Cynnwys

- Main points

- What is the Producer Price Index (PPI)?

- Output prices: summary

- Supplementary analysis: Output prices

- Output prices: detailed commentary

- Output PPI range of movements

- Input prices: summary

- Supplementary analysis: Input prices

- Input prices: detailed commentary

- Input PPI indices range of movements

- Economic context

- Revisions

- Background notes

1. Main points

The price of goods bought and sold by UK manufacturers, as estimated by the producer price index, continued to fall in the year to April 2016.

Factory gate prices (output prices) for goods produced by UK manufacturers fell 0.7% in the year to April 2016, compared with a fall of 0.9% in the year to March 2016.

Core factory gate prices, which exclude the more volatile food, beverage, tobacco and petroleum products, rose 0.5% in the year to April 2016, compared with a rise of 0.3% in the year to March 2016.

The overall price of materials and fuels bought by UK manufacturers for processing (total input prices) fell 6.5% in the year to April 2016, compared with a fall of 6.1% in the year to March 2016.

Core input prices, which exclude purchases from the more volatile food, beverage, tobacco and petroleum industries, fell 1.7% in the year to April 2016, compared with a fall of 2.7% in the year to March 2016.

Nôl i'r tabl cynnwys2. What is the Producer Price Index (PPI)?

The Producer Price Index (PPI) is a monthly survey that measures the price changes of goods bought and sold by UK manufacturers and provides an important measure of inflation, alongside other indicators such as Consumer Price Index (CPI) and Services Producer Price Index (SPPI). This statistical bulletin contains a comprehensive selection of data on input and output index series. It contains producer price indices of materials and fuels purchased, and output of manufacturing industry by broad sector.

The output price indices measure change in the prices of goods produced by UK manufacturers (these are often called “factory gate prices”).

The input price indices measure change in the prices of materials and fuels bought by UK manufacturers for processing. These are not limited to just those materials used in the final product, but also include what is required by the company in its normal day-to-day running.

The factory gate price (the output price) is the price of goods sold by UK manufacturers and is the actual cost of manufacturing goods before any additional charges are added, which would give a profit. It includes costs such as labour, raw materials and energy, as well as interest on loans, site or building maintenance, or rent.

Core factory gate inflation excludes price movements from food, beverage, petroleum, and tobacco and alcohol products, which tend to have volatile price movements. It should give a better indication of the underlying output inflation rates.

The input price is the cost of goods bought by UK manufacturers for the use in manufacturing, such as the actual cost of materials and fuels bought for processing.

Core input inflation strips out purchases from the volatile food, beverage, tobacco and petroleum industries to give an indication of the underlying input inflation pressures facing the UK manufacturing sector.

Nôl i'r tabl cynnwys3. Output prices: summary

Factory gate inflation fell 0.7% in the year to April 2016, compared with a fall of 0.9% last month.

During 2012 and 2013, core factory gate inflation tended to run at a lower rate than total output inflation and showed a smaller degree of volatility. This trend changed in 2014, as total output fell into negative inflation: a result of the downward pressures from petroleum, which is excluded from the core measure of inflation. In 2015, total output inflation has remained consistently below core output price inflation, with total output averaging a fall of 1.7% during 2015 and core output averaging growth of 0.2% in the same period (Figure A).

Looking at the latest estimates (Table A), movements in factory gate prices over the 12 months to April 2016 were as follows:

- factory gate prices fell 0.7%, compared with a fall of 0.9% in the year to March 2016

- core factory gate prices rose 0.5%, compared with a rise of 0.3% in the year to March 2016

- factory gate inflation excluding excise duty fell 0.6%, compared with a decrease of 0.8% in the year to March 2016

Between March and April 2016:

- factory gate prices increased 0.4%, compared with an increase of 0.3% last month

- core factory gate prices increased 0.2%, compared with an increase of 0.1% last month

