Cynnwys

- Main points

- Things you need to know about this release

- A brief description of owner occupiers’ housing costs

- Payments

- Net acquisitions

- Rental equivalence

- Comparing the different approaches of measuring owner occupiers’ housing costs

- Spotlight: Exploratory analysis of the impact of errors in the OOH stratum weights

- Annex 1: List of published articles on the different approaches of measuring OOH

- Annex 2: Methodology

- Annex 3: Weights analysis

1. Main points

Owner occupiers’ housing costs (OOH) in the UK under the rental equivalence approach have grown by 1.9% in Quarter 3 (July to Sept) 2017 compared with the corresponding quarter of the previous year.

OOH according to the net acquisitions approach have grown by 3.9% in Quarter 3 2017 compared with the corresponding quarter of the previous year.

OOH compiled using the payments approach experienced growth of 0.8% in Quarter 3 2017 compared with the corresponding quarter of the previous year.

2. Things you need to know about this release

There has been a revision to the OOH net acquisitions (NA) and OOH (Payments) series covering the period Quarter 2 (Apr to June) 2016 to present. This incorporates the new House Price Index (HPI) 12-month revision policy, which came into force on 13 June 2017. The HPI provides input data for both the net acquisitions approach (acquisition of new dwellings, existing dwellings new to the OOH sector and Stamp Duty) and the payments approach (Stamp Duty).

This series of articles aims to provide more information about the different approaches to measuring owner occupiers’ housing costs (OOH) to aid your understanding of the differences in concept and underlying methodology. It will be updated on a quarterly basis to evaluate the performance of the different measures over time, in prevailing economic conditions. We invite you to submit feedback on this release to cpi@ons.gov.uk.

We have published a number of articles that summarise the different approaches of measuring OOH. The table in Annex 1 provides a link to each article and a summary of its contents. For more general information on the Consumer Prices Index including owner occupiers’ housing costs (CPIH), please see the CPIH compendium.

Nôl i'r tabl cynnwys3. A brief description of owner occupiers’ housing costs

The Consumer Prices Index including owner occupiers’ housing costs (CPIH) extends the Consumer Prices Index (CPI) to include a measure of owner occupiers’ housing costs (OOH), along with Council Tax. OOH are the costs of housing services associated with owning, maintaining and living in one’s own home. This is distinct from the cost of purchasing a house, which is partly for the accumulation of wealth and partly for housing services.

There is not a single defined measure of OOH because they can be calculated differently depending on what the target is. In particular, should OOH be measured at the point of acquisition of the housing service, the point of use, or the point at which it is paid for? Each of these three approaches has its own specific methodological strengths and weaknesses, and is measured using different methods.

Nôl i'r tabl cynnwys4. Payments

What is the payments approach?

The payments approach aims to measure the payments related to the ownership of owner occupier housing. This means that all payments that households make as owner occupiers when consuming housing should be included, such as mortgage interest payments, transaction costs and running costs. The payments approach is not our favoured method to measuring owner occupiers’ housing costs (OOH) in the Consumer Prices Index including owner occupiers’ housing costs (CPIH). This is because a consumer price index aims to measure consumption, and interest payments represent the cost of borrowing money rather than the cost of consumption. However, the payments approach is our preferred measure for the Housing Cost Indices (HCIs) which depart from consumption principles, and aims to capture households’ experience of changing prices and costs. For more information about the HCIs please see the article, "Developing the House Cost Indices (HCIs)".

OOH (Payments) is an experimental series and we therefore advise using it with some caution. We are continuing to work on identifying possible improvements to the current methodology and data sources. Any changes to the index will be highlighted in future releases and we will update the methodology section and historical series accordingly. For more information on the current methodology and data sources used to construct the OOH (Payments) approach, please see Annex 2A.

Payments approach

The payments approach is calculated using the following model:

Payments approach = Mortgage interest payments

+Council Tax (Great Britain)

+ Northern Ireland rates

+ Dwelling insurance

+ Ground rent

+ Stamp Duty

+ Estate agent fees

+ Home-buyers survey

+ Major repairs and maintenance

+ House conveyancing

Latest figure and long-term trend

Owner occupiers’ housing costs (OOH) compiled using the payments approach – OOH (Payments) – rose by 0.8% in Quarter 3 (July to Sept) 2017 as compared with Quarter 3 2016 (Figure 1). This is an increase from the previous quarter and is still broadly in line with historical trends, which have seen growth in OOH (Payments) fluctuating around 0% since the beginning of 2014.

Figure 2 presents the contributions to the quarterly growth rate of OOH (Payments) from the sub-indices used in its construction. Mortgage interest payments remain the largest negative contributor, unchanged from the previous quarter. The increase in the base rate to 0.5% announced by the Bank of England in November 2017 may lead to the negative contribution of mortgage interest rates reducing in future quarters. Council Tax remains the highest positive contributor.

There has been a revision to the OOH (Payments) series covering the period Quarter 2 (Apr to June) 2016 to present. This incorporates the new House Price Index (HPI) 12-month revision policy, which came into force on 13 June 2017. The HPI provides input data for the underlying Stamp Duty component of OOH (Payments).

For a longer time series of contributions, please see the dataset presented alongside this release.

Figure 1: OOH (Payments) growth rate, quarter on corresponding quarter of previous year

UK, Quarter 1 (Jan to Mar) 2006 to Quarter 3 (July to Sep) 2017

Source: Office for National Statistics

Notes:

- Q1 refers to Quarter 1 (January to March); Q2 refers to Quarter 2 (April to June); Q3 refers to Quarter 3 (July to September); and Q4 refers to Quarter 4 (October to December).

