Cynnwys

- Preface

- Introduction

- Construction of UK consumer price indices

- Measurement of owner occupiers’ housing costs

- Sampling procedures

- Collection of prices

- Validation procedures

- Weights

- Special issues, principles and procedures

- Introducing new data sources

- Publication and usage

- Retail Prices Index

- Alternative inflation measures

- Glossary: Terms and concepts

- Appendix 1: Historical background to the development of consumer price indices in the UK

- Appendix 2: Abridged characteristics of the different measures of consumer price inflation

1. Preface

This is the 2019 version of the Consumer Price Indices Technical Manual (with minor updates in 2023, 2024 and 2025, adding Section 10: Introducing new data sources). However, we are planning an extensive update of the Consumer Prices Indices Technical Manual to coincide with the introduction of groceries scanner data planned for March 2026. The Technical Manual is a reference tool that explains how measures of consumer price inflation and associated indices are compiled. This includes consumer price indices, such as the Consumer Prices Index including owner occupiers' housing costs (CPIH), the Consumer Prices Index (CPI) and the Retail Prices Index (RPI). It covers the concepts underpinning the indices, statistical methodology used, collection and validation of prices, calculation of weights, and publication and usage of the indices.

Consumer price indices are often used in contracts to index link or uprate payments to allow for inflation. The Technical Manual will help people drafting contracts to incorporate the major points that are necessary when using consumer price indices in this way. However, users of this manual are advised to form their own independent assessment in relation to consumer price indices and their uses in specific cases and to seek such specific advice as they consider appropriate. We accept no liability whatsoever for losses of any kind arising as a result of reliance on this manual.

The CPIH, CPI and associated indices are National Statistics. These statistics are produced to high professional standards set out in the UK Statistics Authority's 2018 Code of Practice for Statistics. The Technical Manual explains how these standards are met.

The RPI was assessed against the Code of Practice for Official Statistics in early 2013 and the UK Statistics Authority cancelled its designation as a National Statistic because:

the methods used to produce the RPI are not consistent with internationally recognised best practices

the decision to freeze the methods used to produce the RPI and only to contemplate "routine" changes was inconsistent with the requirement in the Code to seek to achieve continuous improvement

The RPI is therefore a legacy measure and only continues to be produced for use in existing long-term contracts.

We welcome feedback and would be happy to receive comments on this Technical Manual at cpi@ons.gov.uk.

Nôl i'r tabl cynnwys2. Introduction

2.1 Overview

This manual describes the procedures we use to produce measures of consumer price inflation and associated price statistics. This includes the Consumer Prices Index including owner occupiers’ housing costs (CPIH), the Consumer Prices Index (CPI) and the Retail Prices Index (RPI).

The CPIH is our most comprehensive measure of consumer price inflation and is the lead measure in our Consumer Price Inflation, UK bulletin. It was launched in early 2013 as a measure of UK consumer price inflation that includes owner occupiers’ housing costs (OOH). These are the costs of housing services associated with owning, maintaining and living in one’s own home and, as such, are an important component of household expenditure. For more information, see Section 4: Measurement of owner occupiers' housing costs.

The CPI is identical to CPIH but excludes OOH and council tax. It is a measure of consumer price inflation produced to international standards and in line with European regulations. First published in 1997 as the Harmonised Index of Consumer Prices (HICP), the CPI is the inflation measure that is currently used as the government’s target for inflation. Since October 2011, the CPI has been used for deflating consumer spending within the national accounts. The CPI is also used for purposes such as uprating pensions, wages and benefits, and it can aid in the understanding of the impact of inflation on family budgets.

The RPI is the longest-standing measure of inflation in the UK, but it is no longer designated as a National Statistic. In accordance with the Statistics and Registration Service Act 2007, the RPI and its derivatives were assessed against the Code of Practice for Official Statistics in early 2013 and found not to meet the required standard for designation as National Statistics. More recently, its use has been strongly discouraged by the then National Statistician John Pullinger in an article outlining the measure’s shortcomings. RPI inflation is currently used to uprate indexed-linked gilts and for the revalorisation of excise duties. Historically, the RPI had been used as the basis for the government’s inflation target and deflation in the national accounts and to index various prices and incomes including tax allowances, state benefits and pensions.

The uses of consumer price inflation statistics by individuals, government, businesses and academics are described more fully in Section 2.4: Uses of consumer price inflation measures and in Users and uses of consumer price inflation statistics.

The manual is aimed at users who want to know the concepts and statistical methods underlying the different indices and how the data are collected. While it does not attempt to go into every detail, which would require a volume many times the size of this one, it will answer most of the questions that we are usually asked about consumer price indices’ methodology and practice.

This manual also includes information on developments as a result of the programme of transformation across our consumer price statistics. This includes identifying alternative data sources (such as scanner and administrative data sources), improving methods, and developing systems. As a result, we will be able to produce more robust, timely and granular inflation statistics. An overview of the changes can be seen in Section 10: Introducing new data sources.

This manual is generally written in terms of the CPIH and CPI as these are the two measures that are National Statistics. However, the methods and procedures described in Sections 3 to 8 are also, in the main, applicable to the RPI; where methods differ, they are made clear in Section 12: Retail Prices Index.

2.2 A brief description of consumer price statistics

Everything that consumers buy has a price; the price may vary over time. Consumer price statistics are designed to measure such changes. A convenient way to understand the nature of these statistics is to envisage a very large shopping basket comprising all the different kinds of goods and services bought by a typical household. As the prices of individual items in this basket vary, the total cost of the basket will also vary – consumer price statistics measure the change from month to month in this total cost.

No two households spend their money in the same way. Each household’s or person’s experience of inflation will be different. UK consumer price statistics are measures of average inflation, based on household expenditure on the items in the shopping basket.

2.3 Historical background and estimates

The Consumer Prices Index including owner occupiers’ housing costs (CPIH) was launched in early 2013 with a back series available from 2005 and is a National Statistic. In December 2018, we produced estimates for CPIH back as far as 1988. We have badged this series as an official statistic (rather than a National Statistic1) reflecting the greater uncertainty around historical estimates and, as such, these data should be treated with some caution.

The Consumer Prices Index (CPI) was launched in January 1996. Estimates, which are broadly consistent with the data from 1996, are also available back to 1988. With the publication of the CPIH historical series, estimates for the CPI have now also been provided at a more detailed level. Indicative figures for the period 1975 to 1987 are also available for the CPI. Again, the historical CPI data should be treated with some caution. Harmonised index of consumer prices: historical estimates (PDF, 106KB) provides more details. More recently, we have produced a modelled historical series for the CPI covering the period 1950 to 2011. Again, these are indicative, modelled figures that should be treated with some caution. Modelling a Back Series for the Consumer Price Index (PDF, 412KB) provides more details. The CPI was published as the Harmonised Index of Consumer Prices (HICP) until December 2003; its name was changed in December 2003 to reflect its new role as the basis for the government’s inflation target that the Bank of England’s Monetary Policy Committee is required to achieve.

The Retail Prices Index (RPI) dates from 1947. The historical background to the development of the index can be found in Appendix 1. The book ‘Inflation: History and Measurement’ (Palgrave Macmillan, 2017) by O’Neill et al. goes into more detail on the history of the various consumer price measures.

2.4 Uses of consumer price inflation measures

Consumer price statistics are used in many ways by individuals, government, businesses and academics. As explained later in this manual, the uses to which the different indices are put have historically helped shape their development. Their uses are summarised in the following sections. A more comprehensive description of the uses is provided in Users and uses of consumer price inflation statistics.

