1. Introduction

This article provides some additional analysis of the August Producer Price Index and Consumer Prices Index. It has a particular focus on how previous and current movements in the sterling exchange rate may have influenced these data. This is an update of the additional analysis article published in August which included an outline of how changes in the exchange rate could feed through to prices data.

A dataset is available with this release which contains longer time series of PPI and CPI contributions to growth by sector and import intensive products respectively. The dataset also contains further information on which goods and services within the CPI basket are grouped into which category of import intensity. “Import intensity” refers to the percentage of final household consumption which is directly due to imports.

Nôl i'r tabl cynnwys2. Main definitions

Producer Price Index (PPI): measures change in the prices of goods bought and sold by UK manufacturers. The PPI index is divided into an input price index and an output price index. The input price indices measure change in the prices of materials and fuels bought by UK manufacturers for processing. These are not limited to just those materials used in the final product, but also include those required by the company in its normal day-to-day running.

Further details on definitions and methodology for producing PPI are contained in the statistical release.

The output price indices measure change in the prices of goods produced by UK manufacturers (these are often called “factory gate prices”).

Consumer Prices Index (CPI): measures change in the prices of goods and services bought by households. A way to understand this is to think of a large shopping basket containing all the goods and services bought by households. Movements in price indices represent the changing cost of this basket. Further details on definitions and methodology for producing CPI are contained in the statistical release.

Sterling effective exchange rate index (ERI): measures the relative strength of a currency relative to a basket of other currencies.

Nôl i'r tabl cynnwys3. Analysis of PPI

This analysis is also covered in the Economic context section of the PPI bulletin.

Sterling appears to have had a greater impact on PPI input prices than on PPI output prices in August 2016. Input producer prices increased 7.6% in the year to August 2016, up from 4.1% in the year to July 2016. Downward pressure on PPI input prices has been easing since the middle of 2015. PPI output price inflation also increased to 0.8% in the year to August 2016 compared with 0.3% in July 2016.

Figure 1 shows the contribution of the main components of PPI input prices to the annual growth rate, some of which are affected by changes in the sterling exchange rate. For example, crude oil and other commodities such as metals and chemicals are often priced in US dollars and other foreign currencies. Other things being equal, the sterling equivalent price UK producers pay for these goods in foreign currencies will rise or fall as the pound depreciates or appreciates respectively.

Figure 1: Contributions to the 12-month rate of input producer price inflation by component and overall input PPI rate

UK, January 2015 to August 2016

Source: Office for National Statistics

Notes:

- Input PPI rate may not match published figure due to rounding.

Download this chart Figure 1: Contributions to the 12-month rate of input producer price inflation by component and overall input PPI rate

Image .csv .xlsFigure 1 provides evidence of the positive contribution to input PPI inflation by imported food, other imported parts and equipment, and other imported materials as well as home-produced food since May 2016, and these have further increased in June and July, and August. An example of the marked increase in the contribution to input PPI inflation in August 2016 is imported metals, which has moved from making a negative to a positive contribution to PPI input prices in recent months, which may be related to the depreciation of sterling.

However, oil prices are also likely to have been a factor in the upward trend in input producer price inflation. The stabilisation and recent recovery of the oil price over the last year means that the downwards contribution of crude oil to the PPI inflation series has waned in recent months. This can be seen in Figure 1 as the negative contribution of crude oil to input producer price inflation began to ease off from August 2015 onwards, contributing to the gradual rise of the input PPI inflation rate. This contribution turned positive in August 2016, which may have been a consequence of the depreciation of sterling increasing the price of imported oil. There has been a similar easing of the negative contribution from refined petroleum products to output producer price inflation in August 2016.

Nôl i'r tabl cynnwys4. Analysis of CPI

The rate of inflation as measured by the Consumer Prices Index (CPI) was 0.6% in the year to August 2016, unchanged on the previous month. Along with July 2016, this is the highest rate since November 2014. However, CPI inflation remains low compared with its long-term performance.