Download this chart Figure 1: OOH (Payments) growth rate, quarter on corresponding quarter of previous year

Image .csv .xls

Figure 2: Contributions to percentage change in OOH (Payments) from component sub-indices, latest quarter on corresponding quarter of previous year

UK, Quarter 3 (July to Sept) 2017

Source: Office for National Statistics

Notes:

- Contributions may not sum due to rounding. Council Tax includes Council Tax in Great Britain and Northern Ireland rates. Other includes dwelling insurance, ground rent, estate agent fees, home-buyers survey and house conveyancing.

- Q1 refers to Quarter 1 (Jan to Mar); Q2 refers to Quarter 2 (Apr to June); Q3 refers to Quarter 3 (July to Sept); and Q4 refers to Quarter 4 (Oct to Dec).

Download this chart Figure 2: Contributions to percentage change in OOH (Payments) from component sub-indices, latest quarter on corresponding quarter of previous year

Image .csv .xls5. Net acquisitions

What is the net acquisitions approach?

The net acquisitions approach to measuring owner occupiers’ housing costs (OOH (NA)) theoretically treats a home as the purchase of a good that is part asset (the land) and part consumable (the house) and excludes the land component from the index. OOH (NA) also includes costs associated with buying and maintaining a house; for example, self-builds and renovations, repairs and maintenance, transfer costs and dwelling insurance. The “net” principle in net acquisitions relates to the fact that only transactions that occur between the OOH sector and other sectors (for example, construction firms and private landlords) should be included.

In practice, while the measure presented here is the best measure of the net acquisitions approach that we can currently produce, the lack of available source data means that some components are not recorded fully. For instance, because of the lack of available data, the methodology used does not separate between the land and house price, and therefore there will be some measure of asset price included in the example. We therefore advise that OOH (NA) should be used and referred to with caution and it is consequently not our favoured approach of measuring OOH in Consumer Prices Index including owner occupiers’ housing costs (CPIH).

As with the OOH (Payments) approach, it is an experimental index and we will continue to work on improving the methodology and data sources used in the index. For more information on the methodology used to construct OOH (NA), please see Annex 2B.

Net acquisitions approach

The net acquisitions approach is calculated using the following model:

Net acquisitions approach = Acquisition of new dwellings

+Self- builds and renovations

+ Existing dwellings new to the OOH sector

+ Services related to acquisition

+ Major repairs and maintenance

+ Insurance connected with the dwelling

+ Other services related to ownership of dwellings

Latest figure and long-term trend

The net acquisitions approach – OOH (NA) – grew by 3.9% in Quarter 3 (July to Sept) 2017 compared with Quarter 3 2016. A stable OOH (NA) index between Quarter 2 (Apr to June) 2016 and Quarter 3 2016 combined with an increase in the OOH (NA) index in Quarter 3 2017 has contributed to this unusually high year-on-year growth. Comparing this with the 2.5% growth rate for Quarter 2 2017 indicates an upwards movement in the series (Figure 3).

Figure 4 shows the contributions to quarter on corresponding quarter of previous year growth rate for OOH (NA). The new dwellings component remains the largest contributor to OOH (NA) growth, contributing 3.6 percentage points to the overall growth rate. This has increased from the previous quarter’s contribution of 2.1 percentage points and could be attributed to the rise in house prices between Quarter 3 2016 and Quarter 3 2017 being greater than the price increase between Quarter 2 2016 and Quarter 2 2017.

There has been a revision to the OOH (NA) series covering the period Quarter 2 2016 to present. This incorporates the new House Price Index (HPI) 12-month revision policy, which came into force on 13 June 2017. The HPI provides input data for the acquisition of new dwellings, existing dwellings new to the OOH sector and Stamp Duty components of OOH (NA).

For a longer time series of contributions, please see the dataset presented alongside this release.

Figure 3: OOH (NA) growth rate, quarter on corresponding quarter of previous year

UK, Quarter 1 (Jan to Mar) 2006 to Quarter 3 (July to Sept) 2017

Source: Office for National Statistics

Notes:

- Q1 refers to Quarter 1 (Jan to Mar); Q2 refers to Quarter 2 (Apr to June); Q3 refers to Quarter 3 (July to Sept); and Q4 refers to Quarter 4 (Oct to Dec)

Download this chart Figure 3: OOH (NA) growth rate, quarter on corresponding quarter of previous year

Image .csv .xlsFigure 4: Contributions to percentage change in OOH (NA) from component sub-indices, latest quarter on corresponding quarter of previous year

UK, Quarter 3 (July to Sept) 2017

Source: Office for National Statistics

Download this chart Figure 4: Contributions to percentage change in OOH (NA) from component sub-indices, latest quarter on corresponding quarter of previous year

Image .csv .xls6. Rental equivalence

What is the rental equivalence approach?

This section presents the rental equivalence approach to measuring owner occupiers’ housing costs (OOH (RE)), which targets the measurement of ongoing consumption of OOH services, rather than when OOH is acquired or when it is paid for. As a consumer price index, the Consumer Prices Index including owner occupiers’ housing costs (CPIH) is a measure of the cost of consumption. Therefore the choice of method for measuring OOH should be based on the most statistically accurate method for measuring the cost of consumption in the UK. This means that asset prices should not be included, as an asset is not consumed in the way that goods and services are.

The rental equivalence approach is our preferred method for measuring OOH costs in the CPIH because the other approaches include either a measure of interest rates, or some measure of the capital element of housing, which make them unsuitable for a price index that measures the changing cost of consumption. The approach is also based on a higher- quality data source than the other approaches presented in this article, allowing for a more reliable estimate of the measure.

For more information about why the rental equivalence is used in CPIH, please see the CPIH compendium.