Table A: Output prices (home sales)

| UK, November 2015 to April 2016 | |||||||

| Percentage change | |||||||

| All manufactured products | Excluding food, beverage, tobacco and petroleum | All manufactured products excluding duty | |||||

| 1 month | 12 months | 1 month | 12 months | 1 month | 12 months | ||

| 2015 | Nov | -0.2 | -1.6 | -0.2 | -0.1 | -0.2 | -1.4 |

| Dec | -0.3 | -1.4 | 0.2 | 0.1 | -0.2 | -1.1 | |

| 2016 | Jan | -0.1 | -1.0 | 0.2 | 0.1 | 0.0 | -0.8 |

| Feb | 0.1 | -1.1 | 0.1 | 0.2 | 0.0 | -0.9 | |

| Mar | 0.3 | -0.9 | 0.1 | 0.3 | 0.3 | -0.8 | |

| Apr | 0.4 | -0.7 | 0.2 | 0.5 | 0.4 | -0.6 | |

| Source: Office for National Statistics | |||||||

Download this table Table A: Output prices (home sales)

.xls (25.6 kB)

Figure A: Output prices

UK, April 2012 to April 2016

Source: Office for National Statistics

Download this chart Figure A: Output prices

Image .csv .xls4. Supplementary analysis: Output prices

Table B shows the annual percentage change in price across all product groups and Figure B shows their contribution to the annual factory gate inflation rate.

Table B: Output prices

| UK, 12 months change to April 2016 | |

| Product group | Percentage change |

| Food products | -2.1 |

| Tobacco and alcohol (incl. duty) | 1.5 |

| Clothing, textile and leather | 0.4 |

| Paper and printing | -0.7 |

| Petroleum products (incl. duty) | -11.2 |

| Chemical and pharmaceutical | -1.7 |

| Metal, machinery and equipment | 0.8 |

| Computer, electrical and optical | -0.1 |

| Transport equipment | 1.2 |

| Other manufactured products | 1.7 |

| All manufacturing | -0.7 |

| Source: Office for National Statistics | |

Download this table Table B: Output prices

.xls (26.6 kB)

Figure B: Output prices, contribution to 12 months growth rate

UK, April 2016

Source: Office for National Statistics

Download this chart Figure B: Output prices, contribution to 12 months growth rate

Image .csv .xlsTable C shows the monthly percentage change in price across all product groups and Figure C shows their contribution to the month factory gate inflation rate.

Table C: Output prices

| UK, 1 month change to April 2016 | |

| Product group | Percentage change |

| Food products | -0.3 |

| Tobacco and alcohol (incl. duty) | 0.8 |

| Clothing, textile and leather | 0.4 |

| Paper and printing | -0.1 |

| Petroleum products (incl. duty) | 2.1 |

| Chemical and pharmaceutical | -0.1 |

| Metal, machinery and equipment | 0.3 |

| Computer, electrical and optical | 0.1 |

| Transport equipment | 0.2 |

| Other manufactured products | 0.5 |

| All manufacturing | 0.4 |

| Source: Office for National Statistics | |

Download this table Table C: Output prices

.xls (26.6 kB)

Figure C: Output prices, contribution to 1 month growth rate

UK, April 2016

Source: Office for National Statistics

Download this chart Figure C: Output prices, contribution to 1 month growth rate

Image .csv .xls5. Output prices: detailed commentary

Factory gate prices fell 0.7% in the year to April 2016, compared with a decrease of 0.9% in the year to March 2016. This index has now seen negative movements on the year for 22 consecutive months. The main contribution to the annual rate for April 2016 came from petroleum products. A fall in the price of food products, and chemicals and pharmaceuticals also contributed towards the fall in the output price of manufactured products. These falls were offset slightly by increases in the prices of other manufactured products, tobacco and alcohol, and transport equipment (Figure B).

Petroleum product prices fell 11.2% in the year to April 2016, compared with a fall of 12.5% in the year to March 2016. This index has now seen year on year falls for 32 consecutive months. The main contributions to the latest fall in the annual rate came from diesel and gas oil, aviation turbine fuel and motor spirit.

Food products fell 2.1% in the year to April 2016, down from a fall of 1.8% in the year to March 2016. The main contributions to this fall came from preserved meat and meat products, prepared animal feed, and bakery and farinaceous products, with prices falling by 3.6%, 4.7% and 1.8% respectively on the year.

Chemicals and pharmaceuticals fell 1.7% in the year to April 2016, unchanged from last month. The main contribution to the fall in this index came from chemicals and chemical products with prices decreasing 3.9% in the year to April 2016.