The CPI data for August is the second month to include information gathered since the UK’s referendum on its membership of the European Union and the changes in the sterling exchange rate which followed. The value of sterling compared with a basket of currencies, known as the effective exchange rate, fell by 7.3% between early August 2015 and 23 June this year and a further 9.5% between 23 June and the last day in July. The decline in sterling has steadied since; between 1 and 31 August, sterling depreciated by 0.5%.

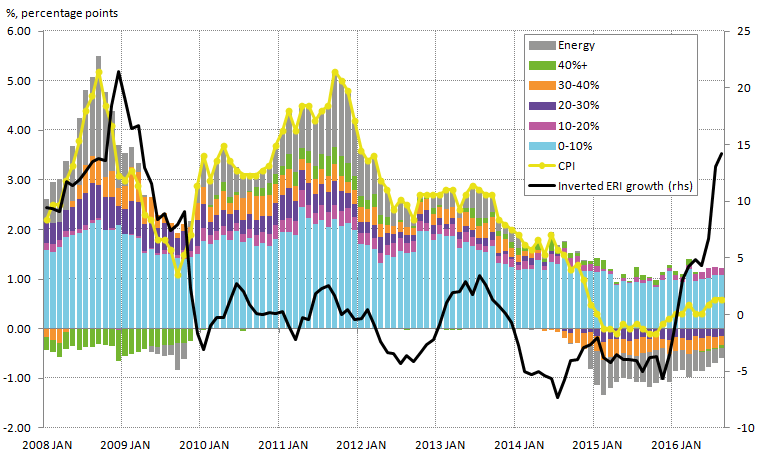

Figure 2 presents contributions to the CPI from products grouped by their relative import intensities, along with the inverted effective exchange rate (ERI). Goods and services which largely originate from domestic producers are grouped together in a low import intensity group, while products which largely come from abroad are grouped into higher import intensity groups. The ERI series has been inverted, so that a depreciation of the currency is represented by an increase in the line graph, helping to interpret a depreciation of the currency as representing a higher sterling equivalent price for imported goods and services. Energy products – which have considerable import content, on which the price of oil has a particular impact – are grouped separately. This updates the analysis previously published in the August Economic Review to include the most recent data.

Figure 2: Headline inflation, contributions to inflation by import intensity and 12-month growth in effective exchange rate of sterling, monthly average (inverted)

UK, January 2008 to August 2016

Source: Office for National Statistics and the Bank of England

Download this image Figure 2: Headline inflation, contributions to inflation by import intensity and 12-month growth in effective exchange rate of sterling, monthly average (inverted)

.png (55.4 kB) .xls (91.1 kB)Figure 2 suggests that energy and more import-intensive products account for a fairly high proportion of recent movements in inflation. The least import-intensive non-energy products in Figure 2 have made a fairly steady contribution to the CPI rate of inflation over recent years. More import-intensive products, by contrast, account for much of the rise in inflation following the depreciation of sterling in 2008 and 2009 and for much of the moderation of inflation over the last 2 years – a period during which sterling appreciated against its major trading partners.

In August 2016, the largest contributor to consumer price inflation continued to be goods in the lowest import intensity category (0 to 10%). The sharp depreciation of sterling seen since the beginning of 2016 has yet to influence upward pressure on the CPI; goods and services in the inflation basket with the highest import intensities are still providing negative contributions to the headline figure. This may change later in the year as the increases seen in the PPI are potentially passed onto consumers. However, this could also be offset or amplified by a range of other factors such as future movements in commodity prices, consumer confidence, employment and GDP growth and any consumer response to their experience of changes in relative prices for domestically produced or imported goods.

Nôl i'r tabl cynnwys5. Next steps

We will continue to monitor the impact of changes in the sterling exchange rate on all our economic statistics and will include additional analysis in the statistical releases or separate articles where appropriate.

Nôl i'r tabl cynnwys