Latest figure and long-term trend

OOH (RE) grew by 1.9% in September 2017 compared with September 2016 (Figure 5). The recent months of OOH (RE) growth corresponding to Quarter 3 (July to Sept ) 2017 have shown a slowdown in the growth of OOH (RE). On a quarterly basis, OOH (RE) grew by 1.9% in Quarter 3 2017 compared with the corresponding quarter of the previous year, down from 2.1% in Quarter 2 (Apr to June) 2017. This highlights a recent trend in decreasing OOH (RE) growth, which may be due to a slowdown in private rental prices seen since the end of 2016.

Figure 5: 12-month growth rate of OOH (rental equivalence)

UK, Jan 2006 to Sept 2017

Source: Office for National Statistics

Download this chart Figure 5: 12-month growth rate of OOH (rental equivalence)

Image .csv .xls7. Comparing the different approaches of measuring owner occupiers’ housing costs

Although there is not a single defined measure of owner occupiers’ housing costs (OOH) and each of the methods discussed measure different aspects of OOH, it is still useful to look at the three measures together to see how they differ over time.

The cumulative measure of all three approaches is presented in Figure 6. It suggests that since 2005, OOH net acquisitions (NA) has shown the strongest growth over the period. OOH payments approach (Payments) saw strong growth prior to the economic downturn due to the large positive contributions from the growth in mortgage interest payments (Figure 6). Of the three measures, it saw the largest fall since the economic downturn, again driven by the falling price of mortgage interest payments and has still not recovered to its pre-downturn peak.

Figure 7 illustrates the changes in OOH growth as 12-month growth rates. OOH rental equivalence (RE) appears at a lag compared with the OOH (NA) and OOH (Payments) approaches for the peak and trough before and after the economic downturn. This lag is because OOH (RE) is a “stock” measure of rents. This means that it captures price information for the entire stock of rental properties, which includes existing contracted properties and properties that are new to the market. Therefore, the flow of new rents based on recent developments in house prices will only gradually influence its development because the stock of existing dwellings is so much larger. This also means that the relative peaks and troughs of OOH (RE) will be subdued relative to OOH (NA), because the large stock of contracted rental properties is likely to mute the impact of volatile house prices.

Figure 6: OOH (rental equivalence), OOH (net acquisitions) and OOH (Payments) indices, index 2005 = 100

UK, Quarter 1 (Jan to Mar) 2006 to Quarter 3 (July to Sept) 2017

Source: Office for National Statistics

Notes:

- Q1 refers to Quarter 1 (Jan to Mar); Q2 refers to Quarter 2 (Apr to June); Q3 refers to Quarter 3 (July to Sept); and Q4 refers to Quarter 4 (Oct to Dec)

Download this chart Figure 6: OOH (rental equivalence), OOH (net acquisitions) and OOH (Payments) indices, index 2005 = 100

Image .csv .xls

Figure 7: 12-month growth rate OOH (rental equivalence); OOH (net acquisitions) and OOH (Payments) growth rate, quarter on corresponding quarter of previous year

UK, Quarter 1 (Jan to Mar) 2006 to Quarter 3 (July to Sept) 2017

Source: Office for National Statistics

Notes:

- Q1 refers to Quarter 1 (Jan to Mar); Q2 refers to Quarter 2 (Apr to June); Q3 refers to Quarter 3 (July to Sept); and Q4 refers to Quarter 4 (Oct to Dec)

Download this chart Figure 7: 12-month growth rate OOH (rental equivalence); OOH (net acquisitions) and OOH (Payments) growth rate, quarter on corresponding quarter of previous year

Image .csv .xlsThe lag for OOH (RE) is not a disadvantage to using the rental equivalence approach in the calculation of the OOH component in the Consumer Prices Index including owner occupiers’ housing costs (CPIH). This is because the rental equivalence approach aims to measure the housing services that are consumed each period (consistent with the principles that underlie the construction of CPIH) and therefore does not need to follow the trend of house prices. If consideration is required of house prices, the House Price Index should be used instead.

Nôl i'r tabl cynnwys8. Spotlight: Exploratory analysis of the impact of errors in the OOH stratum weights

This section is intended to provide an indication of the likely impact that errors in the “ stratum weights” for the Owner Occupiers’ Housing Costs (OOH) Index in the Consumer Prices Index including owner occupiers’ housing costs (CPIH) might have. This analysis is intended to be exploratory only.

“Stratum weights” are expenditure weights that are used to aggregate private rental indices together so that they reflect the owner occupied housing market. Private rental price indices are stratified by the 12 government office regions and four different house types: detached, semi-detached, terraced and flat or maisonette. Stratum weights for these strata are calculated by multiplying counts of the owner occupied dwelling stock by the average rental price:

where Qsy-3 is the quantity of dwelling stock in stratum s in year y-3, and Psy-1 is the average rental price in stratum s in year y-1. For example, the OOH strata weights for 2016 are constructed by multiplying dwelling stock counts for 2013 with average private rental prices for 2015.

Dwelling stock counts are provided by the Department for Communities and Local Government (DCLG) and average rental prices are provided by the Valuation Office Agency (VOA). Note that stratum weights are distinct from the OOH weight, which is used to weight the OOH index into headline CPIH. For more information on stratum weights please see the CPIH Compendium.

Analysis is presented for the CPIH year 2016 only. Note, however, that it is likely that the longer errors in the data persist, the greater the impact that they will have on the index, due to chain linking between years. Therefore some caution is advised when interpreting these results.

Sensitivity analysis for DCLG dwelling stock counts

We simulate the effect of data errors by shifting estimates by 1%, 5%, 10%, 20% and 50%, and recalculating the OOH index for 2016. We do this first for DCLG data then for VOA data.

