouped in the Rest of the World.

- Percentage of outward links is calculated using the total number of outward links from each parent country, not including internal links.

Download this chart Figure 8: More than 50% of Hong Kong’s outward links go to either China or Singapore

Image .csv .xls5. UK’s outward investment network data

UK's outward investment network

Dataset | Released 19 April 2021

Experimental Statistics from the UK's outward investment network. Includes the country pairings required to build the network and statistics on the 60 most common countries in the network by business count.

6. Glossary

Affiliate business

A business with a shareholder based in a different country.

Host country

The country in which an affiliate business is registered. For example, if a UK-owned affiliate was based in Ireland, Ireland would be the host country.

Parent country

The country in which an immediate shareholder is based. For example, if a business in Ireland had an immediate shareholder in the UK, the UK would be the parent country.

Outward link

An instance of a business based in one country, being the immediate shareholder of a business based in another. The host country of the shareholder is said to have an outward link to the country of the subsidiary.

Inward link

An instance of a business based in one country, being the immediate subsidiary of a business based in another. The host country of the subsidiary is said to have an inward link from the country of the shareholder.

Investment hub

A country with a much higher number of outward links and outdegree than the network average.

Round-tripping countries

A country with a high business count that has more than 50% of its outward links going into the UK.

Ultimate destinations

Countries that receive a high number of inward links both compared with other countries and their own outward links.

Nôl i'r tabl cynnwys7. Data sources and quality

In this follow-up article to Foreign-owned UK businesses, experimental insights: July 2020, we have again used an extract from the Orbis dataset (compiled by Bureau van Dijk) to produce our statistics. Our analysis uses a snapshot of Orbis data, containing information on 15.5 million businesses, received by the Office for National Statistics (ONS) in October 2020.

The Orbis dataset contains information on the location of each UK business and the main industry in which each business operates. Like the Inter-Departmental Business Register (IDBR), it contains variables such as turnover and employment, but also alternative financial variables such as total asset values and shareholder's funds.

Because of inconsistent financial variable coverage across different countries, statistics within this article are calculated exclusively on business counts and percentage ownership, rather than the total asset values and shareholder funds that were used in our previous article.

Comparisons with other publications

Direct comparisons between data in this article and other ONS foreign direct investment (FDI) publications should be made with caution as not all publications use the same data sources.

For example, on 10 February 2021, we published UK foreign direct investment, trends and analysis, which used the foreign direct investment (FDI) survey combined with information from the Inter-Departmental Business Register (IDBR) to investigate UK outward investment. Although our article on 10 February and this article both analyse UK outward investment, the former presented analysis using the FDI stock (or position) while this article uses business counts from the Orbis database. Our official estimates of FDI use ONS survey data.

It is also important to note when making comparisons with results in this report that the experimental analysis and methods used may be improved and developed over time in conjunction with the needs of users.

Defining the outward network

Businesses in Orbis are first filtered to only include businesses that have been active since January 2019. From the set of active businesses, UK businesses that own a foreign business are identified using the following conditions, which are that the business:

has at least one direct foreign subsidiary or affiliate business

holds a minimum of 10% ownership of the foreign business

must not be listed as an individual or family

After all conditions are met, the set of UK outward businesses contains 25,603 unique UK businesses, with 40,344 direct foreign subsidiaries.

Business structures are defined starting from direct foreign subsidiaries of UK businesses, and all ownership links in which the UK business holds a total share of at least 10% are included. The combination of the individual business structures below the initial UK business is defined in this article as the UK's outward network. The UK's outward network identified in this analysis consists of 85,115 unique businesses in total.

Understanding individual business structures versus the global outward network

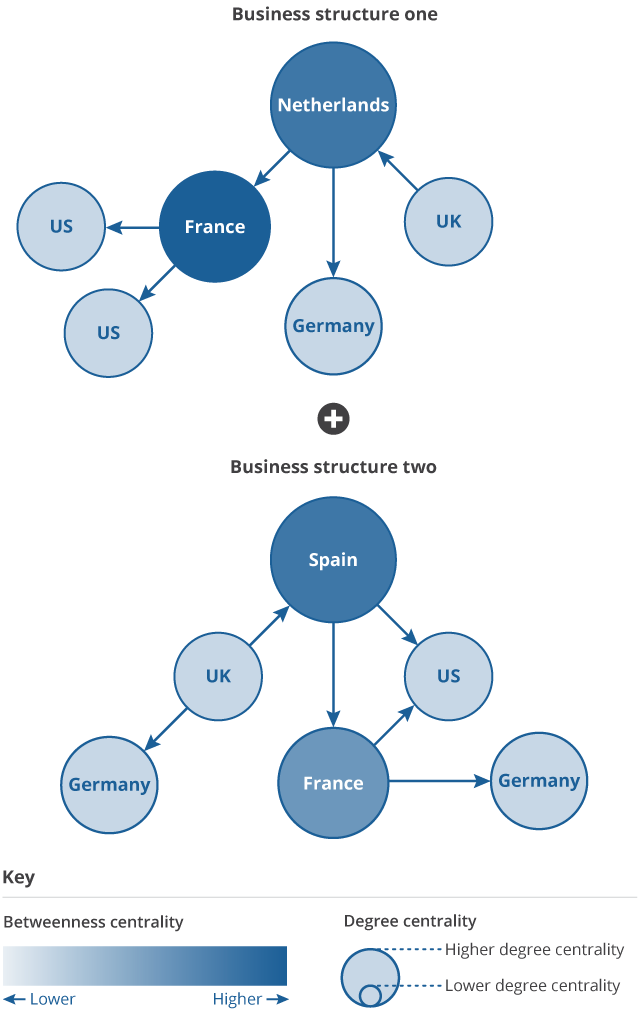

In this article, the UK outward network is analysed in two ways: as a series of individual business structures, and as a network of countries resulting from the combination of individual business structures. The diagram below shows two example business structures, both start from a UK business that has a series of subsidiaries in different countries.

