Cynnwys

- Key points

- About this release

- Upcoming changes to the Quarterly Survey of Capital Expenditure and other methodological information

- Adjustments, revisions and response rates

- Economic background

- Gross fixed capital formation and business investment

- Summary tables

- Additional analyses available to download

- Background notes

- Methodoleg

1. Key points

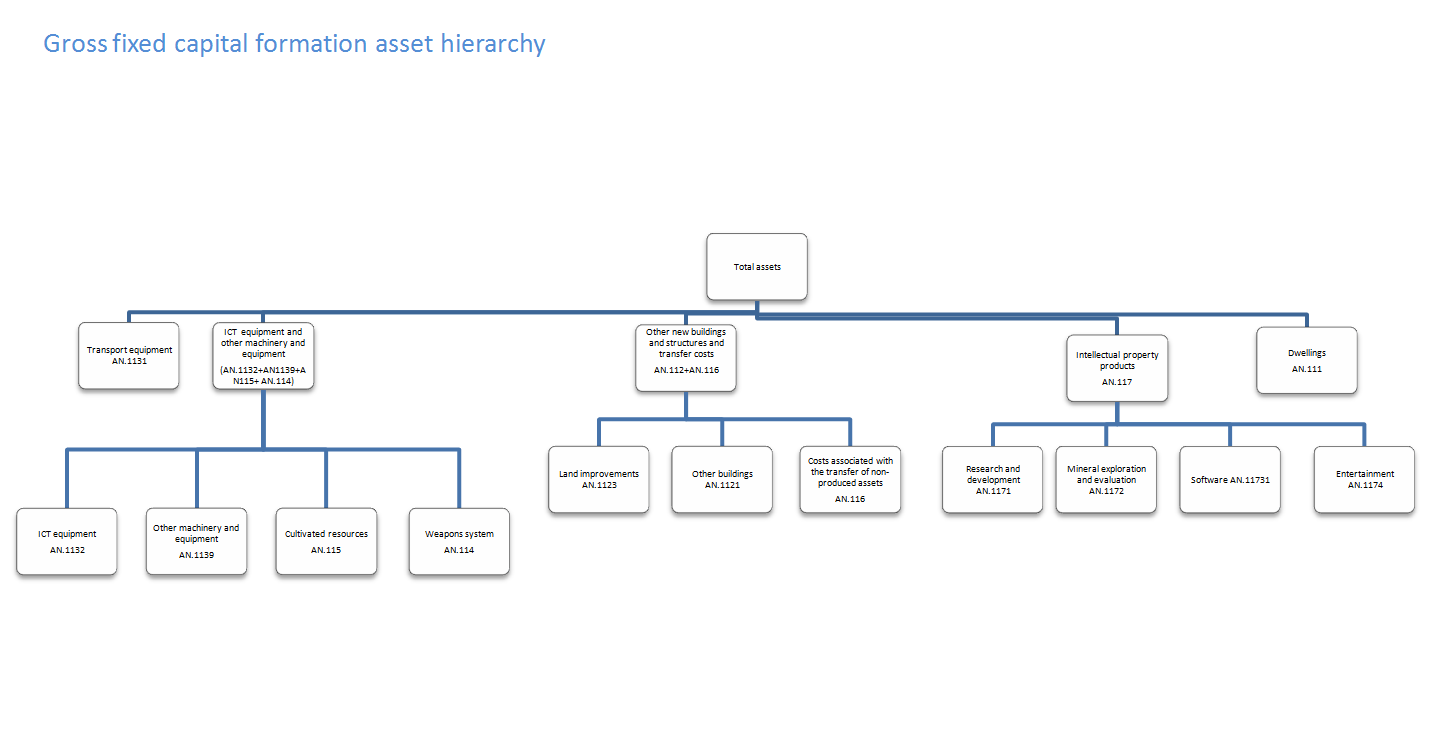

The estimates in this release are short-term indicators of investment in assets, such as dwellings, transport equipment, machinery, buildings and intangible assets. This release covers not only business investment, but asset breakdowns of total gross fixed capital formation (GFCF), of which business investment is one component

