1. Main findings

Private rental prices paid by tenants in Great Britain rose by 2.6% in the 12 months to February 2016, unchanged when compared with the year to January 2016.

Private rental prices grew by 2.8% in England, 0.2% in Wales and 0.7% in Scotland in the 12 months to February 2016.

Rental prices increased in all the English regions over the year to February 2016, with rental prices increasing the most in London (3.8%).

Nôl i'r tabl cynnwys2. About this statistical bulletin

The Index of Private Housing Rental Prices (IPHRP) measures the change in price of renting residential property from private landlords. The index is published as a series of price indices covering Great Britain, its constituent countries and the English regions.

IPHRP measures the change in price tenants’ face when renting residential property from private landlords, thereby allowing a comparison between the prices tenants are charged in the current month as opposed to the same month in the previous year. The index does not measure the change in newly advertised rental prices only, but reflects price changes for all private rental properties.

IPHRP is released as an experimental statistic. This is a new official statistic undergoing evaluation and therefore it is recommended that caution is exercised when drawing conclusions from the published data as the index is likely to be further developed. Once the methodology is tested and assessed, and the publication meets user needs, the IPHRP will be assessed against the Code of Practice for Official Statistics to achieve National Statistic status. A complete description of the methodology and the sources used is included in the article Index of Private Housing Rental Prices - Historical Series. Further details regarding improvements to the IPHRP price collection methodology can be found in the January 2015 article.

The IPHRP is constructed using administrative data. That is, the index makes use of data that are already collected for other purposes in order to estimate rental prices. The sources of private rental prices are Valuation Office Agency (VOA), Scottish government (SG) and Welsh government (WG). All 3 organisations deploy rental officers to collect the price paid for privately rented properties. The sources of expenditure weights are Department for Communities and Local Government (DCLG), Scottish government, Welsh government and VOA.

DCLG produces estimates of the private rental dwelling stock for England and its regions. Scottish government and Welsh government produce estimates of private rental dwelling stock for Scotland and Wales.

Great Britain rental prices

The Great Britain private rental price series starts in January 2011. This is the date for which all the sources for constituting countries are available on a consistent basis. This index has seen small and gradual increases since January 2011 (Figure 1).

Figure 1: IPHRP indices: Great Britain, January 2011 to February 2016

Source: Office for National Statistics

Notes:

- Not seasonally adjusted.

Download this chart Figure 1: IPHRP indices: Great Britain, January 2011 to February 2016

Image .csv .xlsBetween February 2015 and February 2016, Great Britain private rental prices grew by 2.6%. For example, a property that was rented for £500 a month in February 2015, which saw its rent increase by the Great Britain average rate, would be rented for £513 in February 2016. Rental prices for Great Britain excluding London grew by 1.9% in the same period (Figure 2).

Figure 2: IPHRP percentage change over 12 months: Great Britain, January 2012 to February 2016

12 month percentage change

Source: Office for National Statistics

Notes:

- Not seasonally adjusted.

Download this chart Figure 2: IPHRP percentage change over 12 months: Great Britain, January 2012 to February 2016

Image .csv .xls3. Rental prices for constituent countries of Great Britain

All the countries that constitute Great Britain have experienced rises in their private rental prices since 2011 (Figure 3). Since January 2011 England rental prices have increased more than those of Wales and Scotland.

Figure 3: IPHRP indices for Great Britain and its constituent countries, January 2011 to February 2016

Index values (January 2011=100)

Source: Office for National Statistics

Notes:

- Not seasonally adjusted.

Download this chart Figure 3: IPHRP indices for Great Britain and its constituent countries, January 2011 to February 2016

Image .csv .xlsThe annual rate of change in the IPHRP for Wales (0.2%) continues to be below that of England and the Great Britain average (Figure 4). Rental growth in Scotland has gradually slowed to 0.7% in the year to February 2016, from a high of 2.1% in the year to June 2015.