2.4.1 A measure of inflation

2.4.1.1 Domestic

There is no single definition of the word “inflation”. However, most consumers might think of inflation as a fall in the value of money reflecting a continuous increase in the price of the goods and services that they purchase. Prices may also fall, of course, although a sustained fall in prices is unusual. Although a sustained fall in prices is unusual, the indices often fall between consecutive months owing to seasonal effects and random fluctuations.

The amount of money needed to purchase a fixed basket is also known as the internal purchasing power of the currency, which can be expressed in two ways. Firstly, it is the amount of money needed in period y to purchase the same basket of goods and services that one unit of currency could purchase in an earlier period x. Conversely, it is the amount of money needed in an earlier period x that could buy the same basket of goods and services that one unit of currency purchases in period y.

UK governments base their economic policies around targeting a specific rate of inflation, so that a comparison of the outcome for inflation against the target provides a means of measuring the success of the relevant economic policies. In May 1997, the Chancellor of the Exchequer announced that operational responsibility for setting interest rates would pass to the Bank of England. However, the government retains responsibility for setting the objectives of economic policy, including the inflation target. In December 2003, the target measure became the Consumer Prices Index (CPI). The main characteristics of the current inflation target are:

an inflation target for the CPI of 2%

if inflation is more than one percentage point higher or lower than the target, the Governor of the Bank of England is required to publish an open letter explaining why inflation has deviated from the target and what actions the Bank intends to take to get it back to target

provision for the target to be reviewed in each Budget

From May 1997 to December 2003, the target was expressed in terms of the Retail Prices Index excluding mortgage interest payments (RPIX). During the period up to December 2003, the inflation target for RPIX was 2.5%.

2.4.1.2 International

The UK’s harmonised index of consumer prices (HICP) is the same as the Consumer Prices Index (CPI). HICPs were developed in the EU for assessing whether prospective members of the European Monetary Union would pass the inflation convergence criterion and has subsequently acted as the measure of inflation used by the European Central Bank to assess price stability in the euro area. One of the main requirements, therefore, was for a measure that could be used to make reliable ‘like-for-like’ comparisons of inflation rates across EU member states. Such comparisons are not generally possible using national consumer price indices due to differences in index coverage and construction.

The rules underlying the construction of HICP indices for EU member states are specified in a European regulation (legal document). This was developed by Eurostat in conjunction with the National Statistical Institutes of member states of the EU and was effective from 11 May 2016. It replaced an earlier regulation that was established in October 1995, reflecting the need for the legal framework to adapt to current requirements and technical progress.

Eurostat describe the HICP as a “Laspeyres-type ‘consumer inflation’ or ‘pure price’ index measuring average price change on the basis of the changed expenditure of maintaining the consumption pattern of households and the composition of the consumer population in the base or reference period.” (Report from the Commission to the Council on harmonization of consumer price indices in the European Union, COM(2000)742). “Pure” means that, strictly speaking, only changes to prices between the current and the base or reference period are reflected in the index. The CPI therefore measures inflation with reference to the changing cost of a fixed basket of goods and services. The HICP is not a cost of living index. That is, it is not a measure of the change in the minimum cost for achieving the same ‘standard of living’ (as in, constant utility) from two different consumption patterns realised in the two periods compared and where factors other than pure price changes may enter the index.

2.4.2 Deflation of expenditure

For many purposes, comparisons over time are more useful when the effect of price changes is eliminated. For instance, estimates are made of Gross Domestic Product (GDP) and its main components in each period, revalued at the average prices in a selected year. Current levels of household final consumption expenditure (HHFCE) and other economic series in the national accounts are adjusted to produce constant price series. This is typically done by deflating (dividing) estimates of expenditure at current prices by appropriate price indices. The Consumer Prices Index (CPI) and its components have been used for deflation purposes in the national accounts since October 2011, consistent with international best practice. The CPI replaced the Retail Prices Index (RPI) and its components. For more information, see Deflation improvements in the UK National Accounts (PDF, 176KB).

Consumer price inflation indices are used to remove the effect of price changes by a wide range of other government departments, both to inform economic policies and to monitor the implementation of those policies. Other users, for example in business, academia and the general public, are also interested in removing the effect of price changes in economic time series, so they can understand changes in “real” terms. The newness of the Consumer Prices Index including owner occupiers’ housing costs (CPIH) means that users are still evaluating it and its use is still being established. It is being closely monitored by the Bank of England and HM Treasury, and we are aware of some users who have adopted it or are considering its use.

2.4.3 Income adjustment

2.4.3.1 Indexation of tax allowances

Some tax allowances and thresholds are revised annually in line with changes in the Consumer Prices Index (CPI), replacing the use of the Retail Prices Index (RPI) prior to April 2011. For progressive taxes, inflation means that the Exchequer takes a growing share of a person’s income. This is because wages tend to increase over time, resulting in a greater proportion of income moving into a higher tax bracket. This tendency is known as fiscal drag. To offset this partly, the Chancellor frequently raises the tax threshold to take account of changes to the CPI. Unless the Chancellor decides otherwise, an amendment to the Finance Act 1977, known as the Rooker–Wise amendment, made this automatic for income tax allowances and thresholds and certain National Insurance contribution thresholds.

2.4.3.2 Indexation of incomes

Consumer price inflation is an important factor in wage-bargaining and pay-setting deals. Some pay agreements explicitly link pay rises to either the CPI or RPI. It is likely that in the future, negotiations will also include consideration of the rate of growth shown by the Consumer Prices Index including owner occupiers’ housing costs (CPIH).

2.4.3.3 Index-linked gilts and national savings

The redemption values of certain gilt-edged securities and national savings certificates are automatically uprated by an amount dependent on the change in the RPI. A formal consultation on the issuance of CPI-linked gilts was completed in September 2011. A response to the consultation was published on 29 November 2011, concluding that CPI-linked gilts would not be issued in 2012/13, but the case for issuance would be reviewed in the future.

2.4.3.4 Indexation of pensions and benefits

Most benefits were uprated by 1% for three years beginning in April 2013, and from April 2016 to March 2020 most benefits have been frozen. Before this, they were increased in line with the CPI. The following benefits continue to be updated in line with the CPI:

Maternity Allowance

Statutory Sick Pay

Statutory Maternity and Paternity Pay

Statutory Shared Parental Pay

Statutory Adoption Pay

Disability, Carers and Pensioners’ Premiums

Other Disability, Carers and Pensioner Benefits

Support Group Employment and Support Allowance

Before 2011, most state benefits were automatically revised every April in line with the change in the RPI over the 12 months to the previous September.

2.4.4 Price adjustment

Private contracts: Many contracts link payments due, such as rent, to changes in consumer price indices.

Regulation of utilities: Certain regulated privatised utilities have their prices constrained to rise by no more than a rate dependent on a given consumer price inflation index.

Other price regulation: Many pieces of legislation refer to the indices as a way of adjusting prices, and there are several statutory instruments that refer to specific indices.

2.4.5 Price monitoring

Many government departments use consumer price statistics to understand price movements for specific goods or services, or to compare price changes for specific goods or services with general level of price change.

2.5 Overview of the CPIH and CPI

2.5.1 Definition of the CPIH and CPI

The Consumer Prices Index including owner occupiers’ housing costs (CPIH) and Consumer Prices Index (CPI) are consumer inflation or pure price indices defined as an average measure of change in the prices of goods and services bought within the domestic territory for consumption by households in the UK and foreign visitors to the UK.