All estimates in this bulletin are seasonally adjusted chained volume measures. The earliest period being revised in this release is Q1 2014

In Q4 2014, GFCF was estimated to have decreased by £0.4 billion (0.5%) to £72.6 billion compared with Q3 2014. This was the first decrease for GFCF since Q3 2012

In Q4 2014, business investment decreased by an estimated £0.6 billion (1.4%) compared with the previous quarter

The largest quarter on quarter decrease in Q4 2014 by asset was in other buildings and structures and transfer costs, which decreased by an estimated £0.7 billion (3.1%). Falling investment by the oil and gas extraction industry is a large component of this decrease

In Q4 2014, GFCF was estimated to have increased by 3.7% compared with Q4 2013

In Q4 2014, business investment increased by 2.1% compared with Q4 2013. This was the nineteenth consecutive quarter of quarterly growth compared with the same quarter of the previous year

In 2014, GFCF increased by 6.8% from 2013, which is the largest annual growth since 1998 (6.8%). Business investment also grew by 6.8%, the largest annual growth since 2007 (8.1%)

2. About this release

The estimates in this release are short-term indicators of investment in assets in the UK, such as dwellings, transport equipment, machinery, buildings and intellectual property products. This release covers not only business investment, but asset and sector breakdowns of total gross fixed capital formation (GFCF), of which business investment is one component.

