Cynnwys

- Main points

- Statistician’s Comment

- Summary

- In recent years, consumer prices in the UK were generally more volatile compared with the rest of the EU, Germany and France

- The 12-month growth rate of output producer prices in the UK fluctuate more than Germany, France and the EU without the UK

- The 12-month growth rate of house prices in London was negative for the 16th consecutive month in June 2019

- Authors

1. Main points

The 12-month growth rate of the Consumer Prices Index including owner occupiers’ housing costs (CPIH) rose to 2.0% in July 2019, up from 1.9% in June 2019.

The input Producer Price Index (input PPI) grew by 1.3% in the 12 months to July 2019, up from 0.3% in the 12 months to June 2019.

The output Producer Price Index (output PPI) grew by 1.8% in the 12 months to July 2019, up from 1.6% in the 12 months to June 2019.

In recent years, consumer prices in the UK were generally more volatile compared with the rest of the EU, Germany and France.

The 12-month growth rate of output producer prices in the UK fluctuated more than Germany, France and the EU without the UK in recent years.

The 12-month growth rate of house prices in London was negative for the 16th consecutive month in June 2019, one more month than during the economic downturn.

2. Statistician’s Comment

Commenting on today’s inflation figures, Assistant Head of Inflation at the ONS, Chris Jenkins, said:

“Overall house prices growth was unchanged from May, but in London annual growth was negative once again, decreasing for the 16th month in succession. House price growth was strongest in Wales with the increase in England driven by the Midlands.

"The inflation rate increased slightly, with computer games, consoles and hotel prices rising more than they did last year. Conversely, air, international rail and sea fares did not rise by as much as 12 months ago.”

Nôl i'r tabl cynnwys3. Summary

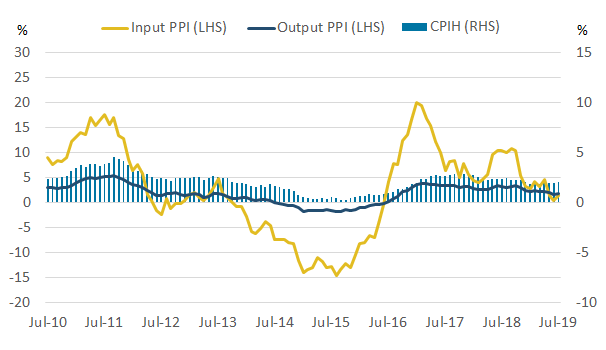

Figure 1 shows that the 12-month growth rate of the Consumer Prices Index including owner occupiers’ housing costs (CPIH) was 2.0% in July 2019, up from 1.9% in June 2019. The largest upward contributions to the change in the 12-month rate came from games, toys and hobbies, accommodation services, clothing and footwear, and other financial services. These upward effects were partly offset by downward contributions from transport services and, to a lesser extent, from domestic fuels.

The input Producer Price Index (input PPI) grew by 1.3% in the 12 months to July 2019, up from 0.3% in the 12 months to June 2019. Fuel, crude oil and imported metals made the largest upward contributions to the change in the 12-month growth rate.

The output Producer Price Index (output PPI) grew by 1.8% in the 12 months to July 2019, up from 1.6% in the 12 months to June 2019. Petroleum products and transport equipment both provided the largest upward contributions to the change in the rate.

Figure 1: The 12-month growth rate of CPIH, input and output PPI increased between June and July 2019

12-month growth rates for input Producer Price Index (PPI) (left-hand side), output PPI (left-hand side), and Consumer Prices Index including owner occupiers' housing costs (CPIH) (right-hand side)

Source: Office for National Statistics – Producer Price Index and Consumer Prices Index including owner occupiers' housing costs

Notes:

- These data are also available within the Dashboard: Understanding the UK economy.

Download this image Figure 1: The 12-month growth rate of CPIH, input and output PPI increased between June and July 2019

.png (21.6 kB) .xlsx (21.5 kB)4. In recent years, consumer prices in the UK were generally more volatile compared with the rest of the EU, Germany and France

Figure 2 shows the Harmonised Index of Consumer Prices (HICP) for the European Union without the UK, Germany, France and the UK between January 2014 and July 2019. The HICP allows for international comparisons to be made on a consistent basis and is equivalent to the UK’s Consumer Prices Index (CPI) measure, as such it does not include owner occupiers’ housing costs.

Figure 2: In recent months, the 12-month growth rate of the HICP in the UK has been higher than in the rest of the EU

12-month growth rates in the HICP for the EU without the UK, Germany, France and the UK.

Source: Office for National Statistics – Consumer Prices Index, Eurostat

Notes:

- The most recent data available for the EU without the UK are June 2019 from Eurostat.