The total output price index saw a rise of 0.4% between March and April 2016, up from a rise of 0.3% last month. Most product groups showed small monthly movements. Petroleum products (incl. duty) provided the largest upward contribution to the monthly rate (Figure C).

Between March and April 2016, petroleum prices rose by 2.1%, unchanged from last month. Increases in the price of motor spirit provided the main upward pressure on this index.

Core factory gate inflation

Core factory gate prices, which exclude the more volatile food, beverage, tobacco and petroleum product prices, giving a measure of the underlying factory gate inflation, rose 0.5% in the year to April 2016, compared with a rise of 0.3% in the year to March 2016. This was driven by an increase in the price of other manufactured products, and transport equipment.

The index showed an increase of 0.2% between March and April 2016, compared with an increase of 0.1% between February and March 2016. This was driven by increases in other manufactured products, transport equipment and clothing, textiles and leather.

Output producer price index contribution to change in rate

The annual percentage rate for the output PPI in April 2016 fell 0.7%, up from a fall of 0.9% last month, resulting in an increase in the annual rate of 0.2 percentage points. The increase was driven by petroleum products, alcohol and tobacco, and other manufactured products (Figure D).

Figure D: Output PPI 12 month contribution to change in annual rate between March and April 2016

UK

Source: Office for National Statistics

Notes:

- The components may not sum exactly to the overall change in the rate due to rounding.

Download this chart Figure D: Output PPI 12 month contribution to change in annual rate between March and April 2016

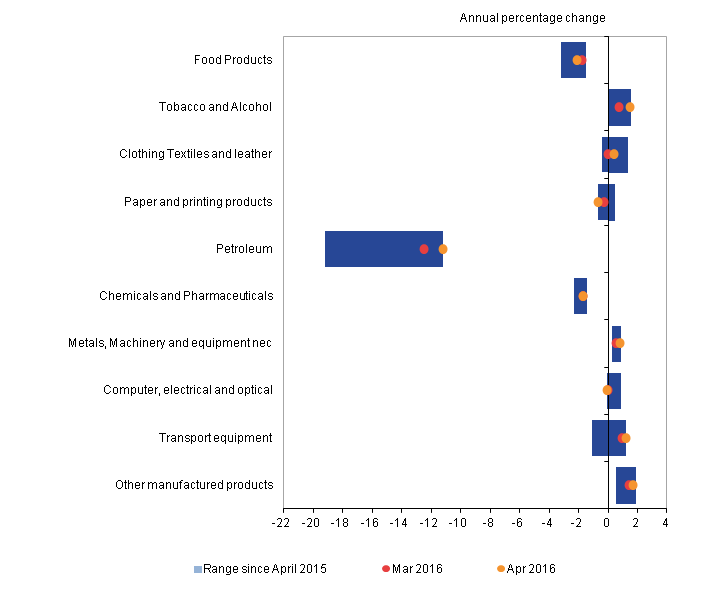

Image .csv .xls6. Output PPI range of movements

Figure E shows the year on year growth in output PPI by grouping for the latest 2 months and the range of the price changes that have been seen in these sections since April 2015. It can be seen that the majority of output PPI indices have experienced little variance in inflation in the past 12 months. Petroleum shows the biggest decrease, as well as the biggest range of movements; ranging from falls of 19.2% in September 2015 to 11.2% in April 2016. Other manufactured products show the biggest increase, ranging from rises of 1.8% in July 2015 to 0.5% in April 2016.

Figure E: Output PPI range of movements

UK, April 2015 to April 2016

Source: Office for National Statistics

Notes:

- nec = not elsewhere classified

Download this image Figure E: Output PPI range of movements

.png (23.5 kB)7. Input prices: summary

Figure F shows the annual movements in total input prices (including materials and fuels) and core input prices (excluding purchases from food, beverage, tobacco and petroleum industries) of materials and fuels purchased by the UK manufacturing industry. Between April 2012 and October 2013, both series showed relatively similar movements. From November 2013, both series have been showing a downward trend, with total input prices falling more rapidly. There has been a significant gap in the price movements of total input prices and core input prices since November 2014, however, this gap has been narrowing in recent months. Currently there is a difference of 4.8 percentage points, compared with a maximum of 10.9 percentage points in January 2015.