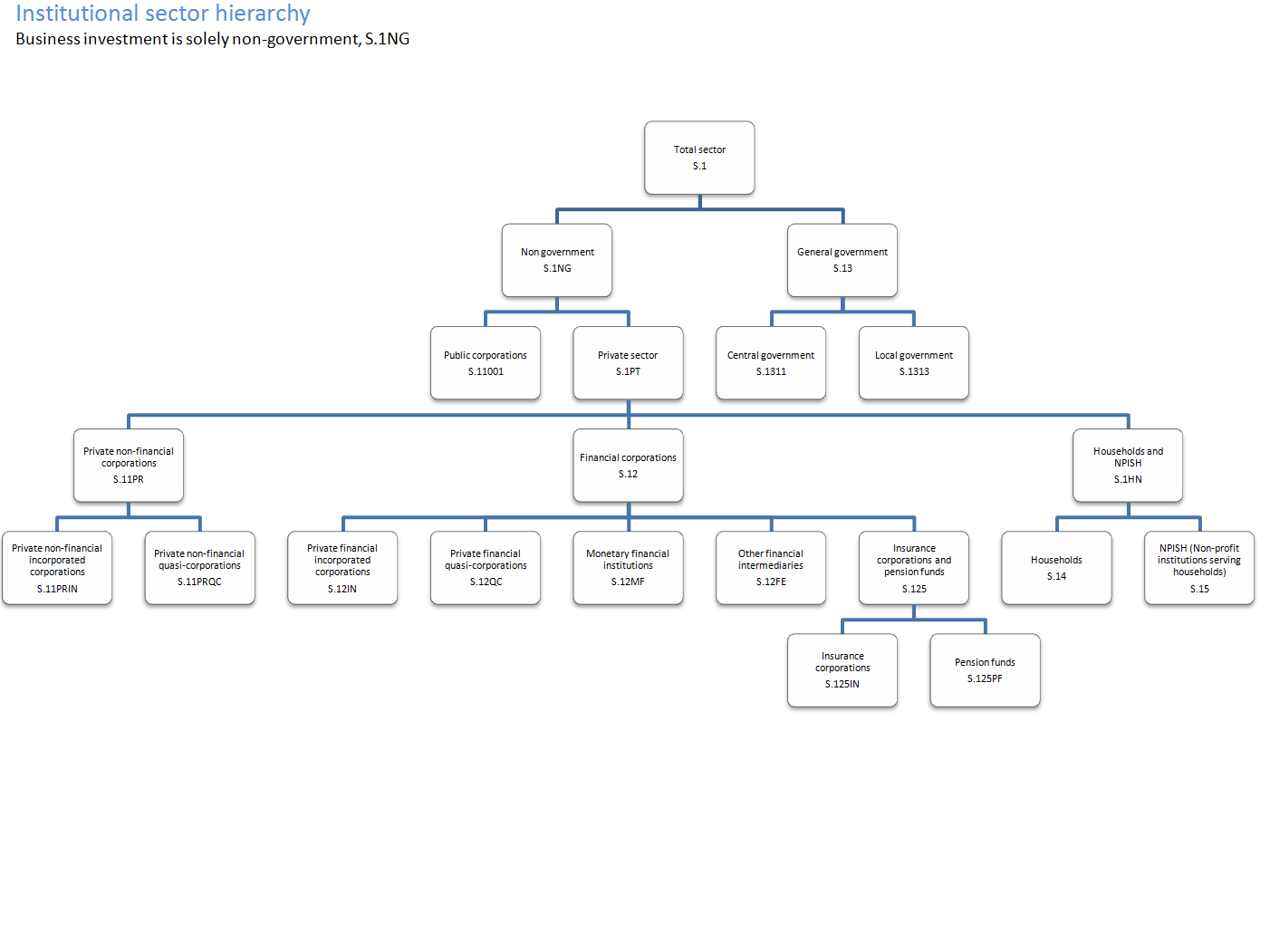

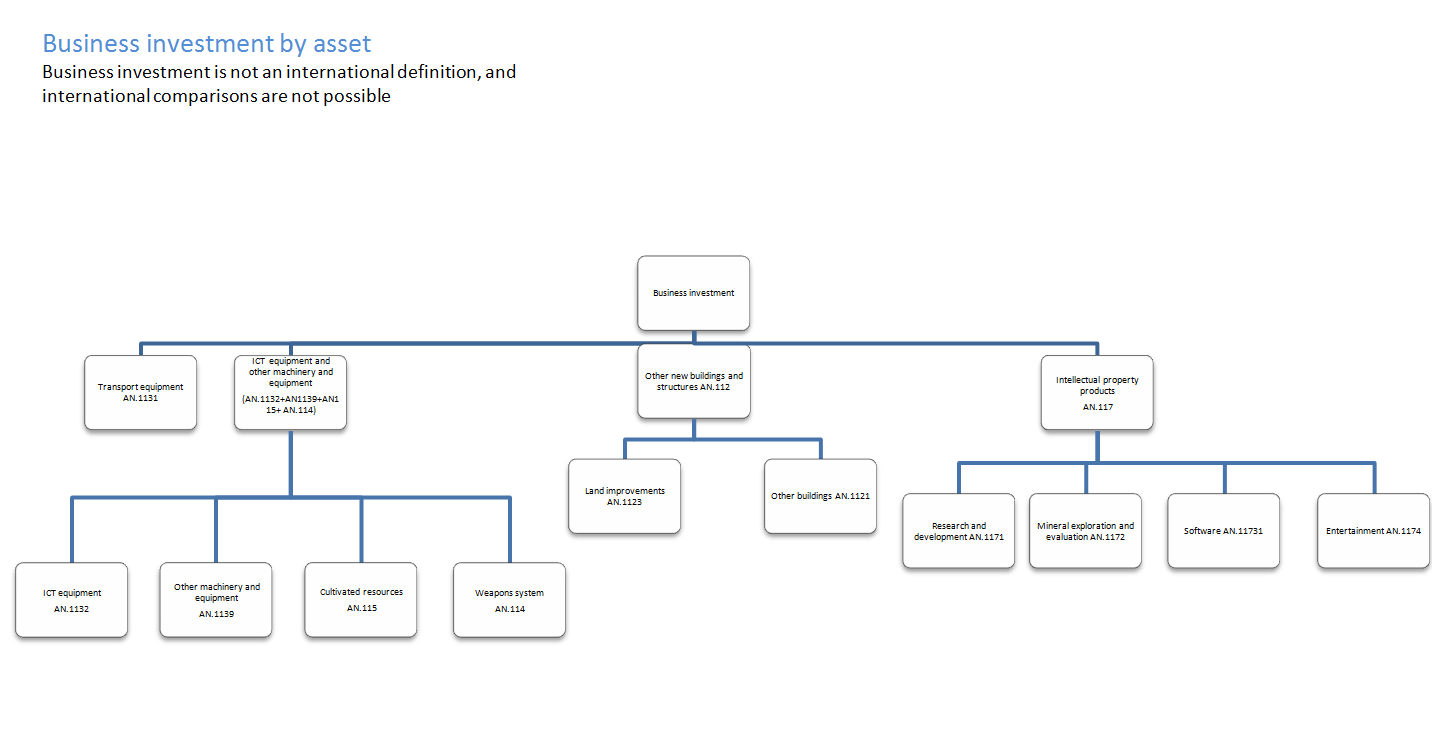

Business investment is net investment by the private sector and public corporations, in transport equipment, information, technology and communications (ICT) equipment, other machinery and equipment, cultivated assets, intellectual property products (IPP, which includes investment in software, research and development, artistic originals and mineral exploration), and buildings and other structures. It does not include investment by central or local government, investment in dwellings or the costs associated with the transfer of non-produced assets (such as land). A full sector and asset hierarchy can be found in the background notes. It should be noted that business investment is not an international concept and therefore it should not be used to make international comparisons.

All investment data referred to in this bulletin are estimates of seasonally adjusted chained volume measures.

Nôl i'r tabl cynnwys3. Upcoming changes to the Quarterly Survey of Capital Expenditure and other methodological information

Changes to the Quarterly Survey of Capital Expenditure

The Office for National Statistics (ONS) will be implementing changes to the Quarterly Survey of Capital Expenditure (Capex) from Q1 2015. These include changes which are legally required under the European System of Accounts 2010 (ESA 2010) and improvements to the questionnaire design. The changes which will be implemented in the compilation of estimates of GFCF and its components from Q1 2015 include:

removal of the lower limit of £500 in reporting GFCF

the inclusion of small tools used in production within the definition of GFCF

improvements to the questionnaire design through question testing with respondents

a change of name, from Capex, to the Quarterly Acquisitions and Disposals of Capital Assets Survey (QCAS), which states the purpose of the survey more clearly, in line with good practice

The exact impact of these changes will not be known until the data are collected. The impact will be monitored, and further information will be available in the Business Investment, Q1 2015 Provisional Results release in May 2015.

The changes to the questionnaire also include some new questions. Data from these new questions will not be included in estimates of GFCF and its components until 2017, when two years of data are available for quality assurance. For more detail on these changes, please see the article Changes to the Annual Business Survey, the Quarterly Survey of Capital Expenditure and the Survey into Business Spending on Capital Items, in 2015 (114.3 Kb Pdf).

Estimates in this release have been compiled under ESA 2010, in compliance with the UK’s legal obligations in producing the National Accounts. Articles are available describing the methodology used to estimate GFCF and the impact of the changes implemented for ESA 2010 in September 2014.

