Cynnwys

- Main points

- Statistician’s comment

- Summary

- Price growth for goods in the UK has converged with that for the EU without the UK in recent months, while price growth for services remains consistently higher in the UK

- Material costs made an increasing contribution to the construction output price index from mid-2016

- Deposit ratios have been gradually falling since 2010 with rates for former owner-occupiers returning to pre-downturn levels

- Authors

1. Main points

- The 12-month growth rate of the Consumer Prices Index including owner occupiers’ housing costs (CPIH) was 2.2% in October 2018, unchanged from September 2018.

- The input Producer Price Index (input PPI) grew by 10.0% in the 12 months to October 2018, slowing from 10.5% in the 12 months to September 2018.

- The output Producer Price Index (output PPI) grew by 3.3% in the 12 months to October 2018, up from 3.1% in the 12 months to September 2018.

- The 12-month growth rate for the price of consumer goods in the UK has converged with those for Germany and the EU excluding the UK in recent months.

- The 12-month growth rate for the price of consumer services in the UK has consistently been above those for France, Germany and the EU excluding the UK in recent years.

- Since mid-2016, material costs have made an increasing contribution to the construction output price index.

- Since 2010, mortgage deposit ratios have gradually fallen, with rates for former owner-occupiers returning to pre-downturn levels.

2. Statistician’s comment

Commenting on today’s inflation figures, Head of Inflation Mike Hardie said:

“Prices paid by consumers continued to rise at a steady rate with falls in food and clothing offset by rising utility bills and petrol, as crude prices continued to rise.

“House price growth ticked up a little as increases in Wales, Scotland and the Midlands were to some extent offset by falls in central London.”

Nôl i'r tabl cynnwys3. Summary

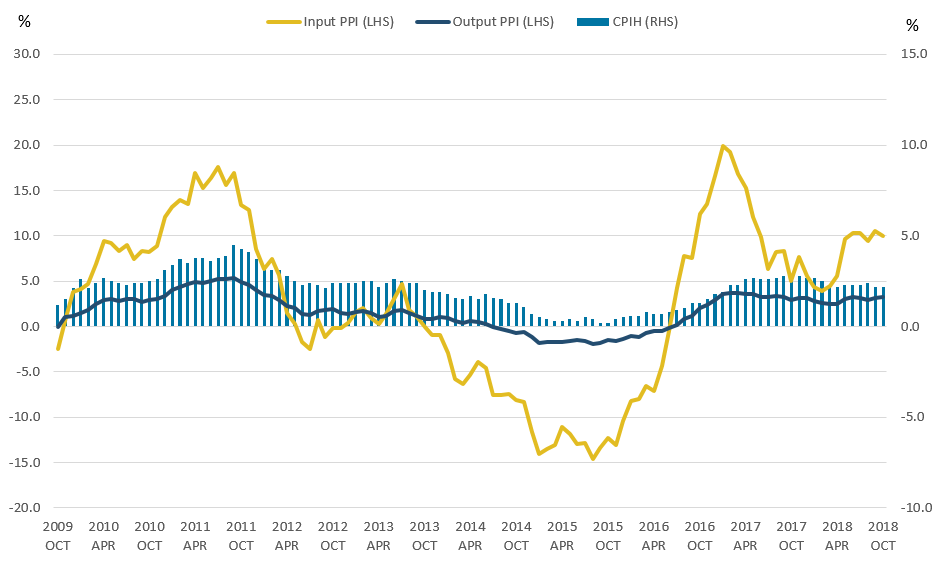

Figure 1 shows that the 12-month growth rate of the Consumer Prices Index including owner occupiers’ housing costs (CPIH) was 2.2% in October 2018, unchanged from September 2018. The large downward contributions from food and non-alcoholic beverages; clothing and footwear; and some transport elements were offset by upward contributions from rising petrol, diesel and domestic gas prices.

The input Producer Price Index (input PPI) grew by 10.0% in the 12 months to October 2018, slowing from 10.5% in the 12 months to September 2018. All product groups except crude oil contributed to the fall in the 12-month growth rate. The output Producer Price Index (output PPI) grew by 3.3% in the 12 months to October 2018, up from 3.1% in the 12 months to September 2018. The largest upward contributions to the increase in the annual rate came from petroleum, and clothing, textiles and leather.

