1. Main points

The 12-month growth rate of the Consumer Prices Index including owner occupiers’ housing costs (CPIH) was 1.5% in October 2019, down from 1.7% in September 2019; this is the lowest annual rate since November 2016.

Transport and energy prices have contributed to falling 12-month growth rates for CPIH in recent months.

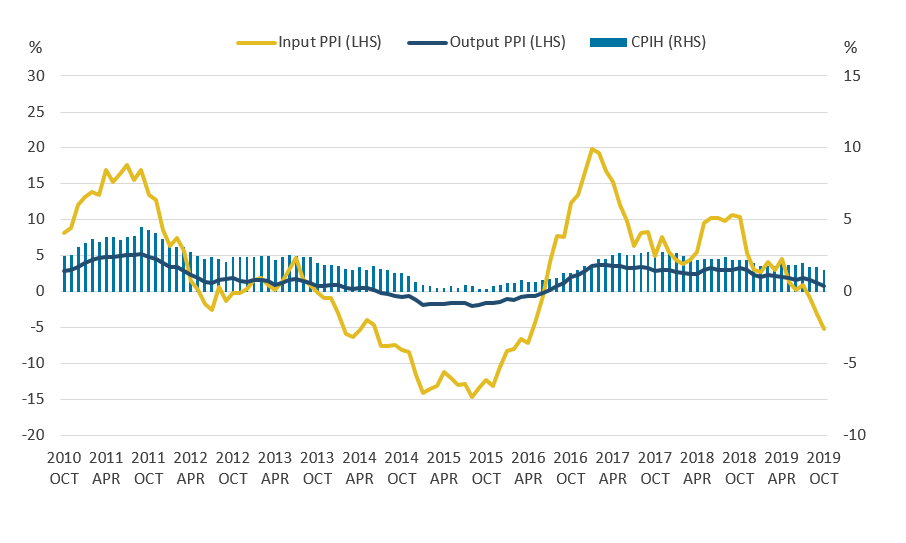

The output Producer Price Index (output PPI) grew by 0.8% in the 12 months to October 2019, down from growth of 1.2% in the 12 months to September 2019.

The input Producer Price Index (input PPI) fell by 5.1% on the year to October 2019, down from a fall of 3.0% in September 2019, largely driven by a fall in crude oil prices.

Average house prices in the UK increased by 1.3% in the year to September 2019, unchanged from August 2019.

Mortgage transaction volumes for first-time buyers have overtaken those for former owner occupiers in 2019.

2. Statistician's comment

Commenting on today’s inflation figures, an ONS spokesperson said:

“A fall in utility prices due to a lowering of the energy price cap helped ease inflation in October. However, this was partially offset by rising clothing prices.”

Nôl i'r tabl cynnwys3. Summary

Today’s inflation figures are in line with the Bank of England’s inflation forecast. Figure 1 shows that the 12-month growth rate of the Consumer Prices Index including owner occupiers’ housing costs (CPIH) was 1.5% in October 2019, down from 1.7% in September 2019. This is the lowest rate since November 2016. This downward movement mainly came from housing and household services because of gas and electricity prices falling between September and October 2019, following a reduction to the Ofgem energy price cap. In 2018, providers had increased prices by 2.0%, between the same two months.

The output Producer Price Index (output PPI) grew by 0.8% in the 12 months to October 2019, down from a growth of 1.2% in the 12 months to September 2019. Eight out of ten product groups provided upward contributions to the annual rate of output inflation, with petroleum, and chemicals and pharmaceuticals being the only groups providing a downward contribution.

The input Producer Price Index (input PPI) fell by 5.1% in the 12 months to October 2019, down from a negative growth of 3.0% in the 12 months to September 2019. This is the third consecutive month that the rate has been negative and the lowest annual rate since April 2016. Crude oil was the biggest driver of the fall, with crude oil prices falling by almost 23% on the year.

The Bank of England monitors inflation and growth in the UK economy in order to set the Bank interest rate. Currently, the Bank of England targets a Consumer Prices Index (CPI) 12-month growth rate of 2%. The Bank of England expects inflation in the UK to fall further next year partly because of lower utility bills. Beyond that, it expects rising excess demand to increase inflationary pressures.