Figure 9: Two example business structures that can be combined to create the network of countries in Figure 10

Each circle represents an individual business labelled with the country in which it is registered. Investment links between the businessess are represented by the arrows

Source: Office for National Statistics

Download this image Figure 9: Two example business structures that can be combined to create the network of countries in Figure 10

.png (59.0 kB)Each individual business structure can be combined to produce a network of countries as in Figure 10. Links are drawn between countries where there is an investment link between businesses based in either country. In the combined network, the number of connections between each country is used to calculate an artificial distance between them. For example, there are three connections between France and the United States in Figure 9. The distance between France and the United States in Figure 10 is therefore calculated as one over the number of connections, or 1/3.

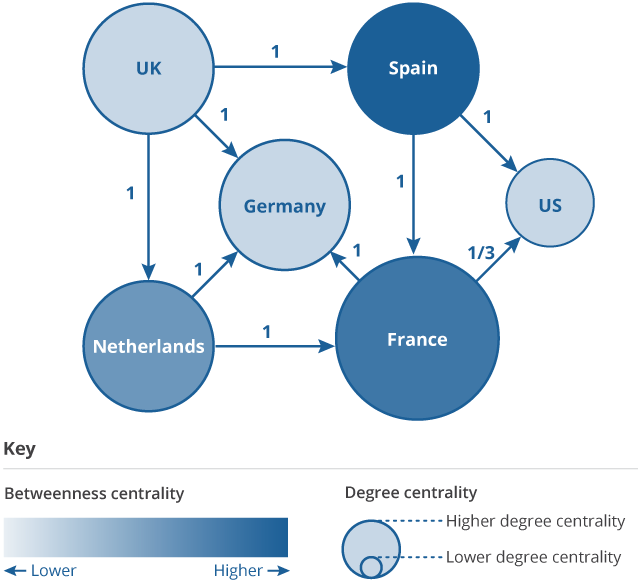

Figure 10: An example of a network of countries resulting from the combination of the two business structures in Figure 9

The circles represent countries and the arrows represent investment links between them. The numeric value next to each arrow is 1 over the number of investment links between the two countries

Source: Office for National Statistics

Download this image Figure 10: An example of a network of countries resulting from the combination of the two business structures in Figure 9

.png (38.8 kB)Network measures

The two network measures used in this article are designed to identify countries that are important to the UK’s outward network. A network is made up of a series of nodes and connections between those nodes are called edges. In this article, the nodes in the network are countries or businesses, and the edges are an investment link between a pair of businesses. In the following explanations, the term nodes will be used, but in this case consider that the term node is interchangeable with country.

Betweenness centrality (business centrality)

Betweenness centrality shows how often a node u is on the shortest path between other pairs of nodes. The betweenness centrality for u is given by:

where s and t are a pair of nodes,

is the number of shortest routes between s and t, and

is the number of shortest routes between s and t that goes through u.

When calculated for the individual business structures in Figure 9 we call betweenness centrality business centrality. The business centrality of a country is found by averaging over all businesses registered in that country. Table 2 contains the business centrality of businesses in business structures 1 and 2 (Figure 9) averaged over the countries in which each business is registered.

For an example of the calculation in action, consider the betweenness centrality of Spain in Figure 9.

Starting with the country pairing UK to United States, there is one shortest route between them, so:

As Spain is on that route:

and

For the country pairing UK to France, there is again one shortest route between them, so:

Spain is on that route too, so:

Spain is also on the shortest route between UK and Germany giving another 1, but not on any other shortest routes. Therefore, all other combinations of s and t give 0. Finally, the betweenness centrality of Spain in Figure 9 is given by:

Degree centrality

Degree centrality is the proportion of a network that a node is directly connected to. For a node u degree centrality is given by:

where n(u) is the number of nodes directly connected to u, and N is the total number of nodes in the network.

| Average degree centrality¹ | Global degree centrality² | Business centrality³ | |

|---|---|---|---|

| UK | 0.3 | 0.6 | 0 |

| Netherlands | 0.6 | 0.6 | 4 |

| Germany | 0.2 | 0.6 | 0 |

| France | 0.6 | 0.8 | 3 |

| United States | 0.3 | 0.4 | 0 |

| Spain | 0.6 | 0.6 | 3 |

Download this table Table 2: Values of betweenness and degree centrality calculated for the individual business structures in Figure 9, and the network of countries in Figure 10

.xls .csv8. Future developments

This analysis focussed on a snapshot of the UK’s outward network. In future work, analysis of the way the network has changed over time may provide insight on the impacts of the UK’s exit from the EU and the coronavirus (COVID-19) pandemic on UK outward investment.

Nôl i'r tabl cynnwys