Figure 1: 12-month growth rates for input PPI and output PPI (left-hand side), and CPIH (right-hand side)

UK, October 2009 to October 2018

Source: Office for National Statistics

Notes:

- These data are also available within the Dashboard: Understanding the UK economy.

Download this image Figure 1: 12-month growth rates for input PPI and output PPI (left-hand side), and CPIH (right-hand side)

.png (39.0 kB) .xlsx (20.5 kB)4. Price growth for goods in the UK has converged with that for the EU without the UK in recent months, while price growth for services remains consistently higher in the UK

Figure 2 shows movements in the 12-month growth rate for goods components of the Harmonised Index of Consumer Prices (HICP) in the UK, France, Germany and the average for the EU without the UK. The HICP is equivalent to the Consumer Prices Index (CPI) in the UK and therefore does not include owner occupiers’ housing costs. Goods account for around 52% of the HICP basket in the UK in 2018, for 56% in France, 54% in Germany and 58% in the EU without the UK; services account for the remainder of the basket.

Growth rates for all three countries and the EU without the UK have followed similar trends over the period since January 2010, but price growth in the UK has been more volatile than elsewhere. This was particularly pronounced in 2015 and 2016, when there was negative price growth for goods and prices in the UK fell at approximately twice the rate of France, Germany and the EU without the UK.

Likewise, for most of 2017, prices for goods grew more quickly in the UK than elsewhere but growth rates have since converged, with growth since mid-2018 being similar for the UK, Germany and the EU without the UK, but higher in France.

Figure 2: 12-month growth rates for goods components of the Harmonised Index of Consumer Prices

UK, France, Germany and the EU without the UK, January 2014 to October 2018

Source: Eurostat, Office for National Statistics

Notes:

- The most recent available data for France, Germany and the EU without the UK are for September 2018. October data for the UK are from the CPI.

Download this chart Figure 2: 12-month growth rates for goods components of the Harmonised Index of Consumer Prices

Image .csv .xlsFigure 3 shows contributions to the 12-month growth rate of goods prices for the UK from January 2014 to October 2018. Changes to the 12-month growth rate of goods prices are often driven by movements in the fuels and lubricants component, which made a negative contribution to the overall growth rate between January 2014 and August 2016, before turning positive in September 2016. Fuels and lubricants prices largely reflect movements in world prices for crude oil, which may explain why price growth also rose sharply in the rest of the EU, France and Germany in late 2016.

Figure 3: Contributions to the 12-month growth rate of goods prices

UK, January 2014 to October 2018

Source: Office for National Statistics

Notes:

- The "other" component includes: materials for maintenance and repair; water supply; purchase of vehicles; spare parts and accessories; furniture, furnishings and carpets; household textiles; major appliances and small electric goods; glassware, tableware and household utensils; tools and equipment for house and garden; non-durable household goods; and medical products, appliances and equipment.

- Contributions to the 12-month growth rate of goods may not sum exactly due to rounding.

Download this chart Figure 3: Contributions to the 12-month growth rate of goods prices

Image .csv .xlsThe depreciation of sterling from mid-2016 likely also drove up the 12-month growth rate for goods prices in the UK. Goods components of CPI tend to be more import intensive than services components, and therefore more responsive to movements in the exchange rate. This may explain why the UK experienced higher 12-month growth rates for goods prices than France, Germany or the EU without the UK in 2017.

Figure 4 shows movements in the 12-month growth rate for services components of the HICP for the UK, France, Germany and the average for the EU without the UK. Growth rates for services prices appear volatile in all three countries and the EU without the UK but, when compared with goods, price growth only moved within a narrow range and grew at a consistently faster rate in the UK than elsewhere across the period.

Figure 4: 12-month growth rates for services components of the Harmonised Index of Consumer Prices

UK, France, Germany and the EU without the UK, January 2014 to October 2018

Source: Eurostat, Office for National Statistics

Notes:

- The most recent available data for the EU without the UK are for September 2018. October data for the UK are from the CPI.

Download this chart Figure 4: 12-month growth rates for services components of the Harmonised Index of Consumer Prices

Image .csv .xlsFigure 5 shows contributions to the 12-month growth rate of services prices for the UK from January 2014 to October 2018. Actual rentals for housing have made a falling contribution to the 12-month growth rate in recent years while transport services and restaurants and hotels have fairly consistently made amongst the highest contributions to the growth rate over the period.