Figure 1: The 12-month growth rates of CPIH, input PPI and output PPI all fell between September 2019 and October 2019

12-month growth rates for input PPI (left-hand side), output PPI (left-hand side), and CPIH (right-hand side), UK, October 2010 to October 2019, %

Source: Office for National Statistics – Consumer Prices Index including owner occupiers' housing costs

Download this image Figure 1: The 12-month growth rates of CPIH, input PPI and output PPI all fell between September 2019 and October 2019

.png (40.2 kB) .xlsx (21.1 kB)Notes

- These data are also available within the Dashboard: Understanding the UK economy.

4. Contributions to the Consumer Prices Index including owner occupiers’ housing costs (CPIH)

Figure 2 shows the contributions to the Consumer Prices Index including owner occupiers’ housing costs (CPIH) by international classification of individual consumption by purpose (COICOP). Looking at contributions allows us to analyse the categories that have driven headline inflation over recent months.

The 12-month growth rate of CPIH was 1.5% in October 2019, down from 1.7% in September 2019, and down from 2.7% in January 2018. Recent falls have largely been driven by falling contributions from the transport, and housing and household services divisions.

Figure 2: The 12-month growth rate of CPIH has gradually fallen since January 2018

Contributions to the CPIH 12-month rate, UK, Jan 2018 to Oct 2019, % and percentage points

Source: Office for National Statistics – Consumer Prices Index including owner occupiers' housing costs

Notes:

- Contributions may not sum due to rounding.

- Other goods and services is made up of health, communications, education and miscellaneous goods and services.

Download this chart Figure 2: The 12-month growth rate of CPIH has gradually fallen since January 2018

Image .csv .xlsMost components have consistently made a positive contribution to CPIH growth throughout the period, with exceptions including clothing and footwear which have made negative contributions in some months.

Transport saw the largest variation in its contribution to the CPIH 12-month growth rate in 2018, rising sharply from a contribution of 0.30 percentage points in April 2018 to 0.75 percentage points in August 2018 before falling to a contribution of 0.41 percentage points in December 2018. This movement was largely driven by fuels and lubricants – prices for which tend to move broadly in line with changes in world prices for crude oil, which had been falling for several months. Other components of transport saw price variations but had less impact on the 12-month growth rate because of their lower weight within the inflation basket.

Figure 3: Transport has made decreasing contributions to CPIH in recent months

Contributions to the 12-month growth rate of all items CPIH within transport, UK, January 2018 to October 2019, % and percentage points

Source: Office for National Statistics – Consumer Prices Index including owner occupiers' housing costs

Notes:

- Contributions may not sum due to rounding.

- Transport services is made up of passenger transport by air, passenger transport by railway, passenger transport by road and passenger transport by sea and inland waterway.

Download this chart Figure 3: Transport has made decreasing contributions to CPIH in recent months

Image .csv .xlsTransport’s contribution to the 12-month growth rate of CPIH fell consistently between April and September 2019 but has risen slightly in October 2019. A range of components have contributed to this fall, including second-hand cars, that have made consistently negative contributions since April 2019.

There may be a number of factors affecting the second-hand car market this year including decreased demand, increased supply, and uncertainty around environmental and political factors. Second-hand cars nonetheless made positive contributions to the 12-month growth rate of CPIH over much of the rest of the period.

Figure 4: Contributions from electricity and gas have moved broadly in line with the Ofgem cap

Contributions to the 12-month growth rate of all items CPIH within housing and household services, UK, January 2018 to October 2019, % and percentage points

Source: Office for National Statistics – Consumer Prices Index including owner occupiers' housing costs

Notes:

- Contributions may not sum due to rounding.

- Other includes products for the regular maintenance and repair of dwelling, services for the regular maintenance and repair of dwelling, water supply, sewerage collection, liquid fuels and solid fuels.

Download this chart Figure 4: Contributions from electricity and gas have moved broadly in line with the Ofgem cap

Image .csv .xlsHousing and household services consistently made one of the largest contributions to the 12-month growth rate of CPIH over the period. It made an increasing contribution over much of 2018, peaking in December 2018 with a contribution of 0.62 percentage points. This increase was largely driven by increasing contributions from the electricity, gas and other fuels component.