There are several important points to note in this definition:

average measure: a single figure that combines, or averages, all the price changes covered

change: its purpose is to measure how prices change over time rather than the absolute level of prices at a point in time

goods and services: it does not just measure price changes for necessities such as food, heating and clothing, but a wide variety of things purchased by most households, including leisure goods and services

consumption: the CPIH and CPI do not cover investment spending. For example, in the CPIH, owner occupiers’ housing costs are included but the cost of the house, an investment, is excluded. Likewise, because they are not consumed, savings and direct taxes2 are also excluded

households: it measures price changes affecting private households, but it excludes price changes that affect business or government

in the UK: coverage extends to the whole of the UK (see Section 2.5.3: Geographical)

foreign visitors: the expenditure of foreign visitors to the UK is included in the reference population (see Section 2.5.4: Reference population)

2.5.2 Scope and coverage of the CPIH and CPI

The scope and coverage can be defined as follows:

Scope: All those transactions that one would ideally want to measure.

Coverage: Those transactions within the scope that it is possible to identify and measure in practice. This is determined by the expenditure categories for which weights are compiled (Section 8: Weights).

The scope and coverage of the Consumer Prices Index including owner occupiers’ housing costs (CPIH) and Consumer Prices Index (CPI) are those goods and services that are included in the household final consumption expenditure (HHFCE) component of the national accounts. The coverage of goods and services is consistent with the Harmonised Index of Consumer Prices (HICP) version of the international classification framework – Classification of Individual Consumption According to Purpose (COICOP). In the CPIH, owner occupiers’ housing costs (OOH) are included in the “Housing, water, electricity, gas and other fuels” division in their own class, which is called “Imputed rentals for housing”. Council tax is also included in its own eponymous class, which sits in the Housing division.

The CPI coverage excludes owner occupiers’ housing costs such as mortgage interest payments (MIPs), house depreciation, buildings insurance, ground rent, and other house purchase costs such as conveyancing and estate agents’ fees. These are also not included in the CPIH, which measures owner occupiers’ housing costs in a different way (see Section 4: Measurement of owner occupiers’ housing costs). Prior to 2012, trade unions subscriptions, vehicle excise duty and TV licence fees were also excluded from the CPI, since none of these categories were included in the HHFCE. However, in 2011 it was agreed that these items were within the scope of the CPI and should be included in the CPI from early 2012. Similarly, in March 2017, as a result of the consultation following Paul Johnson’s UK Consumer Price Statistics: A Review, council tax was introduced into the CPIH and the series was revised to include it from the CPIH’s inception in 2005.

2.5.3 Geographical

The geographical coverage of the Consumer Prices Index including owner occupiers’ housing costs (CPIH) and Consumer Prices Index (CPI) is the economic territory of the UK (England, Wales, Scotland and Northern Ireland), but not the offshore islands (the Channel Islands and the Isle of Man), which, strictly speaking, are not in the UK.

2.5.4 Reference population

This comprises all private households, foreign visitors to the UK and residents of communal establishments such as university halls of residence, retirement homes and nursing homes. Expenditure by UK households abroad is excluded.

2.5.5 Expenditure items

Expenditure items are the goods and services bought by the reference population for the purposes of consumption. Thus, expenditure for savings and investment purposes, most direct taxes, national insurance contributions, cash gifts, and gambling are excluded from the scope of the Consumer Prices Index including owner occupiers’ housing costs (CPIH) and Consumer Prices Index (CPI). Expenditure on illegal transactions is included in the scope but excluded from the coverage. However, expenditure at legitimate outlets on goods that may have been subject to illegal avoidance of tax or duty at some point in the supply chain will generally be covered. For instance, some smuggled alcohol and tobacco is thought to be sold through outlets such as bars, off-licences and similar outlets.

The CPIH and CPI measure the price of goods and services paid for by consumers. Typically, no account is taken of services free at the point of consumption, even if consumers have paid for them indirectly through taxes or National Insurance contributions. The exception to this role is council tax, which is included in the CPIH. For some goods and services provided or partly paid for by the government, a charge is made at the point of consumption, such as the supply of prescription medicines and dental treatment under the NHS. These charges are included in the CPIH and CPI but not the full economic cost of goods or services. When deriving the weights, only the costs paid by the consumer at the point of delivery are included.

2.5.6 Transaction prices

The prices used in the calculation of the Consumer Prices Index including owner occupiers’ housing costs (CPIH) and Consumer Prices Index (CPI) should reflect prices typically paid by the reference population for the goods and services within the scope of the CPIH and CPI. Consumption expenditure can be measured in three ways, which it is important to distinguish. These ways are:

acquisition, which means that the total value of all goods and services delivered during a given period is considered, whether or not they were wholly paid for during the period

use, which means that the total value of all goods and services consumed during a given period is considered

payment, which means that the total payments made for goods and services during a given period is considered, whether or not they were delivered

For practical purposes, these three concepts cannot be distinguished in the case of non-durable items bought for cash, and they do not need to be distinguished for many durable items bought for cash. The distinction is, however, important for purchases financed by some form of credit, notably major durable goods, which are acquired at a certain point of time, used over a considerable number of years, and paid for, at least partly, sometime after they were acquired, possibly in a series of instalments.

The difference between the three concepts of consumption is not just a matter of timing. If payment follows acquisition, interest may be charged on top of the equivalent of the cash price. When use extends over many years, the value of this use will reflect the price level of those years, not the price at the date of acquisition.

There is no simple answer as to which definition of consumption should be used. The CPIH and CPI mostly measure the acquisition of goods and services, but there are exceptions where it has been decided that this is not the most appropriate approach, most notably in the measure of owner occupiers’ housing costs used in the CPIH.

2.5.7 Responsibility for the CPI

The rules underlying the construction of the Harmonised Index of Consumer Prices (HICP) (known as the Consumer Prices Index (CPI) in the UK) are specified in a series of European regulations. These have been developed by Eurostat (the Statistical Office of the EU) in conjunction with the National Statistical Institutes of member states of the EU.

Since November 2015, the development of our consumer price statistics has been guided by our two Advisory Panels for Consumer Prices (APCPs) – Technical and Stakeholder. Further information on the APCPs can be found in Section 2.7: Advisory committees. The APCPs were initiated as a result of the findings of the Review of the Governance of Prices Statistics, led by Professor Sir Adrian Smith in 2014. They replaced the former Consumer Prices Advisory Committee, which ran between 2009 and early 2013.

2.6 Overview of the RPI

2.6.1 Definition of the RPI

Like the Consumer Prices Index including owner occupiers’ housing costs (CPIH) and the Consumer Prices Index (CPI), the Retail Prices Index (RPI) measures the average price change based on the changed expenditure of maintaining the consumption pattern of households and the composition of the consumer population in the base or reference period.

2.6.2 Scope and coverage of the RPI

The scope and coverage of the Retail Prices Index (RPI) are those goods and services that are based largely on our Living Costs and Food Survey (LCF). The coverage of goods and services is similar to the Consumer Prices Index including owner occupiers’ housing costs (CPIH) and Consumer Prices Index (CPI), although the RPI includes mortgage interest payments (MIPs), house depreciation, buildings insurance, ground rent, and other house purchase costs such as conveyancing and estate agents’ fees, whereas the CPIH and CPI do not. Like CPIH, the RPI also includes council tax, which is not included in CPI. The RPI excludes university accommodation fees, foreign students’ university tuition fees, and unit trust and stock broker charges.

2.6.3. Geographical

The geographical coverage of the Retail Prices Index (RPI) is the whole of the UK (England, Wales, Scotland and Northern Ireland), but not the offshore islands (the Channel Islands and the Isle of Man), which, strictly speaking, are not in the UK.