- July 2019 data for Germany and France are estimates.

Download this chart Figure 2: In recent months, the 12-month growth rate of the HICP in the UK has been higher than in the rest of the EU

Image .csv .xlsThe 12-month growth rates for the HICP for all three countries and the EU without the UK have followed similar trends since January 2014, although the UK’s growth experience has generally been more volatile. The similarities in the trend likely reflect parallels in market conditions and global price trends faced by some components of the HICP (such as food and non-alcoholic beverages, and crude oil prices feeding into the transport component).

The 12-month growth rates of the HICP for all areas presented in Figure 2 excluding the UK fell to their lowest rates in January 2015 before increasing again.

In early 2015, Germany experienced a sharp increase in the 12-month growth rate of the HICP, before this fell in late 2015. This may be partially attributed to the change in methodology for package holidays in Germany, which resulted in revisions back to January 2015. The 12-month growth rate of the HICP for Germany in the months of 2015 are distorted because of this methodological change.

The 12-month growth rate of the HICP was consistently higher in the UK compared with all countries and the EU between January 2017 and April 2018, and again more recently. Previous analysis identified components with variation in their contribution to price growth between the UK and euro area. For example, housing, water, gas, electricity and other fuels has made considerably different contributions to price growth in the UK and euro area in the period since 2016. This may be explained partly by weight differences, as the UK housing, water, gas, electricity and other fuels has a weight of 130 parts per thousand for 2019 in the CPI basket whereas for the EU without the UK it has a weight of 162.37 in the HICP basket.

The HICP can be split into two broad categories of inflation: core and non-core. Core HICP strips out some of the most volatile components of HICP to show underlying trends in the rest of the basket. Core components account for around 80% of the HICP basket in the UK, with non-core components making up the remaining 20%. The non-core series consists of food and non-alcoholic beverages, alcoholic beverages and tobacco, and electricity, gas, liquid fuels, solid fuels, and fuels and lubricants. Figure 3 shows the 12-month growth rate in the HICP and core HICP in the UK and EU without the UK.

Figure 3: In recent years, core CPI in the UK has been more volatile than core HICP in the rest of the EU

12-month growth rates in HICP and CPI, and core HICP and CPI for the UK and the EU without the UK, January 2014 to July 2019

Source: Office for National Statistics – Consumer Prices Index, Eurostat

Notes:

- Core HICP excludes electricity, gas, liquid fuels, solid fuels, and fuels and lubricants, food and non-alcoholic beverages, and alcoholic beverages and tobacco.

- The most recent data available for the EU without the UK for overall HICP and core HICP are for June 2019 from Eurostat.

Download this chart Figure 3: In recent years, core CPI in the UK has been more volatile than core HICP in the rest of the EU

Image .csv .xlsThe extent to which the 12-month growth rates of core HICP tend to follow the trend of overall HICP varies between the UK and the EU without the UK. The 12-month growth rate of core HICP in the EU has remained relatively steady between 2014 and 2019, with growth varying between its joint-lowest point of 0.6% in May 2014 and joint-highest of 1.4% in April 2019. In comparison, the 12-month growth rate of core CPI in the UK has been more volatile, with core CPI varying between its joint-lowest point of 0.8% in April 2015 and joint-highest of 2.7% in August 2017.

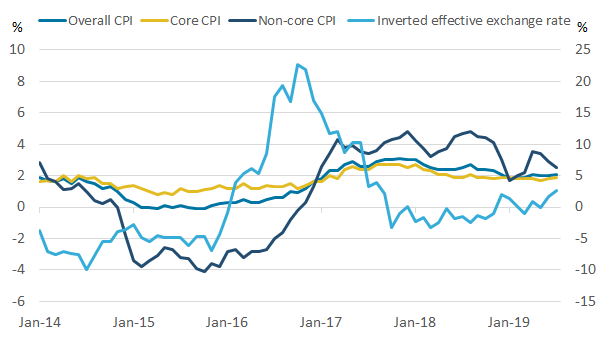

The difference in the volatilities of core HICP in the UK and the EU may be explained partially by the UK’s inflation experience presented in Figure 4, which shows the 12-month growth rate in the UK Consumer Prices Index (CPI), core CPI, non-core CPI, and the sterling effective exchange rate between January 2014 and July 2019. The exchange rate has been inverted so that an increase on the chart corresponds to a fall in the value of sterling, which would be expected to increase the price of imported components of CPI, all else being equal, while the opposite is true for a fall in the inverted effective exchange rate.