Gas and electricity prices rose by around 7% and 9% respectively, between January and December 2018. As with fuels and lubricants, energy prices were driven to a large extent by movements in world prices, as well as seasonal patterns for gas and electricity prices.

Gas and electricity continue to be among the largest drivers of movement in the overall contribution of housing and household services in 2019. Since January 2019, price movements for gas and electricity have reflected changes to the Ofgem energy price cap.

Figure 5: Contributions from food and non-alcoholic beverages have generally seen a decline over the period

Contributions to the 12-month growth rate of all items CPIH within food and non-alcoholic beverages, UK, January 2018 to October 2019, % and percentage points

Source: Office for National Statistics – Consumer Prices Index including owner occupiers' housing costs

Notes:

- Contributions may not sum due to rounding.

- Other includes milk, cheese and eggs, oils and fats, sugar, jam, honey, syrups, chocolate and confectionary, food products and non-alcoholic beverages.

Download this chart Figure 5: Contributions from food and non-alcoholic beverages have generally seen a decline over the period

Image .csv .xlsContributions from food and non-alcoholic beverages to the CPIH 12-month growth rate have varied somewhat over the period since January 2018. Most notably, in late 2018 and early 2019, several food and non-alcoholic beverage categories made negative contributions to CPIH, with meat being one of the biggest drivers.

Vegetables have generally made larger contributions to the 12-month growth rate of CPIH in 2019 than in 2018. This likely reflects the impact of weather on crop production with a particularly cold winter in early 2018, followed by a heatwave, affecting crop yields. Price increases for vegetables can take time to fully feed through to consumer prices, which may explain why the effects are being seen more in 2019.

Nôl i'r tabl cynnwys5. Mortgages transaction volumes

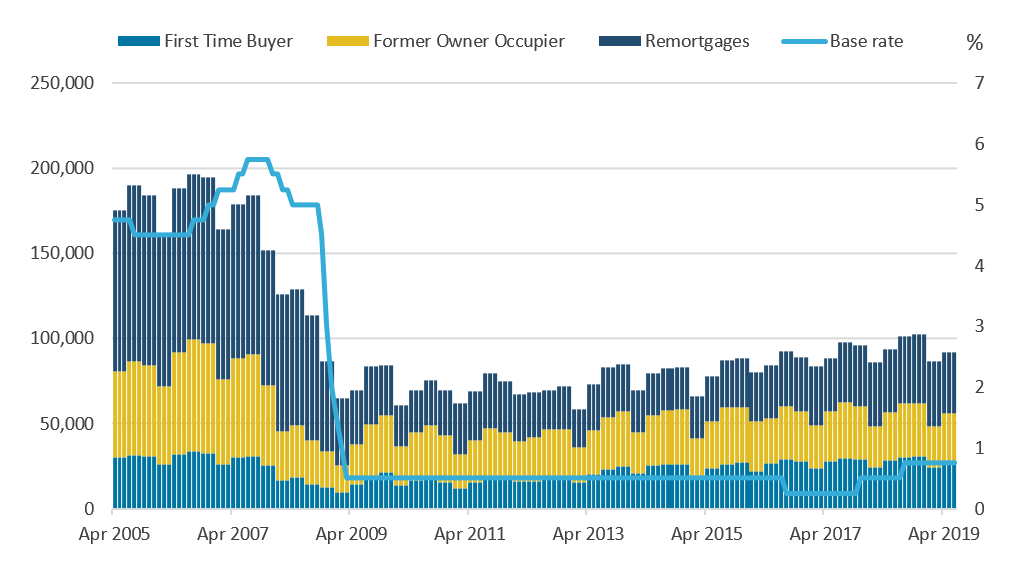

Figure 6 shows mortgage transaction volumes since 2005 for first-time buyers, former owner occupiers and for remortgages for the UK. Mortgage transaction volumes for first-time buyers have been consistently lower than those for former owner occupiers over most of the period but have been gradually converging and have slightly overtaken former owner occupiers, for the first time, in the first two quarters of 2019.