Looking at the latest data (Table D), the main movements in the year to April 2016 were as follows:

- the total input price index fell 6.5%, compared with a fall of 6.1% in the year to March 2016

- the core input price index saw a fall of 1.7%, compared with a fall of 2.7% in the year to March 2016

- the price of imported materials as a whole (including crude oil) fell 4.6%, compared with a decrease of 5.3% in the year to March 2016

Between March and April 2016:

- the total input price index rose 0.9%, compared with a rise of 2.2% last month (Table D)

- the seasonally adjusted input price index for the manufacturing industry excluding the food, beverage, tobacco and petroleum industries (see Table D) rose 0.9%, compared with an increase of 0.2% last month

Table D: Input prices

| UK, November 2015 to April 2016 | ||||||

| Percentage change | ||||||

| Materials and fuels purchased | Excluding purchases from food, beverage, tobacco and petroleum industries | |||||

| 1 month | 12 months | 1 month | 12 months | 1 month | ||

| (NSA)1 | (NSA)1 | (NSA)1 | (NSA)1 | (SA)2 | ||

| 2015 | Nov | -1.6 | -13.1 | -1.3 | -8.5 | -1.6 |

| Dec | -0.3 | -10.4 | 1.1 | -6.6 | 1.1 | |

| 2016 | Jan | -1.2 | -8.1 | 0.2 | -5.2 | 0.2 |

| Feb | 0.3 | -8.0 | 0.6 | -3.4 | 0.5 | |

| Mar | 2.2 | -6.1 | 0.5 | -2.7 | 0.2 | |

| Apr | 0.9 | -6.5 | 0.7 | -1.7 | 0.9 | |

| Source: Office for National Statistics | ||||||

| Notes: | ||||||

| 1. NSA: Not Seasonally Adjusted | ||||||

| 2. SA: Seasonally Adjusted | ||||||

Download this table Table D: Input prices

.xls (26.1 kB)

Figure F: Input prices (materials and fuel) manufacturing industry

UK, April 2012 to April 2016

Source: Office for National Statistics

Download this chart Figure F: Input prices (materials and fuel) manufacturing industry

Image .csv .xlsNotes for Input prices: summary

These indices include the Climate Change Levy which was introduced in April 2001.

These indices include the Aggregates Levy which was introduced in April 2002.

8. Supplementary analysis: Input prices

Table E and Figure G show the percentage change in the price of the main commodities groups over the year and their contributions to the total input index.

Table E: Input prices

| UK, 12 months change to April 2016 | |

| Product group | Percentage change |

| Fuel including Climate Change Levy | -4.6 |

| Crude oil | -28.2 |

| Home food materials | -10.0 |

| Imported food materials | 0.1 |

| Other home-produced materials | 0.3 |

| Imported metals | -6.6 |

| Imported chemicals | -0.8 |

| Imported parts and equipment | 2.0 |

| Other imported materials | 2.5 |

| All manufacturing | -6.5 |

| Source: Office for National Statistics | |

Download this table Table E: Input prices

.xls (27.6 kB)

Figure G: Input prices, contribution to 12 months growth rate

UK, April 2016

Source: Office for National Statistics

Download this chart Figure G: Input prices, contribution to 12 months growth rate

Image .csv .xlsTable F and Figure H show the percentage change in the price of the main commodities groups over the month and their contributions to the total input index.

Table F: Input prices

| UK, 1 month change to April 2016 | |

| Product group | Percentage change |

| Fuel including Climate Change Levy | -0.2 |

| Crude oil | 3.7 |

| Home food materials | 1.0 |

| Imported food materials | -1.2 |

| Other home-produced materials | -0.2 |

| Imported metals | 2.4 |

| Imported chemicals | 0.9 |

| Imported parts and equipment | 0.6 |

| Other imported materials | 0.2 |

| All manufacturing | 0.9 |

| Source: Office for National Statistics | |

Download this table Table F: Input prices

.xls (26.1 kB)

Figure H: Input prices, contribution to 1 month growth rate

UK, April 2016

Source: Office for National Statistics

Download this chart Figure H: Input prices, contribution to 1 month growth rate

Image .csv .xls9. Input prices: detailed commentary

The overall input index for all manufacturing, which measures changes in the price of materials and fuels purchased by manufacturers, fell 6.5% in the year to April 2016, compared with a fall of 6.1% in the year to March 2016. The main downward contributions to the index came from crude oil with a smaller, but notable, downward contribution from home produced food.

