Cynnwys

- Main points

- Things you need to know about this release

- UK R&D expenditure continued long-term upward trend

- Business spending on R&D performed as a proportion of the UK total remained unchanged as government and higher education increased their share

- All sectors’ funding of UK R&D increased, except higher education

- UK defence expenditure on R&D has largest rise since 2007

- The UK ranked 11th of all EU countries’ R&D expenditure as a percentage of GDP

- Links to related statistics

- Quality and methodology

1. Main points

- Research and development (R&D) expenditure rose by £2.3 billion to £37.1 billion in 2018; this is an increase of 6.6%, which was larger than the 4.8% growth in 2017 and the largest annual rise since 2013.

- Total R&D expenditure in the UK in 2018 represented 1.71% of gross domestic product (GDP); this is up from 1.67% in 2017, but it remains below the EU (EU-28) provisional estimate of 2.12%.

- Funding of UK R&D from overseas increased by 1.4% to £5.1 billion in 2018 compared with 2017, but this was 8.4% lower than the peak in 2014 of £5.5 billion.

- The UK spent £558 per head of population on R&D in 2018; this is up from £527 in 2017.

2. Things you need to know about this release

Research and development (R&D) measurement

This release provides estimates of R&D performed in, and funded by, the following four sectors of the UK economy, as defined in the Frascati Manual 2015:

- business enterprise R&D (BERD)

- higher education R&D (HERD)

- government, including UK Research and Innovation, R&D (GovERD)

- private non-profit organisations R&D (PNPRD)

These sectors’ R&D data are known collectively as gross domestic expenditure on R&D (GERD).

In this statistical bulletin, R&D and related concepts follow internationally agreed standards defined by the Organisation for Economic Co-operation and Development (OECD), as published in the Frascati Manual 2015. GERD is the OECD’s preferred measure of R&D activity for use in international comparisons.

This release reports on R&D expenditure in the UK irrespective of the country of residence of the ultimate owner or users of the R&D produced.

R&D is measured by the expenditure on R&D performed by an organisation or the funding received by an organisation for R&D work. These are often but not always the same.

Performance is regarded as a more accurate measure than funding received by an organisation, as not all funds received may be used on R&D as intended.

All figures quoted are in current prices unless otherwise stated.

Constant price comparisons in this release have been made using data from 1990. However, some constant price estimates are available in previous releases for earlier periods.

Industrial strategy

The UK Government’s Industrial Strategy includes a target to raise investment on R&D to 2.4% of gross domestic product (GDP) by 2027. UK R&D statistics are used to assess how sectors of the economy are contributing towards reaching this policy goal.

The business sector is the largest component of GERD, and the estimates in this release are derived from the Business enterprise research and development, UK: 2018 statistical bulletin, released 21 November 2019. The business sector accounted for 1.2% of GDP in 2018.

UK Research and Innovation (UKRI)

In previous GERD publications, estimates were available for research councils as a distinct element in the overall government sector. In this release, separate estimates for the research councils are no longer available as these now form part of the UKRI sector. In 2018, UKRI was created to bring together the UK’s seven research councils, Innovate UK and Research England into one unified body. Research England, the new council within UKRI, has taken over some functions of the former Higher Education Funding Council for England (HEFCE). The category for “research councils” has therefore been replaced by “UKRI” in the data tables that form part of this release.

In this release, Research England is still included with the higher education funding councils (HEFCs) for Scotland, Wales and the Department for Employment and Learning in Northern Ireland, to give one overall UK sector for the HEFCs.

When making comparisons between 2018 estimates for UKRI and research councils in previous years, it should be noted that UKRI now includes Innovate UK, which was previously part of the Department for Business, Energy and Industrial Strategy (BEIS) and therefore the government department total.

Regional estimates

A regional breakdown of expenditure for the higher education sector is not available at the time of the publication of this release. Therefore, the datasets containing the full regional breakdown for countries and regions of the UK, by R&D sectors, that usually form part of the GERD release will be updated on the website at a later date.

Nôl i'r tabl cynnwys3. UK R&D expenditure continued long-term upward trend

At £37.1 billion in 2018, expenditure on research and development (R&D) performed in the UK reached its highest level on record. This was up from £34.8 billion in 2017, an increase of 6.6% and above the long-term annual average growth since 1990 of 4.2%.

In constant prices (that is, adjusted to remove the effects of inflation), the 2018 estimate surpassed 2017’s previous high by £1.6 billion, an increase of 4.6%. With an average annual growth rate of 2.0% since the 1990 level of £21.0 billion, the long-term upward trend, in constant prices, is still evident (Figure 1).

In current price terms, the UK spent £558 per head of population in 2018; this is an increase of 6.0% compared with 2017 and 172.7% from £205 in 1990. Removing the effects of inflation, this represents an increase of 51.7% from the 1990 total of £368.