The market share for first-time buyers in Quarter 2 (Apr to June) 2019 was 31% of mortgage transactions, compared to 30% for former owner occupiers and 39% for remortgages. This is a considerable shift from the beginning of the period, when first-time buyers made up just 17% of the market, former owner occupiers accounted for 29% of mortgage transactions and the remaining 54% were remortgages.

Figure 6: Mortgage transaction volumes for first-time buyers have overtaken those for former owner occupiers in 2019

Mortgage transaction volumes (LHS) and Bank of England base rate (RHS), UK, April 2005 to June 2019

Source: Financial Conducts Authority (FCA) - Product Sales Data, Bank of England - official bank rate (IUDBER)

Notes:

- Quarterly mortgage transaction volumes have been represented as monthly volumes by dividing them equally between each month in the quarter.

Download this image Figure 6: Mortgage transaction volumes for first-time buyers have overtaken those for former owner occupiers in 2019

.png (22.6 kB) .xlsx (24.2 kB)Mortgage transaction volumes and the Bank of England base rate fell sharply during the 2008 to 2009 financial crisis. For new mortgages, this likely reflects market conditions and a similar fall in property sales. For remortgages, it could also be a reaction to movements in the Bank of England base rate, although changes in the base rate are not necessarily fully passed on as changes in the lending rates by lenders.

For existing home owners, when interest rates are high, remortgaging fairly regularly may appeal as a way to balance the cost of repayments and the predictability of monthly outgoings. A variable or tracker mortgage rate would risk sudden, possibly large increases in mortgage payments as the base rate increased. Longer-term fixed rate mortgages would typically incur a higher mortgage rate to accommodate the risk of a base rate increase.

From March 2009 to July 2016, the base rate remained unchanged at 0.5%, which was 5.25 percentage points lower than its pre-downturn peak in July to November 2007. The low level of remortgages over this period perhaps reflects consumers’ perceptions that the base rate was unlikely to change.

Mortgage transaction volumes remain below their pre-downturn peak for first-time buyers, former owner occupiers and remortgages. In the most recent quarter, total remortgage volumes were 108,000, just 35% of their pre-downturn peak in Quarter 3 (July to Sept) 2005. Former owner occupier mortgage volumes in the most recent quarter were 83,000, around 42% of the quarterly volume at their pre-downturn peak in Quarter 3 2006. Mortgage volumes for first-time buyers are more in line with their pre-downturn levels with 85,000 transactions in the most recent quarter, around 84% of the 101,000 transactions in Quarter 3 2006.

A range of policies have been introduced in recent years to support first-time buyers getting onto the property ladder. The schemes vary in different parts of the UK and include Help to Buy ISAs, shared equity schemes, rent to own schemes and stamp duty reductions. This may partly explain the convergence of mortgage transactions for first-time buyers and former owner occupiers over recent years.

Figure 7: Mortgage transaction volumes for first-time buyers have overtaken those for former owner occupiers in 2019

Mortgage transaction volumes, London, April 2005 to June 2019

Source: Financial Conducts Authority (FCA) - Product Sales Data

Download this chart Figure 7: Mortgage transaction volumes for first-time buyers have overtaken those for former owner occupiers in 2019

Image .csv .xlsFigure 7 shows mortgage volumes for first-time buyers, former owner occupiers and remortgages for London since 2005. The volume of first-time buyer transactions has exceeded former owner occupier mortgage transactions since 2013. Remortgages grew between 2015 and 2018, in contrast to both first-time buyers and former owner occupier transactions which decreased over the period.

Annual house price growth in London fell sharply during the financial crisis and was consistently negative between July 2008 and September 2009, reaching a low of negative 16.6% growth on the year to April 2009. More recently, house prices have fallen again, and annual growth has been consistently negative since March 2018.

Generally speaking, falling house prices favour first-time buyers as properties become relatively more affordable, while potentially reducing the equity available to former owner occupiers to move up the property ladder. Nonetheless, average house prices have risen considerably over the period, with the average London property price of £475,000 in September 2019 being more than double the average price of £231,000 in March 2005.

Nôl i'r tabl cynnwys