The monthly input index rose 0.9% between March and April 2016, compared with an increase of 2.2% between February and March 2016. Increases were seen in 6 of the 9 groups, the most significant was seen in crude oil. Smaller increases were seen in imported metals, imported chemicals, home food materials and imported parts and equipment (see Table F and Figure H).

Crude oil annual prices have been falling since October 2013. The index fell 28.2% in the year to April 2016, compared with a decrease of 28.8% in the year to March 2016. The monthly index for crude oil rose 3.7% between March and April 2016, compared with an increase of 18.8% between February and March 2016. Last month’s increase of 18.8% was the largest seen in the index since May 2000, when prices rose 22.9%. The main contribution to the change in both the annual and monthly indices came from imported crude petroleum and natural gas, which fell 27.7% in the year to April 2016 but rose 3.2% between March and April 2016.

Home produced food prices fell 10.0% in the year to April 2016, compared with a fall of 1.5% last month. This is the largest annual decrease seen in the index since June 2015 when prices fell by 11.5%. The main contribution to this movement was from crop and animal production which fell 11.0% in the year to April 2016. In April 2015, home produced potatoes showed strong growth, the fall seen in the annual rate in April 2016 was a result of prices returning to previously seen levels.

Imported metal prices fell 6.6% in the year to April 2016, compared with a fall of 9.2% in the year to March 2016. Although this is still a considerable decrease it is the smallest seen in this index since May 2015, when prices fell 6.4%. The main contribution came from imported products used in the manufacture of other basic metals and casting, which fell 9.4%, compared with a fall of 10.4% last month. The prices of the majority of metals measured in the PPI have fallen significantly, with many metal market prices ending 2015 at low levels. This may have been contributed to by a reduction in growth in the Chinese economy. Until recently the Chinese economy has seen strong growth resulting in high demand for metals, which may have contributed to increased prices. Reduced demand growth resulting from a slowdown of China’s economy may have been a factor in reducing prices, alongside uncertainty about growth prospects in a number of emerging economies. However, recent increases in the month on month growth of imported metal prices are the largest seen in this index since February 2013, when the index rose 4.5% on the month. This could be partly attributed to an increase in construction activity, which has raised market expectations for steel demand, alongside other supply-side factors.

Core input price index (excluding purchases from the food, beverage, tobacco and petroleum industries)

The seasonally adjusted core input price index increased 0.9% between March and April 2016, compared with an increase of 0.2% between February and March 2016. In the year to April 2016, the index fell 1.6% compared with a fall of 2.4% in the year to March 2016. This is the smallest decrease in this index since January 2015, when the index showed no movement.

The unadjusted index fell 1.7% in the year to April 2016, compared with a decrease of 2.7% in the year to March 2016. This is the smallest decrease in this index since November 2014, when prices also decreased by 1.7%. The monthly index increased 0.7% between March and April 2016, compared with an increase of 0.5% between February and March 2016. This increase in the monthly rate is driven by rises in imported metals, imported chemicals and other imported parts and equipment.

Input producer price index contribution to change in rate

The annual percentage rate for the input PPI in April 2016 fell 6.5%, compared with a decrease of 6.1% last month, resulting in a fall in the annual rate of 0.4 percentage points. The most notable downward contribution came from home produced food, which saw prices drop on the year to April (Figure I).