There are a number of ways that we can shift the estimates. As discussed in the introduction, estimates are stratified by tenure type and region, so we could shift tenure estimates, regional estimates or both together. We focus on shifting both tenure and regional estimates at the same time. This provides us with an indication of the impact in more extreme scenarios without the need to calculate all possible permutations.

We preserve dwelling stock totals and shift the relative share of counts as follows:

and:

such that:

where Q is the published estimate of dwelling stock, Q ̃ is the published estimate shifted by f ∈ {0.01, 0.05, 0.1, 0.2, 0.5}, and e is the error strata in the set of s strata. In this way we consider the impact of an error in the mix of dwelling stock.

Given the number of region and tenure type combinations we further restrict our analysis to focus on the South East and detached, semi-detached and terraced properties. These are chosen to show the maximum potential impact, since the highest dwelling stock counts occur in these strata. This illustrates an extreme scenario, in which the errors are most likely to impact on the index.

The impact of these errors on the OOH index is presented in Table 1. As expected, the magnitude of impacts and the number of non-zero impacts increases with the size of the shift. This is most pronounced when an error is induced in the strata for terraced housing. With a 50% shift the largest impact is 0.12 index points in magnitude and there are non-zero impacts in 12 of the 13 months. The results are generally much smaller with a shift of 10% or less.

For example, for an induced error of 10% in the terraced housing strata the largest impact is just 0.02 index points in magnitude and there are non-zero impacts in 8 of the 13 months. This is much less when an error is induced in the semi-detached strata. Here there are just four non-zero impacts.

Note that, in 2016, the OOH index had a weight of 171 parts per thousand. None of the impacts from inducing an error in the DCLG data feed through to the annual growth rates for headline CPIH. We would hope that larger errors would be identified through Prices Division’s quality assurance procedures.

Table 1: Impact on the OOH index of percentage errors in Department of Communities and Local Government OOH tenure dwelling stock counts for the 2016 OOH stratum weights

| Change | ||||||

|---|---|---|---|---|---|---|

| 50% | 20% | 10% | 5% | 1% | ||

| Error in detached housing and South East stratum | Jan | 0 | 0 | 0 | 0 | 0 |

| Feb | 0.01 | 0 | 0 | 0 | 0 | |

| Mar | 0 | 0 | 0 | 0 | 0 | |

| Apr | 0 | 0 | 0 | 0 | 0 | |

| May | 0.05 | 0.02 | 0.01 | 0 | 0 | |

| Jun | 0.06 | 0.02 | 0.01 | 0.01 | 0 | |

| Jul | 0.05 | 0.02 | 0.01 | 0 | 0 | |

| Aug | 0.04 | 0.02 | 0.01 | 0 | 0 | |

| Sep | 0.03 | 0.01 | 0.01 | 0 | 0 | |

| Oct | 0.07 | 0.03 | 0.02 | 0.01 | 0 | |

| Nov | 0.06 | 0.03 | 0.01 | 0.01 | 0 | |

| Dec | 0.05 | 0.03 | 0.01 | 0.01 | 0 | |

| Jan | 0.02 | 0.01 | 0.01 | 0 | 0 | |

| Max | 0.07 | 0.03 | 0.02 | 0.01 | 0 | |

| Min | 0 | 0 | 0 | 0 | 0 | |

| Count > 0 | 10 | 9 | 9 | 4 | 0 | |

| Error in semi-detached housing and South East stratum | Jan | 0 | 0 | 0 | 0 | 0 |

| Feb | 0.01 | 0 | 0 | 0 | 0 | |

| Mar | 0.02 | 0.01 | 0 | 0 | 0 | |

| Apr | 0 | 0 | 0 | 0 | 0 | |

| May | 0 | 0 | 0 | 0 | 0 | |

| Jun | 0 | 0 | 0 | 0 | 0 | |

| Jul | 0.01 | 0.01 | 0 | 0 | 0 | |

| Aug | 0.01 | 0.01 | 0 | 0 | 0 | |

| Sep | 0.05 | 0.02 | 0.01 | 0.01 | 0 | |

| Oct | 0.02 | 0.01 | 0 | 0 | 0 | |

| Nov | 0.05 | 0.02 | 0.01 | 0.01 | 0 | |

| Dec | 0.07 | 0.03 | 0.01 | 0.01 | 0 | |

| Jan | 0.11 | 0.04 | 0.02 | 0.01 | 0 | |

| Max | 0.11 | 0.04 | 0.02 | 0.01 | 0 | |

| Min | 0 | 0 | 0 | 0 | 0 | |

| Count > 0 | 9 | 8 | 4 | 4 | 0 | |

| Error in terraced housing and South East stratum | Jan | 0 | 0 | 0 | 0 | 0 |

| Feb | 0.02 | 0.01 | 0 | 0 | 0 | |

| Mar | 0.02 | 0.01 | 0 | 0 | 0 | |

| Apr | 0.01 | 0 | 0 | 0 | 0 | |

| May | 0.02 | 0.01 | 0 | 0 | 0 | |

| Jun | 0.03 | 0.01 | 0.01 | 0 | 0 | |

| Jul | 0.03 | 0.01 | 0.01 | 0 | 0 | |

| Aug | 0.04 | 0.01 | 0.01 | 0 | 0 | |

| Sep | 0.07 | 0.03 | 0.01 | 0.01 | 0 | |

| Oct | 0.04 | 0.01 | 0.01 | 0 | 0 | |

| Nov | 0.08 | 0.03 | 0.01 | 0.01 | 0 | |

| Dec | 0.08 | 0.03 | 0.01 | 0.01 | 0 | |

| Jan | 0.12 | 0.05 | 0.02 | 0.01 | 0 | |

| Max | 0.12 | 0.05 | 0.02 | 0.01 | 0 | |

| Min | 0 | 0 | 0 | 0 | 0 | |

| Count > 0 | 12 | 11 | 8 | 4 | 0 | |

| Source: Office for National Statistics | ||||||

Download this table Table 1: Impact on the OOH index of percentage errors in Department of Communities and Local Government OOH tenure dwelling stock counts for the 2016 OOH stratum weights