2.6.4 Reference population

This comprises all private households (not those living in institutions such as prisons, retirement homes or student accommodation, for example) excluding pensioner households, which derive at least three-quarters of their total income from state pensions and benefits, and high-income households, defined as those households whose total household income lies within the top 4% of all households, as measured by the Living Costs and Food Survey (LCF). Unlike the Consumer Prices Index including owner occupiers’ housing costs (CPIH) and Consumer Prices Index (CPI), the Retail Prices Index (RPI) also excludes foreign visitors’ expenditure in the UK. Households not excluded are called index households.

2.6.5 Expenditure items

Since expenditure items are the goods and services bought by the reference population for the purposes of consumption, expenditure for savings and investment purposes, direct taxes, National Insurance contributions, cash gifts, and gambling are excluded from the scope of the Retail Prices Index (RPI).

House purchases could represent the acquisition of a major capital asset (investment) rather than consumption, so purchase without a mortgage and capital repayments of a mortgage are excluded. Mortgage interest payments (MIPs), however, are included. Major home improvements, such as building an extension, are capital investments and so are excluded, but re-decoration and maintenance are included. Property taxes, currently council tax in GB (rates in Northern Ireland), are also included as they are considered an important part of the cost of using a dwelling.

Like the Consumer Prices Index including owner occupiers’ housing costs (CPIH) and Consumer Prices Index (CPI), no account is taken in the RPI of services free at the point of consumption, even if consumers have paid for them indirectly through taxes or National Insurance contributions. Charges made at the point of consumption, such as the supply of prescription medicines, are included, which is consistent with the CPIH and CPI.

2.6.6 Transaction prices

The prices used in the Retail Prices Index (RPI) should be purchaser prices actually paid by the reference population households to purchase individual goods and services via monetary transactions. These prices should include any taxes less subsidies on the products and exclude interest or services charges added under credit arrangements.

Section 2.5.6: Transaction prices described the three ways in which consumption expenditure can be measured. The distinction between the measures is important for purchases that are financed by some form of credit, notably major durable goods, which are acquired at a certain point of time, used over a considerable number of years, and paid for, at least partly, sometime after they were acquired, possibly in a series of instalments. In the RPI, housing costs paid by owner occupiers are an obvious example of this.

While the RPI mostly measures the acquisition of goods and services, there are several exceptions where it has been decided that this is not the most suitable approach. This particularly applies to owner occupiers’ housing costs, more detail of which is provided in Section 12.5: Treatment of owner occupiers' housing costs.

2.6.7 Responsibility for the RPI

The Statistics and Registration Service Act 2007 established new governance arrangements for the Retail Prices Index (RPI) and requires the UK Statistics Authority to compile and maintain the RPI and publish it every month. In terms of implementing any changes to the RPI, the Bank of England and the Chancellor of the Exchequer also have key roles in this aspect of RPI governance.

Before making any change to the coverage or the basic calculation of the RPI, the UK Statistics Authority must consult the Bank of England as to whether the change constitutes a fundamental change in the index that would be materially detrimental to the interest of the holders of relevant index-linked gilt-edged securities. If the Bank of England considers that the change does constitute a fundamental change in the index that would be materially detrimental, the change cannot be made without the consent of the Chancellor of the Exchequer.

2.7 Advisory committees

Between 1946 and 1999, major changes in methodology and procedures for the Retail Prices Index (RPI) were referred to an RPI Advisory Committee (RPIAC), convened by the Chancellor of the Exchequer whenever there were major issues on which advice was needed. The reports of successive RPIACs have been published, usually as Command Papers.

From 2000 to the establishment of the Statistics and Registration Act 2007, the National Statistician, within the Framework for National Statistics, was responsible for the definitions and methodology of the RPI. The National Statistician also led on advising on methodological questions concerning the RPI. The scope and definition of the index was the responsibility of the Chancellor of the Exchequer.

With the adoption of the Statistics and Registration Act 2007, any methodological changes to the RPI require the approval of the UK Statistics Authority before being referred to the Bank of England. To facilitate this, the Authority established a body in 2009 to advise it on proposals for changes to the RPI. This body was called the Consumer Prices Advisory Committee (CPAC). The Committee had three distinct roles:

to advise the UK Statistics Authority on the implication for the RPI of the improvements to this index recommended by the Office for National Statistics (ONS)

to provide the UK Statistics Authority with advice on RPI methodological issues

to advise the UK Statistics Authority on improvements to the UK Consumer Prices Index (CPI) recommended by the ONS

On 10 January 2013, the CPAC was suspended when the UK Statistics Authority announced its intention to undertake a review of the governance arrangements for consumer price statistics.

The independent Review of the Governance of Prices Statistics in February 2014, led by Professor Sir Adrian Smith, recommended the establishment of the Technical and Stakeholder APCPs. This considered matters relating to the governance arrangements and structures underpinning the production of consumer price indices by the ONS.

The Technical Panel functions to provide independent advice to the National Statistician on technical aspects of consumer price indices, as requested by the ONS and/or the Stakeholder Panel. The Stakeholder Panel functions to provide independent advice to the National Statistician on the uses and applications of consumer price indices, to ensure that these statistics meet the needs of users and serve the public good. The terms of reference for each of the panels can be found on the Technical APCP page and the Stakeholder APCP page respectively.

Notes for: Introduction

- See Types of official statistics for more details as to what defines an official or national statistic.

- Council tax, which can be thought of as a direct tax, is included in CPIH as it is an important cost associated with using a dwelling. Many of the services that it provides are consumed by households.

3. Construction of UK consumer price indices

3.1 Overview

This section describes the structure and calculation of UK consumer price indices (Consumer Prices Index including owner occupiers’ housing costs (CPIH) and Consumer Prices Index (CPI)). The components of calculation that are covered are:

elementary aggregate formulae

aggregation

chaining

re-referencing

3.2 Structure of UK consumer price indices

Please note that, from March 2025, we have introduced "consumption segments" into the aggregation structure for our consumer price inflation statistics. The information in this section has not been updated and therefore does not reflect this new aggregation process. We aim to fully update the Consumer Prices Indices Technical Manual to coincide with the introduction of groceries scanner data planned for March 2026, and will update the information on aggregation at that point. In the meantime, information on consumption segments can be found in Impact analysis on transformation of UK consumer price statistics, January 2025.

The coverage and classification of item indices are based on the international classification system for household consumption expenditures known as Classification of Individual Consumption According to Purpose (COICOP). Founded on national accounts principles, the COICOP system, along with the conceptual coverage of household final consumption expenditure (HHFCE), is the starting point for defining which expenditures, in principle, should be included in consumer price indices. This is because COICOP and HHFCE define which transactions constitute household final consumption as opposed to other flows such as taxes, other transfers, or capital and financial transactions. However, consumer price indices currently deviate from COICOP and HHFCE in several areas. For example, the Consumer Prices Index (CPI) does not cover owner occupiers’ housing costs (OOH), and neither the Consumer Prices Index including owner occupiers’ housing costs (CPIH) nor the CPI include financial intermediation services indirectly measured (FISIM) or games of chance.

COICOP is a hierarchical classification system comprising:

divisions (for example: 01 food and non-alcoholic beverages)

groups (for example: 01.1 food)

classes (for example: 01.1.1 bread and cereals)

subclasses (for example: 01.1.1.1 rice)

Subclasses are currently the lowest regularly published COICOP level1, although item-level indices underly the COICOP hierarchy and a majority of these are also published regularly.

Consumer price indices are produced in stages, with indices derived at each stage weighted together to produce higher-level indices. Figure 1 provides an example of this structure. A sample of prices is collected in line with the COICOP classification system, from a selection of items that are representative of UK consumer expenditure; prices are only collected for those items selected. To use tea bags as an example, prices are collected for boxes of 80 tea bags and boxes of 240 tea bags. Other box sizes are not priced as it is assumed that their price movements are similar to those of the tea bags that are priced.