Construction price indices: improvements 19 Jun 2014

Measuring and capitalising research & development in the UK National Accounts (349.1 Kb Pdf) 10 Jun 2014

Implementation framework for Research and Development in the United Kingdom National Accounts (206.7 Kb Pdf) 10 Jun 2014

Impact of ESA10 changes on current price GDP estimates 10 Jun 2014

Transition to ESA 2010: capitalising government spending on military weapons (179 Kb Pdf) 10 Jun 2014

Gross Fixed Capital Formation (Investment) - Changes for Blue Book 2014 (excluding ESA10) (157.8 Kb Pdf) 29 May 2014

Impact of ESA95 changes on current price GDP estimates 29 May 2014

Revised methodology and sources as a result of addressing Gross National Income reservations 29 May 2014

Nôl i'r tabl cynnwys4. Adjustments, revisions and response rates

Adjustments

The largest component of the data collected to produce estimates of GFCF and business investment comes from ONS's Quarterly Survey of Capital Expenditure (Capex), which has a sample size of 27,500. Large capital expenditure tends to be reported later in the data collection period than smaller expenditure. This means that larger expenditures are often included in the revised (month 3) results, but are not reported in time for the provisional (month 2) results, leading to a tendency towards upwards revisions in the later estimates for business investment and GFCF. Following investigation of the impact of this effect, from Q3 2013, ONS introduced a bias adjustment to Capex and hence to GFCF and its components, in the provisional estimates.

In this release, the bias adjustment is £850 million. This has been increased from £500 million in previous provisional releases. The increase follows further analysis of the late-reporting bias in the preceding 15 quarters. This analysis showed that, between Q1 2011 and Q3 2014, the mean revision to Capex estimates between the provisional and revised releases was £877 million, with a range between £16 million and £1,417 million over that time period. Users should note that the bias adjustment is a best estimate and the Capex estimate may still be revised either up or down. Therefore, GFCF and business investment could also be revised either up or down in the Q4 2014 revised release. The bias adjustment is intended to reduce the average size of revisions over time.

Forecast data

Not all data required for the compilation of GFCF and its components are available for the latest period at the time of publication. For these components, the latest period is forecast. In this release this includes government investment, investment in new dwellings and improvements to dwellings, investment in research and development and investment in artistic originals.

Revisions

The periods revised in this release are Q1 to Q3 2014.

There are three key reasons for the revisions to GFCF and its components in 2014:

revisions to survey data, including Capex and public corporations

revisions to government investment estimates, with provisional estimates replaced with revised data – this has lead to a downwards revision to Q2 2014 and an upwards revision to Q3 2014 (current prices, not seasonally adjusted)

the impact on seasonal adjustment of adding the final quarter of the year – when the final quarter is added, the seasonally adjusted annual sum of the quarters is benchmarked to equal the not seasonally adjusted annual total; this is the reason for larger revisions in the seasonally adjusted estimates than in the estimates which are not seasonally adjusted

Survey response rates

Table 1 presents the provisional (month 2) response rates for the Quarterly Survey of Capital Expenditure. The estimates in this release are based on the Q4 2014 month 2 (provisional) survey results.

Table 1: Response rates

| At month two (Provisional) | At month three (Revised) | ||||

| Period | Overall response rates (per cent) Questionnaires | Period | Overall response rates (per cent) Questionnaires | ||

| 2013 | Q4 | 80.0 | 2013 | Q4 | 91.9 |

| 2014 | Q1 | 76.2 | 2014 | Q1 | 90.7 |

| Q2 | 79.5 | Q2 | 91.3 | ||

| Q3 | 78.7 | Q3 | 88.3 | ||

| Q4 | 80.1 | ||||

| Source: Office for National Statistics | |||||

Download this table Table 1: Response rates

.xls (52.7 kB)5. Economic background

Business investment was £631 million (1.4%) lower in Q4 2014 than in the previous quarter. The quarter on quarter fall in business investment is the second successive quarterly fall, but only the fourth quarterly fall since the start of 2010. GFCF also decreased, by £390 million (0.5%), compared with the previous quarter. This is the first quarter on quarter fall since Q3 2012.

In terms of quarterly estimates, compared with the same quarter of the previous year, business investment has grown for the last 19 quarters (from Q2 2010). In Q4 2014, it was 2.1% higher than the same period in 2013. In Q4 2014, business investment was estimated to be £2.2 billion higher than the pre-downturn peak, Q2 2008. GFCF also grew compared with Q4 2013, by 3.7%.