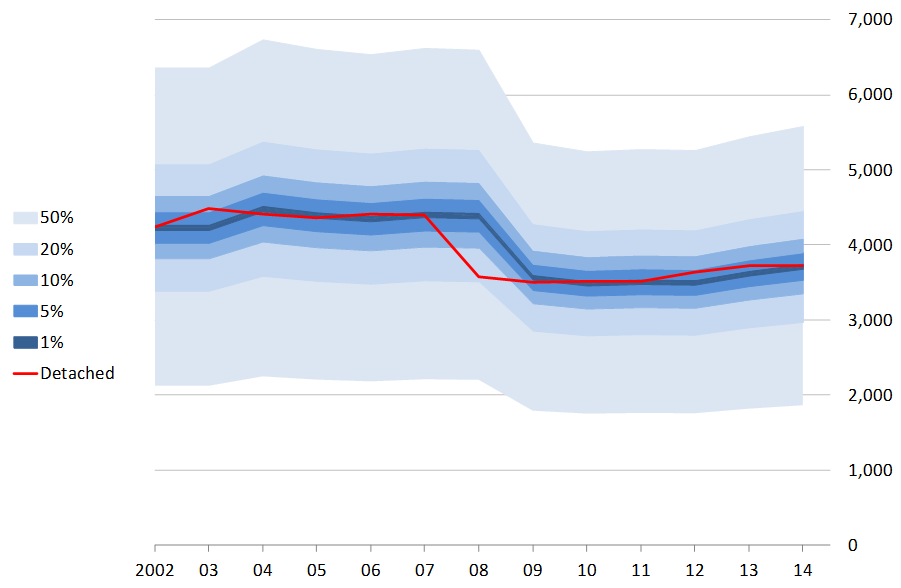

.xls (31.7 kB)To verify this, we consider the likelihood of seeing such shifts in the dwelling stock data. Figure 8 presents owner occupied dwelling stock counts for detached housing in all regions from 2002 to 2014. Although we do not reproduce the charts for all tenure breakdowns, the main findings are broadly the same.

Figure 8: Owner occupied dwelling stock detached housing, all regions

England, 2002 to 2014

Source: Department for Communities and Local Government

Download this image Figure 8: Owner occupied dwelling stock detached housing, all regions

.png (39.5 kB)The shaded regions show where movements in the owner occupied dwelling stock series of 1%, 5%, 10%, 20% and 50% would fall. We see that most movements in the series are within 5%, with only one large movement in 2008 of between 10 and 20% (and a smaller movement of between 5 and 10% in 2003). This coincides with the economic downturn, and is explainable.

The time series for dwelling stock estimates is usually very stable. Therefore large shifts in estimates would be queried by our staff. This suggests that it is unlikely that we would see errors on the scale of those presented in Table 1 for larger shifts. It is possible, however, that the impact of errors will increase the longer the errors persist and so an analysis over more years may show a greater impact.

Sensitivity analysis for VOA average prices

We now consider the impact of inducing errors in the VOA average rents. We shift totals in the same manner as in the previous section:

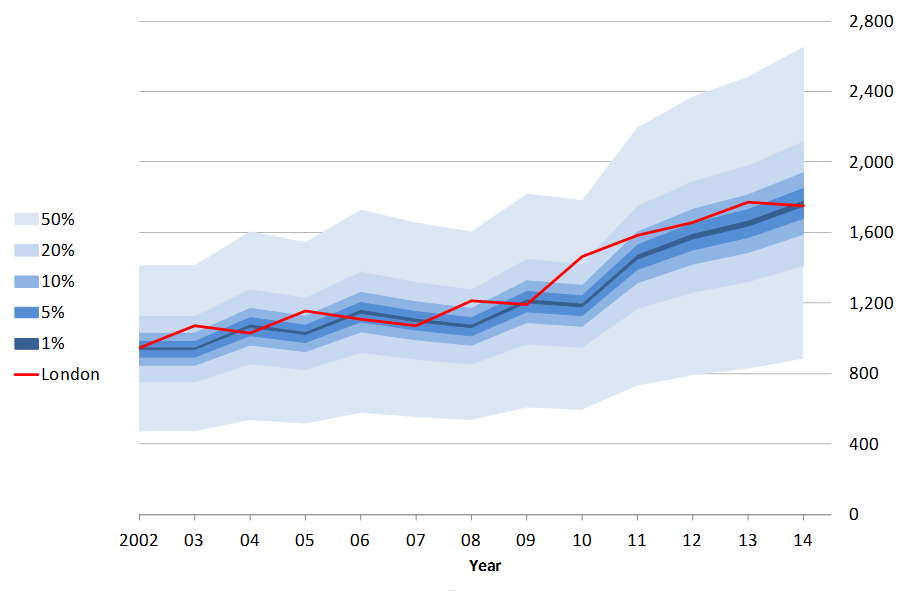

and consider the impact on both tenure type and region. We restrict the analysis to detached, semi-detached and terraced housing and London average private rental prices (because this is the area with the highest average rental prices). The impacts are presented in Table 2.