Figure 4: IPHRP percentage change over 12 months for Great Britain and its constituent countries, January 2012 to February 2016

12 month percentage change

Source: Office for National Statistics

Notes:

- Not seasonally adjusted.

Download this chart Figure 4: IPHRP percentage change over 12 months for Great Britain and its constituent countries, January 2012 to February 2016

Image .csv .xlsBetween February 2015 and February 2016, rental prices grew by 2.8% in England, 0.2% in Wales and 0.7% in Scotland (Figure 5).

Figure 5: IPHRP percentage change over the 12 months to February 2016, Great Britain and its constituent countries

12 month percentage change

Source: Office for National Statistics

Notes:

- Not seasonally adjusted.

Download this chart Figure 5: IPHRP percentage change over the 12 months to February 2016, Great Britain and its constituent countries

Image .csv .xls4. Rental prices in England and its regions

The IPHRP series for England starts in 2005. Private rental prices in England show 3 distinct periods: rental price increases from January 2005 until February 2009, rental price decreases from July 2009 to February 2010, and increasing rental prices from May 2010 onwards (Figure 6). When London is excluded, England shows a similar pattern but with slower rental price increases from around the end of 2010.

Figure 6: IPHRP indices: England, January 2005 to February 2016

Index values (January 2011=100)

Source: Office for National Statistics

Notes:

- Not seasonally adjusted.

Download this chart Figure 6: IPHRP indices: England, January 2005 to February 2016

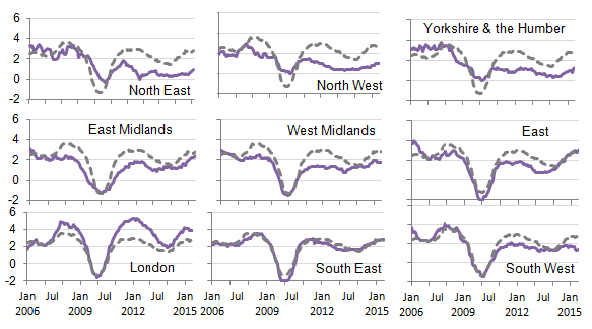

Image .csv .xlsFigure 7 shows the historical 12 month percentage growth rate in the rental prices of each of the English regions.

Figure 7: IPHRP percentage change over 12 months by English region, January 2006 to February 2016

12 month percentage change

Source: Office for National Statistics

Notes:

- Not seasonally adjusted.

- The dotted grey line shows the average England 12 month percentage change.

Download this image Figure 7: IPHRP percentage change over 12 months by English region, January 2006 to February 2016

.png (43.3 kB) .xls (55.8 kB)Since the beginning of 2012, English rental prices have shown annual increases ranging between 1.4% and 3.0% year-on-year, with February 2016 rental prices being 2.8% higher than February 2015 rental prices (Figure 8). Excluding London, England showed an increase of 2.1% for the same period.

Figure 8: IPHRP percentage change over 12 months for England, January 2006 to February 2016

12 month percentage change

Source: Office for National Statistics

Notes:

- Not seasonally adjusted.

Download this chart Figure 8: IPHRP percentage change over 12 months for England, January 2006 to February 2016

Image .csv .xlsIn the 12 months to February 2016, private rental prices increased in each of the 9 English regions (Figure 9). The largest annual rental price increases were in London (3.8%), down from 3.9% in January 2016, followed by the East (3.0%) up from 2.9% and the South East (2.9%) unchanged over the same period. Annual price increases have been stronger in London than the rest of England since November 2010.

The lowest annual rental price increases were in the North East (0.9%) unchanged from January 2016, followed by the North West (1.0%) also unchanged for this period and Yorkshire and The Humber (1.3%) up from 1.2%.

Figure 9: IPHRP percentage change over the 12 months to February 2016 by English region

12 month percentage change

Source: Office for National Statistics

Notes:

- Not seasonally adjusted.