Figure 1: The structure of UK consumer price indices

Download this image Figure 1: The structure of UK consumer price indices

.svg (21.9 kB)There are currently approximately 700 representative items in the CPIH basket of goods and services. This basket is updated yearly to account for changes in the consumption behaviour of UK consumers. The items usually have relatively broad specifications (such as a roll of wallpaper or women’s jeans) and price collectors must choose a selection of products that conform to that item specification and that are believed to be representative of what consumers are purchasing. If goods come in various pack sizes, usually a size or weight range is given in the item specification.

There are two types of price collection for consumer price indices:

the “local price collection”, which involves price collectors going to shops in various locations across the country to collect prices for items (see Section 5 for how these shops and locations are sampled)

the “central price collection”, which involves price collectors from the head office collecting prices for items where there is a national price, or where most of the expenditure is from online, brochures or similar formats.

For more details on price collection, refer to Section 6 of this manual.

The lowest aggregate of prices, an “elementary aggregate”, covers all prices collected for one item in one stratum. For the local price collection, the UK is divided into regions and several locations are selected in each region. Outlets are selected in each location and are usually classified into two shop types: multiples and independents. Thus, prices for an item may be stratified by region, shop type, both or neither (see Section 5 for more detail). Indices for the strata are aggregated together to produce an overall index for each item.

Item indices are first aggregated into subclass indices, which are then aggregated into class indices. Class indices can be further aggregated to form group, division and aggregate indices:

food, alcoholic beverages and clothing are examples of groups

vegetables, wine and garments are examples of classes

potatoes, wine from grapes and garments for women are examples of subclasses.

Price indices are published monthly for each group, class and subclass. Most item indices are also published monthly.

3.3 Index calculation

The UK consumer price indices, the Consumer Prices Index including owner occupiers’ housing costs (CPIH) and the Consumer Prices Index (CPI) are “fixed-basket" price indices: they measure the change in the price of a basket of fixed composition, in terms of quantity and, as far as is possible, quality. This is often summarised by saying that they use a fixed-basket approach.

The index given here, I0,t at time t with base period 0 is a “Laspeyres-type” or fixed-basket index. This being the price of the basket at a given time as a percentage of its price at the base date, with amount of each item bought at time b:

where:

pit is the price of item i at time t (usually the current period)

pi0 is the price of item i in the base period, period 0

qib is the quantity of item i bought at time b

In principle, the sum should be taken over every possible good or service that is within scope (see Section 2.5.2: Scope and coverage of the CPIH and CPI) and the price measured in every outlet that supplies each good or service. In practice, only a sample of prices can be collected (see Section 5 for more information).

The equation can also be expressed as:

where:

is the weight or expenditure share of item i in period b often called the “weight reference period”.

This is a weighted arithmetic average of price relatives, with the weights being calculated using expenditure shares. A price relative is the ratio of a price at a given time to the price for the same commodity at another time, and an expenditure share is the ratio of the expenditure of an item to the total expenditure.

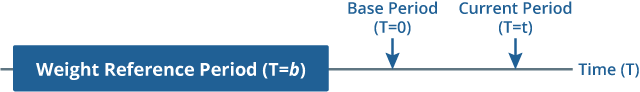

UK consumer price indices are Lowe-type indices. A Lowe-type index is a fixed-basket index where the quantities are taken from a different period to the prices, usually at a time before the base period. A Lowe index takes weights from period b and price updates them to period 0 (Figure 2), to account for prices changes that occurred between the weight reference period and the base period.

Figure 2: Periods in a price index

Download this image Figure 2: Periods in a price index

.png (6.7 kB)For consumer price indices to use Laspeyres formula, the base period and the weight reference period must coincide (that is, b=0). This cannot be done, for various reasons:

time 0 can be defined in different ways and may refer to a month, a week or even a particular day; however, expenditure data for short periods of time are often too variable to be used in practice

the production of comprehensive expenditure data is time consuming, hence reliable data are rarely available at time 0

if expenditure is seasonal, the pattern at time 0 may be unrepresentative of the average over time; in practice, expenditure data for the most recently available 12 months are used (for more information, see Section 8)

The value of consumer price indices also depends on the weight (wi0;b) and on what items are included in the basket of goods and services. For example, between 2015 and 2016 the weight for bananas decreased by 0.2 percentage points, meaning that the price changes of bananas would have less influence on the all-items index in 2016 than they did in 2015. Also in 2016, lemons were added to the basket so that in 2016, the all-items index included price changes associated with lemons while it did not in 2015.

When the index is said to cover or refer to a given population, it means that the weights have been calculated to reflect the expenditure of that population as a whole. With regard to prices, the basket is not comprehensive, since it does not include every possible item. However, the weights reflect all expenditure by households that is within scope (see Section 8.5: Higher-level weights and Section 8.6: Weights calculation for centrally calculated indices), and items that are included are chosen because they make up a significant proportion of households’ expenditure.

3.4 Elementary aggregates

At the lowest level of aggregation, detailed weights are not available with the current data sources. For example, the expenditure on “pink lady apples” bought in Cardiff from an independent shop is not known. To deal with this lack of weighting information, unweighted index formulae are used. The set of indices created using these index formulae are called “elementary aggregates”. These combine prices into indices, treating all the products as equally important. This gives the prices an equal weight, which is the reciprocal of the number of prices in that stratum.

An elementary aggregate index can be constructed in different ways. The most commonly used unweighted index number formulae are:

the Jevons index, the geometric mean of price relatives

the Dutot index, the ratio of average prices

the Carli index, the arithmetic mean of price relatives

The elementary aggregate formula primarily used in UK consumer price indices is the Jevons index. (See Elliot 20122 for the rationale behind the choice and Winton 20133 for properties of the index with respect to substitution.)

Algebraically, a Jevons index is calculated as follows: if prices p10 to pn0 are obtained in the base period and matching prices p1t to pnt are obtained for the same commodities, 1 to n, in month t, then we have:

This can be thought of as the geometric mean of the price relatives. An alternative, and algebraically equivalent, way of thinking about this calculation is to express it as the ratio of the geometric mean of the average prices:

It is essential to use prices for matching products. If, in any month, there is no price for an item corresponding to one in the base month, that price must be excluded from the calculations or a quality adjustment must be made (see Section 9).

The Dutot index is also used in UK consumer price indices at the elementary aggregate level. The Dutot index can be expressed as follows:

Eurostat regulations permit the use of the Jevons index and the Dutot index but forbid the use of the Carli index on the grounds that it does not produce indices that are comparable with other formulae, such as Dutot or Jevons. The regulations therefore help to ensure that differences in inflation rates between EU countries reflect underlying differences in price changes, and not simply differences in the basic formulae used to aggregate the price data.

Furthermore, it can be shown that in certain circumstances, use of the Carli index, when combined with chain-linking of the within-year indices, introduces an upward bias in the overall price index. This phenomenon is known as “chain drift”. The Jevons formula is not as susceptible to bias due to chain drift (nor is the Dutot formula) and, in the context of cross-country comparisons, is much less influenced by detailed differences in index and sample design in individual countries. (See Clews 20144 for an assessment of chain drift with different formulae.)

