Cynnwys

- Main points

- Statistician’s comment

- Things you need to know about this release

- Long-term upward trend for R&D expenditure continues

- What is the breakdown of R&D expenditure by product group?

- Both civil and defence R&D expenditure continue to rise

- Scientific R&D leads the way for industry expenditure

- Employment in R&D reaches highest level yet in 2016

- South East and East of England spent the most on performing R&D

- UK funding of business R&D continues to grow

- Just over half of all UK business expenditure on performing R&D was by UK-owned businesses

- Links to related statistics

- Quality and methodology

1. Main points

Expenditure on research and development (R&D) performed by UK businesses continued to grow, expanding by £1.2 billion to £22.2 billion in 2016, an increase of 5.6%.

Motor vehicles and parts was the product group that had the largest growth in expenditure on R&D performed by UK businesses, of £562 million (20%).

London had the largest growth in regional business R&D expenditure, increasing by £404 million (21.4%) to £2.3 billion in 2016.

UK business R&D consisted of civil R&D of £20.7 billion (93%) and defence R&D of £1.6 billion (7%); civil and defence R&D expenditure grew by 5.7% and 5.1% respectively in 2016.

In 2016, total business employment in R&D in the UK grew by 1.9% to 210,000 full-time equivalents (FTE).

2. Statistician’s comment

"Spending by UK businesses on research and development (R&D) was over £22 billion last year. This continues the growth of more than £1 billion a year since 2013. 2016 also saw employment in R&D reach its highest-ever level, accounting for over 200,000 full-time-equivalents."

Daniel Groves, National Accounts and Economic Statistics, Office for National Statistics.

Nôl i'r tabl cynnwys3. Things you need to know about this release

Business enterprise research and development (BERD) covers estimates of UK businesses expenditure and employment relating to research and development (R&D) performed in the UK in 2016.

In this statistical bulletin, R&D and related concepts follow internationally agreed standards defined by the Organisation for Economic Co-operation and Development (OECD), as published in the Frascati Manual (2015).

When comparing total business R&D intensity across countries, it is important to take into account differences in industrial structure. The Organisation for Economic Co-operation and Development (OECD) produces a Science, Technology and Industry Scoreboard to facilitate these comparisons. International comparisons of R&D data can also be found on the Eurostat website.

This release reports on R&D expenditure in UK businesses irrespective of the country of residence of the ultimate owner or users of the R&D produced.

R&D is measured by the expenditure on R&D performed by a business, or the funding received by a business for R&D work. These are often but not always the same. Performance is regarded as a more accurate measure than funding received by a business, as not all funds received may be used as intended.

Further information on business R&D estimates is available in the UK Business Enterprise Research and Development Quality and Methodology Information (QMI) report.

All figures quoted are in current prices unless otherwise stated.

Nôl i'r tabl cynnwys4. Long-term upward trend for R&D expenditure continues

Expenditure on research and development (R&D) performed by UK businesses was £22.2 billion in 2016. This was up from £21.0 billion in 2015, an increase of 5.6%. The average annual growth rate since 1992 was 4.3%.

A long-term upward trend is evident when considering R&D expenditure in constant price terms, with an average annual growth rate of 2.3% since 1992 levels (£13.0 billion) (Figure 1).

Figure 1: Expenditure by UK businesses on performing research and development, 1992 to 2016

Source: Office for National Statistics

Download this chart Figure 1: Expenditure by UK businesses on performing research and development, 1992 to 2016

Image .csv .xlsThe total business R&D expenditure in 2016 represented 1.1% of gross domestic product (GDP). This estimate has remained unchanged since 2014.

Nôl i'r tabl cynnwys5. What is the breakdown of R&D expenditure by product group?

On an annual basis, the 400 largest research and development (R&D) performers are asked to select the product groups that best describe the type of R&D activities that they undertake. For the 2016 survey, the largest 400 performers were those businesses previously reporting more than approximately £5.7 million expenditure on performing R&D. These businesses accounted for approximately 78% of 2016 business R&D. The concept of "product groups" is described in more detail in the UK Business Enterprise Research and Development Quality and Methodology Information (QMI) report.