Download this chart Figure 9: IPHRP percentage change over the 12 months to February 2016 by English region

Image .csv .xls5. Economic context

The rental market in Great Britain continued to show signs of strength in the year to February 2016, as prices grew by 2.6%, unchanged on the January 2016 rate. This stable rate of rental price growth at the UK level was broadly replicated at the regional level. Rental price inflation remained strongest in London (3.8%), the East (3.0%) and the South East (2.9%) and weakest in Wales (0.2%), Scotland (0.7%) and the North East of England (0.9%).

Conditions in the housing market as a whole may have been supporting rental price growth. Data from the ONS House Price Index release for January 2016 shows that house price growth has typically been stronger than rental price growth for a number of years, while the Bank of England’s Agents’ Summary of Business Conditions for Quarter 4 (Oct to Dec) 2015 reported that private rental demand continued to grow steadily in the 3 months to December. RICS’s Residential Market Survey for February 2016 also noted that tenant demand continued to grow at a robust pace for the 14th month in a row. The strength in demand is in contrast to supply: the latest RICS survey found that new landlord instructions increased modestly in February 2016 for the first time since October 2015 and the Association of Residential Letting Agents (ARLA) reported in January 2016 that the supply of properties was at its lowest in a year. However, there are marked regional patterns in conditions, as noted by ARLA. In London, where they found demand is the strongest of any region and supply is the weakest, price growth has been relatively high at 3.8% in the year to February 2016. In Scotland, by contrast, where supply is the strongest of any region and demand is the weakest in Great Britain, price growth has been more subdued at 0.7% over the past year.

Broader economic indicators suggest that the economy has continued to grow relatively strongly over recent periods, with output increasing 0.5% in Quarter 4 (Oct to Dec) 2015. Labour market conditions have continued to improve as unemployment fell to 5.1% in the 3 months to January 2016. These improvements, along with falls in the inactivity rate over recent months and tightening more widely suggest confidence in labour market outcomes remains high. Regular pay also grew 2.2% in the 3 months to January 2016 compared with the same period a year ago - continuing the run of revived real earnings growth, although rental prices have been growing at a slightly faster rate than real wages in recent months.

Nôl i'r tabl cynnwys6. Improvements to IPHRP

IPHRP is classified as an Experimental Statistic to allow for evaluation of the output against user needs. As part of the ongoing development, we are considering how to improve IPHRP ahead of potential assessment as a National Statistic.

One of the main user requirements was for IPHRP to be published monthly. In response to this requirement, from February 2016, this publication changed from a quarterly to a monthly release. The next monthly publication will be 29 April 2016.

Private housing rental data are collected by Rent Officers from the Valuation Office Agency (VOA) for all regions of England. The VOA has developed an electronic data transfer process for receiving private rental market data from suppliers. Records currently received by VOA via these means only represent a very small proportion (less than 1.5%) of the private rental data held by VOA. Historically these records have not been included in the processing to produce elementary aggregates that are provided to ONS.

In order to capture all available data as more VOA suppliers move towards providing data through the electronic data transfer process, from February 2016, the elementary aggregates provided to ONS from VOA shall include the records received via the electronic data transfer process.

For further details, please contact hpi@ons.gov.uk

Nôl i'r tabl cynnwys7. How are we doing?

We would welcome your views on the data presented in this statistical bulletin. Please contact the Housing Market Indices team using the email address below to discuss any aspect of the data, including your views on how we can improve the data.

The VOA are currently conducting a user engagement exercise on their Private Rental Market Statistics (PRMS) publication. As part of this process, VOA are requesting that users complete a survey questionnaire.

Feedback from this exercise will allow a better understanding of the users and uses of the PRM statistics and how it can best complement IPHRP.

Nôl i'r tabl cynnwys8. Data tables

The IPHRP dataset provides full historical series for the tables accompanying the IPHRP statistical bulletin. This month, the tables have been updated with the latest monthly estimates for February 2016.

Nôl i'r tabl cynnwys