Among EU member states, 17 currently use the Jevons index in their national consumer price index (Austria, Bulgaria, Croatia, Cyprus, Denmark, Finland, France, Greece, Ireland, Italy, Luxembourg, Poland, Portugal, Romania, Slovenia, Spain and Sweden); 8 currently use the Dutot index (Belgium, Czech Republic, Estonia, Germany, Latvia, Lithuania, Malta and Slovakia); and 3 currently use a mixture of Jevons and Dutot (Hungary, Netherlands and the United Kingdom). Beyond Europe, Australia, Canada, New Zealand and the USA mainly use Jevons in the calculation of the national consumer price index, while Japan uses Dutot.

With the introduction of new data sources, to use these sources to their full potential, we will be using a weighted multilateral index method, the GEKS-Törnqvist, to calculate elementary aggregates. More detail on the GEKS-Törnqvist can be found in Section 10: Introducing new data sources.

3.5 Aggregation

As discussed in section 3.2, the information in this section has not yet been updated to reflect the introduction of "consumption segments".

Indices for higher-level aggregates are weighted averages of the elementary aggregate indices. If the kth representative item is stratified by region or shop type into strata in set K, the elementary aggregate indices for the strata K in month t are Ii(0,t) and the stratum weights are wi, then the item index for item k for month t is:

Weights are currently updated in two stages every year for both the Consumer Prices Index including owner occupiers’ housing costs (CPIH) and the Consumer Prices Index (CPI): once with the January index to take account of the new annual Classification of Individual Consumption According to Purpose (COICOP) weights, and once in the following month to take account of the changes to the basket of representative items. (Tucker 20175 provides further detail on this method.)

In practice, the item indices are computed with reference to prices collected in January. For the period February to December therefore, compilation of class indices proceeds straightforwardly, as a weighted arithmetic mean of the relevant item indices corresponding to the updated basket introduced in February:

where:

ICt is the index for COICOP class C, for month t (February to December) based on previous January

Ijt is the index for item j in COICOP class C for month t based on previous January

wjt is the weight for item j in COICOP class C for month t

For January, a different calculation is undertaken for the change of the class weights as the January indices have to be rebased to the previous December. This is done as follows:

where:

Ijm is the Index for item j in month m, based on previous January

wjm is the weight for item j in month m

IC(Jan|Dec) is the January index for COICOP class C based on previous December

For each class, the set of item indices used in this calculation will, in most circumstances, match those used in the compilation of the previous December’s index. However, for any classes subject to extensions in coverage in January, it is important that the calculation is based on an extended set of item indices consistent with the change in coverage.

In both cases – indices for January and indices for February through to December – higher-level aggregates (that is, group, division or the all-items index) are calculated as weighted arithmetic means of the relevant class indices, using COICOP weights for the current year.

The weight for January is calculated by price updating the expenditure (V) in the weight reference period to the December of the previous year:

The weight for February to December is calculated by price updating January’s weight using the month-on-month movement between January in the current year and December in the previous year:

This is mathematically equivalent to taking the original expenditure and price updating it to the January in the current year:

3.6 Chaining

The weights for both the Consumer Prices Index including owner occupiers’ housing costs (CPIH) and the Consumer Prices Index (CPI) are updated in two stages every year (as described in Section 3.5: Aggregation). Therefore, the indices must be chain-linked twice every year. This involves calculating an index for January based on the previous December = 100 and, for February to December, calculating a further index based on January of the current year = 100.

Both indices are currently published with a reference period of 2015 = 100. The chain-linked index is calculated as follows:

where:

IC(t,y|2015) is the index for class C in month t in year y with reference period of 2015

IC(Dec,y-1|2015) is the index for class C in the December of the previous year, y-1, with reference period 2015

IC(Jan,y|Dec) is the index for class C in the January of year y

IC(t,y|Jan) is the index for class C in month t in year y, with reference to January of the current year y

3.7 Re-referencing

When the Harmonised Index of Consumer Prices (HICP) was launched, it was referenced on 1996 = 100. Starting with the publication of the January 2006 index, it was referenced on 2005 = 100. The change of reference period was accompanied by a full re-referencing of all HICP indices back to 1996. This resulted in widespread revisions to 1-month and 12-month rates of change. This is because the rates of change with the 1996 reference period are calculated from indices rounded to one decimal place and are therefore subject to rounding errors. This is not the case for the rates of change referenced to 2005 that are calculated from unrounded indices; therefore, there will be no widespread revisions in future re-referencing exercises. The index was then referenced to 2015 starting with the publication of the January 2016 index. This re-referencing will continue to be completed on a 10-year basis for both the Consumer Prices Index including owner occupiers’ housing costs (CPIH) and the Consumer Prices Index (CPI). Re-referencing aids the interpretation of the indices.

Notes for: Construction of UK consumer price indices

Subclasses were introduced into the CPIH and CPI in 2017; before this, the lowest COICOP level published was class level.

Elliott, D., O'Neill, R., Ralph, J. and Sanderson, R. (2012) Stochastic and sampling approaches to the choice of elementary aggregate formula (PDF, 1,110KB), Office for National Statistics

Winton, J., O'Neill, R. and Elliott, D. (2013) Elementary Aggregate Indices and Lower Level Substitution Bias, Office for National Statistics

Clews, G., Dobson-McKittrick, A. and Winton, J. (2014) Comparing class-level chain-drift for different elementary aggregate formulae using locally collected CPI data (PDF, 677KB), Office for National Statistics.

Tucker, J. (2017) Guide to changes to consumer price inflation statistics: March 2017, Office for National Statistics.

4. Measurement of owner occupiers’ housing costs

4.1 Introduction

This section focuses on the construction of the owner occupiers’ housing costs (OOH) element of the Consumer Prices Index including owner occupiers’ housing costs (CPIH). OOH do not seek to capture increases in house prices. Although this may be inconsistent with some users’ expectations of OOH, the inclusion of an asset price and therefore capital gains makes the measure less suitable for a measure of consumption. For more information on CPIH, please refer to Section 2.

OOH developed faster in the UK than by Eurostat, owing to strong user demand. With guidance from the Consumer Prices Advisory Committee (CPAC), we developed two approaches to measuring OOH: the rental equivalence approach and the net acquisitions approach. The Board of the UK Statistics Authority accepted the National Statistician’s recommendation to use the rental equivalence approach to measure OOH in September 2012, following a report from the CPAC and a public consultation.

The CPIH is constructed using the standard international Classification of Individual Consumption According to Purpose (COICOP) classification system, and OOH are included in the “housing, water, electricity, gas and other fuels” division in its own class, which is called “imputed rentals for housing”.

4.2 OOH and CPIH methods

The underlying concept for a rental equivalence price index is that a dwelling is a capital good and therefore not consumed. Instead, it provides a flow of services that are consumed in each period. Such services include shelter and the security of tenure. The value of the flow of services that owner occupiers receive is assumed equal to the rent that the dwelling might attract in the rental market. Therefore, rental equivalence imputes owner occupiers’ housing costs (OOH) from the rents paid for equivalent rented properties. In other words, it is measuring the price owner occupiers would need to pay to rent their own home.

For more detailed information on our rationale behind the choice of rental equivalence and how the measure is constructed in practice, please see the CPIH Compendium. The remainder of this section summarises its construction.

4.2.1 OOH data source

The rental equivalence approach uses administrative private housing rental data collected by rental officers in the Valuation Office Agency (VOA) for all the regions of England, as well as data from the Welsh and Scottish Governments and the Northern Ireland Housing Executive (NIHE). These data are collected for the purposes of calculating the Local Housing Allowance (LHA) for Broad Rental Market Areas (BRMA).

The VOA provides prices for over 450,000 properties annually for England. Rent Officers Wales, part of the Housing and Regeneration Division of the Welsh Government, provides around 30,000 prices for Wales. Rent Service Scotland, part of the Communities Analysis Division of Scottish Government, provides up to 40,000 property prices for Scotland. The NIHE provides prices for over 10,000 properties in Northern Ireland.