Figure 5: Contributions to the 12-month growth rate of services prices

UK, January 2014 to October 2018

Source: Office for National Statistics

Notes:

- The "other" component includes: cleaning, repair and hire of clothing; services for maintenance and repair; sewerage collection; repair of household appliances; domestic services and household services; out-patient services; hospital services; communication; repair of audio-visual equipment and related products; hairdressing and personal grooming establishments; social protection; insurance; financial services (not elsewhere classified); and other services (not elsewhere classified).

- Contributions to the 12-month growth rate of services may not sum due to rounding.

Download this chart Figure 5: Contributions to the 12-month growth rate of services prices

Image .csv .xlsMost services components have a relatively low import intensity but, even so, imported inputs can drive movements in the overall price. Transport services includes passenger transport by railway, road, air and sea and inland waterway, all of which use fuels as an input and therefore face costs that vary with world prices for crude oil. This may account for the increased contribution from transport services from late 2016. Large movements in the contributions from transport services in March and April of each year reflect the change in the timing of Easter and its effects on air fares.

Nôl i'r tabl cynnwys5. Material costs made an increasing contribution to the construction output price index from mid-2016

The Construction Output Prices Indices (OPIs) provide a best estimate of inflation within the UK construction industry. The OPIs are compiled using existing Office for National Statistics (ONS) data sources on a project cost basis. This approach involves input costs, which are material, labour and plant costs, weighted together for a selection of types of construction projects, with a mark-up being applied to account for profit by the construction firm. The result is considered a proxy for output prices.

Material costs are estimated using individual Producer Price Indices (PPIs), plant costs are measured using the Services Producer Price Index (SPPI) for construction plant hire and labour costs are measured using the Average Weekly Earnings (AWE) index for construction.

The all construction Output Price Index (OPI) is composed of two sectors: new work, and repair and maintenance, which then are aggregated to give an all construction work output.

Since ONS took responsibility for this publication in 2015 with an improved methodology, new work has generally been the biggest driver to the 12-month growth rate. This is mainly down to new work accounting for a larger proportion of the construction industry than repair and maintenance and the weights used to calculate the all construction OPI reflecting this.

The new work component of the construction OPI can be broken down into five types of work – housing (detached house and apartment), infrastructure (roads and bridges), public other (new office building), private industrial (factory building) and private commercial (new office building). Figure 6 shows the contributions each of these work types has made to the 12-month growth rate of new work from September 2015 to September 2018.

Over the period, housing has generally been the biggest driver of the rate; mainly down to housing accounting for a larger proportion of the new work industry and the weights used to calculate the index reflecting this, although infrastructure has made an increasing contribution to the 12-month growth rate of new work since mid-2017.

Figure 6: Annual rate of inflation for all new work and contributions to the annual rate by sector

UK, September 2015 to September 2018

Source: Office for National Statistics

Notes:

- Contributions may not sum due to rounding.

Download this chart Figure 6: Annual rate of inflation for all new work and contributions to the annual rate by sector

Image .csv .xlsThe new work index can also be broken down by its three input cost components: material, labour and plant hire prices. Figure 7 shows the contribution each of these components makes to the 12-month growth rate of new work prices between September 2015 and September 2018.

The rise in new work prices has historically been predominantly driven by labour costs, as measured by average weekly earnings. In the second half of 2016, the contribution of material prices to the new work growth rate started to increase.

In March 2017, material costs provided the highest contribution to the annual rate, contributing more than labour costs to the 12-month growth rate for the first time over the period. Materials’ contribution reached a peak of 1.77 percentage points in both August and September 2017. Since then, the contribution of materials to the new work rate has remained relatively stable, while labour costs have again contributed the most to the 12-month growth rate, reaching a peak of 2.96 percentage points in April 2018. This coincides with increases to the National Living Wage, which impacts on average weekly earnings in the construction sector. The National Living Wage increased 4.4% in April 2018 from £7.50 to £7.83.

Figure 7: Annual rate of inflation for all new work and contributions to the annual rate by input

UK, September 2015 to September 2018

Source: Office for National Statistics

Notes:

- Contributions may not sum due to rounding.

Download this chart Figure 7: Annual rate of inflation for all new work and contributions to the annual rate by input

Image .csv .xlsThe increased contribution of material costs to the 12-month growth rate of new work likely reflects the impact of the sterling depreciation that followed the result of the EU referendum in June 2016. As seen in the Producer Price Index (PPI), prices for imported raw materials increased, as the 12-month growth rate of the imported materials component of input PPI turned positive in June 2016 after 32 consecutive months of negative inflation. The 12-month growth rate for imported material prices has remained positive since June 2016, peaking at 20.2% in January 2017, its highest rate for over eight years. This overall rise in the cost of raw materials is likely to also impact on the cost of materials in the construction industry.