In 2014, both GFCF and business investment grew by 6.8% compared with 2013, the highest annual growth in business investment since 2007 and the highest since 1998 for GFCF. As reported in the Bank of England's February 2015 Inflation Report, the improvement in business investment is likely to be a result of increased demand and more favourable credit conditions.

Investment in ICT equipment and other machinery, intellectual property products and dwellings partially offset the fall in the most recent quarter. The growth in investment in ICT equipment and other machinery in Q4 2014 is also reflected in the Confederation of British Industry’s Service Sector Survey where companies reported that they were investing to increase efficiency and upgrade equipment.

Why has there been a fall in business investment in Q4 2014?

Business investment fell by £631 million (1.4%) between Q3 2014 and Q4 2014. The assets contributing to this fall are buildings and other structures, and transport equipment, which decreased by £686 million and £238 million, respectively. This decrease is somewhat offset by increases in net investment in the other assets.

The fall in investment in new buildings and other structures and major repairs to these is consistent with the fall in construction output in Q4 2014 reported in Output in the Construction Industry, December and Q4 2014. The GFCF asset buildings and other structures includes structures such as oil platforms. Given the recent steep fall in oil prices, it might be expected that investment by the oil extraction industry might also fall, as oil production becomes less profitable. Figures 1a and 1b show that this has been the case in Q4 2014.

Figure 1a shows the Capex (benched to the Annual Business Survey, ABS) survey estimates for net investment in buildings and other structures by the oil and gas extraction industry, in current prices, not seasonally adjusted. There is a steep fall, of £458 million (22.4%), between Q3 and Q4 2014. Figure 1b shows the Cushing, OK West Texas Intermediate Spot Price Free On Board in dollars per barrel, and a steep fall in the price of oil can also be seen in the last quarter of 2014.

Figure 1a: Capital expenditure benched to Annual Business Survey estimates of net investment in buildings and other structures by the oil and gas industry

Current prices, not seasonally adjusted

Source: Quarterly Survey of Capital Expenditure - Office for National Statistics

Download this chart Figure 1a: Capital expenditure benched to Annual Business Survey estimates of net investment in buildings and other structures by the oil and gas industry

Image .csv .xls

Figure 1b: West Texas intermediate spot oil prices

Price index, not seasonally adjusted

Source: Quarterly Survey of Capital Expenditure - Office for National Statistics

Download this chart Figure 1b: West Texas intermediate spot oil prices

Image .csv .xlsThe fall in investment in transport equipment may be related to the implementation of EU legislation on emissions for light passenger and commercial vehicles in September 2014. However, as the contribution of investment in light passenger and commercial vehicles cannot be disentangled from investment in all transport equipment, this cannot be confirmed.

Nôl i'r tabl cynnwys6. Gross fixed capital formation and business investment

Figure 2: Annual gross fixed capital formation chained volume measures

Reference year: 2011 Coverage: United Kingdom

Source: Quarterly Survey of Capital Expenditure - Office for National Statistics

Download this chart Figure 2: Annual gross fixed capital formation chained volume measures

Image .csv .xls

Figure 3a: Quarterly gross fixed capital formation chained volume measures from Q1 1997

Reference year: 2011 Seasonal adjustment: seasonally adjusted Coverage: United Kingdom

Source: Quarterly Survey of Capital Expenditure - Office for National Statistics

Download this chart Figure 3a: Quarterly gross fixed capital formation chained volume measures from Q1 1997

Image .csv .xls

Figure 3b: Quarterly gross fixed capital formation chained volume measures from Q1 2007

Reference year: 2011 Seasonal adjustment: seasonally adjusted Coverage: United Kingdom

Source: Quarterly Survey of Capital Expenditure - Office for National Statistics

Download this chart Figure 3b: Quarterly gross fixed capital formation chained volume measures from Q1 2007