The results for semi-detached and terraced housing are similar to those we saw in Table 1. There appears to be a greater impact on detached housing, however, where the maximum impact is 0.21 index points in magnitude after inducing an error of 50%. There are impacts in 11 of the 13 months and five of these are greater than 0.1 index points . The highest impact at the 10% error level is 0.4 index points in magnitude and there are non-zero impacts in 10 of the 13 months. Only two impacts are greater than 0.2 index points in magnitude. At this level the impacts are broadly comparable with the impacts for inducing errors in the semi-detached and terraced housing strata.

The 0.21 index point error in October 2016 is the only impact to feed through to headline CPIH, where the annual growth rate is increased by 0.1 percentage points. Induced errors of less than 20% have no impact.

Figure 9: Average private rental prices all tenures

London, 2002 to 2014

Source: Valuation Office Agency

Download this image Figure 9: Average private rental prices all tenures

.png (50.1 kB)Figure 9 shows the average private rental prices for London. These appear more volatile than the dwelling stock counts, with movements of 10 to 20% frequently occurring and even a movement of greater than 20% in 2010. Therefore there is a greater possibility of seeing the impacts described in Table 2 should an error in the data occur. Movements of more than 20% would still be considered unusual, however.

Summary

We have seen that inducing a 50% error in the dwelling stock data for 2013 could lead to impacts on the OOH index of up to 0.12 index points; however, it is unlikely that such an error would go undetected and this should be considered an extreme case.

With average rental price data for 2015, an error on a similar scale could lead to impacts on the OOH index of up to 0.21 index points. This should also be considered an extreme case and we have several mitigation strategies in place to assure the quality of VOA private rental data. These are described in Quality assurance of administrative data used in consumer price statistics.

The impact of these errors on headline CPIH is negligible, however, with a 0.1 percentage points increase in the annual growth rate occurring in only one instance, with VOA data.

To take the analysis further one could also consider the combined impact of inducing an error in both of the datasets at once. The impact would likely be greater; however, it is extremely unlikely that this situation would occur in practice and so this is not considered further here. One could also conduct the analysis over several years to estimate the impact of chain- linking on the OOH index, which may show larger errors.

Table 2: Impact on the OOH index of percentage errors in Valuation Office Agency average private rental prices for the 2016 OOH stratum weights

| Change | ||||||

|---|---|---|---|---|---|---|

| 50% | 20% | 10% | 5% | 1% | ||

| Error in detached housing and London stratum | Jan | 0 | 0 | 0 | 0 | 0 |

| Feb | 0 | 0 | 0 | 0 | 0 | |

| Mar | -0.01 | 0 | 0 | 0 | 0 | |

| Apr | 0.04 | 0.02 | 0.01 | 0 | 0 | |

| May | 0.08 | 0.03 | 0.01 | 0.01 | 0 | |

| Jun | 0.09 | 0.03 | 0.02 | 0.01 | 0 | |

| Jul | 0.1 | 0.04 | 0.02 | 0.01 | 0 | |

| Aug | 0.1 | 0.04 | 0.02 | 0.01 | 0 | |

| Sep | 0.04 | 0.01 | 0.01 | 0 | 0 | |

| Oct | 0.21 | 0.07 | 0.04 | 0.02 | 0 | |

| Nov | 0.16 | 0.06 | 0.03 | 0.01 | 0 | |

| Dec | 0.14 | 0.05 | 0.02 | 0.01 | 0 | |

| Jan | 0.06 | 0.02 | 0.01 | 0 | 0 | |

| Max | 0.21 | 0.07 | 0.04 | 0.02 | 0 | |

| Min | -0.01 | 0 | 0 | 0 | 0 | |

| Count > 0 | 11 | 10 | 10 | 7 | 0 | |

| Error in semi-detached housing and London stratum | Jan | 0 | 0 | 0 | 0 | 0 |

| Feb | 0 | 0 | 0 | 0 | 0 | |

| Mar | 0.01 | 0 | 0 | 0 | 0 | |

| Apr | 0.04 | 0.01 | 0.01 | 0 | 0 | |

| May | 0.03 | 0.01 | 0.01 | 0 | 0 | |

| Jun | 0.02 | 0.01 | 0 | 0 | 0 | |

| Jul | 0.05 | 0.02 | 0.01 | 0.01 | 0 | |

| Aug | 0.07 | 0.03 | 0.01 | 0.01 | 0 | |

| Sep | 0.06 | 0.02 | 0.01 | 0.01 | 0 | |

| Oct | 0.1 | 0.04 | 0.02 | 0.01 | 0 | |

| Nov | 0.09 | 0.04 | 0.02 | 0.01 | 0 | |

| Dec | 0.1 | 0.04 | 0.02 | 0.01 | 0 | |

| Jan | 0.1 | 0.04 | 0.02 | 0.01 | 0 | |

| Max | 0.1 | 0.04 | 0.02 | 0.01 | 0 | |

| Min | 0 | 0 | 0 | 0 | 0 | |

| Count > 0 | 11 | 10 | 9 | 7 | 0 | |

| Error in terraced housing and London stratum | Jan | 0 | 0 | 0 | 0 | 0 |

| Feb | 0.01 | 0 | 0 | 0 | 0 | |

| Mar | 0.01 | 0 | 0 | 0 | 0 | |

| Apr | 0.03 | 0.02 | 0.01 | 0 | 0 | |

| May | 0.04 | 0.02 | 0.01 | 0 | 0 | |

| Jun | 0.04 | 0.02 | 0.01 | 0 | 0 | |

| Jul | 0.05 | 0.02 | 0.01 | 0.01 | 0 | |

| Aug | 0.06 | 0.03 | 0.01 | 0.01 | 0 | |

| Sep | 0.04 | 0.02 | 0.01 | 0.01 | 0 | |

| Oct | 0.09 | 0.04 | 0.02 | 0.01 | 0 | |

| Nov | 0.09 | 0.04 | 0.02 | 0.01 | 0 | |

| Dec | 0.08 | 0.04 | 0.02 | 0.01 | 0 | |

| Jan | 0.09 | 0.04 | 0.02 | 0.01 | 0 | |

| Max | 0.09 | 0.04 | 0.02 | 0.01 | 0 | |

| Min | 0 | 0 | 0 | 0 | 0 | |

| Count > 0 | 12 | 10 | 10 | 7 | 0 | |

| Source: Office for National Statistics | ||||||

Download this table Table 2: Impact on the OOH index of percentage errors in Valuation Office Agency average private rental prices for the 2016 OOH stratum weights