Nôl i'r tabl cynnwys6. Deposit ratios have been gradually falling since 2010 with rates for former owner-occupiers returning to pre-downturn levels

Figure 8 shows the average mortgage deposit as a percentage of the property price – the deposit ratio – for first-time buyers and former owner-occupiers for Quarter 1 (Jan to Mar) 2003 to Quarter 3 (July to Sept) 2018. Former owner-occupiers typically have a higher deposit ratio than first-time buyers as they are often able to re-invest the equity from their existing property.

Average deposit ratios for both first-time buyers and former owner-occupiers were falling prior to the 2008 to 2009 economic downturn, with deposit ratios for first-time buyers, in particular, falling sharply from an average of 24.6% in Quarter 4 (Oct to Dec) 2004 to 16.3% in Quarter 4 2005. During and following the financial crisis there was considerable tightening of credit conditions which may partly explain the increase in deposit ratios seen at that time. Current regulations place limits on residential mortgage lending by reference to loan-to-value (LTV) ratios and debt-to-income (DTI) ratios.

Figure 8: Average deposit as a percentage of average dwelling price

UK, Quarter 1 (Jan to Mar) 2003 to Quarter 3 (July to Sept) 2018

Source: Office for National Statistics, Regulated Mortgage Survey

Download this chart Figure 8: Average deposit as a percentage of average dwelling price

Image .csv .xlsDeposit ratios for first-time buyers peaked in Quarter 1 2010 at 33.0%, while deposit ratios for former owner-occupiers peaked in Quarter 3 2009 at 42.9%. Since then, average deposit ratios for both have been falling fairly steadily, with deposits for former owner-occupiers now broadly in line with rates seen immediately prior to the economic downturn. Deposits for first-time buyers, however, are more in line with those seen in 2003 to 2005, before the sharp fall in the build up to the financial crisis.

Figure 9 shows the number of mortgage transactions broken down by the mortgage value as a proportion of the total purchase value – loan-to-value (LTV) ratio – for each quarter from Quarter 2 (Apr to June) 2005 to Quarter 2 2018. Mortgage transaction volumes were relatively high in 2005 to 2007, peaking at around 615,000 in Quarter 3 2006, but fell sharply during the economic downturn and have remained relatively low in the period since.

Figure 9: Mortgage transaction volumes by loan-to-value ratio

UK, Quarter 2 (Apr to June) 2005 to Quarter 2 (Apr to June) 2018

Source: Financial Conduct Authority, Regulated Mortgage Survey

Notes:

- Quarter 2 (Apr to June) 2018 is the most recent quarter for which these data are available.

- Volumes are rounded to the nearest thousand. Volumes lower than 500 round to zero.

Download this chart Figure 9: Mortgage transaction volumes by loan-to-value ratio

Image .csv .xlsMortgage transactions do not represent all property transactions as they exclude cash purchases (i.e. without the use of a mortgage) and also include remortgages by existing homeowners where no new property transaction takes place. The fall in mortgage transaction volumes likely reflects a combination of reduced property transactions and fewer or less frequent remortgage transactions.

Changes in loan-to-value ratios can also be seen in Figure 9, with a sharp reduction in the number of transactions having loan-to-value ratios greater than 90% in 2008. The proportion of mortgage transactions with a loan-to-value ratio of less than or equal to 75% has remained fairly stable over the period at around 60% but peaked in Quarter 1 2009 at 77.4%. Transactions with a loan-to-value ratio of 75% to 90% have accounted for between 20% and 37% of transactions over the period peaking in Quarter 4 2013.

Prior to the economic downturn, mortgages with a loan-to-value ratio of over 95% accounted for around 3% to 5% of mortgage transactions, while those with a loan-to-value ratio of 90% to 95% accounted for around 9% of transactions. Transactions for both fell sharply in late 2008 and by Quarter 4 2010, each accounted for less than 1% of mortgage transactions. More recently, loan-to-value ratios of 90% to 95% have been increasing again and now make up around 8% of mortgage transactions, while ratios above 95% remain below 1% of transactions.

Nôl i'r tabl cynnwys