Figure 1: Expenditure on R&D performed in the UK was £37.1 billion in 2018

UK gross domestic expenditure on research and development, 1990 to 2018

Source: Office for National Statistics – Gross domestic expenditure on research and development

Download this chart Figure 1: Expenditure on R&D performed in the UK was £37.1 billion in 2018

Image .csv .xlsFigure 2 shows UK gross domestic expenditure on R&D (GERD) performed in the UK, as a percentage of gross domestic product (GDP). These percentages are influenced both by the levels of GDP and R&D. This percentage declined steadily between 1990 and 2004, from 1.73% to 1.50%. Since then, the percentage has fluctuated between 1.52% and 1.71%, showing a gradual upward trend. The 2018 estimate of 1.71% of GDP was up from 1.67% in 2017 and above the average of 1.61% for the period 2005 to 2018.

Figure 2: UK's research and development as a percentage of GDP was 1.71%

UK gross expenditure on research and development as a percentage of gross domestic product, 1990 to 2018

Source: Office for National Statistics – Gross domestic expenditure on research and development

Download this chart Figure 2: UK's research and development as a percentage of GDP was 1.71%

Image .csv .xls5. All sectors’ funding of UK R&D increased, except higher education

In 2018, the largest funder of research and development (R&D) performed in the UK was the business enterprise sector, which funded £20.3 billion (55%) of total UK-performed R&D. This was an increase of 8.4% from £18.7 billion in 2017.

At £7.1 billion (19%), the government and UK Research and Innovation (UKRI) sector was the second largest source of UK R&D funding in 2018, increasing by 5.1% compared with 2017. In comparison, the sector only spent £2.5 billion in 2018 performing R&D in the UK.

In Figure 4, the flows from left to right show the value of funds that organisations within each of the sectors of the UK economy provided to other sectors and to organisations within their own sector. This is to highlight the complex nature of how R&D performed in the UK is funded. Funding from overseas is also shown to complete the picture. Values of each sector on the right of the chart are the amounts that each sector spends on performing R&D, which comprises funds from all other sectors.

The total government sector is subdivided into two elements: government departments and UKRI; and higher education funding councils (HEFCs) including Research England. In the government sector, HEFCs primarily provide funds to higher education institutes (HEIs) for them to perform R&D. This contrasts with government departments and UKRI, which receive funds from other sectors as well as partly fund themselves to perform R&D, yet they also provide substantial funds to other sectors.

HEIs are regarded as an R&D-performing sector. However, as this analysis is focusing on funding, and the data shown relate to the flow of funds provided between sectors, in this context HEFCs are regarded as part of the government funding sector. This is because the money they allocate to HEIs comes from the government.

Figure 4: Flows of research and development funding in the UK in 2018

Embed code

Notes:

- HEFCs – Higher Education Funding Councils, including Research England, are funded by the government and primarily provide funds for higher education institutes to perform research and development (R&D). For the purposes of reporting R&D funding, they are classified separately from the rest of government.

The proportions of each sector’s funding of UK R&D expenditure has fluctuated over time. In 1990, R&D funding from business enterprise accounted for 50% of the UK total. While its share has remained the largest, its share has also varied over time with a low of 42% in 2003 rising to 55% in 2018. While business enterprise had the largest growth in value terms since 1990, R&D funding from overseas had the largest annual average growth at 2.5% compared with the business enterprise sector at 2.4%. In constant prices, overseas R&D funding was £2.5 billion in 1990; this is 12% of total UK funding. Despite fluctuations, there was a long-term upward trend in the value of funding from overseas. This peaked at £5.9 billion in 2014, representing 18% of total UK funding. However, since then overseas funding has declined, falling by 14.4% to £5.1 billion in 2018; this is 14% of the UK total.

Figure 5 shows the breakdown of UK gross domestic expenditure on R&D (GERD) by funding sector since 2013.

Figure 5: Business enterprise sector remained the largest funder of R&D in the UK

Composition of UK gross domestic expenditure on research and development by funding sector in constant prices, 2013 to 2018

Source: Office for National Statistics – Gross domestic expenditure on research and development

Notes:

- HEFCs – Higher Education Funding Councils. This includes Research England (formerly Higher Education Funding Council for England, HEFCE).

Download this chart Figure 5: Business enterprise sector remained the largest funder of R&D in the UK

Image .csv .xls6. UK defence expenditure on R&D has largest rise since 2007

In 2018, expenditure for defence purposes accounted for 5% of total research and development (R&D) expenditure at £1.9 billion. This was an increase of 6.9% from 2017 and the largest growth since 2007. In constant prices, defence R&D expenditure has fallen by 59.5% from £4.7 billion in 1990.

Business enterprise expenditure on performing R&D (BERD) in the defence sector has fallen by 46.4% since 1990 in constant price terms to £1.7 billion in 2018, accounting for 88% of the UK defence total. In contrast, over the same period BERD on civil projects grew by 106.2% to £23.4 billion (66% of the UK civil total). The business enterprise sector remains by far the largest performer of both civil and defence R&D.

The UK Government’s funding of defence R&D also increased from 2017 to £1.2 billion in 2018, a rise of 1.8%. As a proportion of total UK defence funding, government sector funding decreased from 65% in 2017 to 62% in 2018. The business enterprise sector provided £0.6 billion (29%) of funding, up from 26% in 2017. Funding from overseas accounted for £0.2 billion (8%); this is unchanged from 2017.