.xls (31.2 kB)9. Annex 1: List of published articles on the different approaches of measuring OOH

Table 3: List of published articles on the different approaches of measuring OOH

| Publication | Description |

|---|---|

| Understanding the different approaches of measuring owner occupiers’ housing costs (OOH): Quarter 2 (Apr to June) 2016 | This is the first article in the series and therefore it provides a more detailed description of each of the methods in the first section of the article (Different approaches of measuring owner occupiers’ housing costs). It also provides a more detailed commentary and analysis of the historical time series and the main drivers behind these long-term trends. Spotlight: the relationship between private rents and house prices |

| Understanding the different approaches of measuring owner occupiers’ housing costs (OOH): UK, Quarter 3 (July to Sept) 2016 | This article provides more of a template for future quarterly releases, with more focus on the latest quarterly movements in the different measures rather than the longer-term trends and methodology. Spotlight: owner occupiers' housing costs in the RPI |

| Understanding the different approaches of measuring owner occupiers’ housing costs (OOH): Weights analysis | This article was published as a stand-alone piece of analysis, which aggregated the approaches with the Consumer Prices Index (CPI) to create a hybrid aggregate inflation measure that includes OOH as measured by each approach. The analysis will be updated on a quarterly basis in a dataset published alongside each quarterly article, and is summarised in Annex 2 of the quarterly article. |

| Understanding the different approaches of measuring owner occupiers’ housing costs (OOH): UK, Quarter 4 (Oct to Dec) 2016 | This article follows the template of the previous quarterly releases. Spotlight: Analysis of revisions to OOH(RE) expenditure weights |

| Understanding the different approaches of measuring owner occupiers’ housing costs (OOH): UK, Quarter 1 (Jan to Mar) 2017 | This article follows the template of the previous quarterly releases. Spotlight: changes to methodology |

| Understanding the different approaches of measuring owner occupiers’ housing costs (OOH): UK, Quarter 2 (April to June) 2017 | This article follows the template of the previous quarterly releases. |

10. Annex 2: Methodology

Annex 2A: Payments methodology

The payments approach is an experimental method for measuring owner occupiers’ housing costs (OOH (Payments)) that attempts to capture what households pay out as owner occupiers when consuming housing (excluding capital repayments). This includes mortgage interest payments, transaction costs such as estate agency fees and legal fees, and running costs such as repairs and maintenance, ground rent and dwelling insurance.

Table 4 presents a full list of the OOH (Payments) component indices, as well as the source data for the prices and weights information used to construct the index. Most of the indices are drawn from the Retail Prices Index (RPI), which can be said to follow a payments approach to measuring OOH.

One of the problems for the payments approach is to account for major repairs and maintenance, which are difficult to obtain prices for on a consistent basis. One method of dealing with this problem is the approach taken in the RPI, which includes a component for the depreciation of the property. The approach was characterised as estimating the amount of money households should put aside for necessary major repairs and updating to maintain the value of the property. The method used here, which is more in line with a true payments approach, is to include a major repairs and maintenance component, proxied by the regular repairs and maintenance series in the Consumer Prices Index (CPI) due to lack of an alternative data source.

The other sub-index that does not come from the RPI is the Stamp Duty Index. This has been constructed for the OOH net acquisitions (NA) approach (see Annex 2B) and uses national accounts gross fixed capital formation (GFCF) and household final consumption expenditure (HHFCE) as the source data for the expenditure weights.

Table 4: Source data for OOH (Payments) sub-indices

| OOH (Payments) indices | Source of price data | Source of weights data |

|---|---|---|

| Mortgage interest payments | RPI | RPI |

| Council Tax (Great Britain) | RPI | RPI |

| Northern Ireland rates | RPI | RPI |

| Dwelling insurance | RPI | RPI |

| Ground rent | RPI | RPI |

| Stamp duty | Stamp Duty index | HHFCE and GFCF |

| Estate agent fees | RPI | RPI |

| Home- buyers survey | RPI | RPI |

| Major repairs and maintenance | CPI | HHFCE |

| House conveyancing | RPI | RPI |

| Source: Office for National Statistics | ||

Download this table Table 4: Source data for OOH (Payments) sub-indices

.xls (27.1 kB)Annex 2B: Net acquisitions methodology

The net acquisitions approach is an experimental method for measuring owner occupiers’ housing costs (OOH (NA)) that are associated with the purchase and ongoing ownership of dwellings for own use. As the Harmonised Index of Consumer Prices (HICP) does not cover investment spending, the net acquisitions approach treats a home as the purchase of a good that is part asset (the land) and part consumable (the house) and excludes the land component from the index.

OOH (NA) also includes costs associated with buying and maintaining a house; for example, self-builds and renovations, repairs and maintenance, transfer costs and dwelling insurance. The method we use to calculate OOH (NA) was proposed by Eurostat. It groups sub-indices measuring different aspects of OOH costs into two classes; those related to the acquisition of dwellings and those related to the ownership of dwellings.