Image .csv .xls

Figure 4: Annual business investment chained volume measures

Reference year: 2011 Coverage: United Kingdom

Source: Quarterly Survey of Capital Expenditure - Office for National Statistics

Download this chart Figure 4: Annual business investment chained volume measures

Image .csv .xls

Figure 5a: Quarterly business investment chained volume measures from Q1 1997

Reference year: 2011 Seasonal adjustment: seasonally adjusted Coverage: United Kingdom

Source: Quarterly Survey of Capital Expenditure - Office for National Statistics

Download this chart Figure 5a: Quarterly business investment chained volume measures from Q1 1997

Image .csv .xlsFigure 5a shows a large spike in business investment in Q2 2005. This is due to the transfer of British Nuclear Fuels Ltd (BNFL). In April 2005, nuclear reactors were transferred from BNFL to the Nuclear Decommissioning Authority (NDA). BNFL is classified as a public corporation in National Accounts, while the NDA is a central government body. The business investment series includes investment by public corporations but not government spending, with the positive spike therefore reflecting the £15.6 billion transfer. More information on the transfer of BNFL can be found in the background notes under section ‘3. Further information on methodology’.

Figure 5b: Quarterly business investment chained volume measures from Q1 2007

Reference year: 2011 Seasonal adjustment: seasonally adjusted Coverage: United Kingdom

Source: Quarterly Survey of Capital Expenditure - Office for National Statistics

Download this chart Figure 5b: Quarterly business investment chained volume measures from Q1 2007

Image .csv .xls7. Summary tables

Total GFCF decreased by an estimated £390 million (0.5%) in Q4 2014 compared with the previous quarter, but is still 3.7% higher than Q4 2013. All sectors show positive growth of at least 2.0% compared with Q4 2013. In the latest quarter, Q4 2014, net investment in private sector dwellings saw the biggest increase compared with the previous quarter, rising by an estimated £155 million (1.1%), with net investment in general government increasing by an estimated £97 million (0.9%). This was offset by a decrease in business investment of an estimated £631 million (1.4%) compared with the previous quarter.

Table 2a: Total gross fixed capital formation by sector

| Percentage change | £ million | |||

| Most recent quarter on previous quarter | Most recent quarter on a year earlier | Most recent level ** | Level change from previous quarter | |

| GFCF | -0.5 | 3.7 | 72,626 | -390 |

| Business investment | -1.4 | 2.1 | 44,262 | -631 |

| General Government | 0.9 | 9.4 | 10,344 | 97 |

| Public corporations dwellings | -1.7 | 8.3 | 826 | -14 |

| Public corporations cost of ownership transfer on non-produced assets | -0.9 | 4.5 | -115 | 1 |

| Private sector dwellings | 1.1 | 5.0 | 13,654 | 155 |

| Private sector cost of ownership transfer on non-produced assets | 0.1 | 2.0 | 3,655 | 2 |

| Source: Office for National Statistics | ||||

| Notes: | ||||

| 1. ** Series may not sum to totals due to rounding | ||||

Download this table Table 2a: Total gross fixed capital formation by sector

.xls (27.1 kB)Net investment in intellectual property products increased by an estimated £277 million (1.7%) in Q4 2014 compared with the previous quarter. This was offset by a decrease in other buildings and structures and transfer costs of an estimated £686 million (3.1%). The decrease in other buildings and structures and transfer costs was largely caused by a decrease of net investment by the oil and gas extraction industry in Q4 2014.