Figure I: Input PPI 12 month contribution to change in annual rate between March and April 2016

UK

Source: Office for National Statistics

Download this chart Figure I: Input PPI 12 month contribution to change in annual rate between March and April 2016

Image .csv .xls10. Input PPI indices range of movements

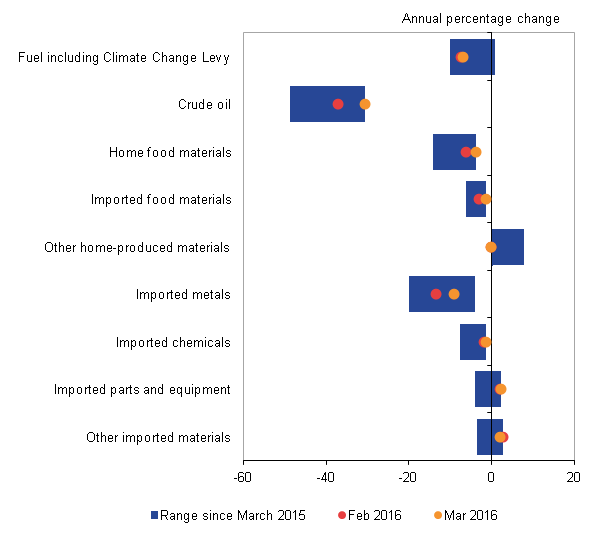

Figure J shows the year on year growth in input PPI by grouping for the latest 2 months and the range of the price changes that have been seen in these groupings since April 2015. Crude oil shows the biggest decrease, ranging from falls of 48.6% in August 2015 to 28.2% in April 2016. This is also the widest range of price movements seen in any PPI grouping in this period.

Other home-produced materials show the biggest increase, ranging from rises of 5.5% in April 2015 to a fall of 0.3% in March 2016.

Figure J: Input PPI range of movements

UK, April 2015 to April 2016

Source: Office for National Statistics

Download this image Figure J: Input PPI range of movements

.png (21.8 kB) .xls (28.7 kB)11. Economic context

Input producer prices fell 6.5% in the year to April 2016, compared with a 6.1% decrease in the year to March 2016, continuing the current trend of falling input prices. While output prices also fell in the year to April, which would suggest lower input costs continue to feed into the output prices of manufactured goods, other factors could also be supporting the prices of manufacturers. In particular, labour costs are a much more significant element of output prices than for input prices, so the gradual rise in labour costs will be offsetting some of the fall in input prices resulting in a more modest fall in output prices. Output producer price inflation strengthened slightly from a fall of 0.9% in the year to March 2016 to a fall of 0.7% in the year to April 2016.

The decline in input and output producer price inflation can be partly attributed to lower oil and petroleum prices, as the cost of crude oil, energy and refined petroleum products has continued to influence the price of manufactured goods. Crude oil prices have been on a downwards trajectory, falling from around $108 per barrel in April 2014 to around $61 per barrel in April 2015 and to around $43 per barrel by April 2016. However, oil prices have stabilised in recent months, rising by 8.4% in April 2016 compared with the previous month –the fourth consecutive month of oil prices increases.

This could be partly attributed to a reduction in global oil supplies, with Organization of the Petroleum Exporting Countries (OPEC) and non-OPEC production contracting, against demand growth easing due to lower demand in Europe and North America and more modest growth in some of the more significant emerging economies. These recent increases notwithstanding, the fall in the oil price on the year meant that oil and refined petroleum product prices accounted for 4.5 percentage points of the 6.5% fall in input producer prices in the year to April 2016 and 0.86 percentage points of the 0.7% fall in output producer prices respectively over the same period.

Along with the decrease in oil prices, imported metal prices accounted for a further 0.48 percentage points of the 6.5% fall in input producer price inflation in April 2016. Figure K shows Office for National Statistics (ONS) imported metal prices and International Monetary Fund (IMF) metal commodity prices indicators between January 2011 and April 2016. The 2 indicators for metal commodity prices have followed a similar path since 2011, with metal prices on a downward trend. This has been widely attributed to a slowdown in demand-growth from China, the largest consumer of metal commodities. However, imported metal prices increased by 2.4% in April 2016, compared with a 4.0% increase in the previous month. This could be partly attributed to an increase in construction activity, which has boosted expectations for steel demand, as well as some supply-side factors. It should be noted, however, that metal and other commodity prices tend to be inherently quite volatile and subject to market expectations as well as more fundamental economic demand and supply pressures.