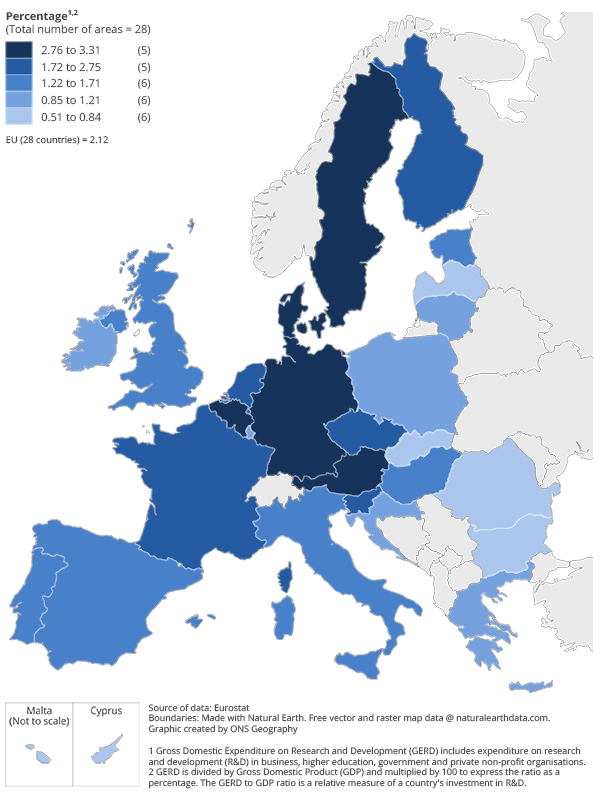

Nôl i'r tabl cynnwys7. The UK ranked 11th of all EU countries’ R&D expenditure as a percentage of GDP

The Europe 2020 targets specify five targets for the EU to achieve by 2020, including a target of 3% of the EU’s gross domestic product (GDP) to be invested in research and development (R&D). The latest Preliminary estimates produced by Eurostat indicate that for the EU as a whole, the percentage of GDP spent on R&D fluctuated between 1.74% in 2005 and 2.12% in 2018 (Figure 6). Please note that the 2018 results for the EU-28 and Organisation for Economic Co-operation and Development (OECD) countries are early estimates and are provisional at the time of this release.

Figure 6: UK had the 11th highest R&D as a percentage of GPD of all EU-28 countries

Gross domestic expenditure on research and development to gross domestic product ratio as a percentage (R&D intensity), by country, EU (EU-28), 2018

Source: Eurostat

Download this image Figure 6: UK had the 11th highest R&D as a percentage of GPD of all EU-28 countries

.png (171.4 kB)Figure 7 shows the UK’s R&D as a proportion of GDP compared with other EU countries.

It includes the average for the EU-28, compared with the Europe 2020 target of 3%. The UK’s gross domestic expenditure on R&D (GERD) represented 1.71% of GDP in 2018, up from 1.67% in 2017. The UK had the 11th highest GERD as a percentage of GDP of all EU-28 countries, where the average was 2.12% of GDP.

Figure 7: UK’s GERD was the 11th largest percentage of GDP of all EU 28

EU countries’ gross domestic expenditure on research and development (R&D) as a percentage of gross domestic product (R&D intensity), 2018

Source: Eurostat

Notes:

- Estimates as at 10 March 2020. Some EU countries' 2018 estimates taken from the Eurostat website are provisional.

Download this chart Figure 7: UK’s GERD was the 11th largest percentage of GDP of all EU 28

Image .csv .xls9. Quality and methodology

About the data

When examining this bulletin or the data tables, please note:

there may be differences between totals and the sum of their independently rounded components

in some tables, entries have either been aggregated or suppressed to avoid disclosure of figures in which the returns of individual organisations could be identified; where this happens, footnotes have been added to the tables

£1.0 billion equals £1,000 million in this release

estimates from 2014 to 2017 have been revised where necessary to take account of improved methodology, organisations’ misreporting and late returns

the time series for estimates of UK research and development (R&D) as a percentage of gross domestic product (GDP) that were previously published have been revised; this is because of the combined effect of revisions to GDP as well as revisions to R&D expenditure

GDP deflators at market prices, and money GDP used, is non-seasonally adjusted; the GDP deflators at market prices, and money GDP September 2019 (Quarterly National Accounts) can be viewed as a measure of general inflation in the domestic economy

More quality and methodology information on strengths, limitations, appropriate uses, and how the data were created is available in the UK gross domestic expenditure on research and development QMI.

Coronavirus (COVID-19)

The collection of the data contained in this statistical bulletin has not been affected by the coronavirus (COVID-19) outbreak.

Our latest data and analysis on the impact of COVID-19 on the UK economy and population is now available on a new web page. This will be the hub for all special virus-related publications, drawing on all available data.

The Office for National Statistics (ONS) has released a public statement on COVID-19 and the production of statistics. Specific queries must be directed to the Media Relations Office.

Nôl i'r tabl cynnwys