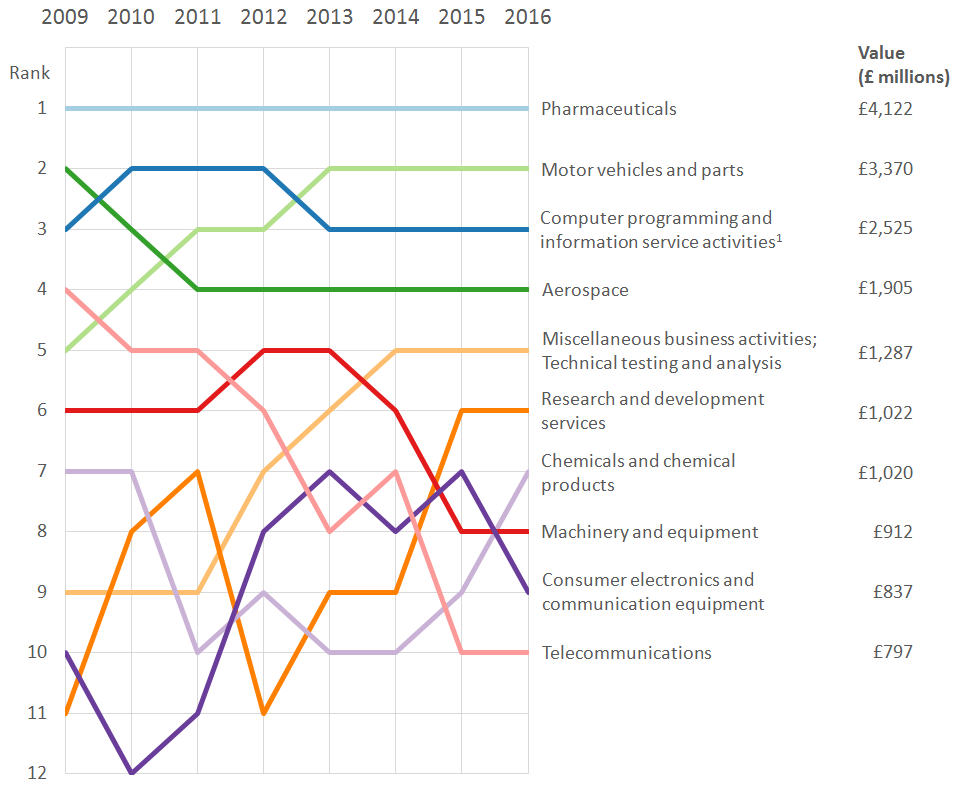

In 2016, pharmaceuticals continued to be the largest product group, with £4.1 billion expenditure. This product group accounted for 19% of total expenditure on R&D performed in UK businesses, falling by 1% in 2016 (Figure 2).

Figure 2: Expenditure by UK businesses on performing research and development in current prices, by largest product groups, 2009 to 2016

Source: Office for National Statistics

Notes:

- Computer programming and information service activities includes software development, which is separately identified in the dataset from 2016.

Download this image Figure 2: Expenditure by UK businesses on performing research and development in current prices, by largest product groups, 2009 to 2016

.png (59.3 kB) .xls (30.7 kB)The largest increase in an individual product group was in the motor vehicles and parts group, which grew for the seventh year in succession, to £3.4 billion in 2016. This was an increase of £562 million (20%) from £2.8 billion in 2015 and accounted for 15% of expenditure on R&D performed in UK businesses in 2016.

More evidence of the growth in the motor industry can be viewed in our UK Manufacturers’ Sales by Product (prodcom) statistical bulletins.

Another notable increase was in the aerospace group, which increased by £206 million (12.1%) from £1.7 billion in 2015. In 2016, this group accounted for 9% of expenditure on R&D performed in UK businesses.

Other product groups reporting £1.0 billion or more R&D expenditure in the UK in 2016 were:

computer programming and information services activities (excluding software development), £1.8 billion (8% of total R&D expenditure)

miscellaneous business activities; technical testing and analysis, £1.3 billion (6%)

research and development, £1.0 billion (5%)

chemicals and chemical products, £1.0 billion (5%)

These seven product groups accounted for 65% of the total UK business R&D expenditure in 2016.

In 2015, the computer programming and information services activities group was the third largest, accounting for 11% of total UK R&D expenditure. For 2016, R&D into software development has been separated from this group to be monitored individually. Comparing with 2015, the two groups in 2016 accounted for £2.5 billion (11% of total UK R&D expenditure).

Since 2015, 16 product groups experienced an increase in levels of R&D expenditure by UK businesses and 16 groups experienced a decrease. The two remaining groups were the result of the split of the former computer programming and information services activities group, to monitor software development separately. Together these two new groups show an increase.

In terms of percentage growth, the largest product group increases were in wholesale and retail trade (43%), rubber and plastic products (37%) and construction (35%). In contrast, the product group that had the largest decrease was casting of iron and steel, which fell by 25% since 2015.

Nôl i'r tabl cynnwys6. Both civil and defence R&D expenditure continue to rise

Analyses of research and development (R&D) expenditure statistics can be split between the civil and defence sectors. Expenditure on R&D performed by UK businesses in the civil sector in 2016 (£20.7 billion) accounted for 93% of the total, with the remainder accounted for by defence (£1.6 billion). The value of R&D expenditure within the civil and defence sectors in 2016 reflected increases of 5.7% and 5.1% respectively on 2015.