The ideal method for excluding the land component in OOH (NA) is the net-net approach, whereby prices and weights both exclude the land component from the house purchase. However, as many member states (including the UK) are unable to implement the net-net approach due to a lack of available data, Eurostat requires all member states to use the net-gross (net weight, gross price) approach. This includes the use of the UK House Price Index (HPI), which does not separate between the land and house price, within the “acquisition of new dwellings” and “existing dwellings new to the OOH sector” components. This means that the net acquisitions approach presented here will include some measure of asset price in the index.

In addition to the HPI, Table 5 presents the other sources of component price indices. With the exception of the Stamp Duty I ndex, all are drawn from some of our existing publications, including the Consumer Prices Index (CPI), Producer Price Index (PPI) and Retail Prices Index (RPI). More information about each of the sub-indices is available.

Table 5 also shows that the component expenditure weights used to compile OOH (NA) are derived from the national accounts gross fixed capital formation (GFCF) and household final consumption expenditure (HHFCE). The “net” principle in net acquisitions relates to the fact that only transactions that occur between the OOH sector and other sectors (for example, construction firms and private landlords) should be included. However, we cannot currently distinguish between sectors and therefore the weight for “acquisition of new dwellings” includes expenditure on all newly- constructed dwellings and not those specifically destined for the OOH sector as per the methodology outlined by Eurostat.

In addition, a weight for “existing dwellings new to the OOH sector” does not exist; therefore, a zero weight is currently applied. The “other services related to ownership of dwellings” is based on the national accounts series 04.4.4 “other services relating to the dwelling” and has zero expenditure recorded in Blue Book 2016. It therefore has a weight of zero in the net acquisitions approach and is excluded from the calculation.

Table 5: Source data for OOH (net acquisitions) sub-indices

| OOH (NA) Indices | Source of price data | Source of weights data | |

|---|---|---|---|

| Acquisitions of new dwellings (excluding land) | HPI | GFCF | |

| Self-builds and renovations | PPI and CPI | GFCF | |

| Existing dwellings new to the OOH sector | HPI | No weight currently exists | |

| Services related to acquisition | RPI and a Stamp Duty index | HHFCE and GFCF | |

| Major repairs and maintenance | CPI | HHFCE | |

| Insurance connected with the dwelling | RPI | HHFCE | |

| Other services related to ownership of dwellings | No price index | HHFCE | |

| Source: Office for National Statistics | |||

Download this table Table 5: Source data for OOH (net acquisitions) sub-indices

.xls (27.1 kB)Annex 2C: Rental equivalence methodology

The rental equivalence approach is a method for measuring owner occupiers’ housing costs (OOH (RE)) at the point at which the services provided by OOH are consumed.

Rental equivalence uses the rent paid for an equivalent house as a proxy for the costs faced by an owner occupier. The rent charged by landlords covers not just the property but many of the other costs borne by owner occupiers, such as repairs and maintenance, and transaction costs. Therefore, under the rental equivalence approach, these are not estimated separately, as to do so would introduce double-counting. The rental equivalence approach also does not capture changes in asset value; rather it measures the change in price of housing services provided.

The rental equivalence approach uses private rental data from the Valuation Office Agency (VOA), supplemented with data from the devolved administrations. The data are stratified regionally as well as by property type (detached, semi-detached, terraced, or flat or maisonette) and whether the property is furnished or unfurnished. For each stratum, elementary aggregates are calculated which are then weighted together to create an aggregate index.

The private rental data are used in both the calculation of the OOH component in the Consumer Prices Index including owner occupiers’ housing costs (CPIH) – the rental equivalence approach – and the Index of Private Housing Rental Prices (IPHRP). The difference between the indices stems from the different weights used to combine the elementary aggregates. Strata weights for OOH (RE) are designed to represent the owner occupied market and strata weights for IPHRP are designed to represent the private rental market.

For example, looking at the range of housing available on the market, there would be a larger proportion of typical rental properties (for example, one-bedroom flats) and the weights calculated would reflect this mix. By comparison, the owner occupied housing weights will reflect the larger proportion of more typically purchased properties (for example, three-bedroom detached houses). Expenditure weights are calculated by multiplying dwelling stock counts for the owner occupied sector or private rental sector by average rental prices.

For a more detailed overview of the rental equivalence approach methodology, please see the CPIH compendium.

Nôl i'r tabl cynnwys11. Annex 3: Weights analysis

In January 2017, we published a stand-alone piece of analysis that aggregated the different approaches to measuring owner occupiers’ housing costs (OOH) with the Consumer Prices Index (CPI) to create a hybrid aggregate inflation measure, which includes OOH as measured by each approach: Understanding the different approaches of measuring owner occupiers’ housing costs (OOH): Weights analysis.

From March 2017, the Consumer Prices Index including owner occupiers’ housing costs (CPIH) was extended to include Council Tax. To ensure that CPIH is of the best possible quality, the full back series of CPIH has been revised to incorporate Council Tax and revised weights for OOH using the rental equivalence approach. This means that the CPIH series published in the dataset alongside this release will be different to that published in the January article.

There are also changes to the CPI-H (Payments) and CPI-H (NA) series. To ensure coherence with the new CPIH series, CPI-H (NA) has been revised to include Council Tax. OOH (NA) remains the same.

Council Tax was double-counted in the previous version of CPI-H (Payments). This error has now been corrected in the latest published dataset. This does not affect the OOH(Payments) series.

For reference, the formula used to calculate the aggregate indices for CPI-H (Payments) and CPI-H (NA) is as follows:

Equation notes:

p is the price level.

q is the volume purchased.

r is the reference period.

t is the time period.

i is the items in the Consumer Prices Index basket.

CT is Council Tax.

CPIH is as published.