When the Consumer Prices Index including owner occupiers’ housing costs (CPIH) was launched in 2013, there was not suitable comparable data available for Northern Ireland. We therefore used the existing Consumer Prices Index (CPI) private rental data collected in Northern Ireland. The Northern Ireland administrative data were deemed unsuitable because they were neither frequent nor timely enough for inclusion within a measure of consumer price inflation, and the coverage of the data only included the Belfast Metropolitan area rather than the whole of Northern Ireland.

The Northern Ireland Housing Executive (NIHE), responsible for collecting private rental data, have since undergone a programme of development to improve the timeliness of the data and to extend the coverage to the whole of Northern Ireland. We have now transformed the Northern Ireland rental indices, including NIHE data within the CPIH from March 2025.

From 2005, private rental data from the VOA are available. Private rental data from the Welsh and Scottish Governments are available from January 2009 and September 2010 onwards, respectively. Prior to this, the CPI unfurnished private rental series for Wales and Scotland have been used to calculate OOH. The CPI unfurnished private rental series for Northern Ireland is used in all years.

4.2.2 OOH methodology

Before 2024, our Index of Private Housing Rental Prices (IPHRP) Quality and Methodology Information (QMI) was used to measure the OOH element of CPIH for England, Wales and Scotland, this was continued to be used for Northern Ireland until 2025. To measure OOH, only unfurnished properties are used, and the strata are weighted by the owner-occupier stock. The IPHRP is based on a matched-pairs approach.

From 2024, the Price Index of Private Rents QMI is used to measure the OOH element of CPIH for England, Wales and Scotland, from 2025 PIPR was used to measure the OOH element of CPIH for Northern Ireland. To measure OOH, only unfurnished properties are used, and the strata are weighted by the owner-occupier stock. The Price Index of Private Rents uses a hedonic double imputation approach to measure how rental prices are changing over time.

Nôl i'r tabl cynnwys5. Sampling procedures

5.1 Introduction

To construct a perfectly accurate consumer price index, we would need to know and record the price of every variety of every good or service available in every retail outlet (both in store and online) available in the UK. This is not feasible in practice. So, it is necessary to sample prices. There are four levels of sampling for local price collection:

locations

outlets within location

items within section

product varieties

As only a sample of prices is recorded, there is inevitably some sampling error in measuring consumer price inflation. This section refers to sampling procedures for the local collection only.

5.2 Sampling of locations

5.2.1 Producing a location boundary

Since 2015, a new methodology termed the “location-allocation” method has been used to identify and define location boundaries around areas of high retail activity, known as hotspots. This forms a sampling frame from which to select locations for field collection. A location boundary sampling frame based on retail data is used to create locations that are representative of both the retail turnover and geographic areas of the UK. Similar to previous methods, location-allocation uses geographic information systems (GIS) software and the following steps:

the UK is split into 500 square metre grids and the latest Inter-Departmental Business Register (IDBR) data (on number of outlets, employees, expenditure and retail turnover) are assigned to each grid

hotspots are then used as the centre of the new location boundaries; these are identified as those areas with high retail turnover

the outlets (on the IDBR) within a certain impedance distance – 3.5 miles across the UK, except for London, which is set to 0.5 miles – of each hotspot are mapped, with each outlet assigned only to its nearest hotspot to avoid any overlaps in coverage

polygons are grown around the outlets for each hotspot, forming outlines of the location boundaries

the boundaries are then adjusted to fit real-world features (such as roads, railways and waterways) using Ordnance Survey map information, maintaining the retail turnover and number of outlets in each location, whilst reducing the space empty of outlets

Further details of the procedures used prior to 2015 can be found in Chapter 4 of the 2014 edition of the Consumer Price Indices Technical Manual.

5.2.2 Location selection

Location selection takes place separately within each region, using probability proportional to size (PPS) systematic sampling with a size measure that is relative to the locations’ retail sector activity. The number of locations selected in each region is determined as the proportion of national expenditure taking place in that region, multiplied by the total number of locations to be visited nationally.

Sampling takes place by first listing all shopping locations within each region. This forms the basic sampling frame, which is then modified in order to ensure that a full shopping basket (all the items in the sample) can be collected in each location.

Locations with too few outlets and where experience suggests that it is not possible to obtain a complete basket of goods are excluded. Locations that are judged not to be large enough to support the collection of a full basket on their own (based on field auditor experiences) are provisionally paired with a nearby excluded location. These locations have the potential to be merged to form a single collection area, from which it will be possible to collect prices for a complete basket of goods.

Interval sampling is performed by generating a random starting point between zero and the interval value. The location whose size variable contains the starting value is selected as the first location. The second random number is generated by adding the interval value to the starting point. This is then used to select the second location, by using the location whose size variable contains the second random number. The process of adding the interval value to the previous random number, and selecting the corresponding location, is repeated until the requisite number of locations has been sampled. This is illustrated in Table 1, with turnover used as the size variable.

| Location name | Number of outlets | Turnover | Cumulative total | Range¹ | Selection | |

|---|---|---|---|---|---|---|

| Location A | 607 | 5,377 | 5,377 | 0 < x ≤ 5,377 | ||

| Location B | 306 | 2,486 | 7,863 | 5,377 < x ≤ 7,863 | ||

| Location C | 264 | 2,265 | 10,128 | 7,863 < x ≤ 10,128 | Selection 1 | |

| Location D | 449 | 4,006 | 14,134 | 10,128 < x ≤ 14,134 | ||

| Location E | 322 | 2,589 | 16,723 | 14,134 < x ≤ 16,723 | ||

| Location F | 319 | 2,097 | 18,820 | 16,723 < x ≤ 18,820 | ||

| Location G | 283 | 2,127 | 20,947 | 18,820 < x ≤ 20,947 | ||

| Location H | 457 | 5,252 | 26,199 | 20,947 < x ≤ 26,199 | ||

| Location I | 539 | 4,945 | 31,144 | 26,199 < x ≤ 31,144 | Selection 2 | |

| Location J | 371 | 4,102 | 35,246 | 31,144 < x ≤ 35,246 | ||

| Location K | 518 | 4,875 | 40,121 | 35,246 < x ≤ 40,121 | ||

| Location L | 928 | 10,923 | 51,044 | 40,121 < x ≤ 51,044 | ||

| Location M | 407 | 3,366 | 54,410 | 51,044 < x ≤ 54,410 | Selection 3 | |

| Location N | 374 | 2,449 | 56,859 | 54,410 < x ≤ 56,859 | ||

| Location O | 539 | 3,625 | 60,484 | 56,859 < x ≤ 60,484 | ||

| Location P | 326 | 3,357 | 63,841 | 60,484 < x ≤ 63,841 | ||

| Number of locations | 3 | |||||

| Total turnover | 63,841 | |||||

| Interval value | 21,280.30 | = Total turnover / no. of locations | ||||

| Random number | 0.39904 | |||||

| Random starting point | 8,491.70 | = Interval value x Random number | ||||

| Random numbers (x) for selection | Derivation | Location to be selected | ||||

| 8,491.70 | = Random starting point | C | ||||

| 29,772.00 | = Random starting point + Interval value | I | ||||

| 51,052.40 | = Random starting point + 2 x Interval value | M | ||||

Download this table Table 1: Illustration of interval sampling

.xls .csv5.2.3 Location rotation and re-enumeration

It is not feasible to select and list all outlets (enumerate) for a fresh set of locations every year. However, maintaining a fixed sample of locations and enumerating only once would reduce the total number of locations ever used for price measurement. More importantly, this would result in enumeration lists that would contain outlets that were no longer operating, omit outlets that had opened since the enumeration and miss regional shifts in consumer expenditure.