Figure 4: Non-core CPI follows trends in the exchange rate more closely than core CPI

12-month growth rate in overall CPI, core CPI, non-core CPI (left-hand side) and the sterling effective exchange rate (right-hand side), UK, January 2014 to July 2019

Source: Office for National Statistics – Consumer Prices Index, Bank of England

Download this image Figure 4: Non-core CPI follows trends in the exchange rate more closely than core CPI

.png (29.6 kB) .xlsx (20.3 kB)Figure 4 allows us to look in more detail at how the different measures of CPI move in relation to the exchange rate. The 12-month growth rate in overall CPI tends to follow movements in the 12-month growth rate of core CPI. This is likely because of the high proportion (80%) of core goods and services in the CPI basket.

For example, in July 2019, the 12-month growth rate of CPI was 2.1%, up slightly from 2.0% in June 2019. This change was driven by the change in the 12-month growth rate of core CPI, which increased slightly from 1.8% in June 2019 to 1.9% in July 2019, while the 12-month growth rate of non-core CPI fell over the period.

Overall, CPI diverges from core CPI during periods when non-core CPI experiences particularly strong positive or negative growth. Figure 4 shows that non-core goods and services tend to follow the exchange rate with a lagged effect as exchange rate changes take time to pass through. This relationship is most obvious following the depreciation of sterling, which followed the EU referendum result.

Goods and services in the CPI basket can be grouped according to import intensity, with 35% of non-core CPI products being classified in the upper import intensity categories (25% to 40% and 40% and over) making them more closely tied to the exchange rate than core goods and services.

Nôl i'r tabl cynnwys5. The 12-month growth rate of output producer prices in the UK fluctuate more than Germany, France and the EU without the UK

We produce an output producer prices in industry (domestic market) index for Eurostat, which can be compared with other countries to understand the cross-country differences in prices experiences. Figure 5 shows the differences between the Office for National Statistics (ONS) headline output Producer Price Index (PPI) and the Eurostat measure.

Figure 5: The Eurostat and ONS output PPI differ in what is included in each series

12-month growth rate in Eurostat output producer prices in industry (domestic market) and ONS output PPI, January 2014 to July 2019

Source: Office for National Statistics- Producer Prices Index, Eurostat

Notes:

- The data for June and July 2019 are provisional for Eurostat output PPI.

Download this chart Figure 5: The Eurostat and ONS output PPI differ in what is included in each series

Image .csv .xlsThe differences between the internationally comparable Eurostat measure and the ONS measure are:

- The Eurostat measure is on a gross basis, while the ONS measure is on a net basis. The PPI methods and guidance (PDF, 1.18MB) provides more detailed information on the methods used to produce the UK PPI.

- The Eurostat measure excludes duty, whereas the ONS measure includes duty.

Figure 6 shows the 12-month growth rates of output producer prices in industry (domestic market) for the EU without the UK, Germany, France and the UK between January 2014 and June 2019.

Figure 6: In recent months the 12-month growth rate of output producer prices in the UK have been more volatile than the rest of the EU

12-month growth rate of output producer prices in industry (domestic market) for the EU without the UK, Germany, France and the UK, January 2014 to July 2019

Source: Office for National Statistics - Producer Prices Index, Eurostat

Notes:

- Producer prices in industry (domestic market) exclude construction, sewerage, waste management and remediation activities.

- The most recent data available for the EU without the UK, France and Germany for producer prices in industry (domestic market) are June 2019 from Eurostat.

- The data for April, May and June 2019 data are provisional for France.

- The data for June and July 2019 are provisional for the UK.

Download this chart Figure 6: In recent months the 12-month growth rate of output producer prices in the UK have been more volatile than the rest of the EU

Image .csv .xlsThe UK has experienced similar trends in the 12-month growth rate of output producer prices to the rest of the EU, but shows more volatility, falling to its lowest rate of negative 9.3% in January 2015, before increasing to its highest rate of 10.2% in February 2017. This may be partially explained by currency effects as the majority of European countries trade in euros and do not experience the direct effects of the exchange rate.

Across all geographical regions shown in Figure 6, output producer prices generally fell between 2014 and 2016, with the sharpest fall in the UK between November 2014 and January 2015.

Output producer prices generally reflect input prices faced by producers with a time lag for the pass-through to be realised. For example, movements in the imported food component of input PPI are strongly associated with exchange rate movements. As well as reflecting input prices output PPI is also influenced by other factors such as processing costs and retailer pricing strategies.

The output producer component, coke and refined petroleum product prices, reflect the global price of crude oil. Between June 2014 and January 2016, the price of Brent crude oil fell from US $108 a barrel to $30 a barrel, which reduced producer prices.

From July 2016 to November 2018, producer price inflation in the UK was consistently higher than the EU and other countries. This may be attributed partially to the depreciation of sterling following the EU referendum in June 2016, as the exchange rate pass-through meant the prices of imported components of manufactured goods in the UK increased.