Table 2b: Total gross fixed capital formation by asset

| Percentage change | £ million | |||

| Most recent quarter on previous quarter | Most recent quarter on a year earlier | Most recent level ** | Level change from previous quarter | |

| GFCF | -0.5 | 3.7 | 72,626 | -390 |

| Transport equipment | -7.1 | -8.1 | 3,125 | -238 |

| ICT equipment and other machinery and equipment | 0.7 | 16.9 | 17,238 | 118 |

| Dwellings | 1.0 | 5.4 | 14,525 | 139 |

| Other buildings and structures and transfer costs | -3.1 | -3.2 | 21,297 | -686 |

| Intellectual property products | 1.7 | 2.0 | 16,441 | 277 |

| Source: Office for National Statistics | ||||

| Notes: | ||||

| 1. ** Series may not sum to totals due to rounding | ||||

Download this table Table 2b: Total gross fixed capital formation by asset

.xls (56.3 kB)8. Additional analyses available to download

ONS also publishes additional analyses of GFCF, business investment, and the Quarterly Survey of Capital Expenditure, which have been created in response to ad hoc user requests. These are available to download free from the ONS website. Below is a list of the most recent ad hoc requests, together with a link to the web pages from which they can be downloaded. Enquiries about ad hoc requests may be made to gcf@ons.gov.uk.

Note: all datasets below have been updated from Q1 1997 to be consistent with the UK Annual National Accounts (Blue Book) 2014.

Research and Development Price Index for Gross Fixed Capital Formation (33 Kb Excel sheet)

This time series is derived from the Research and Development dataset and is based on actual current price values up to and including 2012, all periods subsequent have been forecast using X-13-ARIMA-SEATS. The base year for this analysis is 2005. This price index (deflator) is calculated using a weighted labour, capital and material prices and excludes a productivity adjustment. Data has been extracted from the Q3 2014 dataset.

Regional Gross Fixed Capital Formation, 2000–2012 (110 Kb Excel sheet)

Regional Gross Fixed Capital Formation, NUTS1 and NUTS. 2000–2012

GFCF Quarterly Weapons analysis (40 Kb Excel sheet)

Quarterly GFCF data relating to spending on weapons systems. Q1 1997 Q1 – Q3 2014

Private sector investment in computer hardware (36.5 Kb Excel sheet)

A time series of investment in computer hardware by the private sector broken down by industry; current price, not seasonally adjusted. Q1 1997 – Q3 2014

Gross fixed capital formation estimates for total Business Investment and General Government, excluding British Nuclear Fuels (BNFL) in Q2 2005; current price, chained volume measure, seasonally adjusted, not seasonally adjusted. Q1 1997 – Q3 2014

A time series of estimates from the Quarterly Survey of Capital Expenditure, broken down by industry, asset and acquisitions/disposals; current price, not seasonally adjusted.

Quarterly capital expenditure and survey populations by employment size bands (32.5 Kb Excel sheet)

Estimates from the Quarterly Survey of Capital Expenditure broken down by employment size bands, from Q1 2012. Manufacturing and non-manufacturing, current price, not seasonally adjusted estimates are available. A breakdown of survey populations by employment size bands is also included.

Gross fixed capital formation estimates for total GFCF industry split for purchased software, own-account software, mineral exploration and artistic originals; current price, not seasonally adjusted. Q1 1997 – Q3 2014

Gross fixed capital formation estimates for private sector new dwellings and private sector new dwellings and private sector improvements to dwellings; current price, chained volume measure, seasonally adjusted. Q1 1997 – Q3 2014

Gross Fixed Capital Formation Q3 2014 data for new dwellings (excluding land) and costs associated with the transfer of non-produced assets for the Households and Non-profit Institutions Serving Households sector. The series is in current price not seasonally adjusted format.

Capital Expenditure (CAPEX) investment made by energy industries (35.5 Kb Excel sheet)

Total NET (acquisitions less disposals) investment by SIC for energy industries.

Quarterly capital expenditure estimates, by industry sector and sizeband (131.5 Kb Excel sheet)

Quarterly estimates from the Quarterly Survey of Capital Expenditure: net expenditure (gross fixed capital formation), current prices, not seasonally adjusted. These estimates are the key data source for the Q3 2014 Business Investment release published on 23 December 2014.

Nôl i'r tabl cynnwys