Further splits of civil and defence R&D, such as detailed product groups, sources of funds, capital expenditure and employment, can be found in the 2016 datasets.

Nôl i'r tabl cynnwys7. Scientific R&D leads the way for industry expenditure

Research and development (R&D) expenditure estimates by industry, based on the Standard Industrial Classification 2007 (SIC 2007), were introduced in the 2011 Business enterprise research and development (BERD) statistical bulletin. These broaden the scope of the estimates (see Table 26 in the 2016 datasets).

It is important to note that estimates of R&D expenditure by industry and product group are not directly comparable. This is because businesses may report significant R&D in product groups that are different to the main classification of their business according to the SIC 2007. The concepts of product groups and SIC 2007 are described in more detail in the UK Business Enterprise Research and Development Quality and Methodology Information (QMI) report.

The highest level of business R&D expenditure in 2016 by SIC 2007 was performed by businesses that were classified to the scientific research and development industry, at £5.3 billion, which represented 24% of total expenditure (Figure 3).

There are five other industries that had R&D expenditure of £1.0 billion or more:

manufacture of motor vehicles and trailers, £2.9 billion (13%)

manufacture of other transport equipment, £1.8 billion (8%)

computer programming, consultancy and related activities, £1.6 billion (7%)

architectural and engineering activities, £1.5 billion (7%)

manufacture of computer, electronic and optical products, £1.1 billion (6%)

These six industries accounted for 64% of the total UK business R&D expenditure in 2016.

Figure 3: Percentage share of total expenditure by UK businesses on performing research and development, by largest industries, 2012 to 2016

Source: Office for National Statistics

Download this chart Figure 3: Percentage share of total expenditure by UK businesses on performing research and development, by largest industries, 2012 to 2016

Image .csv .xls8. Employment in R&D reaches highest level yet in 2016

Estimates of employment in research and development (R&D) are produced on a full-time equivalent (FTE) basis, whereby businesses convert part-time employees’ hours into full-time employees’ equivalent. FTE estimates provide a better indication of total labour input than headcount.

The lowest level of employment in R&D in the last decade occurred in 2006, when 147,000 FTEs were employed. Since then, there has been steady growth, reaching the highest level to date in 2016 at 210,000 (Figure 4).

The number of FTEs employed in R&D rose from 206,000 in 2015 to 210,000 in 2016, an increase of 2%. While there has been growth in recent years in the number of people working on R&D, this should be seen in the context of a rise in the total employment in the UK labour market. Therefore, part of the growth in employment on R&D may reflect the wider growth in total employment in the economy. See our labour market statistics for more information on total employment levels.

The 2016 estimate comprised:

110,000 scientists and engineers (52%)

62,000 technicians (30%)

37,000 administrative staff (18%)

Figure 4: Employment in UK businesses on performing research and development, 1992 to 2016

Source: Office for National Statistics

Download this chart Figure 4: Employment in UK businesses on performing research and development, 1992 to 2016

Image .csv .xls9. South East and East of England spent the most on performing R&D

Analysis of research and development (R&D) expenditure by country and region is also possible. In this context, “region” refers to the location where a business performs R&D, not the location of either the business’ headquarters or that of any external funders.

The South East and East of England continue to dominate where R&D expenditure takes place in the UK. These two regions combined accounted for 41% of UK business R&D expenditure in 2016. These regions combined also employed 79,000 full-time equivalent (FTE) staff, which made up 38% of total R&D employment in 2016.

The regions or countries with the lowest levels of employment on performing R&D were the North East employing 4,000 FTE, with Wales and Northern Ireland employing 5,000 and 7,000 FTE R&D staff respectively. These regions or countries also have the lowest corresponding totals of expenditure on business R&D.

The majority (91%) of UK R&D expenditure was carried out in England in 2016. Businesses in England spent the equivalent of £366 per head of population on performing R&D, more than the other countries of the UK, with Northern Ireland spending £258, Scotland spending £198 and Wales spending £140.

The largest overall increase in expenditure by region since 2015 was in London, which rose by £404 million (21.4%) from £1.9 billion in 2015. In contrast, the largest overall decrease in expenditure by region since 2015 was in the South East, which fell by £72 million (1.5%) from £4.8 billion in 2015.

Table 1 shows the change in expenditure on performing R&D by UK businesses between 2015 and 2016 for all regions of the UK.