Nôl i'r tabl cynnwys6. The 12-month growth rate of house prices in London was negative for the 16th consecutive month in June 2019

Figure 7 shows the 12-month growth rate in house prices in the UK and London between January 2008 and June 2019. Although London has been more volatile throughout the period, the UK and London have followed a similar trend. In June 2019, the 12-month growth rate in house prices in London increased from negative 3.1% to negative 2.7%, while in the UK the 12-month growth rate remained the same at 0.9%.

The UK 12-month growth rate is the joint-lowest since late 2012, and has been driven partially by the recent months of falling prices in London, which has a weight of 8.6% in the UK House Price Index (HPI).

Figure 7: House price growth in London has declined more rapidly compared with the UK in recent years

12-month growth rate in house prices for the UK and London, January 2008 to June 2019

Source: Source: Office for National Statistics, HM Land Registry – UK House Price Index

Download this chart Figure 7: House price growth in London has declined more rapidly compared with the UK in recent years

Image .csv .xlsRecent movements in the 12-month growth rate of house prices in London should be seen in the context of longer-term trends, as historically London has experienced increases above the UK average. For example, in March 2016, house prices in London were around 116% higher than the UK average. Until March 2018, negative house price growth had not been experienced in London since September 2009.

During the 2008 to 2009 economic downturn, both house prices and transaction volumes fell sharply as the demand for housing declined, reflecting the macroeconomic conditions of higher unemployment, stagnation of real earnings and a slump in productivity.

The Bank of England lowered the base interest rate in response to the economic downturn, to 0.5% in March 2009, which contributed partially to the recovery of house prices in April 2009 as the cost of borrowing for a mortgage declined. Between September 2009 and November 2016, the 12-month growth rate of house prices in London was consistently higher than the UK average. This may have been caused by high demand for London properties with very little growth in supply. Demand for housing was, for example, boosted by consistently low interest rates and a falling deposit ratio.

Since mid-2016, both London and the UK have seen a slowdown in the 12-month growth rate of house prices. In addition, the Bank of England has noted in their inflation reports that the London housing market has probably been disproportionately affected by regulatory and tax changes (PDF, 5.0MB), and also by lower net migration from the EU.

Previous analysis explored changes such as the increase in Stamp Duty on additional properties. The Bank of England has noted a slowdown in the buy-to-let market in general and that London may have been particularly affected by this as it accounts for a substantial proportion of the UK buy-to-let activity.

In June 2019, the 12-month growth rate of house prices in London was negative 2.7%. This was the 16th consecutive month of negative 12-month price growth in London. This means that for 16 months, on average, house prices have been lower than they were in the same month the previous year. During the economic downturn, the 12-month growth rate of house prices was negative for 15 months making the recent period of negative growth longer. Figure 8 shows the 12-month growth rate of house prices each month, where 1 refers to the first month of negative growth.

Figure 8: The 12-month growth rate of house prices fell by a greater magnitude during the economic downturn compared with the most recent period of negative growth

12-month growth rate of house prices during the economic downturn and the most recent period of negative growth, London, July 2008 to September 2009 and March 2018 to June 2019

Source: Office for National Statistics, HM Land Registry - UK House Price Index

Download this chart Figure 8: The 12-month growth rate of house prices fell by a greater magnitude during the economic downturn compared with the most recent period of negative growth

Image .csv .xlsFigure 8 shows the magnitude of the 12-month growth rates to differ between the two periods. During the economic downturn, the 12-month growth rate of house prices in London fell to its lowest rate at negative 16.6% in April 2009 and was followed closely by the UK average, which fell to its lowest point two months earlier at negative 15.6%. During the more recent period, the 12-month growth rate of house prices has negatively peaked at 3.1% in May 2019, while the UK average has not turned negative.

The turning point to negative 12-month growth also differs between the periods, with the 12-month growth rate of house prices in London dropping by around 10% in the six months before turning negative in 2008, compared with the 12-month growth rate dropping by less than 3% in the six months before the most recent negative period. Previous analysis has explored house price growth by property type, which showed that flats have experienced the most pronounced fall in house prices in London, accounting for just over half of property sales.

Although, the duration of the current period of negative 12-month growth has been greater than during the economic downturn, the magnitude of the fall in growth was much larger during the recession. From their recent peak and trough of £489,000 in July 2017 and £467,000 in June 2019 respectively, average London house prices have fallen 5.1%. This compares with a fall of 17.8% between a peak of £299,000 in January 2008 and a trough of £245,000 in April 2009.

Nôl i'r tabl cynnwys