The compromise used is to update a sample of around 30 locations each year, either by excluding a location and replacing it with a new one (rotation) or refreshing the list of outlets in the existing location (re-enumeration). Locations are enumerated in the year that they are sampled and then introduced into the collection the following year while the basket is updated. They should remain in the sample for four or five years so that each location is refreshed either through rotation or re-enumeration once in a five-year period cycle.

5.3 Sampling of outlets

Enumeration (listing of every shop) of the selected locations is carried out by price collectors visiting the postcodes in each location and noting details of all retail outlets found, up to a limit of 1,500 outlets per location, to produce a sampling frame. The details noted for each outlet include:

the outlet address

the outlet postcode

the range of items sold

(if a shop) its size and whether it is an independent store (I) or part of a multiple chain (M)

Shops of centrally collected chains (see Section 6.3: Central collection: central item) are excluded from the enumeration. In order to use PPS sampling, the ideal size measure of an outlet would be turnover. But as this is not readily available, the net retail floor space (estimated by the outlet enumerators) is used as a proxy. For department stores and other shops selling a wide variety of goods, the floor space devoted to each commodity group is measured. The appropriate code indicating what each shop sells is assigned to each outlet based on the appropriate classification.

5.3.1 Use of the coding list

The Consumer Prices Index including owner occupiers’ housing costs (CPIH) and Consumer Prices Index (CPI) classification, based on the Classification of Individual Consumption According to Purpose (COICOP) at a three-digit level (see Section 3), drives the link between outlets and items. The link is handled via a master list of shop types, taken from the full coding list, which shows those that are in scope for a given group of items, in that they sell all or most of the group. Using this, outlets are classified by commodity group and, where appropriate, by shop type (multiple or independent). This is not a true stratification: an outlet may be in more than one stratum if it sells items from more than one commodity group.

For each commodity group, the required number of outlets, plus some reserves (used if an outlet closes down), are drawn from the sampling frame. PPS sampling is used where there is known to be a wide range of store sizes and therefore a wide range of turnover, such as for do-it-yourself (DIY) stores which may be superstores or local shops.

Table 2 shows how this works for meat. Items are grouped into commodity groups, so fresh beef and lamb are grouped together, as are all cooked meats. The second column lists the shops where meat is sold. These meat items are sold in butchers, supermarkets and some department stores. The third column shows whether a multiple or independent shop should be selected; for meat, either may be selected. For meat there should be one price collected in each location: one from a butcher and one from either a supermarket or a department store that sells food.

| Commodity group | Shops to select | Type |

|---|---|---|

| Meat 1 Fresh beef and lamb 2 Cooked meats 3 Fresh bacon, pork and chicken | Butcher | M or I |

| Supermarket Department store that sells food | M or I | |

Download this table Table 2: Shop types for meat items

.xls .csvA shop holding a closing down sale is treated as already closed and hence excluded from the sampling frame (and new outlets are sought to replace them within the location). This is because its prices will neither be comparable with previous ones nor available in the future. Shops selling only second-hand goods are also excluded. Some exceptions to this rule exist where large high street chains have closed down and are treated on a case by case basis.

5.4 Sampling of representative items

It would be both impractical and unnecessary to measure price changes of every product bought by every household in compiling consumer price inflation statistics. There are some individual goods and services where expenditure is sufficiently large that they merit inclusion in consumer price indices in their own right; these include owner occupiers’ housing costs (OOH), the television licence fee, car insurance and electricity supply. However, more commonly, it is necessary to select a sample of specific goods and services that give a reliable measure of price movements for a broad range of similar items. For example, price changes for garden spades might be considered representative of price changes for other garden tools.

The selection of these representative items in the measures of consumer price inflation is purposive or judgemental; the significant difficulties involved in defining an adequate sampling frame (that is, a list of all the individual goods and services bought by households) precludes the use of traditional random sampling methods.

A number of factors are taken into account when choosing representative items. Specific brands or varieties conforming to the item description must be easy to find by the price collectors, ensuring that estimates of price changes are based on an adequate number of price quotations throughout the UK. Since the measures of consumer price inflation in the UK are based on the cost of a fixed in-year basket of goods and services, they should also be available for purchase throughout the year (except for certain food and clothing products that are seasonal, and so require a slightly different treatment).

The number of items chosen to represent price changes within each class depends both on the weight of the class and the variability of price changes between the various items that could be chosen to represent it (reflecting, for example, the diversity of products available). Intuitively, it makes sense to select more items in areas where spending is high; this helps to minimise volatility in estimates of price changes for high-weighted classes and therefore in the measures of consumer price inflation overall. However, if price movements for all possible items in a given section are very similar, it is sufficient to collect prices for only a few.

By contrast, if price movements within a class are very different, a much larger selection of representative items will be needed to obtain a reliable estimate of price change for that class. This helps to explain why a relatively large number of items are selected in areas such as food and clothing, whereas price changes for more homogenous product groupings, such as petrol, alcohol and tobacco, are based on fewer items.

In practice, relative expenditures on the different types of goods and services play the most important role in determining the selection of representative items used to compile the measures of consumer price inflation. This mainly reflects the wealth of data available describing household spending patterns. Two major sources of information come from household final consumption expenditure (HHFCE) and the Living Costs and Food Survey (LCF), which also underpin the calculation of the weights (see Section 8). This is supplemented by detailed analyses of trends provided by market research companies, trade journals and press reports. The price collectors and auditors also report developments in the retail environment to us.

Representative items are chosen centrally for the whole of the UK and, in order that the measures of consumer price inflation remain representative of consumer spending patterns over time, the selection of items is reviewed each year. Consistent with the principle of a fixed basket, the sample of items is held fixed within each year, with annual changes effective from the February index. At this point, revised item weights and chain-linking of indices (see Section 3.6: Chaining) are also applied.

New items may be introduced for a variety of reasons. These include:

the development of new products, particularly in high technology sectors such as audiovisual equipment

increasing household expenditure in specific spending areas such as leisure or personal services

the need to improve coverage in areas where consumers already spend a significant proportion of their expenditure

the replacement of existing items for very similar products that have become more popular

Additions to the basket of representative items each year are broadly matched by the number of items removed so that production costs and lags can be contained. There are currently approximately 700 items in the basket. In many cases, the decision to remove items from the basket reflects low or declining levels of household spending. However, where price changes for goods and services are very similar to other items within the same product grouping, items may be removed if they do not provide sufficient extra information to justify their continued inclusion; this does not necessarily imply that the consumer market for such items is small or declining.

The detailed contents of the consumer price inflation baskets, and changes to the sample from year to year, should not be afforded significance beyond their purpose as representative items. Indeed, within each product grouping there is usually a point at which the number, choice of items and the precise weights attached to them become a matter of judgement. At this detailed level, it is unlikely that such choices have any significant impact on the measures of consumer price inflation overall. For example, a selection of specific household appliances has been chosen to represent spending on small electrical goods, including irons, kettles and food processors. However, other representations would clearly be possible and equally valid.

In selecting the sample of items to represent distinct categories of household spending, those items must be well defined so that the product prices are reasonably homogeneous. However, sometimes a relatively wide definition is used to accommodate rapidly changing consumer tastes, for instance clothing, where fashions can change very quickly. If the definitions were too specific in these cases, it would be very difficult for the price collectors to find examples of the products in the shops. The diversity of products and therefore the range of possible price quotations that conform to a particular item’s description have implications for the choice of elementary aggregation method (see Section 3.4: Elementary aggregates).