Figure K: ONS imported metal prices and International Monetary Fund metal commodity prices indicators

UK, January 2011 to April 2016

Source: Office for National Statistics, International Monetary Fund

Download this chart Figure K: ONS imported metal prices and International Monetary Fund metal commodity prices indicators

Image .csv .xlsAlongside recent changes in commodity prices, changes in the exchange rate may also have had an impact on producer prices. In trade-weighted terms, sterling has depreciated by 5.9% in the year to April 2016, compared with 5.1% in the year to March 2016. All else equal, a depreciation of sterling increases the prices of UK imports, with a corresponding impact on the prices paid by producers for imports. If these producers raise their prices in turn, then movements in the exchange rate can influence input and output producer prices. Primary commodities tend to be traded on global markets in US dollars, so the depreciation of sterling against the dollar will have had a particular impact on primary commodity imports. Sterling has continued to depreciate against the US dollar, by 4.4% in the year to April 2016, while sterling depreciated against the euro by 8.9% over the same period. The depreciation of sterling in recent months is due to a combination of economic and financial market factors, but is likely to have included uncertainty around the EU referendum.

While lower commodity prices and changes in the exchange rate have had the greatest impact on producer prices, the strengthening of the UK labour market may also be supporting the prices of manufacturers. The unemployment rate amongst those aged 16 and above remained steady at 5.1% in the 3 months to February 2016 while the employment rate amongst those aged 16 to 64 remained at 74.1% during the same period. Output per hour worked in manufacturing – growth in which permits firms to produce more output per unit of labour input – fell by 2.0% in Quarter 4 (October to December) 2015. Despite productivity falling, total weekly earnings have been positive in recent months. Wages in the manufacturing sector grew by 2.0% in the 3 months to February 2016, when compared with the same 3 months a year earlier – but declined slightly on the previous month. This may have partially offset the lower cost pressures from commodity prices.

With a number of factors affecting input and output prices, the demand for goods and services in the UK economy weakened in Quarter 1 (January to March) 2016; with the preliminary estimate showing GDP increased by 0.4%, compared with 0.6% in Quarter 4 (October to December) 2015. However, much of this growth has been concentrated in the services industry, with output increasing by 0.6%, while manufacturing output fell by 0.4%, following an increase of 0.1% in Quarter 4 2015. The manufacturing industries which have shown the largest fall in output were textiles, wearing apparel and leather products (7.1%), electrical equipment (-6.4%) and machinery and equipment (-6.3%) in the 3 months to February 2016 compared with the same 3 months a year ago.

Nôl i'r tabl cynnwys12. Revisions

For this bulletin Producer price index dataset Tables 8R and 9R highlight revisions to movements in price indices previously published in last month’s statistical bulletin. These are mainly caused by changes to the most recent estimates, as more price quotes are received, and revisions to seasonal adjustment factors, which are re-estimated every month.

For more information about our revisions policy, see our website.

Table G: Revisions between first publication and estimates 12 months later

| Percentages | |||

| Value in latest period | Revisions between first publication and estimates 12 months later | ||

| Average over the last 5 years | Average over the last 5 years without regard to sign (average absolute revision) | ||

| Total output (JVZ7) - 12 months | -0.7 | -0.12 | 0.18 |

| Total output (JVZ7) - 1 month | 0.4 | -0.01 | 0.07 |

| Total input (K646) - 12 months | -6.5 | 0.06 | 0.33 |

| Total input (K646) - 1 month | 0.9 | 0.07 | 0.26 |

| Source: Office for National Statistics | |||

| Notes: | |||

| 1. *Statistically significant | |||

Download this table Table G: Revisions between first publication and estimates 12 months later

.xls (25.6 kB)Revisions to data provide one indication of the reliability of main indicators. Table G shows summary information on the size and direction of the revisions which have been made to the data covering a 5-year period. A statistical test has been applied to the average revision to find out if it is statistically significantly different from zero. An asterisk (*) shows that the test is significant.

Table G presents a summary of the differences between the first estimates published between 2011 and 2015 and the estimates published 12 months later. These numbers include the effect of the reclassification onto Standard Industrial Classification (SIC) 2007.

Spreadsheets giving revisions triangles of estimates for all months from February 1998 through to December 2015 and the calculations behind the averages in the table are available in the producer price inflation datasets.

Revision triangle for total output (12 months)

Revision triangle for total output (1 month)

Revision triangle for total input (12 months)

Revision triangle for total input (1 month)

Nôl i'r tabl cynnwys