Table 1: Regional expenditure on research and development performed in UK businesses, 2015 to 2016

| £ million | ||||||

| 2015 | 2016 | % change | ||||

|---|---|---|---|---|---|---|

| UK | 21,038 | 22,224 | 5.6 | |||

| North East | 306 | 302 | -1.3 | |||

| North West | 2,116 | 2,346 | 10.9 | |||

| Yorkshire and the Humber | 769 | 750 | -2.5 | |||

| East Midlands | 1,531 | 1,655 | 8.1 | |||

| West Midlands | 2,159 | 2,303 | 6.7 | |||

| East of England | 4,200 | 4,393 | 4.6 | |||

| London | 1,892 | 2,296 | 21.4 | |||

| South East | 4,765 | 4,693 | -1.5 | |||

| South West | 1,476 | 1,500 | 1.6 | |||

| Wales | 368 | 435 | 18.2 | |||

| Scotland | 953 | 1,072 | 12.5 | |||

| Northern Ireland | 501 | 481 | -4.0 | |||

| Source: Office for National Statistics | ||||||

| Notes: | ||||||

| 1. Differences may occur between totals and the sum of their independently rounded components. | ||||||

Download this table Table 1: Regional expenditure on research and development performed in UK businesses, 2015 to 2016

.xls (27.1 kB)10. UK funding of business R&D continues to grow

The largest source of research and development (R&D) funding in 2016 was businesses’ own funds at £16.2 billion, which increased by £1.4 billion (9%) from £14.8 billion in 2015. Businesses’ own funds accounted for 73% of total business R&D expenditure in 2016 compared with the 2015 estimate of 70%.

Since 2010, UK funding of businesses’ expenditure on performing R&D has increased by £6.5 billion to £18.7 billion in 2016. Over the same period overseas funding has experienced little change with a drop of £301 million to £3.5 billion in 2016.

As a proportion of total funding of UK business R&D, overseas funding has reduced by 8 percentage points from 24% in 2010 to 16% in 2016 (Figure 5). This is due mainly to the large increase in UK investment in business R&D.

The UK government’s funding of businesses’ R&D in 2016 was £1.7 billion, a decrease of £86 million (5%) from £1.8 billion in 2015. This was a decrease for the second year running. It represented 8% of business R&D expenditure. UK government funding was mostly in the defence sector (£1.0 billion), which made up 57% of government funding of business R&D expenditure.

Figure 5: UK and overseas funding of expenditure by UK businesses on performing research and development, 1992 to 2016

Source: Office for National Statistics

Notes:

- Differences may occur between totals and the sum of their independently rounded components.

Download this chart Figure 5: UK and overseas funding of expenditure by UK businesses on performing research and development, 1992 to 2016

Image .csv .xls11. Just over half of all UK business expenditure on performing R&D was by UK-owned businesses

In 1993, when the Business Enterprise Research and Development (BERD) Survey began on an annual basis, 73% of UK business R&D expenditure was by UK-owned businesses. The majority of UK business R&D expenditure continued to be performed by UK-owned businesses until 2011, when for the first time, just over half (50.8%) of business R&D expenditure in the UK was by foreign-owned businesses. This pattern of ownership continued in 2012 and 2013, with 52.1% and 53.6% respectively. For the first time since 2010, the proportion of R&D performed by UK-owned businesses was greater than that performed by foreign-owned businesses, at 50.1% in 2016 (Figure 6).

On 15 March 2013, ONS published R&D expenditure by foreign-owned businesses, which contained more detailed analysis of the pattern of ownership of businesses that performed R&D between 1995 and 2011. This was based on the estimates that had been included in the 2011 BERD statistical bulletin. It should be noted that the original 2011 estimate of the proportion of R&D expenditure by foreign-owned businesses has been revised upwards from 50% to 51%.

Figure 6: Ownership of businesses who perform research and development in the UK, 1993 to 2016

Source: Office for National Statistics

Notes:

- Differences may occur between totals and the sum of their independently rounded components.

Download this chart Figure 6: Ownership of businesses who perform research and development in the UK, 1993 to 2016

Image .csv .xls13. Quality and methodology

The Business Enterprise Research and Development Quality and Methodology Information report contains important information on:

the strengths and limitations of the data and how they compare with related data

uses and users of the data

how the output was created

the quality of the output including the accuracy of the data

About the data

These points should be noted when examining this bulletin or the data tables:

respondents were asked to make a return for the calendar year 2016 or the nearest 12-month period for which figures were available – data for all years published in this statistical bulletin were collected on the same basis

there may be differences between totals and the sum of their independently rounded totals

in some tables, entries have been aggregated to avoid disclosure of figures in which the returns of individual businesses could be identified – where this happens, footnotes have been added to the tables

it is sometimes necessary to suppress figures for certain items to avoid disclosing data from individual institutions – tables that contain data which are disclosive will contain a relevant footnote

note that £1.0 billion equals £1,000 million in this release

the 2014 and 2015 estimates have been revised where necessary to take account of businesses misreporting and late returns

gross domestic product (GDP) deflators at market prices, and money GDP used is non-seasonally adjusted; the GDP deflators at market prices, and money GDP: September 2017 (Quarterly National Accounts) can be viewed as a measure of